444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe plastic waste management market represents a critical component of the continent’s circular economy initiatives and environmental sustainability goals. This dynamic sector encompasses comprehensive solutions for collecting, sorting, recycling, and processing plastic waste materials across diverse industries and consumer segments. European nations have established themselves as global leaders in implementing advanced waste management technologies and regulatory frameworks that promote sustainable plastic waste handling practices.

Market dynamics in the region are primarily driven by stringent environmental regulations, increasing consumer awareness about plastic pollution, and technological innovations in recycling processes. The market demonstrates robust growth potential, with industry projections indicating a compound annual growth rate of 6.2% through the forecast period. Germany, France, and the Netherlands emerge as key contributors to market expansion, leveraging their advanced infrastructure and progressive environmental policies.

Technological advancements in chemical recycling, mechanical processing, and waste-to-energy conversion are reshaping the competitive landscape. The integration of artificial intelligence and automation technologies has enhanced sorting efficiency by approximately 35%, while advanced recycling techniques have improved material recovery rates significantly. Circular economy principles continue to drive innovation in packaging design and waste reduction strategies across European markets.

The Europe plastic waste management market refers to the comprehensive ecosystem of services, technologies, and infrastructure dedicated to the collection, processing, and transformation of plastic waste materials into valuable resources or environmentally safe disposal methods. This market encompasses various stakeholders including waste collection companies, recycling facilities, technology providers, and regulatory bodies working collaboratively to address the growing challenge of plastic waste accumulation.

Plastic waste management involves multiple interconnected processes designed to minimize environmental impact while maximizing resource recovery. These processes include mechanical recycling, where plastic materials are physically processed and reformed into new products, and chemical recycling, which breaks down polymers into their molecular components for reuse. Advanced sorting technologies utilize optical recognition and artificial intelligence to separate different plastic types with remarkable precision.

The market scope extends beyond traditional recycling to encompass innovative approaches such as plastic-to-fuel conversion, biodegradable plastic development, and extended producer responsibility programs. European regulatory frameworks mandate specific recycling targets and waste reduction goals, creating a structured environment for market growth and technological innovation.

The European plastic waste management sector demonstrates exceptional resilience and growth potential, driven by comprehensive regulatory support and increasing environmental consciousness among consumers and businesses. Market expansion is characterized by significant investments in advanced recycling technologies and infrastructure development across key European nations.

Key market drivers include the European Union’s ambitious recycling targets, which mandate 50% plastic packaging recycling rates by 2025, and the growing adoption of circular economy principles across industries. Technological innovation remains at the forefront of market development, with chemical recycling technologies showing particular promise for processing complex plastic waste streams that traditional mechanical methods cannot handle effectively.

Regional market leadership is evident in countries like Germany and the Netherlands, which have achieved recycling rates exceeding 45% for plastic packaging materials. Investment patterns indicate strong capital allocation toward research and development activities, with particular focus on developing solutions for multilayer packaging and contaminated plastic waste streams.

Market challenges include fluctuating raw material prices, varying quality of collected plastic waste, and the need for standardized collection and sorting systems across different European regions. However, these challenges are being addressed through collaborative initiatives and technological advancements that promise to enhance overall market efficiency and effectiveness.

Strategic market analysis reveals several critical insights that shape the European plastic waste management landscape. The market demonstrates strong correlation between regulatory stringency and technological advancement, with regions implementing stricter environmental policies showing higher adoption rates of innovative waste management solutions.

Market penetration varies significantly across European regions, with Western European countries demonstrating higher adoption rates compared to Eastern European markets. This disparity presents both challenges and opportunities for market expansion and technology transfer initiatives.

Regulatory frameworks serve as the primary catalyst for market growth, with European Union legislation establishing mandatory recycling targets and extended producer responsibility requirements. The Single-Use Plastics Directive and various national-level regulations create a structured demand for comprehensive waste management solutions across diverse industry sectors.

Environmental consciousness among European consumers continues to drive demand for sustainable packaging solutions and responsible waste management practices. Consumer preference studies indicate that 78% of European consumers actively seek products with recyclable packaging, creating market pressure for improved waste management infrastructure and services.

