444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The European off-highway vehicle HVAC market represents a dynamic and rapidly evolving sector within the broader automotive climate control industry. This specialized market encompasses heating, ventilation, and air conditioning systems specifically designed for construction equipment, agricultural machinery, mining vehicles, and other industrial off-road applications across European territories. Market dynamics indicate substantial growth potential driven by increasing mechanization in agriculture, expanding construction activities, and stringent operator comfort regulations.

Regional distribution shows Germany, France, and the United Kingdom leading market adoption, collectively accounting for approximately 58% of total European demand. The market demonstrates strong correlation with industrial activity levels, seasonal agricultural cycles, and infrastructure development projects. Technology advancement in climate control systems has become increasingly sophisticated, incorporating energy-efficient compressors, advanced filtration systems, and intelligent temperature management solutions.

Growth projections suggest the market will expand at a compound annual growth rate of 6.2% through the forecast period, supported by replacement demand from aging vehicle fleets and new equipment purchases. Regulatory compliance requirements for operator safety and comfort standards continue driving adoption of advanced HVAC systems across various off-highway vehicle categories.

The European off-highway vehicle HVAC market refers to the specialized segment encompassing climate control systems designed, manufactured, and distributed for non-road mobile machinery operating across European markets. These systems provide essential heating, ventilation, and air conditioning functions for operator cabins in construction equipment, agricultural tractors, forestry machinery, mining vehicles, and industrial equipment.

System components typically include compressors, evaporators, condensers, expansion valves, refrigerant lines, cabin air filters, heating elements, and electronic control modules specifically engineered to withstand harsh operating environments. Performance requirements differ significantly from automotive applications due to extended operating hours, extreme temperature variations, dusty conditions, and vibration exposure common in off-highway operations.

Market scope encompasses original equipment manufacturer installations, aftermarket replacement parts, and retrofit solutions across diverse vehicle categories. The definition extends to both traditional refrigerant-based systems and emerging electric HVAC technologies designed for hybrid and fully electric off-highway vehicles entering European markets.

Market fundamentals demonstrate robust growth trajectory supported by increasing mechanization across European agricultural and construction sectors. The off-highway vehicle HVAC market benefits from stringent operator comfort regulations, technological advancement in climate control systems, and growing emphasis on productivity enhancement through improved working conditions.

Key growth drivers include expanding construction activities, agricultural modernization initiatives, and replacement demand from aging vehicle fleets. Technology trends show increasing adoption of energy-efficient systems, with approximately 42% of new installations featuring variable-speed compressors and intelligent climate management capabilities.

Regional leadership remains concentrated in Western European markets, while Eastern European countries demonstrate accelerating adoption rates. Competitive dynamics feature established HVAC manufacturers expanding their off-highway portfolios alongside specialized suppliers focusing exclusively on industrial climate control applications.

Future outlook indicates continued market expansion driven by electrification trends, sustainability requirements, and evolving operator comfort expectations. Investment priorities focus on developing eco-friendly refrigerants, improving energy efficiency, and integrating smart connectivity features into HVAC control systems.

Strategic insights reveal several critical factors shaping the European off-highway vehicle HVAC market landscape:

Primary growth drivers propelling the European off-highway vehicle HVAC market include expanding mechanization across key industrial sectors. Agricultural modernization initiatives throughout Europe drive increased adoption of climate-controlled tractors and harvesting equipment, with farmers recognizing the productivity benefits of comfortable operating environments during extended work periods.

Construction sector expansion represents another significant driver, as infrastructure development projects across European Union member states require advanced excavators, bulldozers, and other heavy equipment featuring operator comfort systems. Regulatory requirements mandating specific comfort and safety standards for industrial vehicle operators create consistent demand for compliant HVAC installations.

Technological advancement in climate control systems enables manufacturers to offer more efficient, reliable, and feature-rich solutions. Energy efficiency improvements help reduce overall vehicle fuel consumption, making advanced HVAC systems attractive to cost-conscious fleet operators. Operator retention concerns in competitive labor markets drive equipment owners to invest in comfort-enhancing technologies.

Replacement demand from aging vehicle fleets provides steady market foundation, as older HVAC systems require updating to meet current performance and efficiency standards. Export opportunities for European-manufactured off-highway vehicles equipped with advanced climate control systems support continued market growth.

