444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe pharmaceutical blister packaging market represents a cornerstone of the continent’s healthcare infrastructure, serving as the primary protective barrier for millions of pharmaceutical products distributed across European nations. This sophisticated packaging sector encompasses advanced materials, cutting-edge manufacturing technologies, and stringent regulatory compliance measures that ensure medication safety and efficacy throughout the supply chain.

Market dynamics in the European pharmaceutical blister packaging sector are driven by increasing demand for unit-dose packaging solutions, growing emphasis on patient safety, and the rising prevalence of chronic diseases requiring long-term medication management. The market demonstrates robust growth potential with an estimated CAGR of 6.2% projected over the forecast period, reflecting the sector’s resilience and adaptability to evolving healthcare needs.

Technological advancement continues to reshape the landscape, with smart packaging solutions, tamper-evident features, and child-resistant designs becoming increasingly prevalent. European manufacturers are investing heavily in sustainable packaging alternatives, responding to environmental regulations and consumer preferences for eco-friendly pharmaceutical packaging solutions.

Regional distribution shows Germany, France, and the United Kingdom maintaining dominant positions, collectively accounting for approximately 58% of market share across the European pharmaceutical blister packaging sector. These markets benefit from established pharmaceutical manufacturing bases, advanced healthcare systems, and strong regulatory frameworks that support innovation and quality assurance.

The Europe pharmaceutical blister packaging market refers to the comprehensive ecosystem of materials, technologies, and manufacturing processes used to create protective packaging solutions for pharmaceutical products across European countries. This specialized packaging format consists of pre-formed plastic cavities sealed with backing materials to create individual compartments for tablets, capsules, and other solid dosage forms.

Blister packaging technology encompasses multiple components including thermoformed plastic films, aluminum foil backing, heat-sealing processes, and printing technologies that provide product identification, dosage information, and regulatory compliance markings. The packaging serves critical functions including moisture protection, light barrier properties, tamper evidence, and precise dosage control for patients and healthcare providers.

Market scope includes various packaging formats such as unit-dose blisters, multi-dose packaging, child-resistant designs, and specialized packaging for controlled substances. The sector also encompasses packaging machinery, quality control systems, and regulatory compliance services that support pharmaceutical manufacturers throughout the European Union and associated territories.

Strategic positioning of the European pharmaceutical blister packaging market reflects a mature yet dynamic sector characterized by continuous innovation, regulatory evolution, and increasing demand for patient-centric packaging solutions. The market demonstrates strong fundamentals driven by aging demographics, expanding pharmaceutical production, and growing emphasis on medication adherence and safety.

Key growth drivers include the rising prevalence of chronic diseases requiring long-term medication management, increasing adoption of generic pharmaceuticals, and growing demand for unit-dose packaging that enhances patient compliance. Approximately 73% of pharmaceutical companies in Europe are investing in advanced blister packaging technologies to improve product differentiation and patient outcomes.

Market challenges encompass stringent regulatory requirements, environmental sustainability pressures, and the need for cost-effective packaging solutions that maintain high quality standards. European manufacturers are addressing these challenges through innovative material development, process optimization, and strategic partnerships with pharmaceutical companies.

Competitive landscape features a mix of established multinational corporations and specialized regional players, with market consolidation trends driving strategic acquisitions and technology partnerships. The sector benefits from strong research and development capabilities, advanced manufacturing infrastructure, and comprehensive regulatory expertise that supports global pharmaceutical supply chains.

Market intelligence reveals several critical insights that shape the European pharmaceutical blister packaging landscape:

Demographic trends serve as primary catalysts for market expansion, with Europe’s aging population creating sustained demand for pharmaceutical products requiring secure, convenient packaging solutions. The increasing prevalence of chronic conditions such as diabetes, cardiovascular disease, and respiratory disorders drives consistent demand for long-term medication packaging that ensures product integrity and patient compliance.

