444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe sea freight forwarding market represents a cornerstone of international trade and logistics infrastructure, facilitating the movement of goods across maritime routes throughout the European continent and beyond. Sea freight forwarding encompasses comprehensive logistics services that manage the transportation of cargo via ocean vessels, including documentation, customs clearance, warehousing, and end-to-end supply chain coordination. The European market demonstrates robust growth dynamics, driven by increasing international trade volumes, e-commerce expansion, and the region’s strategic position as a global trade hub.

Market expansion continues at a steady pace, with the industry experiencing a compound annual growth rate (CAGR) of 4.2% over the recent forecast period. This growth trajectory reflects the essential role of maritime transportation in European commerce, handling approximately 75% of the region’s international trade volume. The market encompasses diverse service offerings, from full container load (FCL) and less than container load (LCL) services to specialized cargo handling and multimodal transportation solutions.

Digital transformation initiatives are reshaping the competitive landscape, with freight forwarders increasingly adopting advanced technologies such as artificial intelligence, blockchain, and Internet of Things (IoT) solutions to enhance operational efficiency and customer service. The integration of digital platforms has improved visibility across supply chains, enabling real-time tracking and optimized route planning that reduces transit times and operational costs.

The Europe sea freight forwarding market refers to the comprehensive ecosystem of logistics service providers that facilitate the transportation of goods via maritime routes within European waters and international shipping lanes. Sea freight forwarding involves the coordination of multiple logistics functions, including cargo booking, documentation management, customs clearance, port handling, warehousing, and last-mile delivery services to ensure seamless movement of goods from origin to destination.

Freight forwarders act as intermediaries between shippers and carriers, leveraging their expertise and network relationships to provide cost-effective and efficient transportation solutions. These service providers manage complex logistics operations, handling everything from small parcel shipments to oversized industrial equipment, while ensuring compliance with international trade regulations and maritime safety standards.

Service integration extends beyond basic transportation to include value-added services such as cargo insurance, supply chain consulting, inventory management, and distribution services. The market encompasses both traditional freight forwarding companies and modern digital logistics platforms that utilize technology to streamline operations and enhance customer experience through improved transparency and communication.

Market dynamics in the Europe sea freight forwarding sector reflect a mature yet evolving industry characterized by steady growth, technological innovation, and increasing consolidation among service providers. The market benefits from Europe’s extensive port infrastructure, including major maritime hubs such as Rotterdam, Hamburg, Antwerp, and Valencia, which serve as critical gateways for international trade.

Growth drivers include expanding e-commerce activities, increasing manufacturing output, and growing demand for sustainable transportation solutions. The market has demonstrated resilience despite global supply chain disruptions, with freight forwarders adapting their operations to address challenges such as port congestion, capacity constraints, and evolving customer expectations for faster, more reliable service delivery.

Competitive landscape features a mix of global logistics giants, regional specialists, and emerging digital platforms, each competing on service quality, network coverage, and technological capabilities. Market leaders are investing heavily in digitalization initiatives, with approximately 68% of major forwarders implementing advanced tracking and management systems to improve operational efficiency and customer satisfaction.

Future prospects remain positive, supported by continued trade growth, infrastructure investments, and the ongoing shift toward more sustainable and efficient logistics solutions. The market is expected to benefit from emerging trends such as nearshoring, circular economy initiatives, and the development of green shipping corridors that prioritize environmental sustainability.

Strategic positioning of European ports continues to drive market growth, with the region maintaining its status as a critical link between global trade routes. The market demonstrates several key characteristics that define its current trajectory and future potential:

International trade expansion serves as the primary catalyst for market growth, with European countries maintaining strong export and import relationships with global partners. The region’s diverse manufacturing base, from automotive and machinery to chemicals and consumer goods, generates consistent demand for reliable sea freight services that can handle varying cargo requirements and delivery schedules.

E-commerce proliferation has fundamentally transformed freight forwarding demand patterns, creating new opportunities for specialized services that cater to smaller shipment sizes, faster transit times, and enhanced tracking capabilities. The growth of cross-border online retail has increased the complexity of logistics operations while driving innovation in last-mile delivery solutions and warehouse management systems.

