444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe sustainable furniture materials market represents a transformative shift in the furniture industry, driven by increasing environmental consciousness and regulatory pressures across European nations. This dynamic market encompasses eco-friendly materials including recycled wood, bamboo, reclaimed metals, and bio-based composites that are revolutionizing furniture manufacturing processes. European consumers are increasingly demanding furniture products that align with their environmental values, creating substantial opportunities for manufacturers who prioritize sustainability.

Market dynamics indicate robust growth potential, with the sector experiencing a 12.3% annual growth rate as manufacturers transition from traditional materials to sustainable alternatives. The market benefits from strong regulatory support through the European Union’s circular economy initiatives and green building standards. Germany, France, and the United Kingdom lead market adoption, collectively representing 68% of regional demand for sustainable furniture materials.

Innovation drivers include advanced recycling technologies, sustainable forestry practices, and the development of novel bio-based materials that maintain durability while reducing environmental impact. The integration of digital tracking systems enables manufacturers to verify material origins and sustainability credentials, enhancing consumer confidence in eco-friendly furniture products.

The Europe sustainable furniture materials market refers to the commercial ecosystem encompassing environmentally responsible raw materials, components, and manufacturing processes used in furniture production across European countries. This market includes materials sourced through sustainable practices, recycled content integration, and innovative bio-based alternatives that minimize environmental impact throughout the furniture lifecycle.

Sustainable furniture materials encompass various categories including responsibly harvested timber, recycled plastics, reclaimed metals, bamboo, cork, and emerging bio-composites derived from agricultural waste. These materials must meet specific environmental criteria including reduced carbon footprint, renewable sourcing, and end-of-life recyclability to qualify as sustainable alternatives to conventional furniture materials.

Market participants include material suppliers, furniture manufacturers, certification bodies, and distribution networks that collectively ensure sustainable materials reach end consumers through verified supply chains. The market operates within established frameworks including Forest Stewardship Council (FSC) certification, GREENGUARD standards, and European Union environmental regulations that govern material sustainability claims.

Europe’s sustainable furniture materials market demonstrates exceptional growth momentum as environmental regulations and consumer preferences converge to drive demand for eco-friendly alternatives. The market encompasses diverse material categories, with recycled wood products maintaining the largest market share at 34%, followed by bio-based composites and reclaimed metals gaining significant traction among manufacturers seeking sustainable solutions.

Key market drivers include stringent European Union environmental regulations, increasing consumer awareness of environmental issues, and corporate sustainability commitments from major furniture retailers. The market benefits from technological advancements in material processing, improved recycling capabilities, and innovative bio-material development that enhances performance characteristics while maintaining environmental benefits.

Regional dynamics show strong adoption across Western European markets, with Nordic countries leading in sustainable material integration due to established environmental policies and consumer preferences. The market faces challenges including higher material costs, supply chain complexity, and the need for industry-wide standardization of sustainability metrics.

Future prospects remain highly positive, with market expansion expected to accelerate as regulatory frameworks strengthen and material costs decrease through improved production efficiencies. The integration of circular economy principles and digital traceability systems will further enhance market growth potential across European regions.

Strategic market insights reveal fundamental shifts in European furniture material preferences, driven by regulatory requirements and evolving consumer expectations. The market demonstrates strong correlation between environmental policy implementation and sustainable material adoption rates across different European regions.

Environmental regulations serve as the primary catalyst driving sustainable furniture materials adoption across European markets. The European Union’s comprehensive environmental framework, including the Green Deal and Circular Economy Action Plan, establishes mandatory sustainability requirements that directly impact furniture material selection and sourcing practices.

Consumer awareness has reached unprecedented levels, with European consumers increasingly prioritizing environmental considerations in purchasing decisions. This shift reflects broader societal changes toward sustainability, supported by educational initiatives and environmental advocacy that influence consumer behavior patterns. Millennial and Generation Z consumers particularly drive demand for sustainable furniture options, creating long-term market growth potential.

Corporate sustainability commitments from major European furniture retailers and manufacturers create substantial demand for sustainable materials. Companies like IKEA, Steelcase, and numerous regional manufacturers have established ambitious environmental targets that require sustainable material integration throughout their supply chains.

Technological advancements in material processing and recycling capabilities enable the development of high-performance sustainable alternatives that match or exceed traditional material characteristics. These innovations address previous concerns about sustainable material durability and aesthetic appeal, expanding market acceptance among manufacturers and consumers.

