444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The European carbon fiber market represents one of the most dynamic and rapidly evolving sectors within the advanced materials industry. Carbon fiber composites have emerged as critical components across multiple industries, from aerospace and automotive to renewable energy and sporting goods. The region’s commitment to sustainability, technological innovation, and manufacturing excellence has positioned Europe as a global leader in carbon fiber production and application development.

Market dynamics indicate robust growth driven by increasing demand for lightweight, high-strength materials that support environmental objectives and performance requirements. European manufacturers are experiencing unprecedented demand growth of approximately 8.5% annually, reflecting the material’s expanding role in next-generation applications. The region’s established aerospace industry, growing automotive electrification trends, and expanding wind energy sector collectively drive substantial market expansion.

Regional leadership in carbon fiber technology stems from decades of research and development investment, particularly in Germany, France, and the United Kingdom. These nations host major production facilities and research centers that continue advancing carbon fiber manufacturing processes and application technologies. The integration of Industry 4.0 technologies and sustainable manufacturing practices further strengthens Europe’s competitive position in the global carbon fiber landscape.

The European carbon fiber market refers to the comprehensive ecosystem encompassing the production, processing, and application of carbon fiber materials across European nations. Carbon fiber consists of extremely thin fibers composed primarily of carbon atoms, arranged in a crystalline structure that provides exceptional strength-to-weight ratios and unique material properties.

Market scope includes raw carbon fiber production, intermediate products such as prepregs and fabrics, and finished composite components used across diverse industries. The European market encompasses both domestic consumption and export activities, with significant cross-border trade and collaboration among member nations. Value chain integration extends from precursor materials and manufacturing equipment to end-use applications and recycling technologies.

Industry definition covers traditional PAN-based carbon fibers, pitch-based variants, and emerging bio-based alternatives. The market includes both standard modulus and high-performance grades, serving applications ranging from structural components to specialized technical applications requiring specific material characteristics.

European carbon fiber market demonstrates exceptional growth momentum driven by sustainability initiatives, technological advancement, and expanding application portfolios. The region’s strategic focus on reducing carbon emissions and enhancing material performance creates substantial opportunities for carbon fiber adoption across multiple sectors.

Key growth drivers include automotive lightweighting requirements, aerospace industry expansion, and renewable energy infrastructure development. European automotive manufacturers are increasingly incorporating carbon fiber components to meet stringent emission standards, with adoption rates increasing by approximately 12% annually in electric vehicle applications. The aerospace sector continues representing the largest application segment, accounting for roughly 35% of regional consumption.

Market transformation reflects evolving manufacturing technologies, cost reduction initiatives, and expanding supply chain capabilities. European producers are implementing advanced automation technologies and developing more efficient production processes to improve cost competitiveness while maintaining quality standards. Sustainability focus drives innovation in recycling technologies and bio-based precursor materials, positioning the region as a leader in circular economy approaches to carbon fiber utilization.

Competitive landscape features established global players alongside emerging regional specialists, creating a dynamic environment for technological innovation and market development. Strategic partnerships between material suppliers, equipment manufacturers, and end-users facilitate rapid technology transfer and application development across the European market.

Strategic insights reveal several critical factors shaping the European carbon fiber market trajectory and competitive dynamics:

Primary market drivers propelling European carbon fiber market growth encompass regulatory requirements, technological advancement, and evolving industry needs across multiple sectors.

Environmental regulations represent the most significant driver, with European Union emission standards requiring substantial weight reduction in automotive applications. The Green Deal initiative and carbon neutrality targets by 2050 create compelling incentives for lightweight material adoption. Automotive manufacturers face increasing pressure to reduce vehicle weight while maintaining safety and performance standards, making carbon fiber composites essential for meeting regulatory compliance.

Aerospace industry expansion continues driving substantial demand growth, with European aircraft manufacturers increasing production rates and developing next-generation platforms incorporating higher carbon fiber content. The sector’s focus on fuel efficiency and performance optimization creates sustained demand for advanced composite materials. Defense applications also contribute significantly, with military aircraft and equipment requiring high-performance materials for operational effectiveness.

Renewable energy infrastructure development, particularly offshore wind installations, generates substantial demand for large-scale carbon fiber components. European nations’ commitment to renewable energy targets drives continuous expansion of wind power capacity, requiring increasingly larger and more efficient turbine designs that depend on carbon fiber blade construction.

