444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe sugar free energy drinks market represents a dynamic and rapidly evolving segment within the broader beverage industry, characterized by increasing consumer demand for healthier energy alternatives. Market dynamics indicate substantial growth driven by rising health consciousness, fitness culture expansion, and regulatory pressures to reduce sugar consumption across European nations. The market encompasses a diverse range of products featuring artificial sweeteners, natural sugar alternatives, and innovative formulations designed to deliver energy enhancement without traditional sugar content.

Consumer preferences have shifted dramatically toward sugar-free alternatives, with market penetration rates reaching 42% across major European markets in 2024. This transformation reflects broader dietary trends emphasizing low-calorie, functional beverages that support active lifestyles while addressing health concerns associated with excessive sugar intake. Regional variations exist across European markets, with Nordic countries leading adoption rates at 58% market share for sugar-free variants, followed by Western European nations demonstrating strong growth momentum.

Innovation drivers within the European sugar-free energy drinks sector include advanced sweetening technologies, enhanced flavor profiles, and functional ingredient integration. The market benefits from sophisticated consumer bases willing to pay premium prices for products delivering both energy enhancement and health benefits. Distribution channels have expanded beyond traditional retail outlets to include specialized fitness centers, online platforms, and convenience stores, creating comprehensive market accessibility across diverse consumer segments.

The Europe sugar free energy drinks market refers to the commercial ecosystem encompassing the production, distribution, and consumption of energy-enhancing beverages formulated without traditional sugar content across European territories. These products utilize alternative sweetening agents, including artificial sweeteners like aspartame and sucralose, natural alternatives such as stevia, and sugar alcohols to provide sweetness while maintaining low or zero caloric content.

Product characteristics typically include caffeine content ranging from moderate to high levels, B-vitamin complexes, amino acids, and specialized ingredients designed to enhance mental alertness and physical performance. The market encompasses both established multinational brands and emerging regional players, creating a competitive landscape focused on innovation, taste optimization, and health positioning. Consumer targeting spans fitness enthusiasts, professionals seeking energy enhancement, health-conscious individuals, and younger demographics prioritizing wellness-oriented consumption patterns.

Market transformation within the European sugar-free energy drinks sector reflects fundamental shifts in consumer behavior, regulatory environments, and industry innovation capabilities. The market demonstrates robust expansion driven by health consciousness trends affecting 73% of European consumers who actively seek reduced-sugar alternatives in their beverage choices. This consumer evolution creates substantial opportunities for brands positioned to deliver effective energy enhancement without compromising health objectives.

Competitive dynamics feature intense innovation cycles, with leading manufacturers investing heavily in research and development to create superior taste profiles and functional benefits. The market benefits from supportive regulatory frameworks encouraging sugar reduction initiatives, creating favorable conditions for sugar-free product development and marketing. Distribution expansion across multiple channels ensures broad market accessibility, while premium positioning strategies enable sustained profitability despite higher production costs associated with alternative sweetening technologies.

Growth projections indicate continued market expansion supported by demographic trends, lifestyle changes, and increasing awareness of sugar-related health risks. The sector attracts significant investment from both established beverage companies and innovative startups, fostering technological advancement and product diversification that strengthens overall market appeal and consumer adoption rates.

Consumer behavior analysis reveals several critical insights driving European sugar-free energy drinks market development:

Health consciousness expansion represents the primary driver propelling European sugar-free energy drinks market growth. Rising awareness of sugar-related health risks, including obesity, diabetes, and dental problems, motivates consumers to seek healthier alternatives without sacrificing energy enhancement benefits. This trend particularly resonates with younger demographics who prioritize wellness as a lifestyle choice rather than merely addressing existing health concerns.

Fitness culture proliferation across European markets creates substantial demand for products supporting active lifestyles while maintaining health objectives. The integration of fitness activities into daily routines drives consistent consumption patterns, with users seeking energy enhancement that complements rather than contradicts their wellness goals. Gym membership growth of 15% annually across major European cities correlates directly with increased sugar-free energy drink adoption rates.

