444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe passive electronic components in aerospace and defense market represents a critical segment of the continent’s advanced technology ecosystem, encompassing essential electronic elements that enable sophisticated military and civilian aircraft operations. Passive electronic components, including resistors, capacitors, inductors, and transformers, form the foundational building blocks of complex avionics systems, radar equipment, communication devices, and navigation instruments used across European aerospace and defense applications.

Market dynamics indicate robust growth driven by increasing defense modernization programs across European nations, rising demand for commercial aircraft, and the integration of advanced electronic systems in next-generation aerospace platforms. The market demonstrates strong momentum with a projected CAGR of 6.2% through the forecast period, reflecting the critical importance of reliable passive components in mission-critical applications.

European aerospace manufacturers and defense contractors are increasingly prioritizing high-reliability passive components that can withstand extreme environmental conditions, including temperature variations, vibration, electromagnetic interference, and radiation exposure. This emphasis on component reliability has created substantial opportunities for specialized manufacturers offering military-grade passive components designed to meet stringent aerospace and defense specifications.

Regional market leadership is concentrated in countries with established aerospace industries, including Germany, France, the United Kingdom, and Italy, where major aircraft manufacturers and defense contractors maintain significant operations. These nations collectively account for approximately 75% of European aerospace and defense passive component consumption, driven by their substantial investment in both commercial aviation and military modernization programs.

The Europe passive electronic components in aerospace and defense market refers to the comprehensive ecosystem of electronic components that do not require external power sources to function and are specifically designed, manufactured, and deployed within European aerospace and defense applications. These components include resistors, capacitors, inductors, transformers, filters, and connectors that provide essential functions such as energy storage, signal filtering, impedance matching, and circuit protection in aircraft, spacecraft, missiles, radar systems, and other defense equipment.

Passive components distinguish themselves from active components by their ability to operate without external power while performing critical functions including voltage regulation, signal conditioning, electromagnetic interference suppression, and power distribution. In aerospace and defense contexts, these components must meet exceptionally stringent reliability, performance, and environmental resistance standards to ensure mission success and personnel safety.

Market scope encompasses components manufactured specifically for aerospace and defense applications, featuring enhanced specifications for temperature tolerance, shock resistance, vibration immunity, and long-term reliability. The market includes both standard military-specification components and custom-designed solutions tailored to specific platform requirements across commercial aviation, military aircraft, space systems, and ground-based defense equipment.

Strategic market positioning reveals the Europe passive electronic components in aerospace and defense market as a vital enabler of the continent’s technological sovereignty and defense capabilities. The market demonstrates consistent growth momentum driven by increasing electronic content in modern aerospace platforms, ongoing military modernization initiatives, and the transition toward more sophisticated avionics and defense systems.

Key growth drivers include the rising complexity of aerospace electronic systems, increasing demand for lightweight yet durable components, and the growing emphasis on electronic warfare capabilities across European defense forces. The market benefits from substantial government investment in defense modernization programs, with European nations allocating approximately 2.1% of GDP to defense spending, creating sustained demand for advanced passive components.

Technological advancement trends focus on miniaturization, improved performance characteristics, and enhanced reliability under extreme operating conditions. Manufacturers are developing next-generation passive components featuring reduced size and weight while maintaining or improving electrical performance, addressing the aerospace industry’s ongoing requirements for more efficient and capable electronic systems.

Competitive landscape features a mix of established European component manufacturers, global technology leaders, and specialized aerospace suppliers offering comprehensive portfolios of military-grade passive components. Market consolidation trends continue as companies seek to expand their technological capabilities and geographic reach through strategic acquisitions and partnerships.

Market segmentation analysis reveals distinct growth patterns across different component categories and application areas, with capacitors and resistors representing the largest volume segments due to their widespread use in aerospace electronic systems. The following insights highlight critical market dynamics:

Defense modernization programs across European nations serve as primary market drivers, with governments investing substantially in upgrading aging military equipment and acquiring next-generation defense systems. These programs require extensive integration of advanced electronic systems, creating sustained demand for high-performance passive components capable of operating in demanding military environments.

Commercial aviation growth continues driving market expansion as European airlines modernize their fleets with fuel-efficient aircraft featuring sophisticated avionics systems. The increasing electronic content in modern commercial aircraft, including fly-by-wire controls, advanced navigation systems, and passenger entertainment networks, requires substantial quantities of reliable passive components.

Space industry expansion represents a significant growth driver as European space agencies and private companies launch increasing numbers of satellites and spacecraft. Space applications demand the highest-reliability passive components capable of withstanding radiation, extreme temperatures, and vacuum conditions while maintaining performance over extended mission durations.

