444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe satellite bus market represents a critical segment of the continental space industry, encompassing the structural and functional backbone systems that support satellite operations across diverse applications. Satellite bus platforms serve as the fundamental infrastructure enabling communication, navigation, Earth observation, and scientific missions throughout European space programs. The market demonstrates robust growth momentum driven by increasing demand for satellite-based services, technological advancement in miniaturization, and expanding commercial space activities.

European space agencies and commercial operators are investing heavily in next-generation satellite bus technologies, with particular emphasis on standardized platforms that reduce development costs and mission timelines. The market encompasses various bus categories, from small satellite platforms weighing under 500 kilograms to large geostationary satellite buses exceeding 6,000 kilograms. Market dynamics indicate sustained expansion at approximately 8.2% CAGR through the forecast period, reflecting strong institutional and commercial demand.

Key market participants include established aerospace manufacturers, emerging small satellite developers, and specialized component suppliers serving the European space ecosystem. The integration of advanced technologies such as electric propulsion, flexible solar arrays, and software-defined architectures is transforming traditional satellite bus designs. Regional leadership in satellite manufacturing positions Europe as a significant contributor to global space infrastructure development.

The Europe satellite bus market refers to the comprehensive ecosystem encompassing the design, manufacturing, and supply of satellite platform systems that provide essential structural, power, thermal, and operational support for space-based missions across European territories. Satellite bus systems constitute the foundational framework upon which payload instruments and communication equipment are mounted, enabling satellites to function effectively in space environments while maintaining operational stability and mission longevity.

These platforms integrate multiple subsystems including power generation and distribution, attitude determination and control, thermal management, propulsion, and command and data handling capabilities. The market encompasses both standardized bus architectures designed for multiple mission types and customized platforms tailored for specific applications such as Earth observation, telecommunications, navigation, and scientific research.

European satellite bus development emphasizes technological innovation, cost efficiency, and mission flexibility to serve diverse customer requirements ranging from government space agencies to commercial satellite operators. The market includes various size categories from nanosatellites and CubeSats to large geostationary communication satellites, each requiring specialized bus architectures optimized for their intended orbital environments and operational parameters.

The European satellite bus market exhibits strong growth trajectory supported by increasing satellite deployment activities, technological advancement in platform standardization, and expanding commercial space applications. Market expansion is driven by rising demand for satellite-based services including broadband connectivity, Earth monitoring, and navigation systems across European nations.

Key growth drivers include government investment in space infrastructure, commercial constellation deployment, and technological innovation in satellite miniaturization. The market benefits from 65% adoption rate of standardized bus platforms among European satellite manufacturers, reducing development costs and accelerating mission deployment timelines. Small satellite segments demonstrate particularly robust growth, with microsatellite and nanosatellite platforms gaining significant market traction.

Competitive landscape features established aerospace companies alongside emerging small satellite manufacturers, creating dynamic market conditions that foster innovation and cost optimization. European manufacturers maintain strong positions in geostationary satellite bus development while expanding capabilities in small satellite platforms to address growing constellation market opportunities.

Future market outlook indicates continued expansion driven by next-generation satellite technologies, increased commercial space activities, and growing demand for satellite-based services across telecommunications, Earth observation, and navigation applications throughout Europe.

Strategic market analysis reveals several critical insights shaping the European satellite bus landscape:

The European satellite bus market experiences robust growth momentum driven by multiple interconnected factors that create sustained demand for advanced satellite platform technologies.

Government space investment represents a primary market driver, with European space agencies allocating substantial budgets for satellite infrastructure development, scientific missions, and strategic space capabilities. National space programs across major European countries prioritize satellite technology advancement to maintain competitive positions in global space markets while supporting domestic aerospace industries.

Commercial space expansion creates significant market opportunities as private companies deploy satellite constellations for broadband internet, Earth observation, and communication services. The growing demand for satellite-based connectivity drives constellation deployment activities that require cost-effective, standardized bus platforms capable of supporting large-scale manufacturing and deployment.

Technological advancement in satellite miniaturization enables new mission concepts and applications that were previously economically unfeasible. Small satellite platforms democratize space access for universities, research institutions, and commercial operators, expanding the total addressable market for European bus manufacturers.

Digital transformation initiatives across industries create demand for satellite-based services including IoT connectivity, precision agriculture, environmental monitoring, and logistics tracking. These applications require specialized satellite bus platforms optimized for specific mission requirements and operational environments.

