444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe wire and cable market represents a cornerstone of the continent’s industrial infrastructure, serving as the backbone for power transmission, telecommunications, and data connectivity across diverse sectors. This comprehensive market encompasses a vast array of products ranging from low-voltage residential cables to high-voltage transmission lines that power entire cities. European manufacturers have established themselves as global leaders in wire and cable technology, driven by stringent quality standards, environmental regulations, and continuous innovation in materials science.

Market dynamics in Europe are characterized by robust demand from renewable energy projects, smart grid implementations, and the ongoing digital transformation across industries. The region’s commitment to achieving carbon neutrality by 2050 has significantly boosted investments in renewable energy infrastructure, creating substantial opportunities for specialized cables designed for wind farms, solar installations, and energy storage systems. Growth rates in the renewable energy cable segment are particularly impressive, with solar cable applications experiencing 12.5% annual growth driven by ambitious photovoltaic deployment targets.

Industrial automation and the Internet of Things (IoT) revolution have further amplified demand for high-performance cables capable of handling increased data loads and providing reliable connectivity in harsh industrial environments. The automotive sector’s transition toward electric vehicles has created new market segments, with EV charging infrastructure requiring specialized high-power cables that can safely handle rapid charging protocols while maintaining durability under frequent use.

The Europe wire and cable market refers to the comprehensive ecosystem of manufacturers, suppliers, and distributors involved in producing and delivering electrical conductors and communication cables across European nations. This market encompasses various product categories including power cables, control cables, communication cables, and specialty cables designed for specific industrial applications. Wire and cable systems serve as the fundamental infrastructure enabling electricity transmission, data communication, and signal processing across residential, commercial, and industrial sectors throughout Europe.

Market participants range from multinational corporations with extensive manufacturing capabilities to specialized regional players focusing on niche applications. The European market is distinguished by its emphasis on quality, safety standards, and environmental compliance, with products required to meet stringent CE marking requirements and various international standards such as IEC, EN, and VDE specifications.

Europe’s wire and cable market demonstrates remarkable resilience and growth potential, supported by massive infrastructure investments, renewable energy expansion, and digital transformation initiatives across the continent. The market benefits from Europe’s position as a global leader in manufacturing excellence, with companies consistently investing in research and development to maintain competitive advantages in high-value segments.

Key growth drivers include the European Green Deal’s ambitious climate targets, which have accelerated investments in renewable energy infrastructure requiring specialized cables for offshore wind farms, solar installations, and grid modernization projects. The telecommunications sector continues expanding fiber optic networks to support 5G deployment and increased bandwidth demands, with fiber cable installations growing at 8.3% annually across major European markets.

Regional variations within Europe create diverse market opportunities, with Northern European countries leading in offshore wind cable demand, while Southern Europe focuses on solar energy infrastructure. Eastern European markets are experiencing rapid industrialization and infrastructure development, creating substantial demand for power and control cables in manufacturing and construction applications.

Strategic insights reveal several critical trends shaping the European wire and cable landscape:

Primary market drivers propelling the European wire and cable market include the continent’s ambitious renewable energy targets and massive infrastructure modernization programs. The European Union’s commitment to achieving climate neutrality by 2050 has triggered unprecedented investments in clean energy projects, with offshore wind capacity alone expected to increase dramatically over the next decade. These projects require sophisticated submarine cables capable of transmitting power efficiently across vast distances while withstanding harsh marine environments.

Digital transformation initiatives across industries are creating substantial demand for high-performance communication cables. The rollout of 5G networks requires extensive fiber optic infrastructure, with telecommunications companies investing billions in network upgrades. Data center construction is accelerating to support cloud computing growth, creating demand for specialized cables that can handle increased power loads while maintaining optimal thermal performance.

Electrification trends in transportation are driving demand for EV charging infrastructure cables. European governments are mandating extensive charging network deployment, with targets calling for millions of charging points by 2030. This infrastructure requires specialized cables capable of handling high-power fast charging while maintaining safety and reliability standards. Industrial automation continues expanding as manufacturers adopt Industry 4.0 technologies, requiring cables that support advanced communication protocols and real-time data transmission.

Significant market restraints include volatile raw material costs, particularly copper and aluminum prices, which directly impact manufacturing costs and profit margins. Supply chain disruptions have created challenges in securing consistent material supplies, leading to production delays and increased costs. The complexity of European regulatory requirements across different countries creates compliance challenges for manufacturers, particularly smaller companies lacking extensive regulatory expertise.

Environmental regulations while driving innovation, also impose additional costs through requirements for eco-friendly materials and manufacturing processes. The transition away from traditional materials like PVC in certain applications requires significant research and development investments. Competition from low-cost manufacturers in emerging markets puts pressure on European producers, particularly in commodity cable segments where differentiation is limited.