Cost considerations represent the primary restraint limiting European off-highway vehicle HVAC market expansion. Initial investment requirements for advanced climate control systems can significantly increase overall vehicle acquisition costs, particularly challenging for smaller operators and emerging markets within the European region.

Maintenance complexity associated with sophisticated HVAC systems creates ongoing operational challenges for fleet managers. Technical expertise requirements for system installation, troubleshooting, and repair limit market accessibility in regions with insufficient service infrastructure. Component availability issues can result in extended downtime periods affecting productivity.

Energy consumption concerns persist despite efficiency improvements, as HVAC systems continue requiring significant power from vehicle engines or electrical systems. Environmental regulations regarding refrigerant usage create compliance challenges and potential retrofit requirements for existing installations.

Market fragmentation across diverse vehicle categories and applications complicates standardization efforts, increasing development costs and limiting economies of scale. Economic uncertainty affecting construction and agricultural sectors can delay equipment purchases and HVAC system upgrades. Seasonal demand fluctuations create inventory management challenges for manufacturers and distributors.

Electrification trends present substantial opportunities for European off-highway vehicle HVAC market participants. Electric and hybrid vehicles require specialized climate control systems designed for battery-powered operation, creating new market segments with higher value propositions and reduced competition from traditional suppliers.

Smart technology integration offers opportunities to differentiate products through connectivity features, predictive maintenance capabilities, and remote monitoring systems. IoT-enabled HVAC systems can provide valuable operational data to fleet managers while enabling proactive service scheduling and performance optimization.

Sustainability initiatives across European industries create demand for eco-friendly refrigerants, energy-efficient designs, and recyclable components. Carbon footprint reduction goals drive interest in HVAC systems that minimize environmental impact while maintaining performance standards.

Aftermarket expansion represents significant growth potential as existing vehicle fleets require system upgrades, component replacements, and performance enhancements. Retrofit solutions for older equipment enable market participation without requiring complete vehicle replacement. Service revenue opportunities through maintenance contracts and technical support services provide recurring income streams for market participants.

Supply chain dynamics within the European off-highway vehicle HVAC market demonstrate increasing complexity as manufacturers balance cost optimization with performance requirements. Component sourcing strategies have evolved to emphasize regional suppliers while maintaining quality standards and delivery reliability.

Competitive pressures drive continuous innovation in system efficiency, reliability, and feature integration. Market consolidation trends show larger automotive HVAC suppliers acquiring specialized off-highway manufacturers to expand their product portfolios and market reach. Technology transfer from automotive applications accelerates development cycles while reducing research and development costs.

Customer expectations continue evolving toward more sophisticated climate control capabilities, including zone-based temperature management, air quality monitoring, and integration with vehicle telematics systems. Demand patterns show approximately 35% of customers prioritizing energy efficiency over initial cost considerations.

Regulatory dynamics influence product development priorities, with European Union directives regarding emissions, safety standards, and operator comfort requirements shaping market offerings. Market maturity levels vary significantly across European regions, with Western markets showing replacement-driven demand while Eastern European countries demonstrate growth-oriented purchasing patterns.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the European off-highway vehicle HVAC market. Primary research activities included structured interviews with industry executives, equipment manufacturers, fleet operators, and technology suppliers across key European markets.

Secondary research encompassed analysis of industry reports, regulatory filings, patent databases, and trade association publications. Market sizing methodologies utilized bottom-up approaches based on vehicle production data, HVAC system penetration rates, and average system values across different equipment categories.

Data validation processes involved cross-referencing multiple sources and conducting expert interviews to verify market trends and growth projections. Regional analysis incorporated country-specific factors including regulatory environments, economic conditions, and industry development patterns.

Forecasting models considered historical market performance, macroeconomic indicators, technology adoption curves, and regulatory timeline impacts. Competitive intelligence gathered through company annual reports, product announcements, and industry conference presentations provided insights into market positioning and strategic initiatives.

Western European markets maintain leadership positions in the off-highway vehicle HVAC sector, with Germany representing the largest single market due to its substantial construction and agricultural equipment manufacturing base. German market dynamics show strong emphasis on premium HVAC systems with advanced features, reflecting the country’s focus on high-quality industrial equipment.

