444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe tank protection market represents a critical segment of the continental defense industry, encompassing advanced protective systems designed to enhance the survivability and operational effectiveness of armored vehicles. This specialized market has experienced substantial growth driven by evolving security threats, modernization initiatives across European armed forces, and technological advancements in protection systems. The market demonstrates robust expansion with a projected CAGR of 6.2% through the forecast period, reflecting the increasing emphasis on force protection and battlefield survivability.

European nations are investing significantly in next-generation tank protection technologies, including active protection systems, reactive armor, and electronic warfare countermeasures. The market encompasses various protection categories ranging from passive armor solutions to sophisticated active defense mechanisms capable of intercepting incoming threats. Germany, France, and the United Kingdom lead the regional market, accounting for approximately 58% of total market share, driven by their substantial defense budgets and advanced military-industrial capabilities.

Technological innovation continues to reshape the European tank protection landscape, with manufacturers developing integrated protection suites that combine multiple defensive layers. The increasing adoption of modular protection systems allows for customizable defense configurations based on specific threat environments and mission requirements. Urban warfare considerations and asymmetric threats have particularly influenced the development of comprehensive protection solutions that address both conventional and unconventional attack vectors.

The Europe tank protection market refers to the comprehensive ecosystem of defensive technologies, systems, and solutions designed to safeguard armored fighting vehicles against various threats including kinetic projectiles, explosive devices, chemical agents, and electronic warfare attacks. This market encompasses both hardware and software components that work synergistically to enhance vehicle survivability while maintaining operational mobility and effectiveness.

Tank protection systems include passive armor technologies such as composite materials and reactive armor tiles, active protection systems that intercept incoming threats, and electronic countermeasures designed to disrupt enemy targeting systems. The market also covers ancillary protection technologies including blast-resistant seating, fire suppression systems, and crew protection equipment. Integration capabilities represent a crucial aspect of modern tank protection, enabling seamless coordination between multiple defensive layers and battlefield management systems.

European defense contractors and technology providers contribute to this market through research, development, manufacturing, and maintenance of protection systems. The market serves various end-users including national armed forces, NATO alliance partners, and allied nations seeking to enhance their armored vehicle capabilities through European-developed protection technologies.

Market dynamics in the European tank protection sector reflect a complex interplay of geopolitical tensions, technological advancement, and defense modernization priorities. The market has demonstrated resilience and growth potential, driven primarily by increasing security concerns along European borders and the need to maintain technological superiority in armored warfare capabilities. Active protection systems represent the fastest-growing segment, with adoption rates increasing by 12.4% annually as military organizations recognize their effectiveness against modern anti-tank threats.

Regional defense spending has shown consistent upward trends, with European NATO members progressively meeting alliance spending commitments. This increased investment directly benefits the tank protection market through procurement programs, research and development initiatives, and international collaboration projects. Germany and France continue to lead market development through their advanced defense industrial bases and significant military modernization programs.

Technological convergence between traditional armor protection and emerging technologies such as artificial intelligence, advanced sensors, and networked defense systems creates new market opportunities. The integration of cyber protection capabilities within physical protection systems addresses the growing threat of electronic warfare and cyber attacks against armored vehicles. Export potential remains strong, with European protection systems gaining recognition in international markets for their reliability and technological sophistication.

Strategic market insights reveal several critical trends shaping the European tank protection landscape. The following key insights provide comprehensive understanding of market dynamics:

Market intelligence indicates that European defense contractors are increasingly focusing on export opportunities to offset domestic market limitations and leverage their technological advantages in global markets.

Primary market drivers propelling the European tank protection market stem from evolving security landscapes and technological advancement requirements. Geopolitical tensions along European borders have intensified focus on armored vehicle protection, particularly following recent conflicts that demonstrated the vulnerability of conventional armor against modern anti-tank weapons. This security environment has prompted European nations to accelerate their tank protection modernization programs.

