444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe touch screen display market represents a dynamic and rapidly evolving technological landscape that encompasses various industries and applications across the continent. This comprehensive market analysis reveals significant growth momentum driven by increasing digitalization, consumer demand for interactive technologies, and widespread adoption across multiple sectors including automotive, healthcare, retail, and industrial applications.

Market dynamics indicate robust expansion with the European region experiencing a compound annual growth rate (CAGR) of 8.2% over the forecast period. The market demonstrates strong penetration across diverse geographical regions, with Western Europe maintaining 65% market share while Eastern European countries show accelerating adoption rates of 12% annually.

Technology advancement continues to reshape the European touch screen display landscape, with capacitive touch technology dominating 78% of market applications. The integration of advanced features such as multi-touch capabilities, enhanced durability, and improved sensitivity has positioned Europe as a leading consumer and innovator in touch screen display technologies.

Industry applications span across numerous sectors, with automotive applications representing the fastest-growing segment, experiencing 15% annual growth as European automotive manufacturers increasingly integrate touch screen interfaces into vehicle dashboards and infotainment systems. Healthcare applications follow closely with 13% growth rates, driven by digital transformation initiatives across European medical facilities.

The Europe touch screen display market refers to the comprehensive ecosystem of interactive display technologies, manufacturing capabilities, distribution networks, and end-user applications across European countries. This market encompasses various touch screen technologies including capacitive, resistive, infrared, and surface acoustic wave displays designed for consumer, commercial, and industrial applications.

Touch screen displays represent sophisticated input-output devices that combine visual display capabilities with touch-sensitive interfaces, enabling users to interact directly with digital content through finger touches, stylus input, or gesture recognition. These technologies have revolutionized user interaction paradigms across multiple industries throughout Europe.

Market scope includes hardware components such as touch sensors, display panels, controllers, and software integration solutions. The European market specifically addresses regional preferences, regulatory requirements, and technological standards that influence product development, manufacturing processes, and market adoption strategies across different European Union member states and associated countries.

Geographic coverage spans major European markets including Germany, United Kingdom, France, Italy, Spain, Netherlands, and emerging markets in Eastern Europe. Each region presents unique opportunities and challenges related to consumer preferences, industrial requirements, and technological infrastructure development.

Strategic analysis of the Europe touch screen display market reveals a mature yet rapidly evolving landscape characterized by technological innovation, increasing consumer adoption, and expanding industrial applications. The market demonstrates resilience and growth potential across multiple sectors, with particular strength in automotive, healthcare, retail, and industrial automation segments.

Key findings indicate that capacitive touch technology maintains market leadership due to superior performance characteristics, multi-touch capabilities, and enhanced user experience. European manufacturers and suppliers have established strong competitive positions through continuous innovation, strategic partnerships, and focus on quality and reliability standards.

Market segmentation analysis shows diversified applications with no single sector dominating the landscape. This diversification provides stability and multiple growth opportunities, reducing dependency on any particular industry vertical. Consumer electronics, automotive integration, and industrial applications each contribute significantly to overall market expansion.

Growth drivers include increasing digitalization across European businesses, rising consumer expectations for interactive technologies, automotive industry transformation, healthcare digitization initiatives, and growing demand for intuitive user interfaces in industrial applications. These factors collectively support sustained market growth and technological advancement.

Future prospects remain positive with emerging technologies such as flexible displays, haptic feedback integration, and advanced gesture recognition creating new market opportunities. European companies are well-positioned to capitalize on these trends through established research and development capabilities and strong market presence.

Technology leadership in the European touch screen display market demonstrates several critical insights that shape current market dynamics and future growth trajectories. These insights provide valuable understanding of market behavior, consumer preferences, and technological trends across the region.

Regional variations across European countries influence market development patterns, with Western European markets showing mature adoption while Eastern European regions present emerging growth opportunities. This geographic diversity creates multiple market entry points and expansion strategies for industry participants.

Digital transformation initiatives across European industries serve as primary catalysts for touch screen display market expansion. Organizations throughout the region increasingly recognize the value of interactive technologies in improving operational efficiency, enhancing user experiences, and maintaining competitive advantages in rapidly evolving markets.