Despite strong growth prospects, the European satellite bus market faces several challenges that may constrain expansion and profitability for industry participants.

High development costs associated with satellite bus design and qualification create barriers to entry for new market participants while limiting innovation investment among existing manufacturers. Complex regulatory requirements for space systems add significant compliance costs and extend development timelines, particularly for new entrants lacking established regulatory relationships.

Technical complexity in satellite bus systems requires specialized expertise and advanced manufacturing capabilities that may be difficult to acquire or maintain. Supply chain dependencies on critical components from limited suppliers create potential bottlenecks and cost pressures that impact overall market competitiveness.

Market concentration among established aerospace companies may limit competitive dynamics and innovation pace, particularly in large satellite bus segments where high barriers to entry protect incumbent positions. Long development cycles for satellite platforms can delay market response to changing customer requirements and technological opportunities.

International competition from low-cost manufacturers in other regions creates pricing pressure on European suppliers, potentially impacting profitability and investment capacity for research and development activities. Export control restrictions may limit market access for European manufacturers in certain international markets, constraining growth opportunities.

The European satellite bus market presents numerous growth opportunities driven by emerging technologies, expanding applications, and evolving customer requirements across commercial and institutional segments.

Small satellite constellation deployment creates substantial opportunities for standardized, cost-effective bus platforms that can support large-scale manufacturing and rapid deployment schedules. Commercial broadband constellations require hundreds or thousands of satellites, representing significant volume opportunities for European manufacturers capable of achieving competitive cost structures.

Next-generation technology integration enables new mission capabilities and market segments, including electric propulsion systems, advanced solar arrays, and software-defined satellite architectures. Artificial intelligence integration in satellite bus systems creates opportunities for autonomous operations, predictive maintenance, and enhanced mission flexibility.

Emerging market applications such as space-based manufacturing, orbital debris removal, and asteroid mining may require specialized bus platforms designed for unique operational environments and mission requirements. Quantum communication satellites represent a high-value niche market where European technological leadership could translate into significant commercial opportunities.

International partnerships and export opportunities enable European manufacturers to access global markets while leveraging technological advantages in satellite bus design and manufacturing. Dual-use applications serving both commercial and defense markets create additional revenue streams and market diversification opportunities.

The European satellite bus market operates within a complex ecosystem of technological, economic, and regulatory forces that shape competitive dynamics and growth trajectories across different market segments.

Supply and demand dynamics reflect increasing satellite deployment activities driven by commercial constellation projects, government space programs, and emerging applications requiring space-based infrastructure. Market equilibrium is influenced by manufacturing capacity constraints, component availability, and the ability of suppliers to scale production in response to growing demand.

Competitive dynamics feature established aerospace companies competing with emerging small satellite manufacturers, creating market segmentation based on satellite size, mission complexity, and cost requirements. Innovation cycles drive continuous technology advancement as manufacturers seek competitive advantages through improved performance, reduced costs, and enhanced mission flexibility.

Customer behavior patterns show increasing preference for standardized platforms that reduce development risks and costs while enabling faster mission deployment. Procurement trends indicate growing emphasis on total cost of ownership rather than initial acquisition costs, favoring suppliers that can demonstrate long-term value propositions.

Regulatory influences shape market access, technology transfer, and international collaboration opportunities, with European space policy supporting domestic industry development while promoting international competitiveness. Technology transfer dynamics between research institutions and commercial manufacturers accelerate innovation adoption and market development.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into European satellite bus market dynamics, competitive landscape, and growth prospects.

Primary research activities include structured interviews with industry executives, satellite manufacturers, component suppliers, and end-users across European markets. Survey methodologies capture quantitative data on market trends, technology preferences, and purchasing decisions from representative samples of market participants.

Secondary research analysis incorporates industry reports, government publications, academic studies, and company financial disclosures to validate primary research findings and provide comprehensive market context. Data triangulation techniques ensure consistency and accuracy across multiple information sources.

Market modeling approaches utilize statistical analysis, trend extrapolation, and scenario planning to develop growth projections and market forecasts. Competitive intelligence gathering tracks company strategies, product developments, and market positioning across key industry participants.

Expert consultation with industry specialists, academic researchers, and technology developers provides insights into emerging trends, technological developments, and market evolution patterns. Validation processes ensure research findings accurately reflect current market conditions and future growth trajectories.