Installation challenges in densely populated urban areas create project delays and increased costs. Obtaining permits for cable installations, particularly underground projects, can be time-consuming and expensive. Skilled labor shortages in the electrical and telecommunications sectors impact project execution timelines and quality standards.

Emerging opportunities in the European wire and cable market are substantial, driven by the continent’s leadership in sustainable technology adoption and infrastructure modernization. The offshore wind sector presents exceptional growth potential, with European waters hosting some of the world’s largest wind farms requiring sophisticated submarine cable systems. Grid modernization projects across Europe create opportunities for smart cable solutions that integrate monitoring and diagnostic capabilities.

Electric vehicle infrastructure represents a rapidly expanding market segment, with European governments mandating extensive charging network deployment. This creates demand for specialized high-power cables designed for outdoor installations and frequent use. Data center expansion continues accelerating, driven by cloud computing growth and edge computing requirements, creating opportunities for high-performance data cables with superior thermal management properties.

Industrial IoT applications are creating demand for cables that support multiple communication protocols while providing power delivery. The integration of artificial intelligence in manufacturing processes requires cables capable of handling increased data loads with minimal latency. Building automation systems present opportunities for integrated cabling solutions that support multiple building systems through unified infrastructure.

Market dynamics in the European wire and cable sector are characterized by intense competition among established manufacturers and emerging technology companies. Innovation cycles are accelerating as companies invest heavily in research and development to create products that meet evolving customer requirements for higher performance, environmental sustainability, and cost-effectiveness.

Consolidation trends are evident as larger companies acquire specialized manufacturers to expand their product portfolios and geographic reach. This consolidation enables companies to offer comprehensive solutions while achieving economies of scale in manufacturing and distribution. Vertical integration strategies are becoming more common as companies seek to control their supply chains and reduce dependency on external suppliers.

Technology convergence is creating new product categories that combine power and communication capabilities in single cable systems. This trend is particularly evident in industrial applications where space constraints and installation costs favor integrated solutions. Sustainability initiatives are driving development of cables using recycled materials and bio-based compounds, with some manufacturers achieving 35% reduction in carbon footprint through innovative material choices.

Comprehensive research methodology employed in analyzing the European wire and cable market incorporates multiple data collection approaches to ensure accuracy and reliability. Primary research involves extensive interviews with industry executives, technical specialists, and procurement managers across various end-user industries. These interviews provide insights into current market conditions, future requirements, and technology trends that may not be captured through secondary sources.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, and regulatory documents from European standards organizations. Market modeling techniques incorporate historical data analysis, trend extrapolation, and scenario planning to project future market developments under various economic and regulatory conditions.

Data validation processes include cross-referencing information from multiple sources and conducting follow-up interviews to verify key findings. Regional analysis considers country-specific factors including regulatory environments, infrastructure development plans, and economic conditions that influence market dynamics. According to MarkWide Research analysis, this comprehensive approach ensures robust market intelligence that accurately reflects current conditions and future opportunities.

Regional market dynamics across Europe reveal significant variations in demand patterns, growth rates, and technology adoption. Germany maintains its position as the largest market, driven by extensive industrial automation, renewable energy investments, and robust automotive manufacturing. The country’s Energiewende program continues driving demand for grid infrastructure cables, with smart grid investments accounting for 22% of total cable demand in the power sector.

United Kingdom presents substantial opportunities in offshore wind cable applications, with ambitious targets for offshore wind capacity expansion. The country’s focus on becoming a global leader in offshore wind technology creates demand for specialized submarine cables and offshore platform connections. France demonstrates strong growth in nuclear power infrastructure modernization and renewable energy integration, requiring specialized cables for harsh radiation environments and grid interconnection projects.

Nordic countries including Norway, Sweden, and Denmark lead in offshore wind development and smart grid implementation. These markets demonstrate high adoption rates for advanced cable technologies, with Norway’s hydroelectric infrastructure requiring specialized cables for harsh mountain environments. Eastern European markets including Poland, Czech Republic, and Hungary are experiencing rapid industrialization, creating substantial demand for power and control cables in manufacturing facilities and infrastructure projects.

Competitive landscape in the European wire and cable market features a mix of multinational corporations, regional specialists, and emerging technology companies. Market leaders have established strong positions through comprehensive product portfolios, extensive distribution networks, and significant investments in research and development.

Strategic partnerships and joint ventures are common as companies seek to combine complementary capabilities and access new markets. Innovation focus areas include sustainable materials, smart cable technologies, and specialized applications for emerging industries such as offshore wind and electric vehicle infrastructure.

