444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The European travel insurance market represents a dynamic and rapidly evolving sector within the broader insurance industry, driven by increasing travel frequency, heightened awareness of travel risks, and regulatory requirements across European Union member states. This comprehensive market encompasses various insurance products designed to protect travelers against unforeseen circumstances, medical emergencies, trip cancellations, and other travel-related risks.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over recent years. The market has demonstrated remarkable resilience, particularly following the global pandemic, as travelers increasingly recognize the importance of comprehensive coverage. Digital transformation has significantly influenced market evolution, with approximately 67% of policies now purchased through online platforms and mobile applications.

Regional variations across European countries create diverse market opportunities, with Western European nations showing higher penetration rates compared to Eastern European markets. The United Kingdom, Germany, France, and Italy collectively represent 58% of total market activity, while emerging markets in Central and Eastern Europe demonstrate accelerating adoption rates. Consumer behavior patterns reveal increasing demand for customizable policies, comprehensive medical coverage, and digital-first service delivery models.

The European travel insurance market refers to the comprehensive ecosystem of insurance products, services, and providers operating across European countries to offer financial protection and assistance services to travelers. This market encompasses various insurance coverage types including medical expenses, trip cancellation, baggage protection, emergency evacuation, and specialized coverage for adventure activities and business travel.

Core components of this market include traditional insurance companies, specialized travel insurers, comparison platforms, and technology-enabled service providers. The market operates through multiple distribution channels including direct sales, travel agencies, online platforms, and embedded insurance solutions integrated with travel booking systems. Regulatory frameworks vary across European jurisdictions, creating both opportunities and challenges for market participants seeking to operate across multiple countries.

Market participants range from established multinational insurance corporations to innovative insurtech startups, each contributing to the market’s evolution through product innovation, technological advancement, and customer experience enhancement. The market serves diverse customer segments including leisure travelers, business travelers, adventure seekers, and specialized groups requiring tailored coverage solutions.

Strategic analysis reveals the European travel insurance market as a high-growth sector characterized by increasing consumer awareness, technological innovation, and evolving risk landscapes. The market has successfully adapted to changing travel patterns, with flexible policy structures and enhanced digital capabilities driving customer acquisition and retention.

Key market drivers include rising travel volumes, increased awareness of travel risks, regulatory requirements in certain jurisdictions, and growing demand for comprehensive coverage options. The market benefits from demographic trends showing increased travel propensity among younger generations, with millennials and Gen Z travelers representing 42% of policy purchases. Digital adoption has accelerated significantly, with mobile-first approaches and AI-powered customer service becoming standard market practices.

Competitive landscape features both traditional insurance giants and agile insurtech companies, creating a dynamic environment that fosters innovation and customer-centric solutions. Market consolidation trends are evident, with strategic partnerships and acquisitions reshaping the competitive structure. Product diversification has expanded beyond basic coverage to include specialized policies for remote work, extended stays, and adventure travel activities.

Market intelligence reveals several critical insights shaping the European travel insurance landscape. Consumer preferences have shifted dramatically toward comprehensive, flexible policies that can be easily modified or cancelled. The market demonstrates strong correlation between travel recovery patterns and insurance adoption rates across different European regions.

Primary growth drivers propelling the European travel insurance market include fundamental shifts in travel behavior, regulatory developments, and technological advancement. The increasing frequency of international travel, coupled with growing awareness of potential risks, creates sustained demand for comprehensive insurance coverage.

Regulatory requirements in several European countries mandate travel insurance for certain visa categories, creating a stable foundation for market growth. The European Health Insurance Card (EHIC) limitations have heightened awareness of the need for additional coverage, particularly for non-EU travel and specialized medical situations. Brexit implications have further emphasized the importance of comprehensive travel insurance for UK residents traveling to EU countries.

