444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe sports medicine products market represents a dynamic and rapidly expanding sector within the broader healthcare industry, driven by increasing sports participation, growing awareness of injury prevention, and advancing medical technologies. European countries have witnessed a significant surge in demand for specialized sports medicine solutions, encompassing everything from diagnostic equipment to therapeutic devices and rehabilitation products.

Market dynamics indicate robust growth across multiple segments, with the market experiencing a compound annual growth rate (CAGR) of 6.8% during the forecast period. This expansion is particularly pronounced in countries like Germany, the United Kingdom, France, and Italy, where sports culture is deeply embedded and healthcare infrastructure supports advanced medical interventions.

Key market drivers include the rising incidence of sports-related injuries, increasing participation in recreational and professional sports, and growing emphasis on preventive healthcare measures. The market encompasses various product categories including body reconstruction products, body support and recovery products, and accessories designed to enhance athletic performance and facilitate injury recovery.

Regional variations across Europe reflect different healthcare policies, sports participation rates, and economic conditions. Nordic countries demonstrate particularly high adoption rates of advanced sports medicine technologies, with approximately 78% of professional sports facilities utilizing specialized medical equipment for injury prevention and treatment.

The Europe sports medicine products market refers to the comprehensive ecosystem of medical devices, equipment, and therapeutic solutions specifically designed to prevent, diagnose, treat, and rehabilitate sports-related injuries and conditions across European countries. This specialized market segment encompasses a wide range of products from basic support braces to sophisticated diagnostic imaging equipment used in sports medicine facilities.

Sports medicine products include orthopedic implants, arthroscopy devices, body support products such as braces and supports, recovery equipment, therapeutic modalities, and diagnostic tools. These products serve athletes at all levels, from amateur enthusiasts to professional competitors, as well as individuals engaged in recreational physical activities.

Market scope extends beyond traditional medical devices to include innovative technologies such as wearable monitoring systems, biomechanical analysis tools, and advanced rehabilitation equipment. The integration of digital health solutions and telemedicine platforms has further expanded the definition of sports medicine products in the European context.

Market performance across Europe demonstrates consistent growth momentum, with increasing investments in sports medicine infrastructure and rising healthcare expenditure dedicated to sports-related medical care. The market benefits from strong regulatory frameworks, advanced healthcare systems, and a culture that prioritizes both competitive sports and recreational fitness activities.

Key growth segments include body reconstruction products, particularly knee and shoulder reconstruction devices, which account for approximately 42% of the total market share. Body support and recovery products represent another significant segment, driven by growing awareness of injury prevention and the importance of proper recovery protocols among athletes and fitness enthusiasts.

Technological advancement continues to shape market evolution, with manufacturers focusing on developing minimally invasive surgical solutions, smart wearable devices, and personalized treatment approaches. The integration of artificial intelligence and machine learning technologies in diagnostic and treatment planning represents a key trend driving market innovation.

Regional leadership is demonstrated by Germany and the United Kingdom, which together represent over 45% of the European market share, followed by France, Italy, and Spain. These countries benefit from well-established sports medicine programs, advanced healthcare infrastructure, and significant investments in research and development.

Market segmentation reveals distinct patterns in product adoption and usage across different European regions, with notable variations in treatment approaches and technology preferences. The following insights highlight critical market dynamics:

Primary market drivers propelling the Europe sports medicine products market include several interconnected factors that create sustained demand for specialized medical solutions. The increasing participation in sports and fitness activities across all age groups represents a fundamental driver, with recreational sports participation growing by 12% annually in major European markets.

Rising injury rates associated with increased sports participation create consistent demand for both preventive and therapeutic products. Professional sports leagues and amateur athletic organizations are investing heavily in injury prevention programs, driving demand for diagnostic equipment, protective gear, and rehabilitation technologies.

Healthcare system evolution toward preventive care models supports market growth, as healthcare providers recognize the cost-effectiveness of preventing sports injuries compared to treating chronic conditions. This shift encourages investment in sports medicine facilities and specialized equipment across European healthcare networks.