Automotive industry evolution represents a significant market driver as European car manufacturers integrate sophisticated touch screen interfaces into vehicle designs. The transition toward electric vehicles and autonomous driving technologies creates additional demand for advanced display systems that support complex user interactions and information management requirements.

Consumer behavior changes influence market growth as European consumers demonstrate increasing preference for intuitive, touch-based interfaces across various applications. This behavioral shift extends beyond traditional consumer electronics to include home automation, retail interactions, and public service applications.

Healthcare modernization drives substantial demand for touch screen displays as European medical facilities upgrade equipment, implement electronic health records, and enhance patient care delivery systems. The COVID-19 pandemic accelerated digital health initiatives, creating sustained demand for medical-grade touch screen solutions.

Industrial automation advancement supports market growth as European manufacturers adopt smart factory concepts, implement Industry 4.0 principles, and integrate advanced human-machine interfaces. Touch screen displays enable intuitive control of complex manufacturing processes and equipment monitoring systems.

Retail sector transformation creates opportunities for interactive display technologies as European retailers seek to enhance customer experiences, implement self-service solutions, and integrate online-offline shopping experiences. Point-of-sale systems, digital signage, and interactive kiosks drive consistent demand for touch screen displays.

High implementation costs present significant challenges for some market segments, particularly small and medium-sized enterprises seeking to integrate touch screen display technologies. Initial capital investments, installation expenses, and ongoing maintenance requirements can limit adoption rates among cost-sensitive organizations.

Technical complexity associated with advanced touch screen systems creates barriers for certain applications and user groups. Integration challenges, compatibility issues, and the need for specialized technical expertise can slow adoption rates and increase implementation timelines across various market segments.

Durability concerns in harsh operating environments limit market expansion in certain industrial and outdoor applications. Touch screen displays must withstand extreme temperatures, moisture, dust, and physical stress, requiring specialized designs that increase costs and complexity.

Supply chain disruptions affect market stability and growth potential, particularly regarding specialized components and raw materials required for touch screen manufacturing. Global supply chain challenges can impact product availability, pricing stability, and delivery schedules across European markets.

Regulatory compliance requirements in European markets create additional complexity and costs for manufacturers and suppliers. Safety standards, environmental regulations, and industry-specific requirements necessitate specialized product designs and certification processes that can limit market entry and expansion opportunities.

Competition from alternative technologies such as voice recognition, gesture control, and traditional input methods creates market pressure and limits growth potential in certain applications. Users may prefer familiar interfaces or emerging technologies that offer different advantages over touch screen solutions.

Emerging technology integration presents substantial opportunities for market expansion as European companies explore advanced features such as haptic feedback, flexible displays, and augmented reality capabilities. These technological enhancements create new application possibilities and market segments with significant growth potential.

Smart city initiatives across European urban areas generate demand for interactive public displays, information kiosks, and digital signage systems. Government investments in urban technology infrastructure create sustained opportunities for touch screen display providers and system integrators.

Education sector digitalization offers significant market opportunities as European educational institutions implement interactive learning technologies, digital whiteboards, and student engagement systems. The shift toward hybrid learning models creates sustained demand for educational touch screen solutions.

Internet of Things (IoT) integration enables new applications and market segments as touch screen displays become control interfaces for connected devices and smart systems. European markets show strong adoption of IoT technologies, creating opportunities for integrated display solutions.

Sustainability initiatives drive demand for energy-efficient touch screen displays and environmentally responsible manufacturing processes. European environmental regulations and corporate sustainability goals create market opportunities for eco-friendly display technologies and recycling programs.

Customization and specialization opportunities exist for niche applications and specific industry requirements. European markets value tailored solutions that address unique operational needs, regulatory requirements, and performance specifications across various sectors.

Competitive landscape evolution shapes market dynamics as established European manufacturers compete with global technology leaders and emerging regional players. This competition drives continuous innovation, price optimization, and service enhancement across the touch screen display ecosystem.