Technological advancement in recycling processes enables the processing of previously non-recyclable materials, expanding market opportunities and improving economic viability. Chemical recycling technologies demonstrate particular promise for handling complex plastic waste streams, including multilayer packaging and contaminated materials that traditional mechanical recycling cannot process effectively.

Economic incentives provided by government programs and carbon credit systems make plastic waste management investments more attractive to private sector participants. Circular economy initiatives create new revenue streams through material recovery and resource optimization, enhancing the overall business case for comprehensive waste management solutions.

Corporate sustainability commitments from major European companies drive demand for reliable waste management services and recycled material supplies. Many organizations have established ambitious sustainability targets that require robust plastic waste management partnerships and innovative recycling solutions.

Economic volatility in raw material markets creates challenges for recycling operations, as fluctuating prices for virgin plastics can make recycled materials less economically competitive. Market price instability affects investment decisions and long-term planning for waste management infrastructure development.

Technical limitations in current recycling technologies prevent the processing of certain plastic types and contaminated materials, limiting overall market potential. Quality degradation during multiple recycling cycles restricts the applications for recycled materials and affects market demand for processed outputs.

Infrastructure gaps in collection and sorting systems, particularly in rural and less developed regions, limit market expansion and efficiency. Standardization challenges across different European countries create operational complexities and increase costs for companies operating in multiple markets.

Consumer behavior inconsistencies in waste separation and disposal practices affect the quality and quantity of materials available for processing. Contamination issues in collected plastic waste streams require additional processing steps and reduce overall system efficiency.

Investment requirements for advanced recycling technologies and infrastructure development create barriers for smaller market participants and limit competition in certain segments. Regulatory complexity and varying requirements across different European jurisdictions increase compliance costs and operational challenges.

Emerging technologies in chemical recycling and advanced sorting present significant opportunities for market expansion and improved processing capabilities. Artificial intelligence applications in waste sorting and quality control offer potential for substantial efficiency improvements and cost reductions across the value chain.

Circular economy initiatives create new business models and revenue opportunities through extended producer responsibility programs and closed-loop material flows. Partnership opportunities between waste management companies and manufacturing industries enable the development of integrated solutions that optimize resource utilization and minimize environmental impact.

Geographic expansion into Eastern European markets presents growth opportunities as these regions develop their waste management infrastructure and implement EU regulatory requirements. Technology transfer initiatives can accelerate market development and create competitive advantages for early movers.

Innovation in biodegradable plastics and alternative materials creates opportunities for specialized waste management solutions and new market segments. Research and development collaborations between academic institutions and industry participants drive technological advancement and create intellectual property opportunities.

Digital transformation in waste management operations through IoT sensors, blockchain tracking, and data analytics platforms offers opportunities for improved efficiency and transparency. Consumer engagement platforms and mobile applications can enhance participation rates and improve waste stream quality.

Supply chain integration across the European plastic waste management market demonstrates increasing sophistication, with stakeholders developing comprehensive networks that optimize material flows and processing efficiency. Vertical integration strategies enable companies to control quality and costs throughout the value chain while ensuring consistent supply of processed materials.

Competitive dynamics are characterized by consolidation trends as larger companies acquire specialized technology providers and regional operators to expand their capabilities and geographic reach. Strategic partnerships between waste management companies and technology developers accelerate innovation and market penetration.

Pricing mechanisms in the market reflect the complex interplay between collection costs, processing expenses, and end-market demand for recycled materials. Market volatility in commodity prices affects profitability and investment decisions across the entire value chain.

Regulatory evolution continues to shape market dynamics, with new legislation and policy initiatives creating both opportunities and challenges for market participants. Compliance requirements drive standardization and quality improvements while increasing operational costs for some market segments.

Technology adoption patterns vary significantly across different market segments and geographic regions, with advanced recycling technologies showing higher penetration rates in developed markets. Innovation cycles in the industry are accelerating, driven by competitive pressures and regulatory requirements.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research activities include extensive interviews with industry executives, technology providers, regulatory officials, and end-users across various European markets to gather firsthand insights into market trends and challenges.

