444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The European dairy market represents one of the most established and sophisticated agricultural sectors globally, encompassing a diverse range of products from traditional milk and cheese to innovative plant-based alternatives. This comprehensive market spans across multiple countries, each contributing unique dairy traditions and modern processing capabilities that collectively shape the continental landscape. The sector demonstrates remarkable resilience and adaptability, with growth rates projected at 3.2% CAGR through the next decade, driven by evolving consumer preferences and technological advancements.

Market dynamics within the European dairy sector reflect a complex interplay of traditional farming practices, advanced processing technologies, and changing consumer behaviors. The region’s dairy industry benefits from favorable climatic conditions, established supply chains, and strong regulatory frameworks that ensure product quality and safety. Sustainability initiatives have become increasingly important, with approximately 68% of European dairy producers implementing environmentally conscious practices to meet growing consumer demand for responsible sourcing.

Innovation trends continue to reshape the market landscape, with significant investments in automation, precision farming, and alternative protein development. The sector’s ability to balance traditional dairy excellence with modern consumer expectations positions Europe as a global leader in dairy innovation and quality standards.

The European dairy market refers to the comprehensive ecosystem of dairy production, processing, distribution, and consumption across European Union member states and associated countries. This market encompasses traditional dairy products including milk, cheese, butter, yogurt, and cream, as well as emerging categories such as plant-based alternatives, functional dairy products, and specialty artisanal offerings that cater to diverse consumer preferences and dietary requirements.

Scope and definition of this market extends beyond simple agricultural production to include sophisticated processing facilities, advanced packaging technologies, extensive distribution networks, and retail channels that deliver dairy products to millions of consumers daily. The market integrates traditional farming communities with modern industrial operations, creating a complex value chain that supports rural economies while meeting urban consumer demands.

Geographic coverage includes major dairy-producing nations such as Germany, France, Netherlands, Denmark, and Ireland, each contributing distinct product specialties and processing expertise. The market’s definition also encompasses regulatory frameworks, quality standards, and sustainability initiatives that collectively define European dairy excellence and global competitiveness.

Strategic positioning of the European dairy market demonstrates exceptional strength across multiple dimensions, with the region maintaining its status as a global dairy powerhouse through continuous innovation and quality excellence. The market’s foundation rests on centuries of dairy expertise combined with cutting-edge processing technologies that enable efficient production and distribution of high-quality products to domestic and international markets.

Key performance indicators reveal robust market health, with organic dairy products experiencing particularly strong growth at 8.5% annually, reflecting increasing consumer preference for premium, sustainably produced options. The sector’s resilience during recent global challenges demonstrates its fundamental importance to European agriculture and food security, with dairy products representing approximately 15% of total agricultural output across the region.

Future trajectory indicates continued expansion driven by technological innovation, sustainability initiatives, and diversification into alternative protein sources. The market’s ability to adapt to changing consumer preferences while maintaining traditional quality standards positions it favorably for sustained growth and global competitiveness in the evolving food landscape.

Consumer behavior analysis reveals significant shifts in dairy consumption patterns, with increasing demand for premium, organic, and functional dairy products driving market evolution. European consumers demonstrate growing awareness of nutritional benefits, environmental impact, and product origin, influencing purchasing decisions and creating opportunities for value-added dairy offerings.

Consumer demand evolution serves as the primary catalyst for European dairy market expansion, with health-conscious consumers increasingly seeking products that offer nutritional benefits beyond basic sustenance. The growing awareness of dairy products’ role in supporting immune function, bone health, and overall wellness drives consistent demand across diverse demographic segments.

Technological advancement in dairy processing and farming operations significantly enhances productivity and product quality, enabling producers to meet growing demand while maintaining competitive pricing. Modern milking systems, automated processing equipment, and precision agriculture techniques contribute to operational efficiency and product consistency that strengthens market position.

Regulatory complexity across different European markets creates operational challenges for dairy producers seeking to expand their geographic reach. Varying quality standards, labeling requirements, and import/export regulations necessitate significant compliance investments that can limit market entry and expansion opportunities for smaller producers.

Environmental concerns regarding traditional dairy farming practices generate increasing scrutiny from regulatory bodies and consumer advocacy groups. Climate change considerations, water usage concerns, and greenhouse gas emissions associated with livestock operations create pressure for industry transformation that requires substantial capital investment.

Innovation potential within the European dairy sector presents substantial opportunities for market expansion and value creation. The development of functional dairy products, enhanced processing technologies, and sustainable production methods creates pathways for differentiation and premium positioning that can drive revenue growth and market share expansion.

Export market development offers significant growth potential as global demand for high-quality European dairy products continues expanding. Emerging markets demonstrate increasing appetite for premium dairy offerings, while established markets seek innovative products that meet evolving consumer preferences and dietary requirements.

Supply chain integration within the European dairy market demonstrates sophisticated coordination between producers, processors, distributors, and retailers that enables efficient product flow and quality maintenance. This integration supports market stability while providing flexibility to respond to changing consumer demands and seasonal variations in production capacity.

