444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The European digital transaction management software market represents a rapidly evolving technological landscape that is transforming how businesses across the continent handle document workflows, electronic signatures, and contract management processes. This sophisticated market encompasses comprehensive software solutions designed to digitize, automate, and streamline transaction-based processes while ensuring compliance with stringent European regulatory frameworks including GDPR and eIDAS regulations.

Market dynamics indicate robust expansion driven by accelerating digital transformation initiatives across various industry sectors. The market is experiencing significant growth at a compound annual growth rate of 12.4%, reflecting the increasing adoption of paperless transaction processes and the growing demand for secure, compliant digital document management solutions. European organizations are increasingly recognizing the strategic value of implementing comprehensive digital transaction management platforms to enhance operational efficiency and reduce processing costs.

Regional adoption patterns show particularly strong momentum in Western European markets, with Germany, France, and the United Kingdom leading implementation rates at approximately 68% market penetration among large enterprises. The software solutions encompass various functionalities including electronic signature capabilities, document authentication, workflow automation, audit trail management, and integration capabilities with existing enterprise resource planning systems.

Industry verticals driving market expansion include financial services, healthcare, real estate, legal services, and government sectors, each requiring specialized compliance features and security protocols. The market landscape is characterized by both established enterprise software providers and innovative technology startups offering cloud-based solutions tailored to specific European market requirements and regulatory compliance standards.

The European digital transaction management software market refers to the comprehensive ecosystem of technology solutions designed to facilitate, secure, and manage electronic business transactions across European Union member states and associated territories. These sophisticated platforms enable organizations to replace traditional paper-based processes with streamlined digital workflows that maintain legal validity while enhancing operational efficiency and compliance capabilities.

Core functionalities encompass electronic signature management, document lifecycle automation, identity verification protocols, compliance monitoring systems, and integration frameworks that connect with existing business applications. The software solutions provide end-to-end transaction management capabilities, from initial document creation and collaboration through final execution and long-term archival storage with comprehensive audit trail maintenance.

Regulatory compliance represents a fundamental aspect of these solutions, ensuring adherence to European Union directives including the Electronic Identification, Authentication and Trust Services (eIDAS) regulation, General Data Protection Regulation (GDPR), and various industry-specific compliance requirements. The platforms incorporate advanced security measures including multi-factor authentication, encryption protocols, and digital certificate management to maintain transaction integrity and legal enforceability across different European jurisdictions.

Strategic market positioning reveals the European digital transaction management software market as a critical enabler of business transformation initiatives across diverse industry sectors. The market demonstrates exceptional resilience and growth potential, driven by fundamental shifts toward digitalization, remote work adoption, and regulatory compliance requirements that mandate secure electronic transaction capabilities.

Technology advancement continues to reshape market dynamics, with artificial intelligence integration, blockchain verification protocols, and advanced analytics capabilities becoming standard features in premium software offerings. Cloud-based deployment models represent approximately 78% of new implementations, reflecting organizational preferences for scalable, cost-effective solutions that can adapt to changing business requirements and regulatory landscapes.

Competitive landscape analysis indicates a diverse ecosystem comprising established enterprise software vendors, specialized digital signature providers, and emerging technology companies offering innovative workflow automation solutions. Market consolidation activities and strategic partnerships are increasingly common as organizations seek comprehensive platforms that can address complex transaction management requirements across multiple European markets simultaneously.

Future growth projections suggest continued market expansion driven by increasing regulatory complexity, growing cybersecurity awareness, and the ongoing digital transformation of traditional business processes. Small and medium-sized enterprises represent a significant growth opportunity, with adoption rates expected to increase substantially as affordable, user-friendly solutions become more widely available.

Primary market drivers encompass several interconnected factors that are accelerating adoption of digital transaction management solutions across European markets:

Market segmentation analysis reveals distinct adoption patterns across different organizational sizes and industry verticals. Large enterprises demonstrate higher implementation rates due to complex compliance requirements and available technology budgets, while small and medium-sized businesses increasingly adopt cloud-based solutions that offer enterprise-grade capabilities at accessible price points.

