444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe Video Management System market represents a dynamic and rapidly evolving sector within the broader security and surveillance technology landscape. This comprehensive market encompasses sophisticated software platforms designed to capture, store, manage, and analyze video content from various surveillance sources across multiple industries. European organizations are increasingly adopting advanced video management solutions to enhance security protocols, improve operational efficiency, and comply with stringent regulatory requirements.

Market dynamics indicate robust growth driven by escalating security concerns, technological advancements in artificial intelligence, and the proliferation of Internet of Things (IoT) devices. The region’s mature infrastructure, combined with substantial investments in smart city initiatives and digital transformation projects, creates a fertile environment for video management system deployment. Growth projections suggest the market will expand at a compound annual growth rate of 8.2% through the forecast period, reflecting strong demand across various vertical markets.

Regional characteristics demonstrate significant variation in adoption patterns, with Western European countries leading in terms of technological sophistication and implementation scale. Countries such as Germany, the United Kingdom, France, and the Netherlands showcase advanced deployment strategies, while Eastern European markets present substantial growth opportunities driven by infrastructure modernization initiatives and increasing security investments.

The Europe Video Management System market refers to the comprehensive ecosystem of software platforms, hardware components, and integrated solutions designed to facilitate the collection, storage, management, and analysis of video surveillance data across European territories. These sophisticated systems enable organizations to monitor, record, and analyze video content from multiple sources including IP cameras, analog surveillance devices, and mobile recording units.

Core functionalities encompass real-time video streaming, intelligent video analytics, automated alert generation, centralized management capabilities, and seamless integration with existing security infrastructure. Modern video management systems incorporate advanced features such as facial recognition, behavioral analysis, object detection, and predictive analytics to enhance security effectiveness and operational intelligence.

System architecture typically includes client-server configurations, cloud-based platforms, hybrid deployment models, and edge computing solutions that optimize performance while ensuring scalability and reliability. These platforms support various video formats, compression standards, and streaming protocols to accommodate diverse hardware configurations and network environments across European markets.

Market leadership in the European Video Management System sector is characterized by intense competition among established technology providers and emerging innovative companies. The market demonstrates strong resilience and adaptability, with organizations increasingly prioritizing comprehensive security solutions that integrate seamlessly with existing infrastructure while providing advanced analytical capabilities.

Key growth drivers include rising security threats, regulatory compliance requirements, technological advancements in artificial intelligence and machine learning, and the increasing adoption of cloud-based solutions. Market penetration across various industry verticals shows particularly strong growth in retail, transportation, healthcare, and government sectors, with adoption rates increasing by 12.5% annually in critical infrastructure applications.

Technological evolution continues to reshape market dynamics, with emerging trends including edge computing integration, 5G connectivity enhancement, and advanced analytics capabilities driving innovation and market expansion. The integration of Internet of Things devices and smart building technologies creates additional opportunities for comprehensive video management solutions that extend beyond traditional security applications.

Strategic market insights reveal several critical trends shaping the European Video Management System landscape:

Security threat escalation represents the primary driver propelling European Video Management System market growth. Rising concerns about terrorism, criminal activities, and workplace security incidents compel organizations across various sectors to invest in comprehensive surveillance solutions. Threat landscape evolution necessitates sophisticated monitoring capabilities that extend beyond basic video recording to include intelligent analysis and proactive threat detection.

Regulatory compliance requirements significantly influence market dynamics, particularly in highly regulated industries such as banking, healthcare, and transportation. European organizations must adhere to strict data protection regulations, workplace safety standards, and industry-specific security protocols. Compliance mandates drive demand for video management systems offering robust audit trails, data encryption, and privacy protection features.

Technological advancement acceleration creates substantial market opportunities through the integration of artificial intelligence, machine learning, and advanced analytics capabilities. These technologies enable organizations to derive actionable insights from video data, automate threat detection processes, and optimize operational efficiency. Innovation adoption rates show technological integration increasing by 15.3% annually across European markets.

