444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe smart meter market represents a transformative segment within the continent’s energy infrastructure modernization initiatives. Smart meters have emerged as critical components in Europe’s transition toward sustainable energy management, enabling real-time monitoring, automated billing, and enhanced grid efficiency. The market encompasses advanced metering infrastructure (AMI) solutions that facilitate two-way communication between utilities and consumers, supporting the region’s ambitious climate goals and digital transformation objectives.

European utilities are experiencing unprecedented demand for intelligent metering solutions as regulatory mandates drive widespread adoption across residential, commercial, and industrial sectors. The market demonstrates robust growth potential with a projected CAGR of 8.2% through the forecast period, reflecting strong governmental support and increasing consumer awareness of energy efficiency benefits. Key market drivers include stringent EU directives requiring smart meter deployment, rising energy costs, and growing emphasis on renewable energy integration.

Technology advancement continues to shape market dynamics, with next-generation smart meters incorporating advanced features such as load forecasting, demand response capabilities, and enhanced cybersecurity protocols. The integration of Internet of Things (IoT) technologies and artificial intelligence is creating new opportunities for utilities to optimize grid operations and improve customer engagement through detailed energy consumption analytics.

The Europe smart meter market refers to the comprehensive ecosystem of intelligent metering devices, communication networks, and data management systems deployed across European countries to modernize electricity, gas, and water utility infrastructure. Smart meters are advanced digital devices that automatically record energy consumption data and transmit this information to utility companies for monitoring and billing purposes, replacing traditional analog meters with sophisticated two-way communication capabilities.

These intelligent systems enable utilities to collect real-time consumption data, detect outages instantly, and implement dynamic pricing strategies while providing consumers with detailed insights into their energy usage patterns. The market encompasses various technologies including automatic meter reading (AMR), advanced metering infrastructure (AMI), and meter data management systems (MDMS) that collectively support Europe’s smart grid initiatives and sustainability objectives.

Market participants include utility companies, meter manufacturers, communication technology providers, and software developers who collaborate to deliver comprehensive smart metering solutions. The ecosystem supports regulatory compliance with European Union directives while enabling innovative services such as demand response programs, energy efficiency optimization, and integration with renewable energy sources.

Europe’s smart meter market demonstrates exceptional growth momentum driven by regulatory mandates, technological innovation, and increasing focus on energy efficiency. The market benefits from strong governmental support through EU directives requiring member states to deploy smart meters for at least 80% of electricity consumers by 2020, with many countries exceeding these targets and expanding deployment to gas and water utilities.

Key market characteristics include widespread adoption across Nordic countries, aggressive rollout programs in Western Europe, and emerging opportunities in Eastern European markets. The residential segment dominates current installations, while commercial and industrial applications are experiencing accelerated growth due to enhanced energy management capabilities and cost optimization benefits.

Technological evolution toward next-generation smart meters incorporating IoT connectivity, edge computing, and advanced analytics is creating new value propositions for utilities and consumers. Market leaders are investing heavily in research and development to deliver solutions that support grid modernization, renewable energy integration, and enhanced cybersecurity measures.

Competitive dynamics feature established European manufacturers competing with global technology providers, while emerging players focus on specialized applications and innovative communication technologies. The market outlook remains highly positive with sustained investment in smart grid infrastructure and increasing consumer acceptance of digital energy management solutions.

Strategic market insights reveal several critical trends shaping the European smart meter landscape:

Market maturation varies significantly across European regions, with Nordic countries achieving near-universal deployment while Eastern European markets present substantial growth opportunities. According to MarkWide Research analysis, the integration of artificial intelligence and machine learning capabilities is becoming increasingly important for utilities seeking to maximize smart meter investment returns.

Primary market drivers propelling European smart meter adoption include comprehensive regulatory frameworks established by the European Union to modernize energy infrastructure and improve efficiency. The Energy Efficiency Directive and Third Energy Package mandate smart meter deployment where cost-effective, creating sustained demand across member states with implementation timelines extending through 2025.

Rising energy costs and increasing consumer awareness of energy consumption patterns drive demand for intelligent metering solutions that enable better energy management and cost control. Smart meters provide detailed consumption data that empowers consumers to modify usage behaviors, participate in demand response programs, and optimize energy expenses through time-of-use pricing structures.