Technological advancement in manufacturing processes reduces production costs and improves material properties, making carbon fiber composites economically viable for broader applications. Automation technologies and process optimization enable higher production volumes while maintaining quality standards, supporting market expansion across price-sensitive applications.

Market constraints affecting European carbon fiber market development include cost considerations, technical challenges, and supply chain limitations that impact adoption rates across various applications.

High material costs remain the primary barrier to broader carbon fiber adoption, particularly in cost-sensitive applications where traditional materials maintain competitive advantages. Despite ongoing cost reduction efforts, carbon fiber composites typically command premium pricing compared to conventional materials, limiting market penetration in price-competitive segments. Manufacturing complexity and specialized processing requirements contribute to elevated production costs and extended lead times.

Technical challenges in processing and application development create barriers for companies seeking to integrate carbon fiber composites into existing products and manufacturing processes. The material’s anisotropic properties require specialized design expertise and manufacturing capabilities that many potential users lack. Quality control requirements and certification processes, particularly in aerospace applications, create additional complexity and cost burdens.

Supply chain dependencies on non-European precursor materials create vulnerability to supply disruptions and price volatility. The limited number of qualified suppliers for high-performance grades creates potential bottlenecks during periods of strong demand growth. Recycling limitations and end-of-life material management challenges raise sustainability concerns and regulatory compliance issues.

Skills shortage in specialized manufacturing and design capabilities constrains industry growth potential, with many companies struggling to find qualified personnel experienced in carbon fiber composite technologies and applications.

Emerging opportunities within the European carbon fiber market reflect evolving industry needs, technological advancement, and expanding application possibilities across diverse sectors.

Electric vehicle market expansion presents substantial growth opportunities, with European automotive manufacturers increasingly incorporating carbon fiber components to optimize battery efficiency and vehicle performance. The region’s leadership in electric vehicle development creates significant demand potential for lightweight structural components and battery enclosures. Autonomous vehicle development may further accelerate adoption as manufacturers seek to optimize sensor integration and vehicle dynamics.

Infrastructure applications represent an emerging opportunity segment, with carbon fiber composites finding increasing use in bridge reinforcement, building construction, and civil engineering projects. The material’s corrosion resistance and durability advantages create compelling value propositions for infrastructure modernization and maintenance applications. Smart infrastructure development incorporating sensor technologies may drive additional demand for specialized carbon fiber components.

Marine applications offer significant growth potential, particularly in luxury yacht construction, commercial vessel lightweighting, and offshore platform development. European shipbuilding industry’s focus on fuel efficiency and performance optimization creates opportunities for expanded carbon fiber utilization. Hydrogen storage systems for marine applications represent a particularly promising niche market.

Recycling technology development creates opportunities for companies developing circular economy solutions and sustainable material management systems. European regulatory focus on sustainability and waste reduction drives demand for innovative recycling approaches and secondary material applications.

Market dynamics within the European carbon fiber sector reflect complex interactions between supply and demand factors, technological evolution, and competitive pressures that shape industry development patterns.

Supply-demand balance remains tight across most application segments, with production capacity expansion struggling to keep pace with growing demand. European manufacturers are investing heavily in capacity expansion and process optimization to address supply constraints while maintaining quality standards. Demand volatility in key sectors such as aerospace creates challenges for capacity planning and investment decisions.

Price dynamics reflect ongoing tension between cost reduction efforts and raw material price pressures. While manufacturing efficiency improvements help reduce production costs, precursor material price volatility and energy cost fluctuations impact overall pricing trends. Market consolidation among suppliers may influence pricing power and competitive dynamics over the medium term.

Technology evolution continues reshaping market dynamics, with new manufacturing processes and material formulations creating competitive advantages for early adopters. Digital transformation initiatives including process monitoring and quality control systems improve manufacturing efficiency by approximately 15-20% while reducing waste and defect rates.

Competitive intensity increases as new entrants seek to capture growth opportunities while established players defend market positions through innovation and customer relationship development. Strategic partnerships and vertical integration initiatives reshape competitive dynamics and value chain relationships across the European market.

Research approach for analyzing the European carbon fiber market employs comprehensive methodologies combining primary and secondary research techniques to ensure accurate and reliable market insights.

