444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe portable washing machine market represents a dynamic and rapidly evolving segment within the broader home appliance industry. This market encompasses compact, lightweight washing solutions designed for consumers seeking flexibility, convenience, and space-efficient laundry options. European consumers are increasingly embracing portable washing machines due to urbanization trends, smaller living spaces, and growing environmental consciousness.

Market dynamics indicate robust growth driven by changing lifestyle patterns, particularly among millennials and Gen Z consumers who prioritize mobility and sustainable living. The market demonstrates significant expansion across key European regions, with Germany, France, and the United Kingdom leading adoption rates. Technological advancements in compact washing technology have enhanced performance capabilities while maintaining energy efficiency standards.

Consumer preferences are shifting toward multifunctional appliances that offer convenience without compromising washing quality. The market experiences strong demand from various segments including students, urban professionals, RV enthusiasts, and environmentally conscious households. Growth projections suggest the market will continue expanding at a compound annual growth rate of 8.2% through the forecast period, reflecting increasing consumer acceptance and technological improvements.

The Europe portable washing machine market refers to the commercial ecosystem encompassing the manufacturing, distribution, and sale of compact, movable laundry appliances designed for European consumers. These devices typically feature lightweight construction, reduced capacity compared to traditional washers, and enhanced portability for diverse usage scenarios.

Portable washing machines are characterized by their ability to operate in various environments, from small apartments and dormitories to recreational vehicles and temporary accommodations. The market includes various product categories such as countertop washers, twin-tub models, and all-in-one washer-dryer combinations. European market dynamics reflect regional preferences for energy-efficient, space-saving appliances that align with sustainability goals and urban living constraints.

The European portable washing machine market demonstrates exceptional growth potential driven by evolving consumer lifestyles and technological innovations. Key market drivers include increasing urbanization, rising awareness of water conservation, and growing demand for flexible living solutions. The market benefits from strong adoption rates among younger demographics who prioritize convenience and mobility.

Regional analysis reveals that Western European countries account for approximately 68% of market share, with Eastern European markets showing accelerated growth rates. Product innovation focuses on enhanced washing efficiency, reduced water consumption, and smart connectivity features. The competitive landscape features both established appliance manufacturers and emerging specialized brands targeting niche consumer segments.

Market challenges include consumer perception regarding washing capacity limitations and initial cost considerations. However, technological improvements continue addressing these concerns through enhanced performance capabilities and competitive pricing strategies. The market outlook remains positive with sustained growth expected across all major European regions.

Strategic market insights reveal several critical trends shaping the European portable washing machine landscape:

Primary market drivers propelling European portable washing machine adoption include fundamental shifts in consumer behavior and living patterns. Urbanization trends continue accelerating across European cities, creating increased demand for compact appliances that maximize functionality within limited living spaces. This demographic shift particularly impacts younger consumers who prioritize flexibility and convenience in their lifestyle choices.

Environmental awareness serves as a significant growth catalyst, with consumers increasingly seeking appliances that reduce water consumption and energy usage. Portable washing machines typically consume 40-60% less water than traditional units while maintaining effective cleaning performance. Sustainability concerns drive purchasing decisions among environmentally conscious European consumers who view portable washers as eco-friendly alternatives.

Economic factors also contribute to market expansion, as portable washing machines offer cost-effective solutions for consumers unable to invest in full-sized appliances or lacking permanent installation capabilities. Rental market growth across European cities creates additional demand from tenants seeking non-permanent laundry solutions. Technological advancements continue improving product performance, addressing historical concerns about washing capacity and effectiveness.

Market restraints present challenges that may limit growth potential within the European portable washing machine sector. Capacity limitations remain a primary concern for consumers accustomed to traditional washing machine volumes, potentially restricting adoption among larger households. This constraint particularly affects families with significant laundry requirements who may view portable units as inadequate for their needs.

