444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe pharmaceutical glass vials and ampoules market represents a critical component of the continent’s healthcare infrastructure, serving as essential packaging solutions for injectable medications, vaccines, and biologics. This specialized market encompasses the manufacturing, distribution, and utilization of high-quality glass containers designed to maintain the sterility, stability, and efficacy of pharmaceutical products throughout their lifecycle. European pharmaceutical manufacturers rely heavily on these precision-engineered glass containers to meet stringent regulatory requirements and ensure patient safety across diverse therapeutic applications.

Market dynamics in the European region are characterized by robust demand from pharmaceutical companies, biotechnology firms, and contract manufacturing organizations. The market experiences consistent growth driven by increasing pharmaceutical production, expanding vaccine manufacturing capabilities, and rising demand for biologics and biosimilar products. Growth rates in the sector demonstrate strong momentum, with the market expanding at a compound annual growth rate (CAGR) of approximately 6.8% over recent years, reflecting the essential nature of these packaging solutions in modern healthcare delivery.

Regional leadership in pharmaceutical glass manufacturing is concentrated in key European countries including Germany, France, Italy, and the United Kingdom, where established glass manufacturers maintain state-of-the-art production facilities. These facilities produce various types of glass containers, including Type I borosilicate glass vials, clear and amber glass ampoules, and specialized containers for sensitive pharmaceutical formulations. The market serves both domestic pharmaceutical production and export markets, positioning Europe as a significant global supplier of high-quality pharmaceutical glass packaging.

The Europe pharmaceutical glass vials and ampoules market refers to the comprehensive ecosystem encompassing the design, manufacturing, distribution, and application of specialized glass containers used for packaging injectable pharmaceutical products, vaccines, and biological medicines across European countries. These containers are manufactured to meet the highest standards of pharmaceutical packaging, ensuring product integrity, sterility, and compatibility with various drug formulations.

Glass vials are small bottles typically featuring narrow necks and closure systems, designed to hold liquid or lyophilized pharmaceutical products. They are commonly used for vaccines, antibiotics, hormones, and other injectable medications. Ampoules are sealed glass containers that are broken open when the contents are needed, providing a tamper-evident and sterile packaging solution for single-dose medications. Both container types are manufactured using pharmaceutical-grade glass materials that comply with European Pharmacopoeia standards and international quality regulations.

The market encompasses various stakeholders including glass manufacturers, pharmaceutical companies, biotechnology firms, contract manufacturing organizations, and regulatory bodies that ensure compliance with safety and quality standards throughout the supply chain.

Strategic positioning of the Europe pharmaceutical glass vials and ampoules market reflects its fundamental role in supporting the continent’s pharmaceutical industry growth and healthcare objectives. The market demonstrates remarkable resilience and consistent expansion, driven by increasing pharmaceutical production volumes, growing vaccine manufacturing requirements, and rising demand for biologics and specialty medications. Market participants benefit from established manufacturing infrastructure, advanced glass forming technologies, and strong regulatory frameworks that ensure product quality and patient safety.

Key growth drivers include the expansion of pharmaceutical manufacturing capacity, increasing investment in vaccine production facilities, and growing adoption of biologics and biosimilar products. The market experiences particularly strong demand from vaccine manufacturers, which account for approximately 35% of total glass container consumption in the European pharmaceutical sector. Additionally, the trend toward personalized medicine and specialty pharmaceuticals creates opportunities for customized glass packaging solutions.

Technological advancements in glass manufacturing processes, including improved forming techniques, enhanced surface treatments, and advanced quality control systems, contribute to market growth and product innovation. The integration of automation and digital technologies in manufacturing operations improves production efficiency and ensures consistent product quality. Sustainability initiatives also drive market evolution, with manufacturers developing eco-friendly glass formulations and implementing circular economy principles in their operations.

Market segmentation reveals distinct patterns in product demand and application preferences across the European pharmaceutical glass containers market. The following key insights highlight critical market dynamics:

Pharmaceutical industry expansion serves as the primary driver for the Europe pharmaceutical glass vials and ampoules market, with increasing drug development activities, growing pharmaceutical production volumes, and expanding therapeutic applications creating sustained demand for high-quality glass packaging solutions. The continuous growth of the European pharmaceutical sector, supported by robust research and development investments and favorable regulatory environments, directly translates to increased consumption of glass containers across various pharmaceutical applications.