French market characteristics demonstrate balanced demand across agricultural and construction applications, with approximately 28% market share within the Western European region. United Kingdom trends show increasing adoption of energy-efficient systems despite economic uncertainties, with fleet operators prioritizing long-term operational cost reduction.

Nordic countries including Sweden, Norway, and Finland exhibit strong demand for heating-focused HVAC systems due to harsh winter operating conditions. Market penetration rates in these regions reach approximately 78% for new equipment installations, significantly higher than European averages.

Eastern European expansion shows accelerating growth rates as countries like Poland, Czech Republic, and Hungary modernize their agricultural and construction sectors. Investment patterns in these markets favor cost-effective HVAC solutions with proven reliability records. Southern European markets including Italy and Spain prioritize cooling capabilities while showing growing interest in year-round climate control systems.

Market leadership within the European off-highway vehicle HVAC sector features a combination of established automotive climate control manufacturers and specialized industrial equipment suppliers. Competitive positioning strategies vary from comprehensive system integration to focused component specialization.

Strategic initiatives among leading competitors include technology partnerships, regional manufacturing expansion, and aftermarket service network development. Innovation focus areas encompass electric HVAC systems, smart connectivity features, and sustainable refrigerant adoption.

Vehicle type segmentation reveals distinct market characteristics across different off-highway equipment categories:

By Vehicle Type:

By Technology Type:

By Component:

Agricultural equipment category demonstrates the strongest growth momentum within the European off-highway vehicle HVAC market. Tractor applications show increasing adoption of sophisticated climate control systems as farmers recognize productivity benefits during extended operating periods. Seasonal demand patterns create distinct peaks during spring planting and autumn harvest seasons.

Construction equipment segment exhibits steady demand driven by infrastructure development projects across European Union member states. Excavator and bulldozer applications require robust HVAC systems capable of maintaining performance in dusty, high-vibration environments. Operator retention concerns in competitive construction labor markets drive investment in comfort-enhancing technologies.

Mining vehicle category represents a specialized high-value segment with stringent performance requirements. Underground mining applications demand advanced air filtration capabilities alongside climate control functions. Surface mining operations require systems capable of operating in extreme temperature variations and harsh environmental conditions.

Forestry equipment segment shows growing market potential as European forest management practices become increasingly mechanized. Harvester and forwarder applications benefit from HVAC systems providing clean, temperature-controlled cabin environments during extended forest operations. Air quality management becomes critical in applications involving wood dust and debris exposure.

Equipment manufacturers benefit from HVAC system integration through enhanced product differentiation and increased customer satisfaction. Competitive advantages emerge from offering superior operator comfort features, leading to stronger market positioning and premium pricing opportunities. Customer loyalty improves when equipment provides comfortable working environments during extended operation periods.

Fleet operators realize significant benefits through improved operator productivity, reduced turnover rates, and enhanced equipment utilization. Operational efficiency gains result from operators maintaining peak performance levels in comfortable cabin environments. Maintenance cost reduction occurs through advanced HVAC systems featuring predictive maintenance capabilities and extended service intervals.

HVAC suppliers access expanding market opportunities through specialization in off-highway applications. Revenue diversification reduces dependence on traditional automotive markets while leveraging existing technical expertise. Higher margin potential exists in specialized industrial applications compared to commodity automotive segments.

End users experience improved working conditions, enhanced productivity, and reduced fatigue during equipment operation. Health and safety benefits include better air quality, temperature control, and reduced exposure to environmental contaminants. Equipment longevity improves through reduced operator stress and more consistent operating practices in comfortable environments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Electrification acceleration represents the most significant trend shaping the European off-highway vehicle HVAC market. Electric and hybrid vehicles require specialized climate control systems designed for battery-powered operation, creating new technical challenges and market opportunities. System integration with vehicle electrical systems becomes increasingly complex as manufacturers optimize energy consumption and performance.

Smart connectivity adoption transforms traditional HVAC systems into intelligent climate management platforms. IoT-enabled systems provide real-time performance monitoring, predictive maintenance alerts, and remote diagnostic capabilities. Data analytics help fleet operators optimize system performance while reducing operational costs and downtime.

Sustainability emphasis drives adoption of eco-friendly refrigerants and energy-efficient designs. Carbon footprint reduction initiatives across European industries create demand for HVAC systems minimizing environmental impact. Circular economy principles influence product design toward recyclable components and extended service life.

