444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The European motor homes market represents one of the most dynamic and rapidly evolving segments within the recreational vehicle industry. This comprehensive market encompasses a diverse range of mobile living solutions, from compact camper vans to luxury Class A motor homes, catering to the growing demand for flexible travel and lifestyle experiences across European nations. Market dynamics indicate robust growth driven by changing consumer preferences, increased leisure time, and a growing emphasis on experiential travel over traditional vacation models.

Regional variations across Europe showcase distinct preferences and market characteristics, with Germany, France, and Italy leading in both production and consumption. The market demonstrates remarkable resilience and adaptability, particularly following recent global events that have reshaped travel patterns and consumer priorities. Growth projections suggest the market will continue expanding at a compound annual growth rate of 6.2% through the forecast period, driven by technological innovations, improved infrastructure, and evolving demographic trends.

Consumer demographics reveal an interesting shift, with younger generations increasingly embracing the motor home lifestyle alongside traditional older demographics. This trend reflects broader societal changes toward remote work capabilities, digital nomadism, and sustainable travel practices. The market’s evolution encompasses not only traditional recreational use but also alternative living solutions and mobile office concepts.

The European motor homes market refers to the comprehensive ecosystem of self-contained recreational vehicles designed for travel and temporary accommodation across European territories. These vehicles integrate essential living amenities including sleeping quarters, cooking facilities, sanitation systems, and storage solutions within a mobile platform. Motor homes distinguish themselves from other recreational vehicles through their integrated design and self-sufficiency capabilities.

Classification systems within the European market typically follow established categories ranging from compact Class B camper vans to spacious Class A coach-style vehicles. The market encompasses both new vehicle sales and the thriving pre-owned segment, along with associated services including rentals, maintenance, and aftermarket modifications. Regulatory frameworks across European Union member states provide standardized safety and environmental requirements while allowing for regional variations in licensing and operational parameters.

Market participants include established manufacturers, emerging innovative companies, dealership networks, rental operators, and supporting service providers. The ecosystem extends beyond vehicle production to encompass camping infrastructure, insurance services, financing solutions, and specialized accessories that enhance the motor home experience.

Strategic analysis of the European motor homes market reveals a sector experiencing unprecedented transformation driven by evolving consumer lifestyles, technological advancement, and changing travel preferences. The market demonstrates strong fundamentals with consistent growth patterns across multiple European regions, supported by favorable demographic trends and increasing acceptance of alternative living arrangements.

Key performance indicators highlight the market’s resilience and growth potential, with rental segment growth of 8.4% annually outpacing traditional ownership models. This trend reflects changing consumer attitudes toward access over ownership, particularly among younger demographics and urban populations. Technological integration emerges as a critical differentiator, with smart home features, connectivity solutions, and energy-efficient systems becoming standard expectations rather than premium options.

Competitive dynamics showcase a market balancing established European manufacturers with innovative newcomers introducing disruptive technologies and business models. The sector benefits from strong supply chain networks, established distribution channels, and growing infrastructure support across European camping and touring networks. Sustainability initiatives increasingly influence purchasing decisions, with electric and hybrid motor homes representing 12% of new registrations in key markets.

Fundamental market insights reveal several transformative trends reshaping the European motor homes landscape. The sector demonstrates remarkable adaptability to changing consumer needs while maintaining strong growth trajectories across diverse market segments.

Primary market drivers propelling European motor homes market expansion encompass diverse socioeconomic, technological, and lifestyle factors that collectively create favorable conditions for sustained growth. These drivers operate synergistically to expand market reach and deepen consumer engagement across traditional and emerging segments.

Lifestyle transformation represents the most significant driver, with increasing numbers of Europeans seeking flexible travel options that provide independence and safety. The rise of remote work capabilities enables extended travel periods, while growing environmental consciousness drives interest in sustainable tourism alternatives. Demographic shifts contribute substantially, as aging populations with disposable income seek comfortable travel solutions, while younger generations embrace minimalist living and experiential consumption patterns.

Infrastructure development across European nations creates supportive conditions for motor home adoption. Improved camping facilities, dedicated parking areas, and enhanced service networks reduce barriers to entry and improve the overall user experience. Technological advancement in vehicle systems, connectivity solutions, and energy management makes motor homes more appealing to tech-savvy consumers while improving reliability and comfort standards.

Economic factors including favorable financing options, strong resale values, and cost-effective travel alternatives compared to traditional vacation expenses support market growth. The sector benefits from established manufacturing expertise within Europe, creating competitive advantages in quality, innovation, and customer service delivery.