NATO alliance commitments serve as a significant driver, with member nations working to achieve interoperability standards and capability targets. The alliance’s emphasis on collective defense and standardized equipment specifications creates sustained demand for advanced protection systems. Defense spending increases across European nations, with many countries now meeting or approaching the 2% GDP target, provide the financial foundation for substantial protection system investments.

Technological advancement in threat systems necessitates corresponding improvements in protection capabilities. The proliferation of advanced anti-tank guided missiles, improvised explosive devices, and electronic warfare systems requires sophisticated countermeasures. Urban warfare requirements have become increasingly important, driving demand for protection systems optimized for close-quarters combat environments where traditional armor may be insufficient.

Industrial base considerations motivate European nations to maintain and develop domestic protection capabilities, reducing dependence on non-European suppliers while supporting local employment and technological expertise. Export opportunities provide additional market drivers as European protection systems gain recognition for their effectiveness and reliability in international markets.

Significant market restraints challenge the growth trajectory of the European tank protection market despite favorable demand conditions. Budget constraints represent the primary limitation, as advanced protection systems require substantial capital investments that strain defense budgets already competing for resources across multiple capability areas. The high cost of research, development, and procurement creates barriers to rapid market expansion.

Technical complexity associated with modern protection systems presents integration challenges that can delay procurement programs and increase lifecycle costs. The need for specialized training, maintenance infrastructure, and technical support creates additional financial burdens for military organizations. Weight and mobility concerns limit the extent to which protection can be added to existing platforms without compromising operational performance.

Regulatory compliance requirements across different European nations create complexity for manufacturers seeking to serve multiple markets. Varying certification standards, export control regulations, and procurement procedures can slow market entry and increase development costs. Technology transfer restrictions may limit collaboration opportunities and market access for certain advanced protection technologies.

Long development cycles characteristic of defense programs create market uncertainty and delay revenue realization for protection system providers. The conservative nature of military procurement processes can slow adoption of innovative technologies, particularly those that represent significant departures from established approaches. Competition from non-European suppliers offering lower-cost alternatives may pressure market pricing and profit margins.

Substantial market opportunities exist within the European tank protection sector, driven by technological innovation and evolving defense requirements. Active protection system adoption represents the most significant near-term opportunity, with penetration rates currently at 23% of eligible platforms, indicating substantial room for growth. European manufacturers are well-positioned to capitalize on this trend through their advanced technological capabilities and established defense relationships.

Retrofit and upgrade programs offer extensive opportunities as European nations seek to extend the service life of existing armored vehicle fleets through protection system enhancements. These programs typically require lower capital investment than new vehicle procurement while providing significant capability improvements. Modular protection systems enable cost-effective upgrades that can be implemented incrementally based on budget availability and operational priorities.

International export markets present substantial growth opportunities for European protection system manufacturers. The reputation for quality and reliability associated with European defense products creates competitive advantages in global markets. Partnership opportunities with non-European nations seeking technology transfer and local production capabilities can provide sustained revenue streams and market access.

Emerging technologies including artificial intelligence, advanced materials, and directed energy systems create opportunities for next-generation protection solutions. Cyber protection integration represents a growing market segment as military organizations recognize the need to protect against electronic warfare and cyber attacks. Dual-use applications for civilian security and law enforcement markets can provide additional revenue streams and economies of scale.

Complex market dynamics characterize the European tank protection sector, reflecting the interaction of technological, political, and economic factors. Supply chain considerations have gained prominence following recent global disruptions, with European manufacturers seeking to establish resilient supply networks that reduce dependence on non-European suppliers. This trend toward supply chain localization creates opportunities for European component manufacturers while potentially increasing costs.

Competitive dynamics within the European market reflect a balance between collaboration and competition among major defense contractors. Joint development programs enable cost sharing and risk mitigation while fostering technological advancement. However, competition for major procurement contracts remains intense, driving continuous innovation and cost optimization efforts.