Digital transformation initiatives represent the primary catalyst driving European digital transaction management software adoption. Organizations across all sectors are implementing comprehensive digitalization strategies that require secure, compliant electronic transaction capabilities to replace legacy paper-based processes and manual workflows.

Regulatory compliance pressures continue to intensify as European Union authorities implement increasingly sophisticated requirements for electronic transaction management, data protection, and digital identity verification. The eIDAS regulation framework mandates specific technical standards for electronic signatures and digital certificates, creating substantial demand for compliant software solutions.

Remote work proliferation has fundamentally altered business operations, necessitating digital collaboration tools that maintain security standards while enabling distributed teams to execute transactions efficiently. This shift has accelerated adoption rates by approximately 45% annually as organizations adapt to hybrid work models and geographically dispersed operations.

Cost optimization strategies drive organizations to seek automated solutions that reduce administrative overhead, eliminate printing and storage costs, and minimize processing delays associated with traditional document management approaches. The potential for significant operational cost reductions creates compelling business cases for digital transaction management platform implementation.

Customer experience enhancement requirements push businesses to offer streamlined, digital-first service delivery models that meet evolving client expectations for convenient, secure transaction processes. Organizations recognize that superior digital capabilities can provide competitive advantages in increasingly crowded European markets.

Implementation complexity represents a significant barrier for many European organizations considering digital transaction management software adoption. The technical challenges associated with integrating new platforms with existing enterprise systems, training personnel, and ensuring seamless workflow transitions can create substantial implementation hurdles that delay adoption decisions.

Security concerns continue to influence market dynamics, particularly among organizations handling sensitive financial, healthcare, or legal information. Despite advanced encryption and security protocols, some businesses remain hesitant to transition critical transaction processes to digital platforms due to cybersecurity risks and potential data breach vulnerabilities.

Regulatory uncertainty in certain European jurisdictions creates adoption challenges as organizations navigate complex compliance requirements that vary across different member states. The evolving nature of digital transaction regulations can make it difficult for businesses to select solutions that will remain compliant as legal frameworks continue to develop.

Budget constraints limit adoption among smaller organizations that may lack sufficient technology budgets to implement comprehensive digital transaction management platforms. While cloud-based solutions offer more accessible pricing models, the total cost of ownership including training, customization, and ongoing support can still represent significant investments for resource-constrained businesses.

Change management resistance within organizations can slow adoption as employees and stakeholders adapt to new digital workflows. Traditional business processes often have established stakeholder relationships and approval hierarchies that require careful management during digital transformation initiatives.

Small and medium enterprise expansion represents the most significant growth opportunity in the European digital transaction management software market. As cloud-based solutions become more affordable and user-friendly, SMEs are increasingly positioned to adopt enterprise-grade transaction management capabilities that were previously accessible only to large organizations.

Industry-specific solutions offer substantial development opportunities for software providers willing to create specialized platforms tailored to unique sector requirements. Healthcare, legal services, real estate, and financial services sectors each have distinct compliance needs and workflow patterns that can be addressed through customized digital transaction management solutions.

Artificial intelligence integration presents opportunities to enhance platform capabilities through intelligent document processing, automated compliance checking, predictive analytics, and advanced workflow optimization features. AI-powered solutions can provide significant value-added services that differentiate offerings in competitive markets.

Mobile-first development addresses the growing demand for transaction management capabilities accessible through smartphones and tablets. As mobile device usage continues to expand, organizations require platforms that provide full functionality across all device types while maintaining security and compliance standards.

Cross-border transaction facilitation offers opportunities to develop solutions that streamline international business processes across different European jurisdictions. Platforms that can navigate varying regulatory requirements and provide seamless cross-border transaction capabilities address significant market needs for multinational organizations.