Electronic warfare capabilities development drives demand for specialized passive components used in radar systems, electronic countermeasures, and communication equipment. European defense forces are prioritizing electronic warfare readiness, requiring advanced passive components for jamming systems, signal intelligence equipment, and defensive electronic systems.

Regulatory compliance requirements mandate the use of certified passive components in all aerospace and defense applications, creating barriers to entry for non-qualified suppliers while ensuring sustained demand for approved component manufacturers. These regulations drive continuous investment in quality systems and certification processes.

High certification costs represent significant market barriers, as passive components for aerospace and defense applications must undergo extensive qualification testing and certification processes that can cost hundreds of thousands of euros per component family. These requirements limit market entry for smaller manufacturers and increase overall component costs.

Long development cycles constrain market responsiveness, with new passive component designs requiring 2-3 years from concept to market availability due to extensive testing, qualification, and certification requirements. This extended timeline limits manufacturers’ ability to quickly respond to changing market demands or technological advances.

Supply chain vulnerabilities pose ongoing challenges as the aerospace and defense industry relies on complex global supply networks for raw materials and specialized manufacturing processes. Geopolitical tensions and trade restrictions can disrupt component availability and increase costs for European manufacturers.

Technical complexity requirements continue increasing as aerospace systems become more sophisticated, demanding passive components with enhanced performance characteristics that are challenging and expensive to develop. Meeting these evolving requirements requires substantial investment in research and development capabilities.

Market consolidation pressures create challenges for smaller component manufacturers as large aerospace and defense contractors prefer working with established suppliers offering comprehensive product portfolios and global support capabilities. This trend limits opportunities for specialized niche players to expand their market presence.

Next-generation aircraft programs present substantial opportunities as European aerospace manufacturers develop advanced military and commercial platforms requiring innovative passive component solutions. These programs, including the Future Combat Air System and next-generation commercial aircraft, will incorporate unprecedented levels of electronic integration.

Space commercialization creates expanding opportunities as private space companies and government agencies launch increasing numbers of satellites and space missions. The growing satellite constellation market requires cost-effective yet reliable passive components optimized for space applications, representing a significant growth opportunity.

Unmanned systems proliferation offers new market segments as military and civilian drone applications expand rapidly across Europe. These platforms require lightweight, compact passive components optimized for autonomous operation and extended mission durations, creating opportunities for specialized component designs.

Electronic warfare modernization drives demand for advanced passive components used in sophisticated radar, communication, and countermeasure systems. European defense forces are investing heavily in electronic warfare capabilities, creating opportunities for component manufacturers offering specialized solutions.

Sustainability initiatives create opportunities for manufacturers developing environmentally friendly passive components and manufacturing processes. The aerospace industry’s increasing focus on sustainability drives demand for components with reduced environmental impact throughout their lifecycle.

Technological evolution continues reshaping the passive components landscape as manufacturers develop innovative materials, designs, and manufacturing processes to meet increasingly demanding aerospace and defense requirements. Advanced ceramic materials, nanotechnology applications, and additive manufacturing techniques are enabling new component capabilities and performance levels.

Supply chain localization trends reflect European efforts to reduce dependence on non-European suppliers for critical defense components. This shift creates opportunities for European manufacturers while potentially increasing costs and limiting access to certain specialized materials or technologies.

Quality standards evolution drives continuous improvement in component reliability and performance as aerospace and defense applications become more demanding. New testing methodologies, accelerated aging techniques, and predictive reliability models are enhancing component qualification processes and reducing time-to-market.

Market consolidation continues as larger companies acquire specialized manufacturers to expand their product portfolios and technological capabilities. This trend creates both opportunities and challenges, offering growth potential for acquisition targets while increasing competitive pressure on remaining independent suppliers.

Digital transformation impacts component design, manufacturing, and supply chain management as companies adopt advanced simulation tools, automated manufacturing processes, and digital supply chain management systems. These technologies enable more efficient operations and faster response to customer requirements.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights for the Europe passive electronic components in aerospace and defense market. The research approach combines primary and secondary data sources to provide a complete understanding of market dynamics, competitive landscape, and future growth prospects.

Primary research activities include extensive interviews with industry executives, procurement managers, and technical specialists from leading aerospace and defense companies across Europe. These interviews provide firsthand insights into market trends, technology requirements, and purchasing decisions that drive component demand.

Secondary research sources encompass industry reports, government publications, trade association data, and company financial statements to validate primary research findings and provide comprehensive market context. This approach ensures research conclusions are supported by multiple independent data sources.

