444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe single-use plastic packaging market represents a complex and rapidly evolving sector that continues to face unprecedented regulatory pressures and consumer demands for sustainable alternatives. This market encompasses disposable plastic containers, bags, wraps, bottles, and various packaging solutions designed for one-time use across multiple industries including food and beverage, healthcare, retail, and e-commerce sectors.

Market dynamics in the European region are particularly influenced by stringent environmental regulations, with the European Union’s Single-Use Plastics Directive creating significant shifts in manufacturing practices and consumer behavior. The market is experiencing a compound annual growth rate (CAGR) of 2.1% despite regulatory challenges, driven primarily by essential applications in healthcare and food safety sectors where alternatives remain limited.

Regional variations across Europe show distinct patterns, with Western European countries leading in both consumption and innovation of sustainable packaging solutions. The market demonstrates resilience through adaptation, with manufacturers increasingly focusing on recyclable materials and bio-based alternatives while maintaining the functional benefits that have made single-use plastics indispensable in certain applications.

Industry transformation is evident as companies invest heavily in research and development to create packaging solutions that balance regulatory compliance, environmental responsibility, and practical functionality. This evolution reflects broader European sustainability goals while addressing the continued need for hygienic, lightweight, and cost-effective packaging solutions across various sectors.

The Europe single-use plastic packaging market refers to the comprehensive ecosystem of disposable plastic-based packaging products designed for immediate disposal after a single use, encompassing manufacturing, distribution, and end-of-life management within European territories. This market includes various plastic packaging formats such as flexible films, rigid containers, bottles, caps, closures, and protective wrapping materials used across diverse industries.

Single-use plastic packaging encompasses products manufactured from various polymer materials including polyethylene (PE), polypropylene (PP), polystyrene (PS), and polyethylene terephthalate (PET), designed to provide barrier properties, product protection, and convenience for consumers while maintaining cost-effectiveness for manufacturers and retailers.

Market scope extends beyond traditional packaging to include innovative applications in medical devices, pharmaceutical products, fresh food preservation, and e-commerce logistics, where single-use plastic packaging provides critical functions such as sterility maintenance, product integrity, and supply chain efficiency.

Regulatory framework significantly influences market definition, with European legislation distinguishing between essential single-use plastic packaging applications and those targeted for reduction or elimination, creating distinct market segments based on regulatory classification and environmental impact assessments.

Market transformation characterizes the current state of Europe’s single-use plastic packaging sector, where traditional growth patterns are being reshaped by environmental regulations, consumer preferences, and technological innovations. The market demonstrates remarkable adaptability as stakeholders navigate complex regulatory landscapes while maintaining essential packaging functions across critical industries.

Key market drivers include persistent demand from healthcare sectors, where 78% of medical packaging continues to rely on single-use plastic solutions due to sterility requirements and patient safety considerations. Food safety applications maintain strong demand, particularly in fresh produce and ready-to-eat meal segments where plastic packaging provides essential barrier properties and shelf-life extension.

Regulatory impact has created distinct market segments, with essential applications experiencing continued growth while discretionary single-use plastic packaging faces significant restrictions. The European Union’s comprehensive approach to plastic waste reduction has accelerated innovation in recyclable and bio-based alternatives, creating new market opportunities for forward-thinking manufacturers.

Innovation trends focus on developing packaging solutions that maintain functional benefits while improving environmental profiles. Advanced recycling technologies, bio-based materials, and design optimization strategies are reshaping product portfolios across the industry, with MarkWide Research indicating significant investment in sustainable packaging alternatives throughout the European market.

Future outlook suggests continued market evolution rather than decline, with successful companies adapting through sustainable innovation, regulatory compliance, and strategic positioning in essential application segments where single-use plastic packaging remains irreplaceable for safety and functionality requirements.

Market segmentation reveals distinct performance patterns across different application areas and geographic regions within Europe. The following insights highlight critical market dynamics:

Healthcare sector demand continues to serve as the primary market driver, with European medical facilities requiring sterile, single-use packaging solutions for surgical instruments, pharmaceuticals, and medical devices. The ongoing emphasis on infection control and patient safety ensures sustained demand for high-quality plastic packaging that meets stringent regulatory standards and provides reliable barrier properties.

Food safety requirements drive significant market demand, particularly in fresh produce, dairy, and meat packaging applications where plastic materials provide essential protection against contamination, moisture, and oxygen exposure. European food safety regulations mandate specific packaging standards that often require single-use plastic solutions to ensure consumer health and product quality throughout the supply chain.