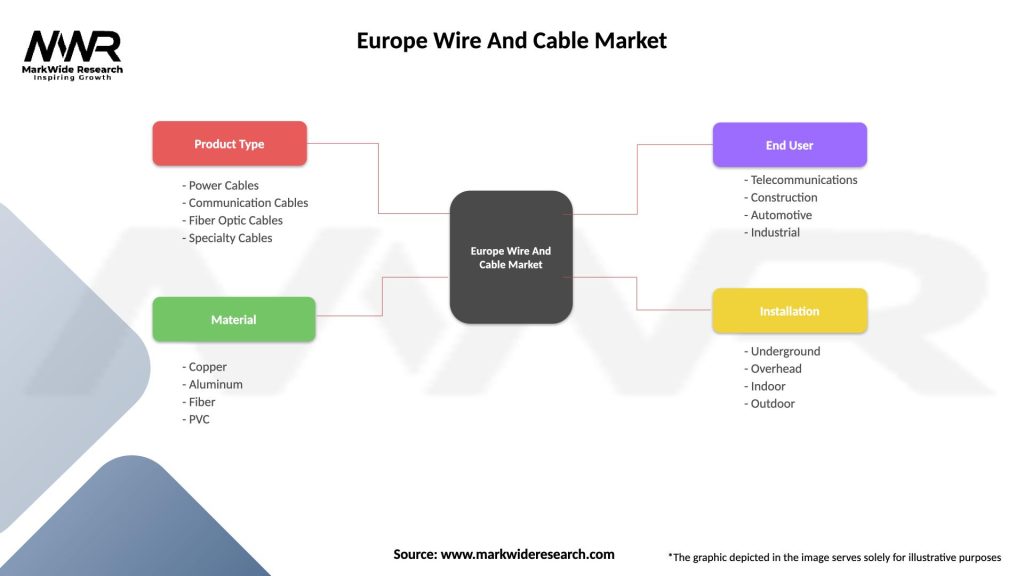

Market segmentation reveals diverse product categories and application areas within the European wire and cable market. By Product Type:

By Application Sector:

Power cable segment dominates the European market, driven by extensive grid modernization projects and renewable energy integration. High-voltage transmission cables are experiencing particularly strong demand as utilities upgrade aging infrastructure and connect remote renewable energy sources to population centers. Submarine power cables represent a high-value niche with significant growth potential, as offshore wind projects require sophisticated underwater transmission systems.

Communication cables segment is experiencing rapid growth driven by 5G network deployment and increased bandwidth requirements. Fiber optic cables are seeing exceptional demand, with installations growing at 9.7% annually as telecommunications companies expand network capacity. Data center applications require specialized cables with superior thermal management and high-density configurations to support increasing server densities.

Control cables benefit from industrial automation trends and Industry 4.0 implementations. These applications require cables that can handle multiple communication protocols while providing reliable performance in harsh industrial environments. Specialty cable segments including marine, aerospace, and medical applications command premium pricing due to stringent performance requirements and specialized manufacturing processes.

Industry participants in the European wire and cable market benefit from several competitive advantages and growth opportunities. Manufacturers gain access to sophisticated end-user markets with high-quality requirements and willingness to pay premium prices for superior performance. The European market’s emphasis on quality and reliability creates opportunities for differentiation through advanced materials, innovative designs, and comprehensive service offerings.

Technology providers benefit from Europe’s leadership in renewable energy and industrial automation, creating demand for cutting-edge cable solutions. The region’s stringent environmental regulations drive innovation in sustainable materials and manufacturing processes, providing early-mover advantages in global markets. Distribution partners benefit from stable demand patterns and long-term customer relationships in infrastructure-focused industries.

End-user stakeholders including utilities, telecommunications companies, and industrial manufacturers benefit from access to world-class cable technologies that enhance system reliability and performance. Investment opportunities exist throughout the value chain, from raw material suppliers to specialized installation services, with particularly strong prospects in renewable energy and digital infrastructure segments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability trends are fundamentally reshaping the European wire and cable market, with manufacturers increasingly adopting eco-friendly materials and production processes. Circular economy principles are driving development of recyclable cable designs and take-back programs for end-of-life products. Companies are achieving significant reductions in environmental impact, with some manufacturers reporting 40% reduction in carbon footprint through innovative material choices and energy-efficient production methods.

Smart cable technologies are emerging as a significant trend, with cables incorporating sensors and communication capabilities for real-time monitoring and diagnostics. These intelligent systems can detect potential failures before they occur, reducing maintenance costs and improving system reliability. Digitalization of manufacturing processes is enhancing quality control and enabling mass customization of cable products to meet specific customer requirements.

Modular cable systems are gaining popularity in industrial applications, allowing for easier installation, maintenance, and reconfiguration. These systems reduce installation time and costs while providing flexibility for future modifications. High-temperature superconducting cables are being developed for specialized applications requiring extremely high power density and minimal losses, particularly in urban power distribution systems where space is limited.