Technological innovation serves as a significant market driver, enabling insurers to offer more personalized products, streamlined purchasing processes, and enhanced customer service capabilities. Data analytics and artificial intelligence allow for better risk assessment and pricing strategies, while mobile technology facilitates instant policy purchases and claims processing. Consumer education initiatives and increased media coverage of travel-related incidents have elevated awareness of potential risks and the value of insurance protection.

Economic factors including rising disposable incomes, increased leisure time, and the growth of the gig economy have contributed to higher travel volumes and corresponding insurance demand. The emergence of adventure tourism and extreme sports activities has created demand for specialized coverage options, driving product innovation and market expansion.

Market challenges facing the European travel insurance sector include regulatory complexity, price sensitivity among consumers, and the inherent difficulty of standardizing products across diverse European markets. Regulatory fragmentation across different European jurisdictions creates compliance challenges and increases operational costs for companies seeking to operate across multiple countries.

Consumer price sensitivity remains a significant restraint, particularly in price-conscious market segments where travelers view insurance as an optional expense rather than essential protection. Complex policy terms and conditions often deter potential customers, while lack of transparency in coverage details and exclusions can lead to customer dissatisfaction and reduced market confidence.

Competitive pressure from low-cost carriers and budget travel options has intensified focus on cost reduction, sometimes at the expense of comprehensive coverage. Fraud concerns and false claims impact the entire market through increased premiums and more stringent underwriting requirements. Economic uncertainty and fluctuating exchange rates can affect travel patterns and insurance demand, particularly during periods of economic instability.

Technology adoption barriers among certain demographic segments limit the effectiveness of digital-first strategies, while concerns about data privacy and security can impact customer willingness to engage with online platforms. Market saturation in mature European markets creates challenges for growth, requiring companies to focus on innovation and differentiation rather than simple market expansion.

Emerging opportunities within the European travel insurance market span technological innovation, market expansion, and product diversification. The growing trend toward sustainable tourism creates opportunities for specialized eco-friendly travel insurance products that align with environmentally conscious travel choices.

Digital health integration presents significant opportunities for insurers to partner with healthcare providers and telemedicine platforms, offering comprehensive health monitoring and emergency response services. Blockchain technology offers potential for streamlined claims processing, enhanced fraud detection, and improved transparency in policy management and settlement processes.

Underserved market segments including senior travelers, digital nomads, and adventure sports enthusiasts represent substantial growth opportunities. The increasing popularity of remote work arrangements has created demand for specialized coverage addressing the unique risks associated with location-independent work and extended travel periods.

Partnership opportunities with travel technology companies, accommodation providers, and transportation services enable the development of integrated insurance solutions that enhance the overall travel experience. Artificial intelligence and machine learning applications offer opportunities for personalized risk assessment, dynamic pricing models, and predictive analytics that can improve both customer satisfaction and operational efficiency.

Market expansion into Eastern European countries and emerging markets presents growth opportunities, particularly as economic development and increased travel propensity drive demand for insurance products. Corporate travel insurance represents an underexploited segment with significant potential for specialized products addressing business travel risks and duty of care requirements.

Market dynamics within the European travel insurance sector reflect the complex interplay of consumer behavior, technological advancement, regulatory evolution, and competitive pressures. The market demonstrates cyclical patterns closely aligned with seasonal travel trends, economic conditions, and geopolitical stability.

Supply-side dynamics are characterized by increasing consolidation among traditional insurers, while new entrants leverage technology to disrupt established business models. Insurtech companies are driving innovation through API-first approaches, embedded insurance solutions, and AI-powered customer service capabilities. Traditional insurers are responding through digital transformation initiatives, strategic partnerships, and acquisition strategies.

Demand-side dynamics reveal evolving customer expectations for seamless digital experiences, transparent pricing, and comprehensive coverage options. Customer loyalty patterns show increasing willingness to switch providers for better value propositions, driving competitive pressure and innovation. Generational differences in purchasing behavior and coverage preferences create opportunities for targeted product development and marketing strategies.

