444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The European wealth management market represents one of the most sophisticated and mature financial services sectors globally, characterized by robust regulatory frameworks, diverse client needs, and innovative technological solutions. European wealth management encompasses a comprehensive range of financial advisory services, investment management, estate planning, and private banking solutions designed to preserve and grow high-net-worth individuals’ assets across the continent.

Market dynamics in the European region reflect a complex interplay of traditional banking excellence, regulatory compliance requirements, and evolving client expectations. The sector demonstrates remarkable resilience with projected growth rates of 6.2% CAGR over the forecast period, driven by increasing wealth accumulation, demographic shifts, and digital transformation initiatives across major European financial centers.

Regional leadership remains concentrated in established financial hubs including Switzerland, Luxembourg, London, and Frankfurt, which collectively account for approximately 78% of European wealth management activities. These centers benefit from favorable regulatory environments, deep capital markets, and centuries-old traditions of financial expertise that continue to attract global wealth.

Technology adoption has accelerated significantly, with digital wealth management platforms experiencing 45% growth rates in client adoption across European markets. This technological evolution encompasses robo-advisory services, artificial intelligence-driven portfolio management, and sophisticated client relationship management systems that enhance service delivery and operational efficiency.

The European wealth management market refers to the comprehensive ecosystem of financial services, advisory solutions, and investment management offerings specifically designed to serve high-net-worth individuals, ultra-high-net-worth clients, and institutional investors across European jurisdictions. This market encompasses traditional private banking, independent wealth advisory firms, family offices, and digital wealth management platforms that collectively provide personalized financial solutions.

Wealth management services in the European context extend beyond simple investment advisory to include sophisticated estate planning, tax optimization strategies, philanthropic advisory, succession planning, and cross-border wealth structuring solutions. The sector operates within a highly regulated environment that emphasizes client protection, transparency, and fiduciary responsibility.

European wealth management distinguishes itself through its emphasis on long-term relationship building, discretionary portfolio management, and comprehensive family wealth preservation strategies that often span multiple generations. The market serves clients with varying wealth thresholds, typically starting from investable assets of €1 million and extending to ultra-high-net-worth families with assets exceeding €100 million.

European wealth management continues to demonstrate robust growth momentum despite global economic uncertainties, regulatory changes, and evolving client expectations. The market benefits from Europe’s position as a global financial center, sophisticated regulatory frameworks, and deep pools of accumulated wealth across diverse economic sectors.

Key growth drivers include increasing wealth creation in technology and entrepreneurial sectors, growing demand for sustainable investment solutions, and the ongoing wealth transfer from baby boomer generations to younger, more digitally-savvy heirs. ESG investing has become particularly significant, with sustainable investment strategies representing 42% of new asset flows in European wealth management.

Digital transformation initiatives are reshaping service delivery models, with hybrid advisory approaches combining human expertise with technological efficiency gaining traction among clients seeking both personal relationships and digital convenience. The integration of artificial intelligence, machine learning, and advanced analytics is enhancing portfolio management capabilities and risk assessment processes.

Regulatory developments including MiFID II, GDPR, and evolving tax transparency requirements continue to influence market structure and operational practices. These regulations, while increasing compliance costs, are also driving consolidation and encouraging innovation in service delivery approaches across the European wealth management landscape.

Market concentration analysis reveals significant opportunities for both established players and emerging fintech solutions across European wealth management. The following insights highlight critical market dynamics:

Wealth creation dynamics across European economies continue to fuel demand for sophisticated wealth management services. The emergence of new wealth from technology entrepreneurship, private equity success, and family business growth creates expanding client bases requiring comprehensive financial advisory solutions.

Demographic transitions represent a fundamental driver as aging wealthy populations require estate planning, succession advisory, and wealth transfer services. Simultaneously, younger generations inheriting substantial wealth demonstrate different service expectations, favoring digital interfaces, sustainable investing, and impact-focused strategies that align with their values.

Regulatory complexity paradoxically drives market growth by creating demand for specialized expertise in tax optimization, compliance management, and cross-border wealth structuring. European clients increasingly require sophisticated advisory services to navigate evolving regulatory landscapes while preserving wealth and minimizing tax obligations.

Investment sophistication among European wealthy individuals continues to increase, driving demand for alternative investments, private markets access, and customized portfolio solutions. Clients seek diversification beyond traditional asset classes, requiring wealth managers to provide access to private equity, hedge funds, real estate, and direct investment opportunities.

