444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe tankless water heater market represents a dynamic and rapidly evolving segment within the continent’s broader home appliance and energy efficiency landscape. Tankless water heaters, also known as on-demand or instantaneous water heaters, have gained significant traction across European households and commercial establishments due to their superior energy efficiency and space-saving design. The market demonstrates robust growth potential, driven by increasing environmental consciousness, stringent energy regulations, and rising demand for sustainable heating solutions.

European consumers are increasingly prioritizing energy-efficient appliances that align with the continent’s ambitious carbon reduction goals. The tankless water heater market benefits from this trend, as these systems typically offer 20-30% higher energy efficiency compared to traditional storage water heaters. Countries such as Germany, France, United Kingdom, and the Netherlands lead market adoption, while emerging markets in Eastern Europe show promising growth trajectories.

Market dynamics indicate strong momentum across both residential and commercial segments, with technological innovations in condensing technology, smart controls, and hybrid systems driving consumer interest. The integration of renewable energy sources and IoT connectivity further enhances the appeal of modern tankless water heating solutions across diverse European markets.

The Europe tankless water heater market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, sales, and servicing of on-demand water heating systems across European countries. These systems heat water instantaneously as it flows through the unit, eliminating the need for storage tanks and providing continuous hot water supply on demand.

Tankless water heaters operate by utilizing high-powered gas burners or electric heating elements that activate when hot water is requested, delivering heated water directly to the point of use. This technology represents a significant advancement over conventional storage water heaters, offering enhanced energy efficiency, reduced space requirements, and longer operational lifespans. The European market encompasses various product categories, including gas-fired units, electric models, and hybrid systems that combine multiple energy sources.

Market participants include established manufacturers, emerging technology companies, distributors, installers, and service providers who collectively contribute to the market’s growth and development across diverse European regions and applications.

The European tankless water heater market demonstrates exceptional growth momentum, driven by increasing consumer awareness of energy efficiency benefits and supportive regulatory frameworks promoting sustainable heating solutions. Market expansion is particularly pronounced in Western European countries, where mature infrastructure and high disposable incomes facilitate adoption of advanced water heating technologies.

Key growth drivers include rising energy costs, environmental regulations mandating energy-efficient appliances, and growing consumer preference for space-saving home solutions. The market benefits from technological advancements in condensing technology, which can achieve efficiency ratings exceeding 95%, making tankless systems increasingly attractive to cost-conscious consumers.

Regional variations exist across the European landscape, with Northern European countries showing strong preference for gas-fired units due to established natural gas infrastructure, while Southern European markets demonstrate growing interest in electric and hybrid models. The commercial segment, including hotels, restaurants, and office buildings, represents a significant growth opportunity as businesses seek to reduce operational costs and environmental impact.

Competitive dynamics feature both established European manufacturers and international players competing through product innovation, energy efficiency improvements, and comprehensive service offerings. Market consolidation trends and strategic partnerships are shaping the competitive landscape as companies seek to expand their geographic reach and technological capabilities.

Strategic market insights reveal several critical trends shaping the European tankless water heater landscape. MarkWide Research analysis indicates that consumer preferences are increasingly shifting toward smart-enabled systems that offer remote monitoring and control capabilities through mobile applications and home automation platforms.

Market maturation varies significantly across European regions, with Western European countries showing higher adoption rates while Eastern European markets present substantial growth opportunities as infrastructure development accelerates and consumer purchasing power increases.

Primary market drivers propelling the European tankless water heater market include a combination of regulatory, economic, and consumer preference factors that create favorable conditions for sustained growth. Environmental regulations across European Union member states increasingly mandate energy-efficient appliances, creating regulatory pressure that favors tankless water heating solutions.

Rising energy costs throughout Europe motivate consumers and businesses to seek more efficient heating solutions that reduce long-term operational expenses. Tankless water heaters address this concern by eliminating standby heat losses associated with traditional storage systems, resulting in energy savings of 20-40% depending on usage patterns and system specifications.