Primary research activities include extensive interviews with industry executives, technical experts, and key stakeholders across the carbon fiber value chain. Survey methodologies capture quantitative data on market trends, application development, and technology adoption patterns from manufacturers, suppliers, and end-users throughout Europe. Expert consultations provide qualitative insights into market dynamics, competitive strategies, and future development prospects.

Secondary research encompasses comprehensive analysis of industry publications, technical literature, patent databases, and regulatory documentation to understand market trends and technological developments. Financial analysis of public companies provides insights into market performance, investment patterns, and strategic priorities across the industry.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources and expert verification of key findings. Market modeling techniques incorporate historical trends, current market conditions, and forward-looking indicators to develop comprehensive market assessments and projections.

Regional analysis methodology examines market conditions across individual European nations while identifying cross-border trends and integration patterns that characterize the broader European market landscape.

Regional market distribution across Europe reveals distinct patterns of carbon fiber production, consumption, and application development that reflect each nation’s industrial strengths and market focus areas.

Germany maintains the largest European carbon fiber market, accounting for approximately 28% of regional consumption. The nation’s automotive industry leadership drives substantial demand for carbon fiber components, while aerospace and industrial applications contribute additional volume. German manufacturers lead in automotive carbon fiber integration and manufacturing technology development.

France represents the second-largest market, with strong aerospace industry presence driving significant carbon fiber demand. Airbus operations and supporting supply chain create substantial market activity, while emerging applications in renewable energy and transportation contribute to market growth. French companies maintain leadership positions in aerospace-grade carbon fiber development and application.

United Kingdom demonstrates strong market presence despite Brexit-related uncertainties, with aerospace, automotive, and marine applications driving demand. The nation’s Formula 1 industry and high-performance automotive sector create specialized market segments requiring advanced carbon fiber technologies. Research institutions and technology companies contribute significantly to global carbon fiber innovation.

Italy shows growing market activity driven by automotive applications, luxury goods manufacturing, and aerospace component production. The nation’s design expertise and manufacturing capabilities create competitive advantages in specialized carbon fiber applications. Sporting goods and luxury automotive segments represent particular strength areas.

Nordic countries demonstrate increasing market activity, particularly in wind energy applications where offshore installations drive substantial carbon fiber blade demand. Sustainability focus and renewable energy leadership create favorable conditions for continued market expansion.

Competitive environment within the European carbon fiber market features established global players alongside specialized regional companies, creating dynamic competitive conditions that drive innovation and market development.

Market positioning strategies vary significantly among competitors, with some focusing on high-performance aerospace applications while others target cost-sensitive industrial markets. Innovation capabilities and customer relationship management represent key competitive differentiators in the European market environment.

Strategic partnerships between material suppliers and end-users facilitate technology development and market expansion, creating competitive advantages for companies with strong collaborative capabilities.

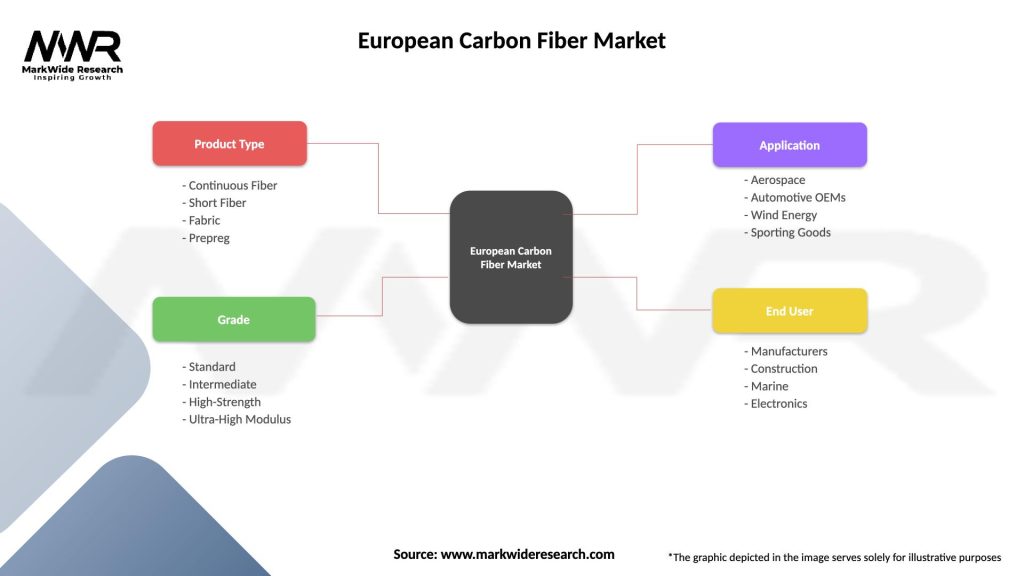

Market segmentation analysis reveals distinct patterns of carbon fiber utilization across various dimensions including application, product type, and end-user industries within the European market.