E-commerce expansion creates growing demand for protective packaging solutions that can withstand shipping stresses while maintaining product integrity. The rise of online retail across Europe has increased the need for lightweight, durable packaging materials that provide cost-effective protection during transportation and delivery processes.

Convenience culture continues to influence consumer preferences, with busy lifestyles driving demand for ready-to-eat meals, portion-controlled products, and on-the-go consumption formats that rely heavily on single-use plastic packaging for functionality and convenience.

Innovation in sustainable materials paradoxically drives market growth by creating new categories of environmentally responsible single-use packaging that maintains traditional functionality while improving end-of-life characteristics through enhanced recyclability or biodegradability features.

Supply chain efficiency requirements favor single-use plastic packaging due to its lightweight properties, cost-effectiveness, and ability to reduce transportation costs and carbon emissions compared to heavier alternative packaging materials.

Regulatory restrictions represent the most significant market restraint, with the European Union’s Single-Use Plastics Directive banning specific products and imposing strict limitations on others. These regulations create compliance costs, reduce market opportunities for traditional products, and require substantial investments in alternative solutions.

Environmental concerns continue to pressure market growth as increasing awareness of plastic pollution, marine debris, and waste management challenges influences consumer behavior and corporate sustainability policies. Public sentiment against single-use plastics creates reputational risks for companies and drives demand for alternative packaging solutions.

Cost pressures from sustainable alternatives challenge market economics, as bio-based and recyclable packaging materials often carry higher production costs compared to traditional single-use plastics. These cost differentials can impact competitiveness and profit margins across the value chain.

Supply chain disruptions affect raw material availability and pricing stability, with petroleum-based feedstock volatility and transportation challenges creating uncertainty for manufacturers and increasing operational complexity.

Consumer behavior shifts toward reusable and sustainable packaging options reduce demand in certain market segments, particularly for discretionary applications where alternatives are readily available and functionally adequate.

Investment requirements for compliance and innovation strain company resources, with significant capital expenditures needed for new production technologies, material research, and regulatory compliance systems that may not generate immediate returns on investment.

Sustainable innovation presents substantial opportunities for companies developing next-generation packaging solutions that maintain single-use functionality while improving environmental profiles. Advanced materials science enables creation of packaging that offers traditional benefits with enhanced recyclability, compostability, or bio-based content.

Healthcare expansion offers significant growth potential as aging European populations increase demand for medical devices, pharmaceuticals, and healthcare services that require sterile single-use packaging solutions. This sector provides stable, regulation-protected demand that supports long-term business planning and investment.

Circular economy integration creates opportunities for companies that can develop closed-loop systems, advanced recycling technologies, and material recovery processes that transform waste streams into valuable inputs for new packaging production.

Premium positioning allows companies to capture value from environmentally conscious consumers willing to pay higher prices for sustainable packaging solutions that align with their values while maintaining desired functionality and convenience.

Technology partnerships enable collaboration between packaging manufacturers, material scientists, and technology companies to develop breakthrough solutions that address regulatory requirements while creating competitive advantages in the marketplace.

Export opportunities exist for European companies that develop compliant, sustainable packaging solutions that can be marketed to other regions facing similar regulatory pressures and environmental challenges, creating global market expansion possibilities.

Niche applications provide opportunities for specialized packaging solutions in emerging sectors such as plant-based foods, personalized medicine, and sustainable consumer goods that require unique packaging characteristics and performance specifications.

Regulatory evolution continues to reshape market dynamics as European authorities implement increasingly stringent requirements for plastic packaging waste reduction, recycling targets, and extended producer responsibility programs. These regulatory changes create both challenges and opportunities, forcing market adaptation while opening new business models and revenue streams.

Consumer awareness drives market transformation through changing purchasing decisions and brand loyalty patterns. European consumers demonstrate increasing sophistication in evaluating packaging sustainability, with 72% of consumers actively seeking products with environmentally responsible packaging, creating market pressure for continuous innovation and improvement.

Technology advancement accelerates market evolution through development of new materials, production processes, and recycling technologies that enable creation of packaging solutions previously considered impossible. These technological breakthroughs create competitive advantages for early adopters and reshape industry standards.

Supply chain integration becomes increasingly important as companies seek to optimize packaging performance throughout the entire value chain, from raw material sourcing through end-of-life management. This integration creates opportunities for vertical integration and strategic partnerships that enhance market positioning.

