444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe polyolefin market represents one of the most dynamic and essential segments within the continental chemical industry, encompassing a comprehensive range of thermoplastic polymers derived from simple olefins. Polyolefins, including polyethylene (PE), polypropylene (PP), and other specialized variants, serve as fundamental building blocks across diverse industrial applications, from packaging and automotive components to construction materials and consumer goods. The European market demonstrates remarkable resilience and innovation capacity, driven by stringent environmental regulations, advanced recycling technologies, and growing demand for sustainable polymer solutions.

Market dynamics in Europe reflect a sophisticated balance between traditional manufacturing excellence and emerging sustainability imperatives. The region’s polyolefin industry benefits from well-established petrochemical infrastructure, technological leadership, and strong research and development capabilities. Growth trajectories indicate sustained expansion at approximately 4.2% CAGR through the forecast period, supported by increasing applications in lightweight automotive components, flexible packaging solutions, and renewable energy infrastructure.

Regional leadership in polyolefin production centers around major industrial hubs in Germany, the Netherlands, Belgium, and Italy, where integrated petrochemical complexes leverage advantageous feedstock access and logistics networks. The market landscape encompasses both large multinational corporations and specialized regional players, creating a competitive environment that fosters innovation in polymer chemistry, processing technologies, and circular economy solutions.

The Europe polyolefin market refers to the comprehensive commercial ecosystem encompassing the production, distribution, and application of polyolefin polymers across European territories. Polyolefins represent a class of thermoplastic polymers synthesized through the polymerization of olefin monomers, primarily ethylene and propylene, resulting in versatile materials characterized by excellent chemical resistance, mechanical properties, and processability.

Market scope includes various polyolefin grades and formulations designed for specific end-use applications, ranging from commodity plastics for packaging and consumer goods to engineering-grade materials for automotive, construction, and industrial applications. The European context emphasizes regulatory compliance with REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) requirements, circular economy principles, and sustainability mandates that influence product development and market positioning.

Value chain integration encompasses upstream feedstock procurement, polymerization processes, downstream conversion operations, and end-of-life management systems. The market definition extends beyond traditional linear models to include recycling infrastructure, bio-based alternatives, and advanced material recovery technologies that align with European Union environmental objectives and climate neutrality goals.

Strategic positioning of the Europe polyolefin market reflects a mature yet evolving industry landscape characterized by technological sophistication, regulatory compliance excellence, and sustainability leadership. The market demonstrates robust fundamentals supported by diversified application portfolios, established supply chains, and continuous innovation in polymer science and processing technologies.

Key performance indicators highlight the market’s resilience and growth potential, with packaging applications representing approximately 42% market share, followed by automotive components at 18% and construction materials at 15%. The European market distinguishes itself through premium product positioning, advanced recycling capabilities achieving 38% recycling rates for polyolefin waste streams, and pioneering development of bio-based alternatives.

Competitive landscape features a balanced mix of global chemical giants and regional specialists, with market consolidation trends balanced by emerging opportunities in specialty grades and sustainable solutions. Investment priorities focus on circular economy infrastructure, digitalization of production processes, and development of next-generation polyolefin materials with enhanced performance characteristics and reduced environmental impact.

Future trajectory indicates continued market expansion driven by automotive lightweighting trends, flexible packaging innovation, and infrastructure modernization projects. Regulatory frameworks supporting plastic waste reduction and recycling enhancement create both challenges and opportunities for market participants, encouraging technological advancement and business model evolution.

Market intelligence reveals several critical insights that define the European polyolefin landscape and influence strategic decision-making across the value chain:

Primary growth drivers propelling the Europe polyolefin market encompass a diverse array of economic, technological, and regulatory factors that create sustained demand across multiple application sectors. Automotive industry transformation represents a significant driver, as manufacturers increasingly adopt lightweight polyolefin components to improve fuel efficiency and reduce emissions in compliance with stringent European environmental standards.

Packaging industry evolution continues to generate substantial demand for polyolefin materials, particularly in flexible packaging applications where superior barrier properties, printability, and cost-effectiveness drive market penetration. The shift toward e-commerce and changing consumer preferences for convenient packaging solutions further amplify this demand trajectory, with specialized grades designed for food safety and extended shelf life applications.

Infrastructure development across European markets creates opportunities for polyolefin applications in construction, telecommunications, and energy sectors. The growing emphasis on renewable energy infrastructure, including solar panel components and wind turbine materials, generates demand for specialized polyolefin grades with enhanced UV resistance and mechanical properties.