Vaccine manufacturing growth represents a particularly significant driver, especially following global health initiatives and pandemic preparedness efforts. European vaccine manufacturers have substantially expanded their production capabilities, requiring corresponding increases in glass vial supply. The development of new vaccines, including mRNA-based formulations and combination vaccines, creates additional demand for specialized glass containers that can maintain product stability and sterility throughout the supply chain.

Biologics and biosimilar expansion drives market growth as these complex pharmaceutical products require specialized packaging solutions to maintain their efficacy and safety. The increasing adoption of biological therapies for cancer treatment, autoimmune disorders, and rare diseases creates demand for high-quality glass containers that can preserve the integrity of sensitive protein-based medications. Regulatory compliance requirements also drive market demand, as pharmaceutical companies must use approved packaging materials that meet stringent quality standards for drug safety and efficacy.

Technological innovation in pharmaceutical manufacturing processes creates opportunities for advanced glass container solutions, including pre-filled syringes, combination products, and specialized delivery systems that require precision-engineered glass components.

High capital investment requirements pose significant barriers to entry in the pharmaceutical glass manufacturing industry, as establishing production facilities requires substantial financial resources for specialized equipment, quality control systems, and regulatory compliance infrastructure. The complex manufacturing processes and stringent quality standards necessitate significant upfront investments that may limit market participation to established players with adequate financial capabilities.

Regulatory complexity creates challenges for market participants, as pharmaceutical glass containers must comply with multiple regulatory frameworks including European Pharmacopoeia standards, FDA requirements for export markets, and various national regulations. The lengthy approval processes and extensive documentation requirements can delay product launches and increase operational costs for manufacturers seeking to introduce new products or expand into different market segments.

Raw material price volatility affects manufacturing costs and profit margins, particularly for specialized glass formulations that require high-purity raw materials. Fluctuations in energy costs, silica sand prices, and other essential materials can impact production economics and pricing strategies. Supply chain disruptions can also create challenges, especially for manufacturers dependent on specific raw material sources or specialized equipment components.

Competition from alternative packaging materials presents ongoing challenges, as pharmaceutical companies evaluate various packaging options including plastic containers, polymer-based solutions, and hybrid materials that may offer cost advantages or specific performance benefits for certain applications. The need to demonstrate superior value propositions compared to alternative packaging solutions requires continuous innovation and competitive pricing strategies.

Emerging therapeutic areas present substantial growth opportunities for pharmaceutical glass container manufacturers, particularly in personalized medicine, gene therapy, and advanced biologics that require specialized packaging solutions. The development of novel drug delivery systems, including combination products and device-integrated solutions, creates demand for customized glass containers with unique specifications and performance characteristics.

Sustainability initiatives offer opportunities for market differentiation and growth through the development of eco-friendly glass formulations, improved recycling programs, and circular economy approaches to glass container manufacturing. European pharmaceutical companies increasingly prioritize environmental sustainability in their supply chain decisions, creating market opportunities for manufacturers that can demonstrate environmental leadership and sustainable practices.

Digital transformation in pharmaceutical manufacturing creates opportunities for smart glass containers with integrated tracking technologies, temperature monitoring capabilities, and authentication features that enhance supply chain visibility and patient safety. The integration of Internet of Things (IoT) technologies and digital tracking systems represents a growing market opportunity for innovative glass container solutions.

Geographic expansion opportunities exist in emerging European markets and export markets where pharmaceutical manufacturing is expanding. The establishment of regional manufacturing capabilities and strategic partnerships can provide access to new customer bases and growth markets. Contract manufacturing growth also creates opportunities as pharmaceutical companies increasingly outsource production activities to specialized contract manufacturers that require reliable glass container suppliers.

Supply and demand dynamics in the Europe pharmaceutical glass vials and ampoules market reflect the interplay between pharmaceutical industry growth, manufacturing capacity expansion, and evolving customer requirements. The market experiences cyclical demand patterns influenced by pharmaceutical production schedules, seasonal vaccine requirements, and new product launches that create temporary supply constraints or surplus capacity situations.

Competitive dynamics are characterized by a mix of large multinational glass manufacturers and specialized regional suppliers that serve specific market segments or geographic areas. Market leaders compete on quality, reliability, technical capabilities, and customer service, while smaller players often focus on niche applications or customized solutions. The consolidation trend in the pharmaceutical industry influences glass container demand patterns and supplier relationships.

