444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe satellite manufacturing market represents a dynamic and rapidly evolving sector that has become increasingly critical to the continent’s technological advancement and strategic autonomy. This sophisticated industry encompasses the design, development, production, and assembly of various satellite systems, ranging from small CubeSats to large geostationary communication satellites. European manufacturers have established themselves as global leaders in satellite technology, with companies like Airbus Defence and Space, Thales Alenia Space, and OHB SE driving innovation across multiple satellite applications.

Market dynamics indicate robust growth driven by increasing demand for satellite-based services including telecommunications, Earth observation, navigation, and scientific research. The sector has experienced significant expansion with a projected CAGR of 8.2% over the forecast period, reflecting the growing importance of space-based infrastructure in modern society. European space agencies and private enterprises are investing heavily in next-generation satellite technologies, including electric propulsion systems, advanced payload capabilities, and enhanced manufacturing processes.

Regional leadership in satellite manufacturing is particularly evident in countries such as France, Germany, Italy, and the United Kingdom, where established aerospace industries and strong government support have created favorable conditions for market growth. The European Space Agency (ESA) plays a crucial role in coordinating continental space initiatives and fostering collaboration between member states, contributing to the market’s sustained development and technological advancement.

The Europe satellite manufacturing market refers to the comprehensive ecosystem of companies, technologies, and processes involved in designing, producing, and delivering satellite systems across European nations. This market encompasses all aspects of satellite production, from initial concept development and component sourcing to final assembly, testing, and delivery of operational spacecraft for various commercial, governmental, and scientific applications.

Satellite manufacturing involves complex engineering processes that integrate advanced materials, sophisticated electronics, precision mechanical systems, and cutting-edge propulsion technologies. European manufacturers specialize in producing satellites for diverse applications including telecommunications, Earth observation, meteorology, navigation, scientific research, and defense purposes. The manufacturing process requires adherence to stringent quality standards, extensive testing protocols, and compliance with international space regulations.

Market participants include prime contractors who lead satellite programs, component suppliers providing specialized subsystems, and service providers offering testing, integration, and launch support services. The sector also encompasses research institutions, universities, and government agencies that contribute to technological development and provide funding for innovative satellite projects across the European continent.

Europe’s satellite manufacturing sector has emerged as a cornerstone of the global space economy, demonstrating remarkable resilience and innovation in an increasingly competitive international landscape. The market benefits from strong institutional support, advanced technological capabilities, and a well-established supply chain that spans multiple European countries. Key market drivers include rising demand for satellite-based communications, growing emphasis on Earth observation for climate monitoring, and increasing government investments in space infrastructure.

Manufacturing capabilities across Europe have evolved significantly, with companies adopting advanced production techniques including additive manufacturing, automated assembly processes, and digital twin technologies. The sector shows particular strength in producing high-value, complex satellites for commercial and institutional customers, with European manufacturers capturing approximately 35% of the global commercial satellite market share.

Strategic initiatives such as the European Union’s space program and national space strategies have provided substantial momentum for market growth. The emphasis on technological sovereignty and reduced dependence on non-European suppliers has led to increased investment in domestic manufacturing capabilities and supply chain development. Innovation trends focus on developing more cost-effective production methods, enhancing satellite performance, and reducing manufacturing timelines to meet growing market demand.

Market analysis reveals several critical insights that define the current state and future trajectory of Europe’s satellite manufacturing industry:

Primary growth drivers propelling the Europe satellite manufacturing market forward include several interconnected factors that create sustained demand for satellite systems and related services. The increasing reliance on satellite-based communications infrastructure has become a fundamental driver, with telecommunications operators requiring advanced satellites to support 5G networks, broadband internet services, and global connectivity solutions.

Earth observation applications represent another significant driver, as governments and commercial organizations seek comprehensive monitoring capabilities for climate change research, agricultural optimization, disaster management, and environmental protection. The European Union’s Copernicus program exemplifies this trend, requiring sophisticated Earth observation satellites manufactured by European companies to support continental environmental monitoring initiatives.

Defense and security requirements continue to drive demand for specialized satellite systems, with European nations investing in secure communications, reconnaissance, and navigation capabilities. The growing emphasis on strategic autonomy in space technologies has led to increased domestic manufacturing requirements and reduced dependence on non-European suppliers. Commercial space activities have expanded significantly, with private companies launching constellation projects and specialized missions that require cost-effective satellite manufacturing solutions.

Technological advancement in satellite capabilities has created new market opportunities, including small satellite applications, advanced payload technologies, and innovative mission architectures. The development of reusable launch systems has reduced access costs to space, stimulating demand for satellites across various applications and market segments.