Technological advancement in polyolefin chemistry and processing enables development of high-performance materials that replace traditional materials in demanding applications. Innovation in catalyst systems, reactor technology, and additive formulations expands the application scope and performance characteristics of polyolefin products, driving market growth through value-added solutions.

Regulatory challenges present significant constraints for the Europe polyolefin market, particularly regarding single-use plastic restrictions, extended producer responsibility requirements, and evolving waste management regulations. Compliance costs associated with REACH registration, environmental impact assessments, and product stewardship programs create financial burdens that affect market dynamics and competitive positioning.

Raw material volatility represents a persistent challenge, as polyolefin production depends on petrochemical feedstocks subject to price fluctuations, supply disruptions, and geopolitical influences. The European market’s reliance on imported feedstocks creates vulnerability to external market conditions and currency exchange rate variations that impact production economics and pricing strategies.

Environmental concerns regarding plastic waste accumulation, marine pollution, and carbon footprint considerations create negative public perception and regulatory pressure that constrains market growth in certain applications. Consumer awareness campaigns and environmental advocacy efforts influence purchasing decisions and policy development, potentially limiting market expansion opportunities.

Competition from alternatives includes bio-based polymers, recycled materials, and non-plastic substitutes that challenge traditional polyolefin applications. The development of competitive alternative materials with comparable performance characteristics and potentially lower environmental impact creates market share pressure and necessitates continuous innovation in polyolefin technology.

Circular economy transformation presents unprecedented opportunities for European polyolefin market participants to develop innovative business models centered on recycling, reuse, and material recovery. Chemical recycling technologies offer pathways to convert polyolefin waste into high-quality feedstocks, creating closed-loop systems that address environmental concerns while generating new revenue streams.

Bio-based polyolefin development represents a strategic opportunity to capture growing demand for sustainable materials while maintaining the performance characteristics that make polyolefins attractive for diverse applications. Investment in bio-feedstock processing and polymer synthesis technologies positions companies to serve environmentally conscious customers and comply with evolving regulatory requirements.

Advanced application development in emerging sectors such as electric vehicles, renewable energy, and smart infrastructure creates opportunities for specialized polyolefin grades with enhanced properties. The transition to electric mobility generates demand for lightweight, electrically insulating materials, while renewable energy applications require materials with superior weatherability and mechanical performance.

Digital integration across the polyolefin value chain enables optimization of production processes, supply chain management, and customer service delivery. Implementation of IoT sensors, artificial intelligence, and blockchain technologies creates opportunities for efficiency improvements, quality enhancement, and transparency that differentiate market participants and create competitive advantages.

Supply-demand equilibrium in the Europe polyolefin market reflects complex interactions between production capacity, consumption patterns, trade flows, and inventory management strategies. Capacity utilization rates averaging 85-90% across major production facilities indicate healthy market conditions while maintaining flexibility for demand fluctuations and maintenance schedules.

Price dynamics demonstrate sensitivity to feedstock costs, energy prices, and competitive pressures from imports and alternative materials. The European market’s premium positioning relative to global commodity markets reflects quality advantages, service capabilities, and regulatory compliance that justify price differentials for many applications.

Innovation cycles drive market evolution through continuous development of new grades, processing technologies, and application solutions. Research and development investments focus on sustainability improvements, performance enhancement, and cost optimization that maintain European competitiveness in global markets.

Trade patterns show Europe as both a significant producer and consumer of polyolefin materials, with export opportunities in specialized grades and import dependencies for certain commodity products. Regional integration within the European Union facilitates efficient distribution and supply chain optimization across national boundaries.

Comprehensive market analysis employs a multi-faceted research approach combining primary data collection, secondary source analysis, and quantitative modeling to provide accurate and actionable insights into the Europe polyolefin market. Primary research includes structured interviews with industry executives, technical experts, and market participants across the value chain to capture current market conditions, strategic priorities, and future expectations.

Secondary research encompasses analysis of company financial reports, industry publications, regulatory documents, and trade statistics to establish market baselines and identify trends. Patent analysis and technology assessment provide insights into innovation directions and competitive positioning among market participants.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources, statistical analysis, and expert review. Market sizing methodologies employ bottom-up and top-down approaches to establish consumption patterns, production capacities, and growth projections with appropriate confidence intervals.

Analytical frameworks include Porter’s Five Forces analysis, SWOT assessment, and scenario planning to evaluate market attractiveness, competitive dynamics, and potential future developments. Quantitative models incorporate economic indicators, demographic trends, and technological factors to generate robust market forecasts and strategic recommendations.