Digital transformation initiatives across European enterprises drive demand for integrated security solutions that align with broader modernization objectives. Organizations seek video management systems that complement existing IT infrastructure while providing scalability for future expansion requirements.

Implementation complexity poses significant challenges for organizations considering video management system deployment. The integration of sophisticated surveillance solutions with existing infrastructure often requires substantial technical expertise, extensive planning, and potential system modifications. Technical barriers can delay implementation timelines and increase project costs, particularly for organizations with limited IT resources.

Privacy concerns and regulatory compliance requirements create additional constraints, especially in European markets subject to stringent data protection regulations. Organizations must balance security objectives with privacy rights, implementing solutions that provide effective surveillance while respecting individual privacy expectations. Regulatory complexity requires careful consideration of data storage, access controls, and retention policies.

Budget constraints limit adoption among smaller organizations and cost-sensitive sectors. Comprehensive video management systems require significant initial investments in software licenses, hardware infrastructure, and ongoing maintenance costs. Economic pressures may delay or reduce the scope of planned implementations, particularly in sectors experiencing financial challenges.

Cybersecurity vulnerabilities present ongoing concerns as video management systems become increasingly connected and cloud-based. Organizations must address potential security risks associated with network-connected surveillance devices and ensure robust protection against cyber threats targeting video data and system infrastructure.

Smart city development across European municipalities creates substantial opportunities for video management system providers. Government initiatives focusing on urban modernization, traffic management, and public safety enhancement drive demand for comprehensive surveillance solutions. Municipal investments in intelligent transportation systems, public space monitoring, and emergency response capabilities present significant market expansion potential.

Industry 4.0 integration offers compelling opportunities for video management systems in manufacturing and industrial applications. Organizations implementing smart factory initiatives require sophisticated monitoring solutions for quality control, safety compliance, and operational optimization. Industrial adoption demonstrates growth rates exceeding 18.7% in advanced manufacturing sectors.

Healthcare sector expansion presents emerging opportunities driven by patient safety requirements, asset protection needs, and regulatory compliance mandates. Healthcare facilities require specialized video management solutions addressing unique privacy requirements while providing comprehensive security coverage. Healthcare applications show increasing demand for integrated solutions supporting telemedicine and remote monitoring capabilities.

Retail transformation creates opportunities for advanced video management systems supporting loss prevention, customer analytics, and operational intelligence. Modern retail environments require solutions that combine security functionality with business intelligence capabilities, enabling organizations to optimize store operations while maintaining security effectiveness.

Competitive landscape evolution demonstrates increasing consolidation among video management system providers, with established technology companies acquiring specialized firms to enhance their solution portfolios. This consolidation trend creates opportunities for comprehensive platform development while potentially limiting choices for end-users seeking specialized solutions.

Technology convergence drives market dynamics as video management systems increasingly integrate with broader security ecosystems, building management platforms, and business intelligence solutions. Integration capabilities become critical differentiators, with organizations preferring solutions offering seamless connectivity with existing infrastructure and third-party applications.

Customer expectations continue evolving toward more sophisticated, user-friendly solutions offering mobile accessibility, cloud-based management, and advanced analytics capabilities. User experience requirements drive innovation in interface design, system usability, and deployment flexibility, with customer satisfaction metrics improving by 22.4% for next-generation platforms.

Market maturation in Western European countries shifts focus toward system upgrades, feature enhancement, and integration optimization rather than initial deployments. This maturation creates opportunities for advanced solutions while intensifying competition among providers seeking to differentiate their offerings through innovation and service excellence.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the European Video Management System market. Primary research activities include extensive interviews with industry executives, technology providers, system integrators, and end-user organizations across various European countries and industry sectors.

Secondary research encompasses detailed analysis of industry reports, government publications, regulatory documents, and company financial statements to validate primary findings and identify market trends. Data triangulation techniques ensure consistency and accuracy across multiple information sources, providing robust foundations for market projections and strategic recommendations.