Investment flows toward sustainable packaging solutions attract venture capital, private equity, and corporate investment that accelerates innovation and market development. According to MWR analysis, European packaging innovation receives substantial funding support, enabling rapid commercialization of breakthrough technologies.

Competitive landscape evolution sees traditional packaging companies competing with new entrants, material science companies, and technology firms that bring different capabilities and perspectives to market challenges, creating dynamic competitive environments that benefit innovation and customer choice.

Primary research encompasses comprehensive interviews with industry executives, regulatory officials, environmental experts, and consumer representatives across major European markets. This qualitative research provides insights into market trends, regulatory impacts, and future development directions that quantitative data alone cannot capture.

Secondary research involves systematic analysis of industry reports, regulatory documents, company financial statements, patent filings, and academic research to establish comprehensive understanding of market structure, competitive dynamics, and technological developments affecting the single-use plastic packaging sector.

Market surveys collect data from packaging manufacturers, converters, brand owners, and retailers to understand current practices, future plans, and investment priorities related to single-use plastic packaging applications and sustainable alternatives.

Regulatory analysis examines existing and proposed legislation across European Union member states, including implementation timelines, compliance requirements, and enforcement mechanisms that influence market development and business strategy decisions.

Technology assessment evaluates emerging materials, production processes, and recycling technologies through expert interviews, laboratory testing data, and pilot project results to understand commercial viability and market potential of innovative packaging solutions.

Consumer research utilizes focus groups, online surveys, and behavioral studies to understand European consumer attitudes, preferences, and purchasing decisions related to single-use plastic packaging and sustainable alternatives across different demographic segments and geographic regions.

Data validation employs multiple source verification, expert review panels, and statistical analysis techniques to ensure research accuracy, reliability, and relevance for strategic decision-making by industry stakeholders and policy makers.

Western Europe leads market innovation and regulatory compliance, with countries like Germany, France, and the Netherlands demonstrating advanced adoption of sustainable packaging solutions. These markets show 45% higher adoption rates of recyclable single-use packaging compared to European averages, driven by strong environmental awareness and supportive policy frameworks.

Northern European countries including Sweden, Denmark, and Finland demonstrate the most aggressive transition toward sustainable packaging alternatives, with government incentives and consumer preferences creating favorable conditions for innovative packaging solutions that maintain functionality while improving environmental performance.

Southern Europe markets including Italy, Spain, and Greece show more gradual adaptation to regulatory changes, with traditional packaging applications maintaining stronger market presence. However, these regions demonstrate growing investment in compliance technologies and sustainable packaging development as regulatory enforcement intensifies.

Eastern European markets present complex dynamics with growing economies driving increased packaging demand while regulatory harmonization with EU standards creates pressure for rapid modernization of packaging practices and technologies.

United Kingdom post-Brexit maintains alignment with European sustainability trends while developing independent regulatory frameworks that influence packaging market development and create opportunities for innovative solutions that address both environmental and economic objectives.

Market concentration varies significantly across regions, with Western European markets showing higher fragmentation and innovation diversity, while Eastern European markets demonstrate more concentrated supplier bases and traditional packaging approaches that are gradually evolving toward sustainability.

Market leaders in the European single-use plastic packaging sector demonstrate strong adaptation capabilities and innovation focus as they navigate regulatory challenges while maintaining market positions. The competitive environment rewards companies that successfully balance compliance, sustainability, and functionality in their product offerings.

Competitive strategies increasingly focus on sustainability innovation, regulatory compliance, and strategic partnerships that enable companies to address market challenges while maintaining profitability and growth potential in evolving market conditions.

By Material Type:

By Application:

By End-Use Industry:

Flexible Packaging represents the largest category within the European single-use plastic packaging market, encompassing films, bags, pouches, and wraps used across multiple industries. This category demonstrates resilience through innovation in recyclable materials and design optimization that maintains functionality while improving environmental performance. Market share for flexible packaging reaches 52% of total European consumption, driven by food packaging applications and e-commerce growth.

Rigid Packaging includes containers, bottles, caps, and closures that provide structural protection and product integrity. This category shows strong performance in healthcare and pharmaceutical applications where safety requirements maintain demand for high-quality plastic packaging solutions. Innovation focuses on lightweighting, recyclability enhancement, and integration of recycled content.

Protective Packaging serves specialized applications in electronics, automotive, and industrial sectors where product protection during transportation and storage requires specific performance characteristics. This category benefits from e-commerce growth and increasing complexity of supply chains that demand reliable protective solutions.

