444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe sortation system market represents a dynamic and rapidly evolving sector within the broader logistics and warehouse automation industry. This sophisticated market encompasses advanced technological solutions designed to streamline sorting processes across various industries, from e-commerce fulfillment centers to postal services and manufacturing facilities. European businesses are increasingly adopting automated sortation systems to enhance operational efficiency, reduce labor costs, and meet growing consumer demands for faster delivery times.

Market dynamics indicate that the European sortation system landscape is experiencing unprecedented growth, driven by the exponential rise in e-commerce activities and the need for sophisticated supply chain management. The region’s commitment to technological innovation and sustainability has positioned it as a global leader in implementing cutting-edge sortation technologies. Growth projections suggest the market is expanding at a robust 8.2% CAGR, reflecting strong demand across multiple sectors.

Key market characteristics include the integration of artificial intelligence, machine learning, and Internet of Things (IoT) technologies into traditional sorting systems. European companies are prioritizing solutions that offer enhanced accuracy, reduced operational costs, and improved scalability. The market encompasses various sortation technologies including cross-belt sorters, tilt-tray sorters, sliding shoe sorters, and bomb-bay sorters, each serving specific operational requirements across different industries.

The Europe sortation system market refers to the comprehensive ecosystem of automated and semi-automated technologies, equipment, and solutions designed to efficiently sort, categorize, and distribute items within logistics and distribution networks across European countries. These systems utilize advanced mechanical, optical, and digital technologies to automatically identify, sort, and route products based on predetermined criteria such as destination, size, weight, or customer specifications.

Sortation systems encompass a wide range of technologies including conveyor-based solutions, robotic sorting mechanisms, optical character recognition systems, and sophisticated software platforms that coordinate the entire sorting process. These solutions are integral to modern supply chain operations, enabling businesses to process thousands of items per hour with minimal human intervention while maintaining high accuracy rates.

Market participants include system integrators, technology providers, component manufacturers, and end-users across various sectors including retail, e-commerce, postal services, pharmaceuticals, and automotive industries. The European market is characterized by stringent quality standards, environmental regulations, and a strong emphasis on energy-efficient solutions that align with the region’s sustainability objectives.

Strategic analysis reveals that the Europe sortation system market is positioned for substantial expansion, driven by digital transformation initiatives and the increasing complexity of modern supply chains. The market benefits from strong technological infrastructure, skilled workforce availability, and supportive regulatory frameworks that encourage automation adoption across various industries.

Key growth drivers include the surge in online shopping activities, which has increased by approximately 42% adoption rate across European markets, necessitating more sophisticated sorting capabilities. The integration of Industry 4.0 principles and smart manufacturing concepts has further accelerated demand for intelligent sortation solutions that can adapt to changing operational requirements.

Regional leadership is evident in countries such as Germany, the United Kingdom, France, and the Netherlands, which collectively account for a significant portion of market activity. These nations have established themselves as innovation hubs for logistics technology, attracting substantial investments in research and development activities focused on next-generation sortation systems.

Competitive dynamics showcase a mix of established global players and innovative European companies that are developing specialized solutions for niche market segments. The market structure supports both large-scale implementations for major distribution centers and smaller, modular solutions suitable for mid-sized operations seeking to enhance their sorting capabilities.

Technology integration represents the most significant trend shaping the European sortation system market, with companies increasingly seeking solutions that combine multiple sorting technologies within unified platforms. This approach enables greater flexibility and scalability while reducing overall system complexity and maintenance requirements.

E-commerce expansion continues to serve as the primary catalyst for sortation system adoption across Europe. The unprecedented growth in online shopping has created demand for sophisticated sorting capabilities that can handle diverse product portfolios while maintaining high throughput rates. Consumer expectations for faster delivery times have compelled logistics providers to invest in automated solutions that can process orders more efficiently than traditional manual methods.

Labor market challenges across European countries have accelerated automation adoption, as companies seek to reduce dependence on manual labor while improving operational consistency. The shortage of skilled warehouse workers, combined with rising labor costs, has made automated sortation systems increasingly attractive from both operational and financial perspectives.

Regulatory compliance requirements in various industries, particularly pharmaceuticals and food processing, have driven demand for sortation systems with enhanced traceability and quality control capabilities. European regulations mandate strict tracking and documentation requirements that are more efficiently managed through automated systems.