Recent industry developments highlight the dynamic nature of the European wire and cable market. Major infrastructure projects including the North Sea Wind Power Hub and various interconnector projects are driving demand for advanced submarine cable systems. These projects require cables capable of transmitting power over hundreds of kilometers with minimal losses while withstanding harsh marine environments.

Technology partnerships between cable manufacturers and technology companies are accelerating innovation in smart cable systems and IoT integration. MWR data indicates that collaborative research projects have increased by 28% annually as companies seek to develop next-generation cable solutions for emerging applications.

Manufacturing capacity expansions are occurring across Europe as companies respond to growing demand from renewable energy and telecommunications sectors. Several manufacturers have announced significant investments in new production facilities and equipment upgrades to support specialized cable production. Acquisition activities continue as larger companies seek to expand their technological capabilities and market reach through strategic purchases of specialized manufacturers.

Strategic recommendations for market participants include focusing on high-value specialty segments where European manufacturers can leverage their technological advantages and quality reputation. Investment priorities should emphasize renewable energy applications, particularly offshore wind and grid interconnection projects that require sophisticated cable solutions.

Innovation focus areas should include sustainable materials, smart cable technologies, and integrated power-communication systems that address evolving customer needs. Companies should consider partnerships with technology providers to accelerate development of IoT-enabled cable systems and predictive maintenance capabilities. Geographic expansion into Eastern European markets presents opportunities for growth, particularly in industrial automation and infrastructure development segments.

Operational excellence initiatives should focus on supply chain optimization and raw material cost management to maintain competitiveness against low-cost producers. Customer relationship management becomes increasingly important as projects become more complex and require comprehensive technical support throughout the product lifecycle.

Future prospects for the European wire and cable market remain highly positive, supported by massive infrastructure investments and technological transformation across multiple industries. Renewable energy expansion will continue driving demand for specialized cables, with offshore wind projects alone requiring substantial submarine cable installations over the next decade. The European Green Deal’s ambitious targets ensure sustained investment in clean energy infrastructure.

Digital transformation will accelerate demand for high-performance communication cables as 5G networks expand and edge computing requirements increase. Industrial automation trends will create opportunities for cables that support Industry 4.0 applications with enhanced connectivity and monitoring capabilities. According to MarkWide Research projections, the industrial cable segment is expected to grow at 6.8% CAGR driven by automation investments.

Electric vehicle infrastructure development will create substantial new market segments, with charging network expansion requiring specialized high-power cables designed for outdoor installations and frequent use. Smart grid implementations will drive demand for intelligent cable systems that integrate monitoring and communication capabilities, enabling more efficient power distribution and grid management.

The European wire and cable market stands at the forefront of global infrastructure transformation, driven by ambitious sustainability goals, digital revolution, and technological innovation. The market’s strength lies in its combination of manufacturing excellence, technological leadership, and access to sophisticated end-user markets that value quality and performance over price alone.

Growth opportunities are substantial across multiple segments, from renewable energy infrastructure to industrial automation and telecommunications. The market’s evolution toward smart, sustainable, and high-performance cable solutions positions European manufacturers to maintain their competitive advantages while addressing emerging global challenges. Strategic focus on innovation, sustainability, and customer partnership will be essential for success in this dynamic and rapidly evolving market landscape.

What is Wire And Cable?

Wire and cable refer to electrical conductors used for transmitting power and signals. They are essential components in various applications, including telecommunications, construction, and automotive industries.

What are the key players in the Europe Wire And Cable Market?

Key players in the Europe Wire And Cable Market include Nexans, Prysmian Group, and General Cable, among others. These companies are known for their extensive product offerings and innovations in wire and cable technology.

What are the main drivers of the Europe Wire And Cable Market?

The main drivers of the Europe Wire And Cable Market include the growing demand for renewable energy solutions, advancements in telecommunications infrastructure, and the increasing need for efficient electrical systems in various industries.

What challenges does the Europe Wire And Cable Market face?

The Europe Wire And Cable Market faces challenges such as fluctuating raw material prices, stringent regulatory standards, and competition from alternative technologies. These factors can impact production costs and market dynamics.

What opportunities exist in the Europe Wire And Cable Market?

Opportunities in the Europe Wire And Cable Market include the expansion of smart grid technologies, increased investment in electric vehicle infrastructure, and the rising demand for high-performance cables in industrial applications.

What trends are shaping the Europe Wire And Cable Market?

Trends shaping the Europe Wire And Cable Market include the shift towards sustainable materials, the integration of IoT in cable management systems, and the development of lightweight and flexible cables for various applications.

Europe Wire And Cable Market

| Segmentation Details | Description |

|---|---|

| Product Type | Power Cables, Communication Cables, Fiber Optic Cables, Specialty Cables |

| Material | Copper, Aluminum, Fiber, PVC |

| End User | Telecommunications, Construction, Automotive, Industrial |

| Installation | Underground, Overhead, Indoor, Outdoor |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Wire And Cable Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at