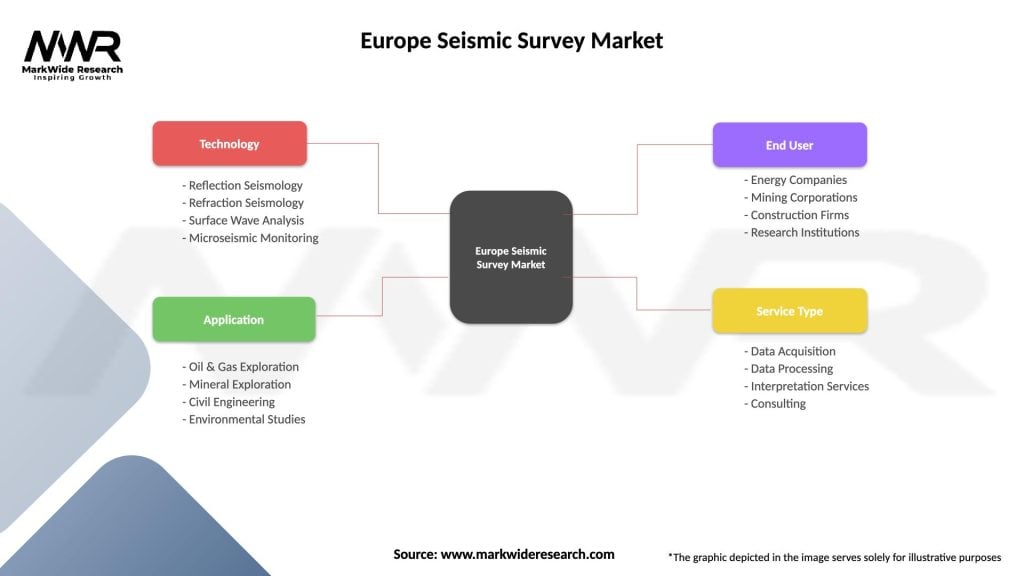

Segmentation

-

By Survey Type: 2D; 3D; 4D (Time-Lapse)

-

By Acquisition Method: Towed-Streamer; Ocean-Bottom Seismometers (OBS/OBN); Land Vibroseis; Autonomous Nodes

-

By Application: Hydrocarbon Exploration; Geothermal Exploration; CCUS Monitoring; Infrastructure & Engineering; Environmental Studies

-

By End User: Oil & Gas Majors; National Oil Companies; Independent E&P; Renewable Energy Developers; Government & Research Institutes

-

By Region: North Sea; Mediterranean; Baltic & Barents; Western Europe; Eastern Europe

Category‑wise Insights

-

2D Surveys: Cost-effective for frontier acreage screening; still prevalent in emerging basins.

-

3D Surveys: Standard for detailed reservoir characterization; 70% of Europe’s offshore projects utilize 3D.

-

4D Surveys: Essential for monitoring reservoir performance and CCUS injection, accounting for 12% of revenue.

-

OBN/OBS: Preferred in complex shallow-water and environmentally sensitive areas to minimize ghost reflections.

-

Onshore Vibroseis: Dominant for land surveys in mature basins, offering high repeatability for time-lapse studies.

Key Benefits for Industry Participants and Stakeholders

-

Optimized Exploration: Reduced drilling risk and enhanced prospect delineation lower overall project costs.

-

Regulatory Compliance: Detailed subsurface imaging supports environmental impact assessments and permitting.

-

Project Efficiency: Integrated acquisition-to-interpretation workflows accelerate decision timelines.

-

Sustainability Credentials: Use of green technologies and reduced environmental footprint strengthens corporate ESG.

-

Innovation Leadership: Early adoption of machine learning and autonomous systems drives competitive advantage.

SWOT Analysis

Strengths:

-

Established technological expertise and multi-client data libraries.

-

Strong regulatory support for CCUS and renewable energy surveys.

Weaknesses:

-

High operational costs and asset utilization challenges in low-demand periods.

-

Complex data management requirements.

Opportunities:

-

Expansion into geothermal and urban engineering markets.

-

Partnerships for CCUS and hydrogen storage monitoring.

Threats:

-

Fluctuating exploration budgets tied to energy price volatility.

-

Environmental restrictions and stakeholder opposition to onshore seismic.