Innovation dynamics drive continuous product development and manufacturing process improvements, with companies investing in research and development to create advanced glass formulations, improved manufacturing techniques, and enhanced product performance characteristics. The pace of innovation is accelerated by customer demands for specialized solutions and regulatory requirements for improved product safety and quality.

Pricing dynamics reflect the balance between manufacturing costs, competitive pressures, and customer value requirements. Long-term supply agreements and strategic partnerships help stabilize pricing relationships, while market competition and alternative packaging options influence pricing strategies. Quality premiums are common for specialized applications and high-performance glass containers that meet stringent pharmaceutical requirements.

Comprehensive market analysis for the Europe pharmaceutical glass vials and ampoules market employs a multi-faceted research approach combining primary and secondary research methodologies to ensure accurate and reliable market insights. The research framework incorporates quantitative and qualitative analysis techniques to provide a complete understanding of market dynamics, competitive landscapes, and future growth prospects.

Primary research activities include structured interviews with industry executives, pharmaceutical manufacturers, glass container suppliers, and regulatory experts across key European markets. These interviews provide firsthand insights into market trends, customer requirements, technological developments, and competitive strategies. Survey methodologies capture quantitative data on market preferences, purchasing patterns, and growth projections from representative industry stakeholders.

Secondary research encompasses comprehensive analysis of industry reports, regulatory documents, company financial statements, patent filings, and trade publications to gather market data and validate primary research findings. The research methodology includes analysis of production statistics, trade data, regulatory approvals, and investment announcements to track market developments and identify emerging trends.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review panels, and statistical analysis techniques. The methodology incorporates market modeling approaches to project future growth scenarios and assess the impact of various market drivers and constraints on industry development.

Germany maintains its position as the largest market for pharmaceutical glass vials and ampoules in Europe, accounting for approximately 28% of regional market share. The country’s strong pharmaceutical manufacturing base, including major companies and contract manufacturers, drives consistent demand for high-quality glass containers. German glass manufacturers benefit from advanced production technologies, skilled workforce, and proximity to key pharmaceutical customers.

France represents the second-largest market with significant pharmaceutical production capabilities and a strong focus on vaccine manufacturing. French pharmaceutical companies require substantial quantities of glass containers for domestic production and export markets. The country’s emphasis on biologics and specialty pharmaceuticals creates demand for specialized glass packaging solutions.

Italy demonstrates strong market growth driven by expanding pharmaceutical manufacturing capacity and increasing focus on generic drug production. Italian glass manufacturers serve both domestic and international markets, with particular strength in traditional pharmaceutical applications and emerging biosimilar products.

United Kingdom maintains significant market presence despite Brexit-related changes, with continued pharmaceutical manufacturing activities and strong export capabilities. The UK market shows particular strength in vaccine production and specialized pharmaceutical applications that require high-quality glass containers.

Other European markets including Spain, Netherlands, Belgium, and Switzerland contribute to regional market growth through pharmaceutical manufacturing activities, research and development centers, and specialized production facilities that require reliable glass container supplies.

Market leadership in the Europe pharmaceutical glass vials and ampoules market is established by several key players that maintain strong competitive positions through manufacturing excellence, product innovation, and customer relationships. The competitive landscape features both global glass manufacturers and specialized pharmaceutical packaging companies.

Competitive strategies focus on product quality, manufacturing efficiency, customer service, and innovation capabilities. Companies invest in advanced manufacturing technologies, quality management systems, and research and development to maintain competitive advantages and meet evolving customer requirements.

Product Type Segmentation:

Glass Type Segmentation:

Capacity Segmentation:

Application Segmentation:

Vaccine Packaging Category represents the most dynamic segment of the European pharmaceutical glass market, experiencing accelerated growth driven by expanded vaccination programs, pandemic preparedness initiatives, and new vaccine development activities. This category requires the highest quality standards and most stringent manufacturing controls to ensure product safety and efficacy. Vaccine manufacturers prioritize suppliers that can demonstrate consistent quality, reliable supply capabilities, and regulatory compliance across multiple jurisdictions.