Regulatory support through sugar reduction initiatives and health-focused policies creates favorable market conditions for sugar-free alternatives. Government campaigns promoting reduced sugar consumption, combined with potential taxation on high-sugar beverages, incentivize both manufacturers and consumers to embrace sugar-free formulations. Innovation advancement in sweetening technologies enables products to achieve superior taste profiles while maintaining health benefits, reducing traditional barriers to sugar-free product adoption.

Taste perception challenges continue to limit market expansion, as some consumers maintain preferences for traditional sugar-sweetened formulations despite health benefits associated with sugar-free alternatives. Artificial sweetener concerns among certain consumer segments create resistance to products utilizing synthetic sweetening agents, requiring manufacturers to invest in natural alternative development and consumer education initiatives.

Premium pricing structures associated with advanced sweetening technologies and specialized ingredients may limit accessibility for price-sensitive consumer segments. Higher production costs translate to retail prices that can exceed traditional energy drinks by 20-30%, potentially restricting market penetration among budget-conscious demographics. Regulatory complexity surrounding artificial sweetener approvals and labeling requirements creates compliance challenges for manufacturers, particularly smaller companies lacking extensive regulatory expertise.

Market saturation risks emerge as increasing numbers of brands enter the sugar-free segment, intensifying competition and potentially fragmenting consumer attention. Supply chain constraints for specialized ingredients, particularly natural sweeteners like stevia, can create production limitations and cost volatility that impact market stability and growth predictability.

Product innovation opportunities abound within the European sugar-free energy drinks market, particularly in developing hybrid formulations combining energy enhancement with additional functional benefits. Nootropic integration presents significant potential, with cognitive enhancement ingredients appealing to professional demographics seeking mental performance improvement alongside physical energy support. The market opportunity extends to specialized formulations targeting specific consumer needs, including pre-workout, post-workout, and sustained energy release products.

Geographic expansion within European markets offers substantial growth potential, particularly in Eastern European countries where sugar-free awareness continues developing. Digital marketing channels provide cost-effective opportunities to reach target demographics, especially younger consumers who prioritize health and wellness in their purchasing decisions. Partnership opportunities with fitness centers, health clubs, and wellness platforms create distribution channels aligned with target consumer lifestyles.

Sustainable packaging innovation represents an emerging opportunity as environmentally conscious consumers seek products aligning with broader sustainability values. Personalization trends create opportunities for customized formulations addressing individual health goals, dietary restrictions, and taste preferences, potentially commanding premium pricing while building customer loyalty.

Competitive intensity within the European sugar-free energy drinks market drives continuous innovation cycles, with established players and emerging brands competing through product differentiation, marketing sophistication, and distribution expansion. Consumer education plays a crucial role in market development, as manufacturers invest in awareness campaigns highlighting health benefits and addressing misconceptions about artificial sweeteners and sugar alternatives.

Supply chain evolution reflects increasing demand for natural sweetening ingredients, creating opportunities for suppliers specializing in stevia, monk fruit, and other plant-based alternatives. Regulatory developments continue shaping market dynamics, with potential sugar taxes and labeling requirements influencing both manufacturer strategies and consumer behavior patterns. Technology advancement in flavoring and sweetening systems enables products to achieve taste profiles previously unattainable in sugar-free formulations.

Market consolidation trends emerge as larger beverage companies acquire innovative smaller brands to expand their sugar-free portfolios and access specialized expertise. Cross-category competition intensifies as traditional energy drink brands develop sugar-free variants while health-focused beverage companies expand into energy enhancement segments, creating dynamic competitive landscapes requiring strategic agility.

Comprehensive market analysis employs multi-faceted research approaches combining quantitative data collection with qualitative insights from industry stakeholders, consumers, and market experts. Primary research methodologies include consumer surveys across major European markets, in-depth interviews with industry executives, and focus groups examining taste preferences, purchasing behaviors, and health consciousness trends affecting sugar-free energy drink adoption.