Secondary research encompasses detailed analysis of industry reports, government publications, academic studies, and company financial statements to validate primary findings and identify emerging trends. Data triangulation methods ensure consistency and reliability across different information sources and research approaches.

Market sizing methodologies utilize bottom-up and top-down approaches to validate market estimates and growth projections. Statistical analysis techniques including regression analysis and correlation studies help identify key market drivers and their relative impact on market development.

Geographic segmentation analysis examines market characteristics and growth patterns across different European regions, considering regulatory environments, economic conditions, and infrastructure development levels. Technology assessment evaluates the current state and future potential of various plastic waste management technologies and their market implications.

Competitive intelligence gathering involves systematic analysis of key market participants, their strategies, capabilities, and market positioning. Trend analysis identifies emerging patterns and potential disruptions that could affect future market development and competitive dynamics.

Western European markets demonstrate the highest levels of market maturity and technological sophistication, with countries like Germany, Netherlands, and Sweden leading in recycling rates and infrastructure development. These markets benefit from well-established regulatory frameworks and high levels of consumer awareness and participation.

Germany maintains its position as the largest market in the region, accounting for approximately 28% of European plastic waste processing capacity. The country’s advanced dual system for packaging waste collection and its strong manufacturing base create robust demand for recycled materials. German companies are at the forefront of developing innovative recycling technologies and circular economy solutions.

The Netherlands demonstrates exceptional performance in waste-to-energy conversion and advanced recycling technologies, achieving recycling rates of over 42% for plastic packaging. Dutch innovation in chemical recycling and plastic-to-fuel conversion technologies positions the country as a technology leader in the European market.

Eastern European markets present significant growth opportunities as these regions develop their waste management infrastructure and implement EU regulatory requirements. Countries like Poland, Czech Republic, and Hungary are investing heavily in modern recycling facilities and collection systems.

Southern European markets including Italy, Spain, and France show strong growth potential driven by increasing regulatory pressure and consumer awareness. Mediterranean countries face particular challenges with marine plastic pollution, creating specialized market opportunities for coastal waste management solutions.

Nordic countries continue to lead in innovation and environmental performance, with Sweden and Denmark achieving some of the highest recycling rates in Europe. These markets serve as testing grounds for advanced technologies and sustainable business models that are later adopted across the broader European market.

Market leadership in the European plastic waste management sector is characterized by a mix of large multinational corporations and specialized regional players. Industry consolidation continues as companies seek to achieve economies of scale and expand their technological capabilities through strategic acquisitions and partnerships.

Competitive strategies focus on technological innovation, geographic expansion, and vertical integration to create comprehensive service offerings. Strategic partnerships between waste management companies and technology providers are becoming increasingly common as companies seek to enhance their capabilities and market reach.

Innovation leadership is demonstrated through investments in research and development, with leading companies allocating significant resources to developing next-generation recycling technologies and sustainable business models.

By Waste Type: The market encompasses various plastic waste categories including packaging materials, automotive components, electronic waste, construction materials, and textile fibers. Packaging waste represents the largest segment, accounting for approximately 60% of total plastic waste volume in European markets.

By Processing Technology: Market segmentation includes mechanical recycling, chemical recycling, biological treatment, and energy recovery methods. Mechanical recycling maintains the dominant market position due to its established infrastructure and cost-effectiveness for clean plastic waste streams.

By End-Use Application: Recycled plastic materials find applications in packaging, automotive, construction, textiles, and consumer goods manufacturing. Packaging applications drive the highest demand for recycled materials, supported by regulatory requirements and corporate sustainability commitments.

By Collection Method: The market includes curbside collection, deposit return systems, commercial waste collection, and specialized industrial waste management services. Curbside collection systems handle the majority of residential plastic waste, while specialized services address industrial and commercial waste streams.

By Service Type: Market offerings encompass collection services, sorting and processing, recycling operations, and waste-to-energy conversion. Integrated service providers offering comprehensive solutions across multiple segments demonstrate stronger market positioning and customer relationships.

