444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe people screening market represents a rapidly evolving security landscape driven by heightened security concerns, technological advancements, and regulatory compliance requirements across the continent. This comprehensive market encompasses various screening technologies and solutions designed to detect threats, contraband, and unauthorized items while ensuring the safety of individuals in airports, government buildings, commercial facilities, and public venues.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 6.8% driven by increasing security threats and the need for enhanced screening capabilities. The integration of artificial intelligence, machine learning, and advanced imaging technologies has revolutionized traditional screening methods, creating opportunities for more efficient and accurate threat detection systems.

European countries have implemented stringent security protocols following various security incidents, leading to increased investments in people screening infrastructure. The market benefits from strong government support, with public sector spending accounting for approximately 72% of total market adoption. Private sector applications, including corporate security and event management, contribute significantly to market expansion.

Technological innovation continues to drive market evolution, with manufacturers focusing on developing non-intrusive screening solutions that balance security effectiveness with passenger convenience. The emergence of millimeter wave technology, advanced threat detection algorithms, and automated screening processes has enhanced the overall efficiency of people screening operations across Europe.

The Europe people screening market refers to the comprehensive ecosystem of technologies, equipment, services, and solutions designed to screen individuals for security threats, prohibited items, and potential risks in various public and private settings across European countries. This market encompasses a wide range of screening modalities including walk-through metal detectors, X-ray body scanners, millimeter wave scanners, explosive detection systems, and biometric identification technologies.

People screening involves the systematic examination of individuals using various technological solutions to identify concealed weapons, explosives, drugs, or other prohibited materials without physical contact. The process typically combines multiple screening layers, including metal detection, imaging technologies, and behavioral analysis to ensure comprehensive security coverage while maintaining operational efficiency.

Market participants include technology manufacturers, system integrators, service providers, and end-users spanning aviation security, border control, government facilities, commercial buildings, educational institutions, and entertainment venues. The market’s scope extends beyond equipment provision to include installation, maintenance, training, and ongoing support services essential for effective screening operations.

The European people screening market demonstrates strong growth momentum driven by evolving security challenges, regulatory requirements, and technological innovations. Market expansion is supported by increasing government investments in security infrastructure, with aviation security representing the largest application segment, accounting for approximately 45% of market share.

Key market drivers include rising security threats, stringent regulatory compliance requirements, and the need for enhanced screening efficiency in high-traffic environments. The integration of artificial intelligence and machine learning technologies has improved threat detection accuracy while reducing false alarm rates, contributing to broader market adoption across various sectors.

Regional analysis reveals that Western European countries lead market adoption, with Germany, France, and the United Kingdom representing the largest markets. Eastern European nations show significant growth potential as they modernize their security infrastructure and align with European Union security standards.

Competitive landscape features established international players alongside regional specialists, with companies focusing on innovation, strategic partnerships, and comprehensive service offerings to maintain market position. The market’s future outlook remains positive, supported by ongoing security concerns and continuous technological advancement.

Strategic market insights reveal several critical trends shaping the Europe people screening market landscape:

Security threat evolution represents the primary driver for Europe people screening market growth. Increasing sophistication of security threats, including advanced concealment methods and emerging threat types, necessitates continuous improvement in screening technologies and capabilities. Organizations across various sectors recognize the critical importance of implementing comprehensive screening solutions to protect personnel, assets, and operations.

Regulatory compliance requirements significantly influence market demand, with European Union directives and national security regulations mandating specific screening standards for aviation, government facilities, and critical infrastructure. These regulatory frameworks create consistent market demand while driving technology standardization across member states.

Technological advancement continues to propel market growth through the development of more effective, efficient, and user-friendly screening solutions. Innovations in artificial intelligence, machine learning, and advanced imaging technologies enable better threat detection while reducing operational complexity and improving passenger experience.

Infrastructure modernization initiatives across European countries drive significant investments in security screening capabilities. Aging screening equipment requires replacement with modern systems offering enhanced performance, reliability, and integration capabilities. Government funding programs and public-private partnerships facilitate these modernization efforts.