Foodservice Packaging faces the most significant regulatory pressure, with many traditional products banned or restricted under European legislation. However, essential applications in food safety and hygiene maintain market demand, driving innovation in sustainable alternatives that meet regulatory requirements while providing necessary functionality.

Medical Packaging demonstrates the strongest growth potential and regulatory protection, with healthcare applications requiring sterile, single-use packaging that meets stringent safety standards. This category benefits from aging populations, healthcare expansion, and continued emphasis on infection control and patient safety.

Manufacturers benefit from market opportunities created by regulatory compliance and sustainability innovation, with companies that successfully adapt to changing requirements gaining competitive advantages and market share. Early investment in sustainable technologies provides long-term positioning benefits and access to premium market segments.

Brand Owners gain access to packaging solutions that align with corporate sustainability goals while maintaining product protection and consumer appeal. Advanced single-use plastic packaging enables brand differentiation through environmental responsibility and functional performance.

Retailers benefit from packaging solutions that reduce waste management costs, improve supply chain efficiency, and meet consumer expectations for environmental responsibility. Sustainable single-use packaging supports retail sustainability initiatives while maintaining operational effectiveness.

Consumers receive packaging that provides safety, convenience, and environmental responsibility through innovative materials and design approaches that maintain traditional benefits while reducing environmental impact.

Healthcare Providers access essential packaging solutions that ensure patient safety, infection control, and regulatory compliance while supporting operational efficiency and cost management in healthcare delivery systems.

Environmental Stakeholders benefit from industry innovation that reduces environmental impact through improved recyclability, material efficiency, and circular economy integration that addresses waste management challenges.

Investors find opportunities in companies developing breakthrough technologies and sustainable solutions that address market needs while generating attractive returns through innovation and market leadership.

Regulatory Bodies achieve policy objectives through industry cooperation and innovation that reduces environmental impact while maintaining essential packaging functions for public health and safety.

Strengths:

Weaknesses:

Opportunities:

Threats:

Circular Economy Integration emerges as the dominant trend reshaping the European single-use plastic packaging market, with companies developing closed-loop systems that maintain packaging functionality while improving material recovery and recycling rates. This trend creates new business models and revenue streams while addressing environmental concerns.

Advanced Recycling Technologies gain momentum as chemical recycling and molecular breakdown processes enable conversion of used packaging into high-quality raw materials for new packaging production. These technologies address quality degradation issues associated with mechanical recycling and expand the range of recyclable packaging materials.

Bio-based Material Development accelerates with increasing investment in plant-based polymers and biodegradable materials that provide similar functionality to traditional plastics while offering improved end-of-life characteristics. Innovation focuses on performance optimization and cost reduction to achieve commercial viability.

Design for Recyclability becomes standard practice as manufacturers optimize packaging design to improve recycling efficiency and material recovery rates. This trend includes elimination of multi-material constructions, improved labeling systems, and standardization of material types to facilitate recycling processes.

Smart Packaging Integration incorporates digital technologies and sensors into single-use packaging to provide enhanced functionality, supply chain visibility, and consumer engagement while maintaining sustainability objectives and regulatory compliance.

Regulatory Harmonization continues across European markets as member states align implementation of EU directives while developing additional national requirements that influence packaging design and material selection decisions.

Consumer Education initiatives increase as industry stakeholders work to improve public understanding of packaging sustainability, recycling processes, and the essential role of single-use packaging in food safety and healthcare applications.

Regulatory Implementation continues with European Union member states enforcing Single-Use Plastics Directive requirements, creating market shifts and driving innovation in alternative packaging solutions. Recent developments include expanded producer responsibility programs and increased recycling targets that influence industry investment priorities.

Technology Breakthroughs in chemical recycling enable processing of previously non-recyclable packaging materials, with several European facilities beginning commercial operations. These developments create new opportunities for circular economy integration and waste stream valorization.

Strategic Partnerships between packaging manufacturers, brand owners, and technology companies accelerate development of sustainable packaging solutions. Recent collaborations focus on scaling innovative materials and implementing circular economy business models across European markets.

Investment Announcements in sustainable packaging technologies reach record levels, with venture capital and corporate investment supporting development of bio-based materials, advanced recycling processes, and innovative packaging designs that address regulatory requirements.

