444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The European specialty food ingredients market represents a dynamic and rapidly evolving sector that serves as the backbone of the region’s food and beverage industry. This sophisticated market encompasses a diverse range of specialized ingredients designed to enhance flavor, texture, nutritional value, and shelf life of food products across multiple categories. European manufacturers have established themselves as global leaders in developing innovative specialty ingredients that cater to changing consumer preferences and regulatory requirements.

Market dynamics indicate robust growth driven by increasing consumer demand for clean-label products, functional foods, and premium culinary experiences. The region’s specialty food ingredients sector benefits from advanced research and development capabilities, stringent quality standards, and a strong tradition of culinary excellence. Growth projections suggest the market will expand at a compound annual growth rate of 6.2% over the forecast period, reflecting sustained demand across key application segments.

Regional leadership in specialty ingredients stems from Europe’s established food processing infrastructure, innovative manufacturing capabilities, and consumer willingness to pay premium prices for high-quality products. The market encompasses various ingredient categories including natural flavors, functional proteins, specialty enzymes, natural preservatives, and texture-enhancing compounds that enable food manufacturers to create differentiated products.

The European specialty food ingredients market refers to the comprehensive ecosystem of specialized chemical compounds, natural extracts, and functional additives specifically designed to enhance the sensory, nutritional, and preservation characteristics of food and beverage products throughout Europe. These ingredients differ from commodity food ingredients by offering unique functionalities, superior performance characteristics, and specialized applications that command premium pricing in the marketplace.

Specialty ingredients encompass a broad spectrum of products including natural and artificial flavoring systems, functional proteins derived from plant and animal sources, specialized enzymes for food processing, natural preservation systems, texture modifiers, nutritional enhancers, and color systems. These ingredients enable food manufacturers to develop products that meet specific consumer demands for taste, health benefits, convenience, and sustainability.

Market participants include ingredient manufacturers, food processors, beverage companies, and specialty chemical producers who collaborate to develop innovative solutions that address evolving consumer preferences and regulatory requirements across European markets.

European specialty food ingredients market demonstrates exceptional resilience and growth potential, driven by fundamental shifts in consumer behavior toward healthier, more sustainable, and premium food products. The market benefits from Europe’s position as a global leader in food safety regulations, quality standards, and innovation in food technology.

Key growth drivers include the rising demand for clean-label ingredients, increasing consumer awareness of functional foods, growing preference for plant-based alternatives, and the expansion of premium food categories. Market penetration of specialty ingredients has reached approximately 78% across major food categories, indicating substantial adoption and integration into mainstream food production.

Technological advancement continues to drive market evolution, with companies investing heavily in research and development to create next-generation ingredients that offer enhanced functionality, improved sustainability profiles, and superior cost-effectiveness. The market’s competitive landscape features both established multinational corporations and innovative specialty companies that focus on niche ingredient categories.

Regional distribution shows strong market presence across Western Europe, with emerging growth opportunities in Eastern European markets as consumer preferences evolve and disposable incomes increase. The market’s future outlook remains positive, supported by continued innovation, regulatory support for food safety, and growing export opportunities to global markets.

Market intelligence reveals several critical insights that shape the European specialty food ingredients landscape and influence strategic decision-making across the value chain.

Consumer behavior shifts represent the primary catalyst driving growth in the European specialty food ingredients market. Increasing health consciousness among European consumers has created substantial demand for functional ingredients that provide specific health benefits beyond basic nutrition. This trend manifests in growing interest in probiotics, omega-3 fatty acids, plant-based proteins, and natural antioxidants that support various health objectives.

Clean label movement continues to reshape ingredient selection criteria, with consumers actively seeking products containing recognizable, natural ingredients. This preference drives demand for specialty ingredients derived from natural sources, including plant extracts, natural flavoring systems, and minimally processed functional compounds. Market research indicates that 72% of European consumers actively read ingredient labels and prefer products with shorter, more understandable ingredient lists.

Regulatory environment in Europe supports market growth through comprehensive food safety standards that create competitive advantages for high-quality specialty ingredient suppliers. European regulations often set global benchmarks for ingredient safety and quality, enabling European companies to export their products worldwide with confidence in their regulatory compliance.

Innovation investment by both ingredient suppliers and food manufacturers drives continuous development of new specialty ingredients with enhanced functionality, improved sustainability profiles, and superior performance characteristics. This innovation cycle creates opportunities for premium pricing and market differentiation.

Cost pressures represent a significant challenge for specialty food ingredient adoption, particularly among price-sensitive consumer segments and cost-conscious food manufacturers. Specialty ingredients typically command premium prices compared to commodity alternatives, which can limit their adoption in value-oriented product categories where cost considerations outweigh functional benefits.