Customer requirements continue to evolve toward more sophisticated, integrated protection solutions that address multiple threat types simultaneously. Military end-users increasingly demand systems that provide real-time threat assessment and adaptive protection responses. This evolution drives market dynamics toward higher-value, technology-intensive solutions that command premium pricing.

Regulatory environment changes, including export control modifications and defense cooperation agreements, significantly impact market dynamics. Brexit implications continue to influence market structure and collaboration patterns within the European defense industry. Standardization initiatives through NATO and EU frameworks create both opportunities and constraints for market participants, promoting interoperability while potentially limiting design flexibility.

Comprehensive research methodology underpins the analysis of the European tank protection market, employing multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with industry executives, military procurement officials, and technical experts across major European defense markets. This direct engagement provides insights into market trends, technology developments, and procurement priorities that may not be available through secondary sources.

Secondary research encompasses analysis of government defense budgets, procurement announcements, industry reports, and technical publications. MarkWide Research analysts utilize proprietary databases and industry contacts to validate information and identify emerging trends. Market sizing and forecasting employ statistical modeling techniques that account for cyclical defense spending patterns and program-specific factors.

Quantitative analysis includes examination of defense spending trends, procurement program timelines, and technology adoption rates across European markets. Qualitative assessment focuses on competitive positioning, technology roadmaps, and strategic initiatives that influence market development. Cross-validation of findings through multiple sources ensures research reliability and accuracy.

Geographic coverage encompasses all major European defense markets, with particular emphasis on countries with significant armored vehicle fleets and protection system requirements. Technology assessment includes evaluation of current capabilities, emerging technologies, and future development trajectories that will shape market evolution.

Regional market distribution across Europe reflects varying defense priorities, budget allocations, and industrial capabilities. Western Europe dominates the market with approximately 67% market share, led by Germany, France, and the United Kingdom. These nations maintain substantial defense budgets, advanced industrial bases, and significant armored vehicle fleets requiring protection system upgrades and modernization.

Germany represents the largest single market, driven by its extensive Leopard 2 tank fleet and ongoing modernization programs. German defense contractors also serve as major suppliers to other European markets, leveraging their technological expertise and manufacturing capabilities. France focuses on protection systems for its Leclerc main battle tanks and armored vehicle export programs, emphasizing advanced active protection technologies.

Eastern Europe shows the highest growth potential with expansion rates of 8.9% annually, driven by security concerns and NATO integration requirements. Countries including Poland, Czech Republic, and the Baltic states are investing heavily in armored vehicle protection as part of broader defense modernization initiatives. Nordic countries represent a specialized market segment focused on protection systems optimized for extreme climate conditions and specific operational requirements.

Southern Europe markets including Italy and Spain emphasize cost-effective protection solutions that provide capability improvements within constrained budgets. Regional cooperation programs facilitate technology sharing and joint procurement initiatives that benefit smaller European markets while promoting industrial collaboration.

Competitive landscape in the European tank protection market features a mix of large defense contractors, specialized technology providers, and emerging innovation companies. The market structure reflects both consolidation trends and niche specialization opportunities:

Market competition intensifies around major procurement programs, with companies forming strategic partnerships and joint ventures to enhance their competitive positioning. Technology differentiation remains crucial for maintaining market share and premium pricing in this sophisticated market segment.

Market segmentation analysis reveals distinct categories within the European tank protection market, each characterized by specific technologies, applications, and growth patterns. By Protection Type, the market divides into passive armor systems, active protection systems, and electronic countermeasures, with active systems showing the highest growth trajectory.

By Technology:

By Platform Type:

By End User:

Active Protection Systems represent the most dynamic market category, experiencing rapid adoption across European armed forces. These systems demonstrate effectiveness rates exceeding 85% against various anti-tank threats, justifying their higher cost compared to passive protection alternatives. German and Israeli technologies dominate this segment, with European manufacturers increasingly developing indigenous capabilities to reduce foreign dependence.