Technological evolution continues to reshape the European digital transaction management software landscape through continuous innovation in security protocols, user interface design, and integration capabilities. Advanced features including biometric authentication, blockchain verification, and machine learning-powered document analysis are becoming standard expectations rather than premium add-ons.

Competitive pressures drive software providers to differentiate their offerings through specialized functionality, superior user experiences, and comprehensive compliance capabilities. The market demonstrates increasing consolidation as larger technology companies acquire specialized providers to expand their digital transaction management portfolios and geographic reach.

Customer expectations are evolving rapidly as organizations become more sophisticated in their digital transformation approaches. Businesses now expect seamless integration capabilities, intuitive user interfaces, comprehensive reporting and analytics, and responsive customer support services as baseline requirements rather than premium features.

Regulatory evolution continues to influence market dynamics as European Union authorities refine digital transaction regulations and introduce new compliance requirements. Software providers must maintain agility to adapt their platforms to changing regulatory landscapes while ensuring backward compatibility for existing implementations.

Economic factors including inflation pressures, supply chain disruptions, and changing business investment priorities influence adoption patterns and purchasing decisions. Organizations are increasingly focused on solutions that provide measurable return on investment and can demonstrate clear business value through improved efficiency and cost reduction.

Comprehensive market analysis was conducted through multiple research methodologies to ensure accurate representation of the European digital transaction management software market landscape. Primary research activities included structured interviews with industry executives, technology providers, end-user organizations, and regulatory experts across major European markets.

Secondary research components encompassed extensive analysis of industry publications, regulatory documentation, company financial reports, technology trend analyses, and competitive intelligence gathering from publicly available sources. This multi-faceted approach provided comprehensive market insights and validated primary research findings through triangulation methodologies.

Data collection processes involved systematic gathering of market information through surveys, focus groups, expert interviews, and observational studies of implementation projects across various industry sectors. Quantitative data was supplemented with qualitative insights to provide comprehensive understanding of market dynamics and future trends.

Analytical frameworks included statistical modeling, trend analysis, competitive benchmarking, and scenario planning to develop accurate market projections and identify key growth opportunities. Advanced analytical techniques were employed to ensure research findings reflect current market realities and provide actionable insights for stakeholders.

Quality assurance measures included peer review processes, data validation procedures, and cross-referencing of findings with multiple independent sources to ensure research accuracy and reliability. All research activities adhered to established industry standards for market research methodology and ethical data collection practices.

Western European markets demonstrate the highest adoption rates and market maturity levels, with Germany, France, and the United Kingdom leading implementation across enterprise and mid-market segments. These markets benefit from advanced digital infrastructure, sophisticated regulatory frameworks, and high levels of technology investment that support comprehensive digital transaction management platform deployment.

Germany represents the largest individual market opportunity, driven by strong manufacturing and financial services sectors that require robust transaction management capabilities. German organizations demonstrate particular interest in solutions that provide comprehensive compliance capabilities and integrate seamlessly with existing enterprise resource planning systems. Market penetration rates reach approximately 72% among large enterprises.

Nordic countries including Sweden, Denmark, Norway, and Finland show exceptional adoption rates due to advanced digital government initiatives and high levels of technology acceptance among businesses and consumers. These markets often serve as testing grounds for innovative features and deployment models that subsequently expand to other European regions.

Southern European markets including Italy, Spain, and Portugal demonstrate growing adoption rates as digital transformation initiatives gain momentum and regulatory compliance requirements drive platform implementation. These markets show particular strength in specific industry verticals including healthcare, legal services, and government sectors.

Eastern European markets represent significant growth opportunities as economies continue to develop and organizations invest in digital infrastructure improvements. Countries including Poland, Czech Republic, and Hungary show increasing adoption rates, particularly among multinational corporations and technology-forward domestic businesses seeking to modernize their transaction management processes.

