444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The European household coffee machines market represents a dynamic and rapidly evolving sector within the broader home appliances industry. This market encompasses various coffee brewing technologies designed for residential use, including espresso machines, drip coffee makers, pod-based systems, and specialty brewing equipment. Consumer preferences across European nations have shifted dramatically toward premium coffee experiences at home, driving substantial growth in this sector.

Market dynamics indicate that European consumers are increasingly investing in sophisticated coffee brewing technologies, with the market experiencing a robust 6.2% CAGR over recent years. The region’s coffee culture, deeply rooted in countries like Italy, France, and Germany, continues to fuel demand for advanced household brewing solutions. Premium segment growth has been particularly notable, with consumers willing to invest in high-quality machines that deliver café-style beverages at home.

Regional variations play a significant role in market development, with Northern European countries showing strong preference for automatic espresso machines, while Southern European markets maintain traditional brewing preferences alongside modern innovations. The market’s expansion is supported by increasing disposable income, urbanization trends, and the growing popularity of specialty coffee culture across European households.

The European household coffee machines market refers to the commercial sector encompassing the manufacturing, distribution, and retail of coffee brewing equipment designed specifically for residential use across European countries. This market includes various product categories ranging from basic drip coffee makers to sophisticated espresso machines, pod-based systems, and specialty brewing equipment that enables consumers to prepare professional-quality coffee beverages in their homes.

Market scope extends beyond simple brewing devices to include integrated systems featuring advanced technologies such as programmable settings, milk frothing capabilities, grind-and-brew functions, and smart connectivity features. The sector serves diverse consumer segments, from casual coffee drinkers seeking convenience to coffee enthusiasts demanding barista-level brewing precision and control.

Geographic coverage spans all major European markets, including Western Europe’s established economies and Eastern Europe’s emerging markets, each presenting unique consumer preferences, purchasing patterns, and growth opportunities within the household coffee machine segment.

Market performance in the European household coffee machines sector demonstrates strong momentum driven by evolving consumer lifestyles and increasing appreciation for premium coffee experiences. The market has experienced consistent growth, with automatic espresso machines capturing approximately 38% market share across the region, reflecting consumer preference for convenience without compromising quality.

Key growth drivers include the rising work-from-home culture, which has increased home coffee consumption by an estimated 25% increase in daily brewing frequency among European households. Premium product segments have shown particularly strong performance, with consumers increasingly investing in machines priced above mid-range categories. Smart connectivity features have emerged as significant differentiators, with connected coffee machines representing a rapidly growing segment.

Regional leadership varies by product category, with Germany and Italy leading in espresso machine adoption, while Scandinavian countries show strong preference for drip coffee systems. The market’s resilience during economic uncertainties demonstrates the essential nature of coffee consumption in European households, positioning this sector for continued expansion across diverse economic conditions.

Consumer behavior analysis reveals several critical insights shaping the European household coffee machines market. MarkWide Research findings indicate that European consumers prioritize quality, convenience, and versatility when selecting coffee brewing equipment for their homes.

Cultural coffee appreciation serves as the primary driver for the European household coffee machines market. Europe’s deep-rooted coffee culture, spanning from Italian espresso traditions to Scandinavian coffee ceremonies, creates sustained demand for quality brewing equipment. Consumer sophistication regarding coffee quality has increased significantly, with households seeking to replicate café experiences at home.

Lifestyle changes have fundamentally altered coffee consumption patterns across European households. The widespread adoption of remote work arrangements has increased home coffee consumption, with many consumers investing in professional-grade equipment to support their daily routines. Convenience factors drive preference for automated systems that deliver consistent results without requiring extensive brewing knowledge or time investment.

Technological advancement continues to propel market growth through innovative features that enhance user experience. Smart connectivity, programmable brewing cycles, and integrated grinding systems appeal to modern consumers seeking efficiency and customization. Premium positioning of household coffee machines as lifestyle accessories rather than mere appliances has expanded the addressable market beyond basic functional needs.

Economic prosperity in key European markets supports discretionary spending on premium home appliances. Rising disposable income levels enable consumers to invest in higher-quality coffee machines, viewing them as long-term investments in daily comfort and convenience.

