444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe wound therapy devices market represents a rapidly evolving healthcare sector focused on advanced treatment solutions for various wound types. This comprehensive market encompasses innovative medical devices designed to accelerate healing processes, reduce infection risks, and improve patient outcomes across diverse healthcare settings. European healthcare systems are increasingly adopting sophisticated wound care technologies to address the growing prevalence of chronic wounds, surgical site complications, and trauma-related injuries.

Market dynamics indicate substantial growth driven by an aging population, rising diabetes prevalence, and increasing awareness of advanced wound care benefits. The region’s robust healthcare infrastructure, combined with significant investments in medical technology research, positions Europe as a leading market for innovative wound therapy solutions. Healthcare providers across European countries are prioritizing cost-effective treatment modalities that demonstrate superior clinical outcomes while reducing overall treatment duration.

Technological advancement continues to reshape the European wound therapy landscape, with smart wound dressings, negative pressure wound therapy systems, and bioactive healing solutions gaining significant traction. The market demonstrates strong growth potential, with analysts projecting a compound annual growth rate of 6.2% over the forecast period, reflecting increasing demand for advanced wound care technologies.

The Europe wound therapy devices market refers to the comprehensive ecosystem of medical devices, technologies, and treatment solutions specifically designed to facilitate wound healing processes across European healthcare systems. This market encompasses a diverse range of products including advanced wound dressings, negative pressure wound therapy systems, wound closure devices, and bioactive healing solutions that address various wound types from acute surgical incisions to chronic ulcerations.

Wound therapy devices represent sophisticated medical technologies that go beyond traditional bandaging approaches, incorporating innovative materials, active healing compounds, and smart monitoring capabilities. These devices are engineered to create optimal healing environments, manage wound exudate, prevent infections, and accelerate tissue regeneration through scientifically proven mechanisms.

European healthcare providers utilize these devices across multiple settings including hospitals, wound care clinics, long-term care facilities, and home healthcare environments. The market significance extends beyond product sales to encompass comprehensive wound management protocols that integrate device technology with clinical expertise to achieve superior patient outcomes.

Europe’s wound therapy devices market demonstrates remarkable resilience and growth potential, driven by demographic shifts, technological innovations, and evolving healthcare delivery models. The market encompasses diverse product categories serving various wound types, with chronic wound management representing the largest application segment due to increasing diabetes prevalence and aging population demographics.

Key market drivers include rising healthcare expenditure, growing awareness of advanced wound care benefits, and increasing adoption of evidence-based treatment protocols. European countries are investing heavily in healthcare infrastructure modernization, creating favorable conditions for advanced wound therapy device adoption. Healthcare cost containment initiatives paradoxically support market growth as advanced devices often reduce total treatment costs through faster healing times and reduced complications.

Competitive landscape features established medical device manufacturers alongside innovative startups developing next-generation wound care solutions. The market benefits from strong regulatory frameworks that ensure product safety while facilitating innovation. Regional variations exist in adoption rates and reimbursement policies, with Western European countries typically leading in advanced technology uptake while Eastern European markets show rapid growth potential.

Future outlook remains highly positive, with emerging technologies such as smart wound monitoring, personalized healing solutions, and AI-driven treatment protocols expected to drive continued market expansion. The integration of digital health technologies with traditional wound care devices represents a significant growth opportunity for market participants.

Strategic market analysis reveals several critical insights shaping the European wound therapy devices landscape. The market demonstrates strong correlation between technological advancement and clinical adoption rates, with healthcare providers increasingly prioritizing evidence-based treatment solutions that demonstrate measurable patient outcomes.

Demographic transformation serves as the primary catalyst driving European wound therapy devices market expansion. The region’s rapidly aging population creates increasing demand for advanced wound care solutions, as elderly individuals experience higher rates of chronic wounds, delayed healing, and complications from age-related conditions. Healthcare systems across Europe are adapting to serve growing numbers of patients requiring specialized wound management interventions.

Diabetes prevalence continues rising across European countries, creating substantial demand for diabetic wound care solutions. Diabetic patients face significantly higher risks of developing chronic wounds, particularly diabetic foot ulcers that require specialized treatment approaches. Healthcare providers are investing in advanced wound therapy devices specifically designed to address the unique challenges associated with diabetic wound healing.