Competitive landscape dynamics reflect a balanced ecosystem of large-scale industrial operations and smaller artisanal producers, each serving distinct market segments and consumer preferences. This diversity strengthens overall market resilience while fostering innovation through competitive pressure and collaborative knowledge sharing across the industry.

Technology adoption rates continue accelerating across the sector, with approximately 72% of European dairy operations implementing some form of automated processing or monitoring systems. These technological improvements enhance product quality, reduce operational costs, and improve traceability throughout the supply chain, strengthening consumer confidence and market competitiveness.

Comprehensive data collection for European dairy market analysis employs multiple research methodologies to ensure accuracy and completeness of market insights. Primary research includes extensive surveys of dairy producers, processors, distributors, and consumers across major European markets, providing direct insights into market trends, challenges, and opportunities.

Secondary research integration incorporates analysis of government agricultural statistics, industry association reports, trade publications, and academic research to validate primary findings and provide historical context for market developments. This multi-source approach ensures robust data foundation for strategic analysis and market projections.

Germany leads the European dairy market with approximately 23% market share, leveraging advanced processing capabilities and strong domestic consumption to maintain its dominant position. The country’s dairy sector benefits from efficient production systems, innovative product development, and robust export networks that serve both European and international markets effectively.

France contributes significantly to market diversity through its renowned cheese production and artisanal dairy traditions, holding roughly 18% of regional market share. French dairy excellence in premium products creates substantial value-added opportunities while supporting rural economies through traditional farming practices and modern processing integration.

Netherlands demonstrates exceptional efficiency in dairy operations, with 12% market share despite its relatively small geographic size. Dutch dairy expertise in breeding, processing, and export logistics provides competitive advantages that enable significant international market penetration and premium product positioning.

Market leadership within the European dairy sector reflects a diverse ecosystem of multinational corporations, regional cooperatives, and specialized producers that collectively serve various market segments and consumer preferences. This competitive diversity fosters innovation while maintaining market stability through balanced competition and collaborative industry development.

Product segmentation within the European dairy market reveals distinct categories serving diverse consumer needs and preferences. Traditional dairy products maintain strong market positions while innovative categories demonstrate rapid growth potential and market expansion opportunities.

By Product Type:

By Distribution Channel:

Cheese category dominance reflects Europe’s rich dairy heritage and sophisticated consumer palate, with artisanal and specialty cheeses experiencing particularly strong growth. The segment benefits from protected designation of origin regulations that preserve traditional production methods while enabling premium positioning and export opportunities.

Organic dairy products demonstrate exceptional growth momentum, with market penetration reaching 11% of total dairy consumption across major European markets. This category expansion reflects increasing consumer awareness of environmental sustainability and health benefits associated with organic farming practices and chemical-free production methods.

Functional dairy innovations create new market opportunities through products enhanced with probiotics, vitamins, and other beneficial compounds. MarkWide Research analysis indicates that functional dairy products appeal particularly to health-conscious consumers seeking convenient ways to incorporate nutritional benefits into their daily routines.

Producer advantages within the European dairy market include access to sophisticated processing technologies, established distribution networks, and strong regulatory frameworks that protect product quality and market integrity. These benefits enable efficient operations while supporting premium positioning and international market expansion opportunities.

Consumer benefits encompass access to diverse, high-quality dairy products that meet various nutritional needs and taste preferences. The market’s emphasis on quality standards, traceability, and innovation ensures consumers receive safe, nutritious products while supporting sustainable agricultural practices and rural community development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation emerges as the dominant trend reshaping European dairy operations, with producers implementing comprehensive environmental management systems that address carbon footprint, water usage, and biodiversity conservation. This trend reflects both regulatory requirements and consumer expectations for responsible production practices.

Digital agriculture adoption accelerates across dairy farms and processing facilities, with smart sensors, automated milking systems, and data analytics improving operational efficiency and animal welfare. These technological advances enable precision farming approaches that optimize resource utilization while maintaining high production standards.

Technological breakthroughs in dairy processing and packaging continue transforming industry capabilities, with advanced pasteurization techniques, extended shelf-life technologies, and smart packaging solutions enhancing product quality and consumer convenience. These developments support market expansion while reducing food waste and improving supply chain efficiency.

Strategic partnerships between traditional dairy companies and technology firms accelerate innovation adoption and market development. These collaborations enable rapid deployment of digital solutions, alternative product development, and sustainable production practices that strengthen competitive positioning and market responsiveness.

Strategic recommendations for European dairy market participants emphasize the importance of balancing traditional strengths with innovative capabilities to maintain competitive advantage in evolving market conditions. MWR analysis suggests that successful companies will integrate sustainability initiatives with technological advancement to meet changing consumer expectations while preserving operational efficiency.

Investment priorities should focus on sustainable production technologies, alternative product development, and digital infrastructure that supports operational optimization and consumer engagement. Companies that proactively address environmental concerns while maintaining product quality and affordability will achieve stronger market positioning and growth potential.

Market evolution over the next decade will be characterized by increased integration of sustainable practices, technological innovation, and product diversification that addresses changing consumer preferences and regulatory requirements. The European dairy sector’s ability to adapt while maintaining its quality leadership position will determine long-term success and global competitiveness.