Significant challenges facing the Europe satellite manufacturing market include several factors that may limit growth potential and operational efficiency. High development costs associated with satellite manufacturing represent a primary constraint, as complex engineering requirements, extensive testing protocols, and stringent quality standards result in substantial capital investments for manufacturers and customers alike.

Regulatory complexity poses ongoing challenges, with manufacturers required to navigate multiple national and international regulatory frameworks governing satellite operations, frequency allocations, and export controls. The lengthy approval processes for satellite missions can delay project timelines and increase overall costs, particularly for commercial operators seeking rapid market entry.

Supply chain vulnerabilities have become increasingly apparent, with dependencies on specialized components and materials that may be subject to geopolitical tensions or supply disruptions. The semiconductor shortage and other component availability issues have impacted production schedules and increased manufacturing costs across the industry.

Intense international competition from established space powers and emerging market players creates pricing pressure and market share challenges for European manufacturers. The rapid pace of technological change requires continuous investment in research and development, straining resources and requiring careful strategic planning to maintain competitive positions in evolving market segments.

Emerging opportunities in the Europe satellite manufacturing market present substantial potential for growth and expansion across multiple sectors and applications. The small satellite revolution has created new market segments with reduced barriers to entry, enabling European manufacturers to develop cost-effective solutions for diverse customer requirements including scientific research, commercial applications, and educational initiatives.

Constellation deployment projects represent significant opportunities, as multiple organizations plan large-scale satellite networks for global communications, Earth observation, and internet connectivity services. European manufacturers are well-positioned to capture substantial portions of these projects through competitive pricing, advanced technology offerings, and established customer relationships.

Sustainability initiatives create opportunities for developing environmentally responsible satellite technologies, including improved end-of-life disposal systems, reduced space debris generation, and more efficient manufacturing processes. The growing emphasis on circular economy principles in space activities opens new markets for satellite servicing, refurbishment, and component recycling services.

Digital transformation in satellite manufacturing processes offers opportunities for efficiency improvements, cost reductions, and enhanced quality control through adoption of artificial intelligence, machine learning, and advanced automation technologies. Public-private partnerships continue to expand, providing new funding mechanisms and market access opportunities for European satellite manufacturers seeking to develop innovative solutions and expand their global presence.

Complex market dynamics shape the Europe satellite manufacturing landscape through interconnected forces that influence supply, demand, pricing, and competitive positioning. The supply side is characterized by a limited number of prime contractors with extensive capabilities, supported by a broader network of specialized component suppliers and service providers distributed across European countries.

Demand patterns reflect the diverse requirements of institutional customers including space agencies and government organizations, alongside growing commercial demand from telecommunications operators, Earth observation service providers, and emerging space economy participants. The customer base diversification has reduced market concentration risks while creating new challenges in meeting varied technical and commercial requirements.

Pricing dynamics are influenced by the high-value, low-volume nature of satellite manufacturing, with costs driven by complex engineering requirements, extensive testing protocols, and stringent quality standards. Competition intensity varies across market segments, with established players maintaining advantages in large, complex satellites while facing increased competition in small satellite and standardized platform segments.

Innovation cycles in satellite technology create both opportunities and challenges, as manufacturers must balance investment in next-generation capabilities with the need to maintain profitability on current product lines. The technology adoption rate has accelerated, with customers increasingly demanding advanced features and improved performance at competitive prices, driving continuous innovation and development efforts across the industry.

Comprehensive research methodology employed for analyzing the Europe satellite manufacturing market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability of market insights. Primary research includes extensive interviews with industry executives, technical experts, and key stakeholders across the satellite manufacturing value chain, providing firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government publications, company financial statements, and technical literature to establish market context and validate primary research findings. Quantitative analysis utilizes statistical modeling techniques to project market trends and identify key growth drivers, while qualitative analysis provides deeper understanding of market dynamics and competitive positioning.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical verification to ensure research accuracy and reliability. Market segmentation analysis examines various dimensions including satellite type, application, customer segment, and geographic distribution to provide comprehensive market understanding.

Forecasting methodology combines historical trend analysis with forward-looking indicators including planned satellite missions, government budget allocations, and technology development roadmaps. Scenario analysis considers multiple potential future outcomes to provide robust market projections and strategic recommendations for industry participants and stakeholders.

Regional distribution of satellite manufacturing capabilities across Europe reveals significant concentration in key countries with established aerospace industries and strong government support for space activities. France maintains the largest market share at approximately 28% of European satellite manufacturing capacity, driven by the presence of major companies like Thales Alenia Space and strong government support through CNES and national space programs.

