444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The European asset management market represents one of the most sophisticated and mature financial ecosystems globally, encompassing a diverse range of investment management services across multiple asset classes. European asset managers oversee substantial portfolios including equities, fixed income, alternative investments, and emerging digital assets, serving institutional investors, pension funds, insurance companies, and high-net-worth individuals throughout the region.

Market dynamics indicate robust growth driven by increasing institutional demand, regulatory harmonization through frameworks like MiFID II and AIFMD, and the rising adoption of sustainable investing practices. The sector demonstrates remarkable resilience with compound annual growth rates consistently outpacing global averages, particularly in ESG-focused investment strategies and technology-driven portfolio management solutions.

Regional distribution shows concentrated activity in major financial centers including London, Frankfurt, Paris, Amsterdam, and Dublin, with emerging hubs in Nordic countries gaining significant traction. The market benefits from cross-border investment flows facilitated by European Union regulatory frameworks, creating opportunities for asset managers to serve clients across multiple jurisdictions seamlessly.

Technology integration has accelerated dramatically, with digital transformation initiatives driving operational efficiency improvements of approximately 25-30% across leading asset management firms. Artificial intelligence, machine learning, and blockchain technologies are reshaping traditional investment processes, risk management frameworks, and client engagement strategies throughout the European landscape.

The European asset management market refers to the comprehensive ecosystem of financial institutions, investment firms, and service providers that professionally manage investment portfolios and financial assets on behalf of clients across European Union member states and associated territories. This market encompasses traditional asset management services, alternative investment management, wealth management, and specialized investment advisory services.

Asset management activities include portfolio construction, risk assessment, investment research, trade execution, performance monitoring, and regulatory compliance across diverse asset classes. European asset managers operate under stringent regulatory frameworks designed to protect investor interests while promoting market efficiency and transparency.

Market participants range from global investment giants with multi-trillion asset bases to boutique specialists focusing on niche investment strategies. The ecosystem includes institutional asset managers, retail-focused investment companies, private equity firms, hedge funds, real estate investment managers, and emerging fintech-enabled investment platforms.

European asset management continues demonstrating exceptional resilience and growth potential despite global economic uncertainties and geopolitical challenges. The sector has successfully navigated Brexit implications, COVID-19 disruptions, and evolving regulatory landscapes while maintaining strong performance metrics and expanding service offerings.

Sustainable investing has emerged as a dominant theme, with ESG-compliant assets representing approximately 35-40% of total managed assets across major European markets. This shift reflects both regulatory requirements under the EU Taxonomy and increasing investor demand for environmentally and socially responsible investment options.

Digital transformation initiatives have accelerated significantly, with leading asset managers investing heavily in technology infrastructure, data analytics capabilities, and client-facing digital platforms. These investments are generating measurable improvements in operational efficiency, risk management, and client satisfaction metrics.

Competitive dynamics show increasing consolidation among mid-tier players while boutique specialists and technology-enabled platforms gain market share through innovative service delivery models. Cross-border mergers and acquisitions activity remains robust, driven by scale economics and regulatory harmonization benefits.

Market leadership in European asset management is characterized by several key insights that define current industry dynamics and future growth trajectories:

Demographic trends represent the most significant long-term driver of European asset management growth, with aging populations across developed European markets creating substantial demand for retirement planning and wealth preservation services. Pension fund assets continue expanding as governments implement pension reforms and individuals take greater responsibility for retirement security.

Regulatory support through frameworks like UCITS, AIFMD, and MiFID II creates standardized operating environments that facilitate cross-border business development and reduce compliance costs for asset managers operating across multiple European jurisdictions. These regulations also enhance investor protection and market transparency.

Sustainable finance initiatives driven by EU taxonomy requirements and climate change commitments are generating unprecedented demand for ESG-compliant investment products. Asset managers are experiencing net inflow rates of approximately 15-20% annually in sustainable investment strategies compared to traditional products.

Technology advancement enables asset managers to deliver more sophisticated investment solutions at lower costs while improving risk management capabilities. Artificial intelligence and machine learning applications are enhancing portfolio optimization, trade execution, and client service delivery across the industry.