Technological advancement continues to drive market expansion through the development of more effective, less invasive treatment options. Innovations in materials science, biotechnology, and digital health create new product categories and improve existing solutions, attracting both healthcare providers and patients to advanced sports medicine options.

Government initiatives promoting physical activity and sports participation, particularly in response to rising obesity rates and sedentary lifestyles, indirectly support market growth by increasing the population at risk for sports-related injuries requiring medical intervention.

Cost considerations represent a significant restraint in the Europe sports medicine products market, particularly for advanced diagnostic and therapeutic equipment that requires substantial capital investment. Many smaller healthcare facilities and sports medicine clinics face budget constraints that limit their ability to adopt the latest technologies and equipment.

Regulatory complexity across different European countries can create barriers to market entry and product distribution, despite harmonization efforts. Varying reimbursement policies and healthcare system structures complicate market access strategies for manufacturers and limit product availability in certain regions.

Limited specialized expertise in sports medicine represents another constraint, as the field requires specific training and certification that may not be readily available in all European markets. This shortage of qualified professionals can limit market growth and product adoption rates.

Economic uncertainty and healthcare budget pressures in some European countries may impact investment in sports medicine infrastructure and equipment purchases. Economic downturns can lead to deferred capital expenditures and reduced healthcare spending on specialized medical equipment.

Competition from alternative treatments and traditional therapy approaches may limit adoption of newer, more expensive sports medicine products. Some healthcare providers and patients may prefer established treatment methods over innovative but costly alternatives.

Emerging market opportunities in the Europe sports medicine products sector present significant potential for growth and innovation. The integration of digital health technologies with traditional sports medicine products creates new revenue streams and enhanced patient care capabilities.

Telemedicine expansion offers substantial opportunities for remote consultation, monitoring, and rehabilitation services, particularly in rural or underserved areas of Europe. This trend accelerated during the pandemic and continues to gain acceptance among healthcare providers and patients.

Personalized medicine approaches represent a growing opportunity, with advances in genetic testing, biomechanical analysis, and individualized treatment planning. These developments enable more targeted and effective interventions, potentially improving outcomes while reducing costs.

Preventive care focus creates opportunities for products and services designed to prevent injuries before they occur, rather than simply treating them after the fact. This shift toward prevention aligns with broader healthcare trends and offers sustainable growth potential.

Aging athlete population presents unique opportunities for specialized products designed for mature individuals who remain active in sports and fitness activities. This demographic requires different approaches to injury prevention and treatment compared to younger athletes.

Cross-border collaboration within the European Union facilitates market expansion and knowledge sharing, creating opportunities for companies to leverage expertise and resources across multiple countries and healthcare systems.

Market dynamics in the Europe sports medicine products sector reflect complex interactions between technological innovation, regulatory frameworks, healthcare policies, and consumer behavior patterns. These dynamics create both challenges and opportunities for market participants.

Supply chain considerations have become increasingly important, particularly following global disruptions that highlighted vulnerabilities in medical device manufacturing and distribution networks. European manufacturers are focusing on building more resilient supply chains and reducing dependence on single-source suppliers.

Competitive landscape evolution shows increasing consolidation among major players, while simultaneously witnessing the emergence of innovative startups bringing disruptive technologies to market. This dual trend creates a dynamic environment where established companies must balance acquisition strategies with internal innovation efforts.

Regulatory environment continues to evolve with new medical device regulations and quality standards that impact product development timelines and market entry strategies. Companies must navigate these requirements while maintaining innovation momentum and competitive positioning.

Healthcare provider preferences increasingly favor integrated solutions that combine multiple functionalities and provide comprehensive data analytics capabilities. This trend drives product development toward more sophisticated, connected devices that can integrate with existing healthcare information systems.

Patient expectations continue to rise, with individuals seeking more convenient, effective, and personalized treatment options. These expectations influence product design, service delivery models, and overall market positioning strategies.

Comprehensive research methodology employed in analyzing the Europe sports medicine products market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of market insights. The methodology combines primary research, secondary research, and advanced analytical techniques to provide a complete market picture.

Primary research activities include extensive interviews with key market participants, including manufacturers, healthcare providers, sports medicine specialists, and end-users. These interviews provide valuable insights into market trends, challenges, and opportunities that may not be apparent from secondary sources alone.

