444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The European automotive display market represents one of the most dynamic and rapidly evolving segments within the global automotive technology landscape. This comprehensive market encompasses various display technologies integrated into modern vehicles, ranging from traditional instrument clusters to advanced infotainment systems and heads-up displays. European manufacturers continue to lead innovation in automotive display technologies, driven by stringent safety regulations, consumer demand for enhanced user experiences, and the accelerating transition toward electric and autonomous vehicles.

Market dynamics in Europe reflect a sophisticated ecosystem where premium automotive brands collaborate with cutting-edge display technology providers to deliver next-generation cockpit experiences. The region’s automotive display market benefits from strong research and development investments, with Germany, France, and the United Kingdom serving as primary innovation hubs. Current market trends indicate robust growth potential, with industry analysts projecting a compound annual growth rate of 8.2% through the forecast period.

Technological advancement remains the cornerstone of market expansion, as European automotive manufacturers increasingly integrate larger, higher-resolution displays with enhanced functionality. The shift toward digital cockpits and connected vehicle technologies has fundamentally transformed how consumers interact with their vehicles, creating unprecedented opportunities for display technology providers across the European market.

The European automotive display market refers to the comprehensive ecosystem of visual interface technologies integrated into passenger vehicles, commercial vehicles, and specialty automotive applications across European countries. This market encompasses various display types including instrument cluster displays, center information displays, heads-up displays, rear-seat entertainment systems, and emerging technologies such as augmented reality windshields and flexible OLED panels.

Automotive displays serve as the primary interface between drivers, passengers, and vehicle systems, providing critical information about vehicle performance, navigation, entertainment, and safety features. These sophisticated systems integrate advanced technologies including touchscreen capabilities, voice recognition, gesture control, and artificial intelligence to create intuitive user experiences that enhance both safety and convenience.

Market scope extends beyond traditional display hardware to include software platforms, user interface design, connectivity solutions, and integration services that enable seamless interaction between human users and increasingly complex vehicle systems throughout the European automotive landscape.

European automotive display market analysis reveals a sector experiencing unprecedented transformation driven by technological innovation, regulatory requirements, and evolving consumer expectations. The market demonstrates strong momentum across multiple vehicle segments, with premium and luxury vehicles leading adoption of advanced display technologies while mainstream manufacturers rapidly integrate similar capabilities into mass-market offerings.

Key market drivers include the accelerating transition toward electric vehicles, increasing demand for connected car features, and stringent European safety regulations requiring enhanced driver information systems. Display technology evolution continues advancing toward larger screen sizes, higher resolutions, and more sophisticated user interfaces, with OLED and AMOLED technologies gaining significant traction among European automotive manufacturers.

Competitive landscape features established display technology leaders alongside emerging innovators, creating a dynamic environment where traditional automotive suppliers collaborate with consumer electronics companies to deliver next-generation cockpit solutions. Market penetration rates for advanced display systems currently exceed 72% in premium vehicle segments, with mainstream adoption accelerating rapidly across European markets.

Strategic market insights reveal several critical trends shaping the European automotive display landscape:

Primary market drivers propelling European automotive display market growth encompass technological, regulatory, and consumer-driven factors that create sustained demand for advanced display solutions. Digital transformation within the automotive industry represents the most significant driver, as manufacturers transition from analog instruments to fully digital cockpit environments that provide enhanced functionality and user experiences.

Safety regulations established by European authorities mandate improved driver information systems, creating substantial market opportunities for display technology providers. These regulations require clear, accessible presentation of critical vehicle information, driving adoption of high-resolution displays with enhanced visibility characteristics. Consumer electronics convergence influences automotive display expectations, as drivers demand smartphone-like interfaces and connectivity features in their vehicles.

Electric vehicle proliferation across European markets creates unique display requirements for battery management, charging information, and energy efficiency optimization. Autonomous driving development further accelerates display technology advancement, as future vehicles will require sophisticated human-machine interfaces for various automation levels. Connected car services expansion drives demand for displays capable of supporting real-time data visualization, navigation services, and cloud-based applications.

Market restraints affecting European automotive display adoption include several technical, economic, and regulatory challenges that may limit growth potential in certain segments. High implementation costs associated with advanced display technologies create barriers for cost-sensitive vehicle segments, particularly in the compact and economy car categories where price pressures remain significant.