Germany represents the second-largest regional market with approximately 24% market share, benefiting from advanced manufacturing capabilities, strong engineering expertise, and companies such as OHB SE and Airbus Defence and Space operations. The country’s focus on small satellite technologies and innovative manufacturing processes has strengthened its competitive position in emerging market segments.

Italy contributes significantly to European satellite manufacturing with approximately 18% market share, leveraging expertise in satellite platforms, propulsion systems, and specialized components. Italian companies have established strong positions in Earth observation and scientific satellite applications, supported by ASI and European Space Agency programs.

United Kingdom maintains a substantial presence despite Brexit challenges, with approximately 15% market share focused on small satellites, advanced technologies, and specialized applications. Other European countries including Spain, Netherlands, Belgium, and Switzerland contribute the remaining market share through specialized capabilities, component manufacturing, and niche technology development, creating a distributed and resilient manufacturing ecosystem across the continent.

Competitive dynamics in the Europe satellite manufacturing market are characterized by a mix of large prime contractors, specialized component suppliers, and emerging technology companies that collectively form a complex and interconnected ecosystem. The market structure reflects both consolidation trends and new entrant activity, creating diverse competitive scenarios across different satellite applications and market segments.

Leading market participants include:

Competitive strategies vary across market participants, with large prime contractors focusing on system integration capabilities, advanced technology development, and comprehensive customer support services. Smaller companies often pursue niche specialization strategies, developing innovative technologies or serving specific market segments with cost-effective solutions and rapid development capabilities.

Market segmentation analysis reveals the diverse nature of the Europe satellite manufacturing market across multiple dimensions including satellite type, application, orbit class, and customer segment. This comprehensive segmentation provides insights into market structure, growth patterns, and strategic opportunities for industry participants.

By Satellite Type:

By Application:

By Orbit Class:

Telecommunications satellites represent the largest category within the Europe satellite manufacturing market, driven by continuous demand for advanced communication services and next-generation satellite technologies. European manufacturers have established strong competitive positions in this segment through development of high-throughput satellites, flexible payload architectures, and electric propulsion systems that reduce operational costs and improve service capabilities.

Earth observation satellites constitute a rapidly growing category, supported by increasing demand for environmental monitoring, climate research, and commercial imagery services. The Copernicus program and other institutional initiatives have created substantial opportunities for European manufacturers, while commercial applications continue to expand across agriculture, urban planning, and disaster management sectors.

Small satellite manufacturing has emerged as a dynamic category with significant growth potential, as cost-effective solutions enable new market participants and innovative applications. European companies have developed competitive advantages in small satellite technologies, including standardized platforms, rapid manufacturing processes, and cost-effective integration approaches that serve diverse customer requirements.

Scientific and exploration satellites represent a specialized category where European manufacturers demonstrate particular expertise in complex mission requirements, advanced instrumentation, and international collaboration projects. These high-value, technically challenging missions showcase European capabilities and contribute to technological advancement across the broader satellite manufacturing sector.

Industry participants in the Europe satellite manufacturing market benefit from numerous advantages that strengthen competitive positioning and support sustainable growth. Manufacturers gain access to a well-developed supply chain ecosystem, advanced technology base, and strong institutional support that facilitates innovation and market expansion across diverse application areas.

Technology development benefits include access to cutting-edge research facilities, collaboration opportunities with leading universities and research institutions, and participation in European Space Agency programs that advance satellite technologies. European manufacturers benefit from shared technology development costs, reduced technical risks, and accelerated innovation cycles through collaborative programs and partnerships.

Market access advantages include preferential treatment in European institutional procurements, established customer relationships, and strong brand recognition in international markets. Supply chain benefits encompass access to specialized component suppliers, established quality standards, and efficient logistics networks that support cost-effective manufacturing operations.

Stakeholder benefits extend to customers who gain access to advanced satellite technologies, reliable manufacturing capabilities, and comprehensive support services. Government stakeholders benefit from strategic autonomy in space technologies, economic development in high-technology sectors, and enhanced capabilities for national security and scientific research applications. Academic and research institutions benefit from industry collaboration opportunities, technology transfer programs, and access to real-world applications for theoretical research.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping the Europe satellite manufacturing market reflect broader changes in space technology, customer requirements, and manufacturing approaches. Miniaturization continues to drive development of smaller, more capable satellites that deliver enhanced functionality while reducing costs and manufacturing complexity, enabling new applications and market segments.