Customization demand increases as equipment manufacturers seek differentiated climate control solutions. Application-specific designs optimize performance for particular operating environments and vehicle types. Modular system architectures enable cost-effective customization while maintaining manufacturing efficiency. User interface evolution incorporates touchscreen controls and smartphone integration for enhanced operator experience.

Technology partnerships between HVAC manufacturers and off-highway vehicle producers have intensified throughout the European market. Collaborative development programs focus on creating integrated climate control solutions optimized for specific vehicle platforms and applications. Joint ventures enable companies to combine automotive HVAC expertise with off-highway market knowledge.

Manufacturing expansion initiatives demonstrate industry confidence in long-term market growth potential. Regional production facilities reduce supply chain complexity while improving customer service capabilities. Automation investments in manufacturing processes enhance quality consistency and cost competitiveness.

Regulatory compliance developments influence product design priorities across the industry. European Union directives regarding emissions, safety standards, and operator comfort requirements shape market offerings. Certification processes for new refrigerants and system designs create barriers to entry while ensuring environmental compliance.

Acquisition activity shows larger automotive suppliers expanding their off-highway portfolios through strategic purchases. Market consolidation enables companies to achieve economies of scale while broadening their technology capabilities. Vertical integration strategies help manufacturers control critical component supply chains and improve profit margins.

Strategic positioning recommendations for European off-highway vehicle HVAC market participants emphasize technology differentiation and customer-centric solutions. MarkWide Research analysis suggests companies should prioritize electric HVAC system development to capitalize on vehicle electrification trends while maintaining traditional product lines for existing markets.

Investment priorities should focus on smart connectivity features and predictive maintenance capabilities that provide ongoing value to fleet operators. Service revenue development through maintenance contracts and technical support services offers attractive recurring income opportunities with higher profit margins than equipment sales.

Market expansion strategies should consider regional specialization based on climate conditions and application requirements. Northern European markets present opportunities for heating-focused systems while southern regions offer potential for advanced cooling technologies. Eastern European growth markets require cost-effective solutions with proven reliability records.

Partnership development with equipment manufacturers enables deeper market penetration and collaborative innovation opportunities. Technology licensing agreements can accelerate market entry while reducing development costs and time-to-market pressures. Aftermarket channel development provides access to replacement demand and upgrade opportunities across existing vehicle fleets.

Long-term growth prospects for the European off-highway vehicle HVAC market remain positive, supported by continued mechanization trends and evolving operator comfort expectations. Market expansion is projected to accelerate at a compound annual growth rate of 6.8% over the next decade, driven by technology advancement and regulatory requirements.

Electric vehicle integration will reshape market dynamics as battery-powered off-highway equipment becomes mainstream. System efficiency improvements will be critical for maximizing vehicle range while maintaining operator comfort. Thermal management integration with battery cooling systems creates opportunities for comprehensive climate control solutions.

Smart technology adoption will transform HVAC systems into connected platforms providing valuable operational data and predictive maintenance capabilities. Artificial intelligence integration may enable autonomous climate control optimization based on operating conditions and operator preferences. MWR projections indicate that approximately 65% of new HVAC installations will feature smart connectivity by the end of the forecast period.

Sustainability requirements will drive continued innovation in eco-friendly refrigerants and energy-efficient designs. Circular economy principles will influence product development toward recyclable components and extended service life. Carbon neutrality goals across European industries will create demand for HVAC systems minimizing environmental impact while maintaining performance standards.

The European off-highway vehicle HVAC market presents substantial growth opportunities driven by mechanization trends, regulatory requirements, and evolving operator comfort expectations. Market dynamics demonstrate strong fundamentals supported by expanding construction activities, agricultural modernization, and replacement demand from aging vehicle fleets across European territories.

Technology advancement in climate control systems continues creating differentiation opportunities through energy efficiency improvements, smart connectivity features, and electric vehicle integration capabilities. Regional market variations provide opportunities for specialized solutions addressing specific climate conditions and application requirements throughout diverse European markets.

Competitive landscape evolution shows increasing collaboration between automotive HVAC suppliers and off-highway equipment manufacturers, enabling integrated solutions optimized for specific vehicle platforms. Investment priorities focus on electric HVAC system development, smart technology integration, and aftermarket service expansion to capture recurring revenue opportunities.

