444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The European snacks bar market represents a dynamic and rapidly evolving segment within the broader food and beverage industry, characterized by increasing consumer demand for convenient, nutritious, and on-the-go food options. This market encompasses a diverse range of products including protein bars, granola bars, cereal bars, energy bars, and specialty dietary bars designed to meet various nutritional needs and lifestyle preferences across European consumers.

Market dynamics indicate robust growth driven by changing consumer lifestyles, increased health consciousness, and the rising trend of snacking as meal replacement. The European market demonstrates significant regional variations, with Western European countries leading in premium product adoption while Eastern European markets show accelerating growth in mainstream categories. Consumer preferences are increasingly shifting toward organic, natural, and functional ingredients, creating opportunities for innovative product formulations.

Growth projections suggest the market is expanding at a compound annual growth rate of 6.2%, with protein bars and functional snack bars leading the growth trajectory. The market benefits from strong retail distribution networks, including supermarkets, convenience stores, health food stores, and e-commerce platforms. Innovation trends focus on clean label ingredients, sustainable packaging, and targeted nutrition solutions for specific consumer segments including fitness enthusiasts, busy professionals, and health-conscious families.

The European snacks bar market refers to the comprehensive ecosystem of manufactured, packaged bar-format snack products designed for convenient consumption across diverse European consumer segments. These products typically combine various ingredients such as nuts, fruits, grains, proteins, and functional additives to create portable nutrition solutions that address specific dietary needs, taste preferences, and lifestyle requirements.

Product categories within this market include energy bars for active consumers, protein bars for fitness and muscle-building applications, meal replacement bars for weight management, granola and cereal bars for everyday snacking, and specialized bars targeting specific dietary restrictions such as gluten-free, vegan, or keto-friendly formulations. The market encompasses both established multinational brands and emerging artisanal producers focusing on premium, organic, and locally-sourced ingredients.

Distribution channels span traditional retail outlets, specialty health stores, online platforms, and direct-to-consumer sales models, reflecting the diverse purchasing behaviors and preferences of European consumers across different age groups, income levels, and geographic regions.

Market performance in the European snacks bar sector demonstrates sustained growth momentum driven by fundamental shifts in consumer behavior, dietary preferences, and lifestyle patterns. The market benefits from strong demographic trends including urbanization, increasing female workforce participation, and growing awareness of nutrition’s role in overall health and wellness.

Key growth drivers include the rising prevalence of active lifestyles, with 73% of European consumers reporting regular engagement in fitness activities, creating demand for convenient protein and energy solutions. The market also benefits from increasing adoption of flexible eating patterns, with traditional meal structures giving way to more frequent, smaller consumption occasions throughout the day.

Innovation leadership remains concentrated among established players who invest heavily in research and development, new product launches, and marketing initiatives. However, the market also shows significant opportunities for niche players focusing on specific dietary needs, premium ingredients, or sustainable production practices. E-commerce penetration continues to accelerate, representing 28% of total category sales and providing platforms for both established brands and emerging competitors to reach consumers directly.

Regional variations reflect different stages of market maturity, with Northern and Western European countries showing preference for premium, organic, and functional products, while Southern and Eastern European markets demonstrate growing adoption of mainstream categories with increasing sophistication in product preferences and willingness to pay premium prices for quality and convenience.

Consumer behavior analysis reveals several critical insights driving market evolution and competitive dynamics across European markets:

Market segmentation demonstrates clear differentiation based on consumer demographics, with millennials and Generation Z showing higher adoption rates for innovative flavors and functional ingredients, while older consumers prioritize familiar tastes and proven nutritional benefits.

Primary growth catalysts propelling the European snacks bar market include fundamental demographic, lifestyle, and economic factors that create sustained demand for convenient nutrition solutions.

Lifestyle transformation represents the most significant driver, with increasing urbanization, longer working hours, and more complex daily schedules creating demand for portable, nutritious food options. The rise of flexible work arrangements and remote working has also changed eating patterns, with consumers seeking convenient options for home offices and co-working spaces.

Health and wellness trends continue to gain momentum, with European consumers becoming more educated about nutrition and actively seeking products that support their health goals. This includes growing interest in protein consumption for muscle maintenance, fiber for digestive health, and functional ingredients for specific wellness benefits. Fitness participation rates show 42% of Europeans engaging in regular exercise, creating substantial demand for sports nutrition products including protein and energy bars.