Technical complexity surrounding display integration poses challenges for automotive manufacturers, requiring specialized expertise in software development, user interface design, and system integration. Driver distraction concerns raised by safety advocates and regulatory bodies may limit certain display functionalities or require additional safety measures that increase development costs and complexity.

Supply chain constraints affecting semiconductor availability and display panel production can impact market growth, particularly during periods of high demand or global supply disruptions. Standardization challenges across different vehicle platforms and manufacturer requirements create additional complexity for display technology providers seeking to achieve economies of scale. Cybersecurity requirements for connected display systems add development costs and ongoing maintenance obligations that may deter some market participants.

Significant market opportunities exist within the European automotive display sector, driven by emerging technologies, evolving consumer preferences, and new vehicle architectures. Augmented reality integration presents substantial growth potential as manufacturers explore heads-up displays and windshield projection systems that overlay digital information onto real-world driving environments.

Flexible display technologies create opportunities for innovative cockpit designs that adapt to different driving modes and user preferences. OLED and AMOLED advancement enables thinner, more energy-efficient displays with superior image quality and design flexibility. Artificial intelligence integration opens possibilities for adaptive user interfaces that learn driver preferences and optimize display configurations automatically.

Commercial vehicle applications represent an underexplored opportunity, as fleet operators increasingly recognize the value of advanced display systems for driver productivity, safety, and vehicle management. Aftermarket opportunities continue expanding as consumers seek to upgrade existing vehicles with modern display technologies. Sustainability initiatives drive demand for eco-friendly display materials and manufacturing processes, creating opportunities for innovative technology providers.

Market dynamics within the European automotive display sector reflect complex interactions between technology providers, automotive manufacturers, regulatory bodies, and end consumers. Competitive pressures drive continuous innovation as companies strive to differentiate their offerings through superior image quality, enhanced functionality, and improved user experiences.

Technology convergence between automotive and consumer electronics industries creates both opportunities and challenges, as traditional automotive suppliers compete with established technology companies entering the automotive market. MarkWide Research analysis indicates that integration complexity remains a critical factor influencing market dynamics, with successful companies demonstrating strong capabilities in both hardware and software development.

Regional variations across European markets influence demand patterns, with Nordic countries showing strong preference for advanced safety features while Southern European markets prioritize entertainment and connectivity capabilities. Economic fluctuations impact premium vehicle sales, which traditionally drive adoption of advanced display technologies before filtering down to mainstream market segments.

Comprehensive research methodology employed for European automotive display market analysis incorporates multiple data sources and analytical approaches to ensure accuracy and reliability of market insights. Primary research includes extensive interviews with automotive manufacturers, display technology providers, component suppliers, and industry experts across major European markets.

Secondary research encompasses analysis of industry reports, regulatory filings, patent databases, and technical publications to identify market trends, technological developments, and competitive dynamics. Quantitative analysis utilizes statistical modeling techniques to project market growth, segment performance, and regional variations based on historical data and identified market drivers.

Market validation processes include cross-referencing multiple data sources, conducting expert interviews, and analyzing real-world implementation examples to ensure research findings accurately reflect market conditions. Continuous monitoring of regulatory changes, technological breakthroughs, and competitive developments ensures research remains current and relevant for market participants and stakeholders.

Regional analysis of the European automotive display market reveals significant variations in adoption patterns, technology preferences, and growth trajectories across different countries and sub-regions. Germany maintains its position as the largest market, accounting for approximately 28% of total European demand, driven by the presence of premium automotive manufacturers and strong consumer purchasing power.

France and the United Kingdom represent the second and third largest markets respectively, with combined market share exceeding 35% of European automotive display demand. Nordic countries demonstrate the highest per-capita adoption rates for advanced display technologies, reflecting strong consumer preference for safety and technology features in harsh driving conditions.

Eastern European markets show rapid growth potential as economic development drives increased vehicle ownership and demand for modern automotive technologies. Italy and Spain focus primarily on entertainment and connectivity features, while Netherlands and Belgium emphasize integration with smart city infrastructure and sustainable transportation initiatives. Market penetration rates for advanced display systems vary significantly, ranging from 45% in emerging markets to 85% in premium segments across established European automotive markets.

Competitive landscape within the European automotive display market features a diverse ecosystem of established automotive suppliers, consumer electronics companies, and specialized display technology providers. Market leadership remains distributed among several key players, each focusing on specific technology segments or customer relationships.