Technological innovation drives market growth through the development of increasingly sophisticated wound care solutions. Smart wound dressings, bioactive healing materials, and negative pressure wound therapy systems offer superior clinical outcomes compared to traditional treatment methods. Medical device manufacturers continue investing in research and development to create next-generation wound therapy technologies that address unmet clinical needs.

Healthcare cost pressures paradoxically support market growth as advanced wound therapy devices often reduce total treatment costs through faster healing times, reduced complications, and decreased hospital readmissions. European healthcare systems recognize the economic benefits of investing in advanced wound care technologies that improve patient outcomes while controlling long-term healthcare expenditures.

High initial costs associated with advanced wound therapy devices present significant barriers to adoption, particularly in resource-constrained healthcare settings. Many European healthcare systems face budget limitations that restrict their ability to invest in expensive wound care technologies, despite potential long-term cost savings. Procurement decisions often prioritize immediate cost considerations over total cost of ownership calculations.

Reimbursement challenges create obstacles for both healthcare providers and patients seeking access to advanced wound therapy devices. European countries maintain varying reimbursement policies for wound care treatments, with some advanced technologies receiving limited coverage. Healthcare providers must navigate complex reimbursement landscapes that may not adequately compensate for the use of innovative wound therapy solutions.

Regulatory complexity increases development timelines and costs for wound therapy device manufacturers. European medical device regulations require extensive clinical evidence and compliance documentation, creating barriers for smaller companies seeking to enter the market. Regulatory requirements while ensuring safety and efficacy, can delay the introduction of innovative wound care technologies to European markets.

Clinical training requirements pose challenges for healthcare providers seeking to implement advanced wound therapy devices. Many sophisticated wound care technologies require specialized training and expertise to achieve optimal outcomes. Healthcare systems must invest in staff education and training programs to ensure proper utilization of advanced wound therapy devices, creating additional implementation costs and complexity.

Digital health integration presents substantial opportunities for wound therapy device manufacturers to develop connected solutions that enhance patient monitoring and treatment optimization. Smart wound dressings equipped with sensors and wireless connectivity enable real-time wound assessment and remote patient monitoring. Healthcare providers increasingly value technologies that support telemedicine capabilities and reduce the need for frequent in-person visits.

Home healthcare expansion creates significant market opportunities as European healthcare systems shift toward community-based care delivery models. Advanced wound therapy devices designed for home use enable patients to receive high-quality wound care in comfortable, familiar environments. Market participants can capitalize on this trend by developing user-friendly devices that maintain clinical effectiveness while supporting independent patient management.

Personalized medicine approaches offer opportunities to develop customized wound therapy solutions based on individual patient characteristics, wound types, and healing responses. Advances in biomarker analysis and genetic testing enable more targeted treatment approaches. Innovation opportunities exist for companies that can integrate personalized medicine principles into wound therapy device design and application protocols.

Emerging market penetration in Eastern European countries presents growth opportunities as these healthcare systems modernize and increase spending on advanced medical technologies. Rising healthcare standards and EU integration drive demand for sophisticated wound care solutions. Market expansion strategies targeting these regions can yield significant returns as healthcare infrastructure development accelerates.

Supply chain evolution significantly impacts the European wound therapy devices market, with manufacturers adapting to changing distribution models and healthcare procurement practices. Direct-to-provider sales channels gain prominence as healthcare systems seek to reduce intermediary costs and establish closer relationships with device manufacturers. Digital transformation enables more efficient supply chain management and inventory optimization across European healthcare networks.

Competitive intensity continues increasing as established medical device companies face challenges from innovative startups developing disruptive wound care technologies. Market consolidation through mergers and acquisitions reshapes the competitive landscape, with larger companies acquiring specialized wound care technology developers. Innovation cycles accelerate as companies compete to develop next-generation wound therapy solutions that offer superior clinical outcomes.

Regulatory harmonization across European countries creates more predictable market conditions while maintaining high safety and efficacy standards. The European Medical Device Regulation provides consistent framework for wound therapy device approval and market access. Regulatory clarity supports increased investment in research and development activities focused on European market requirements.

Healthcare delivery transformation influences wound therapy device design and application as European systems emphasize value-based care models. Providers increasingly evaluate wound care technologies based on total cost of ownership and patient outcome improvements rather than initial purchase costs. Market dynamics favor devices that demonstrate clear clinical and economic benefits through comprehensive outcome measurement.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the European wound therapy devices market. Primary research activities include extensive interviews with healthcare providers, wound care specialists, and medical device manufacturers across major European countries. Data collection encompasses both quantitative market metrics and qualitative insights regarding technology adoption patterns and clinical preferences.