Significant market restraints challenge the European motor homes sector despite overall positive growth trends. These limitations require strategic attention from industry participants to ensure continued market expansion and customer satisfaction.

High initial investment requirements represent the primary barrier to market entry for many potential customers. Quality motor homes require substantial capital outlay, while financing options may not be accessible to all demographic segments. Storage and maintenance challenges in urban environments create practical obstacles for potential owners, particularly in densely populated European cities where parking and storage facilities are limited and expensive.

Regulatory complexity across different European jurisdictions creates compliance challenges for manufacturers and confusion for consumers. Varying licensing requirements, weight restrictions, and operational regulations complicate cross-border travel and market standardization efforts. Seasonal demand patterns create business challenges for manufacturers and dealers, with peak season sales representing 67% of annual volume concentrated in spring and early summer months.

Infrastructure limitations in certain European regions restrict market accessibility and growth potential. Inadequate camping facilities, limited service networks, and insufficient charging infrastructure for electric vehicles constrain market development in emerging regions. Environmental concerns regarding emissions and resource consumption create regulatory pressures and consumer hesitation, particularly in environmentally conscious European markets.

Emerging opportunities within the European motor homes market present significant potential for growth and innovation across multiple dimensions. These opportunities reflect evolving consumer needs, technological possibilities, and market gaps that forward-thinking companies can address strategically.

Electric and hybrid propulsion systems represent transformative opportunities as European environmental regulations tighten and consumer preferences shift toward sustainable solutions. Early movers in electric motor home technology can establish competitive advantages while addressing growing environmental consciousness. Smart technology integration offers opportunities to differentiate products through connectivity, automation, and enhanced user experiences that appeal to tech-savvy demographics.

Rental and sharing economy models present substantial growth opportunities, particularly in urban markets where ownership may be impractical. Platform-based business models can expand market access while generating recurring revenue streams. Customization and personalization services create premium market opportunities as consumers seek unique solutions tailored to specific needs and preferences.

Emerging market penetration in Eastern European countries offers expansion opportunities as economic development and tourism infrastructure improve. Corporate and commercial applications including mobile offices, emergency response units, and specialized service vehicles represent untapped market segments with distinct requirements and purchasing patterns.

Complex market dynamics shape the European motor homes sector through interconnected forces that influence supply, demand, pricing, and competitive positioning. Understanding these dynamics enables stakeholders to navigate market complexities and capitalize on emerging trends effectively.

Supply chain dynamics reflect the sector’s integration with broader automotive and recreational vehicle industries. Component sourcing, manufacturing capacity, and distribution networks create interdependencies that influence market responsiveness and pricing structures. Demand fluctuations driven by economic conditions, weather patterns, and consumer confidence create cyclical patterns that require strategic planning and operational flexibility.

Competitive dynamics showcase established manufacturers defending market positions while innovative newcomers introduce disruptive technologies and business models. This competition drives innovation while creating pricing pressures and market fragmentation. Regulatory dynamics across European jurisdictions influence product development, market access, and operational requirements, creating both challenges and opportunities for market participants.

Consumer behavior dynamics reflect changing preferences, demographic shifts, and lifestyle evolution that reshape market demand patterns. The emergence of younger buyers, increased environmental consciousness, and technology adoption create new requirements while maintaining traditional market segments. Economic dynamics including currency fluctuations, interest rates, and disposable income levels influence purchasing decisions and market accessibility across different European regions.

Comprehensive research methodology employed in analyzing the European motor homes market combines quantitative and qualitative approaches to ensure accurate, reliable, and actionable insights. The methodology encompasses primary research, secondary data analysis, and expert consultation to provide holistic market understanding.

Primary research activities include structured interviews with industry executives, manufacturer representatives, dealer networks, and end consumers across major European markets. Survey methodologies capture consumer preferences, purchasing behaviors, and satisfaction levels while identifying emerging trends and unmet needs. Field research at major trade shows, camping exhibitions, and dealer locations provides direct market observation and stakeholder interaction opportunities.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and academic studies to establish market baselines and validate primary findings. Data triangulation methods ensure accuracy and reliability by comparing multiple information sources and identifying consistent patterns and trends.

Expert consultation with industry specialists, market analysts, and technology experts provides contextual understanding and forward-looking perspectives. Statistical analysis and modeling techniques project market trends while accounting for various scenario possibilities and risk factors that may influence future market development.

Regional market analysis reveals distinct characteristics and growth patterns across European motor homes markets, with significant variations in consumer preferences, regulatory environments, and market maturity levels. These regional differences create diverse opportunities and challenges for market participants.