Urbanization trends across European cities drive demand for space-efficient appliances that maximize living space utilization. Tankless water heaters appeal to urban consumers facing space constraints in apartments, condominiums, and compact homes. The growing trend toward home renovation and modernization further supports market expansion as homeowners upgrade aging water heating systems.

Technological advancement continues to enhance product appeal through improved efficiency, reliability, and user convenience features. Smart connectivity options, advanced safety systems, and enhanced durability contribute to growing consumer confidence in tankless water heating technology. Additionally, government incentives and rebate programs in various European countries provide financial motivation for consumers to adopt energy-efficient heating solutions.

Market restraints present challenges that may limit the pace of tankless water heater adoption across certain European market segments. High upfront costs represent the most significant barrier, as tankless systems typically require substantially higher initial investment compared to conventional storage water heaters, potentially deterring price-sensitive consumers despite long-term savings benefits.

Installation complexity creates additional barriers, particularly in existing buildings where retrofitting tankless systems may require significant modifications to gas lines, electrical systems, or venting configurations. These installation challenges can result in higher total project costs and extended installation timelines that discourage some consumers from making the transition.

Infrastructure limitations in certain European regions may constrain market growth, particularly in areas with inadequate gas supply networks or electrical grid capacity to support high-demand electric tankless units. Rural areas and older urban districts may face particular challenges in accessing the infrastructure required for optimal tankless water heater performance.

Consumer awareness gaps persist in some market segments, where potential customers remain unfamiliar with tankless technology benefits or harbor misconceptions about performance capabilities. Limited availability of qualified installation and service technicians in certain regions further compounds adoption challenges, as consumers may be reluctant to invest in technology without reliable local support networks.

Significant market opportunities exist across multiple dimensions of the European tankless water heater landscape, driven by evolving consumer preferences, technological innovations, and supportive policy environments. Smart home integration represents a particularly promising opportunity as European consumers increasingly adopt connected home technologies that enable remote monitoring, automated controls, and energy optimization.

Renewable energy integration offers substantial growth potential as tankless water heaters can be effectively combined with solar thermal systems, heat pumps, and other renewable energy sources to create comprehensive sustainable heating solutions. This integration aligns with European Union renewable energy targets and provides consumers with enhanced environmental benefits and potential cost savings.

Commercial market expansion presents significant opportunities across diverse sectors including hospitality, healthcare, education, and manufacturing. Commercial establishments increasingly recognize the operational advantages of tankless systems, including reduced maintenance requirements, improved reliability, and enhanced space utilization. The growing trend toward green building certifications further drives commercial adoption.

Emerging market penetration in Eastern European countries offers substantial growth potential as economic development, infrastructure improvements, and rising living standards create favorable conditions for tankless water heater adoption. These markets currently show adoption rates below 15%, indicating significant room for expansion as awareness and accessibility improve.

Market dynamics within the European tankless water heater sector reflect complex interactions between technological innovation, regulatory frameworks, consumer behavior, and competitive forces. Technology evolution continues to drive market transformation through improvements in efficiency, reliability, and user experience that enhance product appeal across diverse consumer segments.

Regulatory influence plays a crucial role in shaping market dynamics, with European Union energy efficiency directives and national building codes increasingly favoring high-efficiency heating solutions. These regulations create market momentum by establishing minimum performance standards and providing incentives for energy-efficient appliance adoption.

Competitive intensity drives continuous innovation and price optimization as manufacturers compete for market share through product differentiation, service quality, and brand positioning. Market leaders invest heavily in research and development to maintain technological advantages while emerging players focus on niche applications and cost-effective solutions.

Supply chain dynamics influence market accessibility and pricing, with manufacturers working to optimize distribution networks, reduce logistics costs, and ensure product availability across diverse European markets. The integration of digital technologies in supply chain management enhances efficiency and responsiveness to market demand fluctuations. Market growth rates vary significantly by region, with mature markets showing steady annual growth of 5-8% while emerging markets demonstrate higher growth potential.

Comprehensive research methodology employed in analyzing the European tankless water heater market incorporates multiple data collection and analysis techniques to ensure accuracy, reliability, and depth of insights. Primary research involves direct engagement with industry stakeholders including manufacturers, distributors, installers, and end-users through structured interviews, surveys, and focus groups to gather firsthand market intelligence.