Institutional investor sophistication continues increasing, with pension funds, insurance companies, and sovereign wealth funds demanding more complex investment solutions, alternative asset access, and customized portfolio management services tailored to specific liability profiles and risk tolerances.

Regulatory complexity poses ongoing challenges for European asset managers, particularly smaller firms lacking extensive compliance infrastructure. The cost of regulatory compliance continues increasing, with some estimates suggesting compliance expenses represent 8-12% of total operating costs for mid-sized asset management firms.

Fee pressure from institutional clients and competitive dynamics continues compressing profit margins across the industry. Passive investment products and robo-advisory platforms are driving down fee expectations, forcing traditional active managers to demonstrate clear value propositions and superior performance metrics.

Brexit implications continue creating operational challenges and increased costs for asset managers serving both UK and EU clients. Firms have invested substantially in dual regulatory compliance systems and expanded operational infrastructure to maintain market access across jurisdictions.

Talent shortage in specialized areas including quantitative analysis, technology development, and ESG research creates recruitment challenges and wage inflation pressures. Competition for experienced professionals is particularly intense in emerging areas like sustainable finance and digital asset management.

Economic uncertainty and geopolitical tensions can impact investor confidence and asset flows, creating volatility in fee-based revenue streams. Market downturns typically result in reduced asset values and corresponding decreases in management fee income for asset managers.

Sustainable investing expansion presents the most significant growth opportunity for European asset managers, with regulatory mandates and investor preferences driving substantial capital allocation toward ESG-compliant strategies. MarkWide Research analysis indicates that sustainable investment assets could represent over 50% of total European managed assets within the next decade.

Digital wealth management platforms offer opportunities to serve previously underserved retail investor segments through technology-enabled advisory services. These platforms can deliver sophisticated portfolio management capabilities at scale while maintaining cost-effective service delivery models.

Alternative asset democratization through technology platforms and regulatory changes enables asset managers to offer private equity, real estate, and infrastructure investments to broader investor bases. This trend expands addressable markets and diversifies revenue streams beyond traditional asset classes.

Cross-border expansion within the European Union continues offering growth opportunities as regulatory harmonization reduces barriers to international business development. Asset managers can leverage existing capabilities to serve clients across multiple European markets efficiently.

Institutional outsourcing trends create opportunities for specialized asset managers to provide investment management services to corporations, pension funds, and insurance companies seeking to focus on core business activities while accessing professional investment expertise.

Competitive intensity in European asset management continues escalating as traditional boundaries between different types of financial service providers blur. Banks, insurance companies, fintech startups, and established asset managers increasingly compete for the same client relationships and investment mandates.

Technology disruption is fundamentally reshaping industry dynamics, with artificial intelligence, blockchain, and cloud computing enabling new business models and service delivery approaches. Asset managers investing in technology infrastructure are achieving operational efficiency gains of 20-25% while improving client experience metrics.

Client expectations continue evolving toward greater transparency, lower fees, and more personalized service delivery. Institutional investors increasingly demand customized reporting, ESG integration, and direct access to investment teams and decision-making processes.

Regulatory evolution remains a constant factor influencing market dynamics, with ongoing developments in areas including digital assets, sustainable finance, and cross-border investment services. Asset managers must continuously adapt operational processes and compliance frameworks to meet changing regulatory requirements.

Market consolidation trends are creating larger, more diversified asset management organizations while also enabling specialized boutique firms to thrive in niche markets. This bifurcation is reshaping competitive dynamics and client service models across the industry.

Primary research for European asset management market analysis encompasses comprehensive surveys and interviews with senior executives from leading asset management firms, institutional investors, regulatory officials, and industry consultants across major European financial centers.

Data collection methodologies include structured questionnaires distributed to asset management professionals, in-depth interviews with industry thought leaders, and focus group discussions with institutional investor representatives. Research participants represent diverse organization types, geographic regions, and functional specializations.

Secondary research incorporates analysis of regulatory filings, industry reports, academic studies, and proprietary databases containing asset management performance metrics, fee structures, and market share information. This research covers both quantitative market data and qualitative industry trend analysis.

Market modeling utilizes sophisticated analytical frameworks incorporating macroeconomic indicators, demographic trends, regulatory developments, and competitive dynamics to project future market evolution and identify emerging opportunities and challenges.