Passive Armor Solutions continue to form the foundation of tank protection, with advanced composite materials and modular designs enabling weight optimization without compromising protection levels. Ceramic and steel composites offer improved protection-to-weight ratios, while modular designs facilitate maintenance and upgrade flexibility. This category benefits from mature manufacturing processes and established supply chains.

Electronic Countermeasures gain importance as threats become more sophisticated, particularly in addressing guided munitions and electronic warfare attacks. Soft-kill systems provide cost-effective protection against certain threat types while complementing hard-kill active protection systems. Integration with vehicle electronic systems enables coordinated defense responses and situational awareness enhancement.

Integrated Protection Suites represent the market’s future direction, combining multiple protection technologies into cohesive systems that address diverse threat environments. These comprehensive solutions command premium pricing but offer superior capability and operational effectiveness. System integration expertise becomes a key competitive differentiator in this high-value market segment.

Defense contractors benefit from sustained demand driven by ongoing security concerns and modernization requirements across European markets. The market’s technical complexity creates barriers to entry that protect established players while rewarding innovation and technological advancement. Long-term contracts and maintenance agreements provide revenue stability and predictable cash flows.

Military end-users gain enhanced survivability and operational effectiveness through advanced protection systems. Crew safety improvements represent the primary benefit, with modern protection systems significantly reducing casualties in combat situations. Improved protection also enables more aggressive tactical employment of armored vehicles, enhancing overall military effectiveness.

Government stakeholders benefit from reduced military casualties, enhanced national security capabilities, and support for domestic defense industrial base development. Technology spillovers from defense protection research often benefit civilian applications, creating broader economic value. Export success in protection systems enhances national prestige and generates foreign currency earnings.

Research institutions and universities gain opportunities for collaboration on advanced materials research, artificial intelligence applications, and systems integration challenges. Academic partnerships with industry provide funding for research programs while developing expertise in critical technology areas. Innovation ecosystems around major defense contractors create opportunities for small and medium enterprises to participate in the market.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration emerges as a transformative trend, with protection systems increasingly incorporating machine learning algorithms for threat detection and response optimization. AI-enabled systems can process sensor data in real-time, identifying threats and coordinating defensive responses faster than human operators. This trend drives demand for more sophisticated protection systems while creating new market opportunities for technology providers.

Modular Protection Architecture gains traction as military organizations seek flexible solutions that can adapt to evolving threats and mission requirements. Plug-and-play protection modules enable rapid reconfiguration of defensive capabilities based on operational needs. This trend supports cost-effective upgrades and reduces lifecycle costs through standardized interfaces and components.

Weight Optimization Focus intensifies as military organizations balance protection requirements with mobility needs. Advanced materials including carbon fiber composites and ceramic technologies enable lighter protection systems without compromising defensive capabilities. This trend particularly benefits infantry fighting vehicles and other platforms where weight constraints are critical.

Networked Defense Systems represent an emerging trend toward integrated battlefield protection that coordinates multiple platforms and defensive assets. Communication protocols enable protection systems to share threat information and coordinate responses across multiple vehicles. This networked approach enhances overall force protection while optimizing resource utilization.

Sustainability Considerations increasingly influence protection system design and manufacturing processes. Environmental regulations and corporate responsibility initiatives drive development of eco-friendly materials and production methods. This trend creates opportunities for innovative companies while potentially increasing development costs.

Recent industry developments highlight the dynamic nature of the European tank protection market and emerging technology trends. Rheinmetall’s Active Defense System achieved significant milestones in testing and evaluation, demonstrating effectiveness against multiple threat types simultaneously. This development reinforces European leadership in active protection technology while creating new market opportunities.

Franco-German cooperation on next-generation main battle tank programs includes advanced protection system requirements that will influence market development for the next decade. Joint development initiatives between European nations promote technology sharing while reducing individual country development costs. These collaborative programs often result in standardized protection systems across multiple European armies.

NATO standardization agreements for protection systems create market opportunities while establishing technical requirements that influence product development. STANAG compliance becomes increasingly important for market access, particularly for companies seeking to serve multiple European markets. Standardization also facilitates interoperability and reduces lifecycle costs for military end-users.