Consumer perception issues regarding washing quality and durability continue impacting market penetration. Some consumers maintain skepticism about portable washers’ ability to deliver thorough cleaning results comparable to conventional machines. Brand awareness challenges exist as many consumers remain unfamiliar with portable washing machine capabilities and benefits, requiring extensive educational marketing efforts.

Infrastructure limitations in certain European regions may restrict market growth, particularly in areas with limited access to appropriate electrical connections or water sources. Regulatory compliance requirements across different European markets create complexity for manufacturers seeking broad regional distribution. Price sensitivity among budget-conscious consumers may limit premium product adoption despite enhanced features and performance capabilities.

Significant market opportunities exist within the European portable washing machine landscape, driven by emerging consumer trends and technological possibilities. Smart home integration presents substantial growth potential as consumers increasingly adopt connected appliances that offer remote monitoring and control capabilities. This trend aligns with broader digitalization efforts across European households.

Niche market segments offer specialized opportunities for targeted product development. Recreational vehicle markets demonstrate strong demand for portable washing solutions, while student housing and temporary accommodation sectors present consistent growth opportunities. Commercial applications including small businesses, healthcare facilities, and hospitality venues represent underexplored market segments with substantial potential.

Geographic expansion opportunities exist within Eastern European markets where portable appliance adoption rates remain below Western European levels. Product innovation possibilities include development of hybrid models combining washing and drying functions, enhanced energy efficiency features, and specialized cleaning programs for different fabric types. Partnership opportunities with furniture retailers, student housing providers, and RV dealers could expand distribution channels and market reach.

Market dynamics within the European portable washing machine sector reflect complex interactions between consumer behavior, technological advancement, and competitive pressures. Supply chain considerations significantly impact product availability and pricing strategies, particularly following recent global disruptions that highlighted manufacturing vulnerabilities. European manufacturers increasingly focus on regional sourcing to enhance supply chain resilience.

Consumer behavior patterns demonstrate seasonal variations with peak demand occurring during spring months and back-to-school periods. Price elasticity analysis indicates moderate sensitivity to pricing changes, with consumers willing to pay premium prices for enhanced features and reliability. Brand loyalty factors play important roles in purchasing decisions, with established appliance manufacturers maintaining competitive advantages through reputation and service networks.

Technological disruption continues reshaping market dynamics through innovations in washing efficiency, water conservation, and smart connectivity. Competitive intensity increases as new entrants challenge established players with specialized products and direct-to-consumer sales models. Regulatory influences including energy efficiency standards and environmental regulations shape product development priorities and market positioning strategies.

Comprehensive research methodology employed for analyzing the European portable washing machine market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability. Primary research activities include structured surveys conducted among European consumers, in-depth interviews with industry executives, and focus group discussions with target demographic segments. These activities provide direct insights into consumer preferences, purchasing behaviors, and market trends.

Secondary research components encompass analysis of industry reports, government statistics, trade association data, and company financial statements. Market sizing calculations utilize bottom-up and top-down approaches to validate findings and ensure consistency across different analytical frameworks. Competitive intelligence gathering includes monitoring of product launches, pricing strategies, and marketing campaigns across major market participants.

Data validation processes involve triangulation of findings from multiple sources and expert review panels to confirm accuracy and eliminate potential biases. Statistical analysis techniques include regression modeling, correlation analysis, and trend extrapolation to identify significant market patterns and growth drivers. Regional analysis methodologies account for cultural differences, economic variations, and regulatory distinctions across European markets to provide localized insights and recommendations.

Regional market analysis reveals distinct patterns across European territories, with Western European countries maintaining market leadership through higher adoption rates and premium product preferences. Germany represents the largest individual market, accounting for approximately 22% of regional demand, driven by strong consumer purchasing power and environmental consciousness. French consumers demonstrate growing interest in compact appliances, particularly within urban centers where space constraints drive portable appliance adoption.

United Kingdom markets show resilience despite economic uncertainties, with student populations and young professionals representing primary growth segments. Scandinavian countries including Sweden, Norway, and Denmark exhibit strong environmental awareness that translates into higher adoption rates for energy-efficient portable washing machines. Market penetration rates in these regions exceed 15% of eligible households, reflecting mature market conditions.

