444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The European craft beer market represents one of the most dynamic and rapidly evolving segments within the global alcoholic beverage industry. This vibrant market encompasses a diverse range of artisanal brewing operations, from small-scale microbreweries to established craft beer producers across the continent. European craft beer has experienced remarkable growth, driven by changing consumer preferences toward premium, locally-sourced, and innovative beer varieties that offer unique flavors and brewing techniques.

Market dynamics indicate that the European craft beer sector is expanding at a compound annual growth rate (CAGR) of 8.2%, significantly outpacing traditional beer segments. This growth trajectory reflects the increasing consumer demand for authentic, high-quality brewing experiences that emphasize craftsmanship, local ingredients, and distinctive taste profiles. The market spans across major European economies including Germany, the United Kingdom, Belgium, Netherlands, France, and emerging craft beer markets in Eastern Europe.

Consumer behavior patterns demonstrate a pronounced shift toward premium beer experiences, with craft beer accounting for approximately 12.5% of total beer consumption across European markets. This transformation is particularly evident among millennials and Generation Z consumers who prioritize quality over quantity and seek authentic brand stories that resonate with their values of sustainability, local sourcing, and artisanal production methods.

The European craft beer market refers to the comprehensive ecosystem of small-scale, independent breweries and their associated products that emphasize traditional brewing methods, innovative flavor profiles, and artisanal production techniques across European territories. This market encompasses breweries that typically produce limited quantities of beer with focus on quality, creativity, and local market engagement rather than mass production and distribution.

Craft beer definition varies across European countries but generally includes breweries that maintain independence from large multinational corporations, produce beer in smaller batches, and demonstrate commitment to innovation and traditional brewing craftsmanship. The European craft beer landscape includes various brewery types such as microbreweries, brewpubs, regional craft breweries, and contract brewing operations that collectively contribute to the market’s diverse product offerings.

Market characteristics include emphasis on premium ingredients, experimental brewing techniques, seasonal and limited-edition releases, direct consumer engagement, and strong connections to local communities and cultural traditions. European craft breweries often incorporate regional ingredients, historical brewing methods, and contemporary innovation to create distinctive products that differentiate them from mass-produced alternatives.

European craft beer market analysis reveals a robust and expanding industry characterized by strong consumer demand, innovative product development, and increasing market penetration across diverse demographic segments. The market benefits from favorable regulatory environments, growing tourism interest in brewery experiences, and rising consumer sophistication regarding beer quality and variety.

Key market drivers include changing lifestyle preferences, increased disposable income among target demographics, growing appreciation for artisanal products, and expanding distribution channels including online platforms and specialty retail outlets. The market demonstrates resilience and adaptability, with craft breweries successfully navigating challenges through direct-to-consumer sales, taproom experiences, and innovative product launches.

Regional performance varies significantly, with established markets like Germany and Belgium showing steady growth while emerging markets in Eastern Europe demonstrate accelerated adoption rates exceeding 15% annual growth. The market’s future outlook remains positive, supported by continued innovation, expanding consumer base, and increasing integration with hospitality and tourism sectors across European destinations.

Strategic market insights reveal several critical trends shaping the European craft beer landscape:

Consumer preference evolution serves as the primary driver propelling European craft beer market expansion. Modern consumers increasingly seek authentic, high-quality products that offer unique experiences and align with personal values regarding sustainability, local sourcing, and artisanal craftsmanship. This shift represents a fundamental change from traditional mass-market beer consumption patterns toward more discerning and experiential purchasing decisions.

Economic prosperity across European markets enables consumers to allocate higher spending toward premium beverage categories. Rising disposable incomes, particularly among urban professionals and younger demographics, create favorable conditions for craft beer market growth. The willingness to pay premium prices for quality products supports brewery profitability and encourages continued market entry and expansion.

Cultural appreciation for brewing heritage and artisanal traditions drives market demand across European regions with rich brewing histories. Countries like Germany, Belgium, and the Czech Republic leverage their brewing legacies to support craft beer market development, while newer markets embrace craft brewing as a form of cultural expression and local identity creation.

Tourism integration significantly contributes to market growth as craft breweries become destination attractions. Brewery tours, beer festivals, and craft beer trails generate additional revenue streams while expanding brand awareness and consumer engagement. This tourism component creates multiplier effects that benefit local economies and support brewery sustainability.

Regulatory complexity presents significant challenges for craft breweries operating across multiple European jurisdictions. Varying taxation structures, labeling requirements, distribution regulations, and alcohol content restrictions create compliance burdens that particularly impact smaller breweries with limited administrative resources. These regulatory differences can impede cross-border expansion and increase operational costs.