Private investment in protection technology startups has increased significantly, with venture capital funding supporting innovative approaches to vehicle protection. Startup companies often focus on specific technology niches such as advanced materials or sensor systems, creating partnership opportunities with established defense contractors. This investment trend accelerates innovation while potentially disrupting traditional market structures.

Strategic recommendations for market participants emphasize the importance of technological innovation and market diversification. MWR analysis suggests that companies should prioritize active protection system development while maintaining capabilities in traditional armor technologies. The convergence of multiple protection technologies creates opportunities for companies that can offer integrated solutions addressing diverse threat environments.

Investment priorities should focus on artificial intelligence integration, advanced materials research, and manufacturing process optimization. Partnership strategies with technology companies outside the traditional defense sector can accelerate innovation while reducing development costs. Companies should also consider strategic alliances with international partners to access new markets and share development risks.

Market entry strategies for new participants should emphasize niche specialization rather than direct competition with established players. Technology differentiation through innovative approaches to specific protection challenges can create market opportunities even in mature segments. Export market development requires sustained investment in international relationships and regulatory compliance capabilities.

Risk management strategies should address supply chain vulnerabilities, technology obsolescence, and changing customer requirements. Diversification across multiple market segments and geographic regions can reduce dependence on single programs or customers. Companies should also invest in scenario planning capabilities to anticipate and respond to market changes effectively.

Future market prospects for the European tank protection sector remain positive, driven by sustained security concerns and technological advancement opportunities. MarkWide Research projects continued market expansion with growth rates of 6.8% annually over the next decade, supported by ongoing modernization programs and emerging technology adoption. The market’s evolution toward more sophisticated, integrated protection solutions will likely command premium pricing while creating new competitive dynamics.

Technology roadmaps indicate significant developments in directed energy protection systems, advanced artificial intelligence applications, and nanotechnology-based materials. These emerging technologies will likely reshape market structure while creating opportunities for innovative companies. Quantum sensing technologies may revolutionize threat detection capabilities, enabling more effective and efficient protection systems.

Geopolitical factors will continue to influence market development, with European nations likely to maintain or increase defense spending in response to evolving security challenges. NATO expansion and partnership programs may create additional market opportunities as new member nations seek to modernize their armored vehicle fleets. Brexit implications will continue to influence market structure and collaboration patterns within the European defense industry.

Market consolidation trends may accelerate as companies seek to achieve economies of scale and broaden their technology portfolios. Vertical integration strategies may become more common as companies seek to control critical supply chain elements and capture more value from protection system sales. International partnerships and joint ventures will likely increase as companies seek to access new markets and share development costs.

The Europe tank protection market represents a dynamic and strategically important segment of the continental defense industry, characterized by technological sophistication, sustained demand, and significant growth potential. Market fundamentals remain strong, supported by ongoing security concerns, defense modernization initiatives, and technological advancement opportunities that create value for industry participants and military end-users alike.

Key success factors in this market include technological innovation, customer relationship management, and strategic positioning across multiple market segments. Companies that can effectively integrate emerging technologies while maintaining cost competitiveness will likely achieve sustainable competitive advantages. The market’s evolution toward more sophisticated, networked protection solutions creates opportunities for companies with systems integration expertise and advanced technology capabilities.

Strategic implications for market participants emphasize the importance of long-term investment in research and development, international market development, and partnership strategies that leverage complementary capabilities. The market’s technical complexity and regulatory requirements create barriers to entry that protect established players while rewarding innovation and customer focus. Future market success will likely depend on companies’ ability to anticipate and respond to evolving threats while delivering cost-effective solutions that meet diverse customer requirements across the European defense landscape.

What is Tank Protection?

Tank Protection refers to the measures and technologies employed to safeguard storage tanks from environmental hazards, corrosion, and physical damage. This includes protective coatings, cathodic protection systems, and monitoring solutions to ensure the integrity of tanks used in various industries.

