444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The European challenger market represents a dynamic and rapidly evolving financial services ecosystem that has fundamentally transformed traditional banking across the continent. Challenger banks, also known as digital-first or neobanks, have emerged as formidable competitors to established financial institutions by leveraging cutting-edge technology, streamlined operations, and customer-centric approaches. These innovative financial service providers have captured significant market attention by offering enhanced user experiences, lower fees, and more accessible banking solutions.

Market dynamics indicate that European challenger banks have experienced remarkable growth trajectories, with adoption rates increasing by 42% annually across major European markets. The sector encompasses a diverse range of financial service providers, from mobile-only banks to specialized lending platforms, each targeting specific customer segments and financial needs. Digital transformation has accelerated dramatically, particularly following the COVID-19 pandemic, which catalyzed consumer acceptance of digital-first banking solutions.

Regulatory frameworks across Europe have evolved to accommodate these innovative financial service providers, with the European Banking Authority implementing comprehensive guidelines that balance innovation with consumer protection. The Payment Services Directive 2 (PSD2) has particularly facilitated challenger bank growth by enabling open banking initiatives and fostering increased competition within traditional banking markets.

The European challenger market refers to the comprehensive ecosystem of innovative financial technology companies that challenge traditional banking models through digital-first approaches, enhanced customer experiences, and streamlined financial services delivery across European markets.

Challenger banks distinguish themselves from conventional financial institutions through several key characteristics. These organizations typically operate without physical branch networks, instead delivering services through sophisticated mobile applications and web platforms. Customer acquisition strategies focus heavily on digital marketing channels, social media engagement, and referral programs that leverage technology to reduce operational costs significantly.

Service offerings within the challenger market extend beyond basic banking functions to include innovative features such as real-time spending analytics, automated savings tools, cryptocurrency integration, and personalized financial management solutions. Many challenger banks have developed specialized products targeting underserved market segments, including freelancers, small businesses, and international travelers who require flexible, technology-driven banking solutions.

Market leadership within the European challenger banking sector has been established by several key players who have successfully scaled their operations across multiple countries. These organizations have demonstrated the viability of digital-first banking models while maintaining regulatory compliance and building substantial customer bases. Customer satisfaction rates for leading challenger banks consistently exceed 78%, significantly higher than traditional banking institutions.

Investment activity in the European challenger market has remained robust, with venture capital and private equity firms continuing to support expansion initiatives and product development efforts. The sector has attracted significant attention from institutional investors who recognize the long-term potential for disrupting traditional banking models. Funding rounds have enabled challenger banks to expand internationally, develop new product offerings, and enhance their technological infrastructure.

Competitive positioning has evolved as challenger banks mature from startup phases into established financial service providers. Many organizations have achieved profitability milestones while maintaining growth momentum, demonstrating the sustainability of their business models. Market penetration varies significantly across European countries, with Nordic markets showing particularly high adoption rates of 35% among younger demographics.

Customer demographics reveal that challenger banks have successfully attracted younger, tech-savvy consumers who prioritize convenience, transparency, and innovative features over traditional banking relationships. Primary users typically fall within the 25-45 age range and demonstrate higher levels of digital literacy and comfort with mobile-first financial services.

Technological advancement serves as the primary catalyst driving European challenger market growth. Artificial intelligence and machine learning capabilities enable personalized financial services, automated customer support, and sophisticated risk assessment algorithms that enhance operational efficiency. Cloud computing infrastructure allows challenger banks to scale rapidly while maintaining cost-effective operations and ensuring robust security measures.

Consumer expectations have evolved significantly, with customers demanding seamless digital experiences, instant transaction processing, and transparent fee structures. Traditional banks often struggle to meet these expectations due to legacy systems and complex organizational structures. Mobile-first preferences among younger demographics create substantial opportunities for challenger banks to capture market share through superior user experiences.

Regulatory support through initiatives like PSD2 has created favorable conditions for challenger bank growth by mandating open banking standards and increasing competition within financial services markets. European regulatory frameworks have generally embraced financial innovation while maintaining appropriate consumer protection measures, enabling challenger banks to operate with greater certainty and confidence.

Economic factors including low interest rates and increased focus on financial inclusion have created market conditions favorable to challenger bank expansion. Cost-conscious consumers appreciate the lower fees and transparent pricing models offered by digital-first financial service providers, particularly during periods of economic uncertainty.

Regulatory compliance presents ongoing challenges for challenger banks as they navigate complex financial services regulations across multiple European jurisdictions. Capital requirements and licensing procedures can be time-consuming and expensive, particularly for smaller organizations seeking to expand internationally. Compliance costs continue to increase as regulatory frameworks evolve to address emerging risks and consumer protection concerns.

