444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The European refrigerator market represents one of the most mature and technologically advanced appliance sectors globally, characterized by strong consumer demand for energy-efficient and smart home solutions. Market dynamics indicate robust growth driven by replacement cycles, urbanization trends, and increasing environmental consciousness among European consumers. The region’s stringent energy efficiency regulations and sustainability initiatives have positioned Europe as a leader in innovative refrigeration technology development.

Consumer preferences across European markets show a distinct shift toward premium appliances with advanced features, including smart connectivity, energy optimization, and enhanced storage solutions. The market demonstrates significant regional variations, with Northern European countries leading in smart appliance adoption at 42% penetration rates, while Southern European markets show strong growth in compact and multi-door refrigerator segments.

Technological innovation continues to drive market evolution, with manufacturers investing heavily in IoT integration, advanced cooling systems, and sustainable refrigerant technologies. The market’s growth trajectory reflects broader European trends toward digitalization and environmental responsibility, creating opportunities for both established players and emerging technology providers.

The European refrigerator market refers to the comprehensive ecosystem of household refrigeration appliances, including traditional refrigerators, freezers, combination units, and smart refrigeration systems sold across European Union member states and associated territories. This market encompasses various product categories, distribution channels, and consumer segments, representing a critical component of the European home appliance industry.

Market scope includes both built-in and freestanding refrigeration units, ranging from compact single-door models to large capacity multi-door systems with advanced features. The definition extends beyond traditional cooling appliances to include smart refrigerators with internet connectivity, energy management systems, and integrated home automation capabilities that align with European digital transformation initiatives.

Market performance in the European refrigerator sector demonstrates resilience and innovation-driven growth, supported by strong replacement demand and evolving consumer preferences for premium appliances. The market benefits from Europe’s mature retail infrastructure, high disposable income levels, and progressive regulatory framework promoting energy efficiency and environmental sustainability.

Key growth drivers include the ongoing transition to smart home ecosystems, increasing demand for energy-efficient appliances, and rising consumer awareness of food preservation technologies. European consumers show strong preference for brands offering superior build quality, advanced features, and comprehensive warranty coverage, with premium segment growth outpacing standard product categories by 15% annually.

Competitive landscape features both established European manufacturers and international brands, with market leadership determined by innovation capabilities, distribution network strength, and brand reputation. The market’s evolution toward connected appliances and sustainable technologies creates opportunities for companies investing in research and development while maintaining competitive pricing strategies.

Strategic insights reveal several critical trends shaping the European refrigerator market’s future direction:

Primary growth drivers propelling the European refrigerator market include several interconnected factors that create sustained demand across diverse consumer segments. Replacement cycle dynamics represent the most significant driver, as European households typically replace refrigerators every 10-15 years, creating consistent baseline demand for new appliances.

Energy efficiency regulations continue driving market growth as European Union directives mandate higher performance standards for household appliances. These regulations encourage consumers to upgrade older, less efficient units, with government incentive programs supporting energy-efficient appliance purchases in several member states. The regulatory environment creates competitive advantages for manufacturers investing in advanced cooling technologies and sustainable design practices.

Smart home adoption accelerates across European markets, with consumers increasingly seeking appliances that integrate seamlessly with connected home ecosystems. This trend drives demand for refrigerators featuring Wi-Fi connectivity, mobile app control, and integration with voice assistants and home automation systems. Technology adoption rates vary by region, with Scandinavian countries leading at 35% smart appliance penetration.

Urbanization trends and changing household demographics create demand for diverse refrigerator configurations, from compact units suitable for small apartments to large-capacity models for growing families. European urban development patterns influence appliance design requirements, driving innovation in space-efficient solutions and flexible storage configurations.

Market challenges facing the European refrigerator industry include several factors that may limit growth potential and create operational difficulties for manufacturers and retailers. Economic uncertainty in various European markets affects consumer spending on durable goods, with refrigerator purchases often delayed during periods of financial constraint.

High product durability paradoxically restrains market growth, as quality European refrigerators typically operate efficiently for extended periods, reducing replacement frequency. This durability, while beneficial for consumers and environmental sustainability, creates challenges for manufacturers seeking consistent sales volumes and market expansion opportunities.