Secondary research encompasses extensive analysis of industry reports, government publications, trade association data, and company financial statements to establish market context and validate primary research findings. This approach ensures comprehensive coverage of market trends, competitive dynamics, and regulatory influences affecting the tankless water heater sector.

Quantitative analysis utilizes statistical modeling techniques to identify market patterns, growth trends, and correlation factors that influence market development. Data validation processes ensure accuracy and reliability of numerical insights presented throughout the analysis.

Qualitative assessment provides deeper understanding of market dynamics through expert interviews, industry observations, and trend analysis that capture nuanced factors influencing market evolution. This methodology combination delivers comprehensive insights that support strategic decision-making for market participants and stakeholders seeking to understand the European tankless water heater market landscape.

Regional market analysis reveals significant variations in tankless water heater adoption, preferences, and growth patterns across different European countries and regions. Western Europe leads market development with mature adoption rates and sophisticated consumer preferences for high-efficiency, feature-rich systems that integrate with smart home technologies.

Germany represents the largest European market for tankless water heaters, driven by strong environmental consciousness, robust economic conditions, and well-established natural gas infrastructure. German consumers demonstrate strong preference for condensing gas-fired units that achieve maximum efficiency ratings. The market shows penetration rates approaching 35% in new construction projects.

France exhibits growing market momentum with increasing adoption in both residential and commercial segments. French consumers show particular interest in electric tankless units and hybrid systems that combine multiple energy sources. Government incentives supporting energy-efficient appliances contribute to market growth.

United Kingdom demonstrates steady market expansion despite economic uncertainties, with consumers increasingly recognizing long-term cost benefits of tankless technology. The market benefits from growing awareness of energy efficiency advantages and space-saving benefits in urban environments.

Nordic countries including Sweden, Norway, and Denmark show strong adoption rates driven by environmental priorities and high energy costs. These markets favor high-efficiency systems with advanced controls and renewable energy integration capabilities.

Eastern Europe presents significant growth opportunities with market penetration rates below 20% in most countries. Economic development, infrastructure improvements, and rising living standards create favorable conditions for market expansion in countries such as Poland, Czech Republic, and Hungary.

The competitive landscape of the European tankless water heater market features a diverse mix of established multinational corporations, regional specialists, and emerging technology companies competing across various market segments and geographic regions. Market leaders leverage extensive distribution networks, comprehensive product portfolios, and strong brand recognition to maintain competitive advantages.

Competitive strategies focus on product innovation, energy efficiency improvements, smart technology integration, and comprehensive service offerings. Companies invest in research and development to maintain technological leadership while expanding geographic presence through strategic partnerships and acquisitions. Market share distribution shows the top five companies controlling approximately 60% of total market volume, with remaining market share distributed among numerous smaller players and regional specialists.

Market segmentation analysis reveals distinct categories within the European tankless water heater market, each characterized by specific features, applications, and consumer preferences. Product segmentation encompasses multiple dimensions including fuel type, capacity, efficiency rating, and technology features that address diverse market needs.

By Fuel Type:

By Application:

By Capacity Range:

Category-wise analysis provides detailed insights into specific market segments within the European tankless water heater landscape, revealing unique characteristics, growth patterns, and consumer preferences that influence purchasing decisions and market development.

Gas-Fired Tankless Systems: This dominant category benefits from established natural gas infrastructure across most European countries and superior heating performance compared to electric alternatives. Condensing gas units represent the premium segment, achieving efficiency ratings exceeding 95% through advanced heat recovery technology. Consumer preference trends favor compact wall-mounted units with smart controls and modulating burner technology that optimizes performance across varying demand levels.

Electric Tankless Units: Growing in popularity particularly in regions with abundant renewable electricity generation and limited gas infrastructure. Electric systems offer advantages including simplified installation, reduced maintenance requirements, and precise temperature control. However, higher operating costs in most European markets limit adoption primarily to specific applications where gas systems are impractical.

