444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe stone fruits market is witnessing steady growth, supported by strong consumer demand for fresh and processed fruits, increasing emphasis on healthy diets, and the expansion of horticultural trade networks across the continent. Stone fruits, including peaches, plums, cherries, apricots, and nectarines, are widely cultivated in Southern and Central Europe, with Spain, Italy, and France being the largest producers. The market is expanding at a CAGR of over 5.2%, driven by rising health-conscious consumption and growing export opportunities across Europe and neighboring regions.

Stone fruits are prized for their nutritional value, rich flavor, and versatility in fresh, frozen, canned, and juice forms. In Europe, over 60% of households regularly consume at least one variety of stone fruit during the peak summer season, reflecting cultural preferences and dietary traditions. According to MarkWide Research, growing consumer awareness of the antioxidant and vitamin-rich profile of stone fruits is shaping demand, while innovations in cold storage and logistics are expanding their availability across the year.

The stone fruits market refers to the production, distribution, and consumption of fruits characterized by a central stone or pit, such as cherries, peaches, plums, nectarines, and apricots. In Europe, the market encompasses both fresh fruit sales and processed applications, including canned fruits, jams, juices, and bakery ingredients. These fruits are recognized for their nutritional properties, including high vitamin C content, antioxidants, and dietary fiber, making them popular choices in balanced diets.

The sector represents a vital component of Europe’s horticulture industry, contributing significantly to agricultural income and trade. MWR notes that stone fruits are increasingly positioned not only as seasonal favorites but also as year-round functional food options, thanks to improvements in preservation and processing technologies.

The Europe stone fruits market continues to expand steadily, driven by increasing consumer demand for fresh, healthy produce and the growing importance of fruit-based processed products. The market is projected to grow at a 5.2% CAGR, with peaches and nectarines leading production volumes, followed by cherries and plums. Spain remains the dominant supplier, accounting for over 35% of regional production, while Italy and France also play key roles.

Consumer preferences are shifting toward natural, low-sugar fruit options, boosting demand for stone fruit-based juices, jams, and snacks. Exports within the EU and to markets such as Russia and the Middle East are also supporting growth. According to MarkWide Research, the long-term trajectory of this market will be shaped by climate adaptation strategies, sustainable farming practices, and evolving consumer habits emphasizing nutritional benefits.

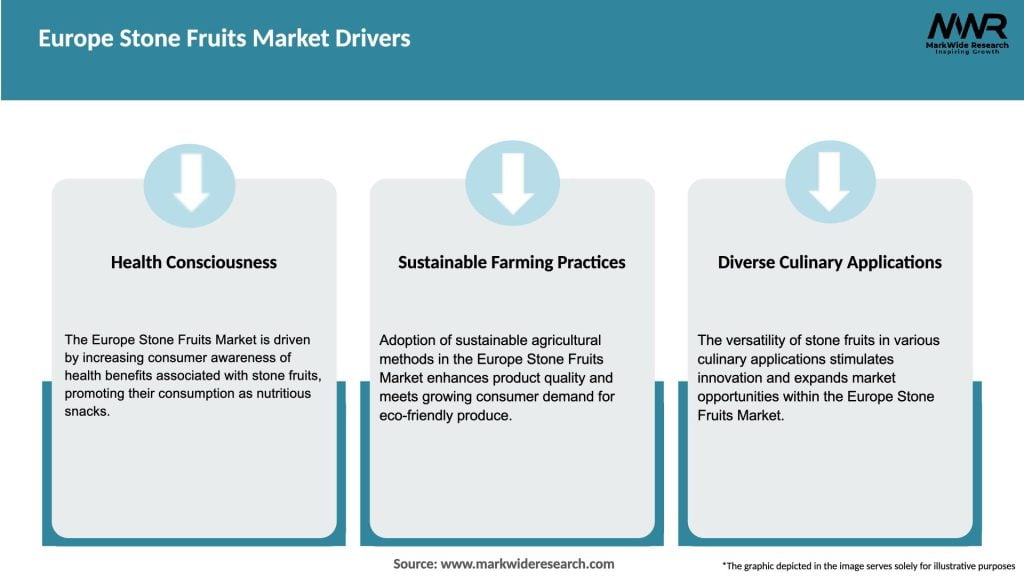

Increasing consumer preference for healthy diets is a major driver of the stone fruits market, as these fruits are rich in vitamins and antioxidants. Rising demand for natural and plant-based products is boosting processed fruit consumption, with jams, juices, and dried fruit gaining popularity. Strong export opportunities within Europe and to nearby regions provide additional growth momentum.

Technological innovations in cold chain logistics and packaging are extending shelf life, reducing post-harvest losses, and enabling year-round availability of stone fruits in European supermarkets.