Customer trust remains a significant barrier, particularly among older demographics who prefer established banking relationships and physical branch access. Brand recognition challenges persist as challenger banks compete against institutions with decades or centuries of market presence. Building credibility and trust requires substantial investment in customer service, security measures, and transparent communication strategies.

Profitability pressures affect many challenger banks as they balance growth objectives with sustainable business models. Customer acquisition costs can be substantial in competitive markets, while revenue generation may be limited by low-fee or no-fee service offerings. Achieving economies of scale necessary for long-term profitability requires significant customer base growth and operational optimization.

Cybersecurity risks pose ongoing threats to challenger banks, which rely heavily on digital infrastructure and data processing capabilities. Security breaches can result in significant financial losses, regulatory penalties, and reputational damage that may be particularly devastating for newer market entrants without established customer loyalty.

International expansion presents substantial growth opportunities for successful European challenger banks. Cross-border services can leverage existing technology platforms and regulatory expertise to enter new markets efficiently. The European Union’s harmonized regulatory framework facilitates expansion across member countries, while emerging markets offer significant potential for digital-first banking solutions.

Business banking services represent an underexplored opportunity within the challenger market. Small and medium enterprises often face challenges accessing appropriate financial services from traditional banks, creating opportunities for challenger banks to develop specialized business banking products. Corporate banking services, trade finance, and business lending represent potential areas for expansion and revenue diversification.

Partnership opportunities with fintech companies, e-commerce platforms, and technology providers can enhance service offerings and accelerate customer acquisition. Embedded finance solutions allow challenger banks to integrate their services into third-party platforms, reaching customers through non-traditional channels and creating new revenue streams.

Sustainable finance initiatives align with growing consumer interest in environmental and social responsibility. Green banking products, carbon footprint tracking, and sustainable investment options can differentiate challenger banks while attracting environmentally conscious customers. ESG-focused services represent a growing market segment with significant potential for customer acquisition and retention.

Competitive intensity within the European challenger market has increased significantly as both new entrants and established players vie for market share. Product differentiation has become increasingly important as basic banking services become commoditized. Challenger banks are focusing on specialized features, superior user experiences, and targeted market segments to maintain competitive advantages.

Technology evolution continues to reshape market dynamics, with artificial intelligence, blockchain technology, and advanced analytics creating new possibilities for service delivery and customer engagement. Innovation cycles have accelerated, requiring challenger banks to continuously invest in technology development and feature enhancement to remain competitive.

Customer behavior patterns indicate increasing comfort with digital-first banking solutions, particularly among younger demographics. Switching behavior has become more common as customers seek better value propositions and enhanced features. According to MarkWide Research analysis, customer loyalty in the challenger banking sector is increasingly driven by service quality and innovation rather than traditional relationship factors.

Market consolidation trends suggest that successful challenger banks may acquire smaller competitors or merge to achieve greater scale and operational efficiency. Strategic partnerships between challenger banks and traditional financial institutions are becoming more common as both sectors recognize mutual benefits from collaboration.

Primary research methodologies employed in analyzing the European challenger market include comprehensive surveys of banking customers, in-depth interviews with industry executives, and focus groups targeting key demographic segments. Data collection processes utilize both quantitative and qualitative approaches to ensure comprehensive market understanding and accurate trend identification.

Secondary research incorporates analysis of regulatory filings, financial statements, industry reports, and market intelligence from various sources. Competitive analysis examines product offerings, pricing strategies, customer acquisition approaches, and market positioning across major challenger banking organizations. Technology assessment includes evaluation of platform capabilities, security measures, and innovation initiatives.

Market segmentation analysis considers geographic regions, customer demographics, service categories, and business models to provide detailed insights into market structure and dynamics. Trend analysis incorporates historical data, current market conditions, and forward-looking indicators to identify emerging opportunities and potential challenges.

Validation processes include cross-referencing multiple data sources, expert consultations, and statistical analysis to ensure accuracy and reliability of research findings. Continuous monitoring of market developments enables real-time updates and refinement of research conclusions as market conditions evolve.

United Kingdom maintains a leading position in the European challenger banking market, with several prominent organizations achieving significant scale and international recognition. Regulatory support through the Financial Conduct Authority’s regulatory sandbox and open banking initiatives has fostered innovation and competition. The UK market demonstrates 31% adoption rates among digital banking users, with particularly strong penetration in urban markets.