By Application:

By Product Type:

By Manufacturing Process:

Aerospace applications continue dominating European carbon fiber consumption, with commercial aircraft manufacturing driving consistent demand growth. Next-generation aircraft programs incorporate higher carbon fiber content, creating substantial long-term demand visibility. Military applications contribute additional volume through defense modernization programs and specialized equipment requirements.

Automotive segment demonstrates the highest growth rates, with European manufacturers accelerating carbon fiber adoption in electric vehicle platforms and high-performance applications. Structural components including body panels, chassis elements, and battery enclosures represent primary growth areas. Luxury automotive brands lead adoption trends, with technology gradually migrating to mainstream applications.

Wind energy applications show strong growth correlation with European renewable energy expansion, particularly offshore installations requiring large-scale turbine blades. Blade length increases and performance optimization drive higher carbon fiber content per turbine, supporting sustained market growth. Technology development focuses on manufacturing efficiency and cost reduction for large-scale applications.

Industrial applications encompass diverse end-uses including pressure vessels, chemical processing equipment, and construction reinforcement. Infrastructure modernization creates opportunities for carbon fiber adoption in bridge reinforcement and building construction applications. Specialized industrial applications continue expanding as companies recognize carbon fiber’s unique property advantages.

Sporting goods represent a mature but stable market segment, with premium bicycle manufacturing and professional sports equipment driving consistent demand. Consumer awareness of carbon fiber benefits supports market stability despite mature market conditions.

Industry participants across the European carbon fiber value chain realize substantial benefits from market participation and strategic positioning within this dynamic sector.

Material Suppliers benefit from:

End-users realize advantages including:

Research Institutions benefit through:

Regional Economies gain from:

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends reshaping the European carbon fiber market reflect technological advancement, sustainability initiatives, and evolving application requirements across diverse industries.

Sustainability Integration represents the most significant trend, with companies developing bio-based precursors and advanced recycling technologies. Circular economy approaches gain traction as manufacturers seek to address end-of-life material management and reduce environmental impact. European companies lead global efforts in sustainable carbon fiber development, with recycling rates improving by approximately 25% annually.

Manufacturing Automation continues advancing through Industry 4.0 technologies, artificial intelligence, and robotics integration. Automated fiber placement and advanced process monitoring systems improve manufacturing efficiency while reducing labor costs and quality variations. Digital twin technologies enable process optimization and predictive maintenance capabilities.

Cost Reduction Initiatives focus on manufacturing process improvements, raw material optimization, and scale economies. Large tow carbon fiber adoption expands in cost-sensitive applications, while new manufacturing technologies reduce production costs across all product grades. Strategic partnerships between suppliers and end-users facilitate cost reduction through volume commitments and technology sharing.

Application Diversification accelerates as carbon fiber properties enable new use cases across multiple industries. Infrastructure applications gain momentum through bridge reinforcement and construction projects, while consumer goods adoption increases in premium product segments. Medical device applications represent an emerging growth area leveraging carbon fiber’s biocompatibility and performance characteristics.

Supply Chain Localization initiatives reduce dependence on non-European suppliers while improving supply security and reducing transportation costs. Vertical integration strategies among major players create more resilient supply chains and improved cost structures.

Recent industry developments demonstrate the dynamic nature of the European carbon fiber market and ongoing evolution across technology, capacity, and application domains.

Capacity Expansion Projects across Europe reflect strong demand growth expectations and strategic positioning initiatives. Major producers are investing in new production facilities and existing plant expansions to meet growing market demand. Advanced manufacturing technologies incorporated in new facilities improve cost competitiveness and product quality while reducing environmental impact.

Strategic Partnerships between material suppliers and end-users facilitate technology development and market expansion. Automotive collaborations focus on developing cost-effective carbon fiber solutions for electric vehicle applications, while aerospace partnerships advance next-generation composite technologies. Research collaborations between companies and universities accelerate innovation and technology commercialization.