Technology convergence influences market development as touch screen displays integrate with artificial intelligence, machine learning, and advanced sensor technologies. These convergence trends create new value propositions and application possibilities that reshape market dynamics and competitive positioning.

Supply and demand balance fluctuates based on economic conditions, industry growth rates, and technological advancement cycles. European markets demonstrate resilience through diversified applications and strong industrial base, but remain sensitive to global economic trends and supply chain disruptions.

Innovation cycles drive market dynamics as new technologies, features, and applications emerge regularly. European companies invest heavily in research and development to maintain competitive advantages and address evolving customer requirements across various market segments.

Regulatory environment impacts market dynamics through safety standards, environmental regulations, and industry-specific requirements. European regulatory frameworks generally support market development while ensuring product quality, safety, and environmental responsibility.

Customer expectations continue evolving toward higher performance, greater reliability, and enhanced user experiences. These changing expectations drive market dynamics by influencing product development priorities, pricing strategies, and competitive differentiation approaches across the European market.

Comprehensive market analysis employs multiple research methodologies to ensure accurate, reliable, and actionable insights into the Europe touch screen display market. The research approach combines quantitative data analysis with qualitative market intelligence to provide complete market understanding.

Primary research activities include extensive interviews with industry executives, technology leaders, and market participants across various European countries. These interviews provide firsthand insights into market trends, challenges, opportunities, and competitive dynamics that shape the touch screen display landscape.

Secondary research analysis incorporates comprehensive review of industry reports, company financial statements, patent filings, and regulatory documents. This analysis provides historical context, market sizing information, and trend identification across different market segments and geographic regions.

Market segmentation analysis examines various dimensions including technology types, application sectors, end-user industries, and geographic markets. This multidimensional approach ensures comprehensive understanding of market dynamics and growth opportunities across different market segments.

Competitive intelligence gathering focuses on major market participants, emerging players, and technology innovators operating in European markets. This analysis includes company profiles, product portfolios, strategic initiatives, and market positioning assessments.

Data validation processes ensure research accuracy and reliability through cross-referencing multiple sources, expert verification, and statistical analysis. Quality control measures maintain research integrity and provide confidence in market insights and projections presented throughout this analysis.

Western Europe maintains market leadership with mature adoption across multiple industries and strong technological infrastructure. Germany leads regional demand through robust automotive and industrial sectors, while the United Kingdom demonstrates strength in financial services and retail applications. France shows significant growth in healthcare and public sector implementations.

Northern Europe exhibits high adoption rates driven by advanced digitalization initiatives and strong technology acceptance. Scandinavian countries demonstrate particular strength in industrial automation and smart city applications, with Nordic markets showing 11% annual growth in touch screen display adoption.

Southern Europe presents emerging opportunities with increasing investment in technology infrastructure and digital transformation initiatives. Italy and Spain show growing demand in automotive, retail, and tourism sectors, while Mediterranean markets benefit from expanding hospitality and service industries.

Eastern Europe represents the fastest-growing regional segment with 14% annual expansion rates driven by industrial modernization, foreign investment, and technology infrastructure development. Poland, Czech Republic, and Hungary lead regional growth through manufacturing sector expansion and European Union integration benefits.

Market distribution across European regions shows Western Europe maintaining 58% market share, followed by Eastern Europe at 22% market share, Northern Europe at 12% market share, and Southern Europe representing 8% market share. This distribution reflects economic development levels, industrial base strength, and technology adoption patterns across different European regions.

Regional growth patterns indicate convergence trends as Eastern and Southern European markets accelerate adoption while Western and Northern European markets focus on advanced applications and technology upgrades. This regional dynamic creates opportunities for market participants across different segments and geographic areas.

Market leadership in the European touch screen display market features a diverse ecosystem of global technology companies, regional specialists, and emerging innovators. The competitive landscape demonstrates healthy competition across different market segments and application areas.

Competitive strategies focus on technological innovation, product differentiation, strategic partnerships, and geographic expansion. European market participants emphasize quality, reliability, and compliance with regional standards to maintain competitive advantages.

Market consolidation trends show increasing collaboration between technology providers, system integrators, and end-user industries. Strategic alliances and partnerships enable companies to address complex customer requirements and expand market reach across different European regions and application sectors.