Market leadership is distributed among several categories of providers, each offering distinct advantages and serving different market segments within the European digital transaction management software ecosystem:

Competitive differentiation occurs through various factors including compliance capabilities, integration options, user experience design, pricing models, and specialized industry functionality. Providers increasingly focus on developing comprehensive platforms that address multiple aspects of digital transaction management rather than single-point solutions.

Strategic partnerships and acquisition activities continue to reshape the competitive landscape as companies seek to expand their geographic reach, enhance their technology capabilities, and access new customer segments. Integration partnerships with enterprise software providers, consulting firms, and system integrators are becoming increasingly important for market success.

By deployment model, the market divides into distinct segments that address different organizational requirements and preferences:

By organization size, adoption patterns vary significantly based on available resources and complexity requirements:

By industry vertical, different sectors demonstrate unique requirements and adoption patterns:

Electronic signature solutions represent the foundational category within the digital transaction management software market, providing legally binding signature capabilities that comply with European Union eIDAS regulations. These solutions range from basic signature capture to advanced biometric authentication and digital certificate management systems that ensure transaction integrity and legal enforceability.

Document workflow automation platforms extend beyond simple signature collection to provide comprehensive process management capabilities including approval routing, conditional logic, template management, and integration with existing business applications. These solutions demonstrate particular value for organizations with complex, multi-step transaction processes that require coordination among multiple stakeholders.

Contract lifecycle management systems offer specialized functionality for managing contractual relationships from initial creation through renewal or termination. These platforms typically include features such as clause libraries, obligation tracking, renewal notifications, and performance monitoring capabilities that provide strategic value beyond basic transaction processing.

Identity verification solutions address growing security requirements through advanced authentication mechanisms including biometric verification, document validation, and multi-factor authentication protocols. These capabilities are becoming increasingly important as organizations seek to prevent fraud and ensure compliance with know-your-customer regulations.

Analytics and reporting platforms provide insights into transaction patterns, processing efficiency, compliance status, and user behavior that enable organizations to optimize their digital transaction management processes. Advanced analytics capabilities including predictive modeling and performance benchmarking are becoming standard expectations among enterprise clients.

Operational efficiency improvements represent the most immediate and measurable benefits for organizations implementing digital transaction management software. Businesses typically experience significant reductions in processing time, administrative overhead, and error rates while improving overall transaction throughput and customer satisfaction levels.

Cost reduction opportunities encompass multiple areas including elimination of paper and printing expenses, reduced storage requirements, decreased postage and courier costs, and minimized administrative labor requirements. Organizations often achieve substantial return on investment within the first year of implementation through these direct cost savings.

Compliance assurance provides peace of mind for organizations operating in heavily regulated industries by ensuring adherence to European Union regulations, industry standards, and internal governance requirements. Automated compliance checking and comprehensive audit trails reduce regulatory risk and simplify compliance reporting processes.

Enhanced security capabilities protect sensitive business information through advanced encryption, secure storage, access controls, and comprehensive audit logging that exceeds the security levels achievable through traditional paper-based processes. These security enhancements are particularly valuable for organizations handling confidential financial, healthcare, or legal information.

Improved customer experience results from streamlined transaction processes that eliminate delays, reduce complexity, and provide convenient digital interaction options that meet modern customer expectations. Organizations often report increased customer satisfaction and retention rates following digital transaction management platform implementation.

Scalability advantages enable organizations to handle increased transaction volumes without proportional increases in administrative resources, supporting business growth and expansion initiatives. Cloud-based solutions provide particular scalability benefits through elastic resource allocation and global accessibility.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is transforming digital transaction management platforms through intelligent document processing, automated data extraction, predictive analytics, and enhanced user experience features. AI-powered capabilities enable platforms to provide more sophisticated automation and decision-support functionality that adds significant value for enterprise users.

Mobile-first design approaches are becoming standard as organizations recognize the importance of providing full transaction management capabilities through smartphones and tablets. Modern platforms prioritize responsive design and native mobile applications that maintain security and compliance standards while delivering optimal user experiences across all device types.