Market Consolidation activities include acquisitions of sustainable packaging technology companies and strategic partnerships that combine traditional packaging expertise with innovative material science capabilities to create competitive advantages in evolving markets.

Product Launches of recyclable and bio-based single-use packaging solutions increase across European markets, with manufacturers introducing products that maintain functionality while improving environmental performance and regulatory compliance.

Certification Programs expand to provide third-party validation of packaging sustainability claims, helping consumers and businesses make informed decisions while supporting market development for environmentally responsible packaging solutions.

Strategic Focus should prioritize development of packaging solutions that address regulatory requirements while maintaining essential functionality for safety-critical applications. Companies should invest in sustainable innovation while protecting market positions in healthcare and food safety segments where alternatives remain limited.

Innovation Investment requires balanced allocation between short-term compliance solutions and long-term breakthrough technologies. MarkWide Research recommends focusing on recyclable materials and circular economy integration as the most promising areas for sustainable competitive advantage development.

Partnership Development enables access to complementary technologies and capabilities that accelerate sustainable packaging development. Companies should seek collaborations with material science firms, recycling technology providers, and brand owners committed to sustainability objectives.

Market Positioning should emphasize essential applications where single-use plastic packaging provides irreplaceable benefits for safety, hygiene, and functionality. Companies should clearly communicate the value proposition of their products while demonstrating commitment to environmental responsibility.

Geographic Strategy should account for regional variations in regulatory implementation and market acceptance of sustainable packaging solutions. Companies should adapt approaches to local market conditions while maintaining consistency in sustainability commitments and innovation directions.

Supply Chain Optimization requires integration of sustainability considerations throughout the value chain, from raw material sourcing through end-of-life management. Companies should develop partnerships that support circular economy objectives while maintaining operational efficiency.

Consumer Communication should focus on education about packaging sustainability, recycling processes, and the essential role of single-use packaging in safety applications. Transparent communication builds trust and supports market acceptance of responsible packaging solutions.

Market evolution will continue toward sustainable packaging solutions that maintain the functional benefits of traditional single-use plastics while addressing environmental concerns and regulatory requirements. The European market is expected to demonstrate sustained growth of 3.2% annually in sustainable packaging segments over the next five years, driven by innovation and regulatory compliance.

Technology advancement will enable breakthrough solutions in bio-based materials, advanced recycling, and circular economy integration that transform market dynamics while preserving essential packaging functions. Chemical recycling technologies are projected to process 35% of European plastic packaging waste by 2030, creating new opportunities for material recovery and reuse.

Regulatory development will expand beyond current restrictions to include additional requirements for recycled content, design standards, and extended producer responsibility that influence packaging development and market structure throughout the European region.

Consumer acceptance of sustainable single-use packaging will increase as products demonstrate equivalent functionality to traditional materials while providing environmental benefits. Market research indicates 68% of European consumers are willing to pay premium prices for packaging that combines convenience with environmental responsibility.

Industry consolidation will accelerate as companies seek scale advantages and complementary capabilities needed to compete in evolving markets that reward innovation, sustainability, and regulatory compliance over traditional cost advantages.

Global influence of European sustainability standards will expand as other regions adopt similar regulatory approaches and market requirements, creating export opportunities for European companies that develop compliant, sustainable packaging solutions.

Investment flows will continue supporting sustainable packaging innovation, with venture capital and corporate investment enabling rapid commercialization of breakthrough technologies that address market needs while generating attractive returns for stakeholders.

The Europe single-use plastic packaging market stands at a critical transformation point where regulatory pressures, environmental concerns, and innovation opportunities converge to reshape industry dynamics and competitive landscapes. While traditional single-use plastic packaging faces significant challenges from regulatory restrictions and changing consumer preferences, essential applications in healthcare, food safety, and specialized industrial uses continue to provide stable market foundations.

Market resilience emerges through strategic adaptation rather than resistance to change, with successful companies investing in sustainable innovation, circular economy integration, and regulatory compliance while maintaining focus on essential packaging functions that cannot be adequately addressed by alternative materials. The sector demonstrates remarkable capacity for evolution, transforming challenges into opportunities for competitive advantage and market leadership.

Future success will depend on companies’ ability to balance multiple objectives including environmental responsibility, regulatory compliance, functional performance, and economic viability. Organizations that achieve this balance through innovation, strategic partnerships, and market positioning will thrive in the evolving European packaging landscape, while those that fail to adapt face increasing market pressures and reduced opportunities.