Regulatory dynamics continue to evolve, with increasing focus on consumer protection, data privacy, and cross-border insurance provision. Brexit implications have created new regulatory considerations and market opportunities, while EU insurance directives influence product standardization and market access requirements. Economic dynamics including currency fluctuations, inflation, and economic growth patterns directly impact travel volumes and insurance demand across European markets.

Comprehensive research methodology employed for analyzing the European travel insurance market incorporates both primary and secondary research approaches, ensuring robust data collection and analysis. Primary research includes extensive surveys of insurance providers, travel agencies, and consumers across major European markets, providing direct insights into market trends, preferences, and challenges.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and market intelligence databases. Quantitative analysis utilizes statistical modeling and trend analysis to identify growth patterns, market share distributions, and forecasting scenarios. Qualitative research includes in-depth interviews with industry executives, regulatory officials, and market experts to understand strategic perspectives and future market directions.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources, expert review, and statistical verification methods. Market segmentation analysis employs demographic, geographic, and behavioral criteria to identify distinct market segments and their characteristics. Competitive analysis utilizes proprietary frameworks to assess market positioning, strategic capabilities, and competitive advantages of key market participants.

Forecasting methodology combines historical trend analysis, econometric modeling, and scenario planning to develop realistic market projections. Regional analysis incorporates country-specific factors including regulatory environments, economic conditions, and cultural preferences that influence market dynamics. Technology impact assessment evaluates the influence of emerging technologies on market evolution and competitive landscapes.

Regional market analysis reveals significant variations in travel insurance adoption, regulatory frameworks, and competitive dynamics across European countries. Western European markets including Germany, France, and the United Kingdom demonstrate mature market characteristics with high penetration rates and sophisticated product offerings.

Germany represents the largest European market by volume, with 23% market share, driven by high travel propensity and strong regulatory requirements for certain travel categories. Digital adoption in Germany has accelerated, with online purchases representing 71% of total policy sales. France demonstrates strong growth in comprehensive coverage products, with annual policies gaining popularity among frequent European travelers.

United Kingdom market dynamics have been significantly influenced by Brexit, creating increased demand for comprehensive EU travel coverage. Post-Brexit travel insurance requirements have driven market growth, with specialized products addressing healthcare coverage and extended stay requirements. Nordic countries including Sweden, Norway, and Denmark show the highest per-capita insurance adoption rates in Europe.

Eastern European markets present significant growth opportunities, with countries like Poland, Czech Republic, and Hungary experiencing rapid market development. Market penetration rates in Eastern Europe average 34% compared to 68% in Western European markets, indicating substantial growth potential. Southern European countries including Spain, Italy, and Portugal benefit from strong domestic tourism markets and increasing international visitor volumes.

Regulatory harmonization efforts across EU member states are gradually reducing market fragmentation, while maintaining country-specific requirements that influence product development and distribution strategies.

Competitive landscape analysis reveals a diverse ecosystem of market participants ranging from established multinational insurance corporations to innovative technology-driven startups. Market leadership is distributed among several key players, each with distinct competitive advantages and strategic positioning.

Competitive strategies focus on digital transformation, product innovation, and strategic partnerships to enhance market position. Technology investments in AI-powered customer service, mobile applications, and automated claims processing have become key differentiators. Market consolidation through mergers and acquisitions continues to reshape the competitive landscape, with companies seeking to expand geographic coverage and technological capabilities.

Market segmentation analysis reveals distinct categories based on coverage type, customer demographics, distribution channels, and geographic regions. Product segmentation encompasses single-trip policies, annual multi-trip coverage, specialized adventure travel insurance, and comprehensive business travel solutions.

By Coverage Type:

By Customer Segment:

By Distribution Channel:

Category analysis provides detailed insights into specific market segments and their unique characteristics, growth patterns, and competitive dynamics. Medical coverage represents the largest and most critical category, driven by increasing healthcare costs and awareness of medical risks during travel.