Regulatory complexity across different European markets creates compliance challenges for ingredient suppliers and food manufacturers. While European regulations generally support high-quality ingredients, the complexity of navigating different national requirements and approval processes can slow product development and market entry for innovative ingredients.

Supply chain vulnerabilities have become more apparent following recent global disruptions, affecting the availability and pricing of specialty ingredients that depend on specific raw materials or complex manufacturing processes. These vulnerabilities can impact product consistency and availability, particularly for ingredients sourced from limited geographic regions.

Consumer skepticism toward certain categories of specialty ingredients, particularly those perceived as highly processed or artificial, can limit market acceptance despite proven safety and functionality. This skepticism requires ongoing education and transparency efforts from ingredient suppliers and food manufacturers.

Plant-based alternatives present exceptional growth opportunities as European consumers increasingly adopt flexitarian and vegetarian diets. Specialty ingredients that enable the development of plant-based meat alternatives, dairy substitutes, and functional plant proteins represent high-growth market segments with substantial long-term potential.

Personalized nutrition emerges as a transformative opportunity, with specialty ingredients enabling the development of customized food products tailored to individual health needs, dietary preferences, and lifestyle requirements. This trend creates demand for specialized functional ingredients that can be precisely dosed and combined to achieve specific nutritional objectives.

Sustainable sourcing initiatives create opportunities for ingredient suppliers who can demonstrate environmental responsibility and social impact in their supply chains. European consumers increasingly value sustainability, creating premium market opportunities for ingredients with verified sustainable sourcing credentials.

Export expansion to emerging markets presents significant growth potential for European specialty ingredient companies. Europe’s reputation for quality and safety creates competitive advantages in international markets where consumers seek premium ingredients and food products.

Competitive intensity in the European specialty food ingredients market reflects the sector’s attractiveness and growth potential. Established multinational corporations compete alongside innovative specialty companies, creating a dynamic environment that drives continuous innovation and improvement in product offerings.

Value chain integration strategies enable companies to capture greater value and improve supply chain control. Many ingredient suppliers are expanding their capabilities to include application development, technical support, and co-manufacturing services that strengthen customer relationships and create competitive differentiation.

Technology adoption accelerates across the market, with companies investing in advanced processing technologies, analytical capabilities, and digital platforms that enhance product development, quality control, and customer service. These technological investments improve operational efficiency and enable the development of more sophisticated ingredient solutions.

Partnership strategies become increasingly important as companies seek to combine complementary capabilities and access new markets. Strategic alliances between ingredient suppliers, food manufacturers, and technology companies create synergies that accelerate innovation and market development.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of market insights. Primary research includes extensive interviews with industry executives, technical experts, and key stakeholders across the European specialty food ingredients value chain.

Data collection encompasses both quantitative and qualitative research approaches, including structured surveys, in-depth interviews, focus groups, and expert panels. This multi-faceted approach provides comprehensive understanding of market dynamics, competitive positioning, and future trends.

Secondary research incorporates analysis of industry reports, regulatory filings, patent databases, trade publications, and academic research to validate primary findings and provide broader market context. This research foundation ensures comprehensive coverage of market developments and emerging trends.

Analytical frameworks include statistical modeling, trend analysis, competitive benchmarking, and scenario planning to develop robust market projections and strategic insights. These analytical approaches provide reliable foundations for strategic decision-making and investment planning.

Western European markets maintain leadership positions in specialty food ingredients consumption and innovation, with Germany capturing approximately 28% market share followed by France, United Kingdom, and Italy. These markets benefit from established food processing industries, sophisticated consumer preferences, and strong regulatory frameworks that support high-quality ingredient adoption.

Germany’s market dominance reflects its position as Europe’s largest food processing market and its strong tradition of technical innovation in food ingredients. German companies lead in enzyme technology, natural flavoring systems, and functional protein ingredients, supported by robust research and development infrastructure.

France’s specialty ingredients sector demonstrates particular strength in natural flavoring systems, premium food additives, and artisanal ingredient categories that support the country’s renowned culinary traditions. French companies excel in developing sophisticated flavor profiles and premium ingredient solutions.

Eastern European markets represent high-growth opportunities as economic development and changing consumer preferences drive demand for premium food products and specialty ingredients. Market penetration in Eastern Europe has reached 45% of Western European levels, indicating substantial growth potential as these markets mature.

Nordic countries lead in sustainable ingredient development and clean-label innovation, reflecting strong environmental consciousness and regulatory support for sustainable food production. These markets serve as testing grounds for next-generation sustainable ingredients.