Secondary research encompasses analysis of industry reports, academic publications, regulatory documents, and company financial statements to establish market baselines and identify key trends. This research provides historical context and supports trend analysis across different market segments and geographic regions.

Market modeling techniques utilize statistical analysis and forecasting methods to project future market trends and identify growth opportunities. These models incorporate various factors including demographic trends, economic indicators, and technological advancement rates to provide realistic market projections.

Data validation processes ensure research accuracy through triangulation of multiple data sources and expert review of findings. This validation approach helps identify and correct potential biases or inaccuracies in the research process, enhancing the reliability of market insights and recommendations.

Regional market analysis reveals significant variations in sports medicine product adoption, healthcare infrastructure, and market development across European countries. Germany leads the European market with approximately 28% market share, driven by advanced healthcare systems, strong sports culture, and significant investment in medical technology research and development.

United Kingdom represents the second-largest market, accounting for approximately 18% of regional market share. The UK benefits from well-established sports medicine programs, particularly in professional football and rugby, which drive demand for advanced diagnostic and treatment technologies.

France demonstrates strong growth potential with 15% market share, supported by government initiatives promoting sports participation and investment in healthcare infrastructure. The country’s focus on Olympic sports development and professional athletics creates sustained demand for sports medicine products.

Italy and Spain together represent approximately 20% of the market, with growing recognition of sports medicine importance and increasing investment in specialized healthcare facilities. These countries show particular strength in rehabilitation and recovery product segments.

Nordic countries including Sweden, Norway, and Denmark demonstrate high per-capita adoption rates of advanced sports medicine technologies, despite smaller overall market sizes. These countries often serve as early adopters of innovative products and treatment approaches.

Eastern European markets show rapid growth potential as healthcare systems modernize and sports participation increases. Countries like Poland, Czech Republic, and Hungary are investing in sports medicine infrastructure and professional training programs.

Competitive landscape in the Europe sports medicine products market features a mix of established multinational corporations, specialized medical device manufacturers, and innovative technology startups. Market leadership is distributed among several key players with different strengths and market positioning strategies.

Market competition intensifies through continuous innovation, strategic partnerships, and acquisition activities. Companies are investing heavily in research and development to maintain competitive advantages and respond to evolving customer needs and regulatory requirements.

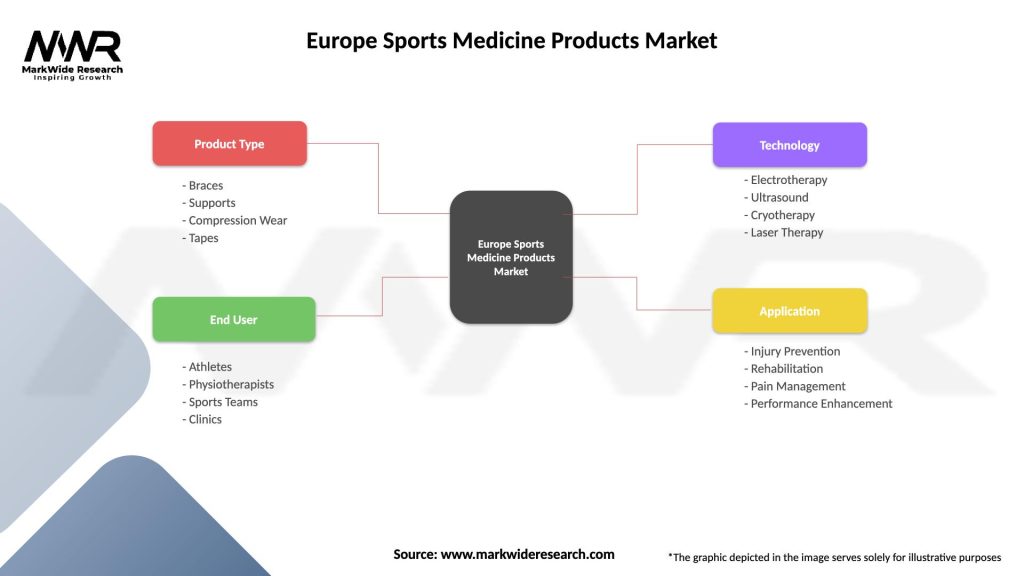

Market segmentation analysis reveals distinct patterns in product categories, applications, and end-user preferences across the Europe sports medicine products market. Understanding these segments is crucial for strategic planning and market positioning.