Germany dominates the European motor homes market with 34% market share, driven by strong manufacturing capabilities, established consumer base, and extensive infrastructure support. German consumers demonstrate preferences for premium features and advanced technology integration, while the country’s central location facilitates cross-border travel and market access. France represents the second-largest market with 22% share, characterized by strong domestic production and diverse consumer segments ranging from budget-conscious buyers to luxury seekers.

Italy and the United Kingdom collectively account for 28% of market volume, with Italy showing particular strength in compact motor home segments while the UK demonstrates growing interest in luxury and technology-enhanced vehicles. Nordic countries including Sweden, Norway, and Denmark show rapid growth rates despite smaller absolute market sizes, driven by high disposable incomes and strong outdoor recreation cultures.

Eastern European markets present emerging opportunities with annual growth rates exceeding 11% in countries like Poland, Czech Republic, and Hungary. These markets benefit from improving economic conditions, developing tourism infrastructure, and increasing consumer awareness of motor home lifestyle benefits.

Competitive landscape analysis reveals a dynamic market structure characterized by established European manufacturers, innovative newcomers, and specialized niche players competing across multiple dimensions including product quality, technology integration, pricing, and customer service excellence.

Competitive strategies focus increasingly on differentiation through technology integration, sustainability initiatives, and enhanced customer experiences. Market leaders invest heavily in research and development while expanding production capacity to meet growing demand across European markets.

Market segmentation analysis provides detailed understanding of diverse consumer needs, preferences, and purchasing behaviors across the European motor homes market. Segmentation approaches encompass vehicle types, price ranges, consumer demographics, and usage patterns to identify specific market opportunities and competitive positioning strategies.

By Vehicle Type:

By Price Range:

By Application:

Category-specific insights reveal distinct market dynamics, consumer preferences, and growth patterns across different motor home segments within the European market. These insights enable targeted strategies and product development approaches tailored to specific category requirements and opportunities.

Compact camper vans demonstrate the strongest growth trajectory with annual increases of 8.7%, driven by urban consumers seeking versatile vehicles suitable for daily use and weekend adventures. This category benefits from improved fuel efficiency, easier parking, and lower total ownership costs while maintaining essential motor home functionality. Technology integration in compact vehicles focuses on space optimization and multi-functional systems that maximize utility within size constraints.

Mid-size motor homes represent the market mainstream, balancing comfort, functionality, and affordability for diverse consumer segments. This category shows steady growth with particular strength in family-oriented features and seasonal usage patterns. Luxury motor homes experience premium growth driven by affluent consumers seeking high-end amenities, custom features, and superior craftsmanship.

Electric and hybrid categories emerge as transformative segments with adoption rates increasing 15.3% annually despite higher initial costs. These categories attract environmentally conscious consumers and early technology adopters while benefiting from improving infrastructure and regulatory support across European markets.

Industry participants across the European motor homes market ecosystem realize substantial benefits through strategic positioning and market engagement. These benefits encompass financial returns, market expansion opportunities, and competitive advantages that support sustainable business growth and stakeholder value creation.

Manufacturers benefit from growing market demand, premium pricing opportunities, and expanding consumer segments that support revenue growth and profitability improvement. Technology integration opportunities enable product differentiation and margin enhancement while building customer loyalty and brand strength. Export opportunities within European markets provide scale advantages and risk diversification benefits.

Dealers and distributors realize benefits through expanding customer bases, improved profit margins, and growing aftermarket service opportunities. The sector’s growth supports employment creation and business expansion while providing stable revenue streams through sales, service, and parts operations. Rental operators benefit from increasing demand for access-based consumption models and growing tourism markets across European destinations.

Suppliers and component manufacturers experience increased demand for specialized systems, technology solutions, and premium materials that support the motor homes industry. Infrastructure providers including camping sites, service centers, and charging networks benefit from growing motor home populations and increased usage patterns.

Consumers realize significant lifestyle benefits including travel flexibility, cost-effective vacation alternatives, and enhanced outdoor recreation opportunities. MarkWide Research analysis indicates that motor home ownership provides long-term value through asset appreciation and reduced travel costs compared to traditional vacation expenses.

Comprehensive SWOT analysis provides strategic insights into the European motor homes market’s internal strengths and weaknesses alongside external opportunities and threats that influence market development and competitive positioning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative market trends reshape the European motor homes landscape through technological innovation, changing consumer behaviors, and evolving industry dynamics. These trends create both opportunities and challenges for market participants while defining future market direction and competitive requirements.