Regulatory requirements across European Union member states mandate specific packaging standards for pharmaceutical products, including tamper-evident features, child-resistant designs, and comprehensive labeling requirements. These regulations create consistent demand for compliant packaging solutions while driving innovation in packaging technologies and materials.

Healthcare system evolution toward patient-centered care models emphasizes medication adherence and safety, creating opportunities for packaging solutions that support these objectives. Unit-dose blister packaging helps reduce medication errors, improves dosage accuracy, and provides clear visual indicators for patients managing complex medication regimens.

Pharmaceutical industry growth in generic medications and biosimilar products creates expanding demand for cost-effective packaging solutions that maintain product quality and regulatory compliance. European pharmaceutical manufacturers are increasing production capacity, driving corresponding demand for advanced blister packaging technologies and materials.

Technological advancement in packaging materials and manufacturing processes enables development of enhanced barrier properties, improved sustainability profiles, and integrated smart packaging features that add value for pharmaceutical companies and patients alike.

Cost pressures within the pharmaceutical industry create challenges for packaging suppliers, as healthcare systems and pharmaceutical companies seek to reduce overall product costs while maintaining quality and safety standards. This pressure particularly affects smaller packaging manufacturers who may lack economies of scale to compete effectively on pricing.

Environmental regulations and sustainability requirements impose additional compliance costs and technical challenges for packaging manufacturers. The transition to more sustainable materials and processes requires significant investment in research, development, and manufacturing infrastructure, potentially impacting short-term profitability.

Regulatory complexity across different European markets creates challenges for packaging manufacturers serving multiple countries, as varying requirements for labeling, materials, and safety features necessitate customized solutions and increase operational complexity.

Raw material volatility affects packaging costs and supply chain stability, particularly for petroleum-based plastic materials and aluminum foil components. Price fluctuations and supply disruptions can impact manufacturer margins and customer relationships.

Technology investment requirements for advanced packaging capabilities, including smart packaging features and sustainable materials, require substantial capital commitments that may strain smaller manufacturers’ resources and limit market participation.

Smart packaging integration presents significant growth opportunities as pharmaceutical companies seek to enhance patient engagement, improve medication adherence, and combat counterfeit products. Technologies such as NFC chips, QR codes, and temperature indicators can be integrated into blister packaging to provide real-time information and connectivity.

Sustainable packaging development offers opportunities for manufacturers who can successfully develop and commercialize environmentally friendly packaging solutions that meet performance requirements while reducing environmental impact. This includes biodegradable materials, recyclable designs, and reduced-waste manufacturing processes.

Emerging pharmaceutical segments including personalized medicine, specialty drugs, and advanced biologics create demand for specialized packaging solutions with enhanced barrier properties, temperature control, and customized designs that protect sensitive formulations.

Digital health integration enables packaging manufacturers to develop solutions that connect with digital health platforms, medication management apps, and healthcare provider systems to support comprehensive patient care and medication monitoring.

Geographic expansion opportunities exist in Eastern European markets where healthcare infrastructure development and pharmaceutical manufacturing growth create demand for advanced packaging solutions and technologies.

Supply chain integration continues to evolve as pharmaceutical companies seek closer partnerships with packaging suppliers to optimize product development, reduce time-to-market, and ensure consistent quality standards. This trend drives consolidation among packaging suppliers and encourages development of comprehensive service offerings beyond basic packaging production.

Innovation cycles in the pharmaceutical blister packaging market are accelerating, driven by competitive pressures, regulatory changes, and evolving customer requirements. Manufacturers are investing approximately 8.5% of revenue in research and development activities to maintain technological leadership and market position.

Market competition intensifies as global packaging companies expand European operations while regional specialists develop niche capabilities and specialized solutions. This competitive dynamic drives continuous improvement in quality, cost efficiency, and customer service capabilities.

Customer relationship evolution toward strategic partnerships reflects pharmaceutical companies’ desire for integrated solutions that encompass packaging design, regulatory support, supply chain management, and technical services. These relationships create barriers to entry for new competitors while providing stable revenue streams for established suppliers.