The European satellite bus market demonstrates significant regional variation in terms of manufacturing capabilities, demand patterns, and technological specializations across major European countries and regions.

Western Europe dominates market activity with 72% regional market share, led by established aerospace industries in France, Germany, Italy, and the United Kingdom. France maintains leadership in large satellite bus development through companies like Thales Alenia Space and Airbus Defence and Space, focusing on geostationary communication satellites and Earth observation platforms.

Germany demonstrates strong capabilities in satellite bus subsystems and components, with particular expertise in propulsion systems, solar arrays, and attitude control technologies. Italian manufacturers specialize in small satellite platforms and constellation applications, leveraging cost-effective manufacturing approaches and innovative design solutions.

Northern European countries including Sweden, Finland, and Norway contribute specialized technologies and niche market solutions, particularly in small satellite applications and Arctic communication systems. Eastern European markets show rapid growth potential with 15% annual expansion rate as emerging space programs and commercial activities create new demand for satellite bus platforms.

Regional collaboration initiatives through the European Space Agency and bilateral partnerships facilitate technology sharing, joint development programs, and market access optimization across European markets. Supply chain integration across European regions enables cost optimization and capability enhancement for satellite bus manufacturers.

The European satellite bus market features a diverse competitive landscape encompassing established aerospace giants, specialized satellite manufacturers, and emerging small satellite companies competing across different market segments and applications.

Competitive strategies focus on platform standardization, cost reduction, and technology innovation to address evolving customer requirements across commercial and institutional markets. Market positioning varies from full-service satellite manufacturers to specialized component suppliers and platform developers.

The European satellite bus market exhibits clear segmentation patterns based on satellite size categories, orbital destinations, and application requirements that drive distinct customer needs and competitive dynamics.

By Satellite Size:

By Orbital Destination:

By Application:

Large satellite bus platforms represent the highest value market segment, serving geostationary communication satellites and advanced Earth observation missions. These platforms require sophisticated subsystems including high-power solar arrays, advanced propulsion systems, and complex thermal management solutions. Market demand remains steady driven by satellite replacement cycles and capacity expansion requirements from telecommunications operators.

Small satellite bus categories demonstrate the fastest growth rates, with 42% annual expansion in microsatellite and nanosatellite segments. Standardized platforms enable cost-effective constellation deployment while maintaining mission flexibility for diverse applications. Commercial customers increasingly prefer small satellite solutions for Earth observation, IoT connectivity, and technology demonstration missions.

Medium satellite platforms serve specialized applications requiring capabilities between small and large satellite categories. These systems often support regional communication services, scientific missions, and technology validation programs that require moderate power and payload capacity. Market opportunities exist for manufacturers capable of optimizing cost-performance ratios in this segment.

Application-specific insights reveal growing demand for multi-mission bus platforms that can accommodate different payload types and mission requirements. Software-defined architectures enable post-launch reconfiguration and mission adaptation, creating value propositions for satellite operators seeking operational flexibility.

European satellite bus market participation offers substantial benefits for various stakeholders across the space industry ecosystem, from manufacturers to end-users and supporting organizations.

For Satellite Manufacturers:

For Component Suppliers:

For End-Users:

Strengths:

Weaknesses:

Opportunities:

Threats:

The European satellite bus market experiences several transformative trends that reshape industry dynamics, technology development, and competitive positioning across different market segments.

Platform Standardization emerges as a dominant trend, with manufacturers developing common bus architectures that serve multiple mission types and customer requirements. This approach reduces development costs, accelerates deployment schedules, and enables volume production economies that improve overall market competitiveness.

Miniaturization Technologies continue advancing, enabling more capable small satellite platforms that can perform missions previously requiring larger, more expensive satellites. Component integration and advanced manufacturing techniques support this trend while maintaining reliability and performance standards.

Software-Defined Architectures gain prominence as satellite operators seek greater mission flexibility and post-launch reconfiguration capabilities. These systems enable payload adaptation, mission evolution, and operational optimization throughout satellite lifetimes.

Electric Propulsion Integration becomes increasingly common across satellite bus platforms, offering improved fuel efficiency, extended mission lifetimes, and enhanced orbital maneuvering capabilities. Adoption rates reach 58% penetration in new satellite designs across European manufacturers.

Artificial Intelligence Implementation in satellite bus systems enables autonomous operations, predictive maintenance, and intelligent resource management that reduce operational costs and improve mission performance.