Public safety awareness has increased following various security incidents, creating stronger support for comprehensive screening measures. Citizens and organizations demonstrate greater acceptance of screening procedures when they understand the security benefits and privacy protections incorporated into modern systems.

High implementation costs represent a significant barrier to market expansion, particularly for smaller organizations and facilities with limited security budgets. Advanced screening systems require substantial capital investments, including equipment procurement, installation, integration, and ongoing maintenance expenses that may strain organizational resources.

Privacy concerns continue to challenge market growth as individuals and advocacy groups raise questions about screening technologies that capture detailed body images or personal information. Balancing security effectiveness with privacy protection requires careful consideration of technology selection and implementation approaches.

Operational complexity associated with advanced screening systems can create implementation challenges for organizations lacking technical expertise or adequate training resources. Complex systems may require specialized personnel, extensive training programs, and ongoing technical support that some organizations find difficult to manage.

False alarm rates in some screening technologies can impact operational efficiency and user acceptance. High false positive rates lead to increased secondary screening requirements, longer processing times, and potential user frustration that may affect overall system effectiveness.

Integration challenges arise when organizations attempt to incorporate new screening technologies into existing security infrastructure. Compatibility issues, system integration complexity, and the need for comprehensive security protocol updates can complicate implementation processes and increase overall project costs.

Artificial intelligence integration presents substantial opportunities for market expansion through the development of intelligent screening systems capable of automated threat recognition, behavioral analysis, and predictive security assessment. AI-powered solutions can significantly improve screening accuracy while reducing human operator workload and training requirements.

Mobile screening solutions offer growing market potential for temporary events, emergency response situations, and facilities requiring flexible security arrangements. Portable screening systems enable organizations to deploy effective security measures in various locations without permanent infrastructure investments.

Biometric integration creates opportunities for enhanced security through the combination of people screening with identity verification capabilities. Integrated systems can simultaneously screen for threats while confirming individual identity, improving overall security effectiveness and operational efficiency.

Smart building integration represents an emerging opportunity as organizations seek to incorporate screening capabilities into comprehensive building security and management systems. Connected screening solutions can share data with other security systems, enabling coordinated threat response and improved situational awareness.

Service expansion opportunities exist in areas such as remote monitoring, predictive maintenance, and security consulting services. Organizations increasingly value comprehensive service packages that include ongoing support, performance optimization, and strategic security guidance beyond basic equipment provision.

Market dynamics in the Europe people screening sector reflect the complex interplay between security requirements, technological capabilities, regulatory frameworks, and operational considerations. The market demonstrates strong resilience driven by consistent security needs and continuous innovation in screening technologies.

Supply chain considerations influence market dynamics through factors such as component availability, manufacturing capacity, and logistics capabilities. European manufacturers benefit from regional supply chain advantages while international suppliers must navigate import regulations and local partnership requirements.

Competitive pressures drive continuous innovation and service improvement as companies seek to differentiate their offerings in an increasingly sophisticated market. Price competition exists alongside technology advancement, creating opportunities for both premium solutions and cost-effective alternatives.

Customer expectations continue to evolve toward more efficient, less intrusive screening experiences that maintain high security standards. Organizations demand solutions that balance security effectiveness with operational efficiency and user convenience, influencing product development priorities.

Technology convergence creates dynamic market conditions as screening systems increasingly integrate with broader security ecosystems, including access control, surveillance, and incident management systems. This convergence enables more comprehensive security solutions while creating new competitive dynamics.

Comprehensive market analysis for the Europe people screening market employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive interviews with industry stakeholders, including manufacturers, system integrators, end-users, and regulatory officials across key European markets.

Secondary research encompasses analysis of industry reports, government publications, regulatory documents, company financial statements, and technical specifications from leading market participants. This approach provides comprehensive market understanding while validating primary research findings through multiple data sources.

Market segmentation analysis utilizes both top-down and bottom-up approaches to accurately assess market size, growth potential, and competitive dynamics across different technology categories, application segments, and geographic regions within Europe.

Expert validation processes involve consultation with industry experts, technology specialists, and market analysts to verify research findings and ensure accuracy of market projections. This validation approach helps identify potential market developments and emerging trends that may impact future growth.