Market leadership in European specialty food ingredients reflects a combination of established multinational corporations and innovative specialty companies that compete across different ingredient categories and application segments.

Competitive strategies focus on innovation, sustainability, and customer partnership development. Leading companies invest heavily in research and development, maintain extensive application laboratories, and provide comprehensive technical support to food manufacturer customers.

By Ingredient Type:

By Application:

By End-User:

Flavoring Systems Category represents the largest segment within European specialty food ingredients, driven by consumer demand for diverse and sophisticated flavor profiles. Natural flavoring systems experience particularly strong growth as consumers seek clean-label alternatives to artificial flavors. Innovation focus centers on developing complex flavor systems that replicate traditional tastes using natural ingredients.

Functional Proteins Segment demonstrates exceptional growth potential, particularly plant-based protein ingredients that support the development of meat alternatives and dairy substitutes. European companies lead in developing protein ingredients from pea, soy, wheat, and emerging sources like algae and insects. Market adoption of plant-based proteins has increased by 42% annually over recent years.

Enzyme Technology continues advancing with new applications in food processing, baking, and beverage production. European enzyme suppliers develop specialized products that improve processing efficiency, enhance product quality, and reduce environmental impact. These ingredients enable food manufacturers to achieve consistent quality while optimizing production costs.

Natural Preservation Systems gain market share as consumers seek alternatives to synthetic preservatives. European companies develop innovative preservation solutions using natural antimicrobials, plant extracts, and fermentation-derived compounds that extend shelf life while maintaining clean-label positioning.

Food Manufacturers benefit from access to innovative specialty ingredients that enable product differentiation, improve processing efficiency, and meet evolving consumer demands. These ingredients allow manufacturers to develop premium products with enhanced functionality, extended shelf life, and superior sensory characteristics that command higher margins in competitive markets.

Ingredient Suppliers capture value through premium pricing, long-term customer relationships, and opportunities for technical collaboration with food manufacturers. The specialty ingredients market offers higher margins compared to commodity ingredients and creates opportunities for sustained competitive advantage through innovation and technical expertise.

Consumers gain access to food products with improved nutritional profiles, enhanced taste experiences, and greater convenience. Specialty ingredients enable the development of functional foods that support health and wellness objectives while maintaining the taste and texture characteristics that consumers expect.

Retailers benefit from differentiated product offerings that attract health-conscious consumers and support premium pricing strategies. Specialty ingredients enable the development of private-label products that compete effectively with national brands while offering superior margins.

Regulatory Bodies achieve food safety and quality objectives through the adoption of high-quality specialty ingredients that meet stringent safety standards and support transparent labeling requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean Label Evolution continues reshaping the specialty ingredients landscape as consumers demand greater transparency and natural ingredients. This trend drives innovation in natural flavoring systems, plant-based functional ingredients, and minimally processed additives that maintain product functionality while meeting clean-label requirements.

Sustainable Sourcing becomes increasingly important as companies respond to environmental concerns and consumer preferences for responsibly sourced ingredients. MarkWide Research indicates that 68% of European consumers consider sustainability when making food purchasing decisions, driving demand for ingredients with verified sustainable sourcing credentials.

Functional Food Integration expands beyond traditional supplement categories into mainstream food products, creating opportunities for specialty ingredients that provide specific health benefits. This trend includes probiotics in everyday foods, protein fortification across categories, and functional compounds that support immune health and cognitive function.

Technology-Enabled Innovation accelerates ingredient development through advanced processing techniques, biotechnology applications, and precision fermentation technologies. These technological advances enable the creation of novel ingredients with enhanced functionality and improved sustainability profiles.

Personalization Trend emerges as companies explore opportunities to customize ingredient formulations for specific consumer segments, dietary requirements, and health objectives. This trend requires flexible manufacturing capabilities and sophisticated ingredient systems that can be precisely tailored to individual needs.

Strategic Acquisitions reshape the competitive landscape as major ingredient companies acquire specialized firms to expand their technology capabilities and market reach. Recent acquisitions focus on plant-based protein technologies, natural flavoring systems, and sustainable ingredient platforms that align with market trends.

Innovation Partnerships between ingredient suppliers and food manufacturers accelerate product development and market introduction of new specialty ingredients. These collaborations combine technical expertise with market knowledge to develop ingredients that meet specific application requirements and consumer preferences.

Sustainability Initiatives gain momentum as companies invest in renewable energy, waste reduction, and circular economy principles. Major ingredient suppliers announce comprehensive sustainability commitments that include carbon neutrality targets, sustainable sourcing requirements, and packaging reduction initiatives.