High initial investment requirements for premium coffee machines present significant barriers for price-sensitive consumers. Quality espresso machines and advanced brewing systems often require substantial upfront costs, limiting market penetration among budget-conscious households. Economic uncertainties in certain European regions may impact consumer willingness to invest in non-essential appliances.

Maintenance complexity associated with sophisticated coffee machines can deter potential buyers. Regular cleaning, descaling, and component replacement requirements may overwhelm consumers seeking simple brewing solutions. Technical knowledge needed to operate advanced features optimally can create adoption barriers among less tech-savvy consumer segments.

Space constraints in urban European homes limit options for larger coffee machines. Compact living spaces require manufacturers to balance functionality with size considerations, potentially compromising feature sets. Kitchen integration challenges may prevent consumers from upgrading to larger, more capable systems.

Market saturation in mature European markets creates intense competition and pricing pressure. Established households may delay replacement cycles, reducing new purchase frequency. Brand proliferation can confuse consumers, making product selection more challenging and potentially slowing purchase decisions.

Smart home integration presents substantial opportunities for coffee machine manufacturers to differentiate their products. Connected devices that integrate with home automation systems appeal to technology-forward European consumers. IoT capabilities enable remote brewing control, maintenance alerts, and personalized brewing profiles, creating premium value propositions.

Sustainability initiatives offer significant market expansion potential as environmental consciousness grows across European markets. Machines featuring energy efficiency, recyclable components, and reduced packaging appeal to eco-minded consumers. Circular economy approaches, including refurbishment programs and component recycling, can attract environmentally responsible buyers.

Emerging market penetration in Eastern European countries provides growth opportunities as economic development increases household spending power. Market education initiatives can introduce coffee culture and premium brewing concepts to regions with developing coffee appreciation.

Subscription service integration creates recurring revenue opportunities through coffee supply partnerships. Machines designed to work optimally with specific coffee brands or subscription services can generate ongoing customer relationships. Personalization technologies that learn user preferences and suggest optimal brewing parameters represent innovative differentiation opportunities.

Competitive intensity characterizes the European household coffee machines market, with established appliance manufacturers competing against specialized coffee equipment brands. Innovation cycles drive continuous product development, with manufacturers investing heavily in research and development to maintain competitive advantages. Market leaders focus on premium positioning while emerging brands target specific niches or price segments.

Supply chain dynamics influence product availability and pricing across European markets. Global component sourcing, manufacturing locations, and distribution networks affect market responsiveness to demand fluctuations. Retail channel evolution toward online sales has transformed how consumers research and purchase coffee machines, requiring manufacturers to adapt marketing and distribution strategies.

Consumer education plays a crucial role in market development, with manufacturers investing in content marketing and demonstration programs to showcase product capabilities. Seasonal demand patterns affect sales cycles, with holiday periods and promotional events driving significant purchase volumes. The market demonstrates resilience to economic fluctuations due to coffee’s essential role in European daily routines.

Regulatory environment impacts product design and marketing approaches, with energy efficiency standards and safety requirements shaping development priorities. Trade relationships between European countries and manufacturing regions influence pricing and availability of coffee machine components and finished products.

Comprehensive market analysis employs multiple research approaches to ensure accurate and reliable insights into the European household coffee machines market. Primary research includes extensive consumer surveys, retailer interviews, and manufacturer consultations across key European markets to gather firsthand market intelligence and trend identification.

Secondary research incorporates analysis of industry reports, trade publications, regulatory filings, and company financial statements to establish market context and validate primary findings. Data triangulation methods ensure consistency and accuracy across multiple information sources, providing robust foundation for market projections and strategic recommendations.

Quantitative analysis utilizes statistical modeling to project market trends, segment performance, and regional growth patterns. Qualitative assessment examines consumer behavior patterns, brand positioning strategies, and competitive dynamics to provide comprehensive market understanding beyond numerical data.

Market segmentation analysis breaks down the overall market into distinct categories based on product type, price range, distribution channel, and geographic region. Trend analysis identifies emerging patterns and potential disruptions that may influence future market development and competitive positioning.