Climate change and weather variability pose significant risks to production, with droughts, frost, and heatwaves impacting yields. Stone fruits are particularly sensitive to temperature fluctuations, which can affect quality and supply consistency. High perishability is another restraint, as these fruits require efficient cold chain management to prevent spoilage.

Additionally, market competition from imported fruits, including tropical varieties, can challenge domestic demand during non-peak seasons. Fluctuating labor availability for harvesting also creates operational challenges for producers.

Organic stone fruits present a major opportunity as European consumers increasingly prefer pesticide-free, sustainable produce. Growth in processed applications, including smoothies, health snacks, and fruit-based bakery ingredients, further expands market potential. Export opportunities to Eastern Europe and the Middle East are also increasing as demand for European fruit quality strengthens.

Innovations in drought-resistant cultivars and smart farming technologies create additional opportunities by helping producers adapt to climate challenges and improve yields.

Market dynamics in Europe are defined by the interplay of consumer health trends, production patterns, and sustainability initiatives. Consumption of cherries and apricots is rising, with sweet cherries alone accounting for 18% of total consumption. Intra-EU trade remains strong, representing 45% of regional distribution, while exports to external markets continue to grow.

Producers are adopting sustainable farming methods, including integrated pest management and water-efficient irrigation, to meet both environmental goals and consumer expectations for eco-friendly produce.

The research methodology for the Europe stone fruits market combines primary and secondary research. Primary insights are gathered from farmers, cooperatives, exporters, retailers, and policymakers. Secondary research includes trade data, agricultural statistics, government publications, and industry reports.

MarkWide Research uses proprietary forecasting models that incorporate climate projections, consumer behavior, and trade patterns to ensure accurate and comprehensive market analysis.

Southern Europe dominates production, with Spain, Italy, and Greece accounting for the majority of peach, nectarine, and apricot output. Spain alone contributes 35% of Europe’s total, making it the leading exporter. Western Europe, particularly France, is known for premium cherries and plums, catering to both domestic and export markets.

Eastern Europe is emerging as a growth hub, with countries like Poland and Hungary expanding production of cherries and plums. Northern Europe represents a smaller market but shows increasing demand for imported fruits, supported by high retail penetration and consumer interest in fresh produce.

By Fruit Type:

By Application:

By Distribution Channel:

Peaches and nectarines dominate European production, especially in Spain and Italy, accounting for 40% of total output. Cherries are the fastest-growing category, supported by rising export demand and premium positioning in Western Europe. Plums have strong domestic consumption in Eastern Europe, while apricots are increasingly used in processed products, expanding their market potential.

Strengths:

Weaknesses:

Opportunities:

Threats:

Organic farming adoption is increasing across Europe, with organic fruit acreage expanding annually. Online retail is emerging as a fast-growing distribution channel. Cold chain innovations are enabling longer shelf life and reducing food waste. Additionally, premium fruit positioning, particularly for cherries and nectarines, is influencing consumer buying behavior.

The Europe stone fruits market is expected to maintain strong growth momentum, driven by health-focused consumer demand, sustainable farming practices, and expanding trade opportunities. Producers will increasingly adopt organic farming and climate-resilient varieties to adapt to weather challenges. The rise of online distribution and value-added processing will further expand market scope. With Southern Europe maintaining production leadership and Eastern Europe emerging as a growth hub, the sector is poised for continued expansion across the continent.

The Europe stone fruits market represents a vibrant and growing sector within the region’s agricultural economy. Supported by rising health-conscious consumption, strong production in Southern Europe, and expanding processed applications, the market is expected to maintain steady growth. Opportunities in organic farming, export expansion, and innovative distribution channels will shape the future landscape. Despite challenges related to perishability and climate variability, investments in technology and sustainability will ensure long-term resilience. As highlighted by MarkWide Research, the market is set to remain a cornerstone of Europe’s horticulture industry, delivering both economic and nutritional value to consumers.

What is Stone Fruits?

Stone fruits are a category of fruits that have a large, hard pit or ‘stone’ inside, surrounded by fleshy fruit. Common examples include peaches, cherries, plums, and apricots, which are popular in various culinary applications across Europe.

What are the key players in the Europe Stone Fruits Market?