Secondary research integration encompasses analysis of industry reports, regulatory documents, company financial statements, and market intelligence databases to establish comprehensive market understanding. Data triangulation ensures accuracy through cross-verification of findings across multiple sources and methodologies. Market modeling utilizes statistical analysis to project growth trends, identify market opportunities, and assess competitive dynamics within the European sugar-free energy drinks sector.

Expert consultation with industry professionals, nutritionists, and regulatory specialists provides specialized insights into market development factors, consumer health trends, and regulatory implications affecting market growth. Real-time monitoring of market developments, product launches, and consumer sentiment through digital channels ensures current and relevant analysis reflecting rapidly evolving market conditions.

Western European markets demonstrate the highest adoption rates for sugar-free energy drinks, led by Germany, France, and the United Kingdom, where health consciousness and fitness culture integration drive consistent demand growth. These markets benefit from sophisticated consumer bases willing to pay premium prices for perceived health benefits, creating favorable conditions for product innovation and brand development. Market penetration rates in Western Europe average 45% for sugar-free variants, significantly higher than global averages.

Nordic countries represent the most advanced markets for sugar-free energy drinks, with Sweden, Norway, and Denmark achieving market leadership in health-conscious beverage consumption. These markets demonstrate 62% preference rates for sugar-free alternatives, driven by strong government health initiatives, high disposable incomes, and cultural emphasis on wellness and fitness. Innovation adoption occurs rapidly in Nordic markets, making them ideal testing grounds for new product concepts and formulations.

Southern European markets, including Spain, Italy, and Portugal, show emerging growth potential with increasing health awareness and fitness culture development. While traditional beverage preferences remain strong, younger demographics drive sugar-free adoption with growth rates exceeding 25% annually. Eastern European markets present significant expansion opportunities as economic development and health consciousness continue evolving, though current penetration rates remain below Western European levels.

Market leadership within the European sugar-free energy drinks sector features a combination of established multinational beverage companies and innovative regional players focused on health-conscious consumer segments. Competition intensity drives continuous product innovation, marketing sophistication, and distribution expansion strategies.

Competitive strategies emphasize product differentiation through unique ingredient combinations, superior taste profiles, and targeted marketing campaigns addressing specific consumer needs and lifestyle preferences.

By Product Type:

By Distribution Channel:

By Consumer Demographics:

Traditional sugar-free energy drinks maintain the largest market share through established brand recognition and widespread availability, though growth rates moderate as consumers increasingly seek enhanced functionality beyond basic energy provision. Artificial sweetener formulations continue dominating this segment due to cost-effectiveness and proven taste profiles, despite growing consumer interest in natural alternatives.

Natural sugar-free variants represent the fastest-growing category, with annual growth rates exceeding 35% as health-conscious consumers prioritize products featuring stevia, monk fruit, and other plant-based sweetening systems. Premium positioning enables higher profit margins while appealing to consumers willing to pay additional costs for perceived natural benefits and cleaner ingredient profiles.

Functional sugar-free products emerge as high-potential categories combining energy enhancement with cognitive benefits, immune support, and performance optimization. Nootropic integration particularly appeals to professional demographics seeking mental performance enhancement, while adaptogen inclusion targets stress management and overall wellness objectives. Organic certification creates additional differentiation opportunities, though higher costs limit mass market accessibility.

Manufacturers benefit from expanding market opportunities driven by health consciousness trends and regulatory support for sugar reduction initiatives. Product innovation capabilities enable differentiation through unique formulations, superior taste profiles, and functional ingredient integration that commands premium pricing. Brand positioning in the health and wellness space creates long-term competitive advantages as consumer preferences continue evolving toward healthier alternatives.

Retailers gain from higher profit margins associated with premium sugar-free products while meeting consumer demand for healthier beverage options. Category expansion opportunities exist through specialized product placement, cross-merchandising with health and fitness products, and targeted marketing campaigns addressing health-conscious consumer segments. Customer loyalty strengthens as retailers position themselves as destinations for wellness-oriented products.