Technology-based segmentation reveals distinct market characteristics and growth patterns across different touch screen technologies deployed in European markets. Each technology segment addresses specific application requirements and user preferences.

By Technology:

By Application:

By Size:

Consumer electronics category maintains steady demand driven by smartphone replacement cycles, tablet adoption, and emerging wearable device markets. European consumers demonstrate preference for high-quality displays with advanced features, supporting premium product segments and technological innovation.

Automotive category experiences rapid expansion as European car manufacturers integrate sophisticated infotainment systems and digital dashboard displays. The transition toward electric vehicles and autonomous driving technologies creates additional demand for advanced touch screen interfaces supporting complex user interactions.

Healthcare category shows consistent growth driven by digital transformation initiatives across European medical facilities. Touch screen displays enable improved patient care delivery, enhanced diagnostic capabilities, and streamlined administrative processes while meeting strict medical device regulations.

Industrial category benefits from Industry 4.0 adoption and smart manufacturing initiatives across European industrial sectors. Touch screen interfaces enable intuitive equipment control, process monitoring, and quality management while supporting advanced automation and connectivity requirements.

Retail category demonstrates steady growth as European retailers implement interactive technologies to enhance customer experiences and streamline operations. Self-service kiosks, digital signage, and point-of-sale systems drive consistent demand for commercial-grade touch screen displays.

Education category presents emerging opportunities as European educational institutions adopt interactive learning technologies and digital classroom solutions. Interactive whiteboards, student tablets, and collaborative learning systems create sustained demand for educational touch screen applications.

Manufacturers benefit from diverse market opportunities across multiple application sectors and geographic regions throughout Europe. The market’s maturity and stability provide predictable demand patterns while emerging technologies create innovation opportunities and competitive differentiation possibilities.

Technology suppliers gain access to sophisticated European markets that value quality, reliability, and advanced features. Strong intellectual property protection, established distribution networks, and collaborative business relationships support long-term market participation and growth strategies.

System integrators benefit from increasing demand for customized solutions and specialized applications across various European industries. Complex integration requirements and industry-specific needs create opportunities for value-added services and long-term customer relationships.

End-user industries achieve operational improvements through enhanced user interfaces, improved efficiency, and better customer experiences. Touch screen displays enable digital transformation initiatives while providing measurable returns on investment through productivity gains and cost reductions.

Investors find attractive opportunities in a stable, growing market with multiple growth drivers and technological advancement potential. The European market’s regulatory stability, economic strength, and innovation focus support sustainable business models and long-term value creation.

Research institutions benefit from collaborative opportunities with industry participants and access to advanced technology development projects. European research and development initiatives support innovation and maintain technological leadership in touch screen display technologies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Flexible display adoption represents a transformative trend as European manufacturers and consumers embrace bendable, foldable, and curved touch screen technologies. These advanced displays enable new form factors and applications across consumer electronics, automotive, and industrial sectors.

Haptic feedback integration enhances user experiences by providing tactile responses to touch interactions. European markets show increasing adoption of haptic-enabled displays in automotive, gaming, and professional applications where enhanced user feedback improves functionality and satisfaction.

Large format display growth continues as European businesses implement interactive digital signage, collaborative workspaces, and presentation systems. Commercial and educational sectors drive demand for large-format touch screen displays supporting group interactions and information sharing.

Multi-touch advancement enables sophisticated gesture recognition and collaborative interactions across various applications. European markets value advanced multi-touch capabilities that support complex user interactions and improve productivity in professional and educational environments.

Durability enhancement addresses demanding industrial and outdoor applications through improved scratch resistance, environmental protection, and extended operational life. European industrial sectors require robust touch screen solutions that withstand harsh operating conditions while maintaining performance.

Energy efficiency improvement aligns with European sustainability goals and regulatory requirements. Low-power touch screen displays reduce energy consumption while maintaining performance, supporting environmental initiatives and operational cost reduction across various applications.

Strategic partnerships between European technology companies and global manufacturers create collaborative opportunities for innovation, market expansion, and competitive positioning. These alliances enable access to advanced technologies, manufacturing capabilities, and distribution networks across different market segments.