Packaging Waste Management represents the most developed and regulated segment of the European market, driven by EU packaging and packaging waste directives. Food packaging recycling presents particular challenges due to contamination issues, requiring specialized cleaning and processing technologies.

Automotive Plastic Recycling is gaining momentum as the automotive industry embraces circular economy principles and seeks to reduce its environmental footprint. End-of-life vehicle regulations mandate specific recycling targets, creating structured demand for automotive plastic processing services.

Electronic Waste Plastics require specialized handling due to the presence of hazardous materials and complex plastic compositions. WEEE directive compliance drives demand for certified processing facilities capable of safely handling electronic waste plastics.

Construction and Demolition Plastics represent an emerging market segment with significant growth potential as building renovation and demolition activities increase across Europe. Building material recycling initiatives create new opportunities for plastic waste recovery and processing.

Agricultural Plastic Waste including greenhouse films, mulch films, and irrigation systems requires specialized collection and processing solutions. Rural collection challenges and contamination issues create unique market dynamics in this segment.

Marine Plastic Waste management has become a priority focus area, with specialized programs and technologies being developed to address ocean and coastal plastic pollution. Fishing industry partnerships and port-based collection systems are expanding market opportunities in this segment.

Environmental Impact Reduction represents the primary benefit for all stakeholders, with effective plastic waste management contributing to reduced landfill usage, lower greenhouse gas emissions, and decreased marine pollution. Circular economy principles enable resource conservation and sustainable material flows.

Economic Value Creation through material recovery and resource optimization provides financial benefits to waste management companies, manufacturers, and consumers. Job creation in the recycling sector contributes to local economic development and provides employment opportunities across skill levels.

Regulatory Compliance benefits enable companies to meet mandatory recycling targets and avoid penalties while demonstrating corporate environmental responsibility. Extended producer responsibility programs create structured frameworks for industry participation and cost sharing.

Technology Innovation drives competitive advantages and creates intellectual property opportunities for companies investing in research and development. Process optimization through advanced technologies reduces operational costs and improves material quality.

Market Access to recycled materials provides manufacturers with sustainable raw material sources and helps meet consumer demand for environmentally responsible products. Supply chain resilience is enhanced through diversified material sourcing and reduced dependence on virgin plastic production.

Brand Enhancement opportunities arise from participation in sustainable waste management initiatives, supporting corporate sustainability goals and consumer engagement strategies. Stakeholder relationships are strengthened through collaborative environmental initiatives and community engagement programs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Chemical Recycling Adoption is accelerating across European markets as companies seek solutions for complex plastic waste streams that cannot be processed through traditional mechanical recycling. Investment in pyrolysis and depolymerization technologies is increasing significantly, with several large-scale facilities under development.

Digital Transformation in waste management operations is enhancing efficiency and transparency through IoT sensors, artificial intelligence, and blockchain tracking systems. Smart waste bins and automated sorting systems are improving collection efficiency and reducing contamination rates.

Extended Producer Responsibility Expansion is creating new business models and revenue streams as more product categories fall under EPR regulations. Packaging producers are increasingly taking direct responsibility for end-of-life management of their products.

Circular Design Innovation is driving development of products and packaging that are designed for recyclability and reuse from the outset. Design for circularity principles are being integrated into product development processes across industries.

Marine Plastic Recovery initiatives are expanding as coastal communities and organizations develop specialized collection and processing systems for ocean plastic waste. Fishing industry partnerships and port-based collection programs are creating new waste streams for processing.

Quality Standardization efforts are improving the consistency and applications of recycled plastic materials through enhanced sorting technologies and quality control systems. Certification programs are helping to build confidence in recycled material quality and performance.

Major infrastructure investments across European markets are expanding processing capacity and technological capabilities. MarkWide Research analysis indicates that several billion-euro investments in advanced recycling facilities are planned or under construction across key European markets.

Strategic partnerships between waste management companies and technology providers are accelerating innovation and market development. Collaborative research initiatives between industry and academic institutions are driving breakthrough developments in recycling technologies.