Consumers receive energy enhancement benefits without sugar-related health concerns, enabling maintenance of active lifestyles while supporting broader wellness objectives. Product variety ensures options addressing diverse taste preferences, dietary restrictions, and functional needs. Health benefits include reduced caloric intake, better blood sugar management, and alignment with fitness and wellness goals, creating sustained value propositions for regular consumption.

Strengths:

Weaknesses:

Opportunities:

Threats:

Natural sweetener adoption accelerates as consumers increasingly prioritize plant-based alternatives over artificial sweetening systems, driving innovation in stevia, monk fruit, and other natural sweetening technologies. Functional enhancement integration becomes standard practice, with manufacturers incorporating nootropics, adaptogens, and specialized performance ingredients to differentiate products beyond basic energy provision.

Personalization trends emerge through customizable formulations addressing individual health goals, dietary restrictions, and taste preferences, enabled by digital platforms and direct-to-consumer sales models. Sustainability focus influences packaging innovation, ingredient sourcing, and manufacturing processes as environmentally conscious consumers seek products aligning with broader sustainability values.

Digital engagement strategies leverage social media platforms, influencer partnerships, and content marketing to reach health-conscious demographics, particularly younger consumers who prioritize wellness in their purchasing decisions. Cross-category convergence creates hybrid products combining energy drinks with sports nutrition, wellness supplements, and functional beverages, expanding market boundaries and consumer appeal. Subscription models gain traction as consumers seek convenient access to preferred products while brands build direct relationships and predictable revenue streams.

Product launch acceleration characterizes recent industry developments, with major brands introducing multiple sugar-free variants targeting specific consumer segments and use occasions. MarkWide Research analysis indicates 67% of new energy drink launches in Europe now feature sugar-free formulations, reflecting industry recognition of consumer preference shifts and market opportunities.

Strategic acquisitions intensify as established beverage companies acquire innovative smaller brands to expand sugar-free portfolios and access specialized expertise in natural sweetening and functional ingredient integration. Manufacturing investments focus on production capacity expansion and technology upgrades enabling superior taste profiles and cost optimization for sugar-free formulations.

Regulatory developments include potential sugar taxation proposals and enhanced labeling requirements that favor sugar-free alternatives while creating compliance challenges for manufacturers. Partnership expansion between energy drink brands and fitness organizations creates distribution opportunities aligned with target consumer lifestyles, while sustainability initiatives address packaging innovation and ingredient sourcing transparency demands from environmentally conscious consumers.

Investment prioritization should focus on natural sweetening technology development and taste optimization capabilities that enable products to achieve parity with traditional formulations while maintaining health benefits. Market expansion strategies should target Eastern European markets where health consciousness continues developing, creating first-mover advantages for well-positioned brands.

Product development emphasis should integrate functional ingredients addressing cognitive enhancement, stress management, and performance optimization to differentiate offerings beyond basic energy provision. Distribution diversification across online channels, fitness centers, and specialized health retailers creates multiple touchpoints with target consumers while reducing dependence on traditional retail channels.

Brand positioning should emphasize health benefits, natural ingredients, and lifestyle alignment rather than solely focusing on energy enhancement, creating emotional connections with health-conscious consumers. Consumer education initiatives addressing artificial sweetener safety and natural alternative benefits can accelerate adoption rates while building brand trust and loyalty. Sustainability integration throughout product development, packaging, and marketing creates competitive advantages with environmentally conscious demographics.

Market evolution toward natural, functional, and personalized sugar-free energy drinks appears inevitable as consumer health consciousness continues expanding and technology enables superior product development. Growth projections indicate sustained expansion with annual growth rates exceeding 18% across major European markets, driven by demographic trends, lifestyle changes, and regulatory support for sugar reduction initiatives.

