444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The European heating equipment market represents a dynamic and rapidly evolving sector driven by stringent environmental regulations, increasing energy efficiency demands, and the continent’s ambitious carbon neutrality goals. This comprehensive market encompasses a diverse range of heating solutions including heat pumps, boilers, radiators, underfloor heating systems, and smart thermostats across residential, commercial, and industrial applications.

Market dynamics indicate robust growth potential, with the sector experiencing a 6.2% CAGR as governments across Europe implement aggressive decarbonization policies. The transition from traditional fossil fuel-based heating systems to renewable energy solutions has created unprecedented opportunities for innovative heating technologies. Heat pump adoption has emerged as a particularly significant trend, with penetration rates reaching 35% in Nordic countries where supportive policies and consumer awareness drive market expansion.

Regional variations across Europe reflect different climate conditions, regulatory frameworks, and consumer preferences. Northern European countries lead in advanced heating technology adoption, while Southern European markets show increasing interest in energy-efficient cooling and heating combinations. The market’s evolution is closely tied to the European Union’s Green Deal initiatives and national energy transition strategies.

The European heating equipment market refers to the comprehensive ecosystem of heating technologies, systems, and solutions designed to provide thermal comfort in residential, commercial, and industrial buildings across European countries. This market encompasses traditional heating equipment such as gas and oil boilers, modern renewable energy solutions including heat pumps and solar thermal systems, and advanced smart heating controls that optimize energy consumption and user comfort.

Market scope extends beyond mere equipment sales to include installation services, maintenance contracts, and integrated heating solutions that combine multiple technologies. The sector plays a crucial role in Europe’s energy transition, representing approximately 50% of total energy consumption in buildings and serving as a key battleground for achieving climate neutrality objectives by 2050.

Strategic positioning within the European heating equipment market reveals a sector undergoing fundamental transformation driven by regulatory mandates, technological innovation, and changing consumer expectations. The market demonstrates strong growth momentum across multiple segments, with particular strength in renewable heating solutions and smart control systems.

Key market drivers include the European Union’s Fit for 55 package, which mandates 55% emission reductions by 2030, creating substantial demand for low-carbon heating alternatives. Heat pump technology leads market innovation, supported by generous government subsidies and improving cost competitiveness. The residential segment dominates market activity, while commercial and industrial applications present significant growth opportunities.

Competitive landscape features established European manufacturers alongside emerging technology providers, creating a dynamic environment characterized by strategic partnerships, technological advancement, and market consolidation. Digital transformation initiatives and smart home integration represent key differentiating factors for market participants.

Market intelligence reveals several critical insights shaping the European heating equipment landscape:

Regulatory mandates serve as the primary catalyst for European heating equipment market growth. The European Green Deal and associated legislation create compelling drivers for heating system modernization. National governments implement increasingly stringent building energy codes and heating system efficiency requirements, while offering substantial financial incentives for renewable heating adoption.

Environmental consciousness among European consumers drives demand for sustainable heating solutions. Rising awareness of climate change impacts and personal carbon footprint considerations influence purchasing decisions, with 78% of consumers expressing willingness to invest in environmentally friendly heating systems despite higher upfront costs.

Energy cost volatility has emerged as a significant market driver, particularly following recent geopolitical events affecting natural gas supplies. Consumers and businesses seek heating solutions that reduce dependence on volatile fossil fuel markets while providing long-term cost predictability. Heat pump efficiency improvements and declining electricity prices from renewable sources enhance the economic attractiveness of electric heating solutions.

Technological advancement continues driving market evolution through improved system efficiency, enhanced user interfaces, and integration capabilities. Smart heating controls, predictive maintenance systems, and artificial intelligence optimization create compelling value propositions for modern heating equipment.

High upfront costs represent the most significant barrier to heating equipment market growth, particularly for advanced renewable heating systems. Despite long-term operational savings, the initial investment required for heat pump installations or comprehensive heating system upgrades can deter cost-sensitive consumers and businesses.

Technical complexity associated with modern heating systems creates implementation challenges. Many consumers lack understanding of heat pump technology, smart controls, and system optimization requirements. Installation complexity and the need for skilled technicians can extend project timelines and increase costs.