Grid modernization initiatives across Europe require advanced metering infrastructure to support renewable energy integration, distributed generation, and smart grid functionality. Utilities invest in smart meters as foundational components for managing increasingly complex energy networks that incorporate solar, wind, and other renewable sources while maintaining grid stability and reliability.

Technological advancement in communication networks, data analytics, and IoT connectivity creates new opportunities for utilities to enhance operational efficiency and customer service. Modern smart meters offer capabilities far beyond basic consumption measurement, including power quality monitoring, outage detection, and support for electric vehicle charging infrastructure.

Environmental sustainability goals drive adoption as smart meters enable more efficient energy distribution, reduced transmission losses, and better integration of clean energy sources. European climate commitments require comprehensive energy management solutions that smart metering infrastructure supports through improved visibility and control of energy consumption patterns.

Implementation challenges pose significant constraints on smart meter deployment across Europe, particularly regarding high upfront capital investments required for comprehensive infrastructure upgrades. Utilities must balance substantial initial costs against long-term operational benefits, creating financial pressures that may delay or limit deployment scope in certain markets.

Consumer privacy concerns and data security issues create resistance to smart meter adoption in some European regions. Public skepticism about data collection, usage monitoring, and potential surveillance capabilities requires utilities to invest heavily in consumer education and robust cybersecurity measures to build trust and acceptance.

Technical complexity associated with integrating smart meters into existing utility infrastructure presents operational challenges, particularly for older grid systems requiring significant upgrades. Compatibility issues between different communication protocols, legacy systems, and new smart metering technologies can increase implementation costs and extend deployment timelines.

Regulatory variations across European countries create market fragmentation that complicates standardization efforts and increases costs for manufacturers and utilities operating in multiple jurisdictions. Different technical requirements, certification processes, and deployment mandates require customized solutions that limit economies of scale.

Skilled workforce shortages in specialized areas such as cybersecurity, data analytics, and advanced metering infrastructure management constrain market growth. The rapid pace of technological advancement requires continuous training and development programs that strain utility resources and increase operational complexity.

Emerging market opportunities in Eastern European countries present substantial growth potential as these regions accelerate smart grid modernization programs with EU funding support. Countries including Poland, Czech Republic, and Hungary are implementing large-scale smart meter deployments that create significant opportunities for technology providers and system integrators.

Next-generation smart meters incorporating advanced features such as edge computing, artificial intelligence, and enhanced communication capabilities offer opportunities for premium product positioning and higher value services. These intelligent devices enable new applications including predictive maintenance, automated demand response, and integration with smart home technologies.

Multi-utility convergence creates opportunities for comprehensive metering solutions that address electricity, gas, and water utilities through integrated platforms. This convergence reduces deployment costs, simplifies consumer interfaces, and enables utilities to offer bundled services that improve customer satisfaction and operational efficiency.

Data monetization opportunities emerge as utilities develop new revenue streams from smart meter data analytics, including energy consulting services, efficiency optimization programs, and partnerships with energy service companies. Advanced analytics capabilities enable utilities to offer personalized energy management solutions and participate in emerging energy markets.

Electric vehicle integration presents significant opportunities as smart meters become essential infrastructure for managing EV charging loads and implementing vehicle-to-grid technologies. The growing European EV market requires intelligent charging solutions that smart meters can support through load management and dynamic pricing capabilities.

Market dynamics in the European smart meter sector reflect complex interactions between regulatory requirements, technological innovation, and evolving consumer expectations. The regulatory environment continues to drive fundamental market growth with EU directives establishing minimum deployment targets while allowing member states flexibility in implementation approaches and timelines.

Competitive pressures intensify as established utility equipment manufacturers face competition from technology companies offering innovative communication solutions and data analytics platforms. This competition drives continuous innovation in meter functionality, communication protocols, and integration capabilities while pressuring profit margins across the value chain.

Consumer behavior evolution influences market development as increasing environmental awareness and energy cost consciousness drive demand for detailed consumption information and energy management tools. Smart meter adoption rates correlate strongly with consumer education programs and utility engagement initiatives that demonstrate tangible benefits.