What are the key players in the Europe Tank Protection Market?

Key players in the Europe Tank Protection Market include companies such as Sherwin-Williams, Hempel, and PPG Industries, which provide a range of protective coatings and solutions for tank integrity. Other notable companies include AkzoNobel and BASF, among others.

What are the main drivers of the Europe Tank Protection Market?

The main drivers of the Europe Tank Protection Market include the increasing demand for safe storage solutions in the oil and gas sector, stringent environmental regulations, and the need for enhanced durability of storage tanks. Additionally, the growth of the chemical and petrochemical industries is contributing to market expansion.

What challenges does the Europe Tank Protection Market face?

The Europe Tank Protection Market faces challenges such as the high costs associated with advanced protective technologies and the need for regular maintenance and inspections. Additionally, the market is impacted by fluctuating raw material prices and competition from alternative storage solutions.

What opportunities exist in the Europe Tank Protection Market?

Opportunities in the Europe Tank Protection Market include the development of innovative protective coatings that offer better performance and sustainability. The increasing focus on environmental protection and the adoption of smart monitoring technologies also present significant growth potential.

What trends are shaping the Europe Tank Protection Market?

Trends shaping the Europe Tank Protection Market include the rising adoption of eco-friendly materials and coatings, advancements in corrosion protection technologies, and the integration of IoT for real-time monitoring of tank conditions. These trends are driving improvements in safety and efficiency across various industries.

Europe Tank Protection Market

| Segmentation Details | Description |

|---|---|

| Product Type | Steel Tanks, Composite Tanks, Fiberglass Tanks, Plastic Tanks |

| Technology | Corrosion Resistance, Leak Detection, Monitoring Systems, Insulation Techniques |

| End User | Oil & Gas, Chemical Industry, Agriculture, Water Treatment |

| Installation | Above Ground, Underground, Mobile, Fixed |

Please note: The segmentation can be entirely customized to align with our client’s needs.

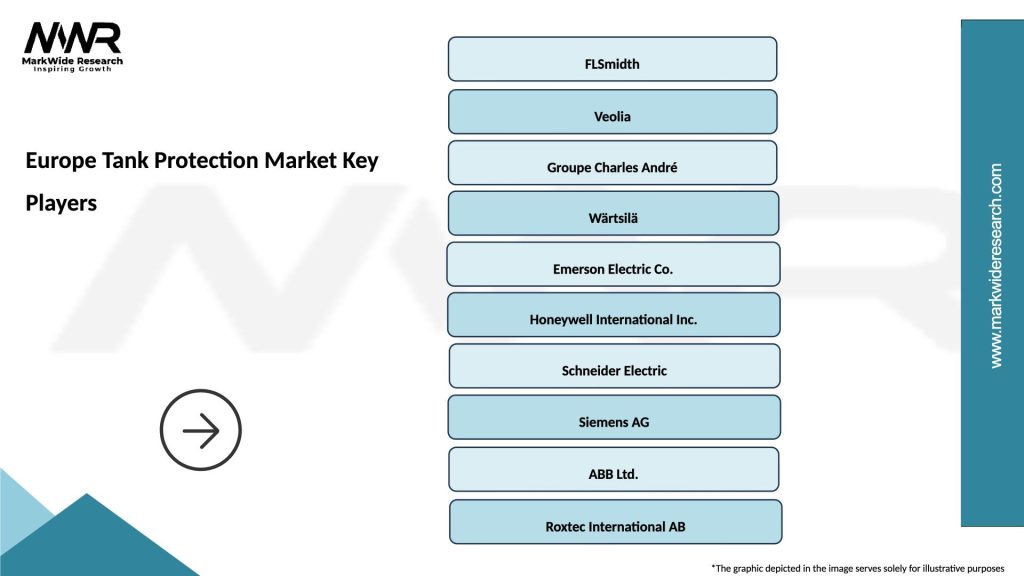

Leading companies in the Europe Tank Protection Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at