Cost considerations remain a significant challenge for sustainable furniture materials adoption, as eco-friendly alternatives often carry premium pricing compared to conventional materials. This cost differential impacts manufacturer margins and can limit market penetration, particularly in price-sensitive market segments where cost optimization takes precedence over environmental considerations.

Supply chain complexity presents operational challenges for manufacturers seeking to integrate sustainable materials into existing production processes. The need for specialized suppliers, certification verification, and quality assurance systems increases operational complexity and can create supply disruptions that impact production schedules and inventory management.

Performance perception issues persist among some manufacturers and consumers who question whether sustainable materials can deliver equivalent durability and aesthetic appeal compared to traditional alternatives. These perceptions, while often unfounded, create market resistance that requires ongoing education and demonstration of sustainable material capabilities.

Standardization gaps across different European markets create compliance challenges for manufacturers operating in multiple regions. Varying sustainability standards, certification requirements, and regulatory frameworks increase operational complexity and can limit economies of scale in sustainable material procurement and utilization.

Circular economy integration presents substantial opportunities for sustainable furniture materials market expansion. The development of comprehensive material lifecycle management systems, including take-back programs and material recovery initiatives, creates new revenue streams while supporting environmental objectives and regulatory compliance requirements.

Bio-material innovation offers significant growth potential through the development of advanced materials derived from agricultural waste, algae, and other renewable sources. These emerging materials can provide unique performance characteristics while addressing sustainability requirements, creating competitive advantages for early adopters in the European market.

Digital integration opportunities include the implementation of blockchain-based traceability systems, IoT-enabled material monitoring, and AI-powered sustainability optimization tools. These technologies enhance transparency, improve supply chain efficiency, and provide valuable data insights that support sustainable material selection and utilization decisions.

Partnership development between material suppliers, furniture manufacturers, and technology providers creates opportunities for integrated sustainable solutions. Collaborative approaches can accelerate innovation, reduce development costs, and create comprehensive sustainability ecosystems that benefit all market participants while advancing environmental objectives.

Supply-demand dynamics in the European sustainable furniture materials market reflect the complex interplay between regulatory requirements, consumer preferences, and manufacturing capabilities. Current market conditions show strong demand growth outpacing supply capacity, creating opportunities for material suppliers while potentially constraining manufacturer options in the near term.

Competitive dynamics are evolving as traditional material suppliers adapt to sustainability requirements while new entrants focus exclusively on eco-friendly alternatives. This competition drives innovation and cost optimization while creating market fragmentation that requires careful supplier selection and relationship management by furniture manufacturers.

Regulatory dynamics continue to strengthen across European markets, with new environmental standards and reporting requirements regularly introduced. These evolving regulations create both opportunities and challenges, requiring market participants to maintain flexibility and adaptability in their sustainable material strategies and implementation approaches.

Technology dynamics play an increasingly important role in market development, with material processing innovations improving sustainable material performance while digital tools enhance supply chain transparency and efficiency. According to MarkWide Research analysis, technology integration contributes to 23% improvement in sustainable material adoption rates across European furniture manufacturers.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the European sustainable furniture materials market. Primary research includes extensive interviews with industry stakeholders, including material suppliers, furniture manufacturers, regulatory officials, and end consumers across major European markets.

Secondary research encompasses analysis of industry reports, regulatory documents, trade publications, and academic studies related to sustainable materials and furniture industry trends. This approach provides historical context and identifies emerging patterns that influence market development and future growth potential.

Quantitative analysis utilizes statistical modeling and trend analysis to project market growth patterns, identify key performance indicators, and assess regional variations in sustainable material adoption. Data validation processes ensure accuracy and reliability of numerical insights presented throughout the market analysis.

Qualitative assessment incorporates expert opinions, industry observations, and stakeholder feedback to provide context and interpretation for quantitative findings. This balanced approach ensures comprehensive understanding of market dynamics, challenges, and opportunities that shape the European sustainable furniture materials landscape.

Western Europe dominates the sustainable furniture materials market, with Germany leading adoption through strong environmental regulations and consumer awareness. German manufacturers demonstrate 78% integration rates for sustainable materials in commercial furniture production, supported by robust certification systems and government incentives for environmental compliance.

Nordic countries including Sweden, Denmark, and Norway show exceptional market maturity, with sustainable materials representing 82% of furniture material procurement in these regions. The Nordic market benefits from established environmental policies, consumer preferences for sustainability, and strong domestic forestry industries that support sustainable wood material supply.

France and the United Kingdom demonstrate strong growth potential, with increasing regulatory pressure and consumer demand driving sustainable material adoption. These markets show 15.7% annual growth in sustainable material utilization, supported by major retailer commitments and government sustainability initiatives.