Market modeling techniques utilize statistical analysis and forecasting methodologies to project future market trends and growth patterns. These models incorporate historical data, current market conditions, and identified growth drivers to provide reliable market projections.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review panels, and statistical verification techniques. This rigorous approach provides confidence in research findings and market projections presented in this analysis.

Germany maintains the largest market share in European passive electronic components for aerospace and defense, accounting for approximately 28% of regional demand. The country’s strong aerospace industry, including major manufacturers and extensive defense programs, drives substantial component consumption across both commercial and military applications.

France represents the second-largest regional market, with significant demand driven by its aerospace industry leadership and substantial defense spending. French aerospace and defense companies require high-performance passive components for aircraft manufacturing, space systems, and military equipment modernization programs.

United Kingdom continues as a major market despite Brexit-related challenges, maintaining strong demand for aerospace passive components through its established defense industry and commercial aviation sector. The country’s focus on maintaining technological sovereignty drives investment in domestic component capabilities.

Italy demonstrates steady market growth supported by its aerospace manufacturing capabilities and defense modernization programs. Italian companies are increasingly focusing on advanced electronic systems integration, creating opportunities for specialized passive component suppliers.

Nordic countries collectively represent an emerging market segment, with increasing defense spending and growing aerospace industry presence driving demand for high-reliability passive components. These markets prioritize advanced technology solutions and environmental sustainability in component selection.

Eastern European nations show rapid market growth as these countries modernize their defense capabilities and integrate with Western aerospace supply chains. This region represents significant growth potential for passive component manufacturers seeking to expand their European presence.

Market leadership is distributed among several categories of suppliers, including global electronic component manufacturers, specialized aerospace suppliers, and European defense contractors offering comprehensive passive component portfolios. The competitive environment emphasizes technological capability, quality certification, and supply chain reliability.

Competitive strategies focus on technological differentiation, quality excellence, and comprehensive customer support capabilities. Leading companies invest heavily in research and development to maintain technological leadership while building strong relationships with major aerospace and defense contractors.

By Component Type: The market segments into distinct categories based on component functionality and application requirements, with each segment demonstrating unique growth patterns and market dynamics.

By Application: Market segmentation reflects diverse aerospace and defense applications requiring specialized passive component solutions.

Capacitor segment analysis reveals strong growth driven by increasing power density requirements and miniaturization trends in aerospace electronic systems. Ceramic capacitors dominate volume applications, while tantalum and film capacitors serve specialized high-reliability applications requiring superior performance characteristics.

Resistor market dynamics show growing demand for precision resistors and current sensing applications as aerospace systems require more accurate monitoring and control capabilities. High-power resistors are increasingly important for electric aircraft applications and advanced power management systems.

Inductor applications expand rapidly in power conversion systems and electromagnetic interference suppression applications. The trend toward more electric aircraft drives demand for high-efficiency power inductors capable of operating at elevated temperatures and frequencies.

Transformer requirements evolve toward higher power density and improved isolation characteristics for aerospace power systems. Planar transformers and custom magnetic solutions are gaining adoption for space-constrained applications requiring optimal performance.

Filter technology advancement focuses on enhanced electromagnetic interference suppression and signal integrity preservation in increasingly complex electronic environments. Multi-stage filters and integrated filter solutions are becoming standard in advanced aerospace systems.

Aerospace manufacturers benefit from access to high-reliability passive components that enable the development of more capable and efficient aircraft systems. These components provide the foundation for advanced avionics, power management, and communication systems that differentiate modern aerospace platforms.

Defense contractors gain competitive advantages through partnerships with leading passive component suppliers offering specialized military-grade products. Access to cutting-edge component technology enables the development of superior defense systems with enhanced performance and reliability.

Component manufacturers benefit from the high-value nature of aerospace and defense applications, which typically offer premium pricing for qualified components. Long-term contracts and stable demand patterns provide revenue predictability and support substantial research and development investments.

Supply chain partners benefit from the stringent quality requirements that create barriers to entry and protect established supplier relationships. The emphasis on supply chain security and domestic sourcing creates opportunities for European suppliers to expand their market presence.

Technology investors find attractive opportunities in the passive components market due to its essential role in aerospace and defense systems and the ongoing trend toward increased electronic content in these applications. The market’s stability and growth prospects make it attractive for long-term investment strategies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Miniaturization acceleration continues as aerospace systems require smaller, lighter components without compromising performance or reliability. Advanced packaging technologies and new materials enable significant size reductions while maintaining or improving electrical characteristics, supporting the industry’s weight reduction objectives.