Western European markets dominate the household coffee machines sector, with Germany, France, and Italy representing the largest consumer bases. German market leadership reflects strong consumer preference for premium appliances and willingness to invest in quality brewing equipment. The market shows approximately 32% regional concentration in these three countries, indicating significant growth potential in other European markets.

Nordic countries demonstrate unique consumption patterns, with Sweden, Norway, and Denmark showing strong preference for drip coffee systems alongside growing espresso machine adoption. Scandinavian markets exhibit high per-capita coffee consumption rates, supporting premium product penetration and frequent replacement cycles.

Southern European markets maintain traditional coffee culture while embracing modern brewing technologies. Italy’s espresso heritage influences consumer expectations for machine performance and coffee quality. Spanish and Portuguese markets show growing interest in automated systems that preserve traditional brewing characteristics.

Eastern European expansion represents significant growth opportunity as economic development increases household spending power. Poland, Czech Republic, and Hungary lead regional adoption of household coffee machines, with market penetration rates reaching approximately 28% of households in urban areas. MWR analysis indicates these markets will experience accelerated growth as coffee culture develops and disposable income increases.

Market leadership in the European household coffee machines sector is distributed among several key players, each with distinct competitive advantages and market positioning strategies. Established appliance manufacturers leverage brand recognition and distribution networks to maintain market presence across multiple product categories.

Competitive strategies focus on product differentiation through advanced features, design innovation, and brand positioning. Market consolidation trends show larger companies acquiring specialized brands to expand product portfolios and market reach.

Product type segmentation reveals distinct market categories with varying growth trajectories and consumer appeal. Espresso machines represent the largest segment, driven by European coffee culture preferences and increasing demand for café-quality beverages at home.

By Technology:

By Price Range:

Espresso machine category dominates European household coffee machine sales, reflecting regional preferences for concentrated coffee beverages. Automatic espresso systems show the strongest growth within this category, with consumers valuing convenience without sacrificing quality. Market data indicates approximately 42% category growth in fully automatic systems over recent periods.

Pod-based systems have gained significant market traction through convenience positioning and consistent brewing results. Nespresso and compatible systems lead this segment, though environmental concerns regarding pod waste are influencing consumer preferences toward more sustainable alternatives. Reusable pod adoption has increased by approximately 35% annually as consumers seek eco-friendly options.

Drip coffee makers maintain strong positions in Northern European markets where filter coffee traditions persist. Programmable features and thermal carafes enhance appeal among consumers seeking convenience for daily coffee routines. Smart connectivity integration is transforming this traditional category with remote brewing capabilities.

Specialty brewing equipment represents an emerging category driven by coffee enthusiast segments. Pour-over systems, French presses, and cold brew makers appeal to consumers seeking diverse brewing methods and flavor profiles. This category shows strong growth potential as coffee appreciation sophistication increases across European markets.

Manufacturers benefit from strong market demand driven by essential product positioning and consumer willingness to invest in quality brewing equipment. Premium positioning opportunities allow for higher margin products while brand loyalty creates sustainable competitive advantages. Innovation leadership in smart features and sustainability initiatives can drive market differentiation.

Retailers gain from consistent consumer demand and opportunities for accessory sales including coffee supplies, cleaning products, and replacement parts. Demonstration capabilities in physical stores create competitive advantages over online-only channels. Service offerings including maintenance and repair services provide additional revenue streams.

Consumers receive enhanced convenience and quality in daily coffee consumption while potentially reducing long-term costs compared to café purchases. Customization capabilities allow personalized brewing preferences and the ability to experiment with different coffee varieties and brewing methods at home.

Coffee suppliers benefit from increased home consumption and opportunities for machine-specific product partnerships. Subscription services create recurring revenue opportunities while premium coffee varieties can command higher prices when paired with capable brewing equipment.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart connectivity integration represents the most significant trend transforming the European household coffee machines market. IoT-enabled devices with smartphone app control allow remote brewing, maintenance scheduling, and personalized recipe management. This trend appeals particularly to younger European consumers who value technology integration in home appliances.