Blockchain integration is emerging as a method to enhance transaction security, provide immutable audit trails, and enable new forms of digital identity verification. While still in early adoption phases, blockchain-based features are gaining interest among organizations seeking enhanced security and transparency for high-value transactions.

Industry-specific customization is increasing as software providers develop specialized functionality tailored to unique sector requirements. Healthcare, financial services, legal, and government sectors each have distinct compliance needs and workflow patterns that benefit from customized platform features and industry-specific integrations.

Advanced analytics capabilities are becoming standard features as organizations seek insights into transaction patterns, process efficiency, user behavior, and compliance status. Modern platforms provide comprehensive reporting dashboards, predictive analytics, and performance benchmarking tools that enable data-driven process optimization.

Zero-trust security models are being implemented to address growing cybersecurity concerns through comprehensive identity verification, continuous authentication, and granular access controls that ensure transaction security without compromising user experience or operational efficiency.

Regulatory advancement continues to shape the European digital transaction management software market as authorities refine eIDAS implementation guidelines and introduce new compliance requirements. Recent developments include enhanced standards for electronic identification, improved cross-border recognition protocols, and strengthened security requirements that influence platform development priorities.

Technology partnerships between digital transaction management providers and enterprise software companies are creating more comprehensive solution ecosystems. These collaborations enable seamless integration with customer relationship management systems, enterprise resource planning platforms, and industry-specific applications that enhance overall business value.

Acquisition activities are consolidating the market as larger technology companies acquire specialized providers to expand their digital transformation portfolios. Recent acquisitions have focused on companies with strong European market presence, specialized industry expertise, or innovative technology capabilities that complement existing platform offerings.

Cloud infrastructure investments by major providers are improving platform performance, security, and scalability while reducing costs for end users. These investments include expanded data center presence across European markets, enhanced security protocols, and improved integration capabilities that support growing customer demands.

Standards development through industry organizations and regulatory bodies is creating more consistent frameworks for digital transaction management across European markets. These standardization efforts facilitate cross-border transactions and simplify compliance requirements for multinational organizations.

Strategic platform selection should prioritize solutions that demonstrate strong European compliance capabilities, comprehensive integration options, and scalable architecture that can accommodate future growth requirements. MarkWide Research analysis indicates that organizations achieving the greatest success focus on platforms offering both current functionality and clear development roadmaps for emerging requirements.

Implementation planning requires careful attention to change management processes, user training programs, and phased deployment strategies that minimize business disruption while maximizing adoption rates. Organizations should allocate sufficient resources for comprehensive staff training and ongoing support to ensure successful platform utilization.

Vendor evaluation should include assessment of financial stability, customer support capabilities, compliance expertise, and long-term strategic vision in addition to current platform functionality. The rapidly evolving nature of digital transaction management technology makes vendor selection a critical strategic decision with long-term implications.

Security considerations must encompass not only platform security features but also organizational policies, user training, and ongoing monitoring procedures that ensure comprehensive protection of sensitive transaction data. Regular security assessments and updates are essential for maintaining effective protection against evolving cyber threats.

ROI measurement should include both direct cost savings and indirect benefits such as improved customer satisfaction, enhanced compliance capabilities, and increased operational agility that contribute to overall business value. Comprehensive metrics enable organizations to optimize their digital transaction management investments and demonstrate business value to stakeholders.

Market expansion is expected to continue at a robust pace driven by ongoing digital transformation initiatives, evolving regulatory requirements, and increasing recognition of digital transaction management as a strategic business capability rather than simply a cost-reduction tool. The market is projected to maintain strong growth momentum with a compound annual growth rate of 12.4% through the forecast period.

Technology evolution will focus on enhanced artificial intelligence capabilities, improved mobile experiences, advanced security features, and more sophisticated integration options that address complex enterprise requirements. Emerging technologies including blockchain, biometric authentication, and quantum encryption may influence future platform development directions.