Innovation acceleration will focus on natural sweetening systems, functional ingredient integration, and personalization capabilities that address individual consumer needs and preferences. MWR projections suggest natural sugar-free variants will capture 55% market share within five years as consumer preferences shift toward plant-based alternatives and clean label products.

Competitive landscape evolution will feature increased consolidation as larger companies acquire innovative smaller brands, while new entrants focus on specialized segments and direct-to-consumer models. Distribution transformation will emphasize online channels, subscription services, and partnerships with health and fitness organizations, creating comprehensive market accessibility for target consumers. Regulatory developments supporting sugar reduction will create increasingly favorable conditions for sugar-free alternatives while potentially challenging traditional energy drink formulations.

The Europe sugar free energy drinks market represents a transformative segment within the broader beverage industry, driven by fundamental shifts in consumer health consciousness, regulatory environments, and technological capabilities. Market dynamics favor continued expansion as health-aware consumers increasingly prioritize products delivering energy enhancement without compromising wellness objectives, creating sustainable growth opportunities for well-positioned brands and innovative product developers.

Success factors within this evolving market include superior taste development, natural ingredient integration, functional enhancement capabilities, and strategic distribution across channels aligned with target consumer lifestyles. Industry participants who invest in innovation, consumer education, and brand positioning emphasizing health benefits will capture disproportionate market share as the segment continues maturing and expanding across European territories.

Future prospects remain highly favorable as demographic trends, lifestyle changes, and regulatory support create sustained demand for sugar-free energy alternatives. The market’s evolution toward natural, functional, and personalized products ensures continued innovation opportunities while premium positioning strategies enable sustained profitability despite higher production costs associated with advanced sweetening technologies and specialized ingredients.

What is Sugar Free Energy Drinks?

Sugar Free Energy Drinks are beverages designed to provide energy and enhance physical and mental performance without the addition of sugar. They typically contain caffeine, vitamins, and other stimulants to boost energy levels while appealing to health-conscious consumers.

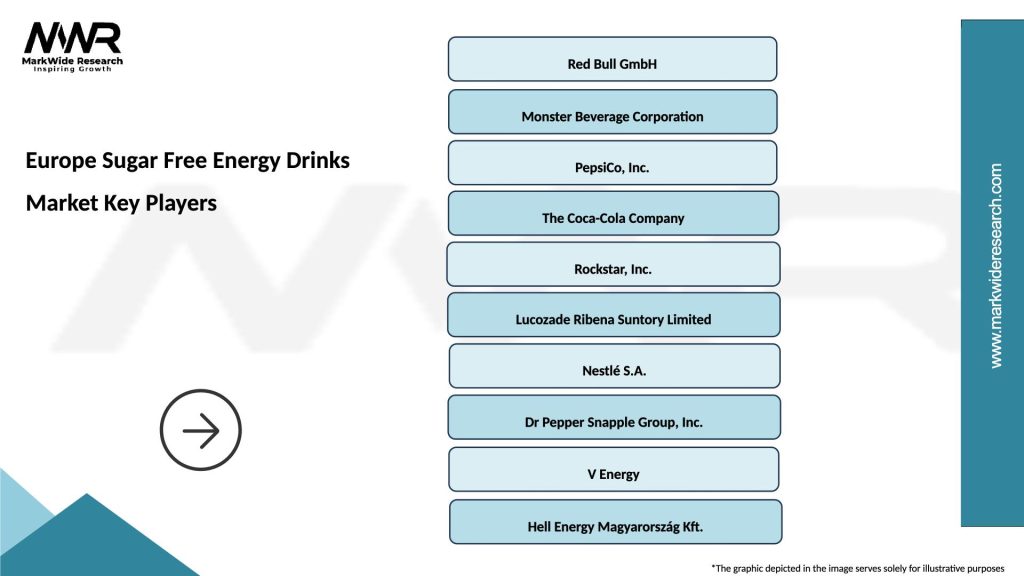

What are the key players in the Europe Sugar Free Energy Drinks Market?