Supply chain complexities impact the European refrigerator market, particularly regarding component sourcing, manufacturing logistics, and distribution networks. Global supply chain disruptions affect production schedules and inventory management, while transportation costs influence final product pricing and market competitiveness.

Regulatory compliance costs associated with European Union energy efficiency standards, safety requirements, and environmental regulations create financial burdens for manufacturers. These compliance requirements, while promoting market quality and sustainability, increase development costs and may limit market entry for smaller manufacturers lacking resources for extensive testing and certification processes.

Emerging opportunities in the European refrigerator market present significant potential for growth and innovation across multiple dimensions. Smart technology integration offers substantial opportunities as European consumers increasingly embrace connected home solutions, creating demand for refrigerators with advanced IoT capabilities, predictive maintenance features, and energy optimization systems.

Sustainability initiatives create opportunities for manufacturers developing eco-friendly refrigeration solutions, including appliances using natural refrigerants, recyclable materials, and energy-efficient technologies. European consumers show strong preference for environmentally responsible products, with 68% of buyers considering environmental impact in purchase decisions.

Customization and personalization trends offer opportunities for manufacturers providing configurable refrigerator solutions, modular designs, and personalized features that adapt to specific household needs and preferences. This trend aligns with European consumer preferences for products that reflect individual lifestyles and home design aesthetics.

Service and maintenance opportunities expand as connected appliances enable predictive maintenance, remote diagnostics, and enhanced customer support services. These value-added services create recurring revenue streams while improving customer satisfaction and brand loyalty in competitive European markets.

Market dynamics in the European refrigerator sector reflect complex interactions between consumer behavior, technological advancement, regulatory requirements, and competitive pressures. Consumer preferences continue evolving toward premium appliances with advanced features, driving manufacturers to invest in innovation while maintaining competitive pricing strategies.

Technological convergence between refrigeration, smart home systems, and energy management creates new market dynamics as traditional appliance boundaries blur. This convergence enables refrigerator manufacturers to expand their value propositions beyond basic cooling functionality to include home automation, energy optimization, and lifestyle enhancement features.

Competitive intensity varies across European markets, with established brands maintaining strong positions through innovation, quality, and distribution network advantages. Market dynamics favor companies capable of balancing premium product development with cost-effective manufacturing and distribution strategies that serve diverse European consumer segments.

Retail channel evolution significantly impacts market dynamics as online sales channels grow rapidly, with 28% of appliance purchases now occurring through digital platforms. This shift requires manufacturers and retailers to adapt their marketing, sales, and customer service strategies to serve increasingly sophisticated and informed European consumers.

Comprehensive research methodology employed in analyzing the European refrigerator market combines quantitative and qualitative research approaches to provide accurate, actionable insights for industry stakeholders. Primary research includes extensive surveys of European consumers, interviews with industry executives, and analysis of retail sales data across major European markets.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and manufacturer financial disclosures to establish market trends, competitive positioning, and growth projections. MarkWide Research methodology emphasizes data triangulation to ensure accuracy and reliability of market insights and forecasts.

Market segmentation analysis utilizes statistical modeling techniques to identify consumer preferences, purchasing patterns, and demographic trends across different European regions and market segments. This analysis provides granular insights into market opportunities and competitive dynamics affecting various product categories and price points.

Forecasting models incorporate economic indicators, demographic trends, technological adoption rates, and regulatory changes to project market growth trajectories and identify emerging opportunities. The methodology accounts for regional variations in consumer behavior, economic conditions, and market maturity levels across European countries.

Regional market dynamics across Europe demonstrate significant variations in consumer preferences, market maturity, and growth potential. Western European markets, including Germany, France, and the United Kingdom, represent mature segments with high penetration rates and strong demand for premium appliances with advanced features and energy efficiency.

Northern European countries, particularly Scandinavian markets, lead in smart appliance adoption and sustainability-focused purchasing decisions. These markets show 45% higher adoption rates for connected refrigerators compared to European averages, driven by high technology penetration and environmental consciousness among consumers.

Southern European markets, including Italy, Spain, and Portugal, demonstrate growing demand for compact and multi-functional refrigeration solutions that accommodate smaller living spaces and traditional cooking patterns. These markets show strong growth potential as economic conditions improve and consumer spending on durable goods increases.

Eastern European markets present significant growth opportunities as rising disposable incomes and modernization trends drive demand for quality appliances. These markets show rapid adoption of energy-efficient refrigerators, with 62% annual growth in premium segment sales as consumers upgrade from older, less efficient units.