Eastern European markets present significant growth opportunities with Poland, Czech Republic, and Hungary leading regional expansion efforts. These markets demonstrate annual growth rates exceeding 12% as rising disposable incomes and urbanization trends drive appliance modernization. Southern European countries including Italy and Spain show moderate growth influenced by economic recovery and changing lifestyle patterns among younger demographics.

The competitive landscape within the European portable washing machine market features diverse participants ranging from established appliance manufacturers to specialized compact appliance brands. Market leaders leverage brand recognition, distribution networks, and technological capabilities to maintain competitive advantages in this growing segment.

Competitive strategies focus on product differentiation through enhanced features, energy efficiency improvements, and smart technology integration. Market positioning varies from premium offerings emphasizing quality and durability to value-oriented products targeting price-sensitive consumers.

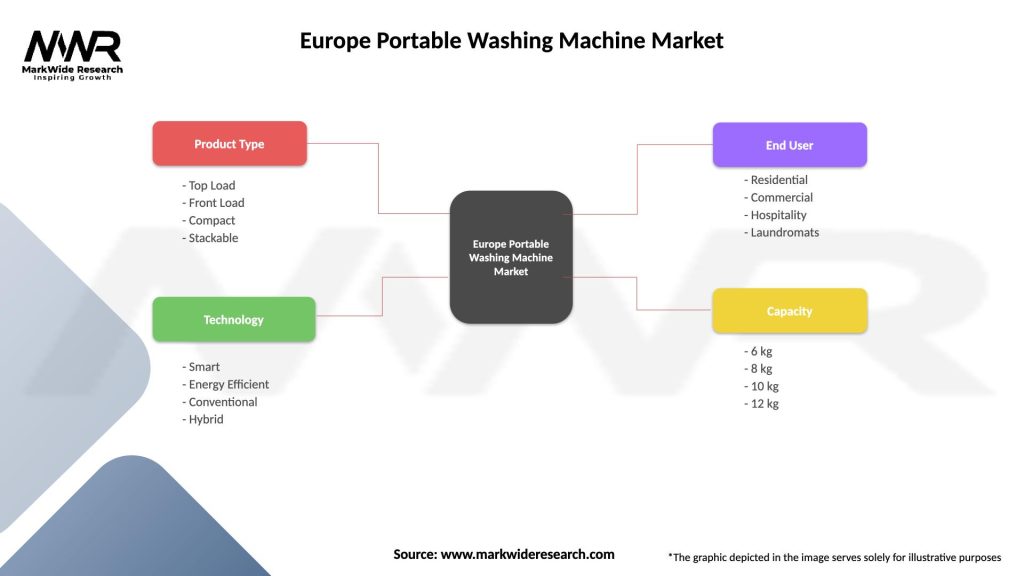

Market segmentation analysis reveals distinct categories within the European portable washing machine market based on various classification criteria. Product type segmentation encompasses different portable washer configurations designed for specific consumer needs and usage scenarios.

By Product Type:

By Capacity Range:

By End-User Application:

Category-wise analysis provides detailed insights into specific market segments within the European portable washing machine landscape. Countertop washers represent the fastest-growing category, experiencing annual growth rates of 11.5% driven by urban consumers seeking ultra-compact solutions. These units appeal particularly to students and young professionals living in small apartments where space optimization remains critical.

Twin-tub models maintain steady market presence among consumers preferring traditional washing approaches with enhanced portability. Performance characteristics of twin-tub systems often exceed single-chamber alternatives, attracting quality-conscious consumers willing to invest in superior washing capabilities. Market share distribution shows twin-tub models accounting for approximately 28% of total sales volume across European markets.

All-in-one washer-dryer combinations demonstrate strong growth potential as consumers increasingly value multifunctional appliances that maximize utility within limited spaces. Technology improvements in drying efficiency and cycle time reduction enhance consumer acceptance of these integrated solutions. Premium pricing strategies for all-in-one units reflect advanced feature sets and enhanced convenience factors that justify higher investment levels among target consumers.