Market segmentation analysis reveals distinct categories within the European automotive display market, each characterized by specific technology requirements, price points, and target applications. By Technology: The market divides into LCD, OLED, AMOLED, and emerging flexible display technologies, with LCD technology currently maintaining the largest market share while OLED adoption accelerates in premium vehicle segments.

By Application: Primary segments include instrument cluster displays, center information displays, heads-up displays, rear-seat entertainment systems, and mirror replacement displays. Instrument cluster displays represent the largest application segment, while heads-up displays demonstrate the highest growth rates across European markets.

By Vehicle Type: Segmentation encompasses passenger cars, commercial vehicles, and specialty vehicles, with passenger cars accounting for the majority of market demand. By Display Size: Categories range from small displays under 7 inches to large displays exceeding 15 inches, with medium-sized displays between 8-12 inches showing strongest growth momentum. By Price Range: Market segments include economy, mid-range, and premium categories, reflecting diverse consumer preferences and purchasing power across European markets.

Instrument cluster displays continue dominating the European automotive display market, driven by regulatory requirements and consumer expectations for digital vehicle information. Technology evolution in this category focuses on higher resolutions, improved readability in various lighting conditions, and integration with advanced driver assistance systems. Customization capabilities allow drivers to personalize information layout and display themes according to individual preferences.

Center information displays represent the fastest-growing category, as manufacturers integrate larger touchscreens with comprehensive infotainment, navigation, and vehicle control functions. Screen sizes in this category continue increasing, with displays larger than 12 inches becoming standard in premium vehicles. Integration complexity requires sophisticated software platforms capable of managing multiple simultaneous applications while maintaining responsive user interfaces.

Heads-up displays demonstrate significant growth potential as European consumers increasingly value safety-focused technologies that minimize driver distraction. Augmented reality capabilities enhance navigation and safety information presentation, while projection quality improvements address previous concerns about visibility and image clarity. Cost reduction initiatives make heads-up display technology accessible to broader vehicle segments beyond luxury applications.

Automotive manufacturers benefit from advanced display technologies through enhanced product differentiation, improved customer satisfaction, and compliance with evolving safety regulations. Brand positioning advantages emerge from offering cutting-edge cockpit experiences that appeal to technology-conscious European consumers. Integration efficiencies reduce overall system complexity while providing comprehensive functionality through unified display platforms.

Display technology providers gain access to substantial market opportunities driven by increasing vehicle production and rising content per vehicle. Long-term partnerships with automotive manufacturers provide stable revenue streams and opportunities for collaborative innovation. Technology advancement requirements drive continuous innovation, creating competitive advantages for companies investing in research and development.

End consumers benefit from improved safety through better access to critical vehicle information, enhanced convenience via intuitive user interfaces, and increased entertainment options during travel. Vehicle value retention improves with modern display technologies that maintain relevance throughout vehicle ownership periods. Connectivity features enable integration with personal devices and cloud-based services, extending functionality beyond traditional automotive applications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital cockpit evolution represents the most significant trend transforming European automotive display markets, as manufacturers transition toward fully integrated digital environments that replace traditional analog instruments. Screen consolidation reduces system complexity while providing enhanced functionality through software-defined interfaces that adapt to different driving scenarios and user preferences.

Artificial intelligence integration enables predictive user interfaces that anticipate driver needs and optimize information presentation accordingly. Voice control advancement reduces reliance on touch interactions, improving safety while maintaining comprehensive functionality. Gesture recognition technology provides alternative input methods that minimize driver distraction during vehicle operation.

Sustainability focus drives development of eco-friendly display materials and energy-efficient technologies that support European environmental objectives. MarkWide Research indicates that circular economy principles increasingly influence display design and manufacturing processes. Over-the-air updates extend display system lifecycles and enable continuous feature enhancement throughout vehicle ownership periods.

Recent industry developments highlight accelerating innovation within European automotive display markets, driven by competitive pressures and evolving consumer expectations. Major automotive manufacturers announce significant investments in digital cockpit technologies, with several European brands committing to fully digital instrument clusters across their vehicle lineups by 2025.

Technology partnerships between automotive suppliers and consumer electronics companies create new opportunities for advanced display integration and functionality enhancement. Regulatory approvals for augmented reality heads-up displays enable broader market adoption of these safety-enhancing technologies. Manufacturing capacity expansion by display technology providers supports growing demand across European automotive markets.