Integration advancement drives development of multi-functional passive components that combine multiple functions in single packages. These integrated solutions reduce system complexity, improve reliability, and save space in crowded aerospace electronic systems.

Environmental resistance enhancement focuses on developing components capable of operating in increasingly harsh environments, including higher temperatures, increased vibration levels, and enhanced radiation tolerance for space applications. These improvements expand component application ranges and improve system reliability.

Digital manufacturing adoption transforms component production through additive manufacturing, automated assembly, and digital quality control systems. These technologies enable more flexible manufacturing, faster prototyping, and improved quality consistency.

Sustainability emphasis drives development of environmentally friendly components and manufacturing processes. The aerospace industry’s increasing focus on sustainability creates demand for components with reduced environmental impact throughout their lifecycle, from raw materials through end-of-life disposal.

Strategic partnerships between component manufacturers and aerospace companies are expanding to accelerate technology development and ensure supply chain security. These collaborations focus on developing next-generation components optimized for specific aerospace applications and platforms.

Manufacturing capacity expansion continues across Europe as component suppliers invest in new production facilities and equipment to meet growing demand. These investments focus on advanced manufacturing technologies that improve quality, reduce costs, and enhance production flexibility.

Technology acquisitions accelerate as larger companies acquire specialized manufacturers to expand their technological capabilities and product portfolios. These transactions consolidate market expertise and create more comprehensive component suppliers.

Certification program development advances as industry organizations work to streamline qualification processes while maintaining rigorous quality standards. New testing methodologies and accelerated qualification procedures aim to reduce time-to-market for innovative components.

Research collaboration increases between component manufacturers, aerospace companies, and research institutions to develop breakthrough technologies. These partnerships focus on advanced materials, new component architectures, and innovative manufacturing processes that will enable next-generation aerospace systems.

MarkWide Research recommends that component manufacturers prioritize investment in advanced materials research and manufacturing technologies to maintain competitive advantages in the evolving aerospace and defense market. Companies should focus on developing components that offer superior performance while meeting increasingly stringent environmental and reliability requirements.

Supply chain diversification strategies should be implemented to reduce dependence on single sources for critical materials and manufacturing processes. European companies should particularly focus on developing domestic supply capabilities to enhance supply chain security and reduce geopolitical risks.

Technology partnership development with aerospace and defense customers will be crucial for understanding future requirements and developing optimized component solutions. These partnerships should focus on long-term technology roadmaps and collaborative development programs that benefit both parties.

Quality system investment remains essential as certification requirements continue evolving and becoming more stringent. Companies should invest in advanced testing capabilities, quality management systems, and process automation to ensure consistent compliance with aerospace and defense standards.

Market expansion strategies should consider emerging applications in space commercialization, unmanned systems, and electric aircraft technologies. These growing segments offer opportunities for companies willing to invest in specialized component development and market entry strategies.

Market growth trajectory indicates sustained expansion driven by increasing electronic content in aerospace and defense systems, ongoing modernization programs, and emerging applications in space and unmanned systems. The market is expected to maintain steady growth with a projected CAGR of 6.2% through the next decade.

Technology evolution will focus on advanced materials, enhanced integration, and improved environmental resistance as aerospace systems become more demanding. Component manufacturers must continue investing in research and development to meet evolving performance requirements while maintaining cost competitiveness.

Supply chain transformation will emphasize localization, security, and sustainability as European aerospace and defense companies prioritize supply chain resilience. This trend creates opportunities for European component manufacturers while potentially increasing costs and complexity.

Application diversification will expand beyond traditional aerospace and defense markets to include commercial space, urban air mobility, and advanced defense systems. These emerging applications will require specialized component solutions and create new growth opportunities for innovative manufacturers.

MWR analysis projects that successful companies will be those that combine technological leadership with strong customer relationships, comprehensive quality systems, and flexible manufacturing capabilities. The market will continue rewarding companies that can deliver reliable, high-performance components while adapting to evolving customer requirements and market conditions.

The Europe passive electronic components in aerospace and defense market represents a vital and growing segment of the continent’s advanced technology ecosystem, driven by increasing electronic system complexity, ongoing modernization programs, and emerging applications in space and unmanned systems. Market fundamentals remain strong, supported by substantial government investment in defense capabilities and continued growth in commercial aviation.

Technological advancement continues reshaping the market as manufacturers develop innovative components offering enhanced performance, reduced size, and improved reliability. The emphasis on supply chain security and domestic sourcing creates opportunities for European manufacturers while driving investment in local production capabilities and technological development.