Biologics Packaging Category shows strong growth potential as European pharmaceutical companies increase their focus on protein-based therapeutics, monoclonal antibodies, and biosimilar products. These complex medications require specialized glass containers that can maintain product stability and prevent protein aggregation or degradation. The category demands advanced glass formulations and specialized manufacturing processes to meet the unique requirements of biological products.

Traditional Pharmaceuticals Category maintains steady demand for conventional injectable medications, antibiotics, and established therapeutic products. While growth rates are moderate compared to newer categories, this segment provides stable revenue streams for glass manufacturers and represents the largest volume segment in the market. Cost optimization and manufacturing efficiency are key competitive factors in this category.

Specialty Applications Category encompasses customized glass solutions for unique pharmaceutical applications, including combination products, device-integrated systems, and specialized drug delivery mechanisms. This category offers higher profit margins and opportunities for differentiation through technical innovation and customer collaboration.

Pharmaceutical Manufacturers benefit from reliable access to high-quality glass containers that ensure product integrity, regulatory compliance, and patient safety. The established European supply base provides manufacturing flexibility, technical support, and customization capabilities that enable pharmaceutical companies to optimize their production processes and meet diverse market requirements. Quality assurance and regulatory expertise from glass suppliers help pharmaceutical companies navigate complex approval processes and maintain compliance with evolving regulations.

Glass Container Manufacturers benefit from stable demand patterns, long-term customer relationships, and opportunities for value-added services in the pharmaceutical market. The high barriers to entry and stringent quality requirements create competitive advantages for established players with proven track records and manufacturing capabilities. Innovation opportunities in specialized applications and advanced glass technologies provide pathways for market differentiation and premium pricing.

Healthcare Systems benefit from reliable pharmaceutical supply chains supported by high-quality packaging solutions that ensure medication safety and efficacy. The European glass manufacturing base contributes to supply chain resilience and reduces dependency on distant suppliers for critical healthcare products. Patient safety is enhanced through the use of pharmaceutical-grade glass containers that meet the highest quality standards.

Regulatory Authorities benefit from working with established glass manufacturers that understand regulatory requirements and maintain comprehensive quality management systems. The mature European glass manufacturing industry provides regulatory predictability and supports efficient approval processes for new pharmaceutical products.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration emerges as a dominant trend in the European pharmaceutical glass market, with manufacturers implementing comprehensive environmental strategies including renewable energy adoption, waste reduction programs, and circular economy principles. Glass manufacturers are developing eco-friendly formulations, improving recycling processes, and reducing carbon footprints to meet customer sustainability requirements and regulatory expectations.

Digital Transformation accelerates across the industry with manufacturers adopting advanced analytics, artificial intelligence, and automation technologies to optimize production processes, improve quality control, and enhance customer service capabilities. Smart manufacturing initiatives integrate IoT sensors, predictive maintenance systems, and real-time monitoring to increase operational efficiency and reduce production costs.

Customization Demand increases as pharmaceutical companies seek specialized glass solutions tailored to specific drug formulations, delivery mechanisms, and patient requirements. This trend drives innovation in glass chemistry, container design, and manufacturing processes to create unique solutions that provide competitive advantages for pharmaceutical customers.

Quality Enhancement continues as a key trend with manufacturers investing in advanced quality control systems, automated inspection technologies, and comprehensive testing protocols to exceed customer expectations and regulatory requirements. Zero-defect manufacturing becomes a competitive necessity in the pharmaceutical glass industry.

Supply Chain Resilience gains importance as pharmaceutical companies prioritize reliable suppliers with robust manufacturing capabilities, geographic diversification, and risk management systems to ensure continuous supply of critical packaging materials.

Manufacturing Capacity Expansion represents a significant industry development as leading glass manufacturers invest in new production facilities and equipment upgrades to meet growing demand from pharmaceutical customers. Recent expansions focus on specialized glass formulations, automated production lines, and enhanced quality control capabilities to serve emerging therapeutic applications.

Technology Partnerships between glass manufacturers and pharmaceutical companies drive innovation in container design, drug compatibility testing, and specialized packaging solutions. These collaborations result in customized products that address specific customer requirements and create competitive advantages for both partners.

Regulatory Harmonization efforts across European markets streamline approval processes and reduce compliance complexity for glass manufacturers serving multiple countries. MarkWide Research analysis indicates that regulatory alignment initiatives improve market efficiency and reduce barriers to cross-border trade in pharmaceutical glass products.

