444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The European outdoor furniture market represents a dynamic and rapidly evolving sector that encompasses a diverse range of products designed for exterior living spaces. This comprehensive market includes patio furniture, garden seating, outdoor dining sets, loungers, umbrellas, and various decorative elements that enhance outdoor environments across residential and commercial applications. Market dynamics indicate robust growth driven by changing lifestyle preferences, increased focus on outdoor living, and rising disposable incomes across European nations.

Consumer behavior has shifted significantly toward creating comfortable and aesthetically pleasing outdoor spaces, with homeowners investing in high-quality furniture that extends their living areas beyond traditional indoor boundaries. The market demonstrates strong seasonal patterns, with peak demand occurring during spring and summer months, while year-round growth is supported by the increasing popularity of weather-resistant materials and all-season designs.

Regional variations across Europe reflect diverse climate conditions, cultural preferences, and economic factors, with Mediterranean countries showing consistent demand for outdoor furniture throughout extended warm seasons, while Northern European markets focus on durable, multi-seasonal products. The market exhibits a compound annual growth rate of approximately 6.2%, driven by urbanization trends, smaller living spaces that emphasize outdoor areas, and growing interest in sustainable outdoor living solutions.

The European outdoor furniture market refers to the comprehensive industry encompassing the design, manufacturing, distribution, and retail of furniture specifically engineered for outdoor use across European countries. This market includes all furniture categories intended for patios, gardens, balconies, terraces, poolside areas, and commercial outdoor spaces such as restaurants, hotels, and public venues.

Product categories within this market span from basic plastic seating to luxury teak dining sets, incorporating materials such as aluminum, steel, wood, wicker, rattan, and advanced synthetic composites. The market encompasses both residential applications, where homeowners seek to create comfortable outdoor living environments, and commercial applications, where businesses invest in durable, attractive furniture to enhance customer experiences in outdoor settings.

Market scope includes traditional furniture pieces alongside emerging categories such as modular outdoor systems, smart furniture with integrated technology, and eco-friendly options made from recycled or sustainable materials. The definition extends to complementary products including outdoor cushions, covers, umbrellas, and heating elements that complete outdoor furniture ensembles.

Market performance across Europe demonstrates consistent expansion driven by evolving consumer lifestyles, increased emphasis on outdoor entertainment, and growing appreciation for al fresco dining and relaxation. The sector benefits from strong demographic trends including urbanization, smaller indoor living spaces, and aging populations seeking comfortable outdoor environments for leisure activities.

Key growth drivers include rising disposable incomes, particularly in Western European markets, increased home ownership rates, and cultural shifts toward outdoor living as an extension of interior design philosophy. The market shows remarkable resilience with seasonal demand patterns becoming more balanced as manufacturers introduce weather-resistant products suitable for year-round use.

Innovation trends focus on sustainability, with approximately 38% of consumers prioritizing eco-friendly materials and manufacturing processes. Smart furniture integration, modular designs, and space-saving solutions address urban living challenges while premium segments emphasize luxury materials and custom design options. The market demonstrates strong recovery patterns following seasonal fluctuations, with digital sales channels contributing 28% of total market revenue.

Competitive dynamics feature a mix of established European manufacturers, international brands, and emerging direct-to-consumer companies leveraging e-commerce platforms. Regional preferences vary significantly, with Mediterranean markets favoring traditional materials like teak and wrought iron, while Northern European consumers prefer modern synthetic materials and minimalist designs.

Consumer preferences reveal several critical trends shaping market development across European regions. The following insights highlight the most significant factors influencing purchasing decisions and market growth:

Lifestyle evolution represents the primary driver transforming European outdoor furniture consumption patterns. Modern consumers increasingly view outdoor spaces as extensions of their homes, investing in furniture that creates seamless transitions between indoor and outdoor living environments. This trend accelerates as urban populations seek to maximize limited living space by creating functional outdoor areas for dining, entertainment, and relaxation.