Data triangulation methods combine quantitative and qualitative research approaches to provide comprehensive market insights while minimizing potential bias or data limitations. Multiple data sources and analytical techniques ensure robust and reliable market intelligence for strategic decision-making.

Western Europe dominates the people screening market, with Germany, France, and the United Kingdom representing the largest individual markets. These countries benefit from mature security infrastructure, substantial government investments, and strong regulatory frameworks that drive consistent market demand. Germany leads in manufacturing and technology development, while France and the UK focus on aviation security and critical infrastructure protection.

Nordic countries demonstrate strong market adoption driven by advanced technology integration and comprehensive security approaches. Sweden, Norway, and Denmark show particular strength in innovative screening solutions and sustainable security practices. These markets account for approximately 18% of regional market share despite their smaller populations.

Southern Europe presents growing opportunities as countries like Italy, Spain, and Portugal modernize their security infrastructure and increase investments in people screening capabilities. Tourism-dependent economies in this region prioritize airport and public venue security, creating substantial market potential.

Eastern Europe shows the highest growth potential, with countries such as Poland, Czech Republic, and Hungary rapidly expanding their security capabilities to align with EU standards. These markets demonstrate strong government support for security infrastructure development, with growth rates exceeding regional averages by 25%.

Market distribution across Europe reflects economic development levels, security threat assessments, and regulatory compliance requirements. Western European markets focus on technology advancement and system replacement, while Eastern European markets emphasize initial deployment and capacity building initiatives.

Market leadership in the Europe people screening sector features a combination of established international corporations and specialized regional providers. The competitive landscape demonstrates strong innovation focus, with companies investing significantly in research and development to maintain technological advantages.

Competitive strategies emphasize technological innovation, strategic partnerships, and comprehensive service offerings. Companies increasingly focus on developing integrated solutions that combine multiple screening technologies while providing extensive support services including training, maintenance, and system optimization.

By Technology:

By Application:

By End-User:

Walk-through metal detectors maintain strong market presence due to their cost-effectiveness, reliability, and ease of operation. These systems serve as primary screening tools in many applications, with modern versions incorporating advanced discrimination capabilities and reduced false alarm rates. Market demand remains steady, particularly in budget-conscious applications and high-volume screening environments.

Advanced imaging technologies represent the fastest-growing segment, driven by enhanced threat detection capabilities and improved user experience. Millimeter wave scanners gain particular traction due to their non-ionizing radiation characteristics and effective threat detection performance. These systems command premium pricing but offer superior security capabilities.

Explosive detection systems show specialized growth in high-security applications where traditional metal detection proves insufficient. These systems integrate with broader screening protocols to provide comprehensive threat assessment capabilities, particularly in aviation and critical infrastructure applications.

Integrated screening solutions demonstrate increasing market appeal as organizations seek comprehensive security approaches combining multiple detection technologies. These systems offer enhanced security effectiveness while streamlining operational processes and reducing overall screening complexity.

Mobile screening solutions emerge as a growing category serving temporary events, emergency response, and flexible security requirements. These systems provide deployment flexibility while maintaining effective screening capabilities, appealing to organizations with varying security needs.

Enhanced security effectiveness represents the primary benefit for organizations implementing people screening solutions. Modern screening technologies provide superior threat detection capabilities while reducing security vulnerabilities and improving overall safety for personnel, visitors, and assets. Advanced systems offer multiple detection layers that significantly improve security outcomes.

Operational efficiency improvements enable organizations to process larger volumes of individuals while maintaining security standards. Automated screening processes reduce manual intervention requirements, decrease processing times, and improve overall throughput in high-traffic environments. These efficiency gains translate to cost savings and improved user experience.

Regulatory compliance assurance helps organizations meet mandatory security requirements while avoiding potential penalties or operational restrictions. Certified screening systems ensure compliance with European Union directives and national security regulations, providing peace of mind and operational continuity.

Cost optimization opportunities arise through improved screening efficiency, reduced false alarm rates, and lower operational overhead. Modern systems require fewer operators while providing better performance, resulting in long-term cost benefits that offset initial investment requirements.