Future market success will depend on companies’ ability to balance performance requirements with cost considerations while adapting to electrification trends and sustainability mandates. The European off-highway vehicle HVAC market offers attractive growth potential for participants who can effectively navigate technological transitions and evolving customer expectations in this dynamic industrial sector.

What is Off-highway Vehicle HVAC?

Off-highway Vehicle HVAC refers to heating, ventilation, and air conditioning systems specifically designed for vehicles that operate outside of traditional roadways, such as agricultural, construction, and mining equipment.

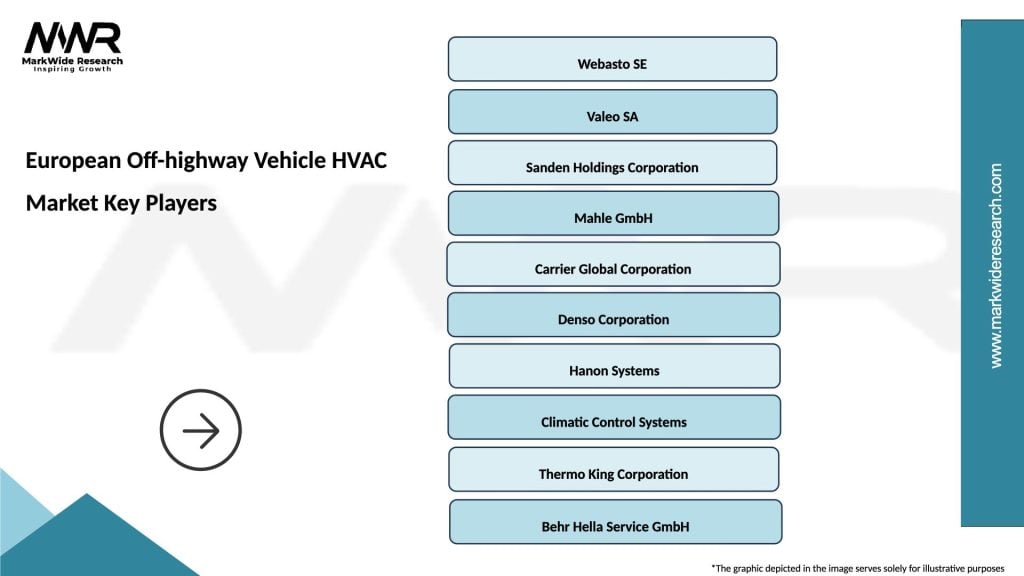

What are the key players in the European Off-highway Vehicle HVAC Market?

Key players in the European Off-highway Vehicle HVAC Market include companies like Webasto, Denso Corporation, and Valeo, which provide innovative climate control solutions for off-highway vehicles, among others.

What are the main drivers of the European Off-highway Vehicle HVAC Market?

The main drivers of the European Off-highway Vehicle HVAC Market include the increasing demand for comfort in off-highway vehicles, advancements in HVAC technology, and the growth of the construction and agriculture sectors.

What challenges does the European Off-highway Vehicle HVAC Market face?

Challenges in the European Off-highway Vehicle HVAC Market include stringent environmental regulations, the high cost of advanced HVAC systems, and the need for energy-efficient solutions to meet sustainability goals.

What opportunities exist in the European Off-highway Vehicle HVAC Market?

Opportunities in the European Off-highway Vehicle HVAC Market include the development of eco-friendly HVAC systems, integration of smart technologies, and the expansion of electric and hybrid off-highway vehicles.

What trends are shaping the European Off-highway Vehicle HVAC Market?

Trends shaping the European Off-highway Vehicle HVAC Market include the increasing adoption of automation in vehicles, the focus on reducing carbon emissions, and the rise of connected vehicle technologies.

European Off-highway Vehicle HVAC Market

| Segmentation Details | Description |

|---|---|

| Product Type | Heating Systems, Cooling Systems, Ventilation Units, Climate Control Modules |

| Technology | Refrigeration, Heat Exchangers, Evaporators, Condensers |

| End User | Agricultural Equipment, Construction Machinery, Mining Vehicles, Forestry Equipment |

| Installation | OEM Installation, Aftermarket Installation, Retrofit Solutions, Custom Installations |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the European Off-highway Vehicle HVAC Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at