444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe pet diet market represents a dynamic and rapidly evolving sector within the broader pet care industry, characterized by increasing consumer awareness about pet nutrition and wellness. European pet owners are demonstrating unprecedented commitment to providing high-quality, nutritionally balanced diets for their companion animals, driving substantial growth across multiple product categories. The market encompasses a comprehensive range of pet food products, including premium dry food, wet food, treats, supplements, and specialized dietary solutions designed to meet specific health requirements.

Market dynamics indicate robust expansion driven by humanization trends, where pets are increasingly viewed as family members deserving premium nutrition. The European market demonstrates strong growth momentum with a projected CAGR of 6.2% over the forecast period, reflecting sustained consumer investment in pet health and nutrition. Regional variations across Western and Eastern Europe showcase diverse consumption patterns, with developed markets like Germany, France, and the United Kingdom leading in premium product adoption, while emerging markets display accelerating growth in basic nutrition categories.

Consumer preferences are shifting toward natural, organic, and functional pet food products, with approximately 73% of European pet owners actively seeking healthier alternatives for their pets. This trend encompasses grain-free formulations, limited ingredient diets, and products featuring novel protein sources. The market also reflects growing demand for age-specific, breed-specific, and condition-specific dietary solutions, indicating sophisticated understanding of pet nutritional requirements among European consumers.

The Europe pet diet market refers to the comprehensive ecosystem of nutritional products, services, and solutions designed specifically for companion animals across European countries. This market encompasses manufactured pet food products, dietary supplements, functional treats, and specialized nutrition programs that cater to the health, wellness, and dietary requirements of dogs, cats, and other companion animals throughout their life stages.

Market scope includes traditional pet food categories such as dry kibble, wet canned food, and treats, alongside emerging segments like freeze-dried raw food, fresh meal delivery services, and therapeutic diets prescribed for specific health conditions. The definition extends beyond basic nutrition to encompass premium and super-premium products that emphasize ingredient quality, nutritional density, and functional benefits designed to support optimal pet health and longevity.

Geographic coverage spans all European Union member states plus the United Kingdom, Norway, and Switzerland, representing diverse regulatory environments, cultural preferences, and economic conditions that influence pet ownership patterns and dietary choices. The market definition includes both retail and professional channels, encompassing pet specialty stores, veterinary clinics, online platforms, and mass retail outlets that distribute pet nutrition products to European consumers.

Strategic analysis reveals the Europe pet diet market as a resilient and growth-oriented sector demonstrating consistent expansion despite economic uncertainties. The market benefits from fundamental demographic trends including increasing pet ownership rates, aging pet populations requiring specialized nutrition, and growing consumer sophistication regarding pet health and wellness. Premium product segments continue to outperform traditional categories, with natural and organic pet food experiencing particularly strong demand growth.

Key market drivers include the humanization of pets, rising disposable incomes in key European markets, and increasing awareness of the connection between nutrition and pet health outcomes. Approximately 68% of European households now own at least one pet, creating a substantial and stable consumer base for pet nutrition products. The market also benefits from favorable regulatory frameworks that support product innovation and ensure food safety standards.

Competitive landscape features a mix of multinational corporations, regional specialists, and emerging direct-to-consumer brands that leverage digital marketing and subscription models to reach pet owners. Innovation focuses on ingredient transparency, sustainability, personalized nutrition, and functional benefits that address specific health concerns. The market demonstrates strong potential for continued growth driven by premiumization trends and expanding product categories.

Consumer behavior analysis reveals significant shifts in European pet owner purchasing patterns and preferences. The following insights highlight critical market dynamics:

Humanization trends represent the primary driver of Europe pet diet market expansion, as pet owners increasingly view their companions as family members deserving high-quality nutrition. This fundamental shift in perception drives willingness to invest in premium products, specialized diets, and functional nutrition solutions that mirror human food trends. Pet humanization manifests in purchasing behaviors that prioritize ingredient quality, nutritional benefits, and brand reputation over price considerations.

Health consciousness among European consumers extends naturally to their pets, creating demand for products that support longevity, vitality, and specific health outcomes. Pet owners actively seek nutrition solutions that address common health concerns such as obesity, allergies, digestive issues, and age-related conditions. This health-focused approach drives growth in functional pet food categories and creates opportunities for products with proven health benefits.

Demographic factors including aging populations, smaller household sizes, and delayed family formation contribute to increased pet ownership and higher per-pet spending across European markets. Urban lifestyle changes also influence pet diet preferences, with convenience, portion control, and storage considerations becoming important product attributes. The growing number of single-person households often results in pets receiving enhanced attention and care, including premium nutrition.