Sustainability emphasis drives product development toward energy-efficient systems, recyclable materials, and reduced packaging. Circular economy principles influence design decisions with manufacturers focusing on product longevity, repairability, and end-of-life recycling. European consumers increasingly consider environmental impact in purchasing decisions.

Premiumization trend continues across all market segments, with consumers willing to invest in higher-quality machines featuring advanced capabilities. Artisanal brewing features that replicate professional barista techniques appeal to coffee enthusiasts seeking café-quality results at home. MarkWide Research data indicates premium segment growth outpacing overall market expansion.

Compact design innovation addresses urban living constraints while maintaining functionality. Space-efficient engineering allows manufacturers to offer advanced features in smaller footprints suitable for European apartment living. Modular systems that can be customized based on available space and user needs represent emerging design approaches.

Technology advancement in brewing precision and automation has accelerated significantly across the European market. Artificial intelligence integration enables machines to learn user preferences and optimize brewing parameters automatically. Pressure profiling technology allows for sophisticated extraction control previously available only in commercial equipment.

Strategic partnerships between coffee machine manufacturers and coffee brands create integrated ecosystems optimizing brewing performance for specific coffee varieties. Exclusive collaborations with premium coffee roasters provide differentiation opportunities and enhanced consumer value propositions.

Retail channel evolution toward omnichannel approaches combines online convenience with in-store demonstration capabilities. Direct-to-consumer strategies allow manufacturers to build stronger customer relationships and gather valuable usage data for product development.

Sustainability initiatives include take-back programs for old machines, component recycling systems, and partnerships with environmental organizations. Carbon-neutral manufacturing commitments from major brands reflect growing environmental responsibility in the industry.

Market participants should prioritize smart technology integration to meet evolving consumer expectations for connected home appliances. Investment in IoT capabilities and app development will become essential for maintaining competitive relevance in the European market. Companies should focus on user-friendly interfaces that enhance rather than complicate the coffee brewing experience.

Sustainability initiatives require immediate attention as environmental consciousness influences purchasing decisions across European markets. Product lifecycle management should incorporate circular economy principles from design through end-of-life recycling. Energy efficiency improvements and sustainable material sourcing will become competitive necessities rather than optional features.

Regional customization strategies should address distinct preferences across European markets while maintaining operational efficiency. Localized product offerings that respect traditional coffee cultures while introducing modern conveniences can capture market share in specific regions. Distribution partnerships with local retailers can enhance market penetration effectiveness.

Premium positioning opportunities should be pursued through innovation leadership and superior customer experience delivery. Value-added services including maintenance programs, brewing education, and customer support can justify premium pricing and build brand loyalty in competitive markets.

Market trajectory for European household coffee machines remains strongly positive, driven by sustained coffee culture appreciation and technological innovation adoption. Growth projections indicate continued expansion at approximately 5.8% CAGR over the next five years, with premium segments outperforming overall market growth rates.

Technology evolution will continue transforming product capabilities with artificial intelligence, machine learning, and advanced automation becoming standard features rather than premium options. Smart home integration will deepen as coffee machines become integral components of connected household ecosystems.

Sustainability requirements will intensify as European environmental regulations become more stringent and consumer awareness increases. Circular economy adoption will transition from voluntary initiatives to market necessities, influencing product design and business model innovation.

Market consolidation may accelerate as larger companies acquire specialized brands to expand technological capabilities and market reach. Innovation partnerships between traditional appliance manufacturers and technology companies will become more common as smart features gain importance.

The European household coffee machines market demonstrates robust growth potential driven by deep-rooted coffee culture, technological innovation, and evolving consumer preferences toward premium home brewing experiences. Market dynamics favor companies that successfully balance traditional coffee appreciation with modern convenience and sustainability requirements.

Strategic success in this market requires understanding regional preferences while delivering universal values of quality, convenience, and innovation. Technology integration and sustainability initiatives will separate market leaders from followers as consumer expectations continue evolving toward more sophisticated and environmentally responsible products.

The market’s resilience and growth trajectory position it as an attractive opportunity for both established players and new entrants willing to invest in innovation and customer-centric product development. Future success will depend on companies’ ability to anticipate and respond to changing consumer needs while maintaining the quality and reliability that European coffee enthusiasts demand from their household brewing equipment.