Capital intensity requirements for brewing equipment, facility development, and quality control systems create barriers to market entry and expansion. Small craft breweries often struggle to secure adequate financing for growth initiatives, limiting their ability to scale operations and compete effectively with established players. Equipment costs and facility requirements represent substantial upfront investments with extended payback periods.

Distribution challenges constrain market reach for many craft breweries, particularly those lacking established relationships with distributors and retailers. Limited shelf space in retail outlets, dominated by major beer brands, restricts craft beer visibility and accessibility. Transportation costs and logistics complexity for small-batch production further complicate distribution strategies.

Market saturation in certain regions creates intensified competition among craft breweries, potentially limiting growth opportunities and pressuring profit margins. As the number of craft breweries increases, differentiation becomes more challenging, and consumer attention becomes increasingly fragmented across numerous brand options.

Digital transformation presents substantial opportunities for European craft breweries to expand market reach and enhance customer engagement. E-commerce platforms, social media marketing, and direct-to-consumer sales channels enable breweries to bypass traditional distribution limitations and build direct relationships with consumers. Digital technologies also support inventory management, customer relationship management, and targeted marketing initiatives.

Export expansion offers significant growth potential as European craft beers gain international recognition and demand. Premium positioning and unique flavor profiles create competitive advantages in global markets, particularly in regions with developing craft beer appreciation. Strategic export initiatives can diversify revenue sources and reduce dependence on domestic market conditions.

Product innovation opportunities include development of functional beers, low-alcohol alternatives, and specialty varieties that address evolving consumer preferences. Health-conscious consumers create demand for beers with added nutritional benefits, organic ingredients, and reduced alcohol content. Seasonal and limited-edition releases generate consumer excitement and premium pricing opportunities.

Partnership development with hospitality, retail, and tourism sectors creates synergistic opportunities for market expansion. Collaborations with restaurants, hotels, and event venues can increase brand exposure and create exclusive distribution channels. Tourism partnerships enable breweries to leverage destination marketing and create immersive brand experiences.

Competitive landscape within the European craft beer market demonstrates increasing sophistication and strategic focus. Established craft breweries are expanding their market presence through acquisition strategies, while new entrants continue to emerge with innovative concepts and niche positioning. The market exhibits healthy competition that drives innovation and quality improvements across the industry.

Supply chain evolution reflects growing emphasis on local sourcing and sustainable practices. Craft breweries increasingly develop relationships with local hop growers, malt producers, and specialty ingredient suppliers to ensure quality control and support regional agricultural economies. This localization trend enhances product authenticity while reducing transportation costs and environmental impact.

Technology adoption accelerates across the craft brewing industry, with breweries implementing advanced brewing equipment, quality control systems, and production management software. Automation technologies enable smaller breweries to maintain consistent quality while scaling production efficiently. Digital technologies support customer engagement, inventory management, and operational optimization.

Consumer engagement strategies evolve beyond traditional marketing approaches to emphasize experiential and community-building initiatives. Craft breweries develop loyal customer bases through taproom experiences, brewery events, educational programs, and social media engagement. These strategies create emotional connections that translate into brand loyalty and word-of-mouth marketing.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into European craft beer market dynamics. Primary research includes extensive surveys of craft brewery operators, distributors, retailers, and consumers across major European markets. This primary data collection provides current market perspectives and identifies emerging trends and challenges.

Secondary research incorporates analysis of industry publications, trade association reports, regulatory filings, and academic studies related to craft brewing and alcoholic beverage markets. Government statistics, customs data, and economic indicators provide quantitative foundations for market sizing and growth projections. Industry expert interviews supplement quantitative data with qualitative insights and strategic perspectives.

Market segmentation analysis examines craft beer categories by product type, distribution channel, price point, and geographic region. This segmentation approach enables identification of high-growth segments and emerging opportunities within the broader market context. Regional analysis considers local market conditions, regulatory environments, and cultural factors influencing craft beer adoption.

Competitive intelligence gathering includes analysis of major craft brewery strategies, product portfolios, pricing approaches, and market positioning. This competitive analysis identifies best practices, strategic gaps, and differentiation opportunities within the market landscape. Financial performance analysis of publicly traded craft brewing companies provides insights into industry profitability and growth trends.

Western European markets demonstrate mature craft beer adoption with established consumer bases and sophisticated distribution networks. Germany leads in brewery count and production volume, leveraging its brewing heritage and beer purity laws to maintain quality standards. The German craft beer market shows steady growth of 6.5% annually, driven by consumer interest in innovative styles beyond traditional lagers and wheat beers.

