444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe spectator sports market represents a dynamic and rapidly evolving entertainment sector that encompasses professional football leagues, basketball competitions, tennis tournaments, motorsports events, and various other sporting spectacles across the continent. European sports entertainment has experienced remarkable transformation in recent years, driven by technological innovations, changing consumer preferences, and evolving broadcast technologies that enhance fan engagement and accessibility.

Digital transformation has fundamentally reshaped how European audiences consume sports content, with streaming platforms and mobile applications gaining significant traction alongside traditional broadcast channels. The market demonstrates robust growth potential, with fan engagement rates increasing by approximately 12% annually across major European leagues and tournaments. Premium sports content continues to command substantial viewership, particularly in football-dominant markets like Germany, England, Spain, and Italy.

Revenue diversification has become increasingly important for sports organizations, with merchandising, digital content, and experiential offerings complementing traditional ticket sales and broadcast rights. The integration of augmented reality and virtual reality technologies has created new opportunities for immersive fan experiences, while social media platforms have revolutionized how sports content is distributed and consumed across European markets.

The Europe spectator sports market refers to the comprehensive ecosystem of professional and amateur sporting events, competitions, and related entertainment activities that generate revenue through audience participation, viewership, and associated commercial activities across European nations. This market encompasses live event attendance, broadcast and streaming rights, merchandise sales, sponsorship agreements, and digital content consumption related to various sporting disciplines.

Spectator sports in the European context include traditional favorites such as football (soccer), rugby, cricket, tennis, and motorsports, alongside emerging disciplines like esports and mixed martial arts. The market structure involves multiple stakeholders including sports leagues, individual teams, broadcast networks, streaming platforms, sponsors, venues, and technology providers who collectively create value through entertainment delivery and fan engagement initiatives.

Market dynamics are influenced by factors such as demographic shifts, technological advancement, regulatory changes, and evolving consumer behavior patterns that shape how European audiences interact with sports content across various channels and platforms.

European spectator sports continue to demonstrate resilience and adaptability in an increasingly competitive entertainment landscape. The market has successfully navigated recent challenges while embracing digital transformation opportunities that enhance fan experiences and expand revenue streams. Football leagues maintain their dominant position, accounting for approximately 68% of total sports viewership across major European markets.

Streaming platforms have emerged as significant disruptors, with digital viewing increasing by 25% year-over-year as younger demographics shift away from traditional broadcast consumption patterns. Mobile engagement has become particularly crucial, with sports apps and social media integration driving real-time interaction and content sharing among European sports fans.

Revenue optimization strategies have evolved beyond traditional models, incorporating data analytics, personalized content delivery, and interactive technologies that create deeper fan connections. The market demonstrates strong fundamentals with consistent growth in key performance indicators including attendance rates, digital engagement metrics, and commercial partnership values across diverse sporting disciplines and geographic regions.

Market intelligence reveals several critical trends shaping the European spectator sports landscape:

Technological advancement serves as the primary catalyst for market expansion, with innovations in broadcast quality, streaming capabilities, and interactive features enhancing the overall spectator experience. 5G network deployment across European markets enables high-definition mobile streaming and real-time data transmission that supports advanced analytics and fan engagement applications.

Demographic shifts are creating new opportunities as younger generations demonstrate increased willingness to pay for premium sports content through subscription services and digital platforms. Social media integration has transformed sports consumption into a more interactive and community-driven experience, driving higher engagement rates and longer viewing sessions among European audiences.

Infrastructure investment in modern stadiums and venues has improved the live spectator experience through enhanced amenities, connectivity, and comfort features that encourage repeat attendance. Corporate sponsorship growth continues to provide substantial revenue streams as brands recognize the value of sports marketing in reaching engaged European consumer segments.

Regulatory support from European Union initiatives promoting sports development and cultural activities has created favorable conditions for market expansion and cross-border collaboration between leagues and organizations.