Southern European markets including Italy, Spain, and Portugal are experiencing accelerated adoption as EU environmental directives create compliance requirements. These regions show particular strength in recycled material integration and bio-composite development, leveraging local agricultural resources for sustainable material production.

Eastern European markets present emerging opportunities as economic development and EU integration drive environmental standard adoption. Countries like Poland, Czech Republic, and Hungary show increasing interest in sustainable materials, particularly in commercial and institutional furniture sectors where regulatory compliance is mandatory.

Market leadership in European sustainable furniture materials is distributed among established material suppliers, innovative startups, and integrated furniture manufacturers who have developed sustainable material capabilities. The competitive environment reflects diverse approaches to sustainability, from traditional suppliers adapting existing processes to new entrants focused exclusively on eco-friendly alternatives.

Material type segmentation reveals diverse categories within the European sustainable furniture materials market, each addressing specific sustainability requirements and performance characteristics. This segmentation reflects the complexity of sustainable material options available to furniture manufacturers and the varying environmental benefits provided by different material categories.

By Material Type:

By Application Segment:

Recycled wood products maintain market leadership through established supply chains and proven performance characteristics. This category benefits from mature recycling infrastructure and strong consumer acceptance, with FSC-certified materials showing particular strength in commercial applications where sustainability credentials are essential for procurement decisions.

Bio-based composites represent the fastest-growing category, driven by innovation in agricultural waste utilization and advanced processing technologies. These materials offer unique sustainability benefits including carbon sequestration and biodegradability, appealing to manufacturers seeking differentiated environmental positioning in competitive markets.

Sustainable metal components show steady growth as recycling technologies improve and supply chains develop. The category benefits from established metal recycling infrastructure and growing awareness of the environmental benefits of recycled metal utilization in furniture manufacturing processes.

Natural fiber materials demonstrate niche market success, particularly in premium furniture segments where unique aesthetic and performance characteristics justify higher material costs. These materials appeal to consumers seeking authentic natural alternatives to synthetic materials in furniture applications.

Recycled plastic materials show emerging potential as processing technologies improve and material performance characteristics enhance. This category addresses plastic waste concerns while providing durable, weather-resistant materials suitable for outdoor and commercial furniture applications.

Manufacturers benefit from sustainable material adoption through enhanced brand positioning, regulatory compliance, and access to environmentally conscious consumer segments. Sustainable materials enable differentiation in competitive markets while supporting corporate sustainability commitments and environmental reporting requirements.

Material suppliers gain competitive advantages through sustainable material development, including access to premium market segments, long-term customer relationships, and alignment with regulatory trends. Sustainable material specialization creates barriers to entry and supports premium pricing strategies in growing market segments.

Consumers receive environmental benefits including reduced carbon footprint, support for sustainable forestry practices, and alignment with personal environmental values. Sustainable furniture materials often provide additional benefits including improved indoor air quality and reduced exposure to harmful chemicals commonly found in conventional materials.

Regulatory bodies achieve environmental policy objectives through market-driven sustainable material adoption, reducing the need for additional regulatory intervention while supporting circular economy goals. Industry self-regulation through sustainable material adoption demonstrates effective policy implementation and stakeholder cooperation.

Environmental organizations benefit from reduced environmental impact of furniture production, including decreased deforestation, reduced waste generation, and lower carbon emissions. Sustainable material adoption supports broader environmental objectives while demonstrating industry commitment to environmental stewardship and responsibility.

Strengths:

Weaknesses:

Opportunities:

Threats:

Circular economy integration emerges as a dominant trend, with manufacturers implementing comprehensive material lifecycle management systems. This approach includes take-back programs, material recovery initiatives, and closed-loop manufacturing processes that maximize material utilization while minimizing waste generation throughout the furniture lifecycle.

Bio-material advancement continues accelerating, with innovative materials derived from agricultural waste, algae, and other renewable sources gaining market traction. These advanced bio-materials offer unique performance characteristics including antimicrobial properties, enhanced durability, and aesthetic appeal that expand application possibilities in furniture manufacturing.

Digital traceability implementation becomes standard practice as manufacturers and consumers demand transparency in sustainable material sourcing and processing. Blockchain technology and IoT sensors enable comprehensive tracking of material origins, processing methods, and environmental impact throughout supply chains.

Certification standardization progresses as industry stakeholders work toward unified sustainability standards that simplify compliance and enhance consumer understanding. This trend reduces operational complexity while improving market transparency and consumer confidence in sustainable material claims and environmental benefits.