Climate adaptation strategies influence purchasing decisions as consumers seek furniture capable of withstanding diverse European weather conditions while maintaining aesthetic appeal. Advanced materials and protective treatments enable furniture to remain outdoors year-round, reducing storage requirements and extending usage seasons. This development particularly benefits Northern European markets where traditional outdoor furniture required seasonal storage.

Economic prosperity across key European markets supports discretionary spending on home improvement and outdoor living enhancements. Rising disposable incomes, particularly in Western European countries, enable consumers to invest in higher-quality, longer-lasting outdoor furniture that justifies premium pricing through durability and design excellence.

Urbanization trends create unique market opportunities as city dwellers with limited indoor space prioritize outdoor areas for entertainment and relaxation. Balconies, terraces, and small gardens become valuable living extensions, driving demand for space-efficient, stylish furniture solutions that maximize functionality within constrained areas.

Health consciousness and wellness trends encourage outdoor activities and fresh air exposure, supporting furniture purchases that facilitate outdoor dining, exercise, and social gatherings. The growing recognition of outdoor living benefits for mental and physical health motivates investment in comfortable, attractive outdoor furniture that encourages regular outdoor use.

Seasonal demand fluctuations create significant challenges for manufacturers and retailers, with sales concentrated in spring and summer months while winter periods show minimal activity. This seasonality requires careful inventory management, impacts cash flow, and necessitates storage facilities for both manufacturers and consumers, particularly in regions with harsh winter conditions.

Weather vulnerability remains a persistent concern despite material improvements, as extreme weather events can damage outdoor furniture and discourage consumer investment. Hailstorms, strong winds, and temperature fluctuations can compromise furniture integrity, leading to replacement costs and consumer reluctance to invest in premium products.

Storage limitations in urban environments restrict consumer ability to purchase larger furniture pieces or multiple sets for different seasons. Limited storage space in apartments and small homes creates barriers to market expansion, particularly for traditional materials requiring indoor storage during winter months.

Price sensitivity affects market penetration as consumers often view outdoor furniture as discretionary purchases that can be delayed during economic uncertainty. Economic downturns disproportionately impact outdoor furniture sales compared to essential indoor furniture, creating volatility in market performance.

Maintenance requirements for certain materials, particularly natural wood and metal products, deter consumers seeking low-maintenance solutions. Regular cleaning, treatment, and protective measures required for material longevity can discourage purchases, especially among time-constrained urban consumers.

Sustainability integration presents substantial growth opportunities as environmental consciousness drives consumer preferences toward eco-friendly products. Manufacturers developing furniture from recycled materials, sustainable wood sources, and biodegradable components can capture the growing segment of environmentally aware consumers willing to pay premium prices for responsible products.

Smart technology adoption offers innovative product development possibilities, including furniture with integrated heating elements, LED lighting, charging stations, and weather monitoring systems. These technological enhancements can justify premium pricing while attracting tech-savvy consumers seeking enhanced outdoor experiences.

Commercial sector expansion provides significant revenue opportunities as restaurants, hotels, and hospitality businesses invest in attractive, durable outdoor furniture to enhance customer experiences and expand seating capacity. The growing trend of outdoor dining and entertainment venues creates consistent demand for professional-grade furniture solutions.

Rental and subscription models address storage and seasonal challenges while providing access to premium furniture for consumers with space or budget constraints. These innovative business models can expand market reach while providing recurring revenue streams for furniture companies.

Customization services enable premium positioning and higher margins by offering personalized design solutions, custom sizing, and unique material combinations. Made-to-order services can differentiate brands while addressing specific consumer needs and space requirements.

Supply chain evolution reflects changing consumer expectations and global manufacturing trends, with European companies balancing local production benefits against cost advantages of international sourcing. Regional manufacturing maintains importance for premium segments emphasizing craftsmanship and reduced environmental impact, while mass market products increasingly utilize global supply chains for cost competitiveness.

Seasonal inventory management requires sophisticated forecasting and flexible production capabilities to meet concentrated demand periods while minimizing carrying costs during off-seasons. Successful companies develop pre-season ordering programs and early-bird promotions to smooth demand patterns and improve cash flow predictability.