Commercial Applications: Demonstrate distinct requirements including higher capacity, enhanced durability, and advanced monitoring capabilities. Commercial systems often feature modular designs allowing multiple units to operate in parallel for increased capacity and redundancy. Energy management features become particularly important as commercial users seek to optimize operational costs and meet sustainability objectives.

Smart-Enabled Systems: Represent the fastest-growing category with adoption rates increasing by over 25% annually as consumers embrace connected home technologies. These systems offer remote monitoring, predictive maintenance alerts, and energy usage optimization through mobile applications and home automation integration.

Industry participants and stakeholders across the European tankless water heater market ecosystem realize significant benefits through engagement with this dynamic and growing sector. Manufacturers benefit from expanding market opportunities driven by increasing consumer awareness, supportive regulations, and technological advancement that create demand for innovative products.

Revenue diversification opportunities allow manufacturers to expand beyond traditional heating products into connected systems, service offerings, and renewable energy integration solutions. The growing emphasis on energy efficiency creates premium pricing opportunities for advanced systems that deliver superior performance and environmental benefits.

Distributors and retailers benefit from higher profit margins associated with tankless systems compared to traditional storage water heaters, while also accessing growing market segments including smart home enthusiasts and environmentally conscious consumers. The longer replacement cycles of tankless systems create opportunities for enhanced customer relationships and service revenue streams.

Installation professionals realize benefits through specialized expertise requirements that command premium pricing and reduced competition from general contractors. The complexity of tankless system installation creates opportunities for certified technicians to build sustainable businesses focused on high-value services.

End-users benefit from reduced energy costs, enhanced convenience, space savings, and improved reliability compared to conventional water heating systems. MarkWide Research indicates that typical residential users experience energy cost reductions of 15-30% after transitioning to tankless systems, providing compelling return on investment over system lifespans.

Comprehensive SWOT analysis reveals the strategic position of the European tankless water heater market by examining internal strengths and weaknesses alongside external opportunities and threats that influence market development and competitive dynamics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the European tankless water heater landscape reflect evolving consumer preferences, technological innovations, and broader societal shifts toward sustainability and digitalization. Smart connectivity emerges as a dominant trend with manufacturers increasingly integrating IoT capabilities, mobile app controls, and home automation compatibility into their product offerings.

Energy efficiency optimization continues driving product development with manufacturers pursuing ever-higher efficiency ratings through advanced heat exchanger designs, improved combustion technology, and intelligent control systems. Condensing technology becomes standard in premium product segments, with efficiency ratings approaching theoretical maximums.

Hybrid system development represents an emerging trend combining tankless water heaters with renewable energy sources, heat pumps, or storage components to create comprehensive heating solutions that maximize efficiency and reliability. These systems appeal to consumers seeking ultimate performance and environmental benefits.

Modular design approaches gain popularity particularly in commercial applications where scalability and redundancy are important considerations. Modular systems allow users to configure capacity precisely to their needs while providing backup capability through multiple unit installations.

Predictive maintenance capabilities enabled by smart sensors and connectivity features help users optimize system performance and prevent failures through proactive service interventions. This trend addresses traditional concerns about tankless system reliability while reducing long-term maintenance costs.

Aesthetic design emphasis reflects growing consumer attention to appliance appearance as tankless units become more visible in modern home designs. Manufacturers respond with sleek, contemporary designs that complement modern interior aesthetics while maintaining functional performance.

Recent industry developments demonstrate the dynamic nature of the European tankless water heater market with significant technological advances, strategic partnerships, and regulatory changes shaping market evolution. Product innovation continues at an accelerated pace with manufacturers introducing next-generation systems featuring enhanced efficiency, improved reliability, and advanced user interfaces.

Strategic acquisitions and partnerships reshape competitive dynamics as companies seek to expand geographic reach, access new technologies, and strengthen market positions. Major manufacturers increasingly focus on developing comprehensive heating solutions that integrate tankless water heaters with other home comfort systems.

Regulatory developments across European Union member states continue favoring high-efficiency heating solutions through updated building codes, energy efficiency standards, and incentive programs. These regulatory changes create market momentum while establishing minimum performance requirements that drive technology advancement.