Demographic shifts favor market growth, particularly the increasing purchasing power of health-conscious millennials and Generation Z consumers who prioritize convenience without compromising nutritional quality. These demographics also demonstrate higher willingness to experiment with new flavors, ingredients, and brands, supporting innovation and market expansion.

Retail evolution supports market accessibility through expanded distribution channels, improved product placement, and enhanced consumer education. The growth of specialty health food retailers, pharmacy chains carrying nutritional products, and e-commerce platforms creates multiple touchpoints for consumer engagement and purchase conversion.

Competitive intensity presents significant challenges for market participants, with numerous established brands, private label products, and emerging competitors creating pricing pressure and requiring substantial marketing investments to maintain market share and consumer awareness.

Regulatory complexity across European markets creates operational challenges, with varying food safety standards, labeling requirements, and health claim regulations requiring careful navigation and compliance investments. Brexit implications have added additional complexity for companies operating across UK and EU markets, requiring separate regulatory compliance and potentially impacting supply chain efficiency.

Raw material volatility affects profitability and pricing strategies, with key ingredients such as nuts, protein powders, and organic components subject to price fluctuations based on agricultural conditions, global demand, and supply chain disruptions. This volatility makes long-term pricing strategies challenging and can impact consumer acceptance of price increases.

Consumer skepticism regarding processed foods and artificial ingredients creates challenges for conventional product formulations, requiring investments in clean label reformulations and transparent communication about ingredient sourcing and processing methods. Some consumers remain concerned about sugar content, artificial sweeteners, and preservatives commonly used in snack bar products.

Seasonal demand patterns create inventory management challenges, with higher sales during fitness-focused periods such as New Year resolutions and summer preparation, while experiencing slower periods during holiday seasons when consumers may prioritize indulgent foods over health-focused options.

Innovation potential remains substantial across multiple dimensions including ingredient technology, flavor development, functional benefits, and packaging solutions. The growing interest in personalized nutrition creates opportunities for customized products targeting specific demographic groups, activity levels, or health goals.

Emerging markets within Eastern Europe present significant growth opportunities as economic development increases disposable income and health consciousness. Countries such as Poland, Czech Republic, and Romania show accelerating adoption of Western European consumption patterns, including increased spending on convenient, premium food products.

Plant-based expansion offers substantial opportunities as 35% of European consumers actively seek to reduce animal product consumption. This trend creates demand for plant-based protein bars, vegan-friendly formulations, and products highlighting sustainable ingredient sourcing. The intersection of plant-based nutrition and sports performance represents a particularly promising niche.

Digital commerce growth provides platforms for direct consumer engagement, subscription models, and personalized product recommendations. E-commerce enables smaller brands to reach consumers without traditional retail distribution challenges while allowing established brands to gather consumer data and test new products efficiently.

Functional food integration presents opportunities to incorporate trending ingredients such as adaptogens, probiotics, collagen, and cognitive enhancement compounds. These functional additions can command premium pricing while addressing specific consumer health concerns and lifestyle goals.

Sustainable positioning offers differentiation opportunities through environmental responsibility, ethical sourcing, and circular economy principles. Consumers increasingly value brands demonstrating commitment to sustainability through ingredient sourcing, packaging choices, and corporate social responsibility initiatives.

Competitive landscape evolution demonstrates increasing sophistication as established food companies, specialized nutrition brands, and startup innovators compete across multiple dimensions including product quality, brand positioning, distribution access, and consumer engagement strategies.

Supply chain optimization becomes increasingly critical as companies seek to balance cost efficiency with quality maintenance and sustainability goals. This includes strategic partnerships with ingredient suppliers, manufacturing optimization, and distribution network enhancement to ensure product availability and freshness across diverse European markets.

Consumer education initiatives play crucial roles in market development, with successful brands investing in content marketing, nutritional education, and lifestyle positioning to build consumer understanding and loyalty. Social media engagement shows 56% of consumers discovering new snack bar products through digital platforms, highlighting the importance of online presence and influencer partnerships.

Seasonal marketing strategies align product promotion with consumer behavior patterns, including fitness-focused campaigns during January and spring months, outdoor activity positioning during summer, and immune support messaging during autumn and winter periods. These seasonal approaches help optimize marketing spend and consumer relevance.