Industry transformation continues to accelerate, driven by technological breakthroughs in sustainable materials, advanced recycling processes, and circular economy business models that create new value propositions for stakeholders throughout the packaging value chain. The Europe single-use plastic packaging market represents not a declining sector, but an evolving industry that maintains essential functions while adapting to contemporary environmental and social expectations through innovation and responsible business practices.

What is Single-use Plastic Packaging?

Single-use plastic packaging refers to plastic materials designed to be used once and then discarded. This type of packaging is commonly found in food service, retail, and consumer goods, often used for items like takeout containers, plastic bags, and beverage bottles.

What are the key players in the Europe Single-use Plastic Packaging Market?

Key players in the Europe Single-use Plastic Packaging Market include Amcor, Sealed Air Corporation, and Berry Global, among others. These companies are involved in the production and distribution of various single-use plastic packaging solutions across multiple industries.

What are the main drivers of the Europe Single-use Plastic Packaging Market?

The main drivers of the Europe Single-use Plastic Packaging Market include the growing demand for convenience in food packaging, increased online shopping leading to higher packaging needs, and the expansion of the food delivery sector. Additionally, consumer preferences for ready-to-eat meals contribute to market growth.

What challenges does the Europe Single-use Plastic Packaging Market face?

The Europe Single-use Plastic Packaging Market faces challenges such as increasing regulations aimed at reducing plastic waste, growing environmental concerns among consumers, and the push for sustainable alternatives. These factors can impact production and demand for traditional plastic packaging.

What opportunities exist in the Europe Single-use Plastic Packaging Market?

Opportunities in the Europe Single-use Plastic Packaging Market include the development of biodegradable and compostable packaging solutions, innovations in recycling technologies, and the potential for new materials that meet sustainability goals. Companies can leverage these trends to capture environmentally conscious consumers.

What trends are shaping the Europe Single-use Plastic Packaging Market?

Trends shaping the Europe Single-use Plastic Packaging Market include a shift towards eco-friendly materials, increased investment in recycling infrastructure, and the rise of reusable packaging systems. These trends reflect a broader movement towards sustainability and responsible consumption in the packaging industry.

Europe Single-use Plastic Packaging Market

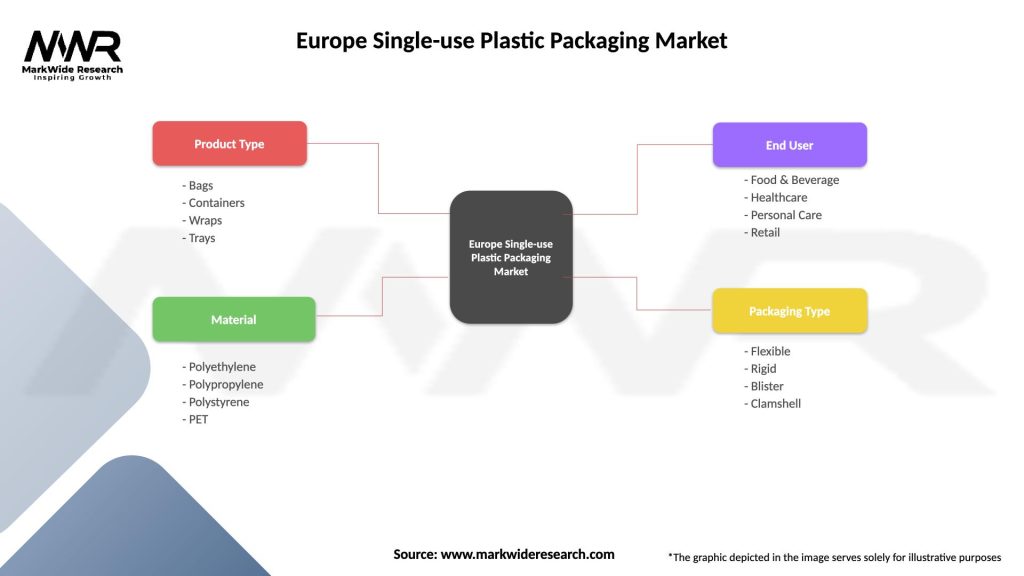

| Segmentation Details | Description |

|---|---|

| Product Type | Bags, Containers, Wraps, Trays |

| Material | Polyethylene, Polypropylene, Polystyrene, PET |

| End User | Food & Beverage, Healthcare, Personal Care, Retail |

| Packaging Type | Flexible, Rigid, Blister, Clamshell |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Single-use Plastic Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at