Economic uncertainty across European markets has created challenges for discretionary spending on sports entertainment, particularly affecting premium ticket sales and merchandise purchases. Inflation pressures have increased operational costs for sports organizations while simultaneously reducing consumer purchasing power for non-essential entertainment activities.

Content piracy remains a persistent challenge that undermines legitimate revenue streams, with illegal streaming services providing unauthorized access to premium sports content. Regulatory complexity across different European jurisdictions creates compliance challenges for organizations operating in multiple markets, particularly regarding broadcasting rights and data protection requirements.

Competition intensity from alternative entertainment options, including streaming services, gaming platforms, and social media content, has fragmented audience attention and created pressure on sports organizations to continuously innovate their offerings. Venue capacity limitations and aging infrastructure in some European markets restrict growth potential for live event attendance.

Talent acquisition costs have escalated significantly, creating financial pressure on sports organizations while potentially limiting competitive balance within leagues and tournaments.

Digital transformation initiatives present substantial opportunities for revenue diversification through direct-to-consumer platforms, personalized content delivery, and enhanced fan engagement technologies. Artificial intelligence integration enables sophisticated data analytics that can optimize everything from player performance to fan experience customization and operational efficiency.

Emerging markets within Eastern Europe offer significant growth potential as economic development increases disposable income and sports infrastructure investment. Women’s sports represent an underexploited segment with growing audience interest and commercial viability, particularly in football, tennis, and basketball disciplines.

Virtual reality experiences can create new revenue streams by offering immersive viewing options for fans unable to attend live events, while augmented reality applications enhance in-venue experiences through interactive content and real-time statistics. Blockchain technology offers opportunities for innovative fan engagement through digital collectibles, tokenized experiences, and decentralized content distribution models.

Sustainability initiatives can attract environmentally conscious consumers while potentially reducing operational costs through energy efficiency and waste reduction programs. Cross-sport collaboration and multi-discipline events can maximize venue utilization and create unique entertainment experiences that appeal to diverse audience segments.

Supply and demand equilibrium in the European spectator sports market is influenced by multiple interconnected factors including content quality, accessibility, pricing strategies, and competitive alternatives. Premium content scarcity creates value concentration around major leagues and tournaments, while technological democratization enables smaller organizations to reach niche audiences effectively.

Consumer behavior evolution reflects broader societal trends toward digital consumption, personalized experiences, and social interaction integration. MarkWide Research analysis indicates that European sports fans increasingly expect multi-platform access and real-time engagement opportunities that extend beyond traditional viewing experiences.

Competitive dynamics have intensified as traditional sports organizations face challenges from new entertainment formats, streaming platforms, and alternative leisure activities. Value chain optimization has become crucial for maintaining profitability while delivering enhanced fan experiences through technology integration and operational efficiency improvements.

Market consolidation trends are evident in broadcast rights acquisition and platform development, while simultaneously creating opportunities for specialized content providers and niche market segments to establish sustainable business models.

Comprehensive market analysis was conducted using a multi-faceted approach that combines quantitative data collection with qualitative insights from industry stakeholders across the European spectator sports ecosystem. Primary research included structured interviews with sports organization executives, broadcast network representatives, technology providers, and fan community leaders to gather firsthand perspectives on market trends and challenges.

Secondary research encompassed analysis of industry reports, financial statements, regulatory filings, and academic studies related to sports entertainment and media consumption patterns. Data triangulation methods were employed to validate findings across multiple sources and ensure accuracy of market insights and projections.

Statistical analysis utilized advanced modeling techniques to identify correlation patterns, growth trajectories, and market segment performance indicators. Geographic segmentation analysis examined regional variations in consumer behavior, regulatory environments, and competitive landscapes across major European markets.

Technology impact assessment evaluated the influence of digital transformation initiatives on market dynamics, revenue models, and fan engagement metrics through case study analysis and performance benchmarking across different sports disciplines and organizational structures.

Western European markets continue to dominate the spectator sports landscape, with the United Kingdom, Germany, France, Spain, and Italy representing approximately 75% of total market activity. English Premier League maintains its position as the most globally recognized European sports property, while Bundesliga and La Liga demonstrate strong international appeal and commercial success.

