444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The European vegan supplements market represents a dynamic and rapidly expanding sector within the broader nutraceuticals industry, driven by increasing consumer awareness of plant-based nutrition and sustainable lifestyle choices. Market dynamics indicate significant growth momentum across key European regions, with countries like Germany, the United Kingdom, France, and the Netherlands leading adoption rates. The market encompasses a comprehensive range of plant-based nutritional products, including vitamins, minerals, protein powders, omega fatty acids, and specialized formulations designed to address specific dietary gaps in vegan diets.

Consumer preferences have shifted dramatically toward cruelty-free and environmentally sustainable supplement options, with adoption rates reaching 23% among European consumers according to recent industry analysis. The market benefits from robust regulatory frameworks supporting supplement safety and efficacy, particularly under European Food Safety Authority guidelines. Innovation trends focus on bioavailability enhancement, sustainable packaging solutions, and targeted formulations addressing common nutritional concerns in plant-based diets, including B12, iron, zinc, and omega-3 fatty acids.

Distribution channels have evolved to include specialized health food stores, online platforms, pharmacies, and mainstream retail outlets, creating multiple touchpoints for consumer engagement. The market demonstrates strong growth potential with projected expansion rates of 8.2% CAGR through the forecast period, supported by increasing veganism adoption, health consciousness, and regulatory support for plant-based nutrition products across European markets.

The European vegan supplements market refers to the comprehensive ecosystem of plant-based nutritional products specifically formulated without animal-derived ingredients, designed to support optimal health and address potential nutritional gaps in vegan and plant-based diets across European consumer segments.

Vegan supplements encompass a diverse range of products including plant-based vitamins, minerals, protein powders, amino acids, omega fatty acids derived from algae, probiotics, and specialized formulations targeting specific health concerns. These products are manufactured using exclusively plant-based ingredients and processing methods that align with vegan ethical principles, avoiding animal testing and animal-derived components throughout the production chain.

Market scope includes various product categories such as multivitamins, single-nutrient supplements, sports nutrition products, beauty supplements, and therapeutic formulations. The market serves multiple consumer segments including committed vegans, vegetarians, flexitarians, and health-conscious individuals seeking plant-based alternatives to traditional supplements. Quality standards emphasize third-party certifications, organic sourcing, and transparent labeling practices that build consumer trust and market credibility.

Market performance in the European vegan supplements sector demonstrates exceptional growth trajectory, driven by fundamental shifts in consumer dietary preferences and increasing awareness of plant-based nutrition benefits. The market has experienced substantial expansion across all major European regions, with particularly strong performance in Western European countries where vegan lifestyle adoption rates exceed 12% of the adult population.

Key growth drivers include rising veganism and vegetarianism, increased health consciousness, environmental sustainability concerns, and improved product availability through diverse distribution channels. The market benefits from supportive regulatory environments, growing scientific evidence supporting plant-based nutrition, and significant investments in research and development by leading manufacturers.

Product innovation focuses on enhanced bioavailability, improved taste profiles, sustainable packaging solutions, and targeted formulations addressing specific nutritional needs. Major market participants have expanded their vegan product portfolios, with traditional supplement companies introducing dedicated plant-based lines alongside specialized vegan brands gaining market share. Distribution expansion through e-commerce platforms has accelerated market accessibility, with online sales representing 34% of total market volume across European markets.

Future prospects remain highly positive, supported by demographic trends favoring plant-based lifestyles, continued product innovation, and expanding consumer awareness of vegan supplement benefits. The market is positioned for sustained growth with opportunities in emerging product categories and untapped regional markets.

Consumer behavior analysis reveals distinct purchasing patterns and preferences driving market evolution across European regions. The following insights highlight critical market dynamics:

Primary growth catalysts propelling the European vegan supplements market include fundamental societal shifts toward plant-based lifestyles and increased awareness of nutrition optimization. Veganism adoption continues accelerating across European populations, with growth rates reaching 15% annually in key markets, creating expanding consumer base for specialized plant-based nutritional products.

Health consciousness trends drive consumer demand for clean-label, natural supplement alternatives that align with holistic wellness philosophies. Scientific research supporting plant-based nutrition benefits has strengthened consumer confidence in vegan supplement efficacy, particularly for cardiovascular health, digestive wellness, and immune system support. Medical community endorsement of plant-based diets has legitimized vegan supplements as essential components of optimal nutrition strategies.