Cost optimization focus intensifies as sustainable material suppliers implement efficiency improvements and scale economies that reduce cost premiums compared to conventional alternatives. MWR data indicates 18% cost reduction in sustainable materials over the past two years through improved production processes and supply chain optimization.

Strategic partnerships between material suppliers and furniture manufacturers are reshaping market dynamics, creating integrated sustainable solutions that benefit all stakeholders. These collaborations focus on joint product development, supply chain optimization, and market education initiatives that accelerate sustainable material adoption across European markets.

Investment increases in sustainable material research and development reflect industry commitment to environmental objectives and market growth potential. Major material suppliers are allocating substantial resources to bio-material innovation, recycling technology advancement, and production capacity expansion to meet growing market demand.

Regulatory enhancements continue strengthening environmental requirements across European markets, with new standards for material transparency, carbon footprint reporting, and end-of-life management creating additional compliance requirements while supporting market growth through mandatory sustainable material adoption.

Technology integration accelerates as digital tools become essential for sustainable material management, including AI-powered optimization systems, predictive analytics, and automated compliance monitoring that enhance operational efficiency while supporting environmental objectives and regulatory compliance requirements.

Market consolidation activities include acquisitions and mergers among sustainable material suppliers seeking to expand capabilities and market reach. These developments create more comprehensive solution providers while potentially reducing supplier options for furniture manufacturers seeking sustainable material alternatives.

Strategic positioning recommendations emphasize the importance of early sustainable material adoption to gain competitive advantages and market leadership positions. Companies should prioritize supplier relationship development, certification compliance, and consumer education initiatives that support long-term market success in the evolving sustainable furniture materials landscape.

Investment priorities should focus on supply chain diversification, technology integration, and sustainability certification to ensure reliable access to sustainable materials while maintaining operational flexibility. Companies should also consider vertical integration opportunities that provide greater control over sustainable material sourcing and quality assurance processes.

Risk management strategies must address potential supply chain disruptions, cost volatility, and regulatory changes that could impact sustainable material availability and pricing. Diversified supplier networks, long-term contracts, and flexible sourcing strategies can mitigate these risks while supporting sustainable material integration objectives.

Market development approaches should emphasize consumer education, performance demonstration, and value communication that address lingering concerns about sustainable material capabilities. Companies should invest in marketing initiatives that highlight environmental benefits while demonstrating equivalent or superior performance compared to conventional alternatives.

Partnership opportunities with technology providers, certification bodies, and industry associations can accelerate sustainable material adoption while reducing individual company investment requirements. Collaborative approaches enable shared risk, accelerated innovation, and comprehensive market development that benefits all participants in the sustainable furniture materials ecosystem.

Market expansion prospects remain highly positive as regulatory requirements strengthen and consumer environmental awareness continues growing across European markets. The sustainable furniture materials market is positioned for sustained growth, driven by mandatory compliance requirements, corporate sustainability commitments, and evolving consumer preferences that prioritize environmental considerations.

Technology advancement will continue driving market development through improved material performance, enhanced processing capabilities, and digital integration that supports supply chain transparency and efficiency. MarkWide Research projects that technology integration will contribute to 35% improvement in sustainable material adoption rates over the next five years.

Innovation acceleration in bio-material development and recycling technologies will expand sustainable material options while improving performance characteristics and cost competitiveness. These developments will address current market limitations while creating new opportunities for differentiation and competitive advantage in European furniture markets.

Regulatory evolution will continue strengthening environmental requirements while potentially harmonizing standards across European markets. This trend will simplify compliance while creating larger addressable markets for sustainable material suppliers and furniture manufacturers committed to environmental objectives and sustainability leadership.

Market maturation will result in improved supply chain efficiency, reduced cost premiums, and enhanced consumer acceptance that supports mainstream adoption of sustainable furniture materials. The market transition from niche specialty to mainstream requirement will create substantial growth opportunities while supporting broader environmental objectives across European furniture industries.

The Europe sustainable furniture materials market represents a fundamental transformation in furniture manufacturing, driven by regulatory requirements, consumer preferences, and technological innovation that collectively support environmental objectives while creating substantial commercial opportunities. Market dynamics demonstrate strong growth potential across all material categories, with particular strength in recycled wood products and emerging bio-based composites that offer unique performance and environmental benefits.

Strategic market positioning requires comprehensive understanding of regulatory requirements, consumer preferences, and supply chain complexities that influence sustainable material adoption decisions. Companies that successfully navigate these challenges while maintaining focus on quality, performance, and cost competitiveness will achieve sustainable competitive advantages in the evolving European furniture materials landscape.