Infrastructure limitations in older European buildings present significant retrofit challenges. Many historic buildings lack adequate insulation, electrical capacity, or space for modern heating equipment installation. Regulatory restrictions on building modifications in heritage areas further complicate heating system upgrades.

Supply chain constraints have emerged as a notable market restraint, with component shortages and extended delivery times affecting project completion schedules. The rapid growth in heat pump demand has outpaced manufacturing capacity in some segments, creating temporary supply-demand imbalances.

Retrofit market potential represents the largest opportunity within the European heating equipment sector. Millions of buildings across Europe require heating system upgrades to meet evolving efficiency standards and carbon reduction targets. This creates sustained demand for replacement equipment and comprehensive system modernization projects.

Smart home integration offers substantial growth opportunities as consumers increasingly adopt connected home technologies. Heating equipment manufacturers can capture additional value through software platforms, data analytics services, and integrated home energy management solutions.

Commercial and industrial segments present significant untapped potential, particularly for large-scale heat pump installations and industrial process heating applications. The growing focus on corporate sustainability commitments drives demand for renewable heating solutions in commercial buildings and manufacturing facilities.

Service-based business models create opportunities for recurring revenue streams through maintenance contracts, performance optimization services, and heating-as-a-service offerings. These models reduce customer upfront costs while providing predictable revenue for equipment manufacturers and service providers.

Competitive intensity within the European heating equipment market continues escalating as traditional manufacturers compete with emerging technology providers and new market entrants. Established companies leverage brand recognition and distribution networks, while innovative startups introduce disruptive technologies and business models.

Technology convergence creates dynamic market conditions as heating, cooling, and energy management systems integrate into comprehensive building automation platforms. This convergence blurs traditional market boundaries and creates opportunities for cross-sector partnerships and acquisitions.

Policy evolution significantly influences market dynamics, with regulatory changes creating both opportunities and challenges for market participants. Companies must continuously adapt product offerings and business strategies to align with evolving environmental regulations and incentive programs.

Consumer behavior shifts toward sustainability and energy independence drive market transformation. According to MarkWide Research analysis, consumer preferences increasingly favor heating solutions that provide energy autonomy and environmental benefits, even at premium price points.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the European heating equipment market. Primary research includes extensive surveys of heating equipment manufacturers, distributors, installers, and end-users across major European markets.

Secondary research encompasses analysis of government statistics, industry association reports, regulatory documents, and company financial statements. This approach provides comprehensive market sizing, trend identification, and competitive landscape mapping across all major European countries.

Expert interviews with industry leaders, technology developers, and policy makers provide qualitative insights into market dynamics, future trends, and strategic considerations. These discussions offer valuable perspectives on emerging technologies, regulatory impacts, and market evolution patterns.

Data validation processes ensure research accuracy through cross-referencing multiple sources, statistical analysis, and expert review. Market forecasts incorporate scenario analysis to account for potential regulatory changes, economic conditions, and technology development trajectories.

Northern Europe leads the European heating equipment market in terms of advanced technology adoption and renewable heating penetration. Countries including Sweden, Norway, and Denmark demonstrate the highest heat pump adoption rates, reaching 60% market share in new installations. Strong government support, favorable electricity pricing, and consumer environmental awareness drive market leadership in this region.

Western Europe represents the largest market segment by volume, with Germany, France, and the United Kingdom accounting for significant market share. These markets show strong growth in heat pump adoption while maintaining substantial traditional heating equipment segments. Government incentive programs and building renovation initiatives drive market expansion.

Central and Eastern Europe present emerging opportunities with rapid market development driven by EU membership requirements and increasing environmental awareness. Countries including Poland, Czech Republic, and Hungary show accelerating adoption of modern heating technologies, supported by EU funding programs and national energy transition strategies.

Southern Europe demonstrates unique market characteristics with emphasis on combined heating and cooling solutions. Markets including Italy, Spain, and Greece show growing interest in heat pump technology for year-round climate control, while traditional heating equipment maintains significant market presence.

Market leadership within the European heating equipment sector features a diverse mix of established manufacturers, technology specialists, and emerging innovators. The competitive environment continues evolving as companies adapt to changing market demands and regulatory requirements.