Globalization effects create opportunities as European wealth managers serve internationally mobile clients requiring multi-jurisdictional expertise. The ability to provide seamless wealth management services across borders becomes increasingly valuable as wealthy individuals maintain residences and business interests in multiple countries.

Regulatory burden continues to challenge European wealth management firms through increasing compliance costs, operational complexity, and reporting requirements. MiFID II implementation has fundamentally altered fee structures and client relationship management, requiring significant technology investments and process modifications that strain smaller advisory firms.

Fee pressure intensifies as clients become more cost-conscious and alternative service providers offer competitive pricing models. Traditional wealth management fee structures face scrutiny from sophisticated clients who demand transparent value propositions and performance-based compensation arrangements.

Technology disruption poses challenges for established wealth management firms that must balance substantial technology investments with maintaining profitability. The emergence of robo-advisory platforms and digital wealth management solutions creates competitive pressure while requiring traditional firms to modernize their service delivery approaches.

Talent acquisition difficulties persist as the industry competes for skilled relationship managers, investment professionals, and technology specialists. Regulatory requirements for professional qualifications and experience create barriers to rapid team expansion while compensation expectations continue to increase across European financial centers.

Economic uncertainty affects client confidence and investment decision-making, potentially reducing asset flows and fee generation during market volatility periods. Brexit implications, European Union policy changes, and global economic fluctuations create ongoing challenges for wealth preservation and growth strategies.

Digital transformation presents significant opportunities for European wealth management firms to enhance client experiences, improve operational efficiency, and expand service capabilities. The integration of artificial intelligence, machine learning, and advanced analytics enables personalized investment strategies and proactive client advisory services.

Sustainable investing represents a substantial growth opportunity as European clients increasingly prioritize environmental, social, and governance factors in investment decisions. ESG integration across portfolio management, impact investing, and sustainable wealth strategies aligns with regulatory trends and client values.

Next-generation wealth transfer creates opportunities for firms that successfully adapt service models to meet younger clients’ expectations. Millennial and Generation Z heirs demonstrate preferences for digital engagement, transparent communication, and values-aligned investing that forward-thinking wealth managers can capture.

Cross-border expansion opportunities exist for European wealth management firms to serve internationally mobile clients and expand into emerging markets. The expertise developed in sophisticated European regulatory environments provides competitive advantages when serving global wealthy families.

Alternative investments access and structuring services offer premium fee opportunities as clients seek diversification beyond traditional asset classes. Private markets, direct investments, and structured products require specialized expertise that commands higher margins and strengthens client relationships.

Competitive landscape evolution reflects ongoing consolidation among traditional wealth management firms while new entrants leverage technology to capture market share. Established private banks acquire smaller advisory firms to expand geographic reach and client bases, while fintech companies partner with traditional institutions to enhance service offerings.

Client expectations continue to evolve toward greater transparency, digital accessibility, and personalized service delivery. Wealthy European clients demand sophisticated investment solutions combined with seamless digital experiences that provide real-time portfolio visibility and communication capabilities.

Regulatory harmonization across European Union jurisdictions creates both challenges and opportunities for wealth management firms. While compliance complexity increases, standardized regulations enable more efficient cross-border service delivery and client relationship management across multiple European markets.

Technology integration accelerates across all aspects of wealth management operations, from client onboarding and portfolio management to regulatory reporting and risk assessment. Firms that successfully implement comprehensive technology solutions achieve operational efficiency improvements of 25-30% while enhancing client satisfaction.

Fee model evolution reflects changing client preferences and competitive pressures, with traditional asset-based fees supplemented by performance-based compensation, subscription models, and project-based advisory fees. This diversification helps wealth management firms maintain profitability while meeting client expectations for value-based pricing.

Primary research methodology encompasses comprehensive interviews with wealth management executives, relationship managers, and industry experts across major European financial centers. This qualitative research provides insights into market trends, client behavior patterns, and competitive dynamics that shape the European wealth management landscape.

Secondary research analysis incorporates regulatory filings, industry reports, and financial performance data from leading European wealth management firms. This quantitative foundation supports market sizing, growth projections, and competitive positioning analysis across different market segments and geographic regions.

Client survey data collection involves high-net-worth individuals and ultra-high-net-worth families across European markets to understand service preferences, satisfaction levels, and future expectations. These insights inform market opportunity assessment and service development recommendations for wealth management providers.