Digital transformation initiatives are revolutionizing operational efficiency and customer service delivery across the freight forwarding sector. Companies investing in advanced technologies report 35% improvement in operational efficiency and significant reductions in documentation processing times. These technological advances enable better resource allocation, predictive analytics for demand planning, and enhanced communication throughout the supply chain.

Infrastructure development continues to support market expansion, with ongoing investments in port facilities, inland transportation networks, and intermodal connectivity. These improvements reduce transit times, increase handling capacity, and enable more efficient cargo flows between different transportation modes, ultimately benefiting both freight forwarders and their customers.

Regulatory support from European Union initiatives promotes trade facilitation and standardization of procedures across member states. Harmonized customs processes, simplified documentation requirements, and digital trade platforms reduce administrative burdens and enable more streamlined operations for freight forwarding companies operating across multiple European markets.

Capacity constraints at major European ports continue to challenge freight forwarders, particularly during peak shipping seasons and following global supply chain disruptions. Limited berth availability, equipment shortages, and labor constraints can lead to delays, increased costs, and reduced service reliability that impacts customer satisfaction and operational planning.

Regulatory complexity remains a significant challenge, especially for shipments involving non-EU countries or specialized cargo types. Varying customs procedures, documentation requirements, and compliance standards across different jurisdictions create administrative burdens that require specialized expertise and can lead to delays or additional costs if not managed properly.

Environmental regulations are becoming increasingly stringent, requiring freight forwarders to adapt their operations and invest in cleaner technologies. While these regulations drive long-term sustainability benefits, they also create short-term compliance costs and operational adjustments that can impact profitability, particularly for smaller service providers with limited resources.

Competitive pressure from both traditional competitors and new market entrants continues to compress profit margins across the industry. Digital platforms and technology-enabled startups are disrupting traditional business models, forcing established players to invest heavily in modernization while maintaining competitive pricing structures.

Economic volatility and geopolitical uncertainties can significantly impact trade volumes and shipping patterns, creating unpredictable demand fluctuations that challenge capacity planning and resource allocation. Currency fluctuations, trade disputes, and regional conflicts can disrupt established trade routes and require rapid operational adjustments.

Sustainability initiatives present significant growth opportunities as businesses increasingly prioritize environmentally responsible logistics solutions. Freight forwarders that develop expertise in green shipping practices, carbon footprint reduction, and sustainable supply chain management can differentiate themselves and capture market share from environmentally conscious customers.

Digital platform development offers substantial potential for service enhancement and operational efficiency improvements. Companies that successfully implement comprehensive digital solutions can reduce costs, improve customer experience, and create new revenue streams through data analytics and value-added services that leverage real-time supply chain visibility.

Emerging market expansion provides opportunities for European freight forwarders to extend their service networks and capture growing trade volumes with developing economies. Strategic partnerships and local presence in high-growth regions can enable access to new customer segments and diversify revenue sources beyond traditional European trade routes.

Specialized cargo services represent a growing niche market, with increasing demand for expertise in handling temperature-sensitive goods, hazardous materials, oversized equipment, and high-value cargo. Developing specialized capabilities in these areas can command premium pricing and create competitive advantages through technical expertise and specialized infrastructure.

Supply chain integration opportunities allow freight forwarders to expand their service offerings beyond basic transportation to include comprehensive logistics management, inventory optimization, and distribution services. This evolution toward integrated logistics providers can increase customer retention, improve profit margins, and create more stable long-term business relationships.

Supply and demand balance in the European sea freight forwarding market reflects the complex interplay between global trade patterns, shipping capacity, and regional economic conditions. The market experiences cyclical fluctuations influenced by seasonal demand variations, economic cycles, and external factors such as fuel prices and regulatory changes that impact operational costs and service pricing.

Technology integration continues to reshape competitive dynamics, with companies that successfully implement digital solutions gaining significant advantages in operational efficiency and customer service delivery. Advanced analytics and automation enable better demand forecasting, route optimization, and resource allocation, while customer-facing digital platforms improve service transparency and booking convenience.