Retail partnership development remains essential for market success, with companies working closely with retailers to optimize product placement, promotional strategies, and consumer education initiatives. The growth of private label products also creates both competitive challenges and potential partnership opportunities for branded manufacturers.

Comprehensive market analysis employs multiple research methodologies to ensure accurate, reliable, and actionable insights into European snacks bar market dynamics, consumer behavior, and competitive landscape developments.

Primary research components include extensive consumer surveys across major European markets, in-depth interviews with industry executives, retailer discussions, and focus groups examining consumer preferences, purchase drivers, and brand perceptions. This primary research provides current market insights and identifies emerging trends not captured in secondary data sources.

Secondary research integration incorporates industry reports, trade association data, regulatory filings, company financial statements, and academic research to provide comprehensive market context and historical trend analysis. MarkWide Research methodology emphasizes cross-validation of data sources to ensure accuracy and reliability of market insights and projections.

Quantitative analysis includes statistical modeling of market trends, consumer behavior patterns, and competitive dynamics to identify significant relationships and predict future market developments. This analysis incorporates economic indicators, demographic trends, and lifestyle factors that influence market growth and evolution.

Qualitative assessment provides deeper understanding of consumer motivations, brand positioning effectiveness, and market opportunity identification through expert interviews, industry observation, and trend analysis. This qualitative component helps interpret quantitative findings and identify strategic implications for market participants.

Western European markets demonstrate the highest levels of market maturity and sophistication, with countries such as Germany, France, and the United Kingdom leading in premium product adoption, organic ingredient preference, and functional food integration. These markets show market penetration rates of 78% among target demographics and strong consumer willingness to pay premium prices for quality and innovation.

Northern European countries including Sweden, Denmark, and Norway exhibit strong preference for organic, sustainable, and minimally processed products, reflecting broader cultural values around environmental responsibility and health consciousness. These markets demonstrate particular strength in plant-based and environmentally sustainable product categories.

Southern European markets such as Spain, Italy, and Greece show growing adoption of snack bar consumption, with traditional food cultures gradually incorporating convenient nutrition solutions. These markets demonstrate preference for Mediterranean-inspired flavors and ingredients, creating opportunities for regionally-adapted product formulations.

Eastern European expansion represents the fastest-growing regional segment, with countries such as Poland, Czech Republic, and Hungary showing annual growth rates exceeding 12% as economic development increases consumer purchasing power and health consciousness. These markets demonstrate strong potential for mainstream product categories with increasing sophistication over time.

Cross-border trends include increasing standardization of consumer preferences across European markets, particularly among younger demographics who share similar lifestyle patterns and health priorities regardless of geographic location. This convergence creates opportunities for pan-European product strategies while still requiring regional adaptation for optimal market success.

Market leadership remains distributed among several categories of competitors, each with distinct competitive advantages and strategic positioning approaches.

Competitive strategies vary significantly across market participants, with some focusing on broad market appeal through mainstream retail distribution, while others target specific consumer segments through specialized channels and premium positioning. Innovation investment remains critical for maintaining competitive advantage, with leading companies allocating 8-12% of revenues to research and development activities.

Emerging competitors include numerous startup brands focusing on specific dietary needs, sustainable ingredients, or innovative product formats. These companies often leverage e-commerce platforms and social media marketing to build consumer awareness and loyalty before expanding into traditional retail channels.

Product type segmentation reveals distinct consumer preferences and market dynamics across different bar categories:

Distribution channel analysis shows evolving consumer shopping patterns:

Consumer demographic segmentation identifies distinct purchasing patterns and preferences across age groups, income levels, and lifestyle categories, enabling targeted marketing strategies and product development initiatives.

Protein bar category demonstrates the strongest growth momentum, driven by increasing consumer awareness of protein’s role in muscle maintenance, weight management, and satiety. This segment benefits from crossover appeal between fitness enthusiasts and mainstream consumers seeking nutritious snack options. Innovation focus includes plant-based protein sources, improved taste profiles, and functional ingredient additions.

Organic and natural segments show premium pricing sustainability with consumers willing to pay 25-40% price premiums for certified organic ingredients and clean label formulations. This category benefits from growing consumer skepticism about artificial ingredients and increasing environmental consciousness.