Technology advancement access enables organizations to benefit from continuous innovation in screening capabilities, artificial intelligence integration, and system performance improvements. Regular software updates and technology enhancements ensure systems remain current with evolving security requirements.

Stakeholder confidence increases through visible security measures that demonstrate organizational commitment to safety and security. Effective screening systems enhance reputation, support business continuity, and provide assurance to employees, customers, and regulatory authorities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration emerges as the dominant trend transforming people screening capabilities. AI-powered systems offer automated threat recognition, behavioral analysis, and predictive security assessment that significantly improve screening effectiveness while reducing operator workload. Machine learning algorithms continuously improve detection accuracy and reduce false alarm rates.

Contactless screening technologies gain prominence driven by health considerations and user preference for non-intrusive security measures. Advanced imaging systems and remote detection capabilities enable effective screening without physical contact, improving user experience while maintaining security effectiveness.

Cloud-based system management represents a growing trend enabling centralized monitoring, remote diagnostics, and predictive maintenance capabilities. Cloud integration facilitates system optimization, performance analysis, and coordinated security management across multiple locations and facilities.

Biometric integration combines identity verification with threat detection, creating comprehensive security solutions that simultaneously confirm individual identity and screen for prohibited items. This integration improves security effectiveness while streamlining access control processes.

Sustainability focus influences technology development toward energy-efficient systems, recyclable components, and environmentally responsible manufacturing processes. Organizations increasingly consider environmental impact alongside security effectiveness when selecting screening solutions.

Mobile and portable solutions address growing demand for flexible security deployment in temporary events, emergency situations, and facilities requiring adaptable screening capabilities. These systems provide security effectiveness without permanent infrastructure requirements.

Technology partnerships between screening equipment manufacturers and artificial intelligence companies accelerate innovation in automated threat detection and system intelligence. These collaborations combine hardware expertise with advanced software capabilities to create next-generation screening solutions.

Regulatory updates across European Union member states continue to refine security requirements and screening standards. Recent developments focus on balancing security effectiveness with privacy protection while maintaining operational efficiency in high-traffic environments.

Market consolidation activities include strategic acquisitions and mergers among screening technology providers seeking to expand capabilities, geographic reach, and market position. These developments create larger, more comprehensive solution providers capable of addressing diverse customer requirements.

Research initiatives supported by government funding and industry collaboration focus on developing next-generation screening technologies including quantum detection, advanced materials analysis, and integrated security systems. According to MarkWide Research analysis, these initiatives show promising potential for market transformation.

Pilot programs in major European airports and government facilities test emerging screening technologies and operational approaches. These programs provide valuable real-world performance data while demonstrating technology capabilities to potential customers and regulatory authorities.

Training program development addresses the growing need for skilled screening system operators and maintenance personnel. Industry associations and equipment manufacturers collaborate to create comprehensive training curricula that ensure effective system utilization and performance optimization.

Investment prioritization should focus on artificial intelligence integration and automated screening capabilities that offer the greatest potential for operational improvement and competitive advantage. Organizations considering screening system investments should evaluate solutions that incorporate advanced AI features and demonstrate clear performance benefits.

Technology selection requires careful consideration of current security requirements, future expansion needs, and integration capabilities with existing infrastructure. MWR recommends comprehensive evaluation processes that include pilot testing, performance validation, and total cost of ownership analysis.

Partnership strategies with established technology providers offer advantages in terms of system reliability, ongoing support, and technology advancement access. Organizations should prioritize vendors with strong European presence, comprehensive service capabilities, and demonstrated innovation track records.

Training investment represents a critical success factor for screening system implementation and optimization. Organizations should allocate adequate resources for operator training, maintenance education, and ongoing skill development to maximize system effectiveness and return on investment.

Regulatory compliance monitoring ensures systems remain current with evolving security requirements and privacy regulations. Organizations should establish processes for tracking regulatory changes and implementing necessary system updates or operational modifications.

Performance measurement systems enable continuous optimization of screening operations and identification of improvement opportunities. Regular performance assessment helps organizations maximize security effectiveness while minimizing operational costs and user inconvenience.