Future success in this market will require companies to balance technological innovation with quality excellence, supply chain security, and cost competitiveness. Organizations that can effectively navigate the complex certification requirements while developing cutting-edge component solutions will be best positioned to capitalize on the market’s growth opportunities and maintain competitive advantages in this critical industry segment.

What is Passive Electronic Components in Aerospace and Defense?

Passive electronic components are essential elements used in aerospace and defense applications, including resistors, capacitors, and inductors. They play a critical role in circuit functionality without requiring external power, ensuring reliability and performance in various systems.

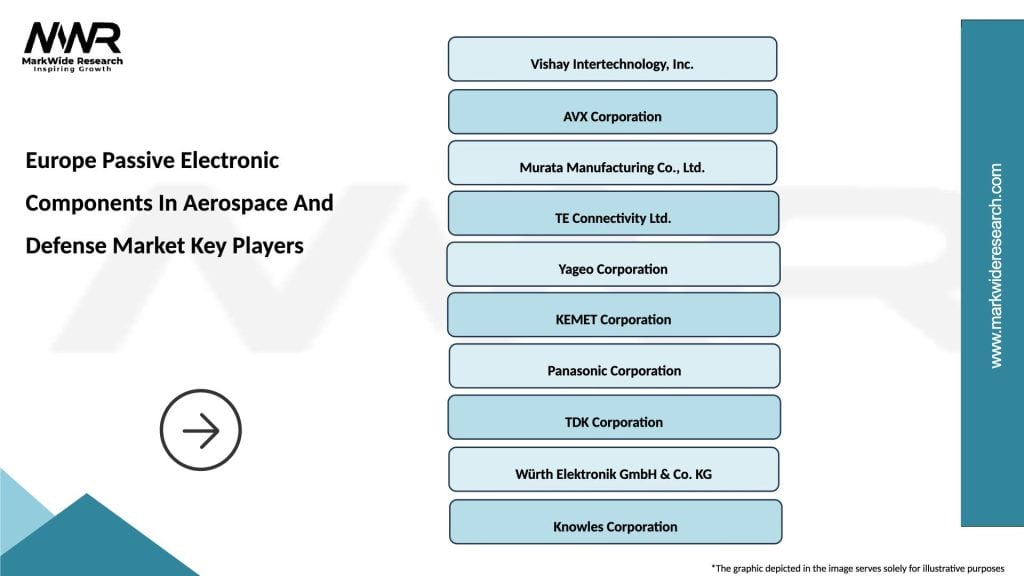

What are the key players in the Europe Passive Electronic Components In Aerospace And Defense Market?

Key players in the Europe Passive Electronic Components In Aerospace And Defense Market include companies like Vishay Intertechnology, Murata Manufacturing, and TDK Corporation. These companies are known for their innovative solutions and extensive product portfolios in passive components, among others.

What are the growth factors driving the Europe Passive Electronic Components In Aerospace And Defense Market?

The growth of the Europe Passive Electronic Components In Aerospace And Defense Market is driven by increasing defense budgets, advancements in aerospace technology, and the rising demand for reliable electronic systems in military applications. Additionally, the push for modernization in defense equipment contributes to market expansion.

What challenges does the Europe Passive Electronic Components In Aerospace And Defense Market face?

Challenges in the Europe Passive Electronic Components In Aerospace And Defense Market include stringent regulatory requirements, high manufacturing costs, and the need for continuous innovation to meet evolving technological demands. These factors can hinder market growth and product development.

What opportunities exist in the Europe Passive Electronic Components In Aerospace And Defense Market?

Opportunities in the Europe Passive Electronic Components In Aerospace And Defense Market include the increasing adoption of advanced materials, the integration of smart technologies, and the growing focus on sustainability in defense systems. These trends present avenues for innovation and market growth.

What trends are shaping the Europe Passive Electronic Components In Aerospace And Defense Market?

Trends shaping the Europe Passive Electronic Components In Aerospace And Defense Market include the miniaturization of components, the rise of IoT applications in defense, and the development of high-frequency components for advanced communication systems. These trends are driving the evolution of passive electronic components.

Europe Passive Electronic Components In Aerospace And Defense Market

| Segmentation Details | Description |

|---|---|

| Product Type | Capacitors, Resistors, Inductors, Filters |

| Technology | Thin Film, Thick Film, Ceramic, Polymer |

| End User | Aerospace Manufacturers, Defense Contractors, Government Agencies, Research Institutions |

| Application | Avionics, Communication Systems, Navigation Systems, Radar Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Passive Electronic Components In Aerospace And Defense Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at