Supply chain optimization initiatives have led companies to recognize sortation systems as critical components for achieving operational excellence. The ability to process higher volumes with greater accuracy while reducing operational costs has made these systems essential for maintaining competitive advantage in increasingly crowded markets.

High initial investment requirements represent the most significant barrier to sortation system adoption, particularly for small and medium-sized enterprises. The substantial capital expenditure associated with system procurement, installation, and integration can be prohibitive for companies with limited financial resources or uncertain return on investment projections.

Technical complexity associated with modern sortation systems requires specialized expertise for implementation and maintenance. Many European companies lack the internal technical capabilities necessary to effectively deploy and manage sophisticated sorting technologies, creating dependence on external service providers and increasing operational costs.

Integration challenges with existing warehouse management systems and enterprise resource planning platforms can complicate implementation processes. Legacy systems may require significant modifications or complete replacement to accommodate new sortation technologies, adding complexity and cost to deployment projects.

Space constraints in established European distribution facilities can limit the types of sortation systems that can be implemented. Many existing warehouses were not designed to accommodate large-scale automated sorting equipment, requiring costly facility modifications or complete relocations to support system installation.

Emerging technologies present substantial opportunities for market expansion, particularly in areas such as artificial intelligence, machine learning, and advanced robotics. The integration of these technologies into sortation systems can deliver enhanced performance capabilities while opening new market segments and application areas.

Sustainability initiatives across European markets create opportunities for energy-efficient sortation solutions that align with environmental regulations and corporate sustainability goals. Companies developing systems with reduced energy consumption and environmental impact are well-positioned to capture growing demand from environmentally conscious organizations.

Small and medium enterprise adoption represents a significant untapped market opportunity, as technological advances make sortation systems more accessible and affordable for smaller operations. The development of modular, scalable solutions specifically designed for SME requirements could substantially expand the addressable market.

Cross-industry applications beyond traditional logistics and e-commerce sectors offer opportunities for market diversification. Industries such as healthcare, automotive, and food processing are increasingly recognizing the benefits of automated sorting technologies, creating new revenue streams for system providers.

Technological evolution continues to reshape the European sortation system market, with innovations in sensor technology, artificial intelligence, and robotics driving performance improvements and expanding application possibilities. These advances enable systems to handle more complex sorting requirements while reducing operational costs and improving accuracy rates.

Competitive pressures within the logistics industry have intensified the focus on operational efficiency and cost reduction, making sortation systems increasingly critical for maintaining market position. Companies that fail to adopt advanced sorting technologies risk losing competitive advantage to more technologically sophisticated competitors.

Customer expectations for faster, more accurate order fulfillment continue to rise, driven by the success of major e-commerce platforms in setting new service standards. This trend has created a cascading effect throughout the supply chain, with companies at all levels seeking sortation solutions that can meet increasingly demanding performance requirements.

Investment patterns show increasing allocation of capital toward automation technologies, with sortation systems representing a significant portion of warehouse automation spending. European companies are demonstrating willingness to invest in advanced sorting capabilities as part of broader digital transformation initiatives, with efficiency improvements averaging 35% operational enhancement post-implementation.

Comprehensive analysis of the Europe sortation system market employs multiple research methodologies to ensure accuracy and completeness of findings. Primary research activities include extensive interviews with industry executives, technology providers, system integrators, and end-users across various sectors and geographic regions within Europe.

Secondary research encompasses analysis of industry publications, company financial reports, patent filings, and regulatory documentation to provide comprehensive market intelligence. This approach ensures that all relevant market factors and trends are captured and analyzed within the broader context of European logistics and automation markets.

Data validation processes involve cross-referencing information from multiple sources and conducting follow-up interviews to verify key findings and market projections. MarkWide Research employs rigorous quality control measures to ensure that all market data and analysis meet the highest standards of accuracy and reliability.

Market modeling techniques incorporate both quantitative and qualitative factors to develop comprehensive projections for market growth and evolution. These models consider technological trends, regulatory changes, economic factors, and competitive dynamics to provide robust forecasts for market development across different time horizons.