Technology convergence accelerates as smart meters integrate with broader IoT ecosystems, smart home platforms, and renewable energy systems. This convergence creates new market dynamics where traditional utility boundaries blur and energy management becomes part of comprehensive digital lifestyle solutions.

Investment patterns show sustained commitment from utilities, governments, and private investors despite economic uncertainties. The strategic importance of smart grid infrastructure for achieving climate goals ensures continued funding support with investment efficiency improvements of 15-20% reported through advanced deployment strategies.

Comprehensive research methodology employed for analyzing the European smart meter market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with utility executives, technology providers, regulatory officials, and industry experts across major European markets to gather firsthand insights on market trends, challenges, and opportunities.

Secondary research encompasses analysis of government publications, regulatory documents, industry reports, and company financial statements to establish market baselines and validate primary research findings. Special attention focuses on EU directive implementation status, national deployment programs, and technology adoption patterns across different European regions.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop growth projections and market forecasts. The methodology incorporates macroeconomic factors, regulatory timeline analysis, and technology adoption curves to ensure realistic and actionable market insights.

Data validation processes include cross-referencing multiple sources, expert review panels, and sensitivity analysis to ensure research accuracy and reliability. Quality assurance measures verify data consistency and eliminate potential biases that could affect market analysis conclusions.

Regional analysis methodology segments Europe into distinct market clusters based on regulatory environments, deployment maturity, and economic conditions. This approach enables detailed understanding of market variations while identifying common trends and best practices across different European markets.

Nordic countries lead European smart meter deployment with near-universal coverage achieved in Sweden, Norway, and Denmark. These markets demonstrate mature smart metering ecosystems with advanced features including hourly consumption reporting, dynamic pricing integration, and comprehensive consumer engagement platforms. Deployment rates exceed 95% in residential segments with expansion into commercial and industrial applications.

Western European markets including Germany, France, and the United Kingdom show varied deployment progress with different regulatory approaches and implementation timelines. Germany’s measured approach emphasizes cost-benefit analysis while France accelerates deployment through centralized programs. The UK market demonstrates innovation in smart meter communication technologies and consumer engagement strategies.

Southern European countries including Italy, Spain, and Portugal have achieved significant deployment milestones with Italy leading through early adoption and comprehensive rollout programs. These markets benefit from favorable regulatory environments and strong utility commitment to smart grid modernization initiatives.

Eastern European markets present substantial growth opportunities as countries including Poland, Czech Republic, and Hungary initiate large-scale smart meter programs supported by EU funding. These emerging markets offer significant potential with current penetration rates below 25% in most countries, creating opportunities for rapid expansion.

Central European markets demonstrate steady progress with Austria, Switzerland, and Netherlands implementing systematic deployment programs that balance regulatory compliance with cost optimization. These markets emphasize technology standardization and interoperability to maximize investment efficiency and consumer benefits.

Market leadership in the European smart meter sector features a diverse ecosystem of established utility equipment manufacturers, technology innovators, and specialized service providers. The competitive landscape reflects regional preferences, regulatory requirements, and technological capabilities that influence market positioning and growth strategies.

Competitive strategies emphasize technological innovation, regional partnerships, and comprehensive service offerings that address utility needs beyond basic metering functionality. Leading companies invest heavily in research and development to deliver next-generation solutions incorporating IoT connectivity, advanced analytics, and enhanced cybersecurity features.

Market consolidation trends reflect strategic acquisitions and partnerships as companies seek to expand geographic coverage, enhance technology portfolios, and achieve operational synergies. MWR analysis indicates that successful market participants focus on developing integrated solutions that combine hardware, software, and services to deliver comprehensive value propositions.

Technology segmentation reveals distinct market categories based on communication protocols and functionality levels:

By Communication Technology:

By Application Segment:

By Utility Type:

Geographic segmentation reflects varying deployment maturity levels, regulatory environments, and market opportunities across European regions, with Nordic countries leading adoption while Eastern European markets present substantial growth potential.

Residential smart meters dominate the European market with widespread deployment driven by EU regulatory mandates and consumer demand for energy management tools. This category benefits from standardized installation procedures, established communication infrastructure, and proven cost-benefit ratios that support continued expansion across all European markets.