Digital transformation initiatives enable manufacturers to enhance customer engagement through online configuration tools, virtual installation support, and remote diagnostic capabilities. These digital capabilities improve customer experience while reducing support costs and enabling new service business models.

Sustainability initiatives drive development of environmentally friendly manufacturing processes, recyclable product designs, and carbon-neutral operations that align with European environmental goals. Companies increasingly emphasize lifecycle environmental impact in product development and marketing strategies.

Supply chain optimization efforts focus on improving product availability, reducing logistics costs, and enhancing responsiveness to market demand fluctuations through advanced planning systems and strategic inventory positioning across European markets.

Strategic recommendations for market participants focus on capitalizing on growth opportunities while addressing key challenges that may limit market expansion. MWR analysis suggests that companies should prioritize smart technology integration to meet evolving consumer expectations for connected home appliances and energy management capabilities.

Product portfolio optimization should emphasize high-efficiency systems that exceed regulatory requirements while providing clear value propositions to justify premium pricing. Companies should focus on developing comprehensive solutions that address complete heating needs rather than standalone products.

Geographic expansion strategies should prioritize emerging Eastern European markets where infrastructure development and rising living standards create favorable conditions for tankless water heater adoption. Companies should adapt products and marketing approaches to local preferences and economic conditions.

Partnership development with renewable energy companies, smart home technology providers, and installation service networks can enhance market reach and provide customers with comprehensive solutions. These partnerships enable companies to participate in broader home energy management ecosystems.

Customer education initiatives remain critical for addressing awareness gaps and misconceptions about tankless technology. Companies should invest in educational content, demonstration programs, and installer training to build market confidence and accelerate adoption.

Service capability development becomes increasingly important as connected systems require ongoing support and maintenance. Companies should build service networks and digital support capabilities to ensure customer satisfaction and capture recurring revenue opportunities.

The future outlook for the European tankless water heater market appears highly promising with multiple favorable trends converging to support sustained growth and market expansion. Technological advancement will continue driving product innovation with next-generation systems offering even higher efficiency, enhanced reliability, and more sophisticated control capabilities.

Market penetration rates are expected to increase significantly across all European regions as consumer awareness grows and product costs decline through manufacturing scale economies. Adoption rates in emerging Eastern European markets could reach 25-30% within the next decade as economic development accelerates and infrastructure improves.

Smart home integration will become standard rather than premium feature as IoT technology costs decrease and consumer expectations for connected appliances increase. Future systems will offer advanced energy management, predictive maintenance, and seamless integration with renewable energy sources and home automation platforms.

Regulatory support for energy-efficient heating solutions will likely strengthen as European countries pursue ambitious carbon reduction goals. Enhanced incentive programs and stricter efficiency standards will create additional market momentum while potentially mandating tankless technology in certain applications.

Commercial market expansion presents substantial growth opportunities as businesses increasingly prioritize operational cost reduction and environmental sustainability. Large-scale commercial installations will drive volume growth while providing manufacturers with high-value project opportunities.

Innovation focus will shift toward integrated heating solutions that combine water heating with space heating, renewable energy integration, and energy storage capabilities. These comprehensive systems will address complete home energy needs while maximizing efficiency and environmental benefits.

The European tankless water heater market represents a dynamic and rapidly evolving sector with exceptional growth potential driven by favorable regulatory environments, increasing consumer awareness, and continuous technological innovation. Market fundamentals remain strong across diverse European regions, with established Western European markets showing steady growth while emerging Eastern European countries present significant expansion opportunities.

Key success factors for market participants include embracing smart technology integration, developing comprehensive heating solutions, and building strong service capabilities that address evolving customer needs. Companies that effectively combine product innovation with strategic partnerships and customer education initiatives will be best positioned to capture market opportunities and achieve sustainable growth.

Future market development will be characterized by increased penetration rates, enhanced product sophistication, and broader application across residential and commercial segments. The convergence of energy efficiency requirements, environmental consciousness, and smart home adoption creates a compelling foundation for continued market expansion throughout the European region.