Acquisition Activities in the industry consolidate market positions and expand manufacturing capabilities as larger companies acquire specialized suppliers or regional manufacturers to strengthen their market presence and customer service capabilities.

Sustainability Certifications become increasingly important as glass manufacturers pursue environmental certifications, carbon neutrality goals, and sustainable manufacturing practices to meet customer requirements and regulatory expectations.

Strategic Focus Areas for market participants should prioritize innovation in specialized glass formulations, expansion of manufacturing capabilities for high-growth applications, and development of comprehensive sustainability programs that address customer and regulatory requirements. Companies should invest in research and development activities that create differentiated products for emerging therapeutic areas and advanced drug delivery systems.

Operational Excellence initiatives should emphasize manufacturing automation, quality management system enhancements, and supply chain optimization to improve efficiency and reduce costs while maintaining the highest quality standards. Digital transformation investments in production monitoring, predictive maintenance, and customer service systems provide competitive advantages and operational improvements.

Market Expansion strategies should consider geographic diversification, customer base expansion, and application area development to reduce market concentration risks and capture growth opportunities. Companies should evaluate partnership opportunities with pharmaceutical manufacturers, contract manufacturing organizations, and emerging market players to expand their market presence.

Customer Relationship Management should focus on providing comprehensive technical support, customized solutions, and value-added services that strengthen customer partnerships and create switching costs for competitors. Long-term supply agreements and collaborative development programs enhance customer loyalty and provide revenue stability.

Risk Management strategies should address supply chain vulnerabilities, regulatory compliance requirements, and competitive threats through diversified sourcing, comprehensive quality systems, and continuous market monitoring to identify emerging challenges and opportunities.

Growth Trajectory for the Europe pharmaceutical glass vials and ampoules market remains positive with sustained expansion expected across key application areas and geographic markets. MWR projections indicate continued market growth driven by pharmaceutical industry expansion, increasing vaccine production requirements, and growing adoption of biologics and specialty medications that require high-quality glass packaging solutions.

Technology Evolution will drive significant changes in manufacturing processes, product capabilities, and customer service offerings as glass manufacturers adopt advanced technologies and develop innovative solutions for emerging pharmaceutical applications. The integration of digital technologies, automation systems, and advanced materials will create new opportunities for market differentiation and operational improvement.

Market Consolidation trends are expected to continue as larger companies acquire specialized suppliers and regional manufacturers to expand their capabilities and market presence. This consolidation will create more comprehensive service offerings and stronger competitive positions for market leaders while potentially reducing supplier options for pharmaceutical customers.

Regulatory Evolution will influence market development as authorities implement new standards for pharmaceutical packaging, environmental compliance, and supply chain security. Companies that proactively address regulatory changes and maintain comprehensive compliance programs will be better positioned for long-term success.

Sustainability Integration will become increasingly important as pharmaceutical companies prioritize environmental responsibility in their supply chain decisions. Glass manufacturers that develop comprehensive sustainability programs and demonstrate environmental leadership will gain competitive advantages in customer selection processes.

The Europe pharmaceutical glass vials and ampoules market represents a critical and dynamic sector within the broader pharmaceutical packaging industry, characterized by steady growth, technological innovation, and evolving customer requirements. Market fundamentals remain strong, supported by expanding pharmaceutical production, increasing vaccine manufacturing, and growing demand for biologics and specialty medications that require high-quality glass packaging solutions.

Strategic opportunities exist for market participants who can successfully navigate the complex regulatory environment, invest in advanced manufacturing technologies, and develop innovative solutions for emerging therapeutic applications. The market rewards companies that maintain the highest quality standards, provide comprehensive customer support, and demonstrate commitment to sustainability and environmental responsibility.

Future success in this market will depend on the ability to balance operational excellence with innovation capabilities, maintain strong customer relationships while expanding market presence, and adapt to evolving regulatory requirements while controlling costs. Companies that can effectively execute these strategies while maintaining their commitment to product quality and customer service will be well-positioned to capitalize on the continued growth and evolution of the European pharmaceutical glass containers market.

What is Pharmaceutical Glass Vials And Ampoules?