Customer expectations are evolving rapidly, driven by experiences in other industries and the increasing importance of supply chain visibility in business operations. Modern shippers demand real-time tracking, predictive delivery estimates, and proactive communication about potential delays or issues, forcing freight forwarders to invest in technology and process improvements to meet these expectations.

Consolidation trends continue to shape the competitive landscape, with larger companies acquiring smaller specialists to expand geographic coverage, service capabilities, or technological expertise. This consolidation creates opportunities for remaining independent operators to focus on niche markets or specialized services while potentially facing increased competition from larger, more resource-rich competitors.

Regulatory evolution impacts operational procedures and compliance requirements, with ongoing changes in customs procedures, security regulations, and environmental standards requiring continuous adaptation and investment. Companies that proactively address regulatory changes can gain competitive advantages while those that lag behind may face compliance issues and operational disruptions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Europe sea freight forwarding market. The research approach combines quantitative data collection with qualitative analysis to provide a holistic understanding of market dynamics, competitive positioning, and future growth prospects.

Primary research activities include structured interviews with industry executives, freight forwarding professionals, port authorities, and shipping companies to gather firsthand insights into market trends, operational challenges, and strategic priorities. These interviews provide valuable perspectives on emerging opportunities, technological developments, and regulatory impacts that shape market evolution.

Secondary research encompasses analysis of industry reports, government statistics, trade association publications, and company financial statements to validate primary findings and establish comprehensive market context. This research includes examination of port throughput data, trade statistics, and regulatory documentation to understand market fundamentals and growth drivers.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources, statistical analysis of quantitative data, and expert review of findings and conclusions. The methodology includes regular updates to reflect changing market conditions and emerging trends that may impact future market development.

Market segmentation analysis examines various dimensions of the freight forwarding market, including service types, cargo categories, geographic regions, and customer segments to provide detailed insights into specific market niches and growth opportunities. This segmentation enables targeted analysis of competitive dynamics and strategic positioning within different market segments.

Western Europe dominates the regional market landscape, accounting for approximately 58% of total market activity, driven by major maritime hubs in the Netherlands, Germany, and Belgium. The region benefits from advanced port infrastructure, efficient intermodal connections, and strong manufacturing and trading economies that generate consistent freight forwarding demand across diverse industry sectors.

Northern Europe represents a significant market segment, with Scandinavian countries and the Baltic region contributing substantial trade volumes through specialized cargo handling and efficient port operations. The region’s focus on sustainable logistics practices and technological innovation positions it as a leader in green shipping initiatives and digital transformation efforts.

Southern Europe serves as a critical gateway for Mediterranean trade routes and connections to Africa and the Middle East. Major ports in Spain, Italy, and Greece handle diverse cargo types while benefiting from strategic geographic positioning that enables efficient access to both European and international markets.

Eastern Europe shows the strongest growth potential, with expanding manufacturing capabilities and increasing integration with Western European supply chains driving demand for freight forwarding services. The region’s developing port infrastructure and improving transportation networks create opportunities for market expansion and service enhancement.

Cross-regional integration continues to strengthen through improved transportation corridors, harmonized regulations, and collaborative initiatives that facilitate seamless cargo movements across European borders. This integration reduces transit times, lowers costs, and enables more efficient supply chain operations for businesses operating across multiple European markets.

Market leadership is characterized by a diverse mix of global logistics companies, regional specialists, and emerging digital platforms that compete across different service segments and geographic markets. The competitive environment reflects ongoing consolidation trends alongside continued innovation and specialization efforts.

Competitive strategies focus on digital transformation, service diversification, and geographic expansion to capture market share and improve profitability. Companies are investing heavily in technology platforms, automation systems, and data analytics capabilities to enhance operational efficiency and customer service delivery.

Market differentiation occurs through specialized expertise, industry focus, geographic coverage, and technological capabilities. Successful companies develop unique value propositions that address specific customer needs while maintaining competitive pricing and service quality standards.