Digital transformation reshapes distribution channels as online sales gain prominence, with approximately 35% of consumers researching outdoor furniture online before purchasing. E-commerce platforms enable smaller brands to reach broader markets while established retailers invest in omnichannel strategies combining online convenience with physical showroom experiences.

Material innovation cycles drive competitive differentiation as manufacturers develop proprietary materials and treatments offering superior weather resistance, comfort, and aesthetic appeal. Research and development investments focus on bio-based materials, advanced composites, and smart materials that respond to environmental conditions.

Consumer education becomes increasingly important as material options expand and maintenance requirements vary significantly between product categories. Successful brands invest in educational content, care instructions, and customer support to maximize product satisfaction and reduce returns.

Primary research methodologies employed comprehensive surveys across major European markets, including face-to-face interviews with consumers, retailers, and industry professionals. Data collection encompassed purchasing behavior analysis, preference studies, and satisfaction assessments across diverse demographic segments and geographic regions.

Secondary research incorporated extensive analysis of industry reports, trade publications, government statistics, and company financial statements to establish market baselines and identify growth trends. Historical data analysis spanning multiple years provided context for current market conditions and future projections.

Market segmentation analysis utilized statistical modeling to identify distinct consumer groups based on purchasing patterns, price sensitivity, material preferences, and usage behaviors. Geographic segmentation considered climate variations, cultural preferences, and economic conditions across European regions.

Competitive intelligence gathered through systematic monitoring of major market participants, including product launches, pricing strategies, distribution partnerships, and marketing initiatives. Industry expert interviews provided insights into technological developments and future market directions.

Validation processes included cross-referencing multiple data sources, conducting follow-up interviews with key stakeholders, and utilizing statistical significance testing to ensure research accuracy and reliability. Quality control measures maintained data integrity throughout the research process.

Western Europe dominates market activity with mature consumer bases demonstrating strong purchasing power and established outdoor living cultures. Countries including Germany, France, and the United Kingdom represent the largest individual markets, with German consumers showing particular preference for high-quality, durable products while French markets emphasize design aesthetics and outdoor dining furniture.

Mediterranean regions including Spain, Italy, and Southern France demonstrate consistent year-round demand patterns due to favorable climates supporting extended outdoor living seasons. These markets show 65% higher per-capita consumption compared to Northern European regions, with strong preferences for traditional materials such as teak, wrought iron, and natural stone elements.

Northern European markets including Scandinavia and the Netherlands focus on weather-resistant, multi-seasonal products that withstand harsh winter conditions while providing comfort during brief summer seasons. These regions drive innovation in synthetic materials and protective treatments, with consumers willing to pay premium prices for products offering extended durability.

Eastern European markets represent emerging opportunities with rapidly growing middle classes and increasing home ownership rates. Countries such as Poland, Czech Republic, and Hungary show accelerating growth rates exceeding established Western markets, though price sensitivity remains higher and mass-market products dominate current demand.

Urban versus rural dynamics create distinct market segments, with urban areas emphasizing space-efficient, low-maintenance solutions while rural markets prefer traditional materials and larger furniture sets. Metropolitan areas account for approximately 58% of total market demand despite space constraints, reflecting higher disposable incomes and lifestyle preferences.

Market leadership features a diverse mix of established European manufacturers, international brands, and emerging direct-to-consumer companies. The competitive environment reflects regional preferences, with different companies dominating specific geographic markets or product categories.

Competitive strategies vary significantly across market segments, with premium brands emphasizing craftsmanship, materials quality, and design innovation while mass-market competitors focus on affordability, convenience, and broad distribution networks. Brand differentiation increasingly relies on sustainability credentials, technological integration, and customer service excellence.

By Material Type:

By Product Category:

By End-User Application:

Premium Segment Analysis reveals strong growth in luxury outdoor furniture categories, with consumers increasingly willing to invest in high-quality pieces that offer superior durability, comfort, and aesthetic appeal. This segment demonstrates resilience to economic fluctuations and maintains consistent demand throughout seasonal variations, particularly in affluent European markets.