By Product Type:

By Application:

By End User:

Body reconstruction products dominate the European sports medicine market, with knee reconstruction devices leading this category due to the high prevalence of anterior cruciate ligament (ACL) injuries and other knee-related conditions. Advanced arthroscopic techniques and minimally invasive surgical approaches drive demand for sophisticated surgical instruments and implant systems.

Shoulder reconstruction products represent a rapidly growing subcategory, particularly in countries with strong swimming, tennis, and overhead sports traditions. The development of anatomical implant designs and improved surgical techniques enhances patient outcomes and drives market adoption.

Body support and recovery products show consistent growth across all European markets, driven by increasing awareness of injury prevention and the importance of proper rehabilitation protocols. Smart braces and supports incorporating sensor technology and mobile connectivity represent emerging growth areas within this category.

Compression garments and recovery equipment benefit from growing understanding of recovery science and the role of proper post-exercise protocols in injury prevention. Professional sports teams and serious amateur athletes increasingly invest in advanced recovery technologies.

Diagnostic and monitoring equipment within the accessories category shows strong growth potential, particularly devices that can provide real-time biomechanical analysis and injury risk assessment. These products appeal to both healthcare providers and sports performance professionals seeking data-driven approaches to injury prevention.

Therapeutic modalities including electrotherapy, ultrasound, and laser therapy devices maintain steady demand in rehabilitation settings, with technological improvements enhancing treatment effectiveness and patient compliance.

Healthcare providers benefit from access to advanced sports medicine products that improve patient outcomes, reduce treatment times, and enhance their ability to attract and retain patients seeking specialized care. Investment in sports medicine capabilities can differentiate healthcare facilities and create new revenue streams.

Athletes and active individuals gain access to more effective treatment options, faster recovery times, and better injury prevention strategies. Advanced sports medicine products enable individuals to maintain active lifestyles and return to sports participation more quickly following injuries.

Manufacturers and suppliers benefit from growing market demand, opportunities for innovation, and potential for geographic expansion within the European market. The sports medicine sector offers attractive margins and opportunities for long-term customer relationships.

Healthcare systems can achieve cost savings through more effective treatments that reduce long-term disability and chronic conditions. Preventive approaches enabled by sports medicine products can reduce overall healthcare costs and improve population health outcomes.

Sports organizations benefit from reduced injury rates, improved athlete performance, and enhanced safety protocols. Investment in sports medicine capabilities can protect valuable human assets and reduce liability risks associated with sports participation.

Research institutions gain opportunities for collaboration with industry partners, access to funding for sports medicine research, and platforms for translating research findings into practical clinical applications that benefit patients and athletes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend shaping the Europe sports medicine products market, with smart devices and connected solutions becoming increasingly prevalent. Wearable technology integration allows for continuous monitoring of athlete performance and injury risk factors, enabling proactive intervention strategies.

Personalized medicine approaches are gaining traction through advances in genetic testing, biomechanical analysis, and individualized treatment planning. MarkWide Research indicates that personalized treatment protocols show 35% better outcomes compared to standardized approaches, driving adoption among healthcare providers.

Minimally invasive surgical techniques continue to evolve, with new arthroscopic procedures and robotic-assisted surgeries reducing recovery times and improving patient outcomes. These advances drive demand for specialized surgical instruments and imaging equipment designed for precision procedures.

Regenerative medicine integration including stem cell therapy, platelet-rich plasma treatments, and tissue engineering approaches represents an emerging trend with significant growth potential. European regulatory frameworks are adapting to accommodate these innovative treatment modalities.

Artificial intelligence and machine learning applications in sports medicine are expanding, particularly in diagnostic imaging, treatment planning, and outcome prediction. These technologies enhance clinical decision-making and improve treatment effectiveness.