Strategic positioning in this market requires long-term commitment to innovation, customer service excellence, and adaptability to evolving regulatory and consumer requirements. Organizations that successfully navigate these dynamics while delivering superior value propositions will realize significant benefits from participation in the European tankless water heater market as it continues its trajectory toward mainstream adoption and technological leadership.

What is a tankless water heater?

A tankless water heater, also known as an on-demand water heater, heats water directly without the use of a storage tank. When a hot water tap is turned on, cold water travels through a pipe into the unit, where it is heated by either gas or electricity, providing a continuous supply of hot water.

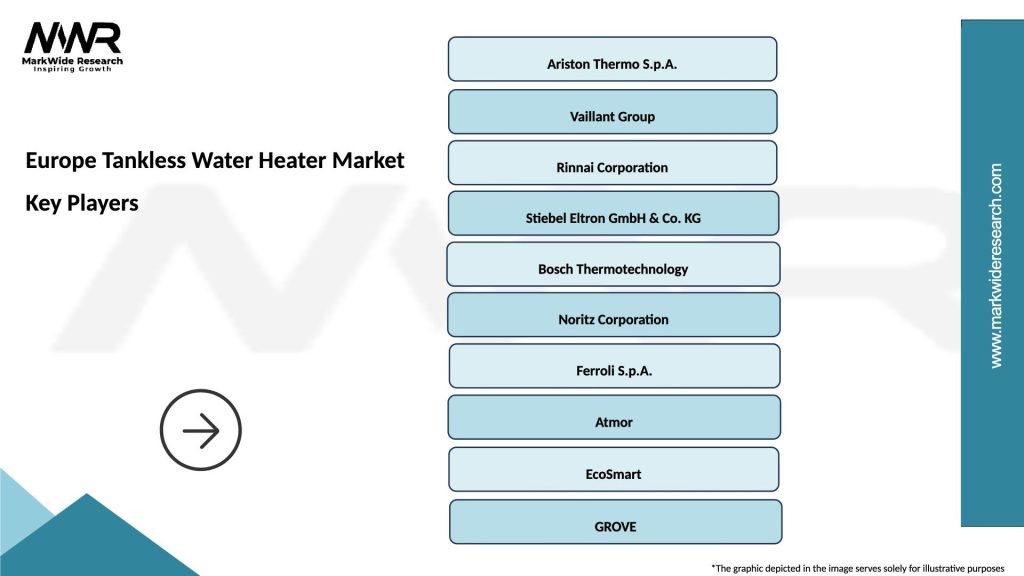

What are the key players in the Europe Tankless Water Heater Market?

Key players in the Europe Tankless Water Heater Market include companies like Bosch, Rinnai, and A.O. Smith, which are known for their innovative heating solutions and energy-efficient products, among others.

What are the main drivers of the Europe Tankless Water Heater Market?

The main drivers of the Europe Tankless Water Heater Market include the increasing demand for energy-efficient appliances, rising awareness of environmental sustainability, and the growing trend of home renovations that prioritize space-saving solutions.

What challenges does the Europe Tankless Water Heater Market face?

The Europe Tankless Water Heater Market faces challenges such as high initial installation costs and the need for adequate gas supply or electrical capacity in homes, which can limit adoption in certain regions.

What opportunities exist in the Europe Tankless Water Heater Market?

Opportunities in the Europe Tankless Water Heater Market include advancements in smart technology integration, which can enhance user convenience, and the potential for growth in the commercial sector, particularly in hotels and restaurants.

What trends are shaping the Europe Tankless Water Heater Market?

Trends shaping the Europe Tankless Water Heater Market include the increasing popularity of hybrid systems that combine tankless and traditional heating methods, as well as a shift towards more compact and efficient designs to meet consumer preferences.

Europe Tankless Water Heater Market

| Segmentation Details | Description |

|---|---|

| Product Type | Electric, Gas, Propane, Solar |

| End User | Residential, Commercial, Industrial, Hospitality |

| Installation | Wall-Mounted, Floor-Standing, Point-of-Use, Centralized |

| Technology | Condensing, Non-Condensing, Hybrid, Instantaneous |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Tankless Water Heater Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at