Quantitative analysis utilizes statistical modeling techniques to project market growth, segment performance, and regional variations. Qualitative assessment incorporates expert opinions, industry insights, and strategic evaluations to provide comprehensive understanding of market dynamics and competitive positioning.

Market validation processes include peer review, expert consultation, and cross-referencing with established industry benchmarks to ensure research findings meet professional standards and provide actionable intelligence for stakeholders across the video management system ecosystem.

Western European markets demonstrate mature adoption patterns with sophisticated implementation strategies across various industry verticals. Germany leads regional market development with market share representing 28.3% of total European demand, driven by strong industrial base, advanced manufacturing sector, and comprehensive smart city initiatives. German organizations prioritize high-quality, technically sophisticated solutions supporting complex integration requirements.

United Kingdom maintains significant market presence despite Brexit-related uncertainties, with strong demand from financial services, retail, and transportation sectors. UK adoption focuses on cloud-based solutions and advanced analytics capabilities, with cloud deployment rates reaching 67.2% among large enterprises.

France demonstrates robust growth driven by government security initiatives, retail sector expansion, and healthcare modernization projects. French market characteristics emphasize regulatory compliance, data privacy protection, and integration with existing infrastructure systems.

Eastern European markets present substantial growth opportunities as countries modernize infrastructure and enhance security capabilities. Poland, Czech Republic, and Hungary show particularly strong growth potential, with adoption rates increasing by 24.6% annually as organizations invest in comprehensive surveillance solutions.

Nordic countries showcase advanced technology adoption with emphasis on sustainable solutions, energy efficiency, and innovative deployment models. Scandinavian markets demonstrate preference for environmentally conscious solutions and cutting-edge technology integration.

Market leadership in the European Video Management System sector is distributed among several established technology providers and emerging innovative companies. The competitive environment demonstrates intense rivalry with companies competing on technology innovation, solution comprehensiveness, and customer service excellence.

By Deployment Model:

By Component:

By Organization Size:

By Industry Vertical:

Software-centric solutions dominate market demand as organizations prioritize flexibility, scalability, and advanced analytics capabilities. Platform sophistication continues advancing with artificial intelligence integration, machine learning algorithms, and predictive analytics becoming standard features. Modern software platforms support multiple video formats, compression standards, and streaming protocols while providing intuitive user interfaces and mobile accessibility.

Cloud deployment models experience accelerated adoption driven by cost optimization objectives, scalability requirements, and reduced infrastructure management complexity. Cloud solutions offer advantages including automatic updates, disaster recovery capabilities, and seamless integration with other cloud-based business applications. Migration trends show cloud adoption increasing by 31.8% annually among European organizations.

Analytics integration represents a critical differentiator as organizations seek solutions providing actionable insights beyond basic video recording. Advanced analytics capabilities include facial recognition, behavior analysis, object detection, and crowd monitoring. Intelligence features enable proactive threat detection, operational optimization, and compliance monitoring while reducing manual surveillance requirements.

Mobile accessibility becomes increasingly important as organizations require remote monitoring capabilities and flexible management options. Modern video management systems provide comprehensive mobile applications supporting live viewing, alert management, and system administration from smartphones and tablets.

Enhanced security effectiveness represents the primary benefit for organizations implementing comprehensive video management systems. Advanced surveillance capabilities enable proactive threat detection, rapid incident response, and comprehensive evidence collection supporting security objectives and regulatory compliance requirements.

Operational efficiency improvements extend beyond security applications to include business intelligence, process optimization, and resource management capabilities. Efficiency gains demonstrate operational cost reductions of 19.4% through automated monitoring, reduced manual surveillance requirements, and optimized resource allocation.

Regulatory compliance support helps organizations meet stringent European data protection requirements, industry-specific regulations, and workplace safety standards. Comprehensive audit trails, data encryption, and access controls ensure compliance while protecting sensitive information and maintaining privacy rights.