Validation processes include cross-referencing multiple data sources, conducting follow-up interviews with key industry participants, and utilizing statistical analysis techniques to ensure research accuracy and reliability across all market segments and geographic regions.

United Kingdom maintains its position as Europe’s largest asset management center despite Brexit challenges, with London-based firms managing substantial global assets and serving international client bases. The UK market demonstrates particular strength in alternative investments, hedge funds, and institutional asset management services.

Germany represents the largest continental European market, driven by substantial institutional investor assets including pension funds, insurance companies, and corporate treasuries. German asset managers show particular expertise in fixed income management and sustainable investing strategies, with ESG assets representing approximately 45% of total managed assets.

France demonstrates strong growth in retail asset management and cross-border investment services, with Paris emerging as a significant post-Brexit financial center. French asset managers excel in luxury goods investing, European equity strategies, and innovative structured products.

Netherlands and Luxembourg serve as major fund domiciliation centers, with Amsterdam and Luxembourg City hosting substantial asset management operations serving pan-European client bases. These markets benefit from favorable regulatory environments and sophisticated financial infrastructure.

Nordic countries including Sweden, Denmark, and Norway demonstrate exceptional growth in sustainable investing and pension fund management, with regional market share in ESG strategies reaching approximately 60% of total assets under management.

Market leadership in European asset management is distributed among several categories of organizations, each with distinct competitive advantages and market positioning strategies:

Competitive differentiation increasingly focuses on specialized expertise areas including sustainable investing, alternative assets, technology-enabled services, and customized institutional solutions rather than traditional scale-based advantages.

By Client Type:

By Asset Class:

By Investment Approach:

Institutional Asset Management represents the largest segment by assets under management, driven by pension fund growth and insurance company investment needs. This segment demonstrates strong demand for liability-driven investment strategies, alternative assets, and customized portfolio solutions tailored to specific risk and return objectives.

Retail Asset Management shows robust growth through digital distribution channels and robo-advisory platforms. European retail investors increasingly embrace ETFs and passive investment strategies, with ETF market growth exceeding 18% annually across major European markets.

Sustainable Investing has emerged as the fastest-growing category, driven by regulatory requirements and investor preferences. Asset managers specializing in ESG strategies are experiencing exceptional growth rates and premium fee structures compared to traditional investment approaches.

Alternative Asset Management continues expanding as institutional investors seek diversification and yield enhancement opportunities. Private equity, real estate, and infrastructure investments are gaining mainstream acceptance among European pension funds and insurance companies.

Wealth Management services targeting high-net-worth individuals demonstrate strong growth potential, particularly in emerging European markets where private wealth accumulation is accelerating rapidly.

Asset Managers benefit from expanding addressable markets, regulatory harmonization reducing compliance costs, and technology enabling more efficient operations and improved client service delivery. The European market offers diverse growth opportunities across multiple client segments and asset classes.

Institutional Investors gain access to sophisticated investment solutions, competitive fee structures, and enhanced transparency through regulatory frameworks. European asset managers provide specialized expertise in areas including sustainable investing, alternative assets, and liability-driven investment strategies.

Retail Investors benefit from increased product choice, lower fees through competitive dynamics, and improved access to professional investment management through technology platforms. Digital distribution channels are democratizing access to sophisticated investment strategies previously available only to institutional clients.

Regulatory Authorities achieve enhanced market oversight, improved investor protection, and greater financial system stability through comprehensive regulatory frameworks governing asset management activities across European markets.

Financial Intermediaries including banks, insurance companies, and independent financial advisors benefit from expanded product offerings, revenue sharing opportunities, and enhanced client service capabilities through partnerships with specialized asset managers.

Strengths:

Weaknesses:

Opportunities:

Threats:

ESG Integration has become the dominant trend shaping European asset management, with regulatory mandates and investor preferences driving fundamental changes in investment processes, product development, and client engagement strategies. Asset managers are investing substantially in ESG research capabilities and sustainable investment expertise.

Technology Adoption continues accelerating across all aspects of asset management operations, from portfolio construction and risk management to client service and regulatory reporting. Artificial intelligence and machine learning applications are becoming standard tools for investment analysis and decision-making processes.

