444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The European fuel card market has been growing rapidly in recent years due to the increasing demand for fuel-efficient vehicles and rising fuel prices. Fuel cards are payment cards that can be used to purchase fuel at petrol stations and can be used by businesses to manage their fuel expenses. The fuel card market in Europe is expected to reach $XX billion by 2025, growing at a CAGR of XX% during the forecast period.

Fuel cards are payment cards that businesses can use to purchase fuel at petrol stations. Fuel cards offer several benefits to businesses, including reducing fuel costs, simplifying fuel management, and providing detailed fuel consumption reports. The European fuel card market includes several players, including oil companies, card issuers, and payment processors.

Executive Summary

The European fuel card market is growing rapidly due to the increasing demand for fuel-efficient vehicles and rising fuel prices. Fuel cards offer several benefits to businesses, including reducing fuel costs, simplifying fuel management, and providing detailed fuel consumption reports. The market is expected to reach $XX billion by 2025, growing at a CAGR of XX% during the forecast period. The market is highly competitive, with several players, including oil companies, card issuers, and payment processors. The key players in the market are focusing on partnerships and acquisitions to expand their market presence.

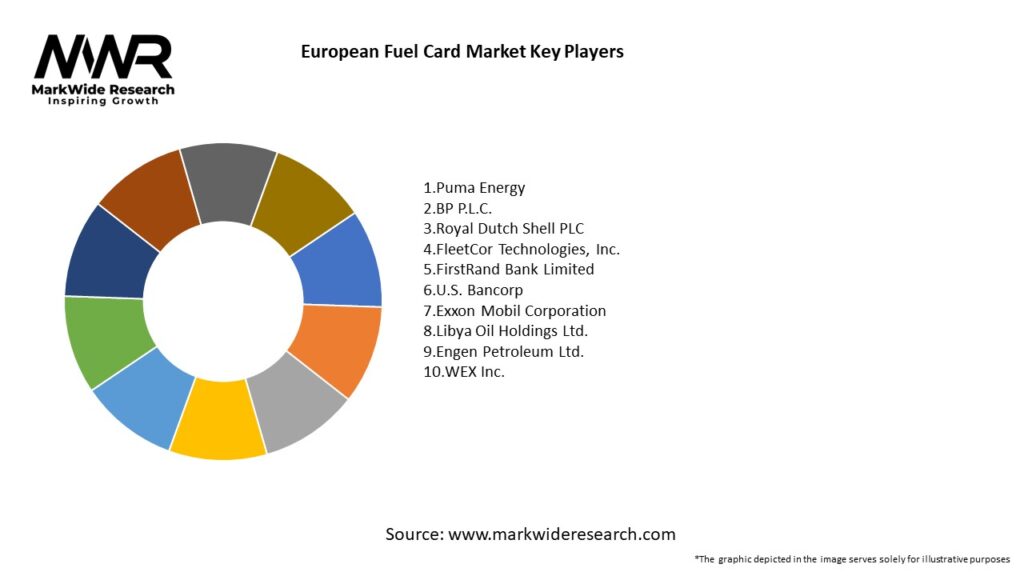

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

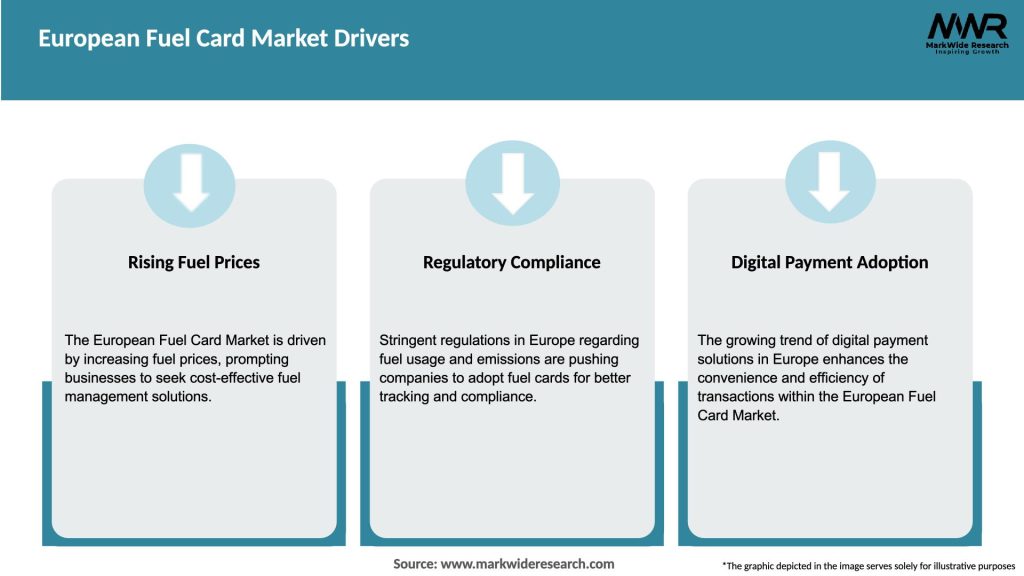

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The European fuel card market is highly competitive, with several players, including oil companies, card issuers, and payment processors. The market is expected to grow rapidly over the forecast period, driven by increasing demand for fuel-efficient vehicles, rising fuel prices, and the need for efficient fuel management. The market is also facing several challenges, including limited acceptance, security concerns, and competition from alternative payment methods.

