444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe precision medicine market represents a transformative healthcare paradigm that is revolutionizing patient care across the continent. This innovative approach to medical treatment leverages advanced genomic technologies, biomarker identification, and personalized therapeutic strategies to deliver targeted healthcare solutions. European healthcare systems are increasingly adopting precision medicine methodologies to enhance treatment efficacy and reduce adverse drug reactions.

Market dynamics in Europe demonstrate robust growth potential, driven by substantial investments in genomic research, advanced diagnostic technologies, and personalized treatment protocols. The region’s sophisticated healthcare infrastructure, combined with strong regulatory frameworks and research capabilities, positions Europe as a global leader in precision medicine implementation. Growth projections indicate the market is expanding at a compound annual growth rate (CAGR) of 12.4% through the forecast period.

Key European countries including Germany, France, the United Kingdom, and Switzerland are spearheading precision medicine initiatives through comprehensive national healthcare programs and strategic research investments. These nations have established robust genomic databases, advanced diagnostic capabilities, and integrated healthcare delivery systems that support personalized medicine approaches. Adoption rates across major European markets show 68% of leading medical centers have implemented some form of precision medicine protocols.

The Europe precision medicine market refers to the comprehensive ecosystem of personalized healthcare solutions that utilize genetic, environmental, and lifestyle factors to develop targeted therapeutic interventions for individual patients across European healthcare systems. This market encompasses genomic testing, biomarker discovery, personalized drug development, and companion diagnostics that enable healthcare providers to deliver more effective and safer treatments.

Precision medicine fundamentally differs from traditional one-size-fits-all medical approaches by recognizing that patients respond differently to treatments based on their unique genetic makeup, environmental exposures, and lifestyle factors. European precision medicine initiatives focus on integrating advanced molecular diagnostics, artificial intelligence, and big data analytics to identify optimal treatment pathways for individual patients.

The market encompasses various components including pharmacogenomics, companion diagnostics, personalized therapeutics, and precision oncology solutions. These technologies enable healthcare providers to predict treatment responses, minimize adverse effects, and optimize therapeutic outcomes through data-driven decision making.

Europe’s precision medicine landscape is experiencing unprecedented growth driven by technological advancements, regulatory support, and increasing healthcare provider adoption. The market benefits from strong government initiatives, robust research infrastructure, and collaborative efforts between pharmaceutical companies, diagnostic manufacturers, and healthcare institutions.

Key market segments include oncology applications, cardiovascular medicine, neurological disorders, and rare diseases, with oncology representing the largest application area. Technological innovations in next-generation sequencing, liquid biopsies, and artificial intelligence are accelerating market expansion and improving patient outcomes across diverse therapeutic areas.

Regional leadership is demonstrated by countries implementing comprehensive precision medicine strategies, with Germany accounting for 28% market share followed by France and the United Kingdom. These markets benefit from advanced healthcare systems, strong research capabilities, and supportive regulatory environments that facilitate precision medicine adoption.

Investment trends show increasing funding for genomic research, biomarker discovery, and personalized therapeutic development. European pharmaceutical companies are allocating significant resources to precision medicine initiatives, with biotechnology investments growing by 15.7% annually across the region.

Strategic market insights reveal several critical factors driving Europe’s precision medicine evolution:

Primary growth drivers propelling the Europe precision medicine market include advancing genomic technologies, increasing disease prevalence, and growing healthcare provider awareness of personalized treatment benefits. Technological innovations in next-generation sequencing have dramatically reduced costs while improving accuracy and turnaround times for genetic testing.

Government initiatives across European countries are providing substantial funding and policy support for precision medicine development. National healthcare systems are recognizing the long-term cost benefits of personalized treatments that improve efficacy and reduce adverse drug reactions. Research investments in genomics and biomarker discovery are accelerating the development of new diagnostic tools and therapeutic targets.