Mid-Range Market Performance shows the strongest volume growth as this segment balances quality, affordability, and style to appeal to mainstream consumers. Products in this category typically feature synthetic materials or treated woods that provide good weather resistance without premium pricing, making them accessible to broader consumer bases.

Budget Category Dynamics reflect price-sensitive consumer behavior, with emphasis on basic functionality and seasonal use patterns. While this segment shows volume strength, margin pressures from international competition and material cost fluctuations create challenges for European manufacturers.

Smart Furniture Emergence represents a growing niche with integrated technology features such as heating elements, LED lighting, and charging capabilities. Early adoption rates indicate strong consumer interest in tech-enhanced outdoor furniture, particularly among younger demographics and urban consumers.

Sustainable Product Categories demonstrate accelerating growth as environmental consciousness influences purchasing decisions. Products featuring recycled materials, sustainable sourcing, and eco-friendly manufacturing command premium pricing while attracting environmentally aware consumers across all age groups.

Manufacturers benefit from expanding market opportunities driven by lifestyle changes and increased outdoor living emphasis. Growing demand for innovative materials and designs creates opportunities for product differentiation and premium positioning, while technological integration opens new revenue streams through smart furniture categories.

Retailers gain from extended selling seasons as weather-resistant products reduce seasonal fluctuations and enable year-round merchandising strategies. E-commerce growth provides additional distribution channels while omnichannel approaches combine online convenience with physical showroom experiences for optimal customer engagement.

Consumers enjoy expanding product choices, improved quality standards, and innovative features that enhance outdoor living experiences. Competitive market dynamics drive continuous innovation while maintaining diverse price points to accommodate various budget requirements and lifestyle preferences.

Commercial End-Users including restaurants and hotels benefit from durable, attractive furniture options that enhance customer experiences while withstanding heavy use and weather exposure. Professional-grade products designed for commercial applications provide long-term value through extended durability and reduced replacement frequency.

Environmental Stakeholders benefit from increasing industry focus on sustainability, with manufacturers developing eco-friendly materials and production processes that reduce environmental impact while meeting consumer demand for responsible products.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Revolution transforms product development as manufacturers prioritize eco-friendly materials, sustainable sourcing, and recyclable designs. Consumer demand for environmentally responsible products drives innovation in bio-based materials and circular economy principles, with companies investing in sustainable supply chains and production processes.

Smart Integration introduces technological features including weather sensors, integrated heating systems, and connectivity options that enhance outdoor furniture functionality. These innovations appeal to tech-savvy consumers while creating opportunities for premium positioning and recurring revenue through connected services and maintenance programs.

Modular Design Philosophy addresses space constraints and changing needs through flexible, reconfigurable furniture systems. Consumers appreciate the ability to adapt their outdoor spaces for different occasions while manufacturers benefit from reduced inventory complexity and enhanced customer satisfaction through customization options.

Year-Round Usability drives development of weather-resistant materials and designs that extend outdoor furniture usage beyond traditional seasons. Advanced treatments and protective technologies enable furniture to remain outdoors permanently, reducing storage requirements and increasing consumer value perception.

Wellness Integration reflects growing health consciousness through furniture designs that support outdoor exercise, meditation, and relaxation activities. Products incorporating ergonomic principles and wellness features appeal to health-focused consumers seeking outdoor lifestyle benefits.

Material Innovation Breakthroughs include development of advanced synthetic materials that replicate natural wood appearance while offering superior weather resistance and durability. These innovations enable manufacturers to combine aesthetic appeal with practical performance, addressing consumer desires for low-maintenance outdoor furniture without compromising visual quality.

Digital Transformation Initiatives encompass augmented reality applications allowing consumers to visualize furniture in their outdoor spaces before purchasing. E-commerce platforms integrate sophisticated product configurators and virtual showrooms, while manufacturers invest in digital marketing strategies to reach online consumers effectively.