Pharmaceutical Glass Vials and Ampoules are containers used for storing and preserving medications, vaccines, and other pharmaceutical products. They are designed to maintain the integrity of their contents and are often made from high-quality glass to ensure safety and stability.

What are the key players in the Europe Pharmaceutical Glass Vials And Ampoules Market?

Key players in the Europe Pharmaceutical Glass Vials And Ampoules Market include Schott AG, Gerresheimer AG, and Nipro Corporation, among others. These companies are known for their innovative packaging solutions and extensive product ranges in the pharmaceutical sector.

What are the growth factors driving the Europe Pharmaceutical Glass Vials And Ampoules Market?

The growth of the Europe Pharmaceutical Glass Vials And Ampoules Market is driven by the increasing demand for biologics and vaccines, the rise in chronic diseases requiring injectable medications, and advancements in glass manufacturing technologies.

What challenges does the Europe Pharmaceutical Glass Vials And Ampoules Market face?

The Europe Pharmaceutical Glass Vials And Ampoules Market faces challenges such as stringent regulatory requirements, the high cost of production, and competition from alternative packaging materials like plastics. These factors can impact market growth and innovation.

What opportunities exist in the Europe Pharmaceutical Glass Vials And Ampoules Market?

Opportunities in the Europe Pharmaceutical Glass Vials And Ampoules Market include the growing trend towards personalized medicine, the expansion of the biopharmaceutical sector, and the increasing focus on sustainable packaging solutions. These trends are likely to shape the future of the market.

What trends are currently influencing the Europe Pharmaceutical Glass Vials And Ampoules Market?

Current trends influencing the Europe Pharmaceutical Glass Vials And Ampoules Market include the shift towards environmentally friendly packaging, the development of smart vials with integrated technology, and the increasing use of pre-filled syringes. These innovations are enhancing the efficiency and safety of pharmaceutical delivery.

Europe Pharmaceutical Glass Vials And Ampoules Market

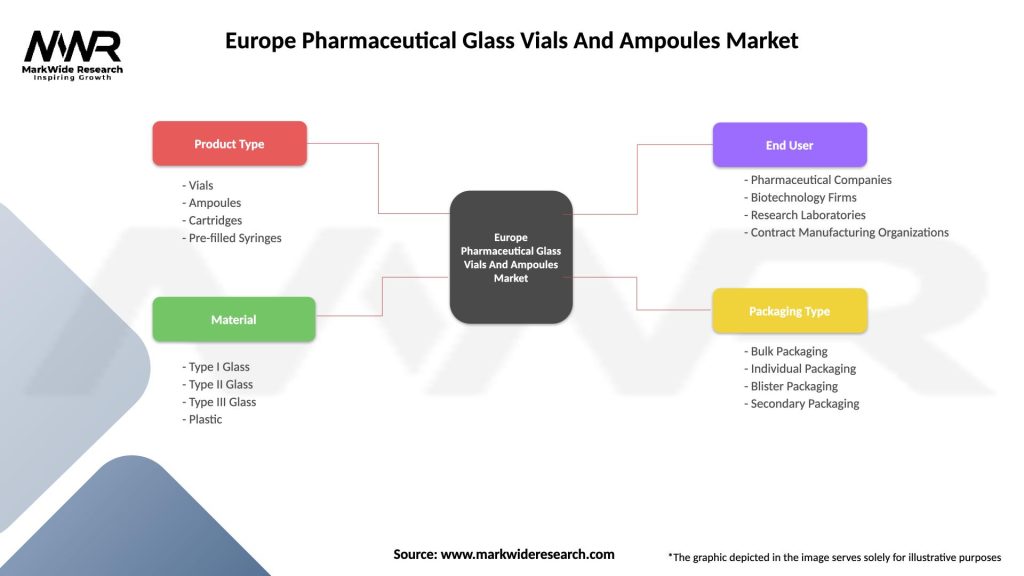

| Segmentation Details | Description |

|---|---|

| Product Type | Vials, Ampoules, Cartridges, Pre-filled Syringes |

| Material | Type I Glass, Type II Glass, Type III Glass, Plastic |

| End User | Pharmaceutical Companies, Biotechnology Firms, Research Laboratories, Contract Manufacturing Organizations |

| Packaging Type | Bulk Packaging, Individual Packaging, Blister Packaging, Secondary Packaging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Pharmaceutical Glass Vials And Ampoules Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at