Technology adoption patterns show increasing acceptance of advanced packaging features among pharmaceutical companies and healthcare providers, with adoption rates for smart packaging technologies reaching approximately 34% penetration in major European markets.

Comprehensive market analysis for the European pharmaceutical blister packaging sector employs multi-source research methodologies that combine primary research, secondary data analysis, and expert consultation to provide accurate market insights and forecasting. The research approach ensures data reliability and market understanding across diverse European markets and industry segments.

Primary research activities include structured interviews with packaging manufacturers, pharmaceutical companies, regulatory officials, and healthcare providers across major European markets. These interviews provide insights into market trends, competitive dynamics, technological developments, and future growth opportunities that shape industry direction.

Secondary research sources encompass industry publications, regulatory filings, company annual reports, trade association data, and academic research that provide quantitative market data and qualitative insights into industry trends and developments.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop accurate market forecasts and identify key growth drivers and market constraints. The methodology incorporates multiple data validation steps to ensure accuracy and reliability of market projections.

Expert consultation with industry specialists, regulatory experts, and technology developers provides additional validation of market findings and insights into emerging trends and future market developments that may impact the pharmaceutical blister packaging sector.

Germany maintains its position as the largest European pharmaceutical blister packaging market, accounting for approximately 22% of regional market share. The country benefits from a robust pharmaceutical manufacturing base, advanced packaging technology capabilities, and strong export orientation that drives demand for high-quality packaging solutions.

France represents the second-largest market with significant pharmaceutical production and consumption, supported by comprehensive healthcare systems and strong regulatory frameworks. French packaging manufacturers are particularly focused on sustainable packaging development and smart packaging integration.

United Kingdom continues to maintain strong market presence despite Brexit-related challenges, with established pharmaceutical companies and packaging suppliers adapting to new regulatory requirements while maintaining European market access through strategic partnerships and compliance programs.

Italy and Spain demonstrate growing market importance, driven by expanding pharmaceutical production, increasing healthcare expenditure, and growing demand for generic medications that require cost-effective packaging solutions. These markets show particular strength in specialized packaging for elderly patient populations.

Eastern European markets including Poland, Czech Republic, and Hungary show rapid growth potential with expanding pharmaceutical manufacturing, improving healthcare infrastructure, and increasing adoption of Western European packaging standards and technologies.

Nordic countries including Sweden, Denmark, and Norway emphasize sustainability and environmental responsibility in packaging selection, driving demand for eco-friendly packaging solutions and innovative materials that reduce environmental impact.

Market leadership in the European pharmaceutical blister packaging sector is characterized by a mix of global packaging corporations and specialized regional players who compete on technology innovation, quality standards, and customer service capabilities.

Competitive strategies focus on technological innovation, sustainability development, and strategic partnerships with pharmaceutical companies to provide integrated packaging solutions and comprehensive customer support.

By Material Type:

By Product Type:

By Application:

Prescription Medications represent the largest application segment, driven by stringent regulatory requirements, patient safety considerations, and the need for precise dosage control. This category benefits from consistent demand and premium pricing for high-quality packaging solutions that ensure medication integrity and compliance.

Over-the-Counter Medications show growing importance as consumer healthcare trends drive demand for convenient, accessible packaging that supports self-medication and health management. This segment emphasizes cost-effectiveness while maintaining quality and safety standards.

Generic Pharmaceuticals create significant volume opportunities for packaging suppliers, as cost-conscious healthcare systems and patients drive adoption of generic alternatives. This segment requires efficient, cost-effective packaging solutions that maintain quality standards while supporting competitive pricing.

Specialty Pharmaceuticals including biologics, oncology drugs, and rare disease treatments require advanced packaging solutions with enhanced barrier properties, temperature control, and specialized handling requirements. This high-value segment supports premium pricing and technological innovation.

