444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview:

The Europe pet insurance market has witnessed significant growth in recent years, driven by the rising pet ownership rates and increasing awareness about the importance of pet healthcare. Pet insurance offers financial protection to pet owners in the event of unexpected veterinary expenses, giving them peace of mind and ensuring their pets receive the best possible care. This comprehensive and SEO-optimized article will delve into the Europe pet insurance market, providing valuable insights and analysis for industry participants and stakeholders.

Meaning:

Pet insurance is a type of insurance coverage designed to provide financial support to pet owners in the event of accidents, illnesses, or other veterinary expenses. It works similarly to health insurance for humans, where policyholders pay regular premiums in exchange for coverage for various medical treatments, surgeries, and medications for their pets. Pet insurance plans vary in terms of coverage, deductibles, and premiums, allowing pet owners to choose a plan that suits their budget and the specific needs of their pets.

Executive Summary:

The Europe pet insurance market has experienced robust growth over the past decade, driven by several key factors. The increasing bond between pet owners and their furry companions, coupled with the rising cost of veterinary care, has led to a growing demand for pet insurance policies. This executive summary provides a concise overview of the market trends, drivers, restraints, opportunities, and key industry developments that shape the Europe pet insurance market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Several drivers contribute to the growth of the Europe pet insurance market:

Market Restraints:

Despite the positive growth prospects, the Europe pet insurance market faces certain challenges:

Market Opportunities:

The Europe pet insurance market presents several opportunities for growth and innovation:

Market Dynamics:

The Europe pet insurance market is dynamic and influenced by various factors:

Regional Analysis:

The Europe pet insurance market exhibits regional variations due to cultural, economic, and regulatory factors. Here is an analysis of the market landscape in key European regions:

Competitive Landscape:

Leading Companies in the Europe Pet Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

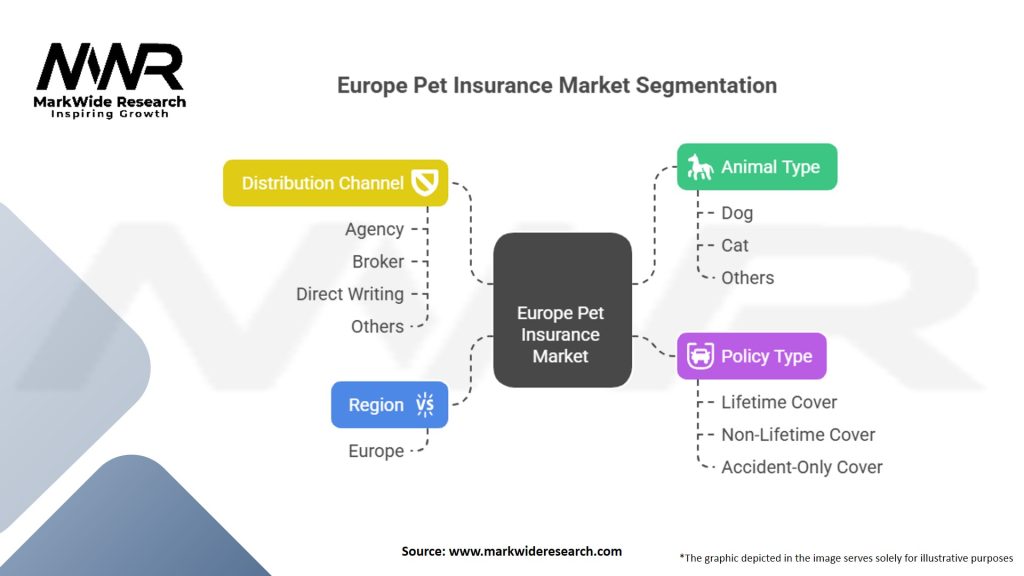

Segmentation:

The Europe pet insurance market can be segmented based on various factors, including:

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends:

Covid-19 Impact:

The Covid-19 pandemic has had mixed effects on the Europe pet insurance market. While the initial lockdowns and economic uncertainty led to a temporary decline in pet insurance sales, the subsequent increase in pet adoptions and the emphasis on pet healthcare during the pandemic have driven the demand for pet insurance. Pet owners recognize the importance of financial protection for unexpected veterinary expenses, leading to a resurgence in pet insurance adoption.

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The Europe pet insurance market is poised for continued growth in the coming years. Increasing pet ownership rates, rising healthcare costs, and the growing awareness of pet insurance benefits will drive market expansion. Technological advancements, personalized policies, and collaborations with veterinary clinics and pet retailers will shape the market landscape. However, insurance providers must address limited awareness, coverage limitations, and regulatory complexities to maximize market potential.

Conclusion:

The Europe pet insurance market is experiencing significant growth driven by rising pet ownership, increasing healthcare costs, and growing awareness of pet insurance benefits. Insurance providers have an opportunity to cater to the diverse needs of pet owners by offering customized policies and embracing technological advancements. Collaborations, education initiatives, and improved customer-centric approaches will play key roles in maximizing market potential. Despite challenges, the future outlook for the Europe pet insurance market remains optimistic, with steady growth anticipated in the coming years.

What is Pet Insurance?

Pet insurance is a type of insurance policy that helps cover veterinary costs for pets, including dogs and cats. It typically includes coverage for accidents, illnesses, and sometimes routine care, providing financial protection for pet owners.

What are the key players in the Europe Pet Insurance Market?

Key players in the Europe Pet Insurance Market include companies like Petplan, Agria Pet Insurance, and Direct Line Group. These companies offer a variety of policies tailored to different pet needs and preferences, among others.

What are the growth factors driving the Europe Pet Insurance Market?

The growth of the Europe Pet Insurance Market is driven by increasing pet ownership, rising awareness of pet health, and the growing trend of pet humanization. Additionally, advancements in veterinary care and the availability of diverse insurance plans contribute to market expansion.

What challenges does the Europe Pet Insurance Market face?

The Europe Pet Insurance Market faces challenges such as high competition among insurers and the complexity of policy terms that can confuse consumers. Additionally, the variability in veterinary costs across regions can impact policy pricing and coverage options.

What opportunities exist in the Europe Pet Insurance Market?

Opportunities in the Europe Pet Insurance Market include the potential for innovative policy offerings that cater to specific pet needs, such as coverage for alternative therapies and preventive care. The increasing trend of pet adoption also presents a growing customer base for insurers.

What trends are shaping the Europe Pet Insurance Market?

Trends shaping the Europe Pet Insurance Market include the rise of digital platforms for policy management and claims processing, as well as the growing demand for customizable insurance plans. Additionally, there is an increasing focus on wellness and preventive care coverage among pet owners.

Europe Pet Insurance Market:

| Segmentation Details | Details |

|---|---|

| Animal Type | Dog, Cat, Others |

| Policy Type | Lifetime Cover, Non-Lifetime Cover, Accident-Only Cover |

| Distribution Channel | Agency, Broker, Direct Writing, Others |

| Region | Europe |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Europe Pet Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at