Sustainable Design Principles influence satellite bus development, with emphasis on end-of-life disposal, debris mitigation, and environmentally responsible manufacturing processes that address growing space sustainability concerns.

Recent industry developments demonstrate the dynamic nature of the European satellite bus market, with significant technological advances, strategic partnerships, and market expansion activities shaping competitive landscape evolution.

Technology Advancement Initiatives include development of next-generation bus platforms incorporating advanced materials, improved power systems, and enhanced communication capabilities. European manufacturers invest heavily in research and development to maintain technological leadership and competitive advantages.

Strategic Partnership Formation between satellite manufacturers, component suppliers, and end-users creates integrated value chains that optimize cost structures and accelerate innovation adoption. Collaborative programs enable risk sharing and capability enhancement across industry participants.

Manufacturing Capacity Expansion responds to growing market demand, with several European companies investing in new production facilities and automated manufacturing systems. These investments support volume production requirements for constellation deployment and commercial market growth.

International Market Expansion efforts by European manufacturers target global opportunities while leveraging technological advantages and established customer relationships. Export activities diversify revenue sources and reduce dependence on domestic markets.

Regulatory Framework Evolution includes updated space policies, licensing procedures, and international cooperation agreements that facilitate market development and technology transfer activities across European markets.

Industry analysts recommend several strategic approaches for European satellite bus market participants to optimize competitive positioning and capitalize on emerging growth opportunities.

Platform Portfolio Optimization should focus on developing standardized bus architectures that serve multiple market segments while maintaining cost competitiveness and technical performance. Manufacturers should prioritize platforms with broad applicability and scalable production potential.

Technology Investment Priorities should emphasize software-defined architectures, electric propulsion systems, and artificial intelligence integration that enhance mission flexibility and operational efficiency. Research and development allocation should target technologies with clear commercial applications and competitive advantages.

Market Diversification Strategies should balance traditional government customers with growing commercial markets, particularly in small satellite and constellation applications. Customer base expansion reduces market concentration risks and creates new revenue opportunities.

Supply Chain Optimization initiatives should focus on cost reduction, quality improvement, and supply security through strategic supplier relationships and vertical integration where appropriate. European supply chain development supports industry competitiveness and reduces external dependencies.

International Collaboration opportunities should be pursued to access global markets, share development costs, and leverage complementary capabilities with international partners. Strategic alliances can accelerate market entry and capability development in key growth segments.

The European satellite bus market demonstrates strong growth prospects supported by expanding commercial space activities, technological innovation, and increasing demand for satellite-based services across diverse applications and market segments.

Market expansion is projected to continue at robust growth rates through the forecast period, driven by constellation deployment activities, government space program investments, and emerging commercial applications. Small satellite segments are expected to demonstrate particularly strong growth as standardized platforms enable cost-effective mission deployment.

Technology evolution will focus on enhanced mission flexibility, improved cost efficiency, and advanced operational capabilities that address evolving customer requirements. Next-generation platforms incorporating artificial intelligence, software-defined architectures, and advanced propulsion systems will create new market opportunities and competitive advantages.

Commercial market development will expand beyond traditional telecommunications applications to include broadband constellations, Earth observation services, and emerging applications such as space-based manufacturing and orbital logistics. Market diversification reduces dependency on government customers while creating new revenue streams.

According to MarkWide Research projections, the European satellite bus market will maintain strong momentum with particular strength in small satellite platforms and multi-mission architectures. Innovation cycles will accelerate as competition intensifies and customer requirements evolve toward greater flexibility and cost efficiency.

Competitive dynamics will favor manufacturers capable of achieving scale economies through standardized platforms while maintaining technological leadership and customer service excellence. Market consolidation may occur in certain segments as companies seek to optimize capabilities and cost structures.

The Europe satellite bus market represents a dynamic and rapidly evolving sector within the continental space industry, characterized by strong growth momentum, technological innovation, and expanding commercial opportunities. Market fundamentals remain robust, supported by increasing satellite deployment activities, government space program investments, and growing demand for satellite-based services across diverse applications.

Key success factors for market participants include platform standardization, technology innovation, cost optimization, and customer diversification strategies that address both traditional government markets and emerging commercial opportunities. European manufacturers maintain competitive advantages through technological excellence, quality standards, and established customer relationships, while facing challenges from international competition and evolving market requirements.