Regulatory Approvals for novel ingredients expand market opportunities, particularly for biotechnology-derived ingredients and alternative protein sources. European regulatory authorities continue evaluating new ingredient categories that support innovation while maintaining food safety standards.

Manufacturing Expansion projects increase production capacity for high-growth ingredient categories, particularly plant-based proteins and natural preservation systems. These investments reflect confidence in long-term market growth and enable companies to meet increasing demand from food manufacturers.

Investment Priorities should focus on sustainable ingredient technologies, plant-based alternatives, and functional ingredient platforms that address evolving consumer preferences. Companies that invest in these growth areas position themselves for long-term success in the evolving specialty ingredients market.

Innovation Strategy recommendations emphasize developing ingredients that combine multiple functionalities, such as flavor enhancement with nutritional benefits or preservation with clean-label positioning. These multi-functional ingredients provide greater value to food manufacturers and create competitive differentiation.

Market Entry Strategies for new participants should focus on niche ingredient categories where specialized expertise can create competitive advantages. Rather than competing directly with established players in commodity-like segments, new entrants should identify underserved applications or emerging trends.

Partnership Development becomes increasingly important for accessing complementary technologies, expanding market reach, and sharing development costs. Strategic alliances enable companies to combine strengths and accelerate innovation while managing investment risks.

Sustainability Integration should be embedded throughout business operations, from raw material sourcing to manufacturing processes and packaging solutions. Companies that demonstrate genuine commitment to sustainability will capture growing market opportunities and build stronger customer relationships.

Market trajectory for European specialty food ingredients remains strongly positive, supported by fundamental trends toward healthier eating, sustainable consumption, and premium food experiences. Long-term growth projections indicate sustained expansion at compound annual growth rates exceeding 6% across key ingredient categories.

Technology advancement will continue driving market evolution, with biotechnology, precision fermentation, and advanced processing techniques enabling the development of next-generation ingredients with enhanced functionality and improved sustainability profiles. These technological capabilities will create new market opportunities and competitive advantages for innovative companies.

Consumer trends toward personalized nutrition, plant-based alternatives, and functional foods will create sustained demand for specialized ingredients that enable food manufacturers to develop differentiated products. MWR analysis suggests that these trends will drive premium ingredient adoption rates above 80% in key food categories over the next five years.

Regulatory environment will continue supporting high-quality ingredient development while potentially creating new opportunities for novel ingredient categories. European leadership in food safety and quality standards will maintain competitive advantages for regional companies in global markets.

Export opportunities will expand as European ingredient suppliers leverage their quality reputation and technical expertise to serve growing demand in emerging markets. This international expansion will provide additional growth drivers beyond domestic European markets.

European specialty food ingredients market represents a dynamic and rapidly evolving sector with exceptional growth potential driven by fundamental shifts in consumer behavior, technological advancement, and regulatory support for high-quality food products. The market’s strength lies in its combination of innovation leadership, quality standards, and consumer sophistication that creates sustainable competitive advantages.

Growth drivers including clean-label demand, functional food trends, and sustainability focus provide multiple avenues for market expansion and value creation. Companies that successfully navigate these trends while investing in innovation and sustainable practices will capture the greatest market opportunities and build lasting competitive positions.

Future success in the European specialty food ingredients market will require continued investment in research and development, strategic partnerships, and sustainable business practices that align with evolving consumer expectations and regulatory requirements. The market’s positive outlook reflects strong fundamentals and emerging opportunities that support long-term growth and profitability for well-positioned industry participants.

What is Specialty Food Ingredients?

Specialty food ingredients refer to unique components used in food production that enhance flavor, texture, and nutritional value. These ingredients are often derived from natural sources and cater to specific dietary needs or culinary trends.