Sustainability Certifications gain importance as manufacturers pursue recognized environmental standards and certifications to validate their sustainability claims. Third-party certifications provide consumer confidence while enabling premium positioning for environmentally responsible products in competitive markets.

Supply Chain Optimization focuses on reducing environmental impact while maintaining cost competitiveness through regional sourcing strategies and efficient logistics networks. Companies invest in supply chain transparency and traceability systems to meet growing consumer demands for ethical sourcing.

Collaborative Design Partnerships between furniture manufacturers and renowned designers create distinctive product lines that differentiate brands in competitive markets. These collaborations combine design expertise with manufacturing capabilities to produce innovative, market-leading products.

MarkWide Research recommends that manufacturers prioritize sustainability initiatives and material innovation to capture growing environmental consciousness among European consumers. Investment in eco-friendly production processes and sustainable material sourcing will provide competitive advantages while meeting regulatory requirements and consumer expectations.

Digital channel development should focus on creating comprehensive online experiences that address the challenge of purchasing furniture without physical inspection. Virtual reality showrooms, detailed product information, and flexible return policies can overcome traditional e-commerce barriers for outdoor furniture purchases.

Seasonal demand management requires innovative approaches including pre-season promotions, flexible manufacturing capabilities, and strategic inventory positioning. Companies should develop year-round product strategies that reduce seasonal dependency while maintaining profitability during peak demand periods.

Commercial market expansion presents significant opportunities for manufacturers willing to develop professional-grade products meeting hospitality industry requirements. Investment in commercial-specific product lines and distribution channels can provide stable revenue streams less affected by seasonal fluctuations.

Technology integration should focus on practical applications that enhance user experience rather than technology for its own sake. Smart features that provide genuine value, such as weather monitoring and adaptive comfort systems, will justify premium pricing while attracting innovation-seeking consumers.

Market trajectory indicates continued expansion driven by lifestyle evolution, urbanization trends, and increasing emphasis on outdoor living across European markets. MWR analysis projects sustained growth with particular strength in sustainability-focused products and technology-integrated solutions that address evolving consumer preferences and environmental concerns.

Innovation acceleration will focus on smart materials that respond to environmental conditions, integrated technology systems, and modular designs addressing space constraints in urban environments. The convergence of sustainability and technology will create premium market segments while mass-market products emphasize durability and value.

Geographic expansion opportunities exist in Eastern European markets where economic development and rising living standards create new consumer bases for outdoor furniture. These emerging markets show growth potential exceeding mature Western European markets, though price sensitivity requires adapted product strategies.

Commercial sector growth will accelerate as hospitality businesses recognize outdoor spaces’ importance for customer attraction and revenue generation. Professional-grade furniture demand will increase as restaurants, hotels, and entertainment venues expand outdoor capacity and enhance customer experiences.

Sustainability integration will become mandatory rather than optional as environmental regulations tighten and consumer awareness increases. Companies investing early in sustainable practices and materials will gain competitive advantages while those failing to adapt may face market share erosion and regulatory challenges.

The European outdoor furniture market demonstrates robust growth potential driven by fundamental lifestyle changes, increasing outdoor living emphasis, and evolving consumer preferences toward quality and sustainability. Market dynamics reflect a maturing industry transitioning from seasonal, weather-dependent products toward year-round, technology-integrated solutions that enhance outdoor living experiences.

Competitive advantages will increasingly depend on innovation capabilities, sustainability credentials, and ability to address diverse consumer needs across varied European markets. Successful companies will balance traditional craftsmanship with modern materials and technologies while maintaining cost competitiveness against international competition.

Future success factors include embracing digital transformation, developing sustainable product lines, and creating flexible business models that address seasonal demand fluctuations. The market rewards companies that understand regional preferences while maintaining operational efficiency and innovation leadership in materials and design.

Strategic positioning requires careful consideration of market segments, with opportunities existing across premium, mid-range, and emerging technology categories. Companies that successfully integrate sustainability, technology, and consumer convenience will capture disproportionate market share in this evolving industry landscape, positioning themselves for long-term growth in the dynamic European outdoor furniture market.