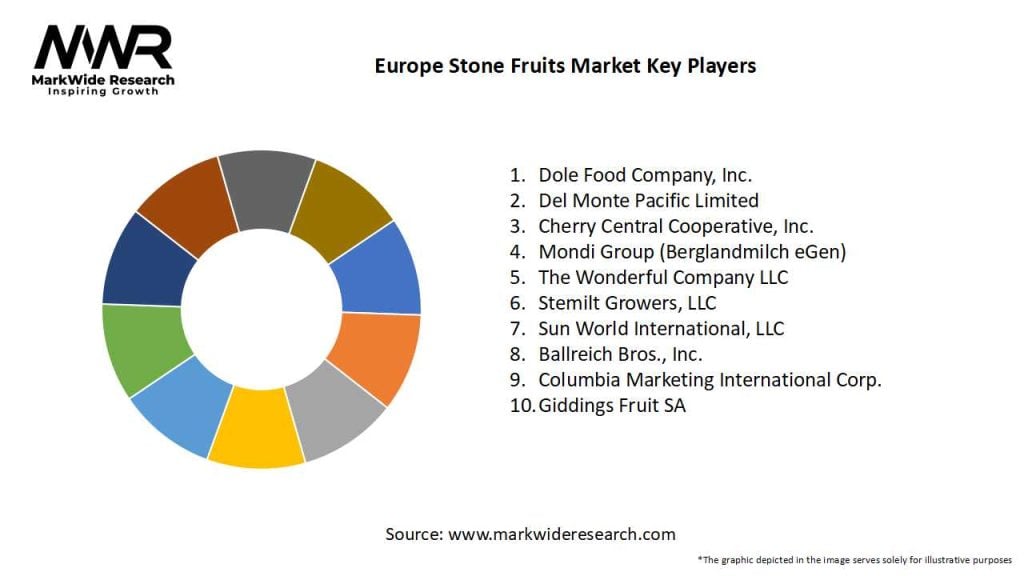

Key players in the Europe Stone Fruits Market include companies like Driscoll’s, Sun World International, and Capespan, which are involved in the cultivation and distribution of stone fruits, among others.

What are the main drivers of the Europe Stone Fruits Market?

The main drivers of the Europe Stone Fruits Market include increasing consumer demand for fresh and healthy snacks, the popularity of organic farming, and the growing trend of using stone fruits in desserts and beverages.

What challenges does the Europe Stone Fruits Market face?

The Europe Stone Fruits Market faces challenges such as climate change affecting crop yields, competition from imported fruits, and the need for sustainable farming practices to meet consumer expectations.

What opportunities exist in the Europe Stone Fruits Market?

Opportunities in the Europe Stone Fruits Market include the potential for expanding organic stone fruit production, increasing exports to non-European markets, and the development of new varieties that cater to changing consumer preferences.

What trends are shaping the Europe Stone Fruits Market?

Trends shaping the Europe Stone Fruits Market include the rise of e-commerce for fresh produce, innovative packaging solutions to enhance shelf life, and a growing interest in local sourcing among consumers.

Europe Stone Fruits Market

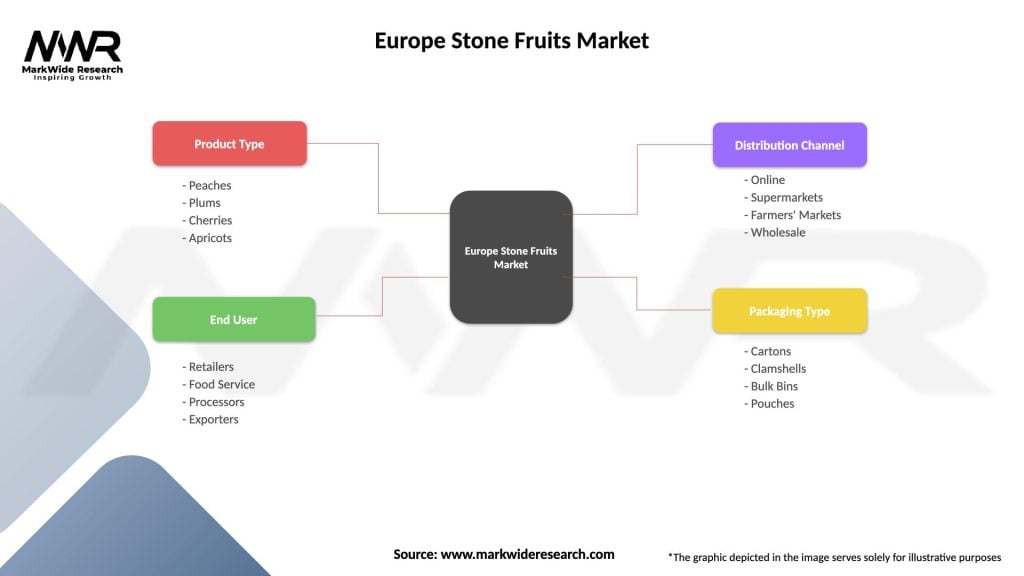

| Segmentation Details | Description |

|---|---|

| Product Type | Peaches, Plums, Cherries, Apricots |

| End User | Retailers, Food Service, Processors, Exporters |

| Distribution Channel | Online, Supermarkets, Farmers’ Markets, Wholesale |

| Packaging Type | Cartons, Clamshells, Bulk Bins, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Europe Stone Fruits Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at