Nordic countries show exceptional digital adoption rates, with streaming penetration reaching 82% among sports fans in Sweden, Norway, and Denmark. These markets serve as testing grounds for innovative technologies and fan engagement strategies that often expand to larger European markets.

Eastern European regions present significant growth opportunities as economic development increases sports infrastructure investment and consumer spending power. Poland, Czech Republic, and Hungary demonstrate particularly strong potential for market expansion, with growing interest in both domestic and international sports content.

Mediterranean markets including Italy, Spain, and Greece maintain strong traditions in football and motorsports, while showing increasing interest in basketball and tennis. Infrastructure modernization in these regions supports enhanced spectator experiences and broadcast capabilities.

Market leadership is distributed across various categories within the European spectator sports ecosystem:

Broadcast partners including Sky Sports, BT Sport, Canal+, and various national broadcasters play crucial roles in content distribution and fan engagement. Streaming platforms such as Amazon Prime Video, DAZN, and specialized sports services are increasingly important in reaching younger demographics and international audiences.

By Sport Type:

By Revenue Source:

By Distribution Channel:

Football dominance remains unchallenged across European markets, with domestic leagues and international competitions generating the highest viewership and commercial value. Premier League global appeal extends far beyond the UK, creating substantial international revenue streams through broadcast rights and merchandise sales.

Tennis tournaments demonstrate exceptional commercial efficiency, with major events like Wimbledon, French Open, and various ATP/WTA tour stops generating significant revenue relative to their duration. Individual sport marketing creates unique opportunities for personality-driven content and fan engagement strategies.

Motorsports entertainment combines high-production values with technological innovation, appealing to audiences interested in both sporting competition and engineering excellence. Formula 1’s Netflix effect has demonstrated how documentary content can expand audience reach and attract new demographic segments.

Basketball growth in Europe reflects increasing American cultural influence and the success of European players in the NBA. EuroLeague expansion strategies focus on creating a more compelling product that can compete with other major sports for audience attention and commercial investment.

Emerging sports categories including esports, mixed martial arts, and extreme sports are gaining traction among younger European audiences, creating opportunities for innovative content formats and engagement strategies.

Sports organizations benefit from diversified revenue streams that reduce dependency on any single income source while creating multiple touchpoints for fan engagement. Digital transformation enables direct relationships with supporters, bypassing traditional intermediaries and capturing greater value from content distribution.

Broadcast partners gain access to premium content that drives subscription growth and advertising revenue, while streaming platforms use sports content as a differentiator in competitive entertainment markets. Technology providers find opportunities to showcase innovative solutions in high-visibility environments that demonstrate their capabilities to broader markets.

Sponsors and advertisers benefit from engaged audiences and measurable marketing outcomes, while venue operators can optimize facility utilization through diverse event programming. Local communities experience economic benefits through tourism, employment, and infrastructure development associated with major sporting events.

Fan communities enjoy enhanced access to content, interactive experiences, and social connection opportunities that extend beyond traditional viewing experiences. Athletes and performers benefit from increased exposure, commercial opportunities, and platform growth that supports career development and personal branding initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Streaming-first strategies are reshaping content distribution as organizations prioritize direct-to-consumer platforms over traditional broadcast partnerships. Personalization algorithms enable customized viewing experiences that adapt to individual preferences and viewing patterns, increasing engagement and retention rates.

Social media integration has transformed sports consumption into a more interactive and community-driven experience, with real-time commentary, sharing, and discussion becoming integral to the viewing experience. Mobile optimization continues to gain importance as younger demographics prefer smartphone and tablet consumption over traditional television viewing.

Data analytics advancement enables sophisticated fan segmentation, predictive modeling, and performance optimization across all aspects of sports organization operations. Sustainability initiatives are becoming increasingly important for brand reputation and operational efficiency, with carbon-neutral events and eco-friendly practices gaining prominence.