Germany maintains its position as the largest market for sortation systems in Europe, accounting for approximately 28% market share due to its strong manufacturing base, advanced logistics infrastructure, and early adoption of automation technologies. German companies have been pioneers in implementing sophisticated sorting solutions across various industries, from automotive manufacturing to e-commerce fulfillment.

United Kingdom represents a significant market opportunity despite Brexit-related uncertainties, with strong demand driven by the country’s mature e-commerce sector and extensive distribution network requirements. British companies are increasingly investing in sortation technologies to maintain competitive advantage and meet growing consumer expectations for rapid delivery services.

France demonstrates robust growth potential, particularly in the retail and pharmaceutical sectors, where companies are modernizing their distribution capabilities to support omnichannel strategies. French market dynamics are influenced by strong regulatory frameworks and emphasis on sustainable business practices, driving demand for energy-efficient sorting solutions.

Netherlands serves as a critical logistics hub for European distribution activities, with companies leveraging the country’s strategic location and advanced infrastructure to implement cutting-edge sortation systems. The Dutch market is characterized by high technology adoption rates and sophisticated supply chain management practices that support advanced sorting applications.

Nordic countries including Sweden, Denmark, and Norway show increasing adoption of sortation technologies, driven by labor market constraints and strong emphasis on operational efficiency. These markets demonstrate particular interest in sustainable sorting solutions that align with regional environmental priorities and corporate sustainability initiatives.

Market leadership is distributed among several key players who have established strong positions through technological innovation, strategic partnerships, and comprehensive service offerings. The competitive environment is characterized by continuous innovation and strategic acquisitions as companies seek to expand their technological capabilities and market reach.

Competitive strategies focus on technological differentiation, with companies investing heavily in research and development to create more efficient, accurate, and flexible sorting solutions. Strategic partnerships with software providers and system integrators enable comprehensive solution offerings that address complete customer requirements.

By Technology: The European sortation system market encompasses various technological approaches, each designed to address specific operational requirements and performance criteria. Cross-belt sorters dominate high-speed applications, while tilt-tray systems excel in handling diverse product types with gentle handling requirements.

By Application: Market segmentation by application reveals diverse use cases across multiple industries, each with specific performance requirements and operational constraints that influence technology selection and system design.

High-speed sortation systems represent the fastest-growing category, driven by e-commerce demands for rapid order processing and fulfillment. These systems typically achieve throughput rates exceeding 15,000 items per hour while maintaining accuracy levels above 99.5% sorting precision, making them essential for large-scale distribution operations.

Modular sortation solutions are gaining popularity among mid-sized operations seeking scalable automation capabilities. These systems offer flexibility to expand capacity incrementally while maintaining operational continuity, making them attractive for companies with evolving operational requirements or uncertain growth projections.

Intelligent sortation systems incorporating artificial intelligence and machine learning capabilities represent the premium market segment. These advanced solutions can adapt to changing operational conditions, optimize performance automatically, and provide predictive maintenance capabilities that reduce downtime and operational costs.

Sustainable sortation technologies are emerging as a distinct category, driven by European environmental regulations and corporate sustainability initiatives. These systems feature energy-efficient designs, recyclable components, and reduced environmental impact throughout their operational lifecycle, appealing to environmentally conscious organizations.

Operational efficiency gains represent the primary benefit for companies implementing sortation systems, with typical installations delivering productivity improvements of 40-60% throughput increase compared to manual sorting processes. These efficiency gains translate directly into reduced operational costs and improved customer service capabilities.

Labor cost reduction provides significant financial benefits, particularly in European markets where labor costs are relatively high. Automated sortation systems can reduce labor requirements by up to 70% workforce optimization while improving consistency and reducing errors associated with manual sorting processes.

Accuracy improvements delivered by modern sortation systems significantly reduce mis-sorts and associated costs including customer service issues, return processing, and brand reputation damage. Advanced systems achieve accuracy rates exceeding 99.9%, substantially better than manual sorting alternatives.

Scalability advantages enable companies to adapt their sorting capabilities to changing business requirements without major system overhauls. Modular system designs allow capacity expansion or reconfiguration to support new products, markets, or operational strategies as business needs evolve.

Data collection capabilities provide valuable insights into operational performance, enabling continuous optimization and strategic decision-making. Modern sortation systems generate comprehensive analytics that support supply chain optimization and business intelligence initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant technological trend, with sortation systems increasingly incorporating machine learning algorithms to optimize performance and adapt to changing operational conditions. These intelligent systems can learn from operational data to improve accuracy and efficiency over time.