Secondary research incorporates analysis of published clinical studies, regulatory filings, company financial reports, and industry publications to validate primary research findings. Healthcare databases and medical literature provide essential information regarding wound care treatment protocols and device utilization patterns. Market intelligence gathering includes monitoring of patent filings, product launches, and competitive developments across the European wound care landscape.

Statistical analysis employs advanced analytical techniques to identify market trends, growth patterns, and correlation factors influencing wound therapy device adoption. Regression analysis and predictive modeling support market forecasting and scenario development. Data validation processes ensure accuracy and reliability of market insights through cross-referencing multiple information sources and expert verification.

Regional analysis methodology incorporates country-specific healthcare system characteristics, reimbursement policies, and demographic factors that influence wound therapy device markets. Comparative analysis across European countries identifies regional variations and growth opportunities. Market segmentation analysis employs both top-down and bottom-up approaches to ensure comprehensive coverage of all relevant market categories and applications.

Western European markets dominate the regional wound therapy devices landscape, with Germany, France, and the United Kingdom representing the largest markets by treatment volume and technology adoption. These countries benefit from well-established healthcare infrastructure, comprehensive reimbursement systems, and high healthcare spending levels. Market maturity in Western Europe drives demand for increasingly sophisticated wound care technologies that offer incremental improvements over existing solutions.

Germany leads European wound therapy device adoption with approximately 24% market share, driven by its robust healthcare system and strong emphasis on evidence-based medicine. German healthcare providers demonstrate high willingness to invest in advanced wound care technologies that demonstrate superior clinical outcomes. Innovation hubs in major German cities foster collaboration between medical device manufacturers and clinical researchers.

Nordic countries including Sweden, Norway, and Denmark show exceptional adoption rates for digital health-integrated wound therapy devices. These markets prioritize technology solutions that support efficient healthcare delivery and patient self-management. Healthcare digitization initiatives in Nordic countries create favorable conditions for smart wound care device adoption.

Eastern European markets demonstrate rapid growth potential as healthcare systems modernize and increase spending on advanced medical technologies. Countries such as Poland, Czech Republic, and Hungary show increasing demand for wound therapy devices as healthcare standards rise. EU integration facilitates technology transfer and knowledge sharing that accelerates market development in these regions.

Southern European countries including Italy and Spain face unique challenges related to healthcare budget constraints but show growing interest in cost-effective wound therapy solutions. These markets prioritize devices that demonstrate clear economic benefits alongside clinical improvements. Regional healthcare variations require tailored market approaches that address specific local needs and preferences.

Market leadership in the European wound therapy devices sector features a combination of established multinational medical device companies and specialized wound care technology developers. The competitive environment emphasizes innovation, clinical evidence generation, and comprehensive product portfolios that address diverse wound care needs across European healthcare systems.

Innovation strategies among leading companies focus on developing smart wound care technologies that integrate digital health capabilities with traditional wound management approaches. Companies invest heavily in clinical research to generate evidence supporting superior outcomes and cost-effectiveness of their wound therapy devices.

Product-based segmentation reveals diverse categories within the European wound therapy devices market, each addressing specific clinical needs and treatment protocols. Advanced wound dressings represent the largest segment, encompassing hydrocolloid, hydrogel, foam, and alginate-based products designed for various wound types and healing stages.

By Product Type:

By Wound Type:

By End User:

Advanced wound dressings dominate the European market due to their versatility and broad applicability across various wound types. These products incorporate sophisticated materials and active ingredients that create optimal healing environments while providing protection against infection. Innovation focus centers on developing smart dressings with integrated sensors that monitor wound conditions and alert healthcare providers to changes requiring intervention.

Negative pressure wound therapy systems show strong growth in European markets, particularly for complex wound management in hospital settings. These devices demonstrate proven efficacy in accelerating healing times and reducing complications for difficult-to-treat wounds. Technological advancement includes development of portable systems suitable for home use and integration with digital monitoring capabilities.

Bioactive healing products represent the fastest-growing segment as European healthcare providers increasingly adopt regenerative medicine approaches to wound treatment. These products include skin substitutes, growth factors, and cellular therapies that actively promote tissue regeneration. Clinical evidence supporting superior outcomes drives adoption despite higher initial costs compared to traditional wound care products.