Regulatory developments including the EU Single-Use Plastics Directive and national-level legislation are reshaping market dynamics and creating new compliance requirements. Policy initiatives supporting circular economy development provide additional market drivers and investment incentives.

Technology breakthroughs in chemical recycling and advanced sorting are expanding the range of materials that can be effectively processed and recycled. Artificial intelligence applications in waste sorting are achieving accuracy rates exceeding 95% for certain material types.

Corporate sustainability commitments from major European companies are creating structured demand for recycled materials and waste management services. Supply chain integration initiatives are developing closed-loop systems that optimize resource utilization and minimize waste generation.

International cooperation on plastic waste management is facilitating technology transfer and best practice sharing across European markets. Cross-border initiatives are addressing transboundary waste flows and harmonizing processing standards.

Investment prioritization should focus on chemical recycling technologies and advanced sorting systems that can handle complex waste streams and improve material recovery rates. Technology diversification strategies will help companies address varying waste stream characteristics and market demands.

Geographic expansion into Eastern European markets presents significant growth opportunities as these regions develop their waste management infrastructure. Early market entry strategies can establish competitive advantages and build market share in developing regions.

Partnership development with technology providers, research institutions, and end-users will accelerate innovation and market penetration. Vertical integration strategies can help companies control quality and costs throughout the value chain.

Digital transformation initiatives should be prioritized to improve operational efficiency and customer service capabilities. Data analytics platforms can provide valuable insights into waste stream characteristics and processing optimization opportunities.

Quality improvement programs are essential for building confidence in recycled materials and expanding end-market applications. Certification and standardization initiatives will help establish consistent quality standards across the industry.

Regulatory engagement and compliance preparation are critical as environmental legislation continues to evolve. Proactive compliance strategies can turn regulatory requirements into competitive advantages and market opportunities.

Market growth prospects remain robust, with industry projections indicating continued expansion driven by regulatory requirements and technological advancement. MWR analysis suggests that the European plastic waste management market will experience sustained growth with increasing emphasis on circular economy principles and advanced recycling technologies.

Technology evolution will continue to expand the range of materials that can be effectively recycled and improve the quality of recycled outputs. Chemical recycling technologies are expected to achieve commercial scale deployment within the next five years, significantly expanding market opportunities.

Regulatory development will likely include more stringent recycling targets and expanded extended producer responsibility requirements. Policy support for circular economy initiatives will create additional market drivers and investment incentives.

Market consolidation is expected to continue as companies seek economies of scale and technological capabilities through strategic acquisitions and partnerships. Vertical integration strategies will become more common as companies seek to control quality and costs throughout the value chain.

Innovation focus will shift toward developing solutions for challenging waste streams and improving the economics of recycling operations. Breakthrough technologies in areas such as enzymatic recycling and molecular recycling could revolutionize the industry within the next decade.

Geographic expansion into developing European markets will continue as infrastructure and regulatory frameworks develop. Cross-border collaboration and harmonization of standards will facilitate market integration and efficiency improvements.

The Europe plastic waste management market stands at a pivotal juncture, characterized by robust regulatory support, technological innovation, and increasing environmental consciousness among consumers and businesses. Market dynamics continue to evolve as stakeholders adapt to changing regulatory requirements and embrace circular economy principles that prioritize resource conservation and sustainable material flows.

Technological advancement remains the key driver of market transformation, with chemical recycling and advanced sorting technologies expanding the range of materials that can be effectively processed and recycled. Investment in innovation and infrastructure development will determine competitive positioning and market success in the coming years.

Regional market development presents both opportunities and challenges, with Western European markets demonstrating maturity and technological sophistication while Eastern European regions offer significant growth potential. Strategic expansion and technology transfer initiatives will be critical for companies seeking to capitalize on these emerging opportunities.

The future outlook for the European plastic waste management market remains positive, supported by continued regulatory development, technological innovation, and growing commitment to environmental sustainability across all market segments. Success in this dynamic market will require strategic vision, technological capability, and collaborative partnerships that address the complex challenges of plastic waste management while creating sustainable value for all stakeholders.