Regulatory support through comprehensive pet food safety standards and clear labeling requirements builds consumer confidence and enables product innovation. European regulatory frameworks facilitate market entry for new products while ensuring safety and quality standards that protect both pets and consumers. This regulatory environment supports market growth by enabling transparent communication about product benefits and ingredients.

Economic pressures pose significant challenges to market growth, particularly during periods of inflation and economic uncertainty when consumers may prioritize essential expenses over premium pet products. Price sensitivity varies across European markets, with economic downturns potentially driving consumers toward more affordable alternatives, limiting growth in premium segments that drive higher margins and innovation.

Regulatory complexity across different European jurisdictions creates barriers for smaller companies seeking to expand regionally, while compliance costs can limit innovation and market entry for new players. Varying standards between countries require significant investment in regulatory expertise and product adaptation, potentially slowing market development and increasing operational complexity for manufacturers.

Supply chain challenges including raw material availability, transportation costs, and quality control requirements can impact product availability and pricing. Ingredient sourcing difficulties, particularly for premium and specialized products, may limit growth in certain categories or force manufacturers to compromise on quality or increase prices beyond consumer acceptance levels.

Market saturation in developed European markets may limit growth opportunities for traditional pet food categories, requiring companies to focus on innovation and premiumization to maintain growth rates. Competitive intensity among established players can lead to margin pressure and increased marketing costs, potentially limiting profitability and investment in new product development.

Emerging market segments present substantial growth opportunities, particularly in Eastern European countries where pet ownership rates and spending per pet continue to increase. Market penetration in these regions remains below Western European levels, creating potential for both premium and mainstream product categories as economic conditions improve and consumer awareness grows.

Product innovation opportunities span multiple categories, including personalized nutrition based on individual pet characteristics, functional foods that address specific health conditions, and sustainable products that appeal to environmentally conscious consumers. Technology integration enables development of smart feeding solutions, subscription services, and data-driven nutrition recommendations that enhance customer engagement and loyalty.

Channel diversification through e-commerce platforms, direct-to-consumer models, and subscription services offers opportunities to reach new customer segments and improve margins through reduced intermediary costs. Digital marketing capabilities enable targeted communication and personalized product recommendations that can drive higher conversion rates and customer lifetime value.

Aging pet populations across Europe create growing demand for senior-specific nutrition products, therapeutic diets, and supplements designed to support health conditions common in older pets. This demographic trend represents a sustainable growth opportunity as pet lifespans continue to increase due to improved veterinary care and nutrition.

Supply and demand dynamics in the Europe pet diet market reflect complex interactions between consumer preferences, manufacturing capabilities, and distribution networks. Demand patterns show consistent growth across most product categories, with premium segments experiencing the strongest expansion as consumers prioritize quality and health benefits over price considerations. Supply-side factors including raw material availability, manufacturing capacity, and regulatory compliance requirements influence product availability and pricing strategies.

Competitive dynamics feature intense rivalry among established multinational brands, regional specialists, and emerging direct-to-consumer companies. Market consolidation continues as larger companies acquire smaller brands to expand product portfolios and geographic reach, while new entrants leverage digital marketing and innovative products to capture market share. Innovation cycles are accelerating as companies invest in research and development to differentiate their offerings.

Consumer dynamics demonstrate increasing sophistication and engagement, with pet owners actively researching products, reading labels, and seeking professional advice before making purchasing decisions. Brand loyalty remains strong but can be influenced by product recalls, ingredient concerns, or superior alternatives that offer better value or health benefits. Social media and online reviews significantly impact brand perception and purchasing decisions.

Distribution dynamics are evolving rapidly with the growth of e-commerce, subscription services, and direct-to-consumer models challenging traditional retail channels. Omnichannel strategies become essential as consumers expect seamless experiences across online and offline touchpoints. Retailers are adapting by expanding premium product selections and enhancing customer education and support services.

Comprehensive research approach combines primary and secondary research methodologies to provide accurate and actionable insights into the Europe pet diet market. Primary research includes surveys of pet owners across major European markets, interviews with industry executives, and discussions with veterinary professionals to understand market trends, consumer preferences, and professional recommendations that influence purchasing decisions.

Secondary research encompasses analysis of industry reports, company financial statements, regulatory filings, and trade association data to validate market trends and quantify market dynamics. Data triangulation ensures accuracy by comparing information from multiple sources and identifying consistent patterns and trends across different data sets and geographic markets.

Market sizing methodology utilizes bottom-up and top-down approaches to estimate market dimensions and growth rates across different product categories and geographic regions. Statistical analysis includes regression modeling, trend analysis, and correlation studies to identify key market drivers and predict future growth patterns based on historical data and current market conditions.