Service type segmentation reveals distinct market categories with varying growth patterns and competitive dynamics. The market encompasses multiple service offerings that cater to different customer requirements and cargo characteristics.

By Service Type:

By Cargo Type:

By End-User Industry:

FCL services represent the largest market segment, driven by manufacturing companies and large retailers that require dedicated container space for efficient transportation of substantial cargo volumes. This segment benefits from economies of scale and direct routing that reduces transit times and handling costs, making it attractive for time-sensitive and high-volume shipments.

LCL consolidation services show strong growth potential, particularly among small and medium enterprises that require cost-effective shipping solutions for smaller cargo volumes. The segment benefits from increasing e-commerce activities and growing demand for flexible shipping options that don’t require full container commitments.

Specialized cargo handling commands premium pricing and demonstrates steady growth across multiple categories. Project cargo services benefit from ongoing infrastructure development and industrial expansion projects, while refrigerated cargo grows with increasing demand for fresh food imports and pharmaceutical transportation requiring temperature control.

Digital freight platforms are emerging as a significant category, offering online booking, real-time tracking, and automated documentation services. These platforms appeal to customers seeking transparency, convenience, and cost efficiency, particularly in the small to medium shipment segments where traditional services may be less competitive.

Multimodal integration represents a growing category as customers increasingly demand seamless transportation solutions that combine sea freight with rail and road connections. This integration reduces overall transit times and provides more flexible routing options while maintaining cost efficiency across the entire supply chain.

Operational efficiency gains through advanced technology implementation enable freight forwarders to reduce processing times, minimize errors, and improve resource utilization. Companies implementing comprehensive digital solutions report 28% reduction in documentation processing time and significant improvements in customer satisfaction scores through enhanced service visibility and communication.

Market expansion opportunities allow established players to diversify their service offerings and geographic coverage while enabling new entrants to capture niche market segments through specialized expertise or innovative service delivery models. The market’s growth trajectory provides multiple pathways for business development and revenue growth.

Supply chain optimization benefits extend to customers through improved transit times, reduced costs, and enhanced reliability. Freight forwarders that successfully integrate their services with customer operations can create competitive advantages and strengthen long-term business relationships through value-added logistics support.

Sustainability advantages emerge from efficient routing, modal optimization, and green shipping initiatives that reduce environmental impact while potentially lowering operational costs. Companies that develop expertise in sustainable logistics practices can differentiate themselves and appeal to environmentally conscious customers.

Technology leverage enables smaller companies to compete more effectively with larger competitors through access to advanced platforms and automated systems that were previously available only to major players. Cloud-based solutions and software-as-a-service platforms democratize access to sophisticated logistics management capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization acceleration continues to transform freight forwarding operations, with companies investing heavily in artificial intelligence, machine learning, and blockchain technologies to improve efficiency and transparency. MarkWide Research analysis indicates that digital platform adoption has increased by 52% over the past two years, driven by customer demands for real-time visibility and streamlined booking processes.

Sustainability integration has become a critical competitive factor, with freight forwarders developing green shipping solutions, carbon footprint tracking, and alternative fuel initiatives. The trend toward environmental responsibility is reshaping service offerings and creating new market opportunities for companies that can demonstrate measurable sustainability improvements.

Supply chain resilience has gained prominence following global disruptions, leading to increased demand for diversified routing options, risk management services, and contingency planning capabilities. Freight forwarders are expanding their service portfolios to include supply chain consulting and risk assessment services that help customers build more resilient operations.

Automation expansion extends beyond basic documentation to include predictive analytics, automated routing optimization, and intelligent exception management. These technologies enable proactive problem-solving and reduce manual intervention requirements while improving service consistency and reliability.

Customer-centric innovation focuses on user experience improvements through intuitive digital interfaces, mobile applications, and self-service capabilities that enable customers to manage their shipments independently. This trend reflects changing customer expectations and the need for freight forwarders to provide more accessible and convenient service delivery.

Strategic partnerships between freight forwarders and technology companies are accelerating digital transformation initiatives and enabling access to advanced capabilities without requiring extensive internal development resources. These collaborations focus on developing integrated platforms that combine logistics expertise with cutting-edge technology solutions.