Functional bar categories targeting specific health benefits such as digestive health, immune support, or cognitive enhancement represent emerging opportunities with significant growth potential. These products often incorporate trending ingredients such as probiotics, adaptogens, or nootropics to address specific consumer wellness goals.

Children’s snack bars present specialized opportunities requiring careful attention to nutritional guidelines, taste preferences, and parental approval factors. This segment emphasizes fun packaging, familiar flavors, and educational marketing approaches highlighting nutritional benefits for growing children.

Senior-focused formulations address the needs of aging European populations through products emphasizing bone health, heart health, and cognitive support. These products often feature softer textures, enhanced nutrient density, and targeted functional ingredients appealing to older consumers.

Manufacturers benefit from multiple market advantages including strong consumer demand growth, premium pricing opportunities for innovative products, and expanding distribution channels that reduce market entry barriers and enable efficient consumer reach.

Retailers gain from high-margin product categories that drive consumer traffic, encourage impulse purchases, and provide opportunities for private label development. The snack bar category also offers excellent cross-merchandising opportunities with complementary products such as beverages, fresh fruits, and fitness accessories.

Ingredient suppliers benefit from growing demand for premium, functional, and sustainable ingredients that command higher prices and create opportunities for long-term partnership relationships with manufacturers seeking differentiation and quality advantages.

Consumers receive convenient access to nutritious, portable food options that support their health goals, lifestyle needs, and taste preferences. The expanding product variety ensures options for diverse dietary requirements and flavor preferences while maintaining nutritional quality and convenience.

Healthcare systems potentially benefit from improved population nutrition as convenient, healthy snack options may support better dietary choices and reduced consumption of less nutritious alternatives. This could contribute to improved public health outcomes and reduced healthcare costs over time.

Environmental stakeholders benefit from increasing industry focus on sustainable packaging, responsible ingredient sourcing, and reduced food waste through longer shelf-life products that maintain nutritional quality without refrigeration requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement continues to gain momentum as consumers increasingly demand transparency in ingredient sourcing, processing methods, and nutritional content. This trend drives reformulation efforts toward recognizable, minimally processed ingredients and elimination of artificial additives, colors, and preservatives.

Personalized nutrition emerges as a significant trend with consumers seeking products tailored to their specific dietary needs, fitness goals, and health conditions. This includes customized protein content, targeted vitamin and mineral profiles, and specialized formulations for different life stages or activity levels.

Sustainable packaging innovation addresses growing environmental consciousness through biodegradable wrappers, recyclable materials, and reduced packaging waste. Companies invest in research and development of eco-friendly packaging solutions that maintain product freshness while minimizing environmental impact.

Flavor globalization introduces international and exotic flavor profiles to European markets, with consumers showing increased interest in Asian, Latin American, and Middle Eastern taste experiences. This trend creates opportunities for unique product differentiation and cultural food exploration.

Functional ingredient integration incorporates trending compounds such as collagen for skin health, adaptogens for stress management, and probiotics for digestive wellness. These functional additions enable premium positioning and targeted health benefit claims that resonate with health-conscious consumers.

Subscription commerce growth provides convenient, regular product delivery while enabling companies to build direct consumer relationships, gather consumption data, and predict demand patterns more accurately. Subscription penetration reaches 18% of regular consumers in key European markets.

Strategic acquisitions reshape competitive landscape as large food companies acquire innovative smaller brands to expand product portfolios, access new consumer segments, and integrate emerging technologies. These acquisitions often focus on companies with strong brand recognition, unique product formulations, or specialized market positioning.

Manufacturing capacity expansion responds to growing demand through new production facilities, upgraded equipment, and enhanced quality control systems. Companies invest in flexible manufacturing capabilities that can accommodate multiple product lines and rapid formulation changes to meet evolving consumer preferences.

Sustainability initiatives gain prominence as companies implement comprehensive environmental responsibility programs including carbon footprint reduction, sustainable ingredient sourcing, and circular economy principles. MarkWide Research indicates that 67% of European consumers consider environmental impact when making food purchase decisions.

Technology integration enhances production efficiency, quality control, and consumer engagement through advanced manufacturing systems, blockchain supply chain tracking, and artificial intelligence-powered consumer insights. These technological investments improve operational efficiency while enabling better consumer understanding and product customization.