Germany represents a substantial opportunity for challenger bank growth, despite traditionally conservative banking preferences among consumers. Market entry strategies have focused on specific segments such as freelancers, startups, and international businesses. German challenger banks have achieved 18% market penetration among younger demographics, with growth accelerating in major metropolitan areas.

France has experienced significant challenger banking growth, supported by favorable regulatory frameworks and increasing consumer acceptance of digital financial services. Partnership strategies with established French financial institutions have facilitated market entry and customer acquisition. The French market shows 24% adoption rates among millennial customers seeking alternative banking solutions.

Nordic countries including Sweden, Denmark, and Norway demonstrate the highest challenger banking adoption rates in Europe, with 43% penetration among digital-native consumers. Cashless society trends and high levels of digital literacy create favorable conditions for challenger bank growth. Nordic challenger banks have successfully expanded internationally, leveraging their domestic success and technological expertise.

Southern European markets including Spain, Italy, and Portugal present emerging opportunities for challenger bank expansion. Economic factors and changing consumer preferences are driving increased interest in alternative banking solutions. Market penetration remains lower at 12% adoption rates, but growth momentum is accelerating as awareness and trust in digital banking solutions increase.

Market leaders within the European challenger banking sector have established strong positions through successful customer acquisition, product innovation, and international expansion strategies. These organizations have demonstrated the ability to scale operations while maintaining service quality and regulatory compliance across multiple markets.

Competitive strategies vary significantly among market participants, with some focusing on broad consumer markets while others target specific segments such as business banking or international customers. Product differentiation has become increasingly important as basic banking services become commoditized across the challenger banking sector.

By Service Type:

By Customer Segment:

By Technology Platform:

Personal Banking Services represent the largest segment within the European challenger market, driven by consumer demand for improved user experiences and transparent fee structures. Account opening processes have been streamlined to minutes rather than days, with digital identity verification and automated onboarding procedures. Advanced spending analytics and budgeting tools provide customers with insights previously unavailable through traditional banking channels.

Business Banking Solutions have emerged as a high-growth segment, with challenger banks addressing pain points experienced by small and medium enterprises when dealing with traditional banks. Invoice management, expense tracking, and integrated accounting features provide comprehensive financial management capabilities. Real-time transaction processing and transparent pricing models appeal to cost-conscious business customers.

Investment and Wealth Management services have expanded significantly as challenger banks seek to increase customer lifetime value and revenue per user. Robo-advisory platforms provide automated investment management at lower costs than traditional wealth management services. Fractional investing and cryptocurrency integration attract younger investors seeking accessible investment opportunities.

Lending and Credit Services utilize advanced algorithms and alternative data sources to assess creditworthiness and provide faster lending decisions. Personal loans and business financing products often feature more competitive rates and flexible terms than traditional banking alternatives. Buy-now-pay-later integration and installment payment options cater to changing consumer preferences.

Customers benefit significantly from challenger banking services through reduced fees, enhanced user experiences, and innovative features unavailable through traditional banking channels. Cost savings can be substantial, particularly for international transactions, currency exchanges, and account maintenance. Real-time notifications, spending insights, and automated savings tools help customers better manage their finances and achieve financial goals.

Small and Medium Enterprises gain access to business banking services specifically designed for their needs, including simplified account opening, integrated accounting features, and competitive lending products. Cash flow management tools and real-time transaction processing improve operational efficiency and financial visibility. Lower fees and transparent pricing models reduce banking costs and improve profitability.

Investors and Shareholders benefit from the growth potential and scalability of challenger banking business models. Technology-driven operations enable rapid expansion and customer acquisition while maintaining lower operational costs than traditional banks. Successful challenger banks demonstrate strong unit economics and path to profitability through efficient customer acquisition and retention strategies.

Financial Services Ecosystem participants including fintech companies, payment processors, and technology providers benefit from partnership opportunities and integration possibilities. Open banking initiatives create new revenue streams and customer touchpoints through API integrations and embedded finance solutions. The challenger banking sector drives innovation and competition that benefits the entire financial services industry.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration has become increasingly prevalent across challenger banking platforms, enabling personalized financial advice, automated customer service, and sophisticated fraud detection capabilities. Machine learning algorithms analyze customer behavior patterns to provide tailored product recommendations and spending insights. Chatbots and virtual assistants handle routine customer inquiries, reducing operational costs while improving service availability.

Sustainable Banking Initiatives are gaining momentum as challenger banks respond to growing consumer interest in environmental and social responsibility. Carbon footprint tracking features help customers monitor and reduce their environmental impact through spending analysis. Green investment products and sustainable lending criteria align with ESG principles while attracting environmentally conscious customers.