Central European markets benefit from strong economic fundamentals and established retail infrastructure, creating stable demand for diverse refrigerator categories. These markets demonstrate balanced growth across all segments, with particular strength in mid-range appliances offering good value propositions for quality-conscious consumers.

Competitive environment in the European refrigerator market features diverse players ranging from established European manufacturers to international brands and emerging technology companies. Market leadership depends on factors including brand reputation, product innovation, distribution network strength, and customer service quality.

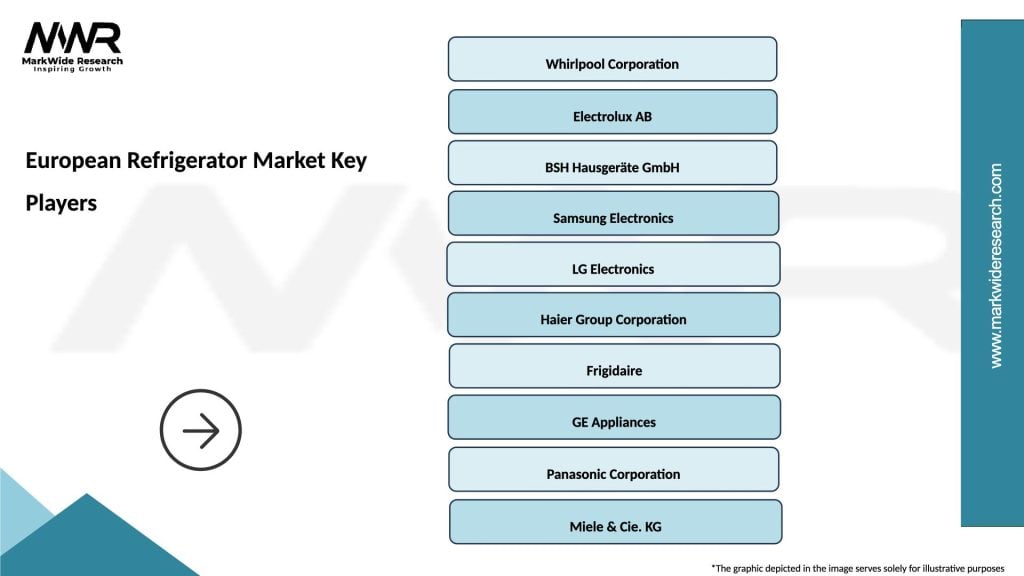

Leading manufacturers in the European market include:

Competitive strategies focus on differentiation through technology innovation, energy efficiency, design aesthetics, and customer service excellence. Companies invest heavily in research and development to maintain competitive advantages while building strong relationships with European retail partners and service networks.

Market segmentation in the European refrigerator market reveals diverse consumer needs and preferences across multiple dimensions. By product type, the market includes single-door refrigerators, double-door models, multi-door configurations, and specialized units such as wine coolers and compact refrigerators for specific applications.

By capacity, European consumers choose from:

By technology level, segmentation includes:

By distribution channel, the market segments into specialty appliance retailers, department stores, online platforms, and direct manufacturer sales, with each channel serving different consumer preferences and purchase behaviors.

Premium refrigerators represent the fastest-growing category in European markets, driven by consumer demand for advanced features, superior build quality, and smart home integration. This segment shows 18% annual growth as European consumers increasingly view refrigerators as long-term investments requiring advanced functionality and aesthetic appeal.

Energy-efficient models dominate European sales, with A+++ rated appliances capturing majority market share across all price segments. European consumers prioritize energy efficiency due to environmental consciousness and long-term operating cost considerations, creating competitive advantages for manufacturers investing in advanced cooling technologies.

Smart refrigerators emerge as a significant growth category, particularly in technology-forward European markets. These appliances offer features including inventory management, recipe suggestions, energy optimization, and integration with home automation systems, appealing to tech-savvy consumers seeking convenience and efficiency.

Compact refrigerators show strong growth in urban European markets where space constraints drive demand for efficient, small-footprint appliances. This category benefits from urbanization trends and changing household demographics, with manufacturers developing innovative solutions that maximize storage capacity while minimizing space requirements.