Sustainability focus is driving development of energy-efficient sortation systems that minimize environmental impact while maintaining high performance levels. European companies are prioritizing solutions that support their sustainability goals and comply with increasingly stringent environmental regulations.

Modular system design is becoming the preferred approach for new installations, offering flexibility to scale capacity and reconfigure systems based on changing business requirements. This trend reflects the need for adaptable solutions in dynamic market environments.

Cloud-based management systems are enabling remote monitoring and control of sortation operations, providing greater visibility and control over distributed logistics networks. This trend supports centralized management of multiple facilities and enables predictive maintenance capabilities.

Collaborative robotics integration is expanding sortation system capabilities by combining automated sorting with flexible robotic handling for complex or irregular items. This hybrid approach maximizes system versatility while maintaining high throughput rates.

Strategic acquisitions continue to reshape the competitive landscape, with major players acquiring specialized technology companies to enhance their sortation system capabilities. These transactions reflect the importance of technological innovation in maintaining competitive advantage within the market.

Technology partnerships between sortation system providers and software companies are creating more comprehensive solutions that address complete customer requirements. These collaborations enable integration of advanced analytics, artificial intelligence, and cloud-based management capabilities.

Sustainability initiatives are driving development of next-generation sortation systems with reduced energy consumption and environmental impact. MWR analysis indicates that energy efficiency has become a primary selection criterion for new system purchases across European markets.

Research and development investments in emerging technologies such as quantum computing and advanced robotics are positioning European companies at the forefront of sortation system innovation. These investments support long-term competitive advantage and market leadership positions.

Regulatory developments related to data privacy, worker safety, and environmental protection are influencing system design and implementation practices. Companies are adapting their solutions to ensure compliance with evolving regulatory requirements across different European markets.

Investment prioritization should focus on technologies that deliver measurable returns on investment while providing flexibility for future expansion or reconfiguration. Companies should evaluate sortation systems based on total cost of ownership rather than initial purchase price alone.

Technology selection requires careful consideration of current and future operational requirements, with emphasis on systems that can adapt to changing business needs. Modular designs offer advantages for companies with uncertain growth projections or evolving operational strategies.

Implementation planning should include comprehensive change management processes to ensure successful adoption and maximize system benefits. Employee training and process optimization are critical success factors that require dedicated attention and resources.

Partnership strategies with experienced system integrators and technology providers can accelerate implementation timelines and reduce project risks. Companies should prioritize partners with proven track records and comprehensive service capabilities.

Performance monitoring systems should be implemented to track key metrics and identify optimization opportunities. Regular performance reviews enable continuous improvement and ensure systems continue to meet operational requirements as business needs evolve.

Market evolution will be characterized by continued technological advancement and expanding application areas, with sortation systems becoming increasingly sophisticated and versatile. The integration of artificial intelligence, machine learning, and advanced robotics will enable new capabilities and performance levels that were previously unattainable.

Growth projections indicate sustained expansion across all major European markets, driven by continued e-commerce growth, supply chain optimization initiatives, and technological advancement. MarkWide Research forecasts suggest the market will maintain strong momentum with projected growth rates of 8.5% annual expansion over the next five years.

Technology trends will focus on increased automation, improved sustainability, and enhanced flexibility to support diverse operational requirements. Future systems will likely incorporate advanced sensors, predictive analytics, and autonomous operation capabilities that minimize human intervention while maximizing performance.

Market consolidation may occur as smaller players struggle to compete with the technological capabilities and resources of larger companies. This trend could lead to increased concentration among system providers while creating opportunities for specialized niche players.

Regulatory evolution will continue to influence market development, with new standards for safety, environmental impact, and data protection affecting system design and implementation practices. Companies that proactively address regulatory requirements will be better positioned for long-term success.

The Europe sortation system market represents a dynamic and rapidly evolving sector with substantial growth potential driven by technological innovation, e-commerce expansion, and operational efficiency requirements. The market benefits from strong technological infrastructure, skilled workforce availability, and supportive regulatory frameworks that encourage automation adoption across various industries.