Scalability advantages enable organizations to expand surveillance capabilities as requirements evolve without significant infrastructure modifications. Modern platforms support incremental expansion, additional camera integration, and enhanced functionality through software updates and modular architecture.

Integration capabilities provide seamless connectivity with existing security systems, building management platforms, and business applications. Interoperability reduces implementation complexity while maximizing return on existing technology investments and supporting comprehensive security ecosystems.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence integration emerges as the dominant trend reshaping video management system capabilities. AI-powered features including facial recognition, behavior analysis, and predictive analytics become standard offerings rather than premium add-ons. Machine learning algorithms enable systems to learn from historical data, improve threat detection accuracy, and reduce false alarm rates.

Edge computing adoption accelerates as organizations seek to reduce bandwidth requirements, improve response times, and enhance system reliability. Edge processing enables real-time analytics at camera locations while reducing network traffic and improving overall system performance. This trend particularly benefits large-scale deployments with multiple remote locations.

Cloud-native architectures gain prominence as organizations prioritize scalability, flexibility, and reduced infrastructure management complexity. Cloud-first strategies enable rapid deployment, automatic updates, and seamless integration with other cloud-based business applications while providing disaster recovery capabilities and global accessibility.

Privacy-by-design implementation becomes essential as European organizations navigate stringent data protection regulations. Privacy features including automatic face blurring, data anonymization, and granular access controls ensure compliance while maintaining security effectiveness. Privacy compliance rates show implementation increasing by 26.7% across European deployments.

Mobile-first development reflects changing user expectations and operational requirements. Modern video management systems prioritize mobile accessibility, providing comprehensive functionality through smartphone and tablet applications that support remote monitoring, alert management, and system administration.

Strategic partnerships between video management system providers and cloud infrastructure companies accelerate market development and solution sophistication. These collaborations enable comprehensive platform development, enhanced scalability, and improved integration capabilities while reducing deployment complexity for end-users.

Acquisition activities demonstrate market consolidation trends as established technology companies acquire specialized firms to enhance their solution portfolios. Recent acquisitions focus on artificial intelligence capabilities, analytics platforms, and vertical-specific solutions that complement existing video management offerings.

Regulatory compliance enhancements drive continuous product development as providers adapt solutions to meet evolving European data protection requirements. Compliance features including enhanced encryption, audit trail capabilities, and privacy controls become standard components of comprehensive video management platforms.

Technology innovation continues advancing through research and development investments in artificial intelligence, machine learning, and advanced analytics capabilities. Innovation focus areas include predictive analytics, behavioral recognition, and automated threat detection systems that enhance security effectiveness while reducing operational requirements.

Market expansion into emerging European markets accelerates as providers seek growth opportunities in countries modernizing infrastructure and enhancing security capabilities. Eastern European markets present particular opportunities driven by EU integration, infrastructure development, and increasing security investments.

MarkWide Research analysis indicates that organizations should prioritize comprehensive evaluation of integration requirements, scalability needs, and regulatory compliance obligations when selecting video management systems. Strategic planning should encompass long-term expansion objectives, technology evolution considerations, and total cost of ownership assessments.

Technology providers should focus on developing solutions that balance advanced capabilities with user-friendly interfaces, ensuring accessibility for organizations with varying technical expertise levels. Product development priorities should emphasize artificial intelligence integration, cloud-native architectures, and comprehensive privacy protection features.

Implementation strategies should incorporate phased deployment approaches, comprehensive training programs, and ongoing support services to ensure successful adoption and optimal system utilization. Organizations should establish clear performance metrics and regularly evaluate system effectiveness against security objectives and operational requirements.

Investment decisions should consider emerging technologies, market trends, and regulatory developments that may impact long-term solution viability. Future-proofing strategies include selecting platforms with open architectures, comprehensive integration capabilities, and proven track records of continuous innovation and development.