Research initiatives focus on next-generation display technologies including flexible OLED panels, holographic displays, and advanced projection systems. Standardization efforts aim to improve interoperability between different display systems and vehicle platforms. Cybersecurity frameworks address growing concerns about connected display system vulnerabilities and data protection requirements.

Strategic recommendations for European automotive display market participants emphasize the importance of balancing innovation with practical implementation considerations. Technology providers should focus on developing scalable solutions that address diverse market segments while maintaining cost competitiveness. Automotive manufacturers benefit from establishing long-term partnerships with display technology specialists to ensure consistent innovation and supply security.

Investment priorities should emphasize user experience optimization, safety feature integration, and sustainability initiatives that align with European regulatory requirements and consumer preferences. Market entry strategies for new participants should consider regional variations in consumer preferences and regulatory requirements across different European countries.

Risk management approaches should address supply chain vulnerabilities, cybersecurity requirements, and potential regulatory changes that may impact display technology specifications or safety requirements. MWR analysis suggests that companies maintaining strong research and development capabilities while building flexible manufacturing and partnership networks will achieve the greatest success in this dynamic market environment.

Future outlook for the European automotive display market indicates sustained growth driven by technological advancement, regulatory requirements, and evolving mobility patterns. Market expansion will continue across all vehicle segments, with premium technologies gradually becoming standard features in mainstream vehicles. Growth projections suggest the market will maintain a compound annual growth rate exceeding 8% through the next decade.

Technology evolution will focus on enhanced integration, improved energy efficiency, and advanced user interface capabilities that support both current driving scenarios and future autonomous vehicle applications. Electric vehicle proliferation will create new display requirements while driving demand for energy-efficient technologies. Connected services integration will transform displays from static information providers to dynamic, cloud-connected platforms.

Market consolidation may occur as smaller players struggle to meet increasing technology and investment requirements, while successful companies expand their capabilities through strategic partnerships and acquisitions. Regional growth patterns will reflect economic development, regulatory changes, and consumer preference evolution across different European markets. Innovation cycles will accelerate as competition intensifies and technology capabilities continue advancing rapidly.

European automotive display market represents a dynamic and rapidly evolving sector characterized by strong growth potential, technological innovation, and increasing strategic importance within the broader automotive industry. Market fundamentals remain robust, supported by regulatory requirements, consumer demand for advanced features, and the ongoing digital transformation of vehicle cockpits across European markets.

Competitive dynamics will continue intensifying as traditional automotive suppliers compete with technology companies entering the automotive space, driving innovation and creating opportunities for market participants with strong technical capabilities and strategic partnerships. Technology trends toward larger displays, enhanced connectivity, and artificial intelligence integration will shape market development while creating new opportunities for differentiation and value creation.

Success factors for market participants include maintaining strong research and development capabilities, building flexible supply chain relationships, and developing deep understanding of regional market variations and consumer preferences. Long-term prospects remain positive as the European automotive industry continues its transformation toward electrification, connectivity, and eventual autonomy, creating sustained demand for advanced display technologies that enhance safety, convenience, and user experience throughout the vehicle ownership lifecycle.

What is Automotive Display?

Automotive Display refers to the visual interface used in vehicles to present information to drivers and passengers. This includes instrument clusters, infotainment systems, and heads-up displays that enhance user experience and vehicle functionality.