Embedded Finance Solutions represent a significant trend as challenger banks integrate their services into third-party platforms and applications. API-first architectures enable seamless integration with e-commerce platforms, accounting software, and business management tools. White-label banking solutions allow non-financial companies to offer banking services to their customers through challenger bank infrastructure.

Cryptocurrency and Digital Assets integration has become increasingly common as challenger banks seek to attract tech-savvy customers interested in alternative investments. Crypto trading platforms and digital wallet functionality provide access to cryptocurrency markets through familiar banking interfaces. Stablecoin integration and blockchain-based payment solutions offer enhanced transaction capabilities.

Open Banking Expansion continues to drive innovation and competition within the challenger banking sector. Third-party integrations enable customers to access multiple financial services through single platforms, improving convenience and user experience. Account aggregation services provide comprehensive financial management capabilities across multiple banking relationships.

Regulatory Evolution has significantly impacted the European challenger banking landscape, with authorities implementing comprehensive frameworks to balance innovation with consumer protection. Banking licenses have become more accessible for qualified challenger banks, while regulatory sandboxes provide safe environments for testing innovative financial services. The European Banking Authority has issued guidance on digital operational resilience and cybersecurity requirements.

Partnership Announcements between challenger banks and established financial institutions have increased substantially, indicating growing recognition of mutual benefits from collaboration. Technology partnerships enable traditional banks to enhance their digital capabilities while providing challenger banks with access to established customer bases and regulatory expertise. Infrastructure sharing agreements reduce operational costs for both parties.

International Expansion initiatives have accelerated as successful challenger banks seek growth opportunities beyond their domestic markets. Cross-border licensing strategies enable challenger banks to offer services across multiple European countries while maintaining regulatory compliance. Strategic acquisitions and joint ventures facilitate market entry and local market expertise acquisition.

Product Innovation continues at a rapid pace, with challenger banks introducing features that differentiate their offerings from traditional banking services. MarkWide Research data indicates that new feature releases occur significantly more frequently among challenger banks compared to traditional institutions. Advanced analytics, personalized insights, and automated financial management tools represent key areas of innovation focus.

Strategic Focus recommendations for challenger banks include prioritizing sustainable profitability over rapid growth, particularly as market competition intensifies and customer acquisition costs increase. Unit economics optimization should focus on increasing customer lifetime value through expanded product offerings and enhanced customer retention strategies. Diversification beyond basic banking services can improve revenue stability and competitive positioning.

Technology Investment priorities should emphasize cybersecurity, data analytics, and artificial intelligence capabilities that enable superior customer experiences and operational efficiency. Infrastructure scalability becomes increasingly important as challenger banks grow their customer bases and expand internationally. Cloud-native architectures and API-first designs facilitate rapid scaling and integration capabilities.

Regulatory Compliance strategies must balance innovation with comprehensive risk management and regulatory adherence across multiple jurisdictions. Compliance automation tools and processes can reduce operational costs while ensuring consistent regulatory compliance. Proactive engagement with regulatory authorities helps challenger banks navigate evolving requirements and maintain operational flexibility.

Partnership Development should focus on strategic alliances that enhance service capabilities, reduce operational costs, and accelerate customer acquisition. Fintech collaborations can provide access to specialized technologies and services while traditional bank partnerships offer regulatory expertise and established customer relationships. Careful partner selection and integration planning ensure successful collaboration outcomes.

Market maturation trends suggest that the European challenger banking sector will continue evolving from a startup-dominated landscape toward established financial services providers with sustainable business models. Consolidation activities are expected to increase as successful challenger banks acquire smaller competitors or merge to achieve greater scale and operational efficiency. Market leaders will likely emerge with significant competitive advantages through technology, customer base, and regulatory expertise.

Technology advancement will continue driving innovation within the challenger banking sector, with artificial intelligence, blockchain technology, and advanced analytics creating new possibilities for service delivery and customer engagement. Quantum computing and advanced cybersecurity measures may become increasingly important as challenger banks handle larger volumes of sensitive financial data and transactions.

Regulatory frameworks are expected to continue evolving to address emerging risks and opportunities within the digital banking sector. MWR analysis suggests that harmonized European regulations may facilitate greater cross-border expansion and competition among challenger banks. Consumer protection measures and cybersecurity requirements will likely become more stringent as the sector matures.

Customer expectations will continue rising as digital banking becomes mainstream, requiring challenger banks to continuously innovate and enhance their service offerings. Personalization capabilities and integrated financial management tools will become standard expectations rather than differentiating features. The growth trajectory is projected to maintain strong momentum with 26% annual expansion in customer adoption rates across European markets over the next five years.