Regulatory compliance evolution addresses changing food safety standards, health claim requirements, and labeling regulations across European markets. Companies invest in regulatory expertise and compliance systems to navigate complex requirements while maintaining market access and consumer trust.

Partnership development creates strategic alliances between manufacturers, retailers, ingredient suppliers, and technology providers to enhance competitive positioning, reduce costs, and accelerate innovation cycles. These partnerships often focus on specific market segments, geographic regions, or technological capabilities.

Innovation investment should prioritize clean label formulations, functional ingredient integration, and sustainable packaging solutions that address evolving consumer preferences while maintaining cost competitiveness and operational efficiency. Companies should allocate resources toward research and development initiatives that create meaningful product differentiation.

Market expansion strategies should focus on Eastern European opportunities where economic development creates growing demand for convenient, healthy food options. Companies should adapt product formulations and pricing strategies to local preferences while building distribution partnerships and brand awareness in these emerging markets.

Digital transformation requires comprehensive e-commerce capabilities, social media engagement, and direct-to-consumer platforms that enable personalized marketing, consumer data collection, and subscription-based revenue models. Companies should invest in digital marketing expertise and technology infrastructure to compete effectively in evolving retail landscapes.

Sustainability integration should encompass ingredient sourcing, packaging materials, manufacturing processes, and supply chain optimization to meet growing consumer expectations for environmental responsibility. Companies should develop comprehensive sustainability strategies that create competitive advantages while supporting long-term business viability.

Consumer education initiatives should focus on nutritional benefits, ingredient transparency, and lifestyle integration to build brand loyalty and justify premium pricing. Companies should invest in content marketing, influencer partnerships, and educational campaigns that demonstrate product value and support informed consumer decision-making.

Strategic partnerships should target complementary companies, innovative startups, and specialized suppliers that can enhance product capabilities, market access, or operational efficiency. Companies should evaluate partnership opportunities that accelerate growth while maintaining brand integrity and competitive positioning.

Long-term growth prospects remain highly favorable as fundamental demographic, lifestyle, and health consciousness trends continue supporting demand for convenient, nutritious snack options across European markets. The market is expected to maintain robust growth rates of 5.8% annually over the next five years, driven by continued innovation, expanding consumer base, and geographic market development.

Technology integration will increasingly influence product development, manufacturing efficiency, and consumer engagement through advanced formulation techniques, personalized nutrition solutions, and enhanced supply chain transparency. Companies that successfully integrate technology capabilities will gain significant competitive advantages in product quality, cost efficiency, and consumer satisfaction.

Sustainability requirements will become increasingly important for market success as consumers, retailers, and regulators prioritize environmental responsibility. Companies that proactively develop sustainable practices, transparent supply chains, and eco-friendly packaging solutions will be better positioned for long-term success and consumer loyalty.

Market consolidation may accelerate as larger companies acquire innovative smaller brands, specialized ingredient suppliers, or complementary technology capabilities. This consolidation could create opportunities for remaining independent companies to focus on niche markets or specialized consumer segments while potentially commanding premium acquisition valuations.

Regulatory evolution will continue shaping market dynamics through enhanced food safety standards, health claim requirements, and environmental regulations. Companies that maintain strong regulatory compliance capabilities and proactive government relations will be better positioned to navigate changing requirements while maintaining market access and consumer trust.

Global expansion opportunities may emerge as successful European market strategies provide templates for expansion into other developed markets with similar consumer preferences and regulatory environments. Companies with strong European market positions may leverage their experience and capabilities for international growth initiatives.

The European snacks bar market presents compelling opportunities for sustained growth and profitability driven by fundamental consumer trends toward health consciousness, convenience, and premium quality food products. Market dynamics favor companies that can successfully balance innovation, sustainability, and operational efficiency while building strong consumer relationships and brand loyalty.

Strategic success factors include continuous product innovation, effective distribution channel management, comprehensive digital marketing capabilities, and proactive sustainability initiatives that address evolving consumer expectations and regulatory requirements. Companies that excel in these areas while maintaining cost competitiveness and quality standards will be best positioned for long-term market leadership.

Market evolution will continue reflecting broader societal trends including urbanization, health consciousness, environmental awareness, and technological integration. Companies that anticipate and adapt to these trends while maintaining focus on consumer needs and preferences will create sustainable competitive advantages and drive market growth.