Sustainability focus influences product development and manufacturing processes, with companies increasingly adopting environmentally responsible practices and developing recyclable or biodegradable products where appropriate.

Recent industry developments highlight the dynamic nature of the Europe sports medicine products market, with significant investments in research and development, strategic partnerships, and technological innovation driving market evolution.

Merger and acquisition activity has intensified as companies seek to expand their product portfolios, geographic reach, and technological capabilities. Major players are acquiring specialized companies with innovative technologies or strong regional market positions to enhance their competitive positioning.

Regulatory approvals for new products and treatment approaches continue to shape market opportunities, with European regulatory agencies working to balance innovation encouragement with patient safety requirements. Recent approvals for advanced implant materials and surgical techniques expand treatment options for healthcare providers.

Partnership agreements between manufacturers, healthcare providers, and research institutions are increasing, facilitating knowledge transfer, clinical validation of new products, and development of evidence-based treatment protocols that support market adoption.

Investment in manufacturing capabilities within Europe has increased as companies seek to reduce supply chain risks and improve responsiveness to local market needs. New production facilities and technology upgrades enhance manufacturing efficiency and product quality.

Digital health platform launches by sports medicine companies provide integrated solutions combining physical products with software applications, data analytics, and telemedicine capabilities to deliver comprehensive patient care solutions.

Market participants should focus on developing integrated solutions that combine traditional sports medicine products with digital health technologies to meet evolving customer expectations and differentiate their offerings in an increasingly competitive market environment.

Investment in research and development remains critical for maintaining competitive advantages, particularly in areas such as biomaterials, minimally invasive surgical techniques, and personalized medicine approaches that show strong growth potential across European markets.

Geographic expansion strategies should prioritize Eastern European markets where healthcare modernization and increasing sports participation create significant growth opportunities. Companies should consider local partnerships to navigate regulatory requirements and cultural preferences effectively.

Healthcare provider education and training programs represent important investment areas, as the success of advanced sports medicine products depends on proper implementation and utilization by qualified professionals. Companies should develop comprehensive support programs for their customers.

Regulatory compliance preparation for evolving medical device regulations should be prioritized to ensure continued market access and avoid potential disruptions to product availability. Early engagement with regulatory authorities can facilitate smoother approval processes.

Supply chain resilience improvements should be implemented to reduce vulnerabilities exposed during recent global disruptions. Diversification of suppliers, local sourcing strategies, and inventory management optimization can enhance operational stability.

Future market prospects for the Europe sports medicine products market remain highly positive, with sustained growth expected across all major product categories and geographic regions. MWR projections indicate continued expansion driven by technological innovation, demographic trends, and evolving healthcare delivery models.

Technology integration will accelerate, with artificial intelligence, machine learning, and Internet of Things capabilities becoming standard features in sports medicine products. These technologies will enable more precise diagnostics, personalized treatment approaches, and improved patient outcomes.

Market consolidation is expected to continue as larger companies acquire specialized manufacturers and technology developers to build comprehensive product portfolios and expand their market reach. This consolidation may create opportunities for innovative startups while potentially reducing overall market competition.

Preventive care emphasis will grow stronger, with injury prevention programs showing 40% growth potential over the next five years. This trend will drive demand for diagnostic equipment, monitoring devices, and educational programs designed to prevent sports injuries before they occur.

Regulatory evolution will continue to shape market dynamics, with new standards for digital health integration, data privacy, and clinical evidence requirements influencing product development and market entry strategies.

Demographic shifts including aging populations and changing sports participation patterns will create new market segments and product requirements, necessitating adaptive strategies from market participants to address evolving customer needs effectively.

The Europe sports medicine products market represents a dynamic and rapidly evolving sector with substantial growth potential driven by technological innovation, increasing sports participation, and evolving healthcare delivery models. Market participants who successfully navigate regulatory requirements, invest in innovative technologies, and develop comprehensive customer support programs will be well-positioned for long-term success.

Key success factors include maintaining focus on clinical outcomes, developing integrated digital health solutions, and building strong relationships with healthcare providers and sports organizations. The market’s future growth will depend on continued innovation, effective regulatory compliance, and adaptation to changing demographic and economic conditions across European countries.