Technology Breakthroughs in manufacturing processes and material formulations create competitive advantages and expand application possibilities. Recycling technology development enables circular economy approaches while reducing material costs and environmental impact. Bio-based precursor development reduces dependence on petroleum-based raw materials while improving sustainability profiles.

Regulatory Developments including updated environmental standards and material specifications influence market dynamics and technology development priorities. Certification processes for new applications and manufacturing methods facilitate market expansion while ensuring safety and performance standards.

Market Consolidation activities including mergers, acquisitions, and strategic investments reshape competitive dynamics and industry structure. Vertical integration initiatives create more integrated value chains while improving cost structures and customer relationships.

Strategic recommendations for European carbon fiber market participants reflect current market conditions, emerging opportunities, and competitive dynamics that will shape industry development.

Investment Priorities should focus on manufacturing automation and process optimization to improve cost competitiveness while maintaining quality standards. MarkWide Research analysis indicates that companies investing in advanced manufacturing technologies achieve 15-20% cost advantages compared to conventional production methods. Recycling technology development represents another critical investment area supporting sustainability objectives and cost reduction goals.

Market Positioning strategies should emphasize application-specific expertise and customer relationship development rather than competing solely on price. Technical service capabilities and application engineering support create competitive differentiation and customer loyalty. Companies should develop specialized expertise in high-growth segments such as electric vehicles and renewable energy applications.

Supply Chain Optimization requires balancing cost considerations with supply security and quality requirements. Regional supplier development reduces dependence on distant suppliers while supporting European industrial policy objectives. Strategic partnerships with key suppliers ensure material availability during periods of strong demand growth.

Innovation Focus should prioritize sustainable technologies, cost reduction, and new application development. Collaborative research with universities and research institutions accelerates technology development while sharing costs and risks. Patent portfolio development protects competitive advantages and creates licensing opportunities.

Market Expansion strategies should target emerging applications while strengthening positions in established segments. Geographic expansion within Europe and internationally creates growth opportunities and reduces market concentration risks.

Future prospects for the European carbon fiber market indicate sustained growth driven by technological advancement, expanding applications, and supportive regulatory environments across multiple industry sectors.

Growth trajectory projections suggest continued market expansion with growth rates of approximately 8-10% annually over the next decade. Electric vehicle adoption and renewable energy infrastructure development represent primary growth drivers, while aerospace applications provide stable demand foundation. MWR projections indicate that automotive applications could achieve 40% market share by 2030 as electric vehicle production scales and carbon fiber costs decline.

Technology evolution will focus on cost reduction, sustainability improvement, and performance enhancement across all application segments. Manufacturing automation and process optimization will continue reducing production costs while improving quality consistency. Bio-based precursor development and advanced recycling technologies will address sustainability concerns and regulatory requirements.

Market structure evolution may include increased consolidation as companies seek scale advantages and vertical integration opportunities. Regional supply chain development will reduce dependence on non-European suppliers while improving supply security and cost structures. Strategic partnerships between material suppliers and end-users will become increasingly important for technology development and market access.

Application expansion will continue across diverse industries as carbon fiber properties enable new use cases and performance improvements. Infrastructure applications represent significant long-term potential, while consumer goods and medical device applications offer niche growth opportunities. Emerging applications in hydrogen storage and advanced transportation systems may create additional demand sources.

Regulatory environment will likely become more supportive as European Union sustainability initiatives and carbon reduction targets create favorable conditions for lightweight material adoption. Standardization efforts and certification processes will facilitate market expansion while ensuring safety and performance requirements.

European carbon fiber market demonstrates exceptional growth potential driven by technological innovation, sustainability initiatives, and expanding application portfolios across diverse industry sectors. The region’s established industrial base, research capabilities, and regulatory support create favorable conditions for continued market development and global competitiveness.

Market fundamentals remain strong with growing demand from automotive electrification, aerospace expansion, and renewable energy infrastructure development. Technology advancement in manufacturing processes and material formulations continues improving cost competitiveness while expanding application possibilities. European companies maintain global leadership positions through innovation capabilities and customer relationship excellence.

Strategic opportunities abound for companies positioned to capitalize on emerging trends including sustainability integration, manufacturing automation, and application diversification. Investment in advanced technologies and supply chain optimization will determine competitive success in an increasingly dynamic market environment. The integration of circular economy principles and sustainable manufacturing practices positions European companies advantageously for long-term market leadership.