What is Plastic Waste Management?

Plastic Waste Management refers to the processes and strategies involved in handling plastic waste, including collection, recycling, and disposal. It aims to reduce the environmental impact of plastic waste through effective management practices.

What are the key players in the Europe Plastic Waste Management Market?

Key players in the Europe Plastic Waste Management Market include Veolia Environnement, SUEZ, and Biffa, among others. These companies are involved in various aspects of waste management, including recycling and waste-to-energy solutions.

What are the main drivers of the Europe Plastic Waste Management Market?

The main drivers of the Europe Plastic Waste Management Market include increasing regulatory pressures to reduce plastic waste, growing public awareness about environmental issues, and advancements in recycling technologies. These factors are pushing companies to adopt more sustainable waste management practices.

What challenges does the Europe Plastic Waste Management Market face?

The Europe Plastic Waste Management Market faces challenges such as the high costs associated with recycling processes, contamination of recyclable materials, and varying regulations across different countries. These issues can hinder effective waste management efforts.

What opportunities exist in the Europe Plastic Waste Management Market?

Opportunities in the Europe Plastic Waste Management Market include the development of innovative recycling technologies, increased investment in waste management infrastructure, and the potential for circular economy initiatives. These opportunities can enhance sustainability and resource recovery.

What trends are shaping the Europe Plastic Waste Management Market?

Trends shaping the Europe Plastic Waste Management Market include the rise of biodegradable plastics, increased focus on reducing single-use plastics, and the implementation of extended producer responsibility (EPR) policies. These trends are influencing how companies approach waste management.

Europe Plastic Waste Management Market

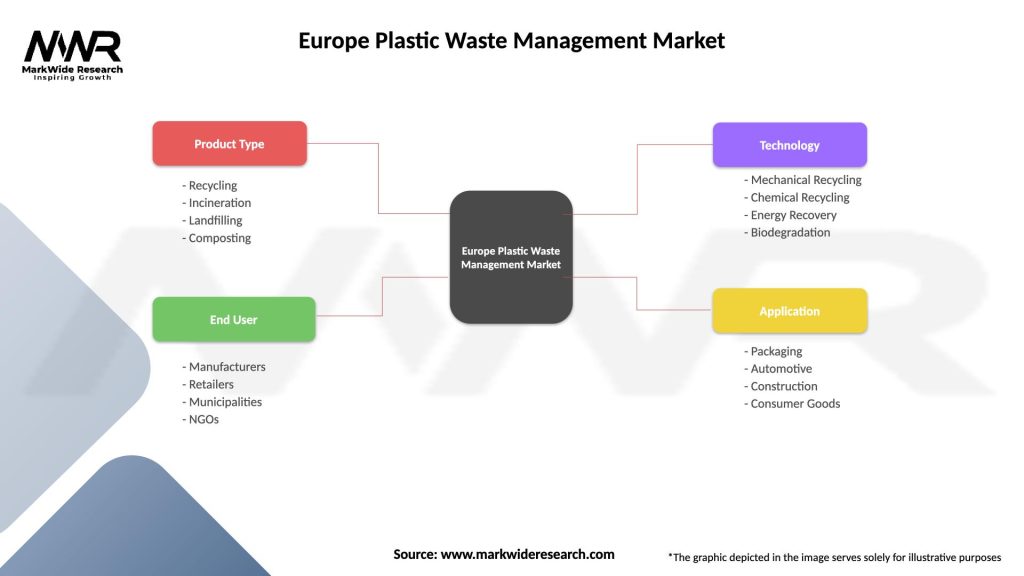

| Segmentation Details | Description |

|---|---|

| Product Type | Recycling, Incineration, Landfilling, Composting |

| End User | Manufacturers, Retailers, Municipalities, NGOs |

| Technology | Mechanical Recycling, Chemical Recycling, Energy Recovery, Biodegradation |

| Application | Packaging, Automotive, Construction, Consumer Goods |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Plastic Waste Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at