Patient demand for personalized healthcare solutions is increasing as awareness grows regarding the benefits of targeted treatments. Healthcare providers are responding to patient expectations for more effective, individualized care approaches that consider genetic predispositions and personal health profiles.

Pharmaceutical industry transformation toward precision medicine is driving innovation in drug development, with companies investing heavily in companion diagnostics and targeted therapies. Regulatory support from European health authorities is facilitating faster approval processes for personalized medicine products and encouraging industry investment.

Significant challenges facing the Europe precision medicine market include high implementation costs, complex regulatory requirements, and data privacy concerns. Healthcare systems face substantial financial investments required for genomic testing infrastructure, specialized equipment, and trained personnel to support precision medicine programs.

Regulatory complexity surrounding genetic testing, data sharing, and personalized therapeutics creates barriers for market participants. European data protection regulations require careful navigation to ensure compliance while enabling necessary research and clinical applications of genetic information.

Technical limitations in current genomic technologies and biomarker validation present ongoing challenges for precision medicine implementation. Healthcare provider readiness varies significantly across European markets, with some regions lacking necessary infrastructure and expertise to support comprehensive precision medicine programs.

Reimbursement uncertainties for precision medicine services and treatments create market access challenges. Insurance coverage for genetic testing and personalized therapies remains inconsistent across European healthcare systems, potentially limiting patient access to these innovative treatments.

Emerging opportunities in the Europe precision medicine market span multiple therapeutic areas and technological applications. Oncology precision medicine represents the largest opportunity, with increasing adoption of tumor profiling, liquid biopsies, and targeted cancer therapies driving market expansion.

Rare disease applications offer significant growth potential as precision medicine approaches enable development of treatments for previously untreatable conditions. European regulatory frameworks provide incentives for rare disease drug development, creating favorable conditions for precision medicine companies.

Digital health integration presents opportunities for comprehensive patient data collection and analysis to support precision medicine decision-making. Artificial intelligence applications in genomic analysis, drug discovery, and treatment optimization are creating new market segments and improving clinical outcomes.

Preventive medicine applications represent an expanding opportunity as genetic testing enables early disease detection and risk assessment. Pharmacogenomics applications for drug selection and dosing optimization offer substantial potential for reducing adverse drug reactions and improving treatment efficacy.

Dynamic market forces shaping the Europe precision medicine landscape include technological convergence, regulatory evolution, and changing healthcare delivery models. Innovation cycles in genomic technologies are accelerating, with new platforms and analytical tools continuously improving precision medicine capabilities.

Competitive dynamics involve pharmaceutical companies, diagnostic manufacturers, technology providers, and healthcare institutions collaborating to develop comprehensive precision medicine solutions. Strategic partnerships between industry participants are becoming increasingly important for market success and technology advancement.

Healthcare system transformation toward value-based care models is creating favorable conditions for precision medicine adoption. Cost-effectiveness demonstrations showing improved patient outcomes and reduced healthcare expenditures are driving institutional adoption of personalized medicine approaches.

According to MarkWide Research analysis, market dynamics indicate strong momentum for precision medicine adoption across European healthcare systems, with implementation rates increasing by 22% annually among leading medical centers. Technology integration and clinical validation efforts are accelerating market maturation and expanding application areas.

Comprehensive research methodology employed for analyzing the Europe precision medicine market incorporates primary and secondary research approaches, expert interviews, and quantitative market analysis. Primary research includes surveys and interviews with healthcare providers, pharmaceutical executives, diagnostic manufacturers, and regulatory experts across major European markets.

Secondary research encompasses analysis of published studies, regulatory filings, company reports, and industry publications to understand market trends, competitive landscapes, and technological developments. Market sizing methodologies utilize multiple data sources and validation techniques to ensure accuracy and reliability of market projections.

Expert consultation with leading precision medicine researchers, clinical practitioners, and industry executives provides insights into market dynamics, technological trends, and future opportunities. Quantitative analysis incorporates statistical modeling and trend analysis to project market growth and segment performance.