Nutraceuticals and Supplements represent an emerging category with growing demand for pharmaceutical-grade packaging that provides product protection, regulatory compliance, and consumer appeal in retail environments.

Pharmaceutical Manufacturers benefit from advanced blister packaging through enhanced product protection, improved patient compliance, reduced medication errors, and comprehensive regulatory compliance support. These packaging solutions enable product differentiation, brand protection, and supply chain optimization that support commercial success.

Healthcare Providers gain advantages through improved medication management, reduced dispensing errors, enhanced patient safety, and streamlined inventory management. Unit-dose packaging supports accurate medication administration and reduces waste in clinical settings.

Patients and Consumers experience benefits including improved medication adherence, convenient dosing, enhanced safety features, and clear product identification. Smart packaging features provide additional value through connectivity and information access.

Packaging Manufacturers achieve growth opportunities through technological innovation, market expansion, and strategic partnerships with pharmaceutical companies. The sector provides stable demand, premium pricing opportunities, and long-term customer relationships.

Regulatory Authorities benefit from packaging solutions that support drug safety, traceability, and anti-counterfeiting efforts. Advanced packaging technologies enable better monitoring and control of pharmaceutical distribution and consumption.

Healthcare Systems realize cost savings through reduced medication errors, improved patient outcomes, and enhanced supply chain efficiency. Effective packaging contributes to overall healthcare quality and cost management objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Integration emerges as a transformative trend, with pharmaceutical companies increasingly adopting smart packaging solutions that incorporate QR codes, NFC technology, and digital connectivity features. These technologies enable patient engagement, medication adherence monitoring, and supply chain traceability that add significant value to traditional packaging functions.

Sustainability Innovation drives development of environmentally responsible packaging solutions, including recyclable materials, reduced-waste manufacturing processes, and biodegradable alternatives. European manufacturers are investing heavily in sustainable packaging development to meet regulatory requirements and consumer preferences.

Personalized Packaging reflects the growing trend toward personalized medicine and patient-specific treatments. This includes customized dosing schedules, patient-specific labeling, and packaging formats that accommodate individual patient needs and preferences.

Anti-counterfeiting Technologies become increasingly important as pharmaceutical companies seek to protect products and patients from counterfeit medications. Advanced security features, serialization technologies, and authentication systems are being integrated into blister packaging designs.

Automation Integration in packaging manufacturing and pharmaceutical production drives demand for packaging solutions that are compatible with automated handling, filling, and quality control systems. This trend supports efficiency improvements and cost reduction objectives.

Patient-Centric Design emphasizes packaging solutions that accommodate diverse patient populations, including elderly patients, those with dexterity challenges, and patients managing complex medication regimens. This includes easy-open designs, clear labeling, and intuitive packaging formats.

Regulatory Evolution continues to shape the industry landscape, with European Medicines Agency guidelines driving adoption of serialization technologies, enhanced labeling requirements, and improved safety features. Recent developments include updated guidelines for packaging materials and environmental impact assessments.

Technology Partnerships between packaging manufacturers and technology companies are creating innovative solutions that combine traditional packaging with digital capabilities. These collaborations focus on smart packaging development, IoT integration, and data analytics capabilities.

Sustainability Initiatives across the industry include development of circular economy approaches, waste reduction programs, and renewable material adoption. Major manufacturers are committing to sustainability targets and investing in environmentally responsible technologies.

Market Consolidation activities include strategic acquisitions, joint ventures, and partnership agreements that reshape the competitive landscape. These developments aim to achieve scale economies, technology integration, and market expansion objectives.

Manufacturing Innovation encompasses advanced production technologies, quality control systems, and process optimization initiatives that improve efficiency, reduce costs, and enhance product quality. Industry leaders are investing in Industry 4.0 technologies and automation capabilities.

Customer Collaboration programs between packaging suppliers and pharmaceutical companies are expanding to include co-development projects, integrated supply chain solutions, and comprehensive service offerings that extend beyond traditional packaging supply relationships.