Geographic expansion opportunities exist particularly in Eastern European markets where digital infrastructure development and economic growth are creating new demand for sophisticated transaction management solutions. These markets represent significant growth potential as organizations modernize their business processes and adopt digital-first operational models.

Industry specialization will likely increase as software providers develop deeper expertise in specific vertical markets and create more tailored solutions that address unique sector requirements. Healthcare, financial services, and government sectors are expected to drive significant specialized development activities.

Regulatory evolution will continue to influence market development as European Union authorities refine digital transaction standards and potentially introduce new compliance requirements. MarkWide Research projections suggest that regulatory changes will generally support market growth by creating clearer frameworks and increasing confidence in digital transaction management solutions.

The European digital transaction management software market represents a dynamic and rapidly expanding technology sector that is fundamentally transforming how organizations across the continent handle business transactions, document workflows, and compliance requirements. With strong regulatory support through the eIDAS framework, robust digital infrastructure, and increasing recognition of digital transformation as a strategic imperative, the market is well-positioned for continued growth and innovation.

Key success factors for market participants include comprehensive European compliance capabilities, seamless integration with existing business systems, superior user experience design, and strong security protocols that address evolving cybersecurity threats. Organizations that prioritize these elements while maintaining competitive pricing and responsive customer support are most likely to achieve sustainable market success.

Future market development will be shaped by technological advancement, regulatory evolution, changing customer expectations, and competitive dynamics that continue to drive innovation and improvement across all platform categories. The integration of artificial intelligence, enhanced mobile capabilities, and advanced analytics will likely define the next generation of digital transaction management solutions.

As European businesses continue their digital transformation journeys, digital transaction management software will play an increasingly critical role in enabling efficient, secure, and compliant business operations that meet the demands of modern commerce while supporting sustainable growth and competitive advantage in global markets.

What is Digital Transaction Management Software?

Digital Transaction Management Software refers to solutions that facilitate the management of digital transactions, including document signing, workflow automation, and secure storage. These tools are essential for businesses looking to streamline their operations and enhance customer experiences.

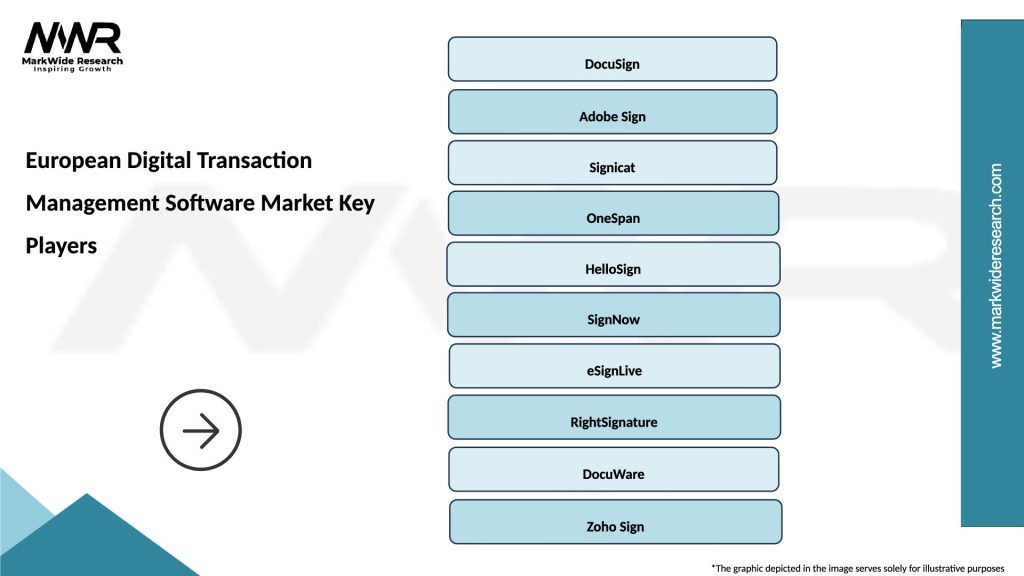

What are the key players in the European Digital Transaction Management Software Market?