Data validation processes include cross-referencing multiple sources, expert review, and sensitivity analysis to ensure research findings accurately reflect market conditions and future prospects. Regional analysis methodology considers country-specific factors including healthcare systems, regulatory environments, and market maturity levels.

Germany leads the European precision medicine market with advanced healthcare infrastructure, strong research capabilities, and comprehensive national genomics initiatives. German healthcare systems have implemented extensive precision medicine programs, with major medical centers achieving 74% adoption rates for genomic testing in oncology applications.

France represents the second-largest market, driven by national precision medicine strategies and significant government investments in genomic research. French healthcare institutions are pioneering personalized medicine approaches in cardiovascular disease and neurological disorders, with strong emphasis on biomarker discovery and validation.

United Kingdom maintains a strong position despite regulatory changes, with NHS genomic medicine initiatives and established research infrastructure supporting precision medicine development. UK biobanks and genomic databases provide valuable resources for precision medicine research and clinical applications.

Switzerland and Netherlands demonstrate high per-capita adoption rates for precision medicine technologies, benefiting from advanced healthcare systems and strong pharmaceutical industry presence. Nordic countries including Sweden, Denmark, and Norway are implementing comprehensive precision medicine programs with population-based genomic initiatives achieving 45% coverage rates.

Southern European markets including Italy and Spain are experiencing rapid growth in precision medicine adoption, driven by increasing healthcare investments and European Union funding for genomic research initiatives.

The competitive landscape in Europe’s precision medicine market features diverse participants including pharmaceutical companies, diagnostic manufacturers, technology providers, and specialized precision medicine companies. Market leaders are establishing comprehensive portfolios spanning genomic testing, companion diagnostics, and personalized therapeutics.

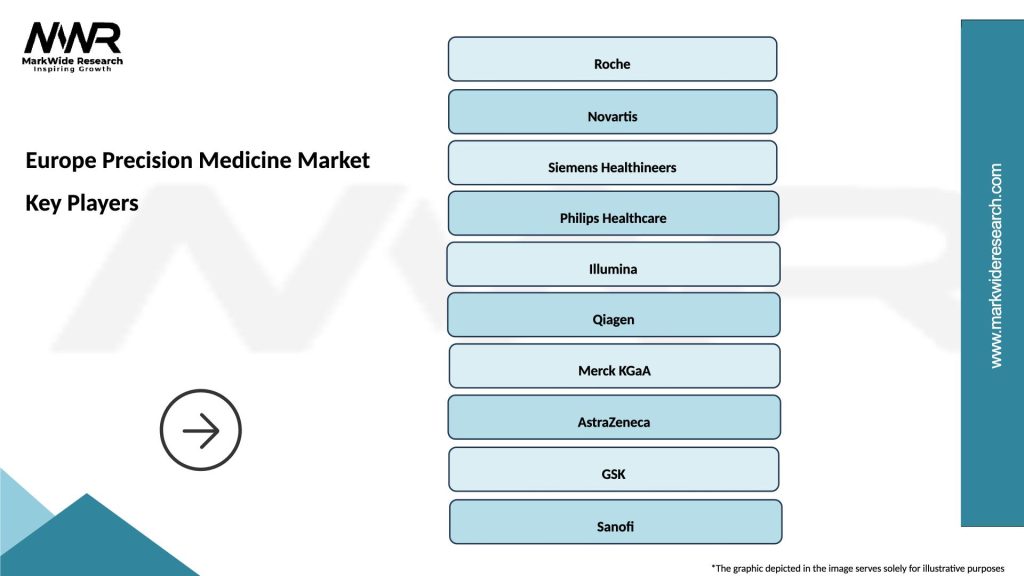

Key market participants include:

Strategic initiatives among market participants include partnerships with healthcare institutions, acquisition of specialized technologies, and development of integrated precision medicine platforms. Innovation focus areas include artificial intelligence integration, multi-omics analysis, and real-world evidence generation.