Port automation projects across major European facilities are improving handling efficiency and reducing turnaround times, benefiting freight forwarders through faster cargo processing and reduced congestion delays. These investments in infrastructure modernization support continued market growth and operational improvements.

Regulatory initiatives promoting trade facilitation and digital documentation are streamlining customs procedures and reducing administrative burdens. The implementation of electronic customs systems and standardized digital formats enables faster processing and reduces the potential for errors and delays.

Sustainability investments include development of green shipping corridors, alternative fuel initiatives, and carbon-neutral service offerings that address growing environmental concerns. These developments create new market segments and competitive differentiation opportunities for forward-thinking companies.

Market consolidation continues through mergers and acquisitions that combine complementary capabilities, expand geographic coverage, and achieve operational synergies. This consolidation trend is reshaping competitive dynamics while creating opportunities for remaining independent operators to focus on specialized market niches.

Technology investment should be prioritized to maintain competitive positioning and meet evolving customer expectations. Companies should focus on integrated platforms that provide end-to-end visibility, automated processes, and user-friendly interfaces that differentiate their services from traditional competitors.

Sustainability initiatives require immediate attention as environmental regulations become more stringent and customer preferences shift toward responsible logistics providers. Developing expertise in green shipping practices and carbon footprint management can create competitive advantages and access to new market segments.

Service diversification beyond basic freight forwarding can improve profit margins and customer retention through value-added offerings such as supply chain consulting, inventory management, and distribution services. This evolution toward comprehensive logistics providers aligns with customer preferences for simplified vendor relationships.

Geographic expansion into emerging markets and developing trade routes can provide growth opportunities and revenue diversification. Strategic partnerships or acquisitions in high-growth regions can enable market entry while leveraging local expertise and established relationships.

Talent development programs should focus on digital skills, sustainability expertise, and customer service capabilities that align with market trends and competitive requirements. Investing in employee training and development ensures organizations can effectively implement new technologies and service offerings while maintaining service quality standards.

Market growth prospects remain positive, supported by continued expansion of international trade, e-commerce development, and ongoing infrastructure investments across European markets. MWR projections indicate sustained growth momentum with increasing demand for specialized services and technology-enabled solutions that address evolving customer requirements.

Technology evolution will continue to reshape operational capabilities and competitive dynamics, with artificial intelligence, automation, and data analytics becoming standard components of freight forwarding operations. Companies that successfully integrate these technologies will gain significant advantages in efficiency, cost management, and customer service delivery.

Sustainability requirements will become increasingly important, with environmental regulations and customer preferences driving demand for green shipping solutions and carbon-neutral service offerings. The development of alternative fuels, efficient routing systems, and sustainable logistics practices will create new market opportunities and competitive differentiators.

Market consolidation is expected to continue, with larger companies acquiring specialized capabilities and geographic coverage while smaller operators focus on niche markets and innovative service delivery models. This trend will reshape competitive dynamics while creating opportunities for differentiation through specialized expertise.

Customer expectations will continue evolving toward greater transparency, faster service delivery, and more comprehensive logistics support. Freight forwarders that can adapt their operations to meet these changing requirements while maintaining cost competitiveness will be best positioned for long-term success in the dynamic European market.

The Europe sea freight forwarding market demonstrates robust fundamentals and positive growth prospects, driven by strong trade relationships, advanced infrastructure, and ongoing technological innovation. The market’s evolution toward digital platforms, sustainability initiatives, and comprehensive logistics services reflects changing customer requirements and competitive dynamics that reward innovation and operational excellence.

Strategic positioning for success requires balanced investment in technology capabilities, service diversification, and sustainability initiatives while maintaining focus on operational efficiency and customer service quality. Companies that can effectively navigate regulatory requirements, capacity constraints, and competitive pressures while delivering value-added services will capture the greatest market opportunities.

Future success in the European sea freight forwarding market will depend on adaptability, technological sophistication, and the ability to provide comprehensive logistics solutions that address evolving customer needs. The market’s continued growth and evolution create substantial opportunities for companies that can effectively balance traditional freight forwarding expertise with modern digital capabilities and sustainable business practices.