Commercial smart metering applications demonstrate strong growth potential as businesses seek to optimize energy costs and improve operational efficiency. Advanced features including demand response capabilities, power quality monitoring, and integration with building management systems create compelling value propositions for commercial customers seeking comprehensive energy management solutions.

Industrial smart meters represent a specialized segment requiring robust functionality, enhanced communication capabilities, and integration with complex industrial systems. These applications often incorporate advanced analytics, predictive maintenance features, and support for industrial IoT platforms that enable comprehensive energy and operational optimization.

Multi-utility smart meters emerge as an important category offering integrated solutions for electricity, gas, and water utilities. This convergence approach reduces deployment costs, simplifies consumer interfaces, and enables utilities to offer comprehensive service packages that improve customer satisfaction and operational efficiency.

Next-generation smart meters incorporating artificial intelligence, edge computing, and advanced cybersecurity features represent the future direction of market development. These intelligent devices enable new applications including autonomous grid management, predictive analytics, and integration with smart city infrastructure initiatives across European markets.

Utility companies realize substantial operational benefits through smart meter deployment including automated meter reading, reduced operational costs, and improved customer service capabilities. Advanced metering infrastructure enables utilities to optimize grid operations, implement dynamic pricing strategies, and integrate renewable energy sources more effectively while reducing technical and commercial losses.

Consumers benefit from enhanced energy awareness, detailed consumption information, and opportunities to reduce energy costs through behavioral changes and participation in demand response programs. Smart meters enable time-of-use pricing, prepayment options, and integration with smart home technologies that improve convenience and energy management capabilities.

Technology providers access growing market opportunities through innovation in communication technologies, data analytics platforms, and integrated smart grid solutions. The expanding European market creates demand for specialized products and services while enabling companies to develop scalable solutions for global deployment.

Governments and regulators achieve policy objectives including improved energy efficiency, reduced carbon emissions, and enhanced grid reliability through systematic smart meter deployment. These technologies support broader smart grid initiatives and renewable energy integration goals while providing detailed data for energy policy development and implementation.

Environmental stakeholders benefit from improved energy efficiency, reduced transmission losses, and better integration of renewable energy sources enabled by smart metering infrastructure. These systems support European climate goals by providing the data and control capabilities necessary for optimizing energy consumption and reducing carbon footprints across all sectors.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration emerges as a transformative trend with smart meters incorporating machine learning capabilities for predictive analytics, automated fault detection, and optimized energy management. These intelligent systems enable utilities to anticipate maintenance needs, prevent outages, and optimize grid operations through advanced data analysis and pattern recognition.

Cybersecurity enhancement becomes increasingly critical as smart meters integrate with broader IoT ecosystems and face growing security threats. Advanced encryption, secure communication protocols, and robust authentication mechanisms are becoming standard features as utilities prioritize data protection and system integrity.

Edge computing adoption enables smart meters to process data locally, reducing communication costs and improving response times for critical applications. This trend supports real-time decision making, reduces bandwidth requirements, and enhances system reliability through distributed intelligence capabilities.

Interoperability standardization accelerates across European markets as utilities and regulators recognize the importance of compatible systems and open communication protocols. Industry initiatives focus on developing common standards that enable seamless integration between different manufacturers and technologies.

Consumer engagement platforms evolve beyond basic consumption reporting to include personalized energy recommendations, gamification elements, and integration with smart home ecosystems. These platforms demonstrate engagement rate improvements of 40-50% when implemented effectively, driving better energy conservation behaviors and customer satisfaction.

Renewable energy integration capabilities become essential smart meter features as distributed generation, energy storage, and electric vehicle charging create complex grid management requirements. Advanced meters support bidirectional energy flows, dynamic pricing, and grid balancing services necessary for renewable energy optimization.

Major utility partnerships across Europe demonstrate accelerating smart meter deployment with comprehensive programs covering millions of consumers. Recent initiatives include large-scale rollouts in Germany, France, and Eastern European countries that establish new benchmarks for deployment efficiency and consumer engagement.

Technology standardization efforts gain momentum through European industry associations and regulatory bodies working to establish common communication protocols and interoperability requirements. These initiatives aim to reduce costs, improve system compatibility, and enable more efficient market development across European countries.