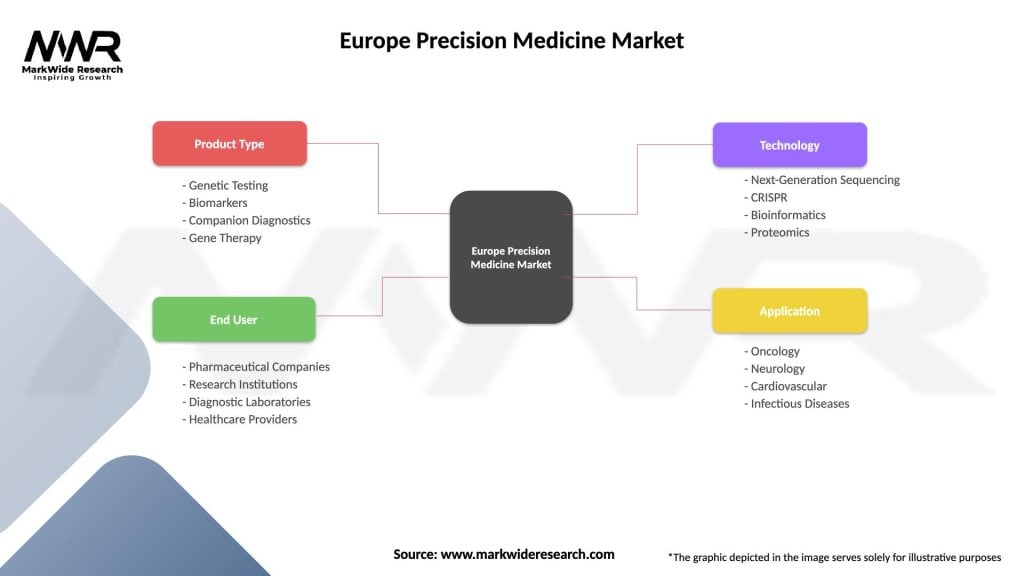

The Europe precision medicine market demonstrates clear segmentation across multiple dimensions including technology type, application area, end-user category, and geographic region. Technology segmentation encompasses genomics, proteomics, pharmacogenomics, and companion diagnostics, with genomics representing the largest segment.

By Technology:

By Application:

By End User:

Oncology applications dominate the Europe precision medicine market, representing the most mature and rapidly growing segment. Cancer genomics has achieved widespread clinical adoption, with tumor profiling rates reaching 58% in major cancer centers across Europe. Liquid biopsy technologies are gaining significant traction for non-invasive cancer monitoring and treatment selection.

Cardiovascular precision medicine is emerging as a high-growth segment, driven by genetic risk assessment tools and personalized treatment protocols for heart disease prevention and management. Pharmacogenomic applications in cardiology are improving drug selection and dosing optimization for cardiovascular medications.

Rare disease applications represent a specialized but important market segment, with precision medicine approaches enabling diagnosis and treatment of previously untreatable genetic conditions. European regulatory incentives for rare disease drug development are supporting market growth in this category.

Neurological applications show promising growth potential as understanding of neurogenetic factors improves. Precision medicine approaches for Alzheimer’s disease, Parkinson’s disease, and other neurological conditions are advancing through clinical trials and research initiatives.

Preventive medicine applications are expanding as genetic testing becomes more accessible and affordable. Population health initiatives incorporating genetic risk assessment are being implemented across European healthcare systems to improve disease prevention strategies.

Healthcare providers benefit from precision medicine through improved treatment efficacy, reduced adverse drug reactions, and enhanced patient satisfaction. Clinical outcomes demonstrate significant improvements in treatment response rates and patient quality of life through personalized medicine approaches.

Pharmaceutical companies gain advantages through more efficient drug development processes, higher success rates in clinical trials, and opportunities for premium pricing of targeted therapies. Companion diagnostic development creates additional revenue streams and strengthens market positioning for pharmaceutical products.