Quality assurance processes include peer review, expert validation, and continuous monitoring of market developments to ensure research findings remain current and accurate. MarkWide Research employs rigorous quality control measures throughout the research process to maintain the highest standards of accuracy and reliability in market analysis and forecasting.

Western Europe dominates the pet diet market, accounting for approximately 78% of total European consumption, led by Germany, France, and the United Kingdom as the largest individual markets. German market characteristics include strong preference for premium products, high adoption of natural and organic pet foods, and sophisticated consumer awareness of pet nutrition requirements. French consumers demonstrate loyalty to domestic brands while showing increasing interest in functional and therapeutic pet food products.

United Kingdom maintains a mature market with high penetration rates across all pet food categories, though Brexit-related regulatory changes create ongoing uncertainty for manufacturers and importers. Nordic countries including Sweden, Norway, and Denmark exhibit the highest per-pet spending levels in Europe, driven by strong economic conditions and cultural emphasis on pet welfare and premium product quality.

Eastern Europe represents the fastest-growing regional segment with projected growth rates of 8.5% annually, driven by increasing pet ownership, rising disposable incomes, and growing awareness of pet nutrition importance. Poland and Czech Republic lead Eastern European growth, with consumers rapidly adopting Western European consumption patterns and showing strong interest in premium and specialized pet food products.

Southern Europe including Italy, Spain, and Portugal demonstrates steady growth with regional preferences for specific protein sources and traditional feeding practices gradually evolving toward commercial pet food adoption. Market penetration in these regions remains below Northern European levels, creating opportunities for both mainstream and premium product categories as consumer education and awareness continue to develop.

Market leadership is distributed among several multinational corporations that maintain strong positions through extensive product portfolios, established distribution networks, and significant marketing investments. The competitive environment features both global brands and regional specialists that compete across different price points and product categories.

Competitive strategies include product innovation, geographic expansion, acquisition of smaller brands, and investment in digital marketing and e-commerce capabilities. Emerging competitors leverage direct-to-consumer models, subscription services, and personalized nutrition approaches to challenge established players and capture market share among younger, digitally-native consumers.

Product category segmentation reveals diverse market dynamics across different pet food types and formats. Dry food maintains the largest market share due to convenience, shelf stability, and cost effectiveness, while wet food segments demonstrate strong growth driven by palatability and perceived freshness benefits.

By Product Type:

By Pet Type:

By Price Segment:

Dry food category continues to dominate European pet diet markets through convenience, cost-effectiveness, and continuous product innovation. Premium dry food segments show particular strength as manufacturers develop grain-free, limited ingredient, and breed-specific formulations that command higher margins while meeting specific consumer demands. Packaging innovations including resealable bags and portion-controlled formats enhance convenience and freshness preservation.

Wet food category demonstrates robust growth driven by palatability advantages and perception of higher nutritional value compared to dry alternatives. Fresh food segments within wet food categories attract health-conscious consumers willing to pay premium prices for refrigerated products with minimal processing and recognizable ingredients. Subscription services and direct-to-consumer models gain traction in this category.

Functional treats represent a high-growth category where pet owners seek products that provide specific health benefits beyond basic nutrition. Dental chews, joint health supplements, and digestive health treats appeal to consumers focused on preventive care and wellness maintenance. This category benefits from strong margins and frequent purchase cycles that enhance customer lifetime value.

Therapeutic diets prescribed by veterinarians for specific health conditions represent a specialized but important market segment with limited competition and strong customer loyalty. Prescription pet food categories include kidney support, weight management, and allergy management formulations that require professional recommendation and ongoing monitoring.

Manufacturers benefit from strong market growth, premiumization trends, and opportunities for product innovation that enable higher margins and brand differentiation. Sustainable growth prospects provide stable investment returns while demographic trends including aging pet populations create predictable demand for specialized products. Innovation opportunities in personalized nutrition, functional ingredients, and sustainable packaging enable competitive advantages.

Retailers gain from consistent consumer demand, high purchase frequencies, and opportunities to develop private label products that enhance margins and customer loyalty. Pet specialty retailers benefit from expert positioning and ability to provide education and consultation services that justify premium pricing. E-commerce platforms capture growing online demand while offering convenience and subscription services.

Pet owners benefit from expanding product choices, improved nutritional quality, and greater transparency in ingredient sourcing and manufacturing processes. Health outcomes improve through access to specialized diets, functional nutrition products, and professional guidance from veterinarians and pet nutrition experts. Convenience benefits include online ordering, subscription services, and portion-controlled packaging options.