Wound closure devices maintain steady demand driven by surgical procedure volumes and emphasis on minimizing surgical site infections. European markets show preference for devices that combine effective wound closure with antimicrobial properties. Product development focuses on biodegradable materials and devices that reduce patient discomfort while maintaining secure wound closure.

Chronic wound management applications drive the largest portion of market demand, reflecting the growing prevalence of diabetes and aging-related conditions across Europe. Healthcare providers seek comprehensive solutions that address the complex challenges associated with chronic wound healing. Treatment protocols increasingly emphasize multidisciplinary approaches that integrate advanced devices with specialized clinical expertise.

Healthcare providers benefit significantly from advanced wound therapy devices through improved patient outcomes, reduced treatment complications, and enhanced operational efficiency. These technologies enable more effective wound management protocols that accelerate healing times and reduce the risk of infections. Clinical benefits include standardized treatment approaches that ensure consistent care quality across different healthcare settings and provider skill levels.

Patients experience substantial advantages from advanced wound therapy devices including faster healing times, reduced pain and discomfort, and improved quality of life during treatment. Modern wound care technologies often enable outpatient or home-based treatment that allows patients to maintain normal activities while receiving effective wound care. Treatment convenience and reduced healthcare facility visits represent significant patient benefits that drive market demand.

Healthcare systems realize economic benefits through reduced total cost of care when utilizing advanced wound therapy devices. Despite higher initial costs, these technologies often reduce overall treatment expenses through shorter healing times, fewer complications, and decreased hospital readmissions. Resource optimization enables healthcare systems to treat more patients effectively while controlling costs and improving care quality.

Medical device manufacturers benefit from growing market demand and opportunities for innovation in wound care technology development. The European market provides substantial revenue potential for companies that can develop effective solutions addressing unmet clinical needs. Competitive advantages accrue to manufacturers that invest in research and development to create next-generation wound therapy devices with superior clinical and economic outcomes.

Research institutions and clinical investigators benefit from collaboration opportunities with industry partners developing innovative wound care technologies. Academic medical centers play crucial roles in clinical validation and evidence generation that supports regulatory approval and market adoption. Knowledge advancement in wound healing science creates opportunities for breakthrough discoveries that benefit all stakeholders.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart wound monitoring emerges as a transformative trend in European wound therapy devices, with manufacturers developing sensors and connectivity features that enable real-time wound assessment. These technologies provide healthcare providers with continuous data regarding wound healing progress, infection risks, and treatment effectiveness. Digital integration supports more precise treatment protocols and enables early intervention when complications arise.

Bioactive healing enhancement represents a significant trend toward incorporating active biological components into wound therapy devices. Growth factors, antimicrobial peptides, and cellular therapy elements are being integrated into advanced wound dressings and treatment systems. Regenerative medicine approaches gain traction as European healthcare providers seek solutions that actively promote tissue repair rather than simply protecting wounds.

Personalized wound care protocols are emerging as healthcare providers recognize that individual patient characteristics significantly influence healing outcomes. Genetic factors, comorbidities, and wound-specific parameters inform customized treatment approaches. Precision medicine principles are being applied to wound care through biomarker analysis and patient-specific treatment optimization.

Sustainability focus influences wound therapy device development as European healthcare systems prioritize environmentally responsible medical technologies. Manufacturers are developing biodegradable wound care products and implementing sustainable packaging solutions. Environmental considerations increasingly influence procurement decisions across European healthcare networks.

Home healthcare integration drives development of wound therapy devices suitable for patient self-management and caregiver administration. User-friendly designs and simplified application procedures enable effective wound care delivery outside traditional healthcare facilities. Patient empowerment through accessible wound care technologies supports healthcare system efficiency while improving patient satisfaction.

Regulatory milestone achievements include successful implementation of the European Medical Device Regulation, creating harmonized standards for wound therapy device approval and market access. This regulatory framework enhances patient safety while providing clear pathways for innovation. Compliance requirements drive manufacturers to invest in comprehensive clinical evidence generation and quality management systems.

Technology breakthrough announcements feature development of artificial intelligence-powered wound assessment systems that analyze digital images to predict healing outcomes and recommend treatment modifications. These systems support clinical decision-making and enable more precise wound management protocols. AI integration represents a significant advancement in wound care technology capabilities.