Patients receive substantial benefits including more effective treatments, reduced side effects, and improved health outcomes through personalized medicine approaches. Early disease detection and prevention strategies enabled by genetic testing provide long-term health benefits and improved quality of life.

Healthcare systems achieve cost savings through more efficient resource utilization, reduced trial-and-error prescribing, and improved treatment outcomes. Population health improvements result from targeted interventions and preventive strategies based on genetic risk assessment.

Diagnostic companies benefit from expanding market opportunities, premium pricing for specialized tests, and strong growth potential across multiple therapeutic areas. Technology providers gain from increasing demand for genomic analysis platforms and precision medicine infrastructure.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents a transformative trend in European precision medicine, with machine learning algorithms improving genomic analysis accuracy and treatment prediction capabilities. AI applications are enhancing biomarker discovery, drug development, and clinical decision-making processes across the precision medicine value chain.

Liquid biopsy adoption is accelerating rapidly across European markets, providing non-invasive alternatives to traditional tissue biopsies for cancer diagnosis and monitoring. Blood-based testing technologies are expanding beyond oncology into other therapeutic areas, creating new market opportunities and improving patient convenience.

Multi-omics approaches combining genomics, proteomics, and metabolomics data are becoming standard practice for comprehensive patient profiling. Integrated analysis platforms are enabling more sophisticated understanding of disease mechanisms and treatment responses.

Population genomics initiatives are expanding across European countries, with national biobanks and genomic databases supporting large-scale precision medicine research. MWR data indicates that population-based genomic programs have achieved 38% coverage across major European markets.

Real-world evidence generation is becoming increasingly important for demonstrating precision medicine value and supporting regulatory approvals. Healthcare systems are implementing comprehensive data collection and analysis capabilities to support evidence-based precision medicine adoption.

Recent industry developments demonstrate accelerating momentum in European precision medicine markets. Major pharmaceutical companies are establishing dedicated precision medicine divisions and investing heavily in companion diagnostic development programs.

Regulatory milestones include updated European Medicines Agency guidelines for personalized medicine products and streamlined approval processes for companion diagnostics. National healthcare systems are implementing comprehensive precision medicine strategies with dedicated funding and infrastructure development programs.

Technology partnerships between pharmaceutical companies, diagnostic manufacturers, and technology providers are creating integrated precision medicine platforms. Academic collaborations are advancing biomarker discovery and validation efforts across multiple therapeutic areas.

Investment activity in European precision medicine companies has reached record levels, with venture capital and strategic investors supporting innovative technologies and clinical applications. Merger and acquisition activity is consolidating market participants and creating comprehensive precision medicine capabilities.

Clinical implementation milestones include widespread adoption of tumor profiling in oncology and expanding use of pharmacogenomic testing for drug selection. Healthcare provider networks are establishing precision medicine centers of excellence and specialized clinical programs.

Market participants should focus on developing comprehensive precision medicine platforms that integrate genomic testing, data analysis, and clinical decision support capabilities. Technology integration and user-friendly interfaces will be critical for successful market penetration and healthcare provider adoption.

Healthcare providers should invest in genomic infrastructure and staff training to support precision medicine implementation. Collaborative partnerships with technology providers and pharmaceutical companies can accelerate precision medicine adoption while managing implementation costs and complexity.

Pharmaceutical companies should prioritize companion diagnostic development alongside therapeutic programs to maximize market opportunities and treatment efficacy. Real-world evidence generation will be essential for demonstrating value and securing reimbursement coverage.

Regulatory engagement remains critical for all market participants, with early dialogue and collaborative approaches facilitating faster approvals and market access. Data privacy compliance and security measures must be prioritized to address European regulatory requirements and patient concerns.

Investment strategies should focus on technologies with clear clinical utility and strong evidence of improved patient outcomes. Market entry approaches should consider regional differences in healthcare systems, regulatory requirements, and market maturity levels across European countries.