Veterinary professionals gain additional revenue streams through therapeutic diet sales while providing enhanced patient care through nutritional counseling and specialized diet recommendations. Professional credibility increases through association with science-based nutrition products and ability to address health conditions through dietary interventions alongside traditional medical treatments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Premiumization continues as the dominant trend across European pet diet markets, with consumers increasingly willing to invest in higher-quality products that offer superior ingredients, functional benefits, and brand reputation. Natural and organic product segments experience particularly strong growth as pet owners seek alternatives to conventional pet food with artificial additives, preservatives, and by-products.

Personalized nutrition emerges as a significant trend with companies developing customized diet plans based on individual pet characteristics including breed, age, weight, activity level, and health conditions. Technology integration enables data collection and analysis that supports personalized recommendations and subscription services tailored to specific pet needs.

Sustainability consciousness influences purchasing decisions as environmentally aware consumers seek products with responsible sourcing, minimal environmental impact, and sustainable packaging solutions. Insect protein and alternative protein sources gain acceptance as sustainable alternatives to traditional meat ingredients while maintaining nutritional quality and palatability.

Functional nutrition expands beyond basic nutritional requirements to include products designed to support specific health outcomes such as joint health, digestive wellness, skin and coat condition, and cognitive function. Nutraceutical ingredients including probiotics, omega fatty acids, and antioxidants become standard features in premium pet food formulations.

Acquisition activity remains robust as major companies seek to expand product portfolios, enter new geographic markets, and acquire innovative brands with strong consumer followings. Strategic partnerships between pet food manufacturers and technology companies enable development of smart feeding solutions, mobile applications, and data analytics capabilities that enhance customer engagement.

Manufacturing investments focus on capacity expansion, automation, and quality control systems that support growth while maintaining safety and consistency standards. Research and development investments increase as companies seek to develop breakthrough products in areas such as digestive health, immune support, and age-related nutrition requirements.

Regulatory developments include enhanced labeling requirements, stricter quality control standards, and new guidelines for health claims that impact product development and marketing strategies. MarkWide Research analysis indicates that regulatory harmonization across European markets could reduce compliance costs and facilitate market expansion for manufacturers.

Distribution evolution includes expansion of e-commerce capabilities, development of subscription services, and integration of online and offline channels to provide seamless customer experiences. Direct-to-consumer models gain traction as companies seek to improve margins, enhance customer relationships, and gather valuable consumer data for product development.

Strategic recommendations for market participants emphasize the importance of innovation, differentiation, and customer engagement in an increasingly competitive environment. Product development should focus on functional benefits, ingredient transparency, and sustainability attributes that resonate with evolving consumer preferences and justify premium pricing strategies.

Geographic expansion opportunities in Eastern European markets require careful consideration of local preferences, economic conditions, and distribution capabilities. Market entry strategies should balance standardized products with localized adaptations that address specific cultural and regulatory requirements in target markets.

Digital transformation initiatives should prioritize e-commerce capabilities, customer data analytics, and personalized marketing approaches that enhance customer acquisition and retention. Omnichannel strategies become essential as consumers expect consistent experiences across online and offline touchpoints throughout their purchasing journey.

Partnership opportunities with veterinary professionals, pet retailers, and technology companies can provide competitive advantages through enhanced credibility, expanded distribution, and innovative product development capabilities. Supply chain optimization should focus on ingredient quality, cost management, and sustainability initiatives that support long-term competitive positioning.

Long-term growth prospects for the Europe pet diet market remain positive, supported by fundamental demographic trends, increasing pet ownership rates, and continued premiumization of pet care spending. Market evolution will likely favor companies that successfully combine product innovation, digital capabilities, and sustainable practices to meet evolving consumer expectations and regulatory requirements.

Technology integration will accelerate with development of smart feeding systems, personalized nutrition algorithms, and data-driven product recommendations that enhance customer satisfaction and loyalty. Artificial intelligence and machine learning applications may enable more sophisticated understanding of pet nutritional needs and optimization of product formulations for specific health outcomes.

Sustainability initiatives will become increasingly important as environmental consciousness grows among European consumers and regulatory pressure increases for responsible business practices. Circular economy principles may influence packaging design, ingredient sourcing, and manufacturing processes as companies seek to minimize environmental impact while maintaining product quality and safety.

Market consolidation may continue as larger companies acquire innovative smaller brands and seek economies of scale in manufacturing and distribution. MWR projections suggest that successful companies will be those that balance growth through acquisition with organic innovation and customer-centric strategies that build long-term competitive advantages in an evolving marketplace.