Strategic opportunities abound for companies willing to invest in research and development, geographic expansion, and technology integration. The convergence of traditional sports medicine with digital health technologies creates new possibilities for improving patient care while building sustainable competitive advantages in an increasingly sophisticated market environment.

What is Sports Medicine Products?

Sports Medicine Products refer to a range of medical devices, equipment, and therapies designed to prevent, diagnose, and treat sports-related injuries. These products are utilized by athletes and active individuals to enhance performance and recovery.

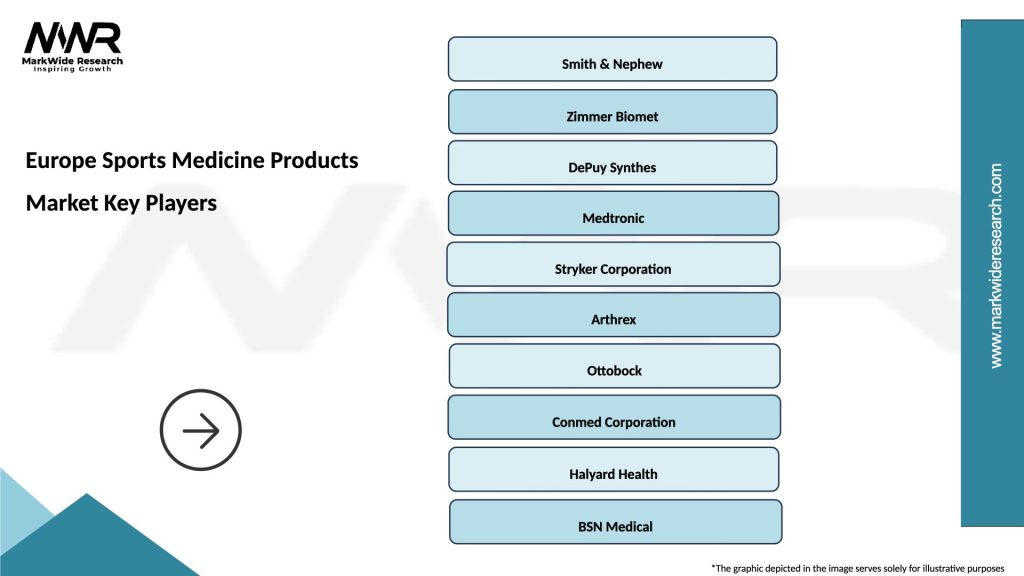

What are the key companies in the Europe Sports Medicine Products Market?

Key companies in the Europe Sports Medicine Products Market include Johnson & Johnson, Medtronic, and Smith & Nephew, among others.

What are the main drivers of the Europe Sports Medicine Products Market?

The main drivers of the Europe Sports Medicine Products Market include the increasing participation in sports and fitness activities, rising awareness of sports injuries, and advancements in medical technology that enhance treatment options.

What challenges does the Europe Sports Medicine Products Market face?

Challenges in the Europe Sports Medicine Products Market include stringent regulatory requirements, high costs of advanced medical devices, and the need for continuous innovation to meet evolving consumer demands.

What opportunities exist in the Europe Sports Medicine Products Market?

Opportunities in the Europe Sports Medicine Products Market include the growing trend of preventive healthcare, increasing investment in sports infrastructure, and the rising demand for personalized medicine solutions.

What trends are shaping the Europe Sports Medicine Products Market?

Trends shaping the Europe Sports Medicine Products Market include the integration of digital health technologies, the rise of telemedicine for rehabilitation, and the development of wearable devices that monitor athletic performance.

Europe Sports Medicine Products Market

| Segmentation Details | Description |

|---|---|

| Product Type | Braces, Supports, Compression Wear, Tapes |

| End User | Athletes, Physiotherapists, Sports Teams, Clinics |

| Technology | Electrotherapy, Ultrasound, Cryotherapy, Laser Therapy |

| Application | Injury Prevention, Rehabilitation, Pain Management, Performance Enhancement |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Sports Medicine Products Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at