By Product Type:

By Application:

By Technology:

Heat pump segment demonstrates exceptional growth momentum, driven by regulatory support and improving technology performance. Air-source heat pumps dominate installations due to lower costs and easier installation, while ground-source systems gain traction in premium applications. Seasonal performance improvements and cold climate capabilities expand heat pump applicability across diverse European climates.

Smart heating controls represent a rapidly expanding category as consumers seek greater comfort and energy efficiency. Integration with home automation systems and smartphone applications drives adoption, while artificial intelligence and machine learning capabilities enhance system optimization. Connected thermostat penetration reaches 25% in advanced markets, with strong growth potential across Europe.

Boiler replacement market remains substantial despite declining new installations, as aging equipment requires modernization to meet efficiency standards. High-efficiency condensing boilers and hybrid systems combining traditional and renewable technologies serve transitional market needs while maintaining installer familiarity and customer comfort.

Underfloor heating systems gain popularity in renovation projects and new construction, offering superior comfort and energy efficiency compared to traditional radiator systems. Electric systems provide retrofit flexibility, while hydronic systems integrate effectively with heat pump installations.

Equipment manufacturers benefit from strong market growth driven by regulatory mandates and consumer environmental awareness. The transition to renewable heating creates opportunities for premium product positioning and higher margins, while service-based business models provide recurring revenue streams and enhanced customer relationships.

Installation contractors experience increased demand for heating system upgrades and replacements, with opportunities for specialization in advanced technologies like heat pumps and smart controls. Training and certification programs enable contractors to capture premium market segments and differentiate service offerings.

Building owners realize significant benefits through reduced energy costs, improved comfort, and enhanced property values. Modern heating systems provide greater reliability, lower maintenance requirements, and compliance with evolving building regulations. Energy cost savings of 30-50% are achievable through heating system modernization.

Energy utilities benefit from increased electricity demand for heat pump systems while supporting grid stability through smart heating controls and thermal storage capabilities. Demand response programs and time-of-use pricing create new revenue opportunities and grid management tools.

Strengths:

Weaknesses:

Opportunities:

Threats:

Electrification acceleration represents the dominant trend shaping the European heating equipment market. The shift from fossil fuel-based heating to electric solutions, primarily heat pumps, continues gaining momentum supported by renewable electricity generation growth and grid decarbonization initiatives.

Smart home integration drives heating equipment evolution toward connected, automated systems that optimize energy consumption and user comfort. Integration with home energy management systems, weather forecasting, and occupancy detection creates sophisticated heating control capabilities.

Hybrid heating systems emerge as transitional solutions combining traditional and renewable heating technologies. These systems provide backup heating capability while maximizing renewable energy utilization, addressing consumer concerns about heat pump performance in extreme weather conditions.

Circular economy principles influence heating equipment design and business models, with emphasis on product longevity, repairability, and end-of-life recycling. Manufacturers develop take-back programs and design products for disassembly and material recovery.

District heating modernization creates opportunities for large-scale renewable heating integration. Fourth-generation district heating networks operating at lower temperatures enable heat pump integration and waste heat recovery from industrial processes and data centers.

Technology partnerships between heating equipment manufacturers and technology companies accelerate smart heating solution development. Collaborations focus on artificial intelligence integration, predictive maintenance capabilities, and enhanced user interfaces for heating system control.

Manufacturing capacity expansion responds to growing heat pump demand across Europe. Major manufacturers announce significant production facility investments to meet projected market growth, while new entrants establish European manufacturing operations to serve local markets.

Acquisition activity intensifies as companies seek to expand technology portfolios and market reach. Strategic acquisitions focus on smart control technologies, installation service capabilities, and specialized heating applications to create comprehensive solution offerings.

Certification program development addresses installer training needs for advanced heating technologies. Industry associations and manufacturers collaborate on comprehensive training programs ensuring proper installation and maintenance of modern heating systems.

Research and development investments focus on next-generation heating technologies including high-temperature heat pumps, thermal storage systems, and hydrogen-ready heating equipment. MWR analysis indicates significant R&D spending increases across major heating equipment manufacturers.

Strategic positioning recommendations for heating equipment manufacturers emphasize technology leadership in renewable heating solutions while maintaining service capabilities for traditional systems during the market transition period. Companies should invest in heat pump technology advancement and smart control integration to capture growth opportunities.