Future success will depend on companies’ ability to balance cost competitiveness with performance excellence while addressing evolving customer requirements and regulatory standards. The European carbon fiber market represents a compelling growth opportunity for stakeholders committed to innovation, sustainability, and operational excellence in advanced materials manufacturing and application development.

What is Carbon Fiber?

Carbon fiber is a lightweight, high-strength material made from thin strands of carbon atoms. It is widely used in various applications, including aerospace, automotive, and sporting goods due to its excellent mechanical properties and resistance to corrosion.

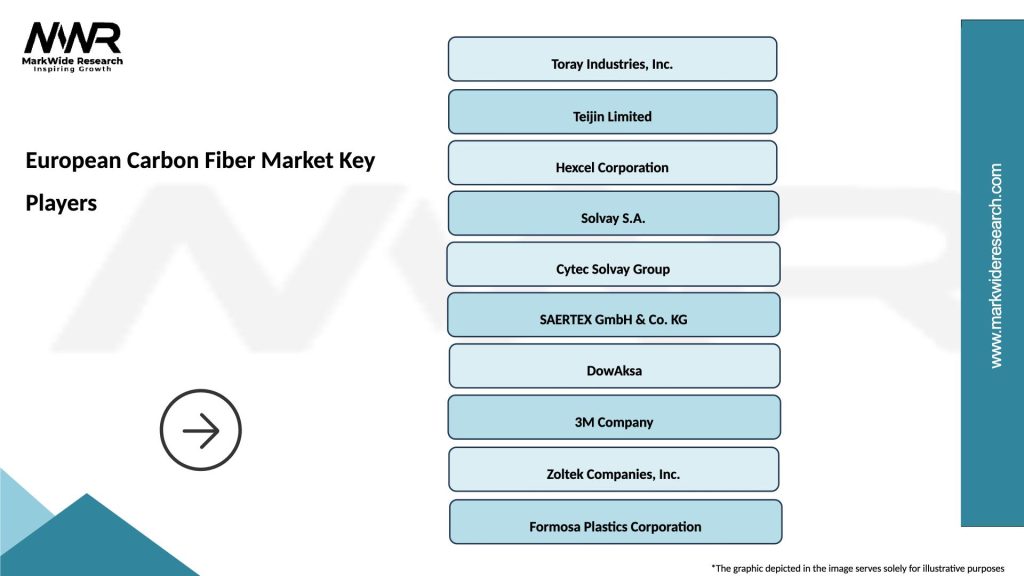

What are the key players in the European Carbon Fiber Market?

Key players in the European Carbon Fiber Market include Toray Industries, SGL Carbon, and Hexcel Corporation, among others. These companies are involved in the production and supply of carbon fiber for various industries, including automotive and aerospace.

What are the main drivers of the European Carbon Fiber Market?

The main drivers of the European Carbon Fiber Market include the increasing demand for lightweight materials in the automotive and aerospace sectors, as well as the growing emphasis on fuel efficiency and performance. Additionally, advancements in manufacturing technologies are enhancing the production capabilities of carbon fiber.

What challenges does the European Carbon Fiber Market face?

The European Carbon Fiber Market faces challenges such as high production costs and the complexity of manufacturing processes. Additionally, the market is impacted by competition from alternative materials like aluminum and plastics, which can be more cost-effective in certain applications.

What opportunities exist in the European Carbon Fiber Market?

Opportunities in the European Carbon Fiber Market include the growing adoption of carbon fiber in renewable energy applications, such as wind turbine blades, and the expansion of electric vehicles, which require lightweight materials for improved efficiency. Furthermore, innovations in recycling technologies present new avenues for growth.

What trends are shaping the European Carbon Fiber Market?

Trends shaping the European Carbon Fiber Market include the increasing use of carbon fiber in sports equipment and consumer goods, as well as the development of bio-based carbon fibers. Additionally, there is a rising focus on sustainability and reducing the environmental impact of carbon fiber production.

European Carbon Fiber Market

| Segmentation Details | Description |

|---|---|

| Product Type | Continuous Fiber, Short Fiber, Fabric, Prepreg |

| Grade | Standard, Intermediate, High-Strength, Ultra-High Modulus |

| Application | Aerospace, Automotive OEMs, Wind Energy, Sporting Goods |

| End User | Manufacturers, Construction, Marine, Electronics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the European Carbon Fiber Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at