Multi-door configurations gain popularity among European consumers seeking flexible storage solutions and premium aesthetics. French door and side-by-side models appeal to households requiring large capacity and convenient access to both fresh and frozen food storage compartments.

Manufacturers benefit from the European refrigerator market’s stability, innovation opportunities, and premium pricing potential. The market rewards companies investing in research and development, energy efficiency, and smart technology integration, while established distribution networks provide reliable sales channels and customer relationships.

Retailers enjoy consistent demand for refrigerators due to replacement cycles and home improvement trends. The market offers opportunities for both traditional appliance stores and online platforms, with growing demand for comprehensive customer service, installation support, and extended warranty programs that enhance customer satisfaction and loyalty.

Consumers benefit from continuous innovation in refrigeration technology, improved energy efficiency, and enhanced features that provide better food preservation, convenience, and home integration. European regulatory standards ensure high product quality and safety while promoting environmental sustainability through energy efficiency requirements.

Technology providers find opportunities in supplying components, software, and services for smart refrigerators, energy management systems, and advanced cooling technologies. The market’s evolution toward connected appliances creates demand for IoT platforms, mobile applications, and cloud-based services that enhance appliance functionality.

Service providers benefit from growing demand for installation, maintenance, and repair services as refrigerators become more sophisticated and consumers seek professional support for optimal performance and longevity.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart connectivity emerges as the dominant trend shaping the European refrigerator market, with manufacturers integrating IoT capabilities, mobile app control, and voice assistant compatibility into their product lines. This trend reflects broader European digital transformation initiatives and consumer demand for seamless home automation experiences.

Sustainability focus drives innovation in refrigerant technologies, energy efficiency, and recyclable materials as European consumers and regulations prioritize environmental responsibility. Manufacturers invest in natural refrigerants, improved insulation, and sustainable manufacturing processes to meet growing environmental expectations.

Customization and flexibility trends see manufacturers offering modular designs, adjustable storage configurations, and personalized features that adapt to diverse household needs and preferences. This trend responds to European consumer demand for products that reflect individual lifestyles and home design aesthetics.

Health and wellness considerations influence refrigerator design, with features including advanced air filtration, humidity control, and specialized storage zones that optimize food preservation and nutritional value. European consumers increasingly view refrigerators as essential tools for maintaining healthy lifestyles and reducing food waste.

Aesthetic integration becomes increasingly important as European consumers seek appliances that complement modern kitchen designs and home décor. This trend drives demand for sleek finishes, integrated designs, and customizable appearance options that enhance overall home aesthetics.

Recent industry developments demonstrate the European refrigerator market’s dynamic evolution and innovation focus. Major manufacturers continue investing in smart technology integration, with several companies launching comprehensive connected appliance platforms that integrate refrigerators with broader home automation ecosystems.

Sustainability initiatives accelerate across the industry, with manufacturers committing to carbon-neutral production processes, sustainable material sourcing, and end-of-life recycling programs. These developments respond to European Union environmental regulations and consumer demand for environmentally responsible products.

Partnership strategies emerge as companies collaborate with technology providers, retailers, and service companies to enhance customer experiences and expand market reach. These partnerships enable manufacturers to leverage specialized expertise while focusing on core refrigeration technology development.

Market consolidation continues as larger manufacturers acquire smaller companies to expand product portfolios, geographic reach, and technological capabilities. This consolidation trend creates more comprehensive product offerings while potentially reducing competition in specific market segments.

Retail innovation transforms how consumers research, purchase, and service refrigerators, with augmented reality showrooms, virtual consultations, and enhanced online purchasing experiences becoming standard across European markets.

Strategic recommendations for European refrigerator market participants emphasize the importance of innovation, sustainability, and customer-centric approaches. MWR analysis suggests that companies prioritizing smart technology integration and energy efficiency will capture disproportionate market share as European consumers increasingly value these features.

Investment priorities should focus on research and development capabilities that enable rapid innovation cycles and response to changing consumer preferences. Companies must balance premium feature development with cost management to serve diverse European market segments effectively while maintaining competitive positioning.

Distribution strategy optimization becomes critical as online sales channels continue expanding, requiring manufacturers to develop omnichannel approaches that serve both traditional retail partners and direct-to-consumer sales effectively. This includes investing in digital marketing capabilities and customer service infrastructure.