Market entry strategies for new participants should focus on specialized applications or underserved market segments rather than direct competition with established players. Opportunities exist in smart controls, installation services, and niche heating applications where innovation can create competitive advantages.

Partnership development represents a critical success factor for heating equipment companies. Strategic alliances with technology providers, installation contractors, and energy utilities can accelerate market penetration and create comprehensive solution offerings that address customer needs.

Investment priorities should emphasize manufacturing capacity for high-growth segments, particularly heat pumps and smart controls. Companies must balance capacity expansion with technology development to maintain competitive positioning in rapidly evolving markets.

Customer education initiatives require significant attention as consumers navigate complex technology choices and financing options. Companies that effectively communicate product benefits and provide comprehensive support services will capture disproportionate market share during the transition period.

Market trajectory for the European heating equipment sector points toward sustained growth driven by regulatory requirements, technology advancement, and changing consumer preferences. The transition to renewable heating solutions will accelerate, with heat pumps becoming the dominant technology for new installations and replacements.

Technology evolution will focus on improving heat pump performance in cold climates, enhancing smart control capabilities, and developing integrated energy solutions that combine heating, cooling, and electricity generation. Artificial intelligence integration will enable predictive maintenance and autonomous system optimization.

Market consolidation is expected as companies seek scale advantages and comprehensive technology portfolios. Successful companies will combine equipment manufacturing with service capabilities and digital platforms to create integrated customer solutions.

Regulatory landscape will continue evolving toward stricter efficiency requirements and carbon reduction mandates. The phase-out of fossil fuel heating systems will accelerate, creating sustained demand for renewable heating alternatives. MarkWide Research projects continued policy support for heating decarbonization across European markets.

Innovation focus will expand beyond equipment efficiency to encompass system integration, user experience, and lifecycle optimization. Companies that successfully combine hardware excellence with software capabilities and service delivery will lead market development in the coming decade.

The European heating equipment market stands at a transformational inflection point, driven by ambitious climate policies, technological innovation, and evolving consumer expectations. The sector demonstrates robust growth potential across multiple segments, with renewable heating solutions leading market expansion and traditional equipment serving transitional needs.

Strategic opportunities abound for companies that successfully navigate the complex landscape of regulatory requirements, technology advancement, and competitive dynamics. Heat pump technology emergence as the dominant heating solution creates substantial market opportunities, while smart controls and integrated energy systems represent additional growth vectors.

Success factors in this dynamic market include technology leadership, comprehensive service capabilities, strategic partnerships, and effective customer education. Companies must balance innovation investments with manufacturing capacity expansion while developing business models that address changing customer needs and market conditions. The European heating equipment market offers compelling opportunities for organizations positioned to capitalize on the ongoing energy transition and contribute to Europe’s carbon neutrality objectives.

What is Heating Equipment?

Heating equipment refers to devices and systems used to generate heat for residential, commercial, and industrial applications. This includes boilers, furnaces, heat pumps, and radiators, which are essential for maintaining comfortable indoor temperatures.