The European snacks bar market offers substantial opportunities for both established players and emerging competitors willing to invest in innovation, consumer understanding, and operational excellence. Success in this dynamic market requires strategic vision, execution capabilities, and commitment to meeting evolving consumer needs through high-quality, convenient, and sustainable nutrition solutions.

What is European Snacks Bar?

European Snacks Bar refers to a category of snack foods that are typically consumed between meals, including a variety of bars made from ingredients like nuts, fruits, grains, and chocolate. These snacks are popular for their convenience and nutritional benefits, catering to health-conscious consumers.

What are the key players in the European Snacks Bar Market?

Key players in the European Snacks Bar Market include companies like Nestlé, Mars, and Kellogg’s, which offer a range of products targeting different consumer preferences. These companies compete on factors such as flavor variety, nutritional content, and packaging innovations, among others.

What are the growth factors driving the European Snacks Bar Market?

The European Snacks Bar Market is driven by increasing consumer demand for healthy and convenient snack options, the rise of on-the-go lifestyles, and growing awareness of nutrition. Additionally, innovations in flavors and ingredients are attracting a broader audience.

What challenges does the European Snacks Bar Market face?

Challenges in the European Snacks Bar Market include intense competition among brands, fluctuating raw material prices, and changing consumer preferences towards healthier options. These factors can impact profitability and market share for companies operating in this space.

What opportunities exist in the European Snacks Bar Market?

Opportunities in the European Snacks Bar Market include the potential for product diversification, such as plant-based and organic options, and expanding into emerging markets. Additionally, leveraging e-commerce platforms for distribution can enhance market reach.

What trends are shaping the European Snacks Bar Market?

Trends in the European Snacks Bar Market include a growing focus on clean label products, increased interest in functional ingredients, and the popularity of personalized nutrition. These trends reflect a shift towards healthier eating habits among consumers.

European Snacks Bar Market

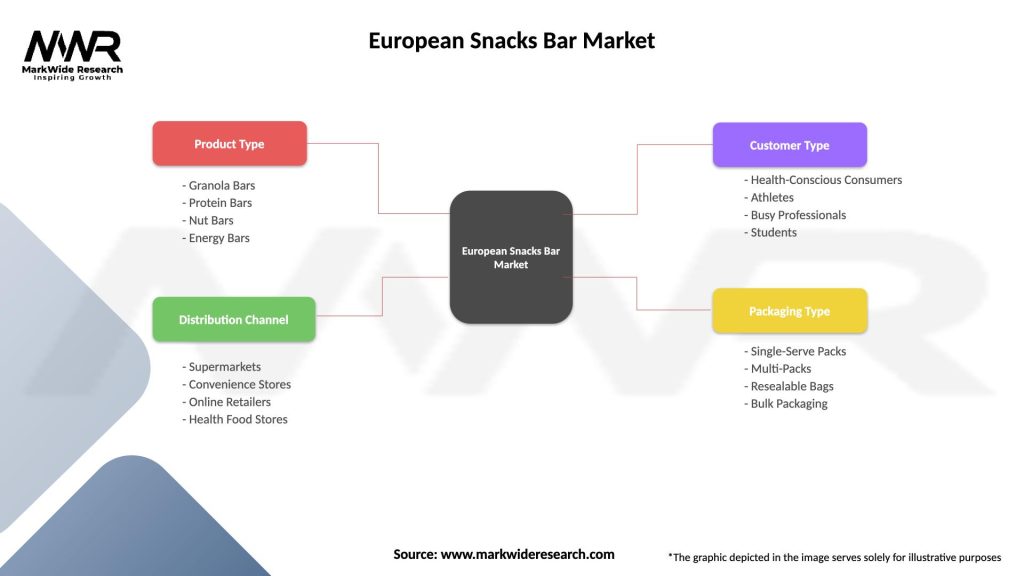

| Segmentation Details | Description |

|---|---|

| Product Type | Granola Bars, Protein Bars, Nut Bars, Energy Bars |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retailers, Health Food Stores |

| Customer Type | Health-Conscious Consumers, Athletes, Busy Professionals, Students |

| Packaging Type | Single-Serve Packs, Multi-Packs, Resealable Bags, Bulk Packaging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the European Snacks Bar Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at