Research and development investments by European companies focus on next-generation touch screen technologies including flexible displays, advanced sensors, and artificial intelligence integration. MarkWide Research analysis indicates increasing R&D spending across European touch screen display companies to maintain technological leadership.

Manufacturing facility expansion in Eastern European countries provides cost-effective production capabilities while maintaining proximity to major European markets. These investments support supply chain optimization and regional market development strategies.

Acquisition activities consolidate market participants and create integrated solutions providers capable of addressing complex customer requirements. European companies pursue strategic acquisitions to expand technology portfolios, market reach, and competitive capabilities.

Sustainability initiatives drive development of environmentally responsible manufacturing processes, recyclable materials, and energy-efficient products. European companies lead industry efforts to address environmental concerns and regulatory requirements through sustainable business practices.

Standardization efforts promote interoperability and quality consistency across European markets. Industry associations and regulatory bodies work to establish common standards that support market development while ensuring product quality and safety.

Technology investment priorities should focus on emerging display technologies such as flexible screens, haptic feedback systems, and advanced sensor integration. European companies can maintain competitive advantages through early adoption and development of next-generation touch screen technologies.

Market expansion strategies should target high-growth Eastern European markets while strengthening positions in mature Western European segments. Balanced geographic expansion enables companies to capture growth opportunities while maintaining stable revenue bases.

Partnership development with system integrators, software developers, and end-user industries creates comprehensive solution offerings that address complex customer requirements. Collaborative approaches enable market participants to deliver integrated solutions and build long-term customer relationships.

Sustainability integration should become central to business strategies as European markets increasingly prioritize environmental responsibility. Companies that proactively address sustainability requirements will gain competitive advantages and regulatory compliance benefits.

Customization capabilities enable differentiation in competitive markets through specialized solutions addressing unique customer requirements. European markets value tailored approaches that address specific industry needs and regulatory requirements.

Supply chain diversification reduces risks associated with component availability and pricing volatility. European companies should develop multiple supplier relationships and consider regional sourcing strategies to enhance supply chain resilience.

Market growth trajectory remains positive with sustained expansion expected across multiple application sectors and geographic regions throughout Europe. MarkWide Research projections indicate continued market development driven by technological advancement, digital transformation initiatives, and expanding industrial applications.

Technology evolution will reshape market dynamics as flexible displays, artificial intelligence integration, and advanced sensor technologies create new application possibilities and competitive landscapes. European companies are well-positioned to capitalize on these technological trends through established innovation capabilities.

Application diversification continues expanding beyond traditional consumer electronics into specialized industrial, healthcare, and commercial applications. This diversification provides market stability and multiple growth opportunities while reducing dependency on any single application sector.

Geographic expansion in Eastern European markets offers significant growth potential as these regions continue economic development and technology infrastructure investment. Western European markets will focus on advanced applications and technology upgrades while maintaining stable demand levels.

Competitive landscape evolution will feature increased collaboration, strategic partnerships, and technology convergence as market participants adapt to changing customer requirements and technological possibilities. European companies can leverage regional advantages while competing effectively in global markets.

Regulatory development will continue supporting market growth through standards harmonization, safety requirements, and environmental regulations that ensure product quality while promoting innovation and competition across European markets.

The Europe touch screen display market demonstrates robust growth potential and technological leadership across diverse application sectors and geographic regions. Market analysis reveals strong fundamentals driven by digital transformation initiatives, automotive industry evolution, healthcare modernization, and industrial automation advancement throughout European markets.

Strategic opportunities exist for market participants through technology innovation, geographic expansion, application diversification, and strategic partnerships. The market’s maturity provides stability while emerging technologies and applications create growth opportunities for companies that effectively adapt to changing market dynamics.

Competitive advantages in European markets stem from quality focus, technological innovation, regulatory compliance, and customer relationship strength. Companies that leverage these advantages while addressing market challenges through strategic planning and operational excellence will achieve sustained success in this dynamic market environment.