Environmental sustainability concerns motivate consumers to choose products with reduced carbon footprints and ethical production methods. The livestock industry’s environmental impact has heightened awareness of plant-based alternatives across all product categories, including nutritional supplements. Regulatory support through favorable policies and clear labeling requirements has facilitated market growth by building consumer trust and ensuring product quality standards.

Innovation advancement in plant-based ingredient sourcing and bioavailability enhancement has improved product effectiveness and consumer satisfaction. Distribution expansion through multiple channels has increased product accessibility, while digital marketing strategies have effectively reached target demographics through social media and influencer partnerships.

Cost considerations present significant challenges for market expansion, as vegan supplements typically command premium pricing compared to conventional alternatives. Manufacturing complexities associated with plant-based ingredient sourcing and specialized processing requirements contribute to higher production costs, potentially limiting market accessibility for price-sensitive consumer segments.

Bioavailability concerns regarding certain nutrients in plant-based forms create consumer skepticism and require ongoing education efforts. Some essential nutrients, particularly vitamin B12, iron, and omega-3 fatty acids, present absorption challenges in plant-based formulations, necessitating advanced delivery technologies and higher dosages that increase product costs.

Regulatory complexities across different European markets create compliance challenges for manufacturers seeking pan-European distribution. Varying national requirements for supplement registration, labeling, and health claims can complicate market entry strategies and increase operational costs for companies operating across multiple jurisdictions.

Consumer education gaps regarding vegan nutrition requirements and supplement necessity limit market penetration in certain demographic segments. Taste and texture challenges associated with plant-based formulations can impact consumer acceptance, particularly for protein powders and functional beverages. Supply chain limitations for specialized plant-based ingredients may create availability constraints and price volatility that affect market stability.

Emerging market segments present substantial growth opportunities, particularly in sports nutrition and beauty supplement categories where vegan formulations are gaining mainstream acceptance. Product innovation potential exists in developing novel delivery systems, combination formulations, and functional food integration that enhance consumer convenience and compliance.

Geographic expansion opportunities remain significant in Eastern European markets where vegan lifestyle adoption is accelerating but supplement availability remains limited. Partnership opportunities with healthcare providers, fitness centers, and wellness practitioners can expand market reach and build professional endorsement for vegan supplement efficacy.

Technology integration through personalized nutrition platforms and AI-driven supplement recommendations can create competitive advantages and improve customer retention. Subscription model development offers recurring revenue opportunities while providing consumers with convenient, automated supplement delivery systems.

Sustainability positioning can differentiate brands in increasingly competitive markets, with opportunities for carbon-neutral products, biodegradable packaging, and circular economy initiatives. Educational content marketing can build brand authority while addressing consumer knowledge gaps about vegan nutrition and supplement benefits. Private label opportunities with major retailers can accelerate market penetration and reduce distribution barriers.

Supply chain evolution reflects increasing sophistication in plant-based ingredient sourcing and processing technologies. Vertical integration strategies among leading manufacturers have improved quality control and cost management, while strategic partnerships with specialized ingredient suppliers have enhanced product innovation capabilities.

Competitive intensity has increased significantly as traditional supplement companies expand vegan product lines alongside specialized plant-based brands gaining market share. Price competition remains moderate due to premium positioning strategies and consumer willingness to pay for ethical alignment, though value-oriented segments are emerging.

Innovation cycles have accelerated with focus on bioavailability enhancement, taste improvement, and sustainable packaging solutions. Consumer engagement strategies emphasize education, transparency, and community building through digital platforms and social media channels. Regulatory landscape continues evolving with increasing support for plant-based nutrition claims and clearer labeling requirements.

Distribution channel dynamics show continued shift toward online platforms, with omnichannel strategies becoming essential for market success. Investment activity remains robust with venture capital and private equity funding supporting innovation and market expansion initiatives across the European vegan supplements ecosystem.

Comprehensive market analysis employed multiple research methodologies to ensure accuracy and reliability of market insights and projections. Primary research included extensive surveys of European consumers across major markets, in-depth interviews with industry executives, and focus groups with target demographic segments to understand purchasing behaviors and preferences.