Single-trip policies continue to dominate the market, particularly among occasional travelers and first-time insurance purchasers. However, annual multi-trip policies are gaining market share among frequent travelers, offering better value and convenience. Premium annual policies with enhanced coverage limits and additional benefits appeal to affluent travelers and business professionals.

Adventure travel insurance represents a high-growth niche category, driven by increasing popularity of extreme sports and adventure tourism. Specialized coverage for activities such as mountaineering, scuba diving, and winter sports commands premium pricing while addressing unique risk profiles. Digital nomad insurance has emerged as a distinct category, addressing the needs of remote workers and extended-stay travelers.

Corporate travel insurance demonstrates steady growth, driven by duty of care requirements and increasing business travel volumes. Group policies for organizations and travel groups offer economies of scale while providing comprehensive coverage for multiple travelers. Event-specific insurance for conferences, trade shows, and corporate events represents an emerging opportunity within the business segment.

Regional preferences influence category performance, with Northern European markets showing higher adoption of comprehensive coverage, while price-sensitive markets focus on basic medical and cancellation protection. Seasonal variations impact category demand, with winter sports coverage peaking during ski seasons and adventure travel insurance aligning with summer vacation periods.

Industry participants across the European travel insurance ecosystem realize significant benefits through market participation, technological advancement, and strategic positioning. Insurance providers benefit from diversified revenue streams, reduced risk concentration, and opportunities for cross-selling additional products and services.

For Insurance Companies:

For Travel Industry Partners:

For Consumers:

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the European travel insurance market reflect broader changes in travel behavior, technology adoption, and consumer expectations. Digital-first strategies have become essential, with companies investing heavily in mobile applications, AI-powered customer service, and automated claims processing capabilities.

Personalization trends are driving demand for customizable policies that allow travelers to select specific coverage components based on individual needs and risk profiles. Dynamic pricing models utilizing real-time data and risk assessment algorithms enable more accurate pricing and competitive positioning. Subscription-based models are gaining traction among frequent travelers, offering continuous coverage and simplified policy management.

Sustainability focus is influencing product development, with insurers developing eco-friendly travel insurance options that align with sustainable tourism practices. Health and wellness integration reflects growing consumer interest in health monitoring and preventive care during travel. Blockchain technology adoption is improving claims processing transparency and reducing fraud risks.

Embedded insurance solutions integrated directly into travel booking platforms are streamlining the purchase process and increasing conversion rates. Artificial intelligence applications in customer service, risk assessment, and fraud detection are enhancing operational efficiency and customer satisfaction. Micro-insurance products targeting specific risks or short-duration travel are expanding market accessibility and addressing price-sensitive segments.

Remote work trends have created demand for specialized coverage addressing the unique risks associated with digital nomad lifestyles and extended travel periods. Real-time assistance services leveraging GPS technology and mobile connectivity provide immediate support during travel emergencies and medical situations.

Recent industry developments highlight the dynamic nature of the European travel insurance market and the continuous evolution of products, services, and business models. Strategic partnerships between insurance providers and technology companies have accelerated digital transformation initiatives and enhanced customer experience capabilities.

Regulatory developments including updated EU insurance directives and Brexit-related changes have influenced market structure and operational requirements. Product innovations addressing pandemic-related risks, remote work travel, and adventure tourism have expanded market coverage and appeal to new customer segments. Technology investments in artificial intelligence, machine learning, and blockchain applications are transforming operational processes and customer interactions.

Market consolidation through mergers and acquisitions has reshaped the competitive landscape, with companies seeking to expand geographic coverage and technological capabilities. Distribution channel evolution has seen increased adoption of embedded insurance solutions and direct-to-consumer digital platforms. Customer experience improvements through mobile applications, chatbot integration, and streamlined claims processing have become key competitive differentiators.

Sustainability initiatives including carbon offset programs and eco-friendly travel insurance options reflect growing environmental consciousness among travelers and insurers. Data analytics advancement has enabled more sophisticated risk assessment, personalized pricing, and targeted marketing strategies. International expansion by European insurers into emerging markets has created new growth opportunities and competitive dynamics.