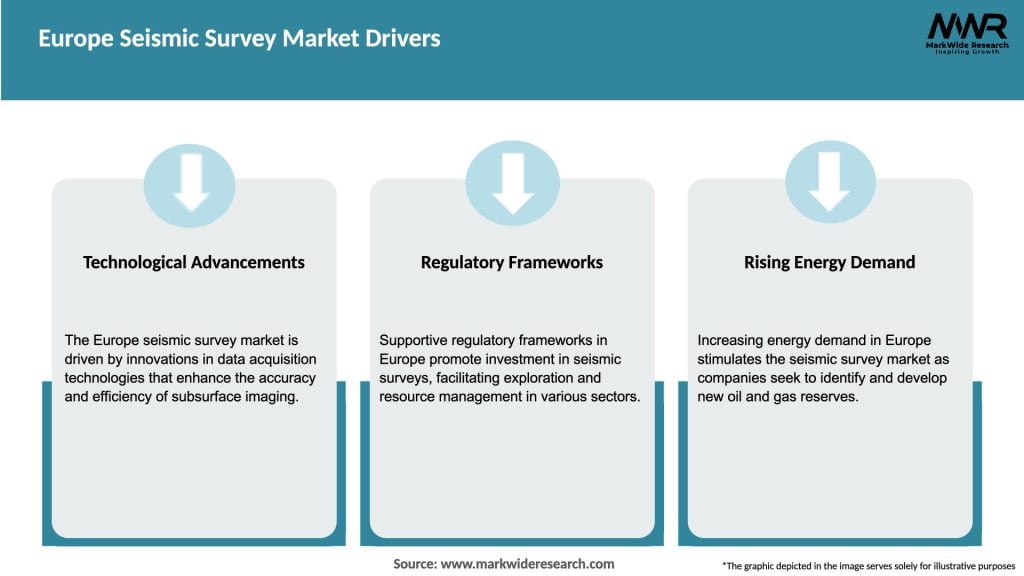

Market Key Trends

-

Machine Learning Applications: Automated noise suppression and feature recognition in seismic processing.

-

Nodal Technology Proliferation: Wireless nodes streamline survey logistics and enable rapid mobilization.

-

Green Seismic Practices: Hybrid hybrid airgun arrays and electric-powered vessels reduce emissions.

-

Cloud-Based Workflows: Collaborative platforms facilitate remote processing and interpretation.

-

Integrated Subsurface Modelling: Combining seismic with well and production data for comprehensive reservoir models.

Covid-19 Impact

-

Operational Delays: Travel restrictions and lockdowns delayed crew mobilization and data processing.

-

Data-Driven Planning: Remote interpretation centers ensured continuity of workflow during lockdowns.

-

Health Protocols: Enhanced safety measures increased mobilization costs but improved crew welfare.

-

Digital Acceleration: Virtual collaboration tools and cloud adoption surged as on-site access diminished.

Key Industry Developments

-

PGS’ WildSeis™ Launch: Next-gen node system offering ultra-wide bandwidth for deepwater imaging.

-

CGG’s AQUILA™ Cloud: Cloud-native processing suite integrating AI for rapid turnaround.

-

TGS Multi-Client Library Expansion: New 3D blocks released in the Norwegian Barents Sea.

-

Shearwater’s Robotic Node Deployment: Field trials of land drones deploying seismic nodes autonomously.

-

Halliburton-Sercel Collaboration: Partnership on low-impact vibroseis sources for protected environments.

Analyst Suggestions

-

Diversify Service Offerings: Bundle seismic with reservoir simulation and monitoring to capture full project lifecycle revenue.

-

Invest in Sustainability: Adopt low-emission vessels and electric acquisition equipment to meet ESG targets.

-

Leverage Data Analytics: Apply big data and cloud-based ML to multi-client libraries for predictive prospectivity analysis.

-

Expand into Renewables: Target geothermal and CCUS clients with tailored seismic solutions and monitoring services.

-

Strengthen Partnerships: Collaborate with national geological surveys and research institutions for funded exploration campaigns.

Future Outlook

The Europe Seismic Survey Market is poised for steady growth as energy transition imperatives and resource replenishment needs converge. While hydrocarbon exploration remains a key driver, seismic services will increasingly support CCUS, geothermal, and urban infrastructure projects. Technological innovations—autonomous nodes, AI-enhanced imaging, and digital twins—will enhance operational efficiency and open new applications. Service providers that adapt to sustainable practices, invest in digitalization, and diversify into adjacent sectors will lead the market’s next evolution.

Conclusion

Seismic surveys are foundational to Europe’s subsurface exploration and monitoring landscape. As oil and gas activities resume alongside ambitious decarbonization and renewable energy initiatives, the demand for high-resolution seismic data will rise. By embracing cutting-edge acquisition and processing technologies, fostering cross-sector collaboration, and prioritizing environmental stewardship, industry stakeholders can capitalize on emerging opportunities and drive the seismic market toward a more sustainable, diversified future.