Regulatory analysis examines current and proposed legislation affecting European wealth management, including tax policy changes, compliance requirements, and cross-border regulations. This analysis helps identify market opportunities and challenges resulting from evolving regulatory environments.

Technology assessment evaluates emerging fintech solutions, digital platforms, and automation technologies impacting wealth management service delivery. This research component identifies innovation trends and competitive threats that influence market dynamics and strategic planning for traditional wealth management firms.

Switzerland maintains its position as Europe’s leading wealth management center, benefiting from political stability, favorable tax policies, and centuries of banking expertise. Swiss private banks continue to attract international wealthy clients seeking discretionary portfolio management and sophisticated wealth structuring solutions, maintaining approximately 32% of European market share.

United Kingdom remains a significant wealth management hub despite Brexit uncertainties, with London-based firms serving both domestic and international clients. The UK market demonstrates strength in alternative investments, hedge fund management, and family office services, representing roughly 24% of European wealth management activities.

Luxembourg has emerged as a major center for cross-border wealth management, particularly serving German, French, and Belgian clients seeking tax-efficient investment solutions. The jurisdiction’s favorable regulatory environment and EU passport rights support continued growth in international wealth management services.

Germany represents the largest domestic wealth management market in Europe by client numbers, with strong demand for conservative investment approaches and comprehensive financial planning services. German wealth management firms focus on relationship-based advisory services and demonstrate particular strength in serving successful entrepreneurs and family businesses.

France combines traditional private banking with innovative fintech solutions, serving both domestic wealthy families and international clients seeking European Union access. French wealth managers demonstrate expertise in luxury asset management, art advisory, and sophisticated estate planning services.

Market leadership in European wealth management reflects a combination of traditional private banks, independent advisory firms, and emerging digital platforms that serve diverse client segments with varying service models and geographic focus areas.

By Client Segment:

By Service Type:

By Geography:

Traditional Private Banking continues to dominate European wealth management through relationship-based service models that emphasize personal advisory relationships, discretionary portfolio management, and comprehensive wealth planning solutions. These institutions benefit from established client relationships, regulatory expertise, and access to exclusive investment opportunities.

Independent Wealth Advisors gain market share by offering specialized expertise, transparent fee structures, and personalized service approaches that appeal to sophisticated clients seeking alternatives to traditional banking relationships. These firms often focus on specific client segments or investment specializations that differentiate their service offerings.

Digital Wealth Platforms experience rapid growth among younger wealthy clients and those seeking cost-effective investment management solutions. These platforms combine automated portfolio management with human advisory support, providing scalable service models that appeal to tech-savvy investors across European markets.

Family Offices represent the fastest-growing segment as ultra-high-net-worth families seek comprehensive wealth management solutions that extend beyond investment management to include lifestyle services, philanthropy, and next-generation education. Single-family offices and multi-family office structures both demonstrate strong growth across European markets.

Sustainable Wealth Management emerges as a distinct category driven by client demand for ESG integration, impact investing, and values-aligned wealth strategies. European wealth managers increasingly develop specialized sustainable investing capabilities to meet growing client interest in responsible wealth management approaches.

Wealth Management Firms benefit from expanding client bases, premium fee opportunities, and long-term relationship stability that characterizes the European wealthy client segment. Successful firms achieve sustainable revenue growth through comprehensive service offerings and strong client retention rates.

High-Net-Worth Clients gain access to sophisticated investment solutions, tax optimization strategies, and comprehensive wealth planning services that preserve and grow family wealth across generations. Professional wealth management provides expertise, time savings, and peace of mind for complex financial situations.

Technology Providers find significant opportunities in serving European wealth management firms seeking digital transformation solutions. Fintech companies, software developers, and data analytics providers benefit from increasing technology adoption across the wealth management industry.

Regulatory Authorities achieve improved market oversight, client protection, and financial system stability through enhanced regulatory frameworks that govern European wealth management activities. Proper regulation supports market confidence and sustainable industry growth.

Economic Development benefits from wealth management industry growth through job creation, tax revenue generation, and financial center development that strengthens European competitiveness in global financial services markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

ESG Integration accelerates across European wealth management as clients increasingly prioritize sustainable investing approaches that align investment strategies with personal values and long-term sustainability goals. MarkWide Research indicates that sustainable investment strategies demonstrate superior client retention and satisfaction metrics compared to traditional investment approaches.

Digital Client Engagement transforms wealth management relationships through sophisticated client portals, mobile applications, and virtual advisory services that provide real-time portfolio access and communication capabilities. Hybrid service models combining digital efficiency with personal relationships gain traction across all client segments.