Electrification trend accelerates across European markets as manufacturers introduce electric and hybrid motor homes responding to environmental regulations and consumer preferences. This trend requires substantial investment in battery technology, charging infrastructure, and vehicle design optimization while creating differentiation opportunities for early adopters. Smart technology integration becomes standard rather than optional, with consumers expecting connectivity, automation, and digital services as baseline features.

Sustainability focus influences design, manufacturing, and operational aspects of motor homes as environmental consciousness grows among European consumers. This trend encompasses material selection, energy efficiency, waste management, and lifecycle considerations that affect product development and marketing strategies. Customization demand increases as consumers seek personalized solutions tailored to specific needs, preferences, and usage patterns.

Sharing economy adoption expands through peer-to-peer rental platforms and commercial sharing services that provide motor home access without ownership requirements. This trend particularly appeals to younger demographics and urban consumers while creating new business models and revenue opportunities. Year-round usage patterns emerge as manufacturers improve insulation, heating systems, and weather resistance capabilities.

Significant industry developments demonstrate the European motor homes market’s dynamic evolution through strategic initiatives, technological breakthroughs, and market expansion activities that shape competitive positioning and future growth trajectories.

Manufacturing capacity expansion across major European producers reflects growing demand and market confidence. Leading manufacturers invest in production facility upgrades, automation technologies, and workforce development to meet increasing market requirements while improving operational efficiency. Strategic partnerships between motor home manufacturers and technology companies accelerate innovation in connectivity, energy management, and autonomous driving capabilities.

Sustainability initiatives gain prominence as manufacturers implement environmental management systems, sustainable material sourcing, and carbon-neutral production processes. These developments respond to regulatory requirements while appealing to environmentally conscious consumers and stakeholders. Digital transformation initiatives encompass online sales platforms, virtual showrooms, and digital customer service solutions that enhance market reach and customer experience.

Infrastructure development projects across European countries improve camping facilities, charging networks, and service capabilities supporting market growth and accessibility. Regulatory harmonization efforts within European Union frameworks aim to simplify compliance requirements and facilitate cross-border market access for manufacturers and consumers.

Strategic recommendations for European motor homes market participants focus on capitalizing on growth opportunities while addressing market challenges and competitive pressures. These suggestions reflect comprehensive market analysis and industry expertise to guide effective decision-making and strategic planning.

Technology investment represents a critical priority for manufacturers seeking competitive differentiation and market leadership. Companies should prioritize electric propulsion development, smart home integration, and connectivity solutions that appeal to evolving consumer preferences. Market diversification strategies should encompass emerging segments including rental markets, commercial applications, and younger demographic targeting through appropriate product positioning and marketing approaches.

Infrastructure partnerships with camping site operators, charging network providers, and service centers can enhance customer experience while supporting market expansion. MarkWide Research recommends that companies develop comprehensive ecosystem strategies that address the complete customer journey from purchase through ongoing ownership experience.

Sustainability leadership provides competitive advantages and regulatory compliance while appealing to environmentally conscious consumers. Companies should implement comprehensive environmental strategies encompassing product design, manufacturing processes, and lifecycle management. Digital transformation initiatives should focus on customer engagement, operational efficiency, and data-driven decision making to improve competitiveness and market responsiveness.

Future market outlook for the European motor homes sector indicates continued growth and transformation driven by evolving consumer preferences, technological advancement, and supportive market conditions. The outlook encompasses both opportunities and challenges that will shape market development over the forecast period.

Growth projections suggest sustained market expansion with compound annual growth rates of 6.2% supported by demographic trends, lifestyle changes, and infrastructure development. Electric vehicle adoption is expected to accelerate significantly, with electric and hybrid motor homes projected to represent 25% of new registrations by the end of the forecast period as technology improves and costs decline.

Market evolution will likely encompass new business models, enhanced customer experiences, and improved sustainability performance as industry participants respond to changing market dynamics. Technology integration will deepen with autonomous driving capabilities, artificial intelligence applications, and Internet of Things connectivity becoming standard features rather than premium options.

Geographic expansion into Eastern European markets presents substantial growth opportunities as economic development and tourism infrastructure continue improving. Consumer segment diversification will likely continue with younger demographics, urban populations, and alternative lifestyle adopters representing increasing market shares. MWR analysis indicates that successful market participants will be those who effectively balance innovation, sustainability, and customer-centric strategies while maintaining operational excellence and competitive positioning.