Key players in the Europe Sugar Free Energy Drinks Market include Red Bull, Monster Beverage Corporation, PepsiCo, and Coca-Cola, among others. These companies are known for their innovative product offerings and strong brand presence in the energy drink segment.

What are the growth factors driving the Europe Sugar Free Energy Drinks Market?

The growth of the Europe Sugar Free Energy Drinks Market is driven by increasing health awareness among consumers, a rising demand for low-calorie beverages, and the growing trend of fitness and active lifestyles. Additionally, the expansion of distribution channels enhances product availability.

What challenges does the Europe Sugar Free Energy Drinks Market face?

The Europe Sugar Free Energy Drinks Market faces challenges such as regulatory scrutiny regarding health claims, competition from other beverage categories, and potential health concerns related to high caffeine content. These factors can impact consumer perception and market growth.

What opportunities exist in the Europe Sugar Free Energy Drinks Market?

Opportunities in the Europe Sugar Free Energy Drinks Market include the introduction of new flavors and formulations, targeting niche consumer segments, and leveraging e-commerce for wider distribution. Additionally, the growing trend of natural and organic ingredients presents avenues for innovation.

What trends are shaping the Europe Sugar Free Energy Drinks Market?

Trends shaping the Europe Sugar Free Energy Drinks Market include the rise of functional beverages that offer additional health benefits, the popularity of plant-based ingredients, and the increasing demand for sustainable packaging solutions. These trends reflect changing consumer preferences towards healthier and environmentally friendly options.

Europe Sugar Free Energy Drinks Market

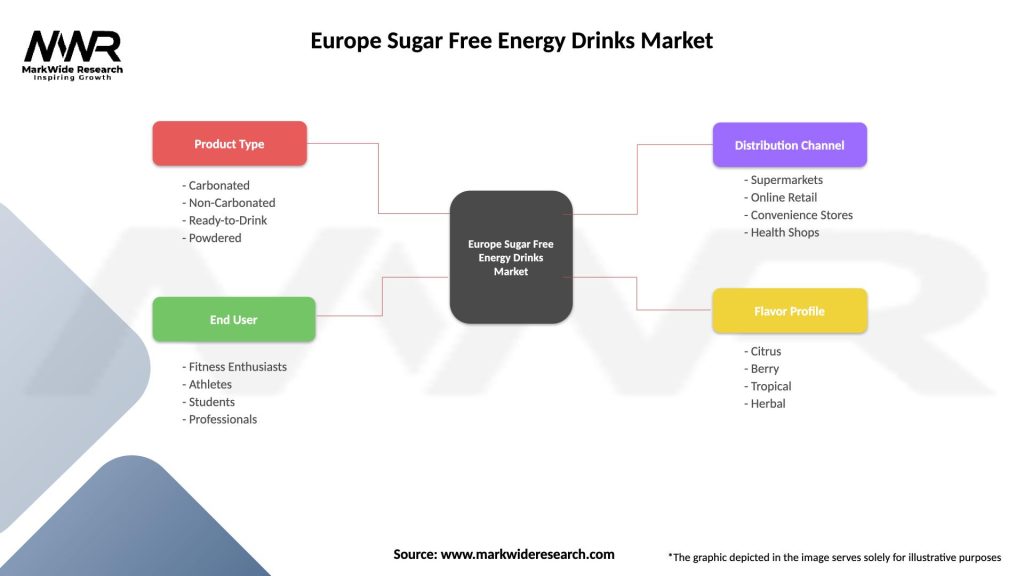

| Segmentation Details | Description |

|---|---|

| Product Type | Carbonated, Non-Carbonated, Ready-to-Drink, Powdered |

| End User | Fitness Enthusiasts, Athletes, Students, Professionals |

| Distribution Channel | Supermarkets, Online Retail, Convenience Stores, Health Shops |

| Flavor Profile | Citrus, Berry, Tropical, Herbal |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Sugar Free Energy Drinks Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at