United Kingdom represents a dynamic craft beer market with strong pub culture integration and innovative brewing approaches. British craft breweries excel in cask ales, IPAs, and experimental styles that reflect contemporary brewing trends. The UK market benefits from supportive regulatory frameworks and active consumer engagement through beer festivals and brewery tourism initiatives.

Belgium and Netherlands maintain strong positions in premium craft beer segments, building on centuries of brewing tradition while embracing modern innovation. Belgian craft breweries particularly excel in specialty styles including lambics, abbey ales, and seasonal varieties that command premium pricing. The Netherlands shows robust growth in craft beer consumption, with market penetration reaching 18% among beer consumers.

Eastern European markets demonstrate accelerated craft beer adoption as economic development and urbanization drive consumer sophistication. Countries including Poland, Czech Republic, and Hungary show strong growth potential with emerging craft brewing scenes and increasing consumer interest in premium beer experiences. These markets benefit from lower operational costs and growing tourism sectors.

Market leadership within the European craft beer sector includes a diverse mix of established regional breweries, innovative startups, and strategic acquisitions by larger beverage companies. The competitive landscape demonstrates healthy fragmentation with numerous players competing across different market segments and geographic regions.

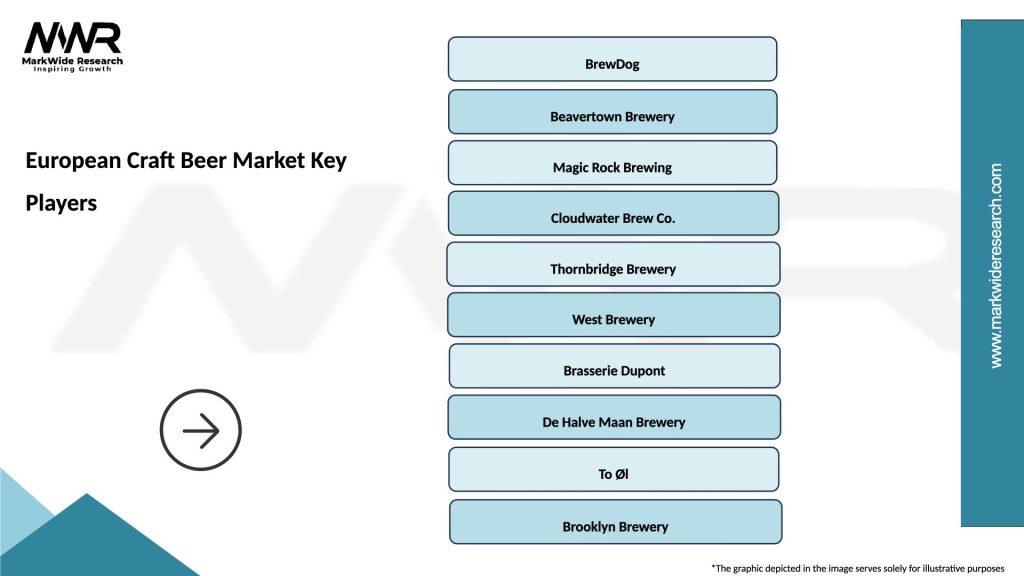

Leading craft breweries include:

Strategic positioning varies among competitors, with some focusing on traditional styles and heritage marketing while others emphasize innovation and contemporary brewing techniques. Successful breweries demonstrate strong brand identity, consistent quality, and effective customer engagement strategies that build loyal consumer bases.

Product type segmentation reveals diverse craft beer categories serving different consumer preferences and occasions:

Distribution channel segmentation includes:

Geographic segmentation considers regional preferences, regulatory environments, and market maturity levels across European countries. Western European markets show higher per-capita consumption while Eastern European markets demonstrate faster growth rates and emerging opportunities.

Premium craft beer category demonstrates strongest growth momentum with consumers willing to pay significant premiums for unique, high-quality products. This segment includes limited-edition releases, barrel-aged beers, and specialty ingredients that create distinctive flavor profiles. Premium craft beers often command prices 200-300% higher than mass-market alternatives while maintaining strong consumer demand.

Session beer category addresses consumer demand for lower-alcohol options that maintain craft beer quality and flavor characteristics. These products appeal to health-conscious consumers and social drinking occasions where moderation is preferred. Session beers typically contain 3-4% alcohol by volume compared to traditional craft beer ranges of 5-7%.