Key players in the European Digital Transaction Management Software Market include DocuSign, Adobe Sign, and SignNow, among others. These companies offer a range of solutions that cater to various industries, enhancing efficiency and compliance in digital transactions.

What are the main drivers of growth in the European Digital Transaction Management Software Market?

The growth of the European Digital Transaction Management Software Market is driven by the increasing demand for paperless transactions, the need for enhanced security in digital communications, and the growing adoption of remote work practices. Businesses are increasingly seeking solutions that improve efficiency and reduce operational costs.

What challenges does the European Digital Transaction Management Software Market face?

Challenges in the European Digital Transaction Management Software Market include concerns over data privacy and compliance with regulations such as GDPR. Additionally, the integration of these solutions with existing systems can pose technical difficulties for organizations.

What opportunities exist in the European Digital Transaction Management Software Market?

Opportunities in the European Digital Transaction Management Software Market include the expansion of e-commerce and the increasing need for digital solutions in various sectors such as finance and healthcare. As businesses continue to digitize their operations, the demand for innovative transaction management solutions is expected to rise.

What trends are shaping the European Digital Transaction Management Software Market?

Trends in the European Digital Transaction Management Software Market include the rise of artificial intelligence in automating transaction processes and the growing emphasis on user-friendly interfaces. Additionally, there is a shift towards mobile solutions that allow users to manage transactions on-the-go.

European Digital Transaction Management Software Market

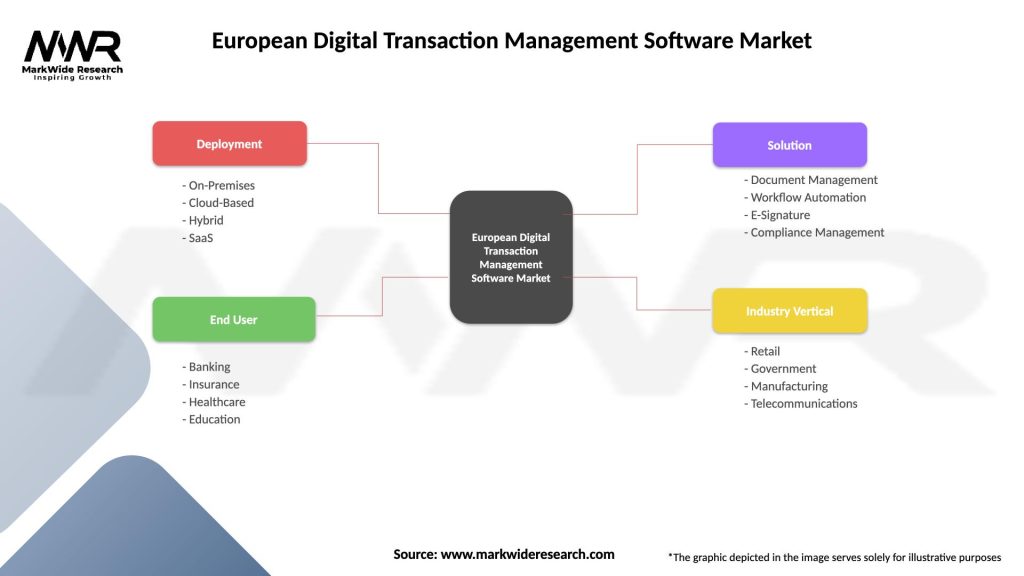

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premises, Cloud-Based, Hybrid, SaaS |

| End User | Banking, Insurance, Healthcare, Education |

| Solution | Document Management, Workflow Automation, E-Signature, Compliance Management |

| Industry Vertical | Retail, Government, Manufacturing, Telecommunications |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the European Digital Transaction Management Software Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at