Germany maintains its position as the largest European polyolefin market, accounting for approximately 28% regional consumption, driven by robust automotive, packaging, and chemical industries. The country’s advanced manufacturing capabilities, strong research infrastructure, and strategic location create competitive advantages for polyolefin producers and converters serving European and global markets.

Western European markets including France, Italy, Spain, and the United Kingdom collectively represent 45% market share, characterized by mature applications, sophisticated end-users, and emphasis on high-performance materials. These markets demonstrate stable demand patterns with growth opportunities in specialty applications and sustainable solutions.

Central and Eastern Europe exhibits the highest growth potential, with countries like Poland, Czech Republic, and Hungary showing 6-8% annual growth rates driven by industrial development, infrastructure investment, and increasing consumer spending. These markets offer opportunities for capacity expansion and market penetration strategies.

Nordic countries demonstrate leadership in sustainability initiatives and circular economy implementation, creating demand for recycled content materials and bio-based alternatives. The region’s environmental consciousness and regulatory framework influence product development and market positioning strategies across the broader European market.

Benelux region serves as a critical hub for polyolefin production and distribution, leveraging port infrastructure, chemical industry clusters, and favorable business environments. The region’s strategic importance extends beyond domestic consumption to serve as a gateway for European market access and export operations.

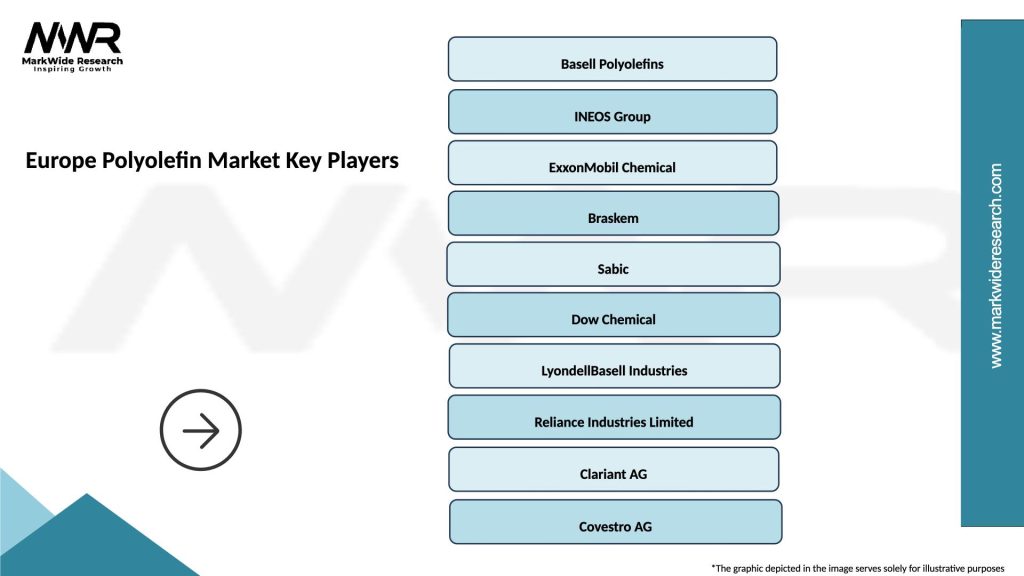

Market leadership in the Europe polyolefin sector features a concentrated yet competitive structure with several key players maintaining significant market positions through operational excellence, innovation capabilities, and strategic positioning:

Competitive strategies emphasize differentiation through product innovation, sustainability leadership, and customer service excellence. Market participants invest heavily in research and development, capacity optimization, and strategic partnerships to maintain competitive positioning and capture growth opportunities in evolving market conditions.

Product-based segmentation reveals distinct market dynamics and growth patterns across different polyolefin categories:

By Product Type:

By Application:

By End-Use Industry:

Polyethylene categories demonstrate distinct performance characteristics and market positioning within the European landscape. High-density polyethylene (HDPE) maintains strong demand in pipe applications, chemical containers, and automotive fuel tanks, benefiting from excellent chemical resistance and mechanical properties. The segment shows steady growth supported by infrastructure development and replacement of traditional materials.

Low-density polyethylene (LDPE) and linear low-density polyethylene (LLDPE) dominate flexible packaging applications, where superior processability, transparency, and sealing properties create competitive advantages. These categories benefit from e-commerce growth, food packaging innovation, and agricultural film applications that drive consistent demand growth.