Manufacturing digitalization represents a significant trend, with companies adopting advanced automation, artificial intelligence, and digital twin technologies to improve production efficiency, quality control, and cost management. Additive manufacturing adoption is accelerating, enabling rapid prototyping, complex component production, and reduced material waste in satellite manufacturing processes.

Constellation architecture trends focus on distributed satellite systems that provide enhanced coverage, redundancy, and service capabilities compared to traditional single-satellite approaches. European manufacturers are developing specialized platforms and manufacturing processes to support large-scale constellation deployments efficiently and cost-effectively.

Sustainability initiatives are becoming increasingly important, with manufacturers developing environmentally responsible production processes, improved end-of-life satellite management, and reduced space debris generation capabilities. Circular economy principles are being integrated into satellite design and manufacturing processes, creating new business models and service opportunities. Software-defined satellites represent an emerging trend that enables enhanced flexibility, reduced development costs, and improved mission adaptability through advanced software architectures and reconfigurable hardware platforms.

Recent industry developments demonstrate the dynamic nature of the Europe satellite manufacturing market and highlight significant technological advances, strategic partnerships, and market expansion initiatives. Airbus Defence and Space has announced major investments in next-generation satellite manufacturing facilities, incorporating advanced automation and digital manufacturing technologies to improve production efficiency and reduce costs.

Thales Alenia Space has secured several significant contracts for telecommunications and Earth observation satellites, demonstrating continued market confidence in European manufacturing capabilities. The company has also announced partnerships with emerging space companies to develop innovative satellite technologies and expand market reach across new application areas.

Small satellite initiatives have gained momentum with multiple European companies launching new product lines and manufacturing capabilities focused on CubeSat and microsatellite applications. OHB SE has expanded its small satellite production capacity and developed new standardized platforms to serve growing market demand efficiently.

International collaboration projects have advanced with European manufacturers participating in global satellite programs and technology development initiatives. ESA programs continue to support technology development and market expansion through funding for innovative satellite projects and international partnership opportunities. Sustainability initiatives have progressed with several companies announcing commitments to reduce environmental impact and develop more sustainable satellite manufacturing processes.

Strategic recommendations for Europe satellite manufacturing market participants focus on leveraging competitive advantages while addressing key challenges and capitalizing on emerging opportunities. MarkWide Research analysis suggests that manufacturers should prioritize investment in advanced manufacturing technologies, including automation, digitalization, and additive manufacturing capabilities to improve cost competitiveness and production efficiency.

Market diversification strategies should emphasize expansion into high-growth segments including small satellites, constellation applications, and emerging commercial markets. European manufacturers should leverage their technology leadership and quality reputation to capture market share in these expanding segments while maintaining positions in traditional satellite applications.

Supply chain optimization initiatives should focus on reducing dependencies on non-European suppliers while maintaining cost competitiveness and quality standards. Strategic partnerships with component suppliers, technology companies, and international partners can enhance capabilities and market access while sharing development costs and risks.

Innovation investment should prioritize technologies that address customer requirements for improved performance, reduced costs, and enhanced sustainability. Digital transformation initiatives can improve manufacturing efficiency, quality control, and customer service capabilities while reducing operational costs and improving competitive positioning in global markets.

Future prospects for the Europe satellite manufacturing market appear highly favorable, with multiple growth drivers supporting sustained expansion across diverse application areas and market segments. Market projections indicate continued growth at a robust CAGR of 8.2% through the forecast period, driven by increasing demand for satellite-based services, technological advancement, and expanding commercial applications.

Technology evolution will continue to shape market development, with advances in satellite miniaturization, manufacturing automation, and software-defined architectures creating new opportunities and competitive dynamics. European manufacturers are well-positioned to capitalize on these trends through established technology capabilities, strong research and development programs, and collaborative relationships with leading institutions.

Market expansion is expected across multiple dimensions, including geographic reach, application diversity, and customer base growth. Constellation deployment projects will provide substantial opportunities for European manufacturers, while emerging applications in areas such as Internet of Things connectivity, precision agriculture, and environmental monitoring will create new market segments.

Competitive positioning will increasingly depend on manufacturers’ ability to combine advanced technology capabilities with cost-effective production processes and comprehensive customer support services. MWR analysis suggests that companies successfully integrating these capabilities will capture disproportionate market share and achieve sustainable competitive advantages in the evolving satellite manufacturing landscape. Sustainability considerations will become increasingly important, with manufacturers required to demonstrate environmental responsibility and contribute to sustainable space activities through innovative design and manufacturing approaches.