Fee Compression remains a persistent trend, with institutional clients demanding greater value demonstration and retail investors gravitating toward low-cost passive investment options. Asset managers are responding through operational efficiency improvements and value-added service offerings.

Alternative Asset Mainstreaming shows private equity, real estate, and infrastructure investments becoming standard portfolio components for institutional investors. This trend is driving product innovation and expanding addressable markets for specialized asset managers.

Digital Client Engagement has transformed how asset managers interact with clients, with digital platforms enabling more frequent communication, transparent reporting, and personalized service delivery at scale.

Regulatory Evolution continues with ongoing implementation of sustainable finance regulations, digital asset frameworks, and enhanced investor protection measures. The EU Taxonomy and SFDR requirements are fundamentally reshaping product development and marketing practices across the industry.

Merger and Acquisition Activity remains robust, with strategic consolidation creating larger, more diversified asset management organizations capable of competing globally while achieving operational scale economies. M&A transaction volumes have increased approximately 22% annually over recent years.

Technology Infrastructure Investments by leading asset managers are creating competitive advantages in areas including data analytics, client service, and operational efficiency. Cloud computing adoption and cybersecurity enhancements represent major investment priorities across the industry.

Product Innovation focuses on sustainable investing strategies, outcome-oriented solutions, and technology-enabled investment approaches. Asset managers are developing increasingly sophisticated products addressing specific client needs and market opportunities.

Talent Development initiatives emphasize ESG expertise, technology skills, and data analytics capabilities as asset managers adapt to evolving client requirements and competitive dynamics.

Strategic Focus recommendations for European asset managers emphasize sustainable investing capabilities, technology infrastructure development, and operational efficiency improvements as key success factors in the evolving competitive landscape. MWR analysis suggests that firms investing in these areas are achieving superior growth and profitability metrics.

Client Relationship Management should prioritize transparency, personalized service delivery, and outcome-focused investment solutions. Asset managers demonstrating clear value propositions and superior client service are maintaining pricing power despite competitive pressures.

Regulatory Compliance strategies should emphasize proactive adaptation to evolving requirements, particularly in sustainable finance and digital asset areas. Firms with robust compliance frameworks are achieving competitive advantages through reduced operational risk and enhanced client confidence.

Technology Investment priorities should focus on data analytics capabilities, client-facing digital platforms, and operational automation systems. These investments are generating measurable returns through improved efficiency and enhanced service delivery capabilities.

Market Expansion opportunities exist in underserved client segments, emerging European markets, and specialized investment strategies. Asset managers with focused expansion strategies are achieving superior growth rates compared to broad-based approaches.

Long-term growth prospects for European asset management remain positive, driven by demographic trends, regulatory support for sustainable investing, and continued financial market development across the region. The sector is expected to maintain steady growth rates of 6-8% annually over the next decade.

Sustainable investing will likely dominate industry growth, with ESG-compliant assets potentially representing the majority of European managed assets within the next decade. This transition will create substantial opportunities for asset managers with specialized sustainable investment capabilities.

Technology integration will continue reshaping industry operations, client service delivery, and competitive dynamics. Asset managers successfully leveraging technology advantages will likely gain market share and achieve superior profitability metrics.

Market consolidation trends are expected to continue, creating larger, more diversified asset management organizations while enabling specialized boutique firms to thrive in niche markets. This bifurcation will reshape competitive dynamics across the industry.

Regulatory evolution will remain a constant factor, with ongoing developments in areas including digital assets, cross-border investment services, and enhanced investor protection measures continuing to influence market structure and competitive positioning.

European asset management represents a dynamic and evolving industry positioned for continued growth despite ongoing challenges including regulatory complexity, fee pressure, and technological disruption. The sector’s fundamental strengths including sophisticated financial markets, comprehensive regulatory frameworks, and deep investment expertise provide solid foundations for future development.

Sustainable investing has emerged as the defining trend reshaping industry dynamics, creating substantial opportunities for asset managers with specialized ESG capabilities while challenging traditional investment approaches. This transition represents both the greatest opportunity and most significant competitive threat facing industry participants.

Technology adoption continues accelerating across all aspects of asset management operations, enabling more efficient service delivery, enhanced risk management, and improved client engagement. Asset managers successfully leveraging technology advantages are achieving superior competitive positioning and financial performance.