Industry participants within the European portable washing machine market enjoy numerous strategic advantages and growth opportunities. Manufacturers benefit from expanding market demand that supports increased production volumes and economies of scale. Product differentiation opportunities allow companies to develop specialized solutions targeting specific consumer segments and usage scenarios.

Retailers and distributors experience advantages through growing consumer interest and relatively high profit margins compared to traditional appliances. Online sales channels particularly benefit from portable washer characteristics that facilitate shipping and reduce logistics complexities. Market expansion potential provides opportunities for geographic growth and customer base diversification across European regions.

Consumers gain significant benefits including enhanced flexibility, reduced utility costs, and improved convenience in laundry management. Environmental advantages include lower water consumption, reduced energy usage, and decreased carbon footprint compared to traditional washing methods. Economic benefits encompass lower initial investment requirements, reduced installation costs, and elimination of laundromat expenses for many users.

Stakeholder value creation extends to property developers and housing providers who can offer enhanced amenities without permanent appliance installations. Educational institutions benefit from providing convenient laundry solutions for student populations while minimizing infrastructure investments and maintenance requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the European portable washing machine landscape reflect evolving consumer preferences and technological capabilities. Smart connectivity integration emerges as a dominant trend, with manufacturers incorporating Wi-Fi capabilities, mobile app controls, and automated cycle optimization features. Consumer adoption rates for smart-enabled portable washers show annual increases of 18%, indicating strong market acceptance of connected appliance technologies.

Sustainability focus continues driving product development priorities, with manufacturers emphasizing water conservation, energy efficiency, and eco-friendly materials. Circular economy principles influence design decisions as companies develop more durable, repairable, and recyclable portable washing machines. Environmental certifications become increasingly important for market positioning and consumer appeal across European markets.

Customization trends reflect growing consumer demand for personalized appliance solutions tailored to specific needs and preferences. Modular designs allow users to adapt washing capabilities based on changing requirements, while aesthetic customization options enable integration with diverse interior design schemes. Subscription service models emerge as alternative ownership approaches, particularly appealing to younger consumers prioritizing access over ownership.

Recent industry developments demonstrate significant innovation and market evolution within the European portable washing machine sector. Product launches by major manufacturers focus on enhanced efficiency, reduced noise levels, and improved user interfaces. Technology partnerships between appliance companies and smart home platforms accelerate integration capabilities and expand functionality options for consumers.

Manufacturing investments in European production facilities reflect growing market confidence and desire to reduce supply chain dependencies. Research and development initiatives prioritize breakthrough technologies including ultrasonic cleaning, ozone treatment systems, and advanced water recycling capabilities. Sustainability commitments by leading manufacturers include carbon-neutral production goals and increased use of recycled materials in product construction.

Distribution channel evolution includes expansion of direct-to-consumer sales models and partnerships with online marketplaces. Service network development addresses consumer concerns about maintenance and support for portable appliances. Regulatory compliance efforts ensure products meet evolving European energy efficiency standards and environmental requirements while maintaining competitive positioning.

Strategic recommendations for market participants focus on capitalizing on growth opportunities while addressing existing challenges. MarkWide Research analysis suggests manufacturers should prioritize smart technology integration to meet evolving consumer expectations and differentiate products in competitive markets. Investment priorities should emphasize research and development activities that enhance washing performance while maintaining compact form factors.

Market positioning strategies should emphasize environmental benefits and convenience factors that resonate with target demographics. Brand building efforts require educational marketing campaigns that address consumer misconceptions about portable washer capabilities and performance. Distribution expansion should focus on online channels and strategic partnerships with retailers serving target consumer segments.

Product development recommendations include enhanced capacity options, improved energy efficiency, and expanded smart features that provide meaningful value to users. Pricing strategies should balance affordability with quality perceptions to maximize market penetration across diverse consumer segments. Geographic expansion efforts should prioritize Eastern European markets where growth potential exceeds current market penetration levels.