The European challenger market has established itself as a transformative force within the financial services industry, successfully challenging traditional banking models through innovative technology, superior customer experiences, and cost-effective operations. Market dynamics indicate continued growth potential as consumer preferences shift toward digital-first banking solutions and regulatory frameworks evolve to support financial innovation while maintaining appropriate consumer protections.

Competitive positioning within the sector has matured significantly, with leading challenger banks demonstrating sustainable business models and path to profitability through efficient operations and diversified revenue streams. Technology leadership remains a critical success factor, enabling challenger banks to deliver personalized services, streamlined user experiences, and innovative features that differentiate their offerings from traditional banking alternatives.

Future success in the European challenger banking market will depend on organizations’ ability to balance growth objectives with sustainable profitability, regulatory compliance, and customer trust building. Strategic partnerships, international expansion, and continuous innovation will likely determine which challenger banks emerge as long-term market leaders in the evolving financial services landscape. The sector’s continued evolution promises significant opportunities for stakeholders who can successfully navigate the complex interplay of technology, regulation, and customer expectations that define the modern banking environment.

What is a Challenger?

A Challenger refers to a company or brand that seeks to disrupt established market leaders by offering innovative products or services, often targeting specific consumer needs or gaps in the market.

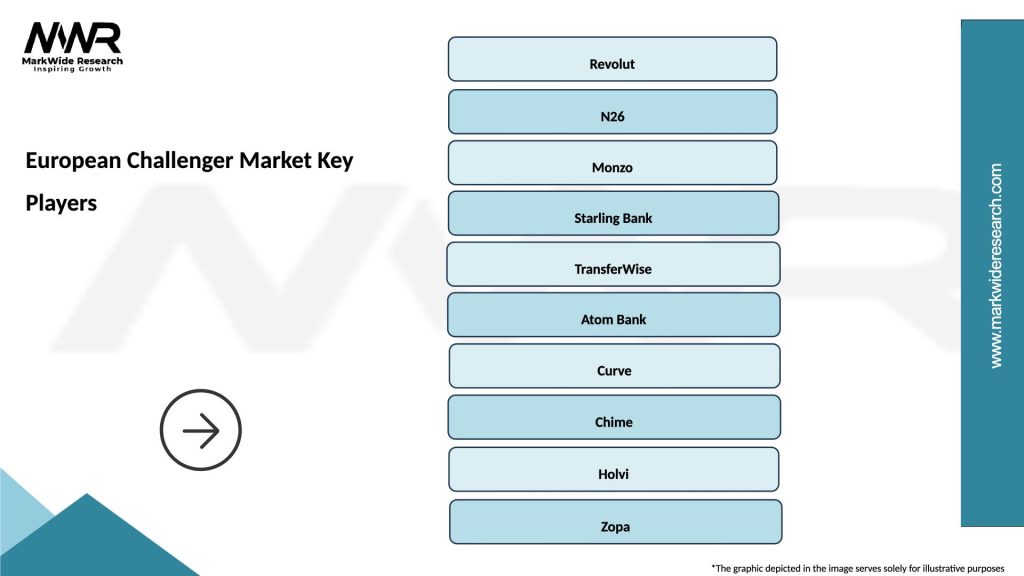

What are the key players in the European Challenger Market?

Key players in the European Challenger Market include companies like Revolut, Monzo, and N26, which focus on fintech solutions, as well as other challengers in sectors like telecommunications and e-commerce, among others.

What are the main drivers of growth in the European Challenger Market?

The main drivers of growth in the European Challenger Market include the increasing demand for digital solutions, consumer preference for personalized services, and the rise of mobile technology, which enables easier access to innovative offerings.

What challenges do companies face in the European Challenger Market?

Companies in the European Challenger Market face challenges such as regulatory compliance, intense competition from established players, and the need for continuous innovation to meet evolving consumer expectations.

What opportunities exist in the European Challenger Market?

Opportunities in the European Challenger Market include expanding into underserved demographics, leveraging emerging technologies like AI and blockchain, and forming strategic partnerships to enhance service offerings.

What trends are shaping the European Challenger Market?

Trends shaping the European Challenger Market include the rise of subscription-based models, increased focus on sustainability, and the integration of advanced technologies to improve customer experience and operational efficiency.

European Challenger Market

| Segmentation Details | Description |

|---|---|

| Product Type | Smartphones, Wearables, Tablets, Laptops |

| Technology | 5G, AI, Augmented Reality, Blockchain |

| End User | Consumers, Enterprises, Educational Institutions, Government |

| Distribution Channel | Online Retail, Physical Stores, Direct Sales, Resellers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the European Challenger Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at