Sustainability integration should extend beyond product features to encompass entire business operations, including supply chain management, manufacturing processes, and end-of-life product management. European consumers and regulations increasingly evaluate companies based on comprehensive environmental responsibility.

Market expansion opportunities exist in Eastern European markets where economic development drives appliance modernization, while Western European markets offer premium segment growth potential through advanced feature integration and superior customer experiences.

Future market prospects for the European refrigerator industry appear positive, driven by continued innovation, sustainability trends, and evolving consumer preferences. Growth projections indicate steady expansion across most European markets, with particularly strong performance expected in smart appliance segments and premium product categories.

Technology evolution will continue shaping market dynamics, with artificial intelligence, machine learning, and advanced sensors enabling more sophisticated refrigeration management and energy optimization. These technologies will create new value propositions while improving appliance performance and user experiences.

Market maturation in Western European countries will drive focus toward replacement sales and premium upgrades, while Eastern European markets offer significant growth potential as economic development continues. This geographic diversity provides balanced growth opportunities for manufacturers with appropriate market strategies.

Regulatory environment evolution will likely introduce more stringent energy efficiency requirements and environmental standards, creating competitive advantages for companies investing in sustainable technologies and manufacturing processes. These regulations will continue driving market quality improvements while promoting environmental responsibility.

Consumer behavior trends suggest continued preference for premium appliances with advanced features, smart connectivity, and superior design aesthetics. European consumers will likely maintain willingness to pay premium prices for appliances offering exceptional value, quality, and environmental benefits, supporting healthy profit margins for innovative manufacturers.

The European refrigerator market represents a mature, innovative, and sustainable industry segment with strong fundamentals and positive growth prospects. Market dynamics favor companies capable of balancing technological innovation with environmental responsibility while serving diverse consumer preferences across European regions.

Key success factors include investment in smart technology integration, energy efficiency advancement, and comprehensive customer service capabilities that differentiate products in competitive markets. The industry’s evolution toward connected appliances and sustainable solutions creates opportunities for both established manufacturers and emerging technology providers.

Market outlook remains positive, supported by replacement demand, premium segment growth, and expansion opportunities in developing European markets. Companies that successfully navigate technological transformation while maintaining focus on quality, sustainability, and customer satisfaction will capture disproportionate value in this evolving market landscape. The European refrigerator market’s combination of stability, innovation potential, and environmental leadership positions it as an attractive industry for long-term investment and growth strategies.

What is a refrigerator?

A refrigerator is a household appliance used to store food and beverages at low temperatures to prevent spoilage. It typically consists of a thermally insulated compartment and a heat pump that transfers heat from the inside to the external environment.

What are the key players in the European Refrigerator Market?

Key players in the European Refrigerator Market include companies like Bosch, Whirlpool, and Electrolux, which are known for their innovative designs and energy-efficient models. These companies compete on technology, features, and sustainability, among others.

What are the main drivers of growth in the European Refrigerator Market?

The main drivers of growth in the European Refrigerator Market include increasing consumer demand for energy-efficient appliances, advancements in refrigeration technology, and a growing focus on food safety and preservation. Additionally, the rise in urbanization and changing lifestyles contribute to market expansion.

What challenges does the European Refrigerator Market face?

The European Refrigerator Market faces challenges such as stringent regulations regarding energy consumption and environmental impact, as well as intense competition among manufacturers. Additionally, fluctuating raw material prices can affect production costs and pricing strategies.

What opportunities exist in the European Refrigerator Market?

Opportunities in the European Refrigerator Market include the growing trend of smart refrigerators with IoT capabilities, increasing demand for eco-friendly products, and the expansion of online retail channels. These factors present avenues for innovation and market penetration.

What trends are shaping the European Refrigerator Market?

Trends shaping the European Refrigerator Market include the rise of energy-efficient models, the integration of smart technology, and a focus on sustainable materials. Additionally, consumer preferences are shifting towards multifunctional appliances that offer convenience and enhanced features.

European Refrigerator Market

| Segmentation Details | Description |

|---|---|

| Product Type | Top Freezer, Bottom Freezer, Side-by-Side, French Door |

| Technology | Frost-Free, Direct Cool, Smart Refrigerators, Energy Efficient |

| End User | Households, Restaurants, Supermarkets, Hotels |

| Size | Compact, Standard, Large, Extra Large |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the European Refrigerator Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at