The European motor homes market represents a dynamic and rapidly evolving sector characterized by strong growth fundamentals, technological innovation, and expanding consumer adoption across diverse demographic segments. Market analysis reveals a sector successfully adapting to changing consumer preferences while maintaining traditional strengths in quality, craftsmanship, and customer satisfaction.

Key success factors for market participants include technology leadership, sustainability commitment, customer experience excellence, and strategic market positioning that addresses evolving consumer needs and preferences. The market’s future trajectory appears positive with multiple growth drivers supporting continued expansion including demographic trends, lifestyle changes, infrastructure development, and technological advancement.

Strategic opportunities abound for companies willing to invest in innovation, market expansion, and customer-centric strategies while addressing challenges related to sustainability, regulatory compliance, and competitive pressure. The European motor homes market is well-positioned for continued growth and transformation, offering substantial opportunities for industry participants, stakeholders, and consumers seeking flexible, sustainable, and enjoyable travel and lifestyle solutions.

What is Motor Homes?

Motor homes are self-propelled vehicles designed for recreational travel, providing living accommodations and amenities such as sleeping areas, kitchens, and bathrooms. They are popular among travelers seeking flexibility and comfort on the road.

What are the key players in the European Motor Homes Market?

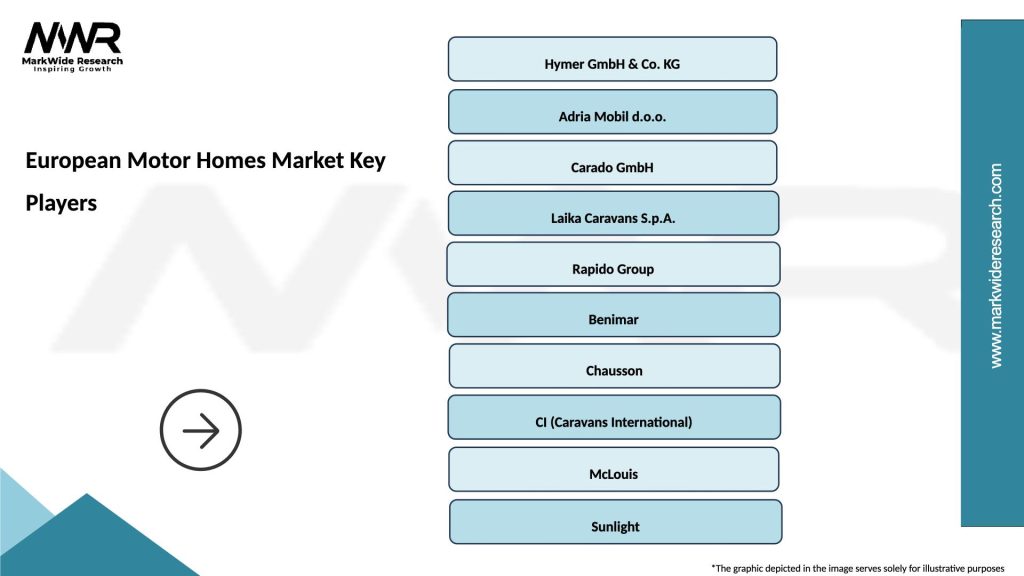

Key players in the European Motor Homes Market include companies like Dethleffs, Hymer, and Adria Mobil, which are known for their innovative designs and quality manufacturing. These companies compete in various segments, including luxury and compact motor homes, among others.

What are the growth factors driving the European Motor Homes Market?

The European Motor Homes Market is driven by increasing consumer interest in outdoor activities, a growing trend towards staycations, and advancements in motor home technology. Additionally, the rise in disposable income among consumers contributes to market growth.

What challenges does the European Motor Homes Market face?

The European Motor Homes Market faces challenges such as high initial costs, regulatory compliance regarding emissions and safety, and competition from alternative travel options like vacation rentals. These factors can impact consumer purchasing decisions.

What opportunities exist in the European Motor Homes Market?

Opportunities in the European Motor Homes Market include the development of eco-friendly models, the integration of smart technology for enhanced user experience, and expanding rental services to cater to a broader audience. These trends can attract new customers and increase market penetration.

What trends are shaping the European Motor Homes Market?

Trends in the European Motor Homes Market include a shift towards electric and hybrid models, increased customization options for consumers, and a focus on sustainability in manufacturing processes. These trends reflect changing consumer preferences and environmental concerns.

European Motor Homes Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Class A, Class B, Class C, Fifth Wheel |

| Fuel Type | Diesel, Gasoline, Electric, Hybrid |

| End User | Families, Retirees, Adventurers, Tourists |

| Size | Compact, Mid-size, Full-size, Luxury |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the European Motor Homes Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at