Future market development will be shaped by small satellite growth, constellation deployment activities, and next-generation technology adoption that enhances mission flexibility and operational efficiency. Strategic positioning in high-growth segments such as small satellite platforms and multi-mission architectures will be critical for long-term success in this evolving market landscape.

Overall market prospects remain positive, with sustained growth expected across multiple segments and applications as the European space industry continues expanding its capabilities and market reach in the global space economy.

What is Satellite Bus?

A Satellite Bus is the primary structure and support system of a satellite, providing the necessary power, thermal control, and communication capabilities. It serves as the platform for various payloads and is essential for the satellite’s functionality in space applications.

What are the key players in the Europe Satellite Bus Market?

Key players in the Europe Satellite Bus Market include Airbus Defence and Space, Thales Alenia Space, and OHB System AG, among others. These companies are involved in the design and manufacturing of satellite buses for various applications, including telecommunications and Earth observation.

What are the growth factors driving the Europe Satellite Bus Market?

The Europe Satellite Bus Market is driven by increasing demand for satellite-based services, advancements in satellite technology, and the growing need for Earth observation data. Additionally, the rise in government and commercial investments in space exploration contributes to market growth.

What challenges does the Europe Satellite Bus Market face?

The Europe Satellite Bus Market faces challenges such as high development costs, regulatory hurdles, and competition from emerging technologies like small satellites and CubeSats. These factors can impact the profitability and sustainability of traditional satellite bus manufacturers.

What opportunities exist in the Europe Satellite Bus Market?

Opportunities in the Europe Satellite Bus Market include the increasing demand for broadband connectivity, the expansion of satellite constellations, and the potential for partnerships in international space missions. These factors can lead to innovative solutions and new market entrants.

What trends are shaping the Europe Satellite Bus Market?

Trends in the Europe Satellite Bus Market include the shift towards modular satellite designs, the integration of artificial intelligence for satellite operations, and the focus on sustainability in satellite manufacturing. These trends are influencing how satellite buses are developed and deployed.

Europe Satellite Bus Market

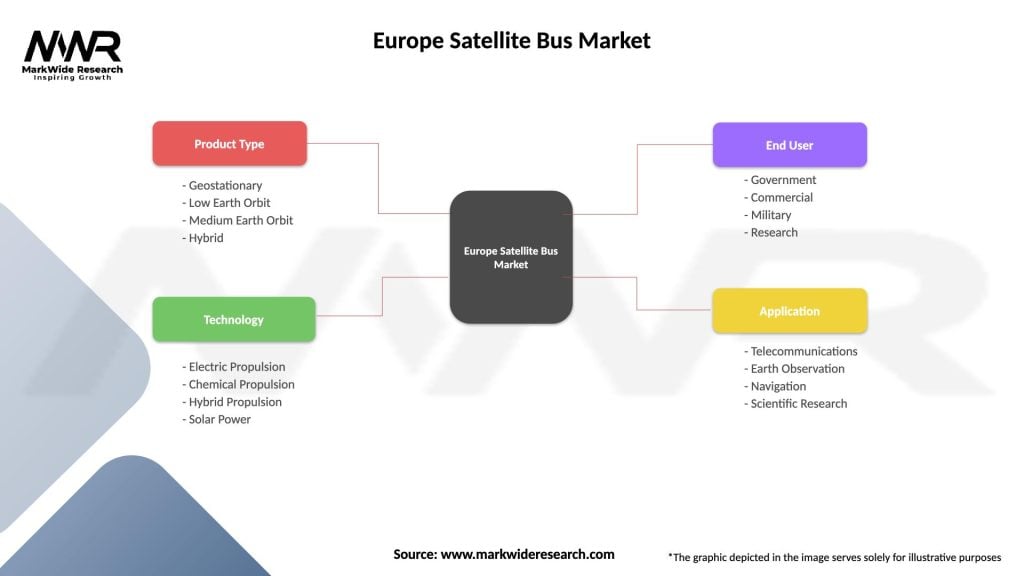

| Segmentation Details | Description |

|---|---|

| Product Type | Geostationary, Low Earth Orbit, Medium Earth Orbit, Hybrid |

| Technology | Electric Propulsion, Chemical Propulsion, Hybrid Propulsion, Solar Power |

| End User | Government, Commercial, Military, Research |

| Application | Telecommunications, Earth Observation, Navigation, Scientific Research |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Satellite Bus Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at