The future outlook for Europe’s precision medicine market remains highly positive, with continued growth expected across all major segments and applications. Technology advancement will drive expanding capabilities and new clinical applications, while healthcare system adoption will accelerate through demonstrated value and improved patient outcomes.

Market expansion is projected to continue at robust growth rates, with adoption rates expected to reach 85% among major medical centers by 2030. Geographic expansion will extend precision medicine benefits to smaller healthcare systems and emerging European markets through technology advancement and cost reduction.

Innovation trajectories point toward more sophisticated multi-omics approaches, artificial intelligence integration, and real-time treatment optimization capabilities. Preventive medicine applications will expand significantly as genetic testing becomes routine in healthcare delivery and population health management.

Regulatory evolution will continue supporting precision medicine development through streamlined approval processes and adaptive regulatory frameworks. Reimbursement coverage will expand as health economic evidence demonstrates cost-effectiveness and improved patient outcomes.

MarkWide Research projects that European precision medicine markets will achieve mainstream adoption across major therapeutic areas, with implementation rates growing by 18% annually through the next decade. Technology convergence and clinical validation will drive continued market expansion and innovation.

The Europe precision medicine market represents a transformative healthcare opportunity with substantial growth potential and significant benefits for patients, healthcare providers, and industry participants. Market dynamics demonstrate strong momentum driven by technological advancement, regulatory support, and increasing clinical adoption across major therapeutic areas.

Key success factors include comprehensive technology integration, clinical evidence generation, and collaborative partnerships between industry participants and healthcare systems. Regional leadership in genomic research and healthcare innovation positions Europe as a global precision medicine hub with continued growth prospects.

Future opportunities span expanding therapeutic applications, technology advancement, and population health initiatives that will drive sustained market growth and improved patient outcomes. Strategic investments in precision medicine capabilities will be essential for healthcare systems and industry participants to capitalize on this transformative healthcare paradigm and deliver personalized medicine benefits to European patients.

What is Precision Medicine?

Precision medicine is a medical approach that tailors treatment and healthcare strategies to individual characteristics, including genetic, environmental, and lifestyle factors. This approach aims to improve patient outcomes by providing more effective and personalized therapies.

What are the key players in the Europe Precision Medicine Market?

Key players in the Europe Precision Medicine Market include Roche, Novartis, and Illumina, which are known for their advancements in genomics and targeted therapies. These companies focus on developing innovative solutions that enhance patient care and treatment efficacy, among others.

What are the main drivers of the Europe Precision Medicine Market?

The main drivers of the Europe Precision Medicine Market include the increasing prevalence of chronic diseases, advancements in genomic technologies, and a growing emphasis on personalized healthcare. These factors contribute to the demand for tailored treatment options that improve patient outcomes.

What challenges does the Europe Precision Medicine Market face?

The Europe Precision Medicine Market faces challenges such as high costs of research and development, regulatory hurdles, and the need for extensive data integration. These challenges can hinder the widespread adoption of precision medicine solutions across healthcare systems.

What opportunities exist in the Europe Precision Medicine Market?

Opportunities in the Europe Precision Medicine Market include the potential for breakthroughs in cancer treatment, the rise of digital health technologies, and collaborations between biotech firms and research institutions. These factors can drive innovation and expand the market further.

What trends are shaping the Europe Precision Medicine Market?

Trends shaping the Europe Precision Medicine Market include the increasing use of artificial intelligence in drug discovery, the growth of biomarker research, and the integration of big data analytics in patient care. These trends are enhancing the precision and effectiveness of medical treatments.

Europe Precision Medicine Market

| Segmentation Details | Description |

|---|---|

| Product Type | Genetic Testing, Biomarkers, Companion Diagnostics, Gene Therapy |

| End User | Pharmaceutical Companies, Research Institutions, Diagnostic Laboratories, Healthcare Providers |

| Technology | Next-Generation Sequencing, CRISPR, Bioinformatics, Proteomics |

| Application | Oncology, Neurology, Cardiovascular, Infectious Diseases |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Precision Medicine Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at