Secondary research encompassed analysis of industry reports, regulatory filings, company financial statements, and trade association data to establish market baselines and competitive landscapes. Data triangulation methods validated findings across multiple sources to ensure consistency and accuracy of market estimates and growth projections.

Market sizing methodology utilized bottom-up and top-down approaches, analyzing product categories, distribution channels, and regional markets to develop comprehensive market assessments. Trend analysis incorporated historical data spanning five years to identify growth patterns and market evolution trajectories.

Expert validation through industry advisory panels and academic partnerships ensured research findings reflected current market realities and future growth potential. Statistical modeling employed advanced analytical techniques to project market growth scenarios and identify key success factors for market participants.

Western European markets dominate the regional landscape, with Germany representing the largest market share at 28% of total European volume, driven by strong vegan lifestyle adoption and well-established distribution networks. United Kingdom follows as the second-largest market, benefiting from high consumer awareness and favorable regulatory environment supporting plant-based nutrition claims.

France and Netherlands demonstrate robust growth trajectories with increasing veganism rates and expanding retail availability. Scandinavian markets including Sweden, Norway, and Denmark show exceptional per-capita consumption rates, reflecting high disposable income and strong environmental consciousness among consumers.

Southern European markets including Italy, Spain, and Portugal present emerging opportunities with growing vegan populations and increasing health consciousness, though adoption rates remain below Northern European levels. Eastern European markets represent significant growth potential with expanding middle-class populations and increasing exposure to plant-based lifestyle trends.

Switzerland and Austria demonstrate premium market characteristics with high-value product preferences and strong organic supplement demand. Regional distribution patterns show concentration in urban areas with higher education levels and disposable income, while rural markets present untapped expansion opportunities across all European regions.

Market leadership reflects diverse competitive dynamics with established supplement companies, specialized vegan brands, and emerging direct-to-consumer players competing across different market segments. Key market participants include:

Competitive strategies emphasize product innovation, quality certifications, sustainable practices, and direct consumer engagement through digital channels. Market consolidation trends show increasing acquisition activity as larger companies seek to expand vegan supplement capabilities and market reach.

Product category segmentation reveals diverse market structure addressing various consumer needs and preferences across the European vegan supplements landscape:

By Product Type:

By Distribution Channel:

Vitamin supplements dominate market share with B12 formulations representing critical category due to limited plant-based sources. Multivitamin products show strong growth as consumers seek convenient, comprehensive nutrition solutions. Vitamin D supplements gain importance particularly in Northern European markets with limited sunlight exposure.

Mineral supplements address key nutritional gaps with iron supplements showing highest demand among female consumers. Calcium formulations target bone health concerns while zinc supplements support immune system function. Bioavailability enhancement through chelation and combination formulations improves absorption rates and consumer satisfaction.

Protein supplements experience rapid growth driven by fitness trends and sports nutrition demand. Plant-based protein powders from pea, hemp, and rice sources offer complete amino acid profiles. Ready-to-drink formats expand convenience options while maintaining nutritional efficacy.

Omega fatty acid supplements from algae sources provide sustainable alternatives to fish oil with comparable EPA and DHA content. Probiotic supplements support digestive health with plant-based strains and prebiotic combinations. Specialty categories including beauty supplements and cognitive health formulations represent emerging growth opportunities with premium positioning potential.

Manufacturers benefit from expanding market opportunities and premium pricing potential in the growing vegan supplements sector. Product differentiation through vegan positioning creates competitive advantages and brand loyalty among target consumer segments. Innovation opportunities in plant-based formulations drive research and development investments with potential for patent protection and market exclusivity.

Retailers gain from higher margin products and increased customer traffic from health-conscious consumer segments. Category expansion into vegan supplements attracts new customer demographics while supporting existing customer retention. Private label opportunities offer additional revenue streams and brand building potential.

Consumers receive ethical alignment with personal values while accessing high-quality nutritional support for plant-based lifestyles. Health benefits include reduced environmental impact, absence of animal-derived ingredients, and often superior ingredient quality through organic sourcing. Product transparency and third-party certifications provide confidence in supplement safety and efficacy.

Healthcare providers can recommend evidence-based nutritional support for patients adopting plant-based diets. Environmental stakeholders benefit from reduced animal agriculture demand and sustainable ingredient sourcing practices throughout the vegan supplements supply chain.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalization trends drive demand for customized supplement formulations based on individual dietary patterns, health goals, and genetic factors. Technology integration through mobile apps and wearable devices enables personalized nutrition recommendations and supplement optimization strategies.