MarkWide Research analysis indicates that European pharmaceutical blister packaging manufacturers should prioritize sustainability development and smart packaging integration to maintain competitive advantage in evolving market conditions. Companies that successfully combine environmental responsibility with technological innovation are positioned for superior long-term performance.

Investment priorities should focus on advanced manufacturing technologies, sustainable material development, and digital integration capabilities that support pharmaceutical industry trends toward personalized medicine and patient-centric care. Strategic partnerships with technology providers and pharmaceutical companies can accelerate innovation and market penetration.

Market expansion strategies should consider opportunities in Eastern European markets, specialty pharmaceutical segments, and emerging application areas such as nutraceuticals and personalized medicine. These segments offer growth potential with less competitive intensity than traditional pharmaceutical packaging markets.

Regulatory compliance capabilities must be continuously updated to address evolving European Union requirements, environmental regulations, and safety standards. Companies should invest in regulatory expertise and compliance systems that support multi-market operations and product development.

Customer relationship development should emphasize strategic partnerships, integrated service offerings, and collaborative innovation programs that create value beyond traditional packaging supply. These relationships provide competitive differentiation and revenue stability in challenging market conditions.

Market evolution over the next decade will be characterized by increasing integration of digital technologies, sustainability requirements, and patient-centric design principles that transform traditional pharmaceutical packaging into intelligent, connected solutions. The sector is projected to maintain steady growth with an estimated CAGR of 6.8% through the forecast period.

Technology advancement will drive development of next-generation packaging materials, smart packaging features, and integrated manufacturing systems that support pharmaceutical industry transformation toward personalized medicine and digital health integration. Investment in research and development will remain critical for competitive success.

Regulatory landscape will continue evolving toward enhanced safety requirements, environmental sustainability mandates, and digital compliance systems that require ongoing adaptation and investment from packaging manufacturers. Companies must maintain flexibility and compliance capabilities to address changing requirements.

Market consolidation trends are expected to continue, with strategic acquisitions and partnerships reshaping the competitive landscape. Successful companies will combine scale advantages with specialized capabilities and innovation leadership to maintain market position.

Sustainability integration will become increasingly important, with circular economy principles, renewable materials, and waste reduction initiatives becoming standard requirements rather than competitive differentiators. Early investment in sustainable technologies will provide long-term competitive advantages.

MWR projections indicate that companies successfully integrating sustainability, technology innovation, and customer collaboration will achieve superior performance and market leadership in the evolving European pharmaceutical blister packaging landscape.

The European pharmaceutical blister packaging market represents a dynamic and essential component of the continent’s healthcare infrastructure, characterized by continuous innovation, regulatory evolution, and growing emphasis on patient-centric solutions. Market fundamentals remain strong, supported by demographic trends, pharmaceutical industry growth, and increasing demand for advanced packaging technologies that enhance medication safety and patient compliance.

Strategic opportunities abound for companies that successfully navigate the complex landscape of regulatory requirements, sustainability mandates, and technological advancement. The integration of smart packaging features, sustainable materials, and patient-focused design principles will define market leadership in the coming decade, while traditional competitive advantages based solely on cost or scale become less sustainable.

Industry transformation toward digitalization, personalization, and environmental responsibility creates both challenges and opportunities for market participants. Companies that invest in innovation capabilities, strategic partnerships, and comprehensive service offerings are positioned to capture disproportionate value creation as the market evolves toward more sophisticated and integrated solutions that serve the complex needs of modern healthcare systems and patient populations across Europe.

What is Pharmaceutical Blister Packaging?

Pharmaceutical blister packaging refers to a type of packaging that consists of a pre-formed plastic cavity or pocket, typically used to contain tablets, capsules, or other pharmaceutical products. This packaging method is designed to protect the contents from moisture, light, and contamination, ensuring product integrity and safety.