Regional Analysis

The European fuel card market is divided into several regions, including Western Europe, Eastern Europe, and the Nordic countries. Western Europe is the largest market for fuel cards in Europe, with a market share of XX% in 2020. The market in Western Europe is expected to continue to grow over the forecast period, driven by the increasing demand for fuel-efficient vehicles and rising fuel prices. The market in Eastern Europe is also expected to grow rapidly, driven by increasing adoption of fuel cards in emerging markets.

Competitive Landscape

Leading companies in the European Fuel Card Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

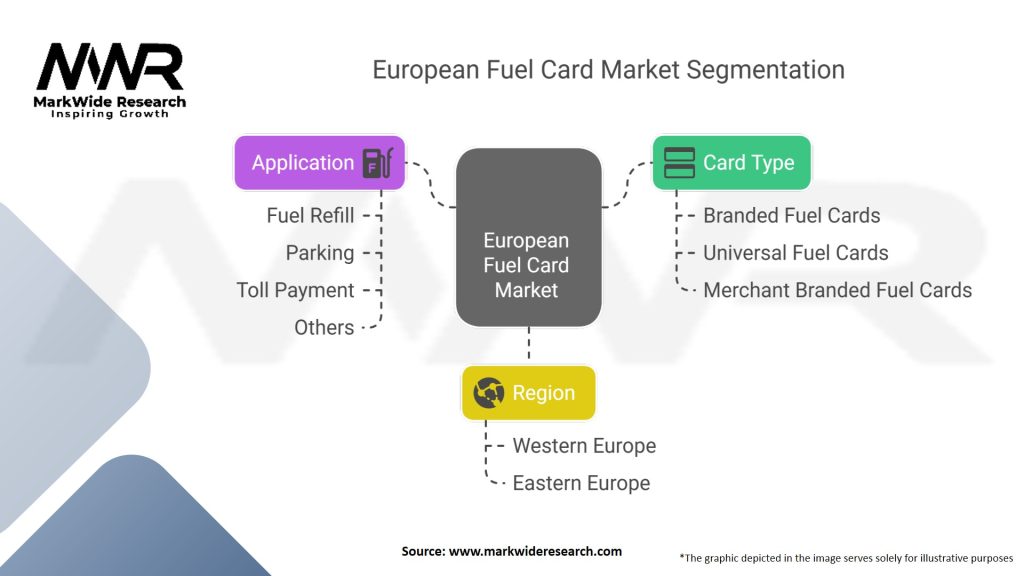

Segmentation

The European fuel card market is segmented based on type, application, and end-user. By type, the market is segmented into branded fuel cards and universal fuel cards. By application, the market is segmented into fuel purchases, vehicle maintenance, and others. By end-user, the market is segmented into transportation and logistics, government, and others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the European fuel card market. The pandemic led to a decline in demand for fuel, as businesses reduced their operations and travel. The decline in fuel demand led to a decline in fuel card usage, impacting the revenue of fuel card providers. However, as businesses start to recover from the pandemic, the demand for fuel and fuel cards is expected to increase.

Key Industry Developments

Analyst Suggestions

Future Outlook

The European fuel card market is expected to continue to grow over the forecast period, driven by increasing demand for fuel-efficient vehicles, rising fuel prices, and the need for efficient fuel management. The market is expected to reach $XX billion by 2025, growing at a CAGR of XX% during the forecast period. The market is highly competitive, with several players, including oil companies, card issuers, and payment processors. The key players in the market are focusing on partnerships and acquisitions to expand their market presence and increase their customer base.

Conclusion

The European fuel card market is growing rapidly, driven by increasing demand for fuel-efficient vehicles, rising fuel prices, and the need for efficient fuel management. Fuel cards offer several benefits to businesses, including reduced fuel costs, simplified fuel management, and detailed fuel consumption reports. The market is highly competitive, with several players, including oil companies, card issuers, and payment processors. The key players in the market are focusing on partnerships and acquisitions to expand their market presence and increase their customer base. The market is expected to reach $XX billion by 2025, growing at a CAGR of XX% during the forecast period.

What is the European Fuel Card?

The European Fuel Card is a payment card that allows businesses to manage fuel expenses efficiently across various countries in Europe. It simplifies the process of refueling by providing access to a network of fuel stations and often includes features like expense tracking and reporting.

Who are the key players in the European Fuel Card Market?

Key players in the European Fuel Card Market include companies like Shell, BP, and TotalEnergies, which offer a range of fuel card solutions tailored for businesses. Other notable companies include DKV Euro Service and Fleetcor, among others.

What are the main drivers of growth in the European Fuel Card Market?

The growth of the European Fuel Card Market is driven by the increasing need for businesses to manage fuel expenses effectively, the rise in transportation and logistics activities, and the growing emphasis on fuel efficiency and cost control.

What challenges does the European Fuel Card Market face?

Challenges in the European Fuel Card Market include regulatory compliance across different countries, competition from alternative payment methods, and the need for continuous technological advancements to meet customer expectations.

What opportunities exist in the European Fuel Card Market?

Opportunities in the European Fuel Card Market include the expansion of digital payment solutions, the integration of telematics for better fleet management, and the increasing demand for sustainable fuel options among businesses.

What trends are shaping the European Fuel Card Market?

Trends in the European Fuel Card Market include the adoption of contactless payment technologies, the rise of mobile fuel card applications, and a growing focus on sustainability, with many companies exploring alternative fuels and eco-friendly practices.

European Fuel Card Market

| Segmentation | Details |

|---|---|

| Card Type | Branded Fuel Cards, Universal Fuel Cards, Merchant Branded Fuel Cards |

| Application | Fuel Refill, Parking, Toll Payment, Others |

| Region | Western Europe, Eastern Europe |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the European Fuel Card Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at