Future success in the Europe touch screen display market requires balanced approaches combining technological innovation with market development, geographic expansion with customer focus, and competitive positioning with collaborative partnerships. The market’s continued evolution presents opportunities for companies prepared to invest in advanced technologies and customer-centric solutions across the diverse European landscape.

What is Touch Screen Display?

Touch screen displays are interactive screens that detect the presence and location of a touch within the display area. They are widely used in various applications, including smartphones, tablets, and kiosks, enhancing user interaction and experience.

What are the key players in the Europe Touch Screen Display Market?

Key players in the Europe Touch Screen Display Market include companies like Samsung Display, LG Display, and Sharp Corporation, among others. These companies are known for their innovative technologies and extensive product offerings in the touch screen display segment.

What are the growth factors driving the Europe Touch Screen Display Market?

The Europe Touch Screen Display Market is driven by increasing demand for interactive displays in retail and education sectors, advancements in touch technology, and the growing popularity of smart devices. Additionally, the rise in automation and digital signage is contributing to market growth.

What challenges does the Europe Touch Screen Display Market face?

The Europe Touch Screen Display Market faces challenges such as high manufacturing costs, competition from alternative display technologies, and issues related to durability and reliability. These factors can hinder market expansion and product adoption.

What opportunities exist in the Europe Touch Screen Display Market?

Opportunities in the Europe Touch Screen Display Market include the increasing integration of touch technology in automotive displays, growth in the healthcare sector for patient interaction, and the expansion of smart home devices. These trends are expected to create new avenues for market players.

What are the current trends in the Europe Touch Screen Display Market?

Current trends in the Europe Touch Screen Display Market include the rise of flexible and foldable displays, advancements in multi-touch technology, and the growing use of touch screens in public transportation systems. These innovations are shaping the future of user interaction.

Europe Touch Screen Display Market

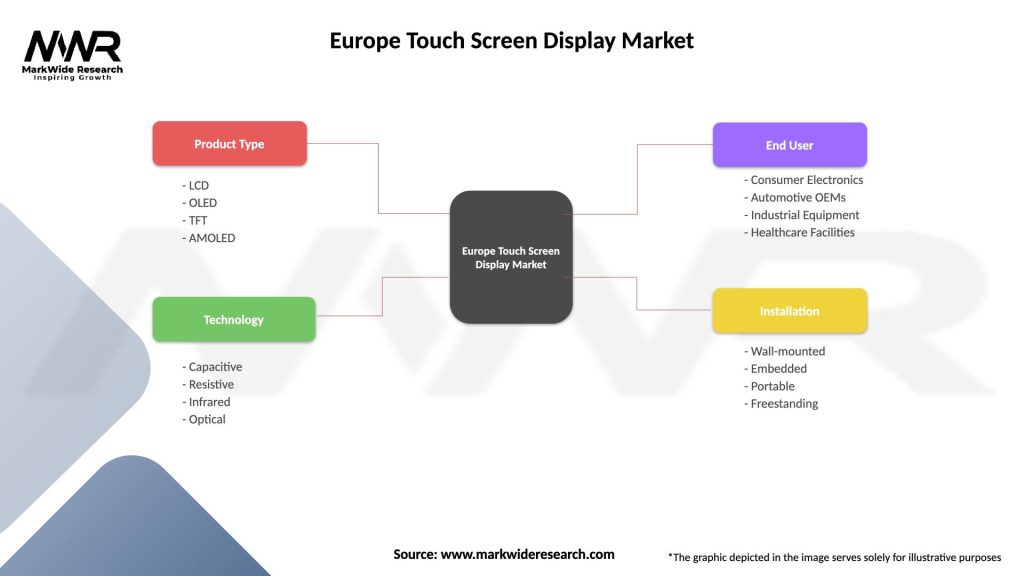

| Segmentation Details | Description |

|---|---|

| Product Type | LCD, OLED, TFT, AMOLED |

| Technology | Capacitive, Resistive, Infrared, Optical |

| End User | Consumer Electronics, Automotive OEMs, Industrial Equipment, Healthcare Facilities |

| Installation | Wall-mounted, Embedded, Portable, Freestanding |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Touch Screen Display Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at