Strategic recommendations for market participants emphasize the importance of digital transformation, customer-centric innovation, and strategic partnership development. MarkWide Research analysis suggests that companies prioritizing mobile-first strategies and AI-powered customer service will achieve competitive advantages in the evolving market landscape.

Technology investment should focus on areas that directly impact customer experience and operational efficiency, including automated claims processing, real-time risk assessment, and personalized product recommendations. Market expansion strategies should target underserved segments including senior travelers, adventure enthusiasts, and digital nomads through specialized product development and targeted marketing approaches.

Partnership development with travel technology companies, healthcare providers, and fintech organizations can create integrated solutions that enhance value propositions and market reach. Regulatory compliance strategies should anticipate evolving requirements and maintain flexibility to adapt to changing regulatory environments across European markets.

Product innovation should address emerging travel trends including sustainable tourism, remote work travel, and extended stay requirements. Data analytics capabilities should be enhanced to enable predictive modeling, personalized pricing, and improved risk assessment accuracy. Customer education initiatives can increase market awareness and drive adoption of comprehensive coverage options.

Distribution strategy optimization should balance direct-to-consumer channels with strategic partnerships to maximize market reach and conversion rates. Brand differentiation through superior customer service, innovative products, and transparent pricing can create sustainable competitive advantages in increasingly crowded markets.

Future market projections indicate continued growth and evolution within the European travel insurance sector, driven by technological advancement, changing travel patterns, and increasing risk awareness. Market expansion is expected to continue, with projected growth rates of 7.5% CAGR over the next five years, supported by recovery in travel volumes and enhanced product offerings.

Technology integration will accelerate, with artificial intelligence, machine learning, and blockchain applications becoming standard market features. Digital transformation initiatives will focus on creating seamless customer experiences, from policy purchase through claims settlement. Personalization capabilities will advance significantly, enabling highly customized products and pricing strategies based on individual risk profiles and travel patterns.

Market consolidation is expected to continue, with strategic mergers and acquisitions reshaping the competitive landscape. New market entrants including insurtech startups and technology companies will continue to challenge traditional business models and drive innovation. Regulatory harmonization across European markets may reduce operational complexity and enable more efficient cross-border operations.

Product evolution will address emerging risks including climate change impacts, cybersecurity threats, and evolving health requirements. Sustainability focus will become increasingly important, with eco-friendly insurance products and carbon-neutral operations becoming market expectations. Customer expectations for instant service, transparent pricing, and comprehensive coverage will continue to drive market innovation and competitive differentiation.

MarkWide Research forecasts indicate that companies successfully adapting to digital-first strategies while maintaining strong customer service capabilities will capture the largest market share gains in the evolving European travel insurance landscape.

The European travel insurance market represents a dynamic and rapidly evolving sector with substantial growth potential driven by technological innovation, changing consumer behavior, and increasing travel risk awareness. Market analysis reveals a complex ecosystem of established insurers, innovative technology companies, and diverse distribution channels working together to serve the evolving needs of European travelers.

Key success factors for market participants include digital transformation capabilities, customer-centric product development, and strategic partnership formation. The market’s future trajectory will be shaped by continued technology adoption, regulatory evolution, and the ability of companies to adapt to changing travel patterns and consumer expectations. Growth opportunities remain substantial, particularly in underserved market segments and emerging European economies, while established markets offer potential for product innovation and service enhancement.

Strategic positioning for long-term success requires balancing traditional insurance expertise with technological innovation, maintaining regulatory compliance across diverse European markets, and developing comprehensive solutions that address the full spectrum of travel-related risks. The European travel insurance market will continue to evolve as an essential component of the broader travel ecosystem, providing critical protection and peace of mind for millions of European travelers while creating significant value for industry participants and stakeholders.

What is European Travel Insurance?