Sustainable packaging innovations address environmental concerns with biodegradable materials, refillable containers, and carbon-neutral shipping options. Transparency initiatives include blockchain tracking, ingredient sourcing disclosure, and third-party testing results to build consumer trust and brand credibility.

Functional food integration expands beyond traditional supplement formats into fortified beverages, snack bars, and meal replacement products. Subscription model adoption provides convenience and cost savings while building recurring customer relationships and predictable revenue streams.

Clean label movement emphasizes minimal ingredient lists, organic certifications, and absence of artificial additives. Sports nutrition expansion targets active lifestyle consumers with plant-based performance supplements and recovery formulations. Beauty supplement growth addresses skin, hair, and nail health through plant-based collagen alternatives and antioxidant formulations.

Product launches continue accelerating with major supplement companies introducing dedicated vegan product lines and specialized formulations. Acquisition activity shows established companies acquiring vegan supplement brands to expand market presence and capabilities.

Research investments focus on bioavailability enhancement, novel plant-based ingredients, and clinical studies supporting vegan supplement efficacy. Manufacturing capacity expansion reflects growing demand with new production facilities and equipment investments across European markets.

Certification programs have expanded with new vegan verification standards and quality assurance protocols. Distribution partnerships between online platforms and traditional retailers create omnichannel strategies for market expansion. Regulatory approvals for new health claims and ingredient applications support market development and consumer education efforts.

Technology partnerships integrate artificial intelligence and data analytics into product development and customer engagement strategies. Sustainability initiatives include carbon-neutral manufacturing, renewable energy adoption, and circular economy practices throughout the supply chain.

MarkWide Research recommends that market participants focus on product innovation and quality differentiation to maintain competitive advantages in the expanding European vegan supplements market. Investment priorities should emphasize research and development, particularly in bioavailability enhancement and novel delivery systems that address current formulation challenges.

Market entry strategies should prioritize high-growth segments including sports nutrition and beauty supplements where consumer acceptance of plant-based alternatives is accelerating. Distribution expansion through omnichannel approaches combining online platforms with traditional retail partnerships will maximize market reach and customer engagement opportunities.

Brand positioning should emphasize transparency, sustainability, and scientific validation to build consumer trust and justify premium pricing strategies. Consumer education initiatives through content marketing and healthcare professional partnerships will address knowledge gaps and expand market penetration in underserved demographic segments.

Geographic expansion into Eastern European markets presents significant growth opportunities as vegan lifestyle adoption accelerates and disposable income increases. Partnership strategies with fitness centers, wellness practitioners, and healthcare providers can build professional endorsement and expand market credibility.

Long-term growth prospects remain exceptionally positive for the European vegan supplements market, supported by fundamental demographic and lifestyle trends favoring plant-based nutrition. Market expansion is projected to continue at robust rates with growth acceleration expected in emerging product categories and geographic regions.

Innovation trajectories will focus on personalized nutrition solutions, enhanced bioavailability formulations, and sustainable packaging technologies. MWR analysis indicates that companies investing in research and development will capture disproportionate market share as consumer sophistication increases and product differentiation becomes more critical.

Regulatory evolution is expected to support market growth through clearer labeling requirements and expanded health claim approvals for plant-based supplements. Consumer adoption patterns suggest mainstream market penetration will accelerate as product quality improves and pricing becomes more competitive through scale economies.

Technology integration will transform customer engagement and product development processes, with artificial intelligence and data analytics driving personalized supplement recommendations and optimized formulations. Sustainability requirements will intensify, creating competitive advantages for companies implementing comprehensive environmental responsibility programs throughout their operations and supply chains.

The European vegan supplements market represents a compelling growth opportunity characterized by strong consumer demand, favorable regulatory environment, and significant innovation potential. Market fundamentals remain robust with expanding vegan populations, increasing health consciousness, and growing environmental awareness driving sustained demand for plant-based nutritional products.

Competitive dynamics favor companies that prioritize product quality, innovation, and consumer education while building transparent, sustainable business practices. Success factors include bioavailability enhancement, premium positioning, omnichannel distribution, and strategic partnerships with healthcare and fitness industry stakeholders.