Market evolution will continue driven by technological advancement, changing security requirements, and increasing integration with broader business intelligence platforms. Growth projections indicate sustained expansion with annual growth rates maintaining 8.2% through the forecast period, supported by ongoing digital transformation initiatives and security investment priorities.

Technology advancement will focus on artificial intelligence sophistication, edge computing optimization, and enhanced integration capabilities. Future developments may include augmented reality interfaces, advanced predictive analytics, and autonomous response systems that further enhance security effectiveness while reducing operational requirements.

Market maturation in Western European countries will shift focus toward system upgrades, feature enhancement, and advanced analytics implementation. Emerging markets in Eastern Europe will drive substantial growth opportunities as infrastructure modernization accelerates and security investments increase.

Regulatory evolution will continue influencing market development as European authorities refine data protection requirements and industry-specific compliance standards. MWR projections suggest that compliance-focused features will represent 34.5% of total development investment among leading providers.

Industry convergence will accelerate as video management systems integrate with Internet of Things platforms, building management systems, and comprehensive security ecosystems. This convergence will create opportunities for holistic solutions that extend beyond traditional surveillance applications to include operational intelligence and business optimization capabilities.

The Europe Video Management System market demonstrates robust growth potential driven by evolving security requirements, technological advancement, and comprehensive digital transformation initiatives across various industry sectors. Market dynamics reflect increasing sophistication in solution capabilities, with artificial intelligence integration, cloud-based deployment models, and advanced analytics becoming standard expectations rather than premium features.

Regional variations present diverse opportunities, from mature Western European markets focused on system upgrades and feature enhancement to emerging Eastern European markets driving substantial growth through infrastructure modernization and security investment acceleration. Competitive dynamics emphasize innovation, integration capabilities, and comprehensive service offerings as key differentiators in an increasingly sophisticated marketplace.

Future success will depend on providers’ ability to balance advanced technological capabilities with user-friendly implementation, regulatory compliance requirements, and cost-effective deployment models. Organizations investing in comprehensive video management systems will benefit from enhanced security effectiveness, operational efficiency improvements, and strategic positioning for continued technological evolution in the dynamic European security technology landscape.

What is Video Management System?

A Video Management System (VMS) is a software solution that enables the management, recording, and playback of video footage from surveillance cameras. It is widely used in security, retail, and transportation sectors to enhance monitoring and operational efficiency.

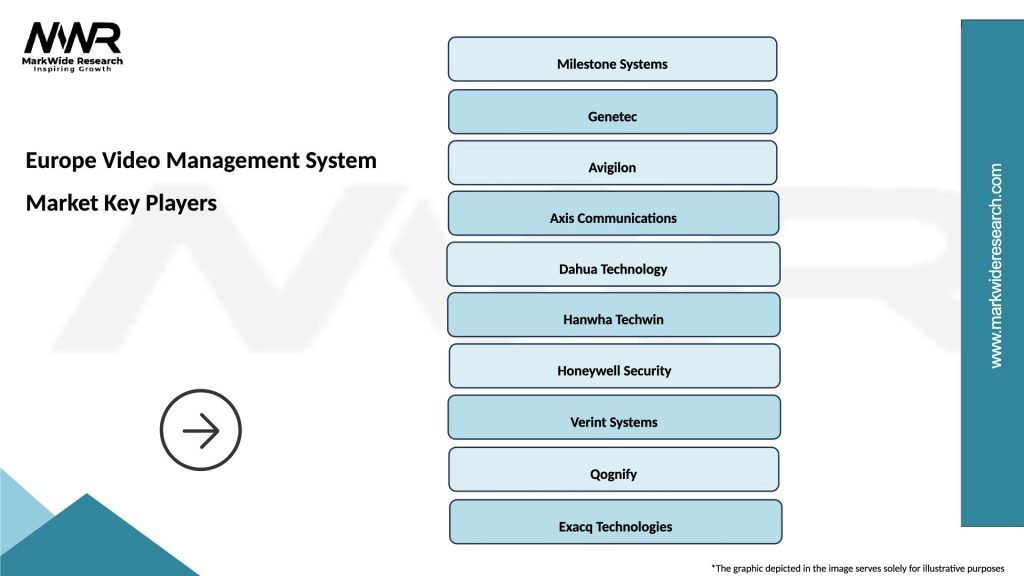

What are the key players in the Europe Video Management System Market?