Growth projections indicate continued market expansion at 3.8% CAGR through 2030, driven by innovation in functional products, sustainable production methods, and international market development. The sector’s resilience and adaptability position it favorably for sustained growth despite challenges from alternative products and environmental regulations.

Technological integration will accelerate across all aspects of dairy operations, with artificial intelligence, automation, and precision agriculture becoming standard practices. These advances will enable more efficient resource utilization, improved product quality, and enhanced traceability that supports consumer confidence and regulatory compliance.

The European dairy market stands at a pivotal juncture where traditional excellence meets modern innovation, creating unprecedented opportunities for growth and market leadership. The sector’s foundation of quality, sustainability, and technological advancement positions it strongly for continued success in an evolving global marketplace that increasingly values responsible production and premium products.

Strategic positioning for future success requires balanced investment in sustainability initiatives, technological innovation, and product diversification that addresses changing consumer preferences while maintaining the quality standards that define European dairy excellence. Companies that successfully navigate this transformation will achieve sustainable competitive advantages and market leadership positions.

Long-term prospects remain highly favorable, with the European dairy market’s combination of traditional expertise, innovative capabilities, and strong regulatory frameworks providing a solid foundation for sustained growth and global competitiveness in the dynamic food industry landscape.

What is Dairy?

Dairy refers to products made from the milk of mammals, primarily cows, goats, and sheep. It includes a variety of items such as milk, cheese, yogurt, and butter, which are integral to many diets worldwide.

What are the key players in the European Dairy Market?

Key players in the European Dairy Market include companies like Danone, Lactalis, and Arla Foods, which are known for their extensive range of dairy products. These companies compete in various segments such as cheese, yogurt, and milk, among others.

What are the growth factors driving the European Dairy Market?

The European Dairy Market is driven by increasing consumer demand for dairy products, the rise of health-conscious eating habits, and innovations in dairy processing technologies. Additionally, the popularity of plant-based alternatives is influencing traditional dairy consumption patterns.

What challenges does the European Dairy Market face?

The European Dairy Market faces challenges such as fluctuating milk prices, stringent regulations regarding food safety, and competition from non-dairy alternatives. These factors can impact profitability and market stability.

What opportunities exist in the European Dairy Market?

Opportunities in the European Dairy Market include the growing trend of organic dairy products, the expansion of e-commerce for dairy sales, and the potential for product innovation in lactose-free and fortified dairy items. These trends can attract new consumer segments.

What trends are shaping the European Dairy Market?

Trends shaping the European Dairy Market include the increasing focus on sustainability and animal welfare, the rise of functional dairy products, and the integration of technology in dairy farming and processing. These trends are influencing consumer preferences and industry practices.

European Dairy Market

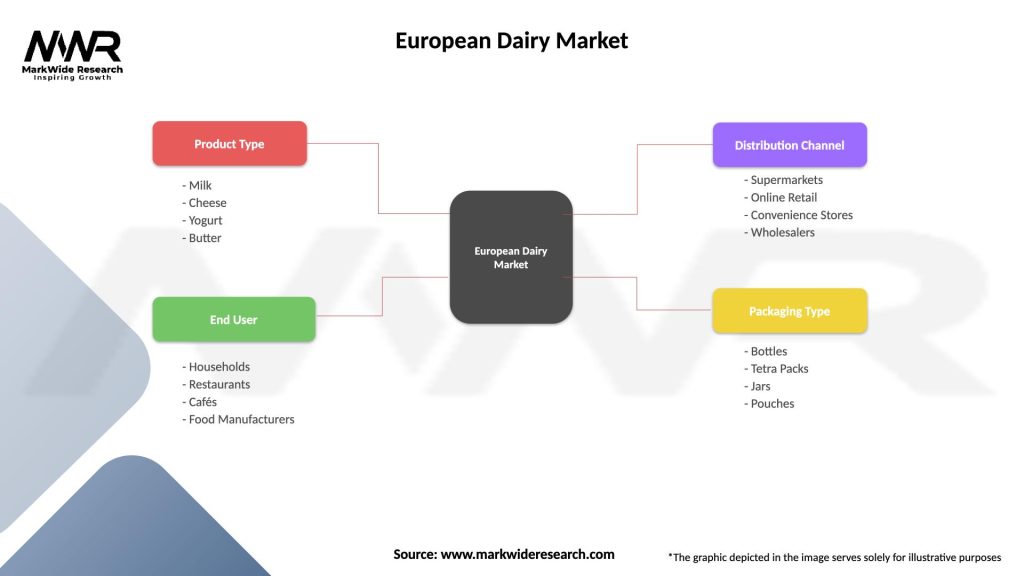

| Segmentation Details | Description |

|---|---|

| Product Type | Milk, Cheese, Yogurt, Butter |

| End User | Households, Restaurants, Cafés, Food Manufacturers |

| Distribution Channel | Supermarkets, Online Retail, Convenience Stores, Wholesalers |

| Packaging Type | Bottles, Tetra Packs, Jars, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the European Dairy Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at