Functional beer category represents emerging opportunities with products incorporating health benefits, organic ingredients, or specific nutritional profiles. These innovations include probiotic beers, gluten-free options, and beers with added vitamins or minerals. Functional beers appeal to wellness-focused consumers seeking indulgence with perceived health benefits.

Seasonal beer category creates regular consumer engagement through limited-time offerings that reflect seasonal ingredients and consumption patterns. Summer wheat beers, autumn harvest ales, and winter stouts provide breweries with opportunities for product differentiation and inventory management while generating consumer anticipation and repeat purchases.

Brewery operators benefit from premium pricing opportunities, direct customer relationships, and creative freedom in product development. Craft brewing enables entrepreneurs to build distinctive brands while contributing to local economic development and cultural expression. Successful craft breweries achieve higher profit margins compared to mass-market beer production while building strong community connections.

Distributors and retailers gain access to high-margin products that attract discerning consumers and differentiate their offerings from competitors. Craft beer categories generate higher per-unit profits while driving foot traffic and customer loyalty. Specialty retailers particularly benefit from craft beer’s appeal to affluent, educated consumers who often purchase complementary premium products.

Consumers enjoy expanded choice, superior quality, and authentic experiences that mass-market beers cannot provide. Craft beer offers opportunities for exploration, education, and social engagement through brewery visits, beer festivals, and tasting events. The craft beer community provides social connections and shared interests that enhance the overall consumption experience.

Tourism sectors leverage craft breweries as destination attractions that generate visitor spending and extend trip duration. Beer tourism creates economic multiplier effects benefiting hotels, restaurants, transportation, and retail businesses. Craft brewery trails and beer festivals become signature attractions that enhance destination marketing and visitor satisfaction.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend with craft breweries implementing environmentally responsible practices throughout their operations. This includes renewable energy adoption, water conservation, waste reduction, and sustainable packaging solutions. Consumers increasingly consider environmental impact in purchasing decisions, creating competitive advantages for breweries demonstrating genuine sustainability commitments.

Low and no-alcohol alternatives gain significant traction as health-conscious consumers seek craft beer experiences without alcohol content. These products maintain craft beer quality and flavor profiles while addressing wellness trends and expanding consumption occasions. The low-alcohol craft beer segment shows growth rates exceeding 25% annually across European markets.

Collaborative brewing becomes increasingly common as breweries partner to create unique products, share resources, and expand market reach. These collaborations often generate consumer excitement while enabling smaller breweries to access new markets and technologies. International collaborations particularly enhance brand prestige and create export opportunities.

Technology integration transforms craft brewing operations through advanced equipment, quality control systems, and customer engagement platforms. Breweries adopt Internet of Things (IoT) sensors for fermentation monitoring, artificial intelligence for quality prediction, and augmented reality for consumer experiences. Technology adoption enables craft breweries to maintain quality consistency while scaling operations efficiently.

Consolidation activities reshape the European craft beer landscape as successful breweries expand through acquisitions and strategic partnerships. Major beverage companies increasingly acquire craft breweries to access growing market segments while craft brewery founders seek capital for expansion and succession planning. These transactions often maintain brand independence while providing resources for growth.

Regulatory evolution across European markets generally favors craft brewery development through reduced taxation, simplified licensing, and support for small business development. Government initiatives recognize craft brewing’s economic contributions and cultural value, leading to more favorable operating environments. Brexit implications continue affecting UK craft beer trade relationships with European Union markets.

Infrastructure development includes expansion of craft beer distribution networks, specialty retail outlets, and brewery tourism facilities. Investment in cold chain logistics, specialized storage facilities, and transportation networks improves craft beer quality and availability. Tourism infrastructure development supports brewery visits and beer-focused travel experiences.

Innovation acceleration drives continuous product development with breweries experimenting with novel ingredients, brewing techniques, and flavor combinations. According to MarkWide Research analysis, European craft breweries launch an average of 4.2 new products annually, significantly higher than traditional beer producers. This innovation pace maintains consumer interest and creates differentiation opportunities.

Strategic positioning recommendations emphasize the importance of clear brand differentiation and authentic storytelling that resonates with target consumers. Craft breweries should develop compelling narratives around their brewing philosophy, local connections, and quality commitments. Successful positioning requires consistent execution across all customer touchpoints and marketing communications.

Distribution strategy optimization should balance direct-to-consumer sales with strategic retail partnerships that align with brand positioning. Breweries should prioritize quality distribution partners who understand craft beer positioning and can provide appropriate merchandising support. Online sales channels deserve significant investment as digital commerce continues expanding.