Esports integration represents a significant trend as traditional sports organizations seek to engage younger audiences through competitive gaming and virtual competitions. Augmented reality applications enhance live and broadcast experiences through interactive statistics, player information, and immersive content overlays.

Major league expansions and format innovations have created new competitive structures designed to increase excitement and commercial appeal. Technology partnerships between sports organizations and leading tech companies have accelerated innovation in fan engagement, performance analytics, and operational efficiency.

Broadcast rights negotiations have reached unprecedented values, reflecting the continued importance of premium sports content in competitive media landscapes. Stadium modernization projects across Europe have enhanced spectator experiences while incorporating sustainable design principles and advanced technology infrastructure.

Women’s sports investment has increased significantly, with major organizations launching dedicated leagues and competitions that demonstrate growing commercial viability. International expansion initiatives have seen European leagues hosting games and events in global markets to build international fan bases and revenue streams.

Digital platform launches by major sports organizations represent strategic shifts toward direct fan relationships and reduced dependency on traditional broadcast partners. Regulatory developments regarding player transfers, financial fair play, and competitive balance continue to shape league structures and operational practices.

Strategic recommendations for European spectator sports organizations focus on accelerating digital transformation while maintaining the authentic fan experiences that create emotional connections. MWR analysis suggests that successful organizations will balance technological innovation with traditional sporting values to maximize both engagement and commercial success.

Investment priorities should emphasize data analytics capabilities, mobile-first content delivery, and personalization technologies that enable deeper fan relationships. Partnership strategies with technology companies, streaming platforms, and international media organizations can accelerate market expansion while sharing development costs and risks.

Content diversification beyond live events should include behind-the-scenes programming, documentary series, and interactive experiences that extend fan engagement throughout the year. Sustainability integration should be viewed as both a operational efficiency opportunity and a brand differentiation strategy that appeals to environmentally conscious consumers.

Talent development programs should focus on creating compelling personalities and storylines that transcend pure athletic performance to create entertainment value. International market development requires cultural sensitivity and localized content strategies that respect regional preferences while maintaining brand authenticity.

Market projections indicate continued growth driven by technological innovation, global expansion, and evolving fan engagement strategies. Digital consumption patterns are expected to account for an increasing share of total viewership, with mobile viewing potentially reaching 60% of total consumption within the next five years.

Revenue diversification will become increasingly important as organizations seek to reduce dependency on traditional income sources while creating new value streams through technology integration and direct fan relationships. MarkWide Research forecasts that successful organizations will achieve revenue growth rates of 8-12% annually through strategic digital transformation initiatives.

Competitive dynamics will intensify as entertainment options continue to fragment audience attention, requiring sports organizations to continuously innovate their offerings and fan engagement strategies. Sustainability requirements will become increasingly important for regulatory compliance and consumer appeal, driving operational changes across the industry.

Technology integration will enable new forms of immersive experiences, predictive analytics, and personalized content that enhance both live and remote viewing experiences. Global market expansion will create opportunities for European sports properties to build international audiences while potentially facing increased competition from other regional sports entertainment options.

The Europe spectator sports market stands at a pivotal moment of transformation, balancing rich sporting traditions with technological innovation and evolving consumer expectations. Digital transformation has emerged as the primary driver of market evolution, enabling new forms of fan engagement, revenue generation, and operational efficiency that extend far beyond traditional broadcasting and attendance models.

Market fundamentals remain strong, supported by passionate fan bases, premium content quality, and substantial commercial investment from sponsors and media partners. The successful navigation of recent challenges has demonstrated the resilience and adaptability of European sports organizations, while highlighting the importance of strategic innovation and fan-centric approaches to business development.

Future success will depend on organizations’ ability to embrace technological advancement while preserving the authentic sporting experiences that create emotional connections with audiences. The integration of sustainability initiatives, global expansion strategies, and personalized fan experiences will define competitive advantage in an increasingly complex entertainment landscape that demands continuous innovation and strategic adaptation.