Strategic partnerships between medical device manufacturers and digital health companies accelerate development of connected wound care solutions. These collaborations combine traditional wound therapy expertise with advanced digital technologies. Innovation ecosystems emerge as companies recognize the benefits of collaborative development approaches.

Clinical evidence publications demonstrate superior outcomes achieved with advanced wound therapy devices compared to traditional treatment methods. Large-scale clinical studies provide robust data supporting the adoption of innovative wound care technologies. Evidence generation continues as manufacturers invest in comprehensive clinical research programs.

Market expansion activities include entry of established medical device companies into specialized wound care segments and acquisition of innovative wound therapy technology developers. Industry consolidation creates larger companies with comprehensive wound care portfolios and enhanced research capabilities.

Investment priorities should focus on developing wound therapy devices that integrate digital health capabilities with proven clinical effectiveness. European healthcare providers increasingly value technologies that support remote patient monitoring and telemedicine applications. MarkWide Research analysis indicates that connected wound care devices show superior adoption rates compared to traditional standalone products.

Market entry strategies for new participants should emphasize clinical evidence generation and regulatory compliance as essential prerequisites for European market success. Healthcare providers require comprehensive data demonstrating superior outcomes before adopting new wound therapy technologies. Evidence-based approaches to product development and marketing prove most effective in European markets.

Geographic expansion opportunities exist in Eastern European countries where healthcare systems are modernizing and increasing spending on advanced medical technologies. These markets offer significant growth potential for companies that can adapt their products to local healthcare needs and economic conditions. Regional customization strategies should address specific market characteristics and reimbursement environments.

Technology development should prioritize sustainability and environmental responsibility as European healthcare systems increasingly consider environmental impact in procurement decisions. Biodegradable materials and sustainable manufacturing processes create competitive advantages. Green innovation aligns with European Union environmental policies and healthcare system sustainability goals.

Partnership strategies should focus on collaboration with clinical research institutions and healthcare providers to generate robust evidence supporting product effectiveness. Academic partnerships facilitate clinical validation and provide credibility that supports market adoption. Collaborative approaches to innovation and evidence generation prove most successful in European healthcare markets.

Market trajectory for European wound therapy devices remains highly positive, with continued growth expected across all major product categories and geographic regions. Demographic trends, technological advancement, and healthcare system evolution create favorable conditions for sustained market expansion. Growth projections indicate the market will maintain robust expansion with a compound annual growth rate exceeding 6% through the forecast period.

Technology evolution will continue transforming wound care delivery through integration of artificial intelligence, advanced materials science, and personalized medicine approaches. Smart wound monitoring systems and bioactive healing enhancement technologies represent the future of wound therapy devices. Innovation acceleration is expected as companies invest heavily in research and development to maintain competitive positions.

Healthcare delivery transformation toward value-based care models will favor wound therapy devices that demonstrate clear clinical and economic benefits. European healthcare systems will increasingly evaluate technologies based on total cost of ownership and patient outcome improvements. Value demonstration becomes critical for market success as healthcare providers seek technologies that optimize both clinical and economic outcomes.

Regulatory landscape evolution will continue emphasizing patient safety while supporting innovation through streamlined approval processes for breakthrough technologies. European regulatory harmonization facilitates market access while maintaining high safety standards. MWR projections suggest regulatory clarity will support increased investment in wound therapy device development.

Market consolidation is expected to continue as larger medical device companies acquire specialized wound care technology developers to build comprehensive product portfolios. Strategic partnerships and collaborations will accelerate innovation and market development. Industry structure evolution creates opportunities for both established companies and innovative startups to participate in market growth.

The Europe wound therapy devices market represents a dynamic and rapidly evolving healthcare sector with exceptional growth potential driven by demographic trends, technological innovation, and healthcare system transformation. European healthcare providers increasingly recognize the clinical and economic benefits of advanced wound care technologies, creating favorable market conditions for continued expansion.

Market fundamentals remain strong with aging population demographics, rising chronic disease prevalence, and growing emphasis on evidence-based medicine supporting sustained demand for innovative wound therapy solutions. The region’s sophisticated healthcare infrastructure and regulatory frameworks provide stable foundations for market development while ensuring high safety and efficacy standards.

Innovation opportunities abound in areas such as smart wound monitoring, bioactive healing enhancement, and personalized medicine approaches that address individual patient needs. Companies that successfully integrate digital health capabilities with proven clinical effectiveness will capture the greatest market opportunities in the evolving European healthcare landscape.