Future success in this market depends on continued innovation, strategic partnerships, and commitment to environmental objectives that align with broader European sustainability goals. The market offers substantial opportunities for companies willing to invest in sustainable material development, supply chain optimization, and consumer education initiatives that support long-term growth and environmental stewardship across European furniture industries.

What is Sustainable Furniture Materials?

Sustainable furniture materials refer to resources used in furniture production that are environmentally friendly, renewable, and have a minimal ecological footprint. These materials often include reclaimed wood, bamboo, and recycled metals, which contribute to sustainable practices in the furniture industry.

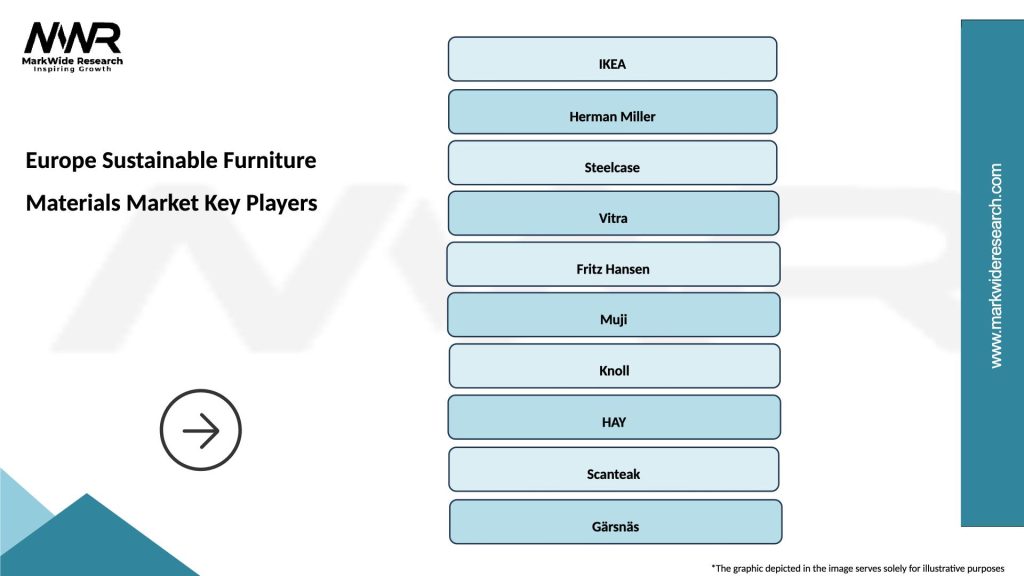

What are the key players in the Europe Sustainable Furniture Materials Market?

Key players in the Europe Sustainable Furniture Materials Market include IKEA, HAY, and Vitra, which focus on sustainable sourcing and eco-friendly designs. These companies are known for their commitment to reducing environmental impact and promoting sustainable practices in furniture manufacturing, among others.

What are the growth factors driving the Europe Sustainable Furniture Materials Market?

The growth of the Europe Sustainable Furniture Materials Market is driven by increasing consumer awareness of environmental issues, a rise in demand for eco-friendly products, and government initiatives promoting sustainability. Additionally, the trend towards minimalistic and sustainable living spaces is influencing consumer choices.

What challenges does the Europe Sustainable Furniture Materials Market face?

Challenges in the Europe Sustainable Furniture Materials Market include the higher costs associated with sustainable materials and the limited availability of certain eco-friendly resources. Additionally, consumer skepticism regarding the durability and quality of sustainable furniture can hinder market growth.

What opportunities exist in the Europe Sustainable Furniture Materials Market?

Opportunities in the Europe Sustainable Furniture Materials Market include the potential for innovation in material technology and the growing trend of circular economy practices. Companies can explore new sustainable materials and design methods that appeal to environmentally conscious consumers.

What trends are shaping the Europe Sustainable Furniture Materials Market?

Trends shaping the Europe Sustainable Furniture Materials Market include the increasing use of biodegradable materials, the rise of upcycled furniture, and a focus on transparency in sourcing. Consumers are increasingly seeking products that align with their values of sustainability and ethical production.

Europe Sustainable Furniture Materials Market

| Segmentation Details | Description |

|---|---|

| Material Type | Bamboo, Recycled Wood, Cork, Biocomposite |

| End Use | Residential, Commercial, Hospitality, Office |

| Manufacturing Process | Handcrafted, Engineered, Modular, Upcycled |

| Design Style | Modern, Rustic, Minimalist, Scandinavian |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Sustainable Furniture Materials Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at