The Europe satellite manufacturing market represents a dynamic and strategically important sector that combines advanced technology capabilities with strong institutional support and established market positions. Market analysis reveals substantial growth potential driven by increasing demand for satellite-based services, technological innovation, and expanding commercial applications across diverse industry sectors.

European manufacturers have established competitive advantages through technology leadership, quality excellence, and comprehensive capabilities that position them well for future market expansion. The sector benefits from strong government support, well-developed supply chains, and collaborative relationships that facilitate innovation and market development. Key success factors include continued investment in advanced manufacturing technologies, strategic market diversification, and maintenance of technology leadership in critical satellite applications.

Future market development will be shaped by evolving customer requirements, technological advancement, and competitive dynamics that require strategic adaptation and continuous innovation. European satellite manufacturers that successfully navigate these challenges while capitalizing on emerging opportunities will achieve sustainable growth and maintain leadership positions in the global satellite manufacturing market, contributing to Europe’s strategic autonomy and technological advancement in space activities.

What is Satellite Manufacturing?

Satellite manufacturing involves the design, construction, and testing of satellites for various applications, including communication, Earth observation, and scientific research.

What are the key players in the Europe Satellite Manufacturing Market?

Key players in the Europe Satellite Manufacturing Market include Airbus Defence and Space, Thales Alenia Space, and OHB System AG, among others.

What are the main drivers of the Europe Satellite Manufacturing Market?

The main drivers of the Europe Satellite Manufacturing Market include the increasing demand for satellite-based services, advancements in satellite technology, and the growing need for Earth observation data.

What challenges does the Europe Satellite Manufacturing Market face?

Challenges in the Europe Satellite Manufacturing Market include high development costs, regulatory hurdles, and competition from emerging space economies.

What opportunities exist in the Europe Satellite Manufacturing Market?

Opportunities in the Europe Satellite Manufacturing Market include the rise of small satellite technology, partnerships with private companies, and expanding applications in sectors like agriculture and disaster management.

What trends are shaping the Europe Satellite Manufacturing Market?

Trends in the Europe Satellite Manufacturing Market include the shift towards miniaturization of satellites, increased collaboration between government and private sectors, and the integration of artificial intelligence in satellite operations.

Europe Satellite Manufacturing Market

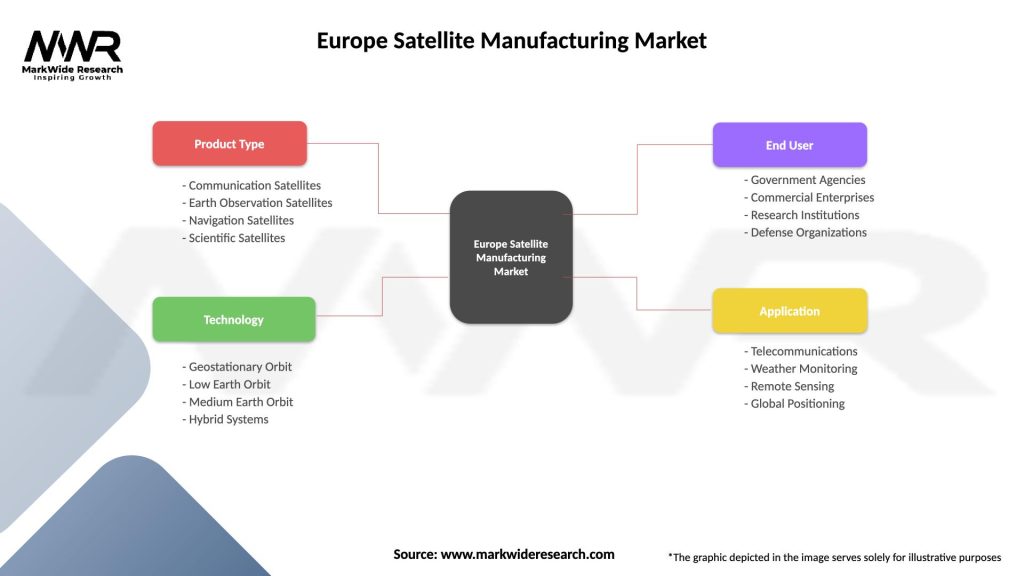

| Segmentation Details | Description |

|---|---|

| Product Type | Communication Satellites, Earth Observation Satellites, Navigation Satellites, Scientific Satellites |

| Technology | Geostationary Orbit, Low Earth Orbit, Medium Earth Orbit, Hybrid Systems |

| End User | Government Agencies, Commercial Enterprises, Research Institutions, Defense Organizations |

| Application | Telecommunications, Weather Monitoring, Remote Sensing, Global Positioning |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Satellite Manufacturing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at