Alternative Investment Access expands as wealth managers develop capabilities to provide clients with private equity, hedge funds, real estate, and direct investment opportunities previously available only to institutional investors. These alternative investments offer diversification benefits and potential return enhancement for sophisticated portfolios.

Cross-Generational Planning becomes increasingly important as wealthy European families prepare for substantial wealth transfers to younger generations with different values, expectations, and financial objectives. Wealth managers develop specialized services addressing family governance, next-generation education, and values-based investing.

Regulatory Technology adoption accelerates as firms implement automated compliance monitoring, reporting systems, and risk management solutions that enhance regulatory adherence while reducing operational costs and human error risks.

Consolidation Activity continues across European wealth management as larger institutions acquire smaller advisory firms to expand geographic reach, client bases, and specialized capabilities. These acquisitions enable scale economies and enhanced service offerings while providing succession solutions for aging advisory firm founders.

Technology Partnerships proliferate between traditional wealth managers and fintech companies, creating hybrid service models that combine human expertise with digital efficiency. These collaborations enable established firms to enhance their technology capabilities without substantial internal development investments.

Sustainable Finance Initiatives expand across European wealth management firms as regulatory requirements and client demand drive ESG integration across investment processes, product development, and client advisory services. Firms develop specialized sustainable investing teams and capabilities to meet growing market demand.

Cross-Border Expansion strategies focus on serving internationally mobile wealthy clients and expanding into emerging markets where European wealth management expertise provides competitive advantages. Firms establish offices in key markets while maintaining European operational centers.

Next-Generation Platforms launch across European markets as wealth managers develop digital-first service models targeting younger wealthy clients and those seeking cost-effective investment management solutions combined with professional advisory support.

Technology Investment priorities should focus on client-facing digital platforms, automated portfolio management systems, and comprehensive data analytics capabilities that enhance service delivery while improving operational efficiency. Firms that successfully implement integrated technology solutions achieve competitive advantages in client acquisition and retention.

Talent Development strategies must address evolving skill requirements including digital literacy, sustainable investing expertise, and next-generation client relationship management. Wealth management firms should invest in comprehensive training programs and competitive compensation structures to attract and retain top talent.

Service Model Evolution requires balancing traditional relationship-based approaches with digital efficiency and transparency that younger clients expect. Successful firms develop hybrid models that maintain personal advisory relationships while providing digital accessibility and real-time communication capabilities.

Regulatory Preparation involves proactive compliance system development and process optimization that anticipates future regulatory requirements while managing current obligations efficiently. Firms should view regulatory excellence as a competitive advantage rather than merely a compliance burden.

Market Positioning strategies should emphasize specialized expertise, unique value propositions, and differentiated service offerings that justify premium pricing in an increasingly competitive market environment. Clear positioning helps firms attract appropriate clients and maintain profitability.

Growth trajectory for European wealth management remains positive despite economic uncertainties, with projected expansion driven by continued wealth creation, demographic transitions, and increasing demand for sophisticated financial advisory services. MWR analysis suggests sustained growth rates of 6-8% annually across major European markets over the next five years.

Digital transformation will accelerate as firms complete technology infrastructure modernization and develop comprehensive digital service capabilities. The integration of artificial intelligence, machine learning, and advanced analytics will enhance investment management processes and client advisory services while improving operational efficiency.

Sustainable investing will become mainstream across European wealth management as regulatory requirements and client preferences drive ESG integration across all investment processes. Firms that develop comprehensive sustainable investing capabilities will achieve competitive advantages in client acquisition and retention.

Market consolidation will continue as smaller advisory firms seek succession solutions and larger institutions pursue geographic expansion and capability enhancement through strategic acquisitions. This consolidation will create more comprehensive service providers while maintaining specialized boutique firms serving niche markets.

Cross-border opportunities will expand as European wealth managers leverage their regulatory expertise and sophisticated service capabilities to serve international clients and expand into emerging markets. The combination of European financial center advantages with global reach will drive continued market growth.

European wealth management demonstrates remarkable resilience and growth potential despite facing significant challenges from regulatory complexity, technological disruption, and evolving client expectations. The market’s fundamental strengths including sophisticated regulatory frameworks, deep financial expertise, and established client relationships provide solid foundations for continued expansion and innovation.