Future market outlook for the European portable washing machine sector remains highly positive, with sustained growth expected across all major market segments. Technology advancement trajectories suggest continued improvements in washing efficiency, energy conservation, and smart connectivity that will enhance consumer appeal and market adoption rates. Demographic trends including urbanization and changing lifestyle preferences support long-term demand growth.

Market expansion projections indicate the sector will maintain robust growth momentum with compound annual growth rates exceeding 8% through the next five years. Innovation cycles will likely accelerate as manufacturers compete for market share through enhanced features and improved performance capabilities. MWR forecasts suggest Eastern European markets will experience particularly strong growth as economic development and urbanization trends continue.

Regulatory environment evolution will likely drive further improvements in energy efficiency and environmental performance, creating opportunities for manufacturers investing in sustainable technologies. Consumer behavior shifts toward sustainable living and flexible lifestyle choices will continue supporting market growth and product innovation. Competitive landscape changes may include consolidation activities and new market entrants seeking to capitalize on growth opportunities.

The European portable washing machine market represents a dynamic and rapidly expanding sector with substantial growth potential driven by changing consumer lifestyles, technological innovations, and environmental consciousness. Market fundamentals remain strong with increasing urbanization, rising disposable incomes, and growing acceptance of compact appliance solutions supporting sustained demand growth across European regions.

Strategic opportunities exist for manufacturers, retailers, and service providers willing to invest in product innovation, market education, and distribution expansion. Technology integration particularly smart connectivity and enhanced efficiency features, will likely determine competitive success in this evolving marketplace. Consumer education efforts addressing performance perceptions and highlighting environmental benefits will be crucial for maximizing market penetration.

Long-term prospects indicate the European portable washing machine market will continue expanding as demographic trends, lifestyle changes, and technological capabilities align to create favorable growth conditions. Market participants positioned to capitalize on these trends through strategic investments and innovative product development will likely achieve significant success in this promising market segment.

What is Portable Washing Machine?

A portable washing machine is a compact and lightweight appliance designed for washing clothes in small spaces, such as apartments or RVs. These machines are typically easy to move and connect to standard faucets, making them ideal for users with limited laundry facilities.

What are the key players in the Europe Portable Washing Machine Market?

Key players in the Europe Portable Washing Machine Market include companies like Haier, LG Electronics, and Whirlpool. These companies are known for their innovative designs and energy-efficient models, catering to the growing demand for portable laundry solutions among consumers.

What are the main drivers of the Europe Portable Washing Machine Market?

The main drivers of the Europe Portable Washing Machine Market include the increasing trend of urbanization, the rise in small living spaces, and the growing demand for convenient laundry solutions. Additionally, the focus on energy efficiency and water conservation is propelling market growth.

What challenges does the Europe Portable Washing Machine Market face?

The Europe Portable Washing Machine Market faces challenges such as competition from traditional washing machines and consumer perceptions regarding the performance of portable units. Additionally, price sensitivity among consumers can hinder market expansion.

What opportunities exist in the Europe Portable Washing Machine Market?

Opportunities in the Europe Portable Washing Machine Market include the potential for technological advancements, such as smart washing machines and improved energy efficiency. Furthermore, the growing trend of eco-friendly appliances presents a chance for manufacturers to innovate.

What trends are shaping the Europe Portable Washing Machine Market?

Trends shaping the Europe Portable Washing Machine Market include the increasing popularity of compact and multifunctional appliances, as well as the integration of smart technology. Additionally, there is a rising consumer preference for sustainable and energy-efficient products.

Europe Portable Washing Machine Market

| Segmentation Details | Description |

|---|---|

| Product Type | Top Load, Front Load, Compact, Stackable |

| Technology | Smart, Energy Efficient, Conventional, Hybrid |

| End User | Residential, Commercial, Hospitality, Laundromats |

| Capacity | 6 kg, 8 kg, 10 kg, 12 kg |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Portable Washing Machine Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at