Future success in European asset management will likely depend on firms’ ability to adapt to evolving client expectations, regulatory requirements, and competitive dynamics while maintaining operational excellence and investment performance standards. The industry’s continued evolution toward greater specialization, technology integration, and sustainable investing focus positions European asset management for sustained long-term growth and global leadership.

What is Asset Management?

Asset management refers to the systematic process of developing, operating, maintaining, and selling assets in a way that maximizes their value. This includes managing investments in various asset classes such as equities, fixed income, real estate, and alternative investments.

What are the key players in the European Asset Management Market?

Key players in the European Asset Management Market include companies like BlackRock, Amundi, and Schroders, which provide a range of investment solutions and services. These firms compete on factors such as performance, fees, and client service, among others.

What are the growth factors driving the European Asset Management Market?

The European Asset Management Market is driven by factors such as increasing wealth among individuals, a growing demand for retirement planning, and the rise of sustainable investing. Additionally, advancements in technology are enabling better investment strategies and client engagement.

What challenges does the European Asset Management Market face?

Challenges in the European Asset Management Market include regulatory pressures, market volatility, and competition from low-cost passive investment options. These factors can impact profitability and client retention for asset management firms.

What opportunities exist in the European Asset Management Market?

Opportunities in the European Asset Management Market include the expansion of ESG (Environmental, Social, and Governance) investment products and the increasing adoption of digital platforms for investment management. Firms that innovate and adapt to changing investor preferences are likely to thrive.

What trends are shaping the European Asset Management Market?

Trends in the European Asset Management Market include a shift towards passive investment strategies, the integration of technology in portfolio management, and a heightened focus on sustainability. These trends are influencing how firms develop their investment products and engage with clients.

European Asset Management Market

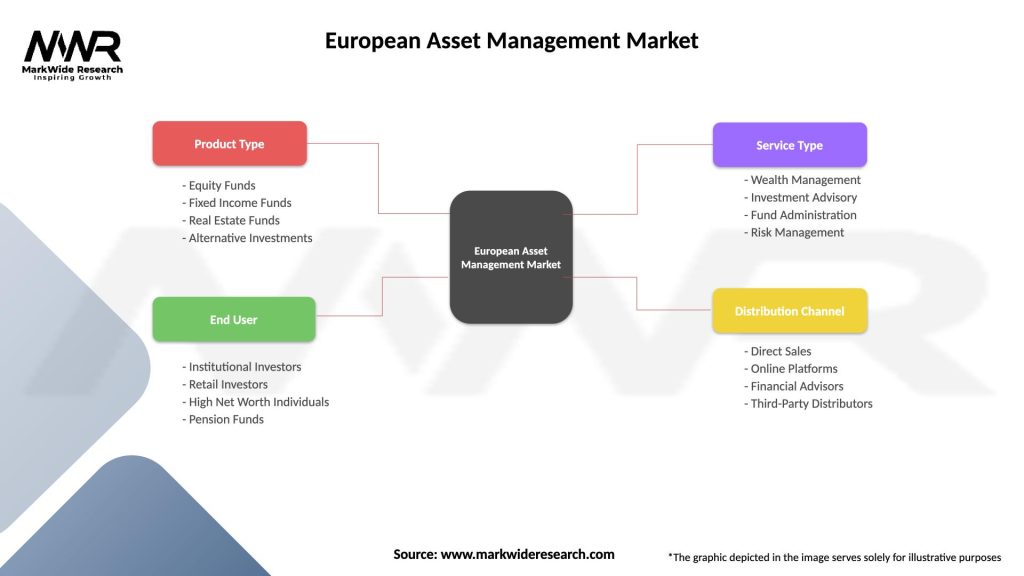

| Segmentation Details | Description |

|---|---|

| Product Type | Equity Funds, Fixed Income Funds, Real Estate Funds, Alternative Investments |

| End User | Institutional Investors, Retail Investors, High Net Worth Individuals, Pension Funds |

| Service Type | Wealth Management, Investment Advisory, Fund Administration, Risk Management |

| Distribution Channel | Direct Sales, Online Platforms, Financial Advisors, Third-Party Distributors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the European Asset Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at