Success factors for European wealth management firms center on balancing traditional relationship-based service excellence with digital innovation, sustainable investing capabilities, and comprehensive technology integration. Firms that successfully navigate this balance while maintaining regulatory compliance and operational efficiency will capture the greatest market opportunities.

Future growth will be driven by continued wealth creation across European economies, substantial intergenerational wealth transfers, and increasing demand for sophisticated advisory services that address complex financial planning needs. The market’s evolution toward hybrid service models combining human expertise with digital efficiency positions European wealth management for sustained long-term success in serving the world’s wealthy families and individuals.

What is Wealth Management?

Wealth management refers to a comprehensive financial service that combines investment management, financial planning, tax services, and estate planning to help clients grow and preserve their wealth. It typically caters to high-net-worth individuals and families, providing tailored strategies to meet their unique financial goals.

What are the key players in the European Wealth Management Market?

Key players in the European Wealth Management Market include UBS Group AG, Credit Suisse Group AG, and Deutsche Bank AG, among others. These firms offer a range of services from investment advice to estate planning, catering to affluent clients across Europe.

What are the growth factors driving the European Wealth Management Market?

The European Wealth Management Market is driven by factors such as increasing high-net-worth individuals, rising disposable incomes, and a growing demand for personalized financial services. Additionally, the expansion of investment opportunities in alternative assets is also contributing to market growth.

What challenges does the European Wealth Management Market face?

Challenges in the European Wealth Management Market include regulatory compliance, market volatility, and the need for digital transformation. Firms must navigate complex regulations while adapting to changing client expectations and technological advancements.

What opportunities exist in the European Wealth Management Market?

Opportunities in the European Wealth Management Market include the integration of technology in service delivery, the rise of sustainable investing, and the expansion into emerging markets. Firms that leverage digital tools and focus on ESG investments can attract a broader client base.

What trends are shaping the European Wealth Management Market?

Trends in the European Wealth Management Market include the increasing use of robo-advisors, a shift towards holistic financial planning, and a growing emphasis on client education. These trends reflect the evolving preferences of clients seeking more accessible and transparent wealth management solutions.

European Wealth Management Market

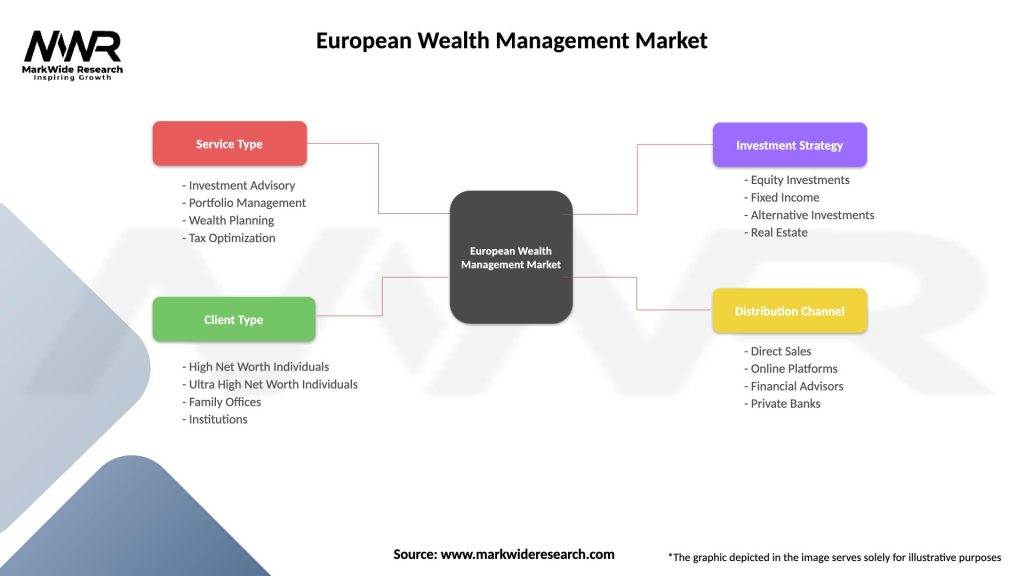

| Segmentation Details | Description |

|---|---|

| Service Type | Investment Advisory, Portfolio Management, Wealth Planning, Tax Optimization |

| Client Type | High Net Worth Individuals, Ultra High Net Worth Individuals, Family Offices, Institutions |

| Investment Strategy | Equity Investments, Fixed Income, Alternative Investments, Real Estate |

| Distribution Channel | Direct Sales, Online Platforms, Financial Advisors, Private Banks |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the European Wealth Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at