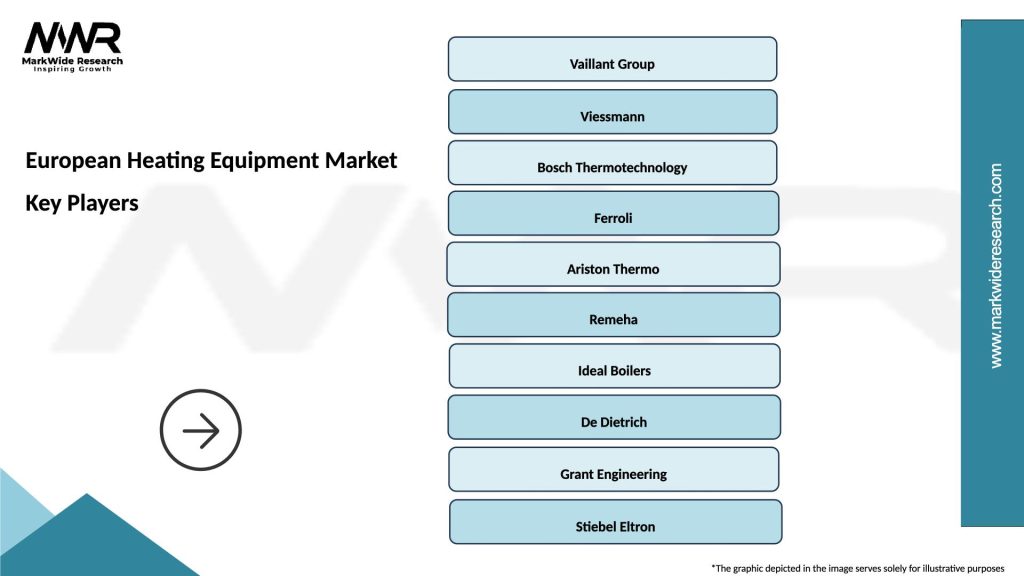

What are the key players in the European Heating Equipment Market?

Key players in the European Heating Equipment Market include companies like Vaillant Group, Bosch Thermotechnology, and Ariston Thermo, which are known for their innovative heating solutions and extensive product ranges, among others.

What are the main drivers of the European Heating Equipment Market?

The main drivers of the European Heating Equipment Market include the increasing demand for energy-efficient heating solutions, the push for sustainable energy sources, and the growing focus on reducing carbon emissions in residential and commercial buildings.

What challenges does the European Heating Equipment Market face?

Challenges in the European Heating Equipment Market include stringent regulations regarding emissions, the high initial costs of advanced heating technologies, and the need for ongoing maintenance and upgrades to meet evolving energy standards.

What opportunities exist in the European Heating Equipment Market?

Opportunities in the European Heating Equipment Market include the rising adoption of smart heating systems, advancements in renewable energy integration, and the increasing trend towards home automation, which can enhance energy efficiency and user convenience.

What trends are shaping the European Heating Equipment Market?

Trends shaping the European Heating Equipment Market include the growing popularity of heat pumps, the shift towards hybrid heating systems, and the integration of IoT technology for better energy management and user control.

European Heating Equipment Market

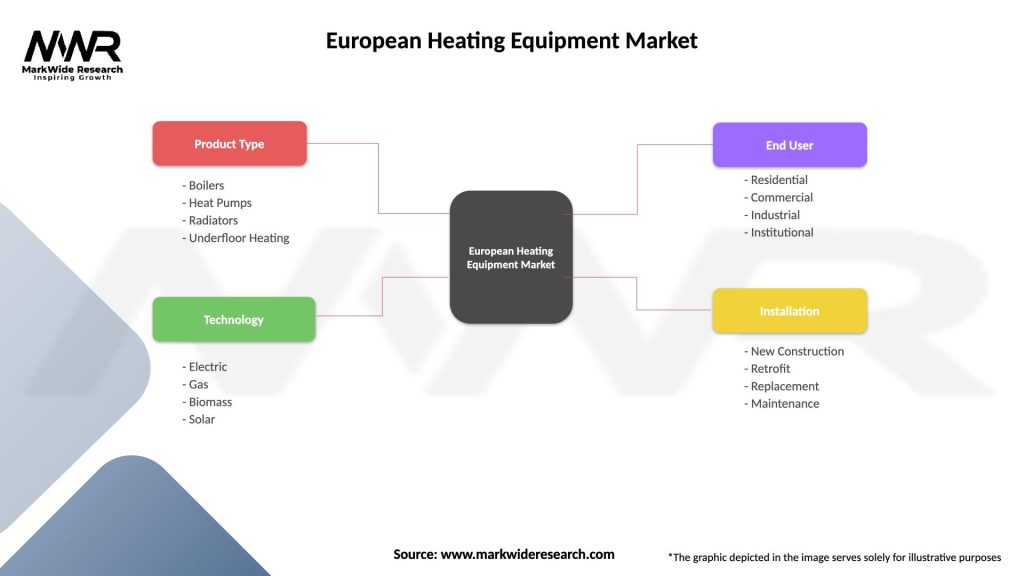

| Segmentation Details | Description |

|---|---|

| Product Type | Boilers, Heat Pumps, Radiators, Underfloor Heating |

| Technology | Electric, Gas, Biomass, Solar |

| End User | Residential, Commercial, Industrial, Institutional |

| Installation | New Construction, Retrofit, Replacement, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the European Heating Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at