The Europe pet diet market represents a dynamic and resilient sector characterized by consistent growth, ongoing innovation, and evolving consumer preferences that favor premium, functional, and sustainable pet nutrition products. Market fundamentals remain strong, supported by increasing pet ownership, humanization trends, and growing awareness of the connection between nutrition and pet health outcomes across diverse European markets.

Strategic opportunities abound for companies that can successfully navigate competitive pressures while delivering innovative products that meet specific consumer needs and preferences. The market rewards companies that invest in research and development, maintain high quality standards, and build strong relationships with customers through transparent communication and superior product performance. Future success will depend on the ability to balance traditional strengths with emerging trends in digitalization, personalization, and sustainability that are reshaping the pet care landscape across Europe.

What is Pet Diet?

Pet Diet refers to the nutritional regimen and food products designed specifically for pets, including dogs, cats, and other domesticated animals. This encompasses various types of food such as dry kibble, wet food, raw diets, and specialized nutrition for health conditions.

What are the key players in the Europe Pet Diet Market?

Key players in the Europe Pet Diet Market include Nestlé Purina PetCare, Mars Petcare, and Hill’s Pet Nutrition, among others. These companies are known for their extensive range of pet food products and innovative formulations catering to diverse pet dietary needs.

What are the main drivers of growth in the Europe Pet Diet Market?

The growth of the Europe Pet Diet Market is driven by increasing pet ownership, rising awareness of pet health and nutrition, and the demand for premium and specialized pet food products. Additionally, trends towards natural and organic ingredients are influencing consumer choices.

What challenges does the Europe Pet Diet Market face?

The Europe Pet Diet Market faces challenges such as regulatory compliance regarding pet food safety, fluctuating raw material prices, and competition from private label brands. These factors can impact product availability and pricing strategies.

What opportunities exist in the Europe Pet Diet Market?

Opportunities in the Europe Pet Diet Market include the growing trend of pet humanization, which encourages owners to invest in high-quality diets for their pets. Additionally, the rise of e-commerce platforms provides new channels for distribution and customer engagement.

What trends are shaping the Europe Pet Diet Market?

Trends shaping the Europe Pet Diet Market include the increasing popularity of grain-free and high-protein diets, the incorporation of functional ingredients for health benefits, and a focus on sustainability in sourcing and packaging. These trends reflect changing consumer preferences towards healthier and environmentally friendly options.

Europe Pet Diet Market

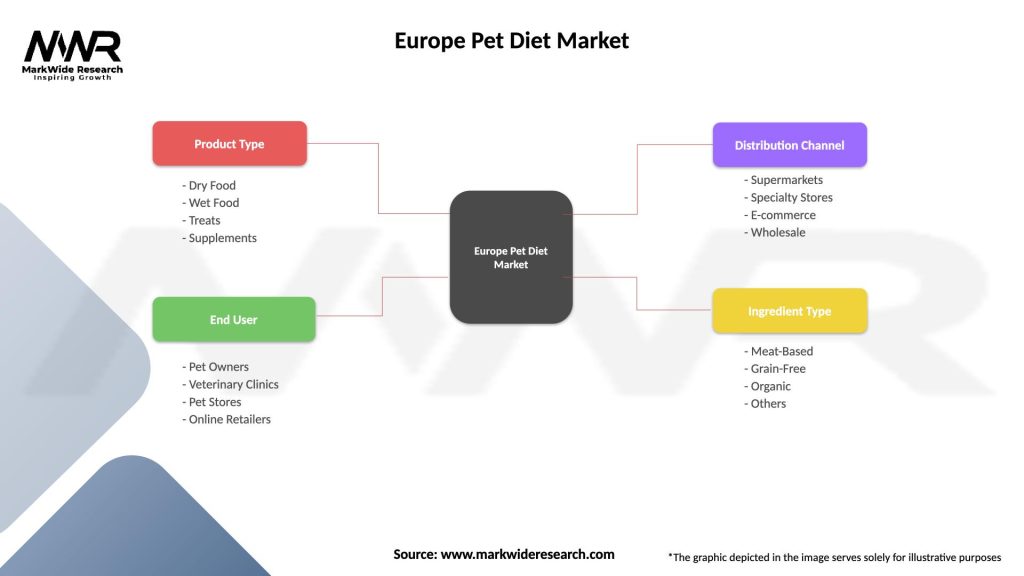

| Segmentation Details | Description |

|---|---|

| Product Type | Dry Food, Wet Food, Treats, Supplements |

| End User | Pet Owners, Veterinary Clinics, Pet Stores, Online Retailers |

| Distribution Channel | Supermarkets, Specialty Stores, E-commerce, Wholesale |

| Ingredient Type | Meat-Based, Grain-Free, Organic, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Pet Diet Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at