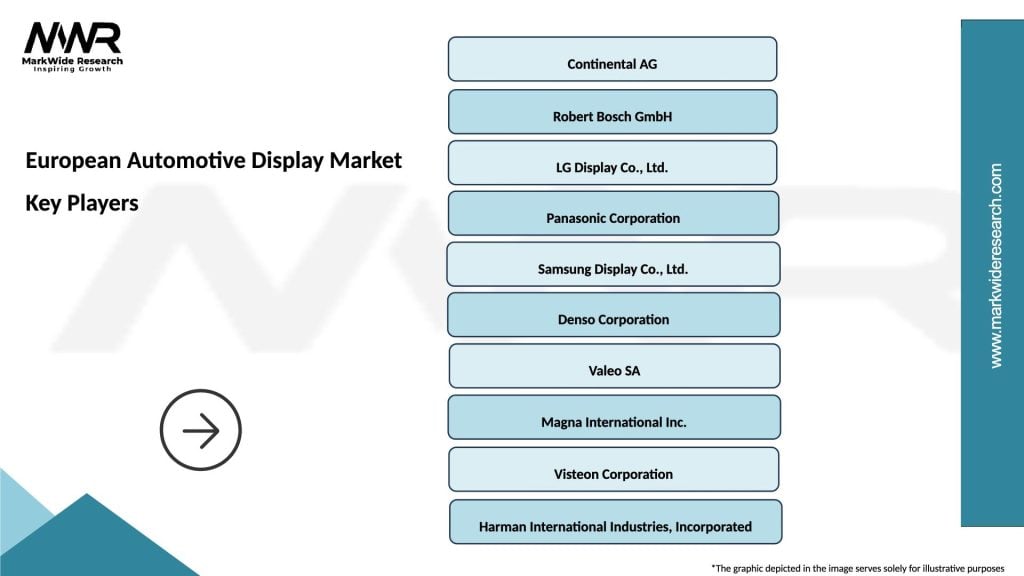

What are the key players in the European Automotive Display Market?

Key players in the European Automotive Display Market include companies like Continental AG, Bosch, and LG Display. These companies are known for their innovative display technologies and solutions for the automotive sector, among others.

What are the main drivers of the European Automotive Display Market?

The European Automotive Display Market is driven by the increasing demand for advanced infotainment systems, the rise of electric vehicles, and the growing emphasis on driver safety features. Additionally, consumer preferences for enhanced connectivity and user interfaces are contributing to market growth.

What challenges does the European Automotive Display Market face?

The European Automotive Display Market faces challenges such as high production costs, rapid technological changes, and the need for compliance with stringent automotive regulations. Additionally, supply chain disruptions can impact the availability of components.

What opportunities exist in the European Automotive Display Market?

Opportunities in the European Automotive Display Market include the integration of augmented reality in displays, the development of flexible and lightweight display technologies, and the increasing adoption of electric and autonomous vehicles. These trends are expected to create new avenues for innovation.

What trends are shaping the European Automotive Display Market?

Trends shaping the European Automotive Display Market include the shift towards larger, high-resolution displays, the incorporation of touch and gesture controls, and the rise of digital cockpit solutions. These innovations are enhancing the overall driving experience and vehicle aesthetics.

European Automotive Display Market

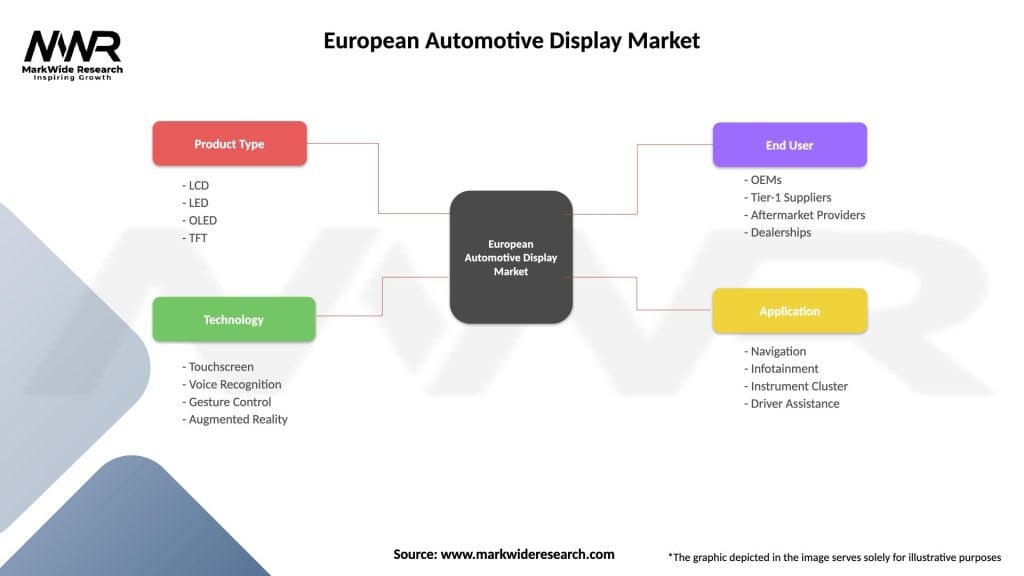

| Segmentation Details | Description |

|---|---|

| Product Type | LCD, LED, OLED, TFT |

| Technology | Touchscreen, Voice Recognition, Gesture Control, Augmented Reality |

| End User | OEMs, Tier-1 Suppliers, Aftermarket Providers, Dealerships |

| Application | Navigation, Infotainment, Instrument Cluster, Driver Assistance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the European Automotive Display Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at