Key success factors for market participants include technological innovation, comprehensive service capabilities, and the ability to deliver measurable returns on investment for customers. Companies that can combine advanced technology with practical implementation expertise will be best positioned to capture market opportunities and maintain competitive advantage.

Future market development will be shaped by continued technological advancement, evolving customer requirements, and regulatory changes that influence system design and implementation practices. The integration of artificial intelligence, sustainability initiatives, and modular system designs will define the next generation of sortation solutions serving European markets.

What is Sortation System?

Sortation systems are automated solutions used in logistics and warehousing to efficiently categorize and distribute products based on various criteria. They play a crucial role in enhancing operational efficiency and accuracy in supply chain management.

What are the key players in the Europe Sortation System Market?

Key players in the Europe Sortation System Market include Siemens AG, Dematic, Honeywell Intelligrated, and Vanderlande Industries, among others. These companies are known for their innovative solutions and technologies in the sortation system space.

What are the main drivers of the Europe Sortation System Market?

The main drivers of the Europe Sortation System Market include the increasing demand for automation in warehouses, the growth of e-commerce, and the need for efficient inventory management. These factors are pushing companies to adopt advanced sortation systems.

What challenges does the Europe Sortation System Market face?

Challenges in the Europe Sortation System Market include high initial investment costs, the complexity of integration with existing systems, and the need for skilled labor to operate and maintain these systems. These factors can hinder market growth.

What opportunities exist in the Europe Sortation System Market?

Opportunities in the Europe Sortation System Market include the rising trend of smart warehouses, advancements in artificial intelligence and machine learning, and the increasing focus on sustainability in logistics operations. These trends are likely to shape the future of the market.

What trends are currently influencing the Europe Sortation System Market?

Current trends influencing the Europe Sortation System Market include the adoption of robotics for enhanced efficiency, the integration of IoT for real-time tracking, and the shift towards eco-friendly sortation solutions. These innovations are transforming how sorting operations are conducted.

Europe Sortation System Market

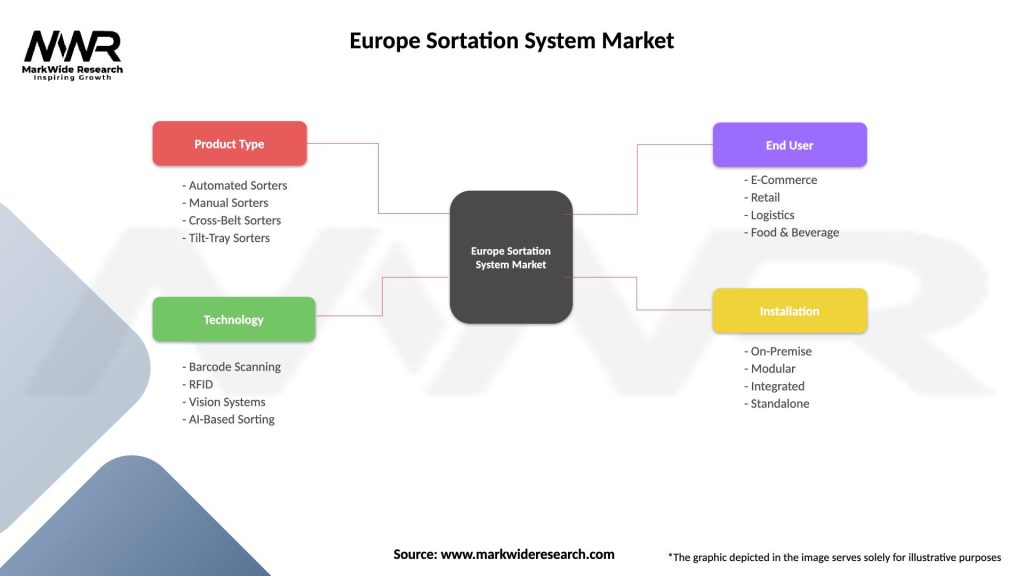

| Segmentation Details | Description |

|---|---|

| Product Type | Automated Sorters, Manual Sorters, Cross-Belt Sorters, Tilt-Tray Sorters |

| Technology | Barcode Scanning, RFID, Vision Systems, AI-Based Sorting |

| End User | E-Commerce, Retail, Logistics, Food & Beverage |

| Installation | On-Premise, Modular, Integrated, Standalone |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Sortation System Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at