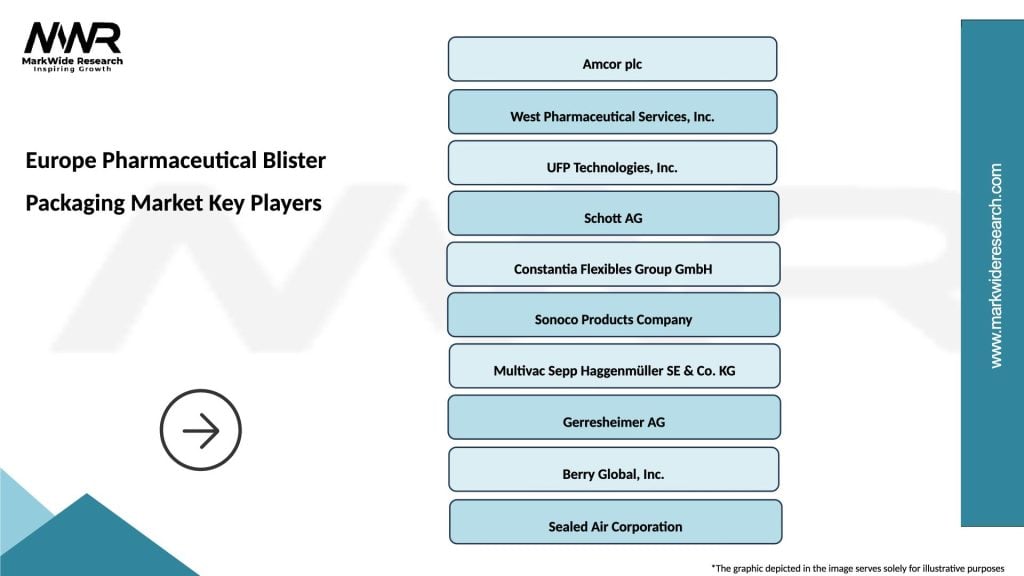

What are the key players in the Europe Pharmaceutical Blister Packaging Market?

Key players in the Europe Pharmaceutical Blister Packaging Market include Amcor plc, West Pharmaceutical Services, and UFP Technologies, among others. These companies are known for their innovative packaging solutions and commitment to quality in the pharmaceutical sector.

What are the main drivers of the Europe Pharmaceutical Blister Packaging Market?

The main drivers of the Europe Pharmaceutical Blister Packaging Market include the increasing demand for unit dose packaging, the rise in chronic diseases requiring long-term medication, and the growing focus on patient safety and compliance. Additionally, advancements in packaging technology are enhancing product shelf life and usability.

What challenges does the Europe Pharmaceutical Blister Packaging Market face?

The Europe Pharmaceutical Blister Packaging Market faces challenges such as stringent regulatory requirements, high production costs, and the need for sustainable packaging solutions. These factors can impact the overall growth and innovation within the market.

What opportunities exist in the Europe Pharmaceutical Blister Packaging Market?

Opportunities in the Europe Pharmaceutical Blister Packaging Market include the development of eco-friendly packaging materials and the integration of smart packaging technologies. These innovations can enhance user experience and meet the growing demand for sustainable practices in the pharmaceutical industry.

What trends are shaping the Europe Pharmaceutical Blister Packaging Market?

Trends shaping the Europe Pharmaceutical Blister Packaging Market include the increasing adoption of child-resistant packaging, the use of advanced materials for better barrier properties, and the rise of personalized medicine requiring customized packaging solutions. These trends reflect the evolving needs of consumers and healthcare providers.

Europe Pharmaceutical Blister Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Cold Formed, PVC, PVDC, Aluminum |

| End User | Pharmaceutical Companies, Contract Packaging Organizations, Hospitals, Retail Pharmacies |

| Packaging Type | Blister Packs, Strip Packs, Sachets, Pouches |

| Technology | Thermoforming, Cold Forming, High-Speed Packaging, Automation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Pharmaceutical Blister Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at