What is Spectator Sports?

Spectator sports refer to organized sports events that are watched by an audience, including activities like football, basketball, and tennis. These events often involve professional teams and leagues, attracting large crowds and significant media coverage.

What are the key players in the Europe Spectator Sports Market?

Key players in the Europe Spectator Sports Market include major organizations such as UEFA, the English Premier League, and La Liga, which govern and promote popular sports leagues. Additionally, companies like Sky Sports and BT Sport play significant roles in broadcasting these events, among others.

What are the growth factors driving the Europe Spectator Sports Market?

The Europe Spectator Sports Market is driven by factors such as increasing disposable income, rising interest in sports among youth, and the growing popularity of digital streaming platforms. These elements contribute to higher attendance at events and increased viewership.

What challenges does the Europe Spectator Sports Market face?

Challenges in the Europe Spectator Sports Market include issues like the impact of economic downturns on ticket sales, competition from other entertainment options, and regulatory changes affecting broadcasting rights. These factors can hinder market growth and audience engagement.

What opportunities exist in the Europe Spectator Sports Market?

Opportunities in the Europe Spectator Sports Market include the expansion of e-sports, which attracts younger audiences, and the potential for enhanced fan engagement through technology such as virtual reality. These trends can lead to new revenue streams and increased participation.

What trends are shaping the Europe Spectator Sports Market?

Trends shaping the Europe Spectator Sports Market include the rise of social media in promoting events, the integration of technology for enhanced viewing experiences, and a growing focus on sustainability in sports events. These trends are influencing how fans interact with sports.

Europe Spectator Sports Market

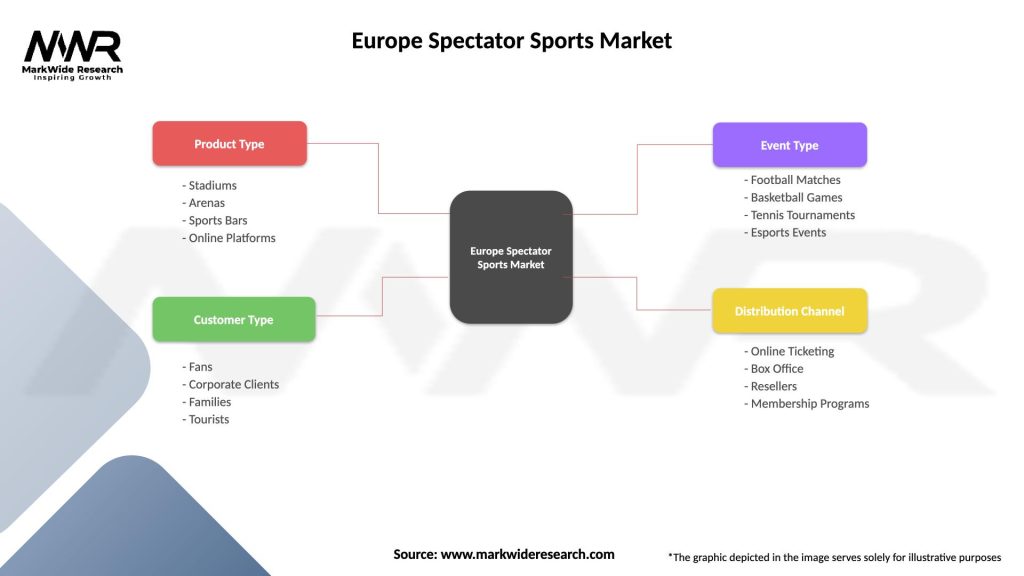

| Segmentation Details | Description |

|---|---|

| Product Type | Stadiums, Arenas, Sports Bars, Online Platforms |

| Customer Type | Fans, Corporate Clients, Families, Tourists |

| Event Type | Football Matches, Basketball Games, Tennis Tournaments, Esports Events |

| Distribution Channel | Online Ticketing, Box Office, Resellers, Membership Programs |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Spectator Sports Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at