What is Sea Freight Forwarding?

Sea freight forwarding involves the coordination and shipment of goods via ocean transport. It includes various services such as cargo booking, documentation, and customs clearance, facilitating international trade.

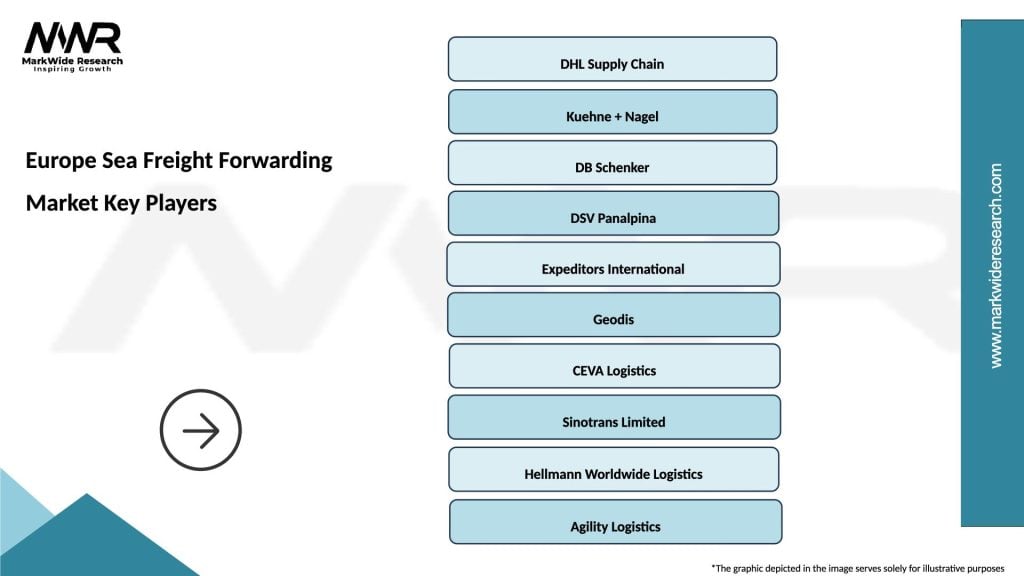

What are the key players in the Europe Sea Freight Forwarding Market?

Key players in the Europe Sea Freight Forwarding Market include Maersk, DHL Supply Chain, and Kuehne + Nagel, among others. These companies provide comprehensive logistics solutions and have extensive networks across Europe.

What are the main drivers of the Europe Sea Freight Forwarding Market?

The main drivers of the Europe Sea Freight Forwarding Market include the growth of e-commerce, increasing international trade, and the demand for cost-effective shipping solutions. These factors contribute to the rising volume of goods transported by sea.

What challenges does the Europe Sea Freight Forwarding Market face?

The Europe Sea Freight Forwarding Market faces challenges such as fluctuating fuel prices, regulatory compliance issues, and port congestion. These factors can impact shipping schedules and operational efficiency.

What opportunities exist in the Europe Sea Freight Forwarding Market?

Opportunities in the Europe Sea Freight Forwarding Market include the adoption of digital technologies for tracking shipments, the expansion of green logistics practices, and the growth of trade agreements. These trends can enhance service offerings and operational capabilities.

What trends are shaping the Europe Sea Freight Forwarding Market?

Trends shaping the Europe Sea Freight Forwarding Market include the increasing use of automation in logistics, the rise of sustainable shipping practices, and the integration of advanced data analytics. These innovations are transforming how freight forwarding services are delivered.

Europe Sea Freight Forwarding Market

| Segmentation Details | Description |

|---|---|

| Service Type | Full Container Load, Less than Container Load, Breakbulk, Ro-Ro |

| End User | Manufacturers, Retailers, Wholesalers, E-commerce |

| Shipping Mode | Deep Sea, Short Sea, Intermodal, Coastal |

| Container Type | Standard, Refrigerated, Open Top, Flat Rack |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Sea Freight Forwarding Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at