What is Outdoor Furniture?

Outdoor furniture refers to furniture specifically designed for outdoor use, including items such as patio chairs, tables, loungers, and umbrellas. It is typically made from weather-resistant materials to withstand various environmental conditions.

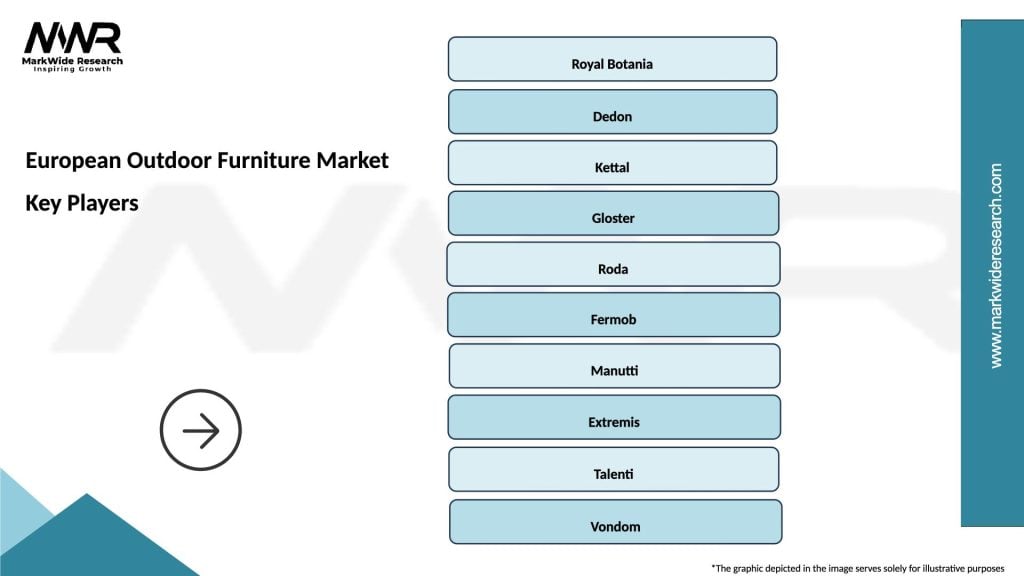

What are the key players in the European Outdoor Furniture Market?

Key players in the European Outdoor Furniture Market include companies like Kettler, Royal Botania, and Fermob, which are known for their innovative designs and quality materials. These companies compete in various segments such as luxury, mid-range, and budget outdoor furniture, among others.

What are the growth factors driving the European Outdoor Furniture Market?

The growth of the European Outdoor Furniture Market is driven by increasing consumer interest in outdoor living spaces, rising disposable incomes, and a growing trend towards home improvement. Additionally, the popularity of outdoor dining and leisure activities contributes to market expansion.

What challenges does the European Outdoor Furniture Market face?

The European Outdoor Furniture Market faces challenges such as fluctuating raw material prices and competition from low-cost manufacturers. Additionally, changing consumer preferences and environmental regulations can impact production and sales.

What opportunities exist in the European Outdoor Furniture Market?

Opportunities in the European Outdoor Furniture Market include the growing demand for sustainable and eco-friendly products, as well as the potential for innovation in design and materials. The rise of e-commerce also presents new avenues for reaching consumers.

What trends are shaping the European Outdoor Furniture Market?

Trends in the European Outdoor Furniture Market include a focus on multifunctional furniture, the use of sustainable materials, and the integration of technology in outdoor settings. Additionally, there is a growing preference for customizable and modular outdoor solutions.

European Outdoor Furniture Market

| Segmentation Details | Description |

|---|---|

| Product Type | Chairs, Tables, Loungers, Umbrellas |

| Material | Wood, Metal, Plastic, Wicker |

| End User | Residential, Commercial, Hospitality, Public Spaces |

| Distribution Channel | Online, Retail Stores, Wholesale, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the European Outdoor Furniture Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at