Cybersecurity framework development reflects growing industry focus on protecting smart meter infrastructure from evolving security threats. New standards and certification programs ensure robust security measures while enabling innovation in communication technologies and data analytics capabilities.

Next-generation meter launches by leading manufacturers incorporate advanced features including edge computing, artificial intelligence, and enhanced communication capabilities. These product developments demonstrate industry commitment to continuous innovation and meeting evolving utility and consumer requirements.

Regulatory updates across European countries refine smart meter deployment requirements, establish new performance standards, and address consumer protection concerns. Recent developments include updated privacy regulations, enhanced cybersecurity requirements, and expanded deployment mandates covering gas and water utilities.

Investment announcements from utilities, technology companies, and government agencies demonstrate sustained commitment to smart meter deployment and grid modernization. These investments support research and development, manufacturing capacity expansion, and comprehensive deployment programs across European markets.

Strategic recommendations for market participants emphasize the importance of developing comprehensive solutions that address utility needs beyond basic metering functionality. Companies should focus on integrated platforms combining hardware, software, and services to deliver maximum value and establish competitive differentiation in increasingly crowded markets.

Technology investment priorities should emphasize cybersecurity, artificial intelligence, and interoperability capabilities that address current market challenges while positioning companies for future growth opportunities. MarkWide Research analysis suggests that companies investing in these areas achieve market share growth rates 25-30% higher than competitors focusing solely on traditional metering functionality.

Regional expansion strategies should prioritize Eastern European markets where smart meter penetration remains low but regulatory support and EU funding create favorable conditions for rapid deployment. Companies should develop partnerships with local utilities and system integrators to establish market presence and navigate regulatory requirements effectively.

Customer engagement initiatives become increasingly important as utilities seek to maximize smart meter investment returns through improved consumer participation in energy management programs. Companies should develop user-friendly interfaces, mobile applications, and personalized energy services that demonstrate tangible benefits to consumers.

Partnership development with technology companies, system integrators, and service providers enables comprehensive solution delivery while sharing investment risks and accessing specialized capabilities. Strategic alliances should focus on complementary strengths that enhance overall value propositions and market competitiveness.

Innovation focus areas should include edge computing, IoT integration, and advanced analytics capabilities that enable new applications and revenue streams. Companies should invest in research and development programs that anticipate future market requirements while addressing current utility challenges and consumer needs.

Market trajectory for European smart meters remains highly positive with sustained growth expected through the next decade driven by regulatory requirements, technology advancement, and increasing focus on energy efficiency. The market benefits from strong fundamentals including government support, utility investment, and growing consumer acceptance of digital energy management solutions.

Technology evolution toward intelligent, connected devices will transform smart meters from simple measurement tools into comprehensive energy management platforms. Integration with artificial intelligence, IoT ecosystems, and smart city infrastructure creates new opportunities for utilities to optimize operations and deliver enhanced customer services.

Regional development patterns indicate continued leadership from Nordic countries while Eastern European markets emerge as primary growth drivers. Western European markets will focus on technology upgrades and advanced feature deployment while Southern European countries expand coverage and enhance system capabilities.

Regulatory environment evolution will likely include updated EU directives addressing cybersecurity, data privacy, and interoperability requirements while potentially expanding mandates to cover gas and water utilities more comprehensively. These developments will create new opportunities while establishing higher standards for technology providers and utilities.

Investment outlook remains robust with continued utility spending on smart grid infrastructure, government funding for energy modernization programs, and private sector investment in technology development. Market growth projections indicate compound annual growth rates of 8-10% across most European markets through 2030.

Innovation trajectory will emphasize integration capabilities, advanced analytics, and consumer engagement features that maximize smart meter value propositions. Future developments will likely include autonomous grid management capabilities, predictive maintenance features, and seamless integration with renewable energy and electric vehicle infrastructure.

The Europe smart meter market represents a dynamic and rapidly evolving sector that plays a crucial role in the continent’s energy transformation and sustainability objectives. Strong regulatory support through EU directives, combined with technological innovation and increasing consumer awareness, creates a favorable environment for sustained market growth and development.

Market fundamentals remain robust with comprehensive deployment programs across European countries, substantial utility and government investment, and proven technology solutions that deliver measurable benefits to utilities and consumers. The integration of advanced features including artificial intelligence, IoT connectivity, and enhanced cybersecurity capabilities positions smart meters as foundational elements of modern energy infrastructure.