Market growth prospects remain strong for the Europe people screening market, supported by continuous security challenges, regulatory requirements, and technological advancement. The market is expected to maintain steady expansion with growth rates of approximately 6.8% CAGR over the next five years, driven by infrastructure modernization and technology adoption.

Technology evolution will continue toward more intelligent, efficient, and user-friendly screening solutions incorporating artificial intelligence, machine learning, and advanced automation capabilities. These developments promise improved security effectiveness while reducing operational complexity and enhancing user experience.

Market expansion opportunities exist particularly in Eastern European countries as they continue modernizing security infrastructure and aligning with EU standards. These markets represent significant growth potential with government support and increasing security investment priorities.

Integration trends will drive development of comprehensive security ecosystems combining people screening with access control, surveillance, and incident management systems. This convergence creates opportunities for solution providers capable of delivering integrated security platforms.

Service sector growth will expand beyond traditional equipment provision to include comprehensive support services, remote monitoring, predictive maintenance, and security consulting. Organizations increasingly value service partnerships that ensure optimal system performance and security effectiveness.

Sustainability considerations will influence future technology development toward energy-efficient systems and environmentally responsible manufacturing processes. Market participants who prioritize sustainability alongside security effectiveness will gain competitive advantages in environmentally conscious markets.

The Europe people screening market demonstrates robust growth potential driven by evolving security requirements, technological innovation, and regulatory compliance needs across diverse applications. Market expansion reflects the critical importance of effective security screening in protecting individuals, assets, and operations while maintaining operational efficiency and user convenience.

Technology advancement continues to transform screening capabilities through artificial intelligence integration, advanced imaging systems, and automated threat detection processes. These innovations improve security effectiveness while addressing operational challenges and user experience considerations that influence market adoption decisions.

Regional market dynamics reveal strong opportunities across Europe, with Western European countries leading technology adoption and Eastern European markets showing significant growth potential. Government support, regulatory frameworks, and infrastructure modernization initiatives create favorable conditions for continued market expansion.

Competitive landscape evolution emphasizes innovation, comprehensive service offerings, and strategic partnerships as key success factors. Market participants who combine technological excellence with strong customer support and regulatory compliance capabilities are best positioned for long-term success in this dynamic market environment.

Future market development will be shaped by continued security challenges, technological advancement, and evolving user expectations for efficient, non-intrusive screening experiences. Organizations that invest in advanced screening capabilities while prioritizing operational efficiency and user satisfaction will realize significant benefits from this growing market opportunity.

What is People Screening?

People screening refers to the process of evaluating individuals for various purposes, such as employment, security, or compliance. It often involves background checks, identity verification, and assessment of criminal records.

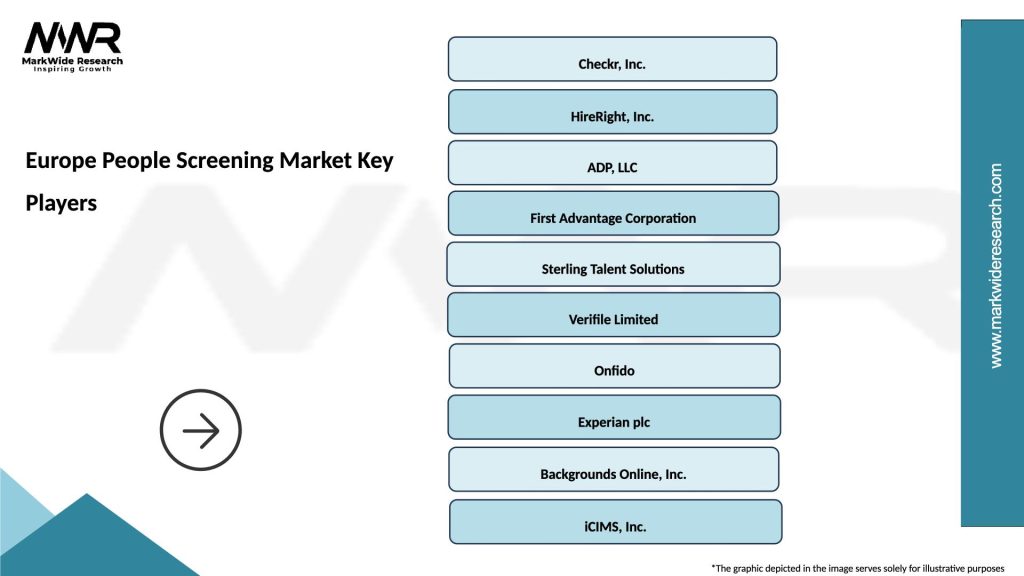

What are the key players in the Europe People Screening Market?