Polypropylene segments exhibit strong growth potential in automotive applications, where lightweight properties and design flexibility support vehicle efficiency improvements. Impact copolymers and random copolymers serve specialized applications requiring enhanced toughness or transparency, commanding premium pricing and higher margins.

Specialty polyolefin categories represent the highest value segments, including metallocene polyolefins with superior optical properties and mechanical performance. These advanced materials enable new application development and provide differentiation opportunities for producers investing in catalyst technology and process optimization.

Manufacturers benefit from the European polyolefin market’s stability, regulatory clarity, and innovation ecosystem that supports long-term investment planning and technology development. Operational advantages include access to skilled workforce, advanced infrastructure, and collaborative research institutions that enhance competitiveness and market positioning.

Converters and processors gain access to high-quality raw materials, technical support, and supply chain reliability that enable efficient operations and product quality assurance. The European market’s emphasis on sustainability creates opportunities for value-added services and differentiated product offerings that command premium pricing.

End-users benefit from product quality, regulatory compliance, and innovation that meet demanding application requirements while supporting sustainability objectives. Supply chain advantages include reduced logistics costs, shorter lead times, and responsive customer service that enhance operational efficiency and market responsiveness.

Investors find attractive opportunities in a market characterized by stable cash flows, growth potential, and strategic importance within the broader chemical industry. The sector’s evolution toward sustainability and circular economy principles creates long-term value creation opportunities aligned with ESG investment criteria.

Research institutions benefit from industry collaboration, funding opportunities, and real-world application of advanced polymer science research. The European market’s innovation focus creates demand for cutting-edge research and development that advances the field of polymer chemistry and materials science.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend reshaping the European polyolefin market, with companies investing heavily in recycling technologies, bio-based feedstocks, and circular economy solutions. Mechanical recycling capacity expansion and chemical recycling technology development create new value streams while addressing environmental concerns and regulatory requirements.

Digitalization initiatives accelerate across the industry, with smart manufacturing systems, predictive maintenance, and supply chain optimization technologies improving operational efficiency and customer service. Data analytics and artificial intelligence applications enable better demand forecasting, quality control, and process optimization that enhance competitiveness.

Application diversification drives market growth through development of specialized grades for emerging applications in electric vehicles, renewable energy infrastructure, and advanced packaging solutions. Lightweighting trends in automotive and aerospace sectors create demand for high-performance polyolefin materials with superior strength-to-weight ratios.

Collaborative partnerships between producers, converters, recyclers, and end-users become increasingly important for developing integrated solutions and circular economy business models. Value chain integration strategies focus on creating closed-loop systems that optimize resource utilization and minimize environmental impact.

Regulatory evolution continues to influence market dynamics through extended producer responsibility requirements, plastic waste reduction targets, and sustainability reporting mandates. Companies adapt through proactive compliance strategies and innovation investments that align with regulatory directions.

Capacity expansion projects across Europe focus on high-value specialty grades and sustainable production technologies rather than commodity volume increases. MarkWide Research analysis indicates that recent investments emphasize flexibility, efficiency, and environmental performance to maintain competitiveness in evolving market conditions.

Technology partnerships between chemical companies and technology providers accelerate development of advanced recycling processes, bio-based feedstock utilization, and next-generation catalyst systems. These collaborations enable faster commercialization of innovative solutions and risk sharing for capital-intensive projects.

Acquisition activities target companies with specialized technologies, recycling capabilities, or strategic market positions that complement existing operations. Consolidation trends focus on creating integrated value chains and achieving synergies in research, production, and market access.

Regulatory compliance initiatives drive significant investments in environmental management systems, product stewardship programs, and transparency reporting. Companies proactively engage with regulators and stakeholders to influence policy development and ensure sustainable business practices.

Innovation breakthroughs in catalyst technology, reactor design, and polymer chemistry enable production of advanced materials with enhanced properties and reduced environmental impact. These developments support premium positioning and new application development that drive market growth and profitability.

Strategic recommendations for European polyolefin market participants emphasize the critical importance of sustainability integration, innovation investment, and value chain collaboration to maintain competitiveness and capture growth opportunities. MWR analysis suggests that companies should prioritize circular economy business models and advanced recycling capabilities to address regulatory requirements and customer demands.

Investment priorities should focus on specialty grade development, digital technology implementation, and geographic expansion in high-growth Central and Eastern European markets. Companies should evaluate acquisition opportunities that provide access to recycling technologies, bio-based feedstocks, or specialized application expertise that complement existing capabilities.