Innovation focus should address evolving consumer preferences while maintaining core brand identity and quality standards. MWR recommends that breweries allocate 15-20% of production capacity to experimental and limited-edition releases that generate consumer excitement and media attention. Innovation should extend beyond products to include packaging, experiences, and service delivery.

Financial management requires careful balance between growth investment and profitability maintenance. Craft breweries should develop robust financial planning processes that account for seasonal variations, expansion costs, and market uncertainties. Strategic partnerships and alternative financing options can support growth while maintaining operational independence.

Market expansion prospects remain positive across European craft beer markets, with continued growth expected in both established and emerging regions. MarkWide Research projects that craft beer market penetration will reach 20% of total beer consumption by 2028, driven by ongoing consumer preference shifts and brewery innovation. This growth trajectory supports continued investment and market entry opportunities.

Technology integration will accelerate across craft brewing operations, enabling smaller breweries to achieve quality consistency and operational efficiency previously available only to large producers. Automation technologies, quality control systems, and customer engagement platforms will become standard tools for competitive craft breweries. Digital transformation will particularly impact customer relationships and direct sales capabilities.

Sustainability requirements will intensify as environmental consciousness influences consumer purchasing decisions and regulatory frameworks. Craft breweries demonstrating genuine environmental commitments will gain competitive advantages while those ignoring sustainability trends may face market challenges. Carbon neutrality and circular economy principles will become essential operational considerations.

International expansion opportunities will grow as European craft beer gains global recognition and export markets develop. Premium positioning and unique flavor profiles create competitive advantages in international markets seeking authentic European brewing experiences. Strategic export initiatives will become important growth drivers for established craft breweries seeking market diversification.

The European craft beer market represents a dynamic and rapidly evolving industry segment characterized by strong consumer demand, continuous innovation, and expanding market opportunities. This comprehensive analysis reveals a market driven by changing consumer preferences toward premium, authentic, and locally-sourced products that offer unique experiences beyond traditional beer consumption.

Market fundamentals remain strong with favorable demographic trends, increasing disposable income among target consumers, and growing appreciation for artisanal products supporting continued expansion. The industry demonstrates resilience and adaptability through economic challenges while maintaining focus on quality, innovation, and customer engagement that differentiates craft beer from mass-market alternatives.

Strategic opportunities exist across multiple dimensions including product innovation, market expansion, technology adoption, and sustainability integration. Successful craft breweries will leverage these opportunities while addressing challenges related to distribution, competition, and operational scaling. The market’s future success depends on maintaining authenticity and quality while embracing necessary business evolution and professional management practices.

The European craft beer market outlook remains optimistic with continued growth expected across established and emerging markets, supported by innovation, consumer loyalty, and expanding distribution channels that will drive long-term industry success and market development throughout the European region.

What is Craft Beer?

Craft beer refers to beer produced by small, independent breweries that emphasize quality, flavor, and traditional brewing methods. These breweries often focus on unique recipes and local ingredients, distinguishing themselves from mass-produced beers.

What are the key players in the European Craft Beer Market?

Key players in the European Craft Beer Market include BrewDog, Camden Town Brewery, and Mikkeller, among others. These companies are known for their innovative brewing techniques and diverse product offerings that cater to a growing consumer base.

What are the growth factors driving the European Craft Beer Market?

The European Craft Beer Market is driven by increasing consumer demand for unique flavors, the rise of local breweries, and a growing interest in craft beer culture. Additionally, the trend towards premiumization in alcoholic beverages is contributing to market growth.

What challenges does the European Craft Beer Market face?

The European Craft Beer Market faces challenges such as intense competition from larger breweries, regulatory hurdles, and market saturation in certain regions. These factors can impact the growth and sustainability of smaller craft breweries.

What opportunities exist in the European Craft Beer Market?

Opportunities in the European Craft Beer Market include expanding into new geographic regions, developing innovative flavors, and tapping into the growing trend of sustainable brewing practices. Additionally, collaborations between breweries can enhance product offerings.

What trends are shaping the European Craft Beer Market?

Trends shaping the European Craft Beer Market include the rise of non-alcoholic craft beers, increased focus on sustainability, and the popularity of unique flavor combinations. These trends reflect changing consumer preferences and a desire for diverse drinking experiences.

European Craft Beer Market

| Segmentation Details | Description |

|---|---|

| Product Type | IPA, Stout, Lager, Wheat Beer |

| Distribution Channel | Retail Stores, Online, Bars, Restaurants |

| Customer Type | Millennials, Gen X, Baby Boomers, Tourists |

| Flavor Profile | Citrus, Malty, Spicy, Fruity |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the European Craft Beer Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at