Key players in the Europe People Screening Market include HireRight, Sterling, and Checkr, which provide comprehensive background screening services. These companies focus on various sectors, including employment, healthcare, and financial services, among others.

What are the growth factors driving the Europe People Screening Market?

The Europe People Screening Market is driven by increasing regulatory requirements, the need for enhanced security measures, and the growing emphasis on workplace safety. Additionally, the rise in remote hiring practices has further fueled the demand for effective screening solutions.

What challenges does the Europe People Screening Market face?

Challenges in the Europe People Screening Market include data privacy concerns, varying regulations across countries, and the potential for inaccuracies in background checks. These factors can complicate the screening process and affect compliance.

What opportunities exist in the Europe People Screening Market?

Opportunities in the Europe People Screening Market include the integration of advanced technologies like AI and machine learning to enhance screening accuracy and efficiency. Additionally, the growing gig economy presents new avenues for screening services tailored to freelance and contract workers.

What trends are shaping the Europe People Screening Market?

Trends in the Europe People Screening Market include the increasing use of automated screening tools, a shift towards more comprehensive assessments, and a focus on candidate experience during the screening process. These trends aim to streamline operations and improve the overall effectiveness of screening.

Europe People Screening Market

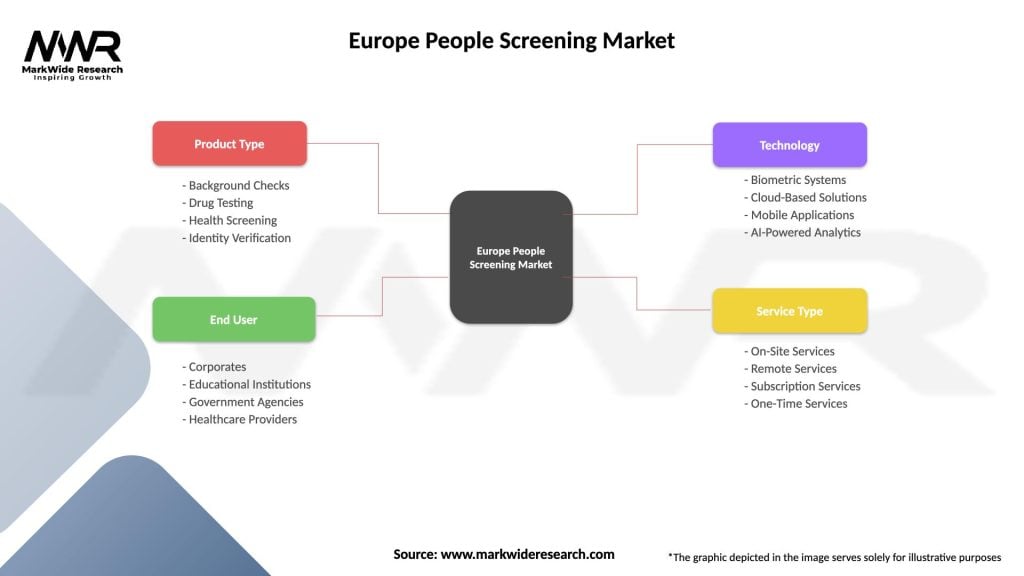

| Segmentation Details | Description |

|---|---|

| Product Type | Background Checks, Drug Testing, Health Screening, Identity Verification |

| End User | Corporates, Educational Institutions, Government Agencies, Healthcare Providers |

| Technology | Biometric Systems, Cloud-Based Solutions, Mobile Applications, AI-Powered Analytics |

| Service Type | On-Site Services, Remote Services, Subscription Services, One-Time Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe People Screening Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at