Future growth will be driven by product innovation, geographic expansion, and category diversification into emerging segments including personalized nutrition and functional foods. The market’s evolution toward mainstream acceptance positions early movers and innovation leaders for sustained competitive advantages and superior financial performance in the expanding European vegan supplements market.

What is Vegan Supplements?

Vegan supplements are dietary products made from plant-based ingredients that provide essential nutrients without any animal-derived components. They are popular among individuals seeking to maintain a vegan lifestyle or enhance their nutrition with natural sources.

What are the key players in the European Vegan Supplements Market?

Key players in the European Vegan Supplements Market include companies like MyVegan, Garden of Life, and Sunwarrior, which offer a range of plant-based protein powders, vitamins, and minerals. These companies focus on innovation and quality to meet the growing demand for vegan products among health-conscious consumers.

What are the growth factors driving the European Vegan Supplements Market?

The European Vegan Supplements Market is driven by increasing consumer awareness of health and wellness, a rise in veganism, and the demand for clean-label products. Additionally, the growing prevalence of dietary restrictions and the desire for sustainable nutrition options contribute to market growth.

What challenges does the European Vegan Supplements Market face?

The European Vegan Supplements Market faces challenges such as regulatory hurdles regarding labeling and health claims, as well as competition from traditional supplements. Additionally, consumer skepticism about the efficacy of vegan supplements can hinder market expansion.

What opportunities exist in the European Vegan Supplements Market?

Opportunities in the European Vegan Supplements Market include the potential for product innovation, such as new formulations and flavors, and the expansion into emerging markets. There is also a growing trend towards personalized nutrition, which can create niche markets for tailored vegan supplements.

What trends are shaping the European Vegan Supplements Market?

Trends shaping the European Vegan Supplements Market include the rise of plant-based diets, increased focus on sustainability, and the incorporation of superfoods into supplements. Additionally, the use of technology in product development and marketing is becoming more prevalent, appealing to a tech-savvy consumer base.

European Vegan Supplements Market

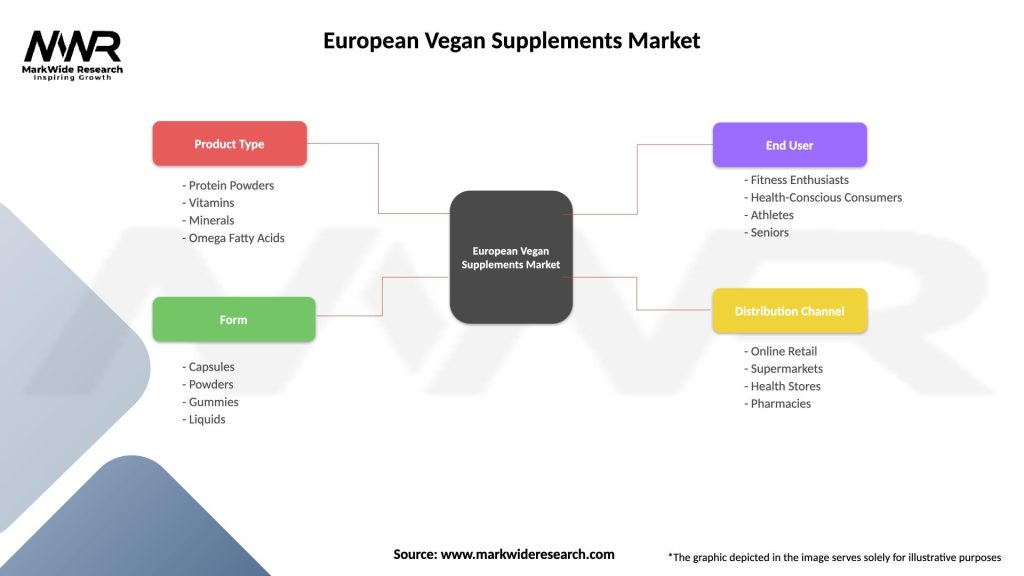

| Segmentation Details | Description |

|---|---|

| Product Type | Protein Powders, Vitamins, Minerals, Omega Fatty Acids |

| Form | Capsules, Powders, Gummies, Liquids |

| End User | Fitness Enthusiasts, Health-Conscious Consumers, Athletes, Seniors |

| Distribution Channel | Online Retail, Supermarkets, Health Stores, Pharmacies |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the European Vegan Supplements Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at