Operational excellence initiatives should emphasize energy efficiency, waste reduction, and process optimization to improve cost competitiveness and environmental performance. Implementation of Industry 4.0 technologies can enhance productivity, quality control, and supply chain responsiveness while reducing operational costs.

Market positioning strategies should emphasize differentiation through sustainability leadership, technical innovation, and customer service excellence rather than competing primarily on price. Development of integrated solutions and value-added services can create competitive moats and improve customer loyalty in challenging market conditions.

Risk management approaches should address feedstock volatility, regulatory changes, and competitive pressures through diversification strategies, flexible operations, and proactive stakeholder engagement. Companies should develop scenario planning capabilities and contingency strategies to navigate uncertain market conditions effectively.

Long-term prospects for the European polyolefin market remain positive despite near-term challenges, with growth driven by innovation, sustainability transformation, and emerging application development. Market evolution toward circular economy principles and advanced materials creates opportunities for companies that invest in appropriate technologies and business model adaptation.

Growth projections indicate continued expansion at 3.8-4.5% CAGR through 2030, supported by automotive lightweighting trends, packaging innovation, and infrastructure development. Specialty grades and sustainable solutions are expected to outperform commodity segments, driving margin improvement and value creation for market participants.

Technology development will focus on advanced recycling processes, bio-based feedstock integration, and high-performance material development that addresses evolving customer requirements and regulatory mandates. Digital transformation initiatives will enhance operational efficiency and enable new business models centered on data-driven insights and customer collaboration.

Regulatory landscape evolution will continue to influence market dynamics through plastic waste reduction targets, extended producer responsibility requirements, and sustainability reporting mandates. Companies that proactively address these requirements through innovation and collaboration will achieve competitive advantages and market leadership positions.

Competitive dynamics will intensify as market participants compete for growth opportunities in specialty segments while managing cost pressures in commodity applications. Success will depend on innovation capabilities, operational excellence, and strategic positioning in high-value market segments that offer sustainable competitive advantages.

The Europe polyolefin market stands at a critical juncture where traditional industry strengths must evolve to address contemporary challenges and opportunities. Sustainability imperatives, regulatory evolution, and changing customer expectations create both pressures and possibilities that will define the market’s future trajectory. Companies that successfully navigate this transformation through innovation investment, circular economy integration, and strategic collaboration will emerge as leaders in the next phase of market development.

Market fundamentals remain robust, supported by diversified application portfolios, technological leadership, and strong customer relationships that provide stability amid changing conditions. The European market’s emphasis on quality, compliance, and innovation creates competitive advantages that justify premium positioning and support long-term value creation for stakeholders across the value chain.

Future success will depend on companies’ ability to balance operational excellence with strategic transformation, leveraging existing strengths while developing new capabilities in sustainability, digitalization, and advanced materials. The polyolefin industry’s evolution toward circular economy principles and high-performance applications offers significant opportunities for growth, differentiation, and value creation in the years ahead.

What is Polyolefin?

Polyolefin refers to a group of polymers produced from olefin monomers, primarily used in various applications such as packaging, automotive parts, and consumer goods. Common types include polyethylene and polypropylene.

What are the key players in the Europe Polyolefin Market?

Key players in the Europe Polyolefin Market include BASF, LyondellBasell, and INEOS, which are known for their extensive product portfolios and innovations in polyolefin applications, among others.

What are the main drivers of the Europe Polyolefin Market?

The main drivers of the Europe Polyolefin Market include the growing demand for lightweight materials in the automotive industry, increasing use in packaging solutions, and advancements in recycling technologies.

What challenges does the Europe Polyolefin Market face?

The Europe Polyolefin Market faces challenges such as fluctuating raw material prices, environmental concerns regarding plastic waste, and stringent regulations on plastic usage.

What opportunities exist in the Europe Polyolefin Market?

Opportunities in the Europe Polyolefin Market include the development of bio-based polyolefins, increasing investments in sustainable packaging solutions, and the expansion of applications in the healthcare sector.

What trends are shaping the Europe Polyolefin Market?

Trends shaping the Europe Polyolefin Market include the rise of circular economy initiatives, innovations in polymer processing technologies, and a shift towards more sustainable and recyclable materials.

Europe Polyolefin Market

| Segmentation Details | Description |

|---|---|

| Product Type | Polyethylene, Polypropylene, Polybutylene, Polystyrene |

| Grade | High-Density, Low-Density, Linear Low-Density, Specialty |

| Application | Packaging, Automotive Components, Consumer Goods, Construction |

| End Use Industry | Healthcare, Agriculture, Electronics, Textiles |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Polyolefin Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at