Future success in the European wound therapy devices market will depend on companies’ ability to demonstrate superior clinical outcomes, economic value, and alignment with healthcare system priorities including sustainability and patient-centered care. The market outlook remains highly positive for participants that embrace innovation while maintaining focus on evidence-based product development and comprehensive stakeholder value creation.

What is Wound Therapy Devices?

Wound therapy devices are medical instruments designed to promote healing in various types of wounds, including chronic, surgical, and traumatic wounds. These devices can include negative pressure wound therapy systems, advanced dressings, and electrical stimulation devices.

What are the key players in the Europe Wound Therapy Devices Market?

Key players in the Europe Wound Therapy Devices Market include Smith & Nephew, Mölnlycke Health Care, and ConvaTec, among others. These companies are known for their innovative products and extensive distribution networks across Europe.

What are the main drivers of the Europe Wound Therapy Devices Market?

The main drivers of the Europe Wound Therapy Devices Market include the increasing prevalence of chronic wounds, a growing aging population, and advancements in wound care technologies. Additionally, rising healthcare expenditures are contributing to market growth.

What challenges does the Europe Wound Therapy Devices Market face?

The Europe Wound Therapy Devices Market faces challenges such as high costs associated with advanced wound care technologies and stringent regulatory requirements. Additionally, the availability of alternative treatment options can hinder market growth.

What opportunities exist in the Europe Wound Therapy Devices Market?

Opportunities in the Europe Wound Therapy Devices Market include the development of innovative products tailored for specific wound types and the expansion of telehealth services for wound management. Furthermore, increasing awareness of advanced wound care solutions presents significant growth potential.

What trends are shaping the Europe Wound Therapy Devices Market?

Trends shaping the Europe Wound Therapy Devices Market include the integration of smart technology in wound care devices, the rise of personalized medicine, and a focus on sustainability in product development. These trends are driving innovation and improving patient outcomes.

Europe Wound Therapy Devices Market

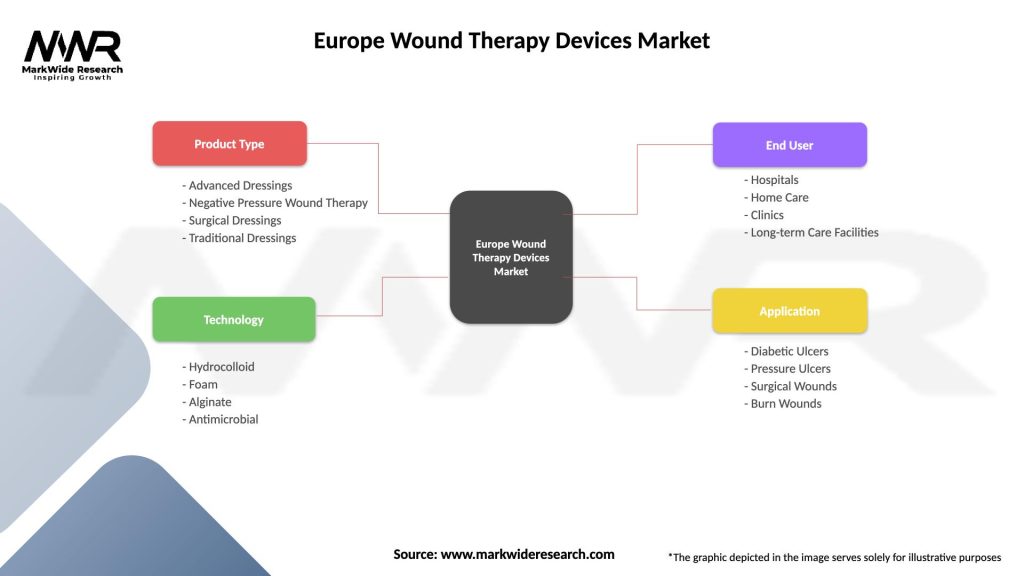

| Segmentation Details | Description |

|---|---|

| Product Type | Advanced Dressings, Negative Pressure Wound Therapy, Surgical Dressings, Traditional Dressings |

| Technology | Hydrocolloid, Foam, Alginate, Antimicrobial |

| End User | Hospitals, Home Care, Clinics, Long-term Care Facilities |

| Application | Diabetic Ulcers, Pressure Ulcers, Surgical Wounds, Burn Wounds |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Wound Therapy Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at