European Travel Insurance provides coverage for various risks associated with traveling, including trip cancellations, medical emergencies, lost luggage, and travel delays. It is designed to protect travelers from unforeseen events that may disrupt their travel plans.

What are the key players in the European Travel Insurance Market?

Key players in the European Travel Insurance Market include Allianz Global Assistance, AXA Assistance, and Generali Global Assistance, among others. These companies offer a range of travel insurance products tailored to different traveler needs.

What are the main drivers of growth in the European Travel Insurance Market?

The growth of the European Travel Insurance Market is driven by increasing travel activities, rising awareness of travel risks, and the growing demand for comprehensive travel protection. Additionally, the expansion of online distribution channels has made purchasing travel insurance more accessible.

What challenges does the European Travel Insurance Market face?

The European Travel Insurance Market faces challenges such as regulatory compliance, competition from alternative insurance products, and fluctuating travel patterns due to global events. These factors can impact the demand and pricing of travel insurance policies.

What opportunities exist in the European Travel Insurance Market?

Opportunities in the European Travel Insurance Market include the development of customized insurance products for niche travel segments, such as adventure travel and business travel. Additionally, leveraging technology for better customer engagement and claims processing presents significant growth potential.

What trends are shaping the European Travel Insurance Market?

Trends in the European Travel Insurance Market include the increasing integration of digital platforms for policy management, the rise of on-demand travel insurance, and a focus on sustainability in insurance offerings. These trends reflect changing consumer preferences and technological advancements.

European Travel Insurance Market

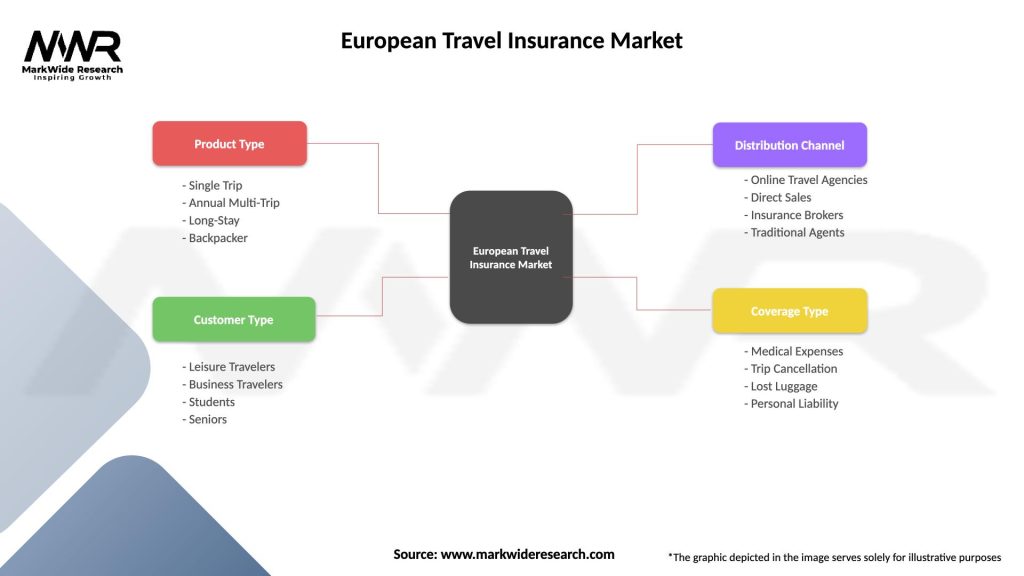

| Segmentation Details | Description |

|---|---|

| Product Type | Single Trip, Annual Multi-Trip, Long-Stay, Backpacker |

| Customer Type | Leisure Travelers, Business Travelers, Students, Seniors |

| Distribution Channel | Online Travel Agencies, Direct Sales, Insurance Brokers, Traditional Agents |

| Coverage Type | Medical Expenses, Trip Cancellation, Lost Luggage, Personal Liability |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the European Travel Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at