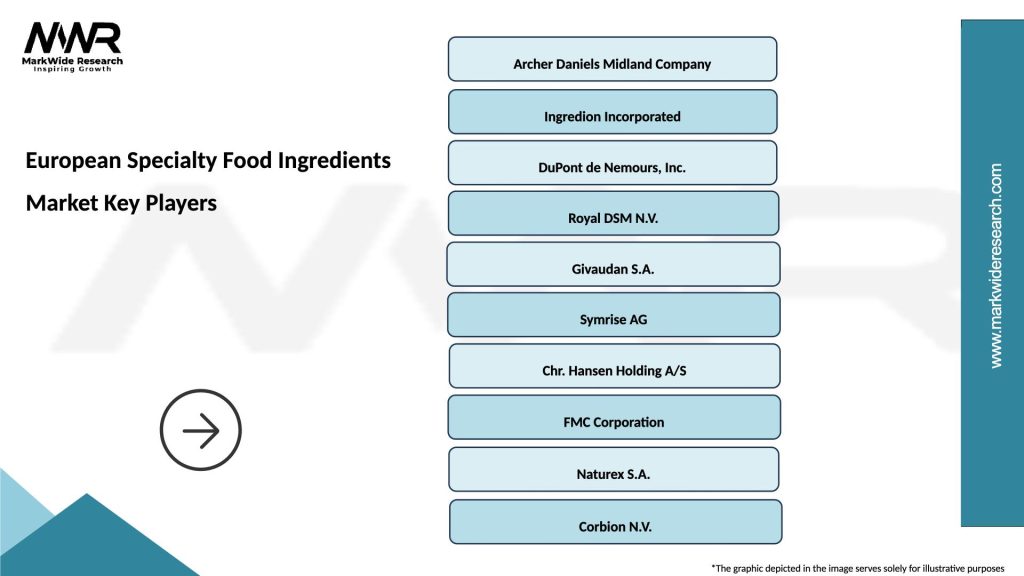

What are the key players in the European Specialty Food Ingredients Market?

Key players in the European Specialty Food Ingredients Market include companies like DSM, Ingredion, and Kerry Group, which provide a range of innovative ingredients for various food applications, among others.

What are the main drivers of growth in the European Specialty Food Ingredients Market?

The growth of the European Specialty Food Ingredients Market is driven by increasing consumer demand for clean label products, the rise in health-conscious eating habits, and the expansion of the plant-based food sector.

What challenges does the European Specialty Food Ingredients Market face?

Challenges in the European Specialty Food Ingredients Market include regulatory compliance issues, the high cost of sourcing specialty ingredients, and competition from conventional food ingredients that may offer lower prices.

What opportunities exist in the European Specialty Food Ingredients Market?

Opportunities in the European Specialty Food Ingredients Market include the growing trend of personalized nutrition, advancements in food technology, and the increasing popularity of functional foods that offer health benefits.

What trends are shaping the European Specialty Food Ingredients Market?

Trends in the European Specialty Food Ingredients Market include the rise of plant-based alternatives, the demand for sustainable sourcing practices, and innovations in flavor enhancement technologies.

European Specialty Food Ingredients Market

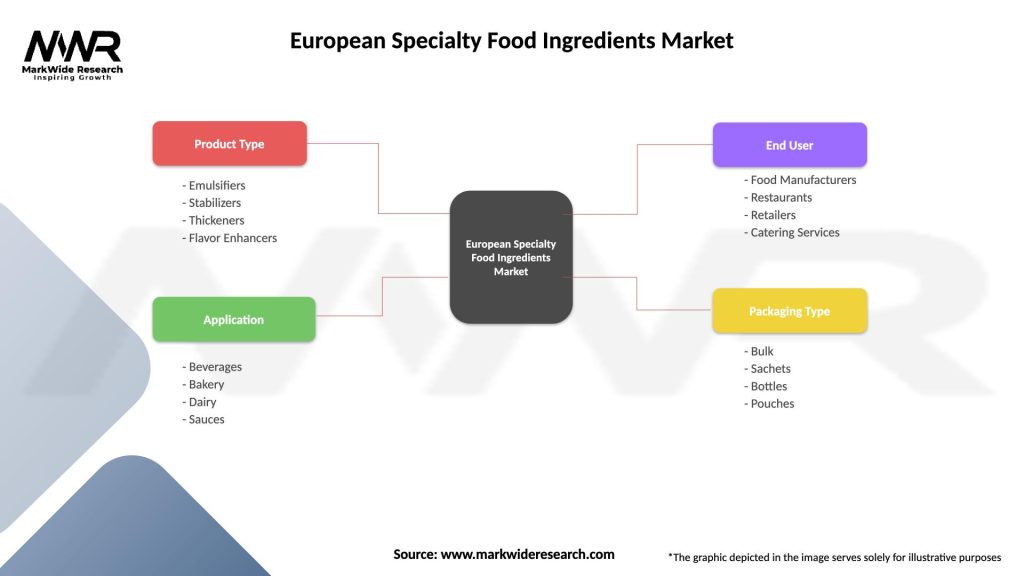

| Segmentation Details | Description |

|---|---|

| Product Type | Emulsifiers, Stabilizers, Thickeners, Flavor Enhancers |

| Application | Beverages, Bakery, Dairy, Sauces |

| End User | Food Manufacturers, Restaurants, Retailers, Catering Services |

| Packaging Type | Bulk, Sachets, Bottles, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the European Specialty Food Ingredients Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at