Future success in the European smart meter market will depend on companies’ ability to deliver integrated solutions that address comprehensive utility needs while providing tangible consumer benefits. Organizations that invest in technology innovation, develop strategic partnerships, and focus on customer engagement will be best positioned to capitalize on emerging opportunities and achieve sustainable competitive advantages in this transformative market segment.

What is Smart Meter?

Smart meters are advanced metering devices that provide real-time data on energy consumption, enabling better energy management and efficiency. They facilitate two-way communication between the utility and the consumer, allowing for more accurate billing and improved energy usage insights.

What are the key players in the Europe Smart Meter Market?

Key players in the Europe Smart Meter Market include Siemens AG, Schneider Electric, Itron, and Landis+Gyr, among others. These companies are involved in the development and deployment of smart metering technologies across various regions.

What are the main drivers of the Europe Smart Meter Market?

The main drivers of the Europe Smart Meter Market include the increasing demand for energy efficiency, government regulations promoting smart grid technologies, and the growing adoption of renewable energy sources. These factors are pushing utilities to invest in smart metering solutions.

What challenges does the Europe Smart Meter Market face?

The Europe Smart Meter Market faces challenges such as high initial installation costs, data privacy concerns, and the need for interoperability among different systems. These issues can hinder the widespread adoption of smart meters.

What opportunities exist in the Europe Smart Meter Market?

Opportunities in the Europe Smart Meter Market include advancements in IoT technology, the integration of smart meters with home automation systems, and the potential for enhanced energy management services. These developments can lead to increased consumer engagement and energy savings.

What trends are shaping the Europe Smart Meter Market?

Trends shaping the Europe Smart Meter Market include the rise of smart home technologies, the implementation of advanced analytics for energy consumption, and the growing focus on sustainability and carbon reduction. These trends are influencing how consumers and utilities interact with energy data.

Europe Smart Meter Market

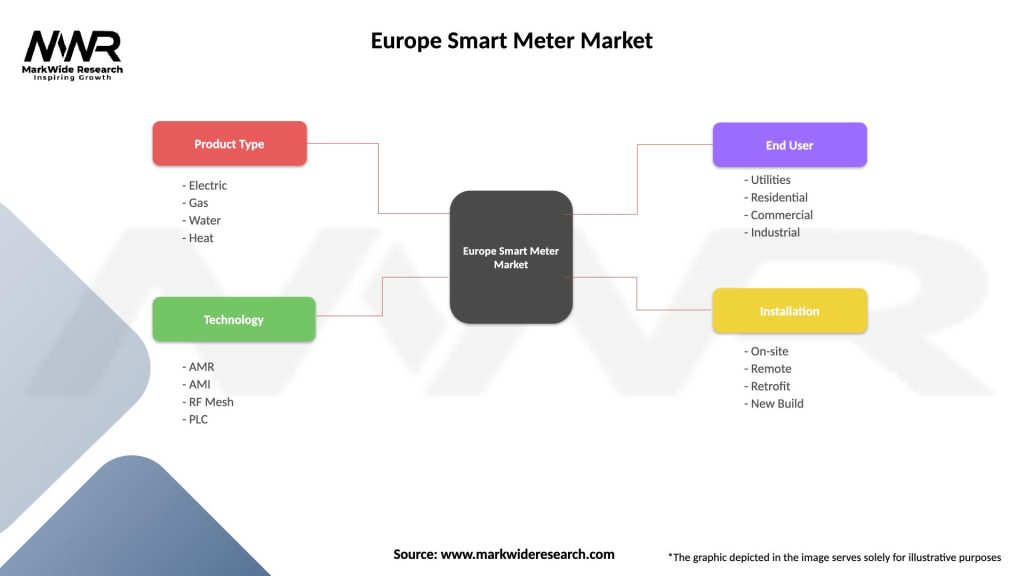

| Segmentation Details | Description |

|---|---|

| Product Type | Electric, Gas, Water, Heat |

| Technology | AMR, AMI, RF Mesh, PLC |

| End User | Utilities, Residential, Commercial, Industrial |

| Installation | On-site, Remote, Retrofit, New Build |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Smart Meter Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at