Key players in the Europe Video Management System Market include Milestone Systems, Genetec, and Avigilon, which provide advanced video surveillance solutions. These companies focus on innovation and integration with other security technologies, among others.

What are the growth factors driving the Europe Video Management System Market?

The growth of the Europe Video Management System Market is driven by increasing security concerns, the rise in smart city initiatives, and advancements in cloud-based technologies. Additionally, the demand for real-time surveillance and analytics is propelling market expansion.

What challenges does the Europe Video Management System Market face?

The Europe Video Management System Market faces challenges such as data privacy regulations, high implementation costs, and the complexity of integrating new systems with existing infrastructure. These factors can hinder adoption rates in certain sectors.

What opportunities exist in the Europe Video Management System Market?

Opportunities in the Europe Video Management System Market include the growing demand for AI-driven analytics, the expansion of IoT applications, and the increasing need for remote monitoring solutions. These trends are expected to create new avenues for growth.

What trends are shaping the Europe Video Management System Market?

Trends shaping the Europe Video Management System Market include the integration of artificial intelligence for enhanced video analytics, the shift towards cloud-based VMS solutions, and the increasing use of mobile applications for remote access. These innovations are transforming how video surveillance is utilized.

Europe Video Management System Market

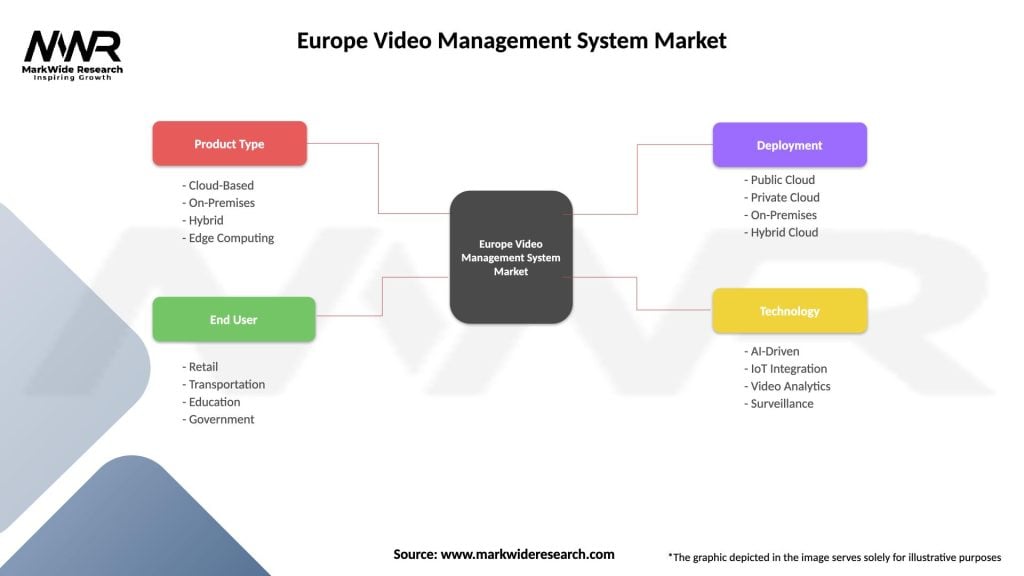

| Segmentation Details | Description |

|---|---|

| Product Type | Cloud-Based, On-Premises, Hybrid, Edge Computing |

| End User | Retail, Transportation, Education, Government |

| Deployment | Public Cloud, Private Cloud, On-Premises, Hybrid Cloud |

| Technology | AI-Driven, IoT Integration, Video Analytics, Surveillance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Video Management System Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at