What is Household Coffee Machines?

Household coffee machines are appliances designed for brewing coffee at home, including various types such as drip coffee makers, espresso machines, and single-serve pod systems. They cater to diverse consumer preferences and brewing methods.

What are the key players in the European Household Coffee Machines Market?

Key players in the European Household Coffee Machines Market include companies like De’Longhi, Breville, and Philips, which offer a range of innovative coffee machines. These companies focus on enhancing user experience and product functionality, among others.

What are the main drivers of the European Household Coffee Machines Market?

The European Household Coffee Machines Market is driven by increasing consumer demand for high-quality coffee at home, the rise of specialty coffee culture, and advancements in coffee machine technology. Additionally, convenience and ease of use are significant factors influencing market growth.

What challenges does the European Household Coffee Machines Market face?

Challenges in the European Household Coffee Machines Market include intense competition among manufacturers, fluctuating raw material prices, and changing consumer preferences towards healthier beverage options. These factors can impact profitability and market dynamics.

What opportunities exist in the European Household Coffee Machines Market?

Opportunities in the European Household Coffee Machines Market include the growing trend of smart home appliances, increasing interest in sustainable coffee practices, and the potential for product innovation in brewing technology. These trends can lead to new market segments and consumer engagement.

What trends are shaping the European Household Coffee Machines Market?

Trends in the European Household Coffee Machines Market include the rise of connected coffee machines that integrate with smart home systems, the popularity of single-serve coffee options, and a focus on eco-friendly materials and energy-efficient designs. These trends reflect changing consumer lifestyles and preferences.

European Household Coffee Machines Market

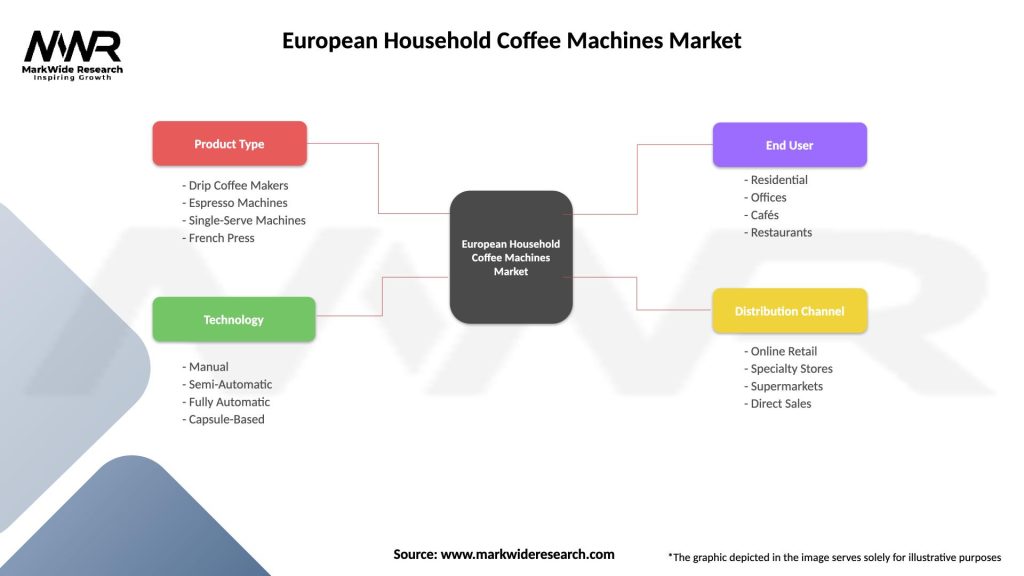

| Segmentation Details | Description |

|---|---|

| Product Type | Drip Coffee Makers, Espresso Machines, Single-Serve Machines, French Press |

| Technology | Manual, Semi-Automatic, Fully Automatic, Capsule-Based |

| End User | Residential, Offices, Cafés, Restaurants |

| Distribution Channel | Online Retail, Specialty Stores, Supermarkets, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the European Household Coffee Machines Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at