444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview:

The Europe palladium market is a crucial segment of the global precious metals industry. Palladium, a rare and lustrous silvery-white metal, is primarily used in catalytic converters for automobiles, electronics manufacturing, jewelry, and industrial applications. Europe is a significant player in the global palladium market, with diverse industrial sectors driving both demand and supply dynamics in the region. Understanding the market trends, supply chain dynamics, and regulatory landscape is essential for stakeholders operating in the Europe palladium market to make informed decisions and capitalize on opportunities.

Meaning:

Palladium is a precious metal belonging to the platinum group metals (PGMs), which also includes platinum, rhodium, ruthenium, iridium, and osmium. It is characterized by its high melting point, excellent corrosion resistance, and catalytic properties, making it indispensable in various industrial applications. In Europe, palladium is primarily used in automotive catalytic converters to reduce emissions and improve air quality, reflecting the metal’s critical role in addressing environmental challenges and meeting regulatory standards.

Executive Summary:

The Europe palladium market is influenced by factors such as automotive production trends, industrial demand, investment activity, geopolitical developments, and macroeconomic indicators. Despite challenges such as supply constraints, price volatility, and regulatory uncertainties, the market offers significant opportunities for industry participants and investors. Strategic partnerships, technological innovations, sustainable practices, and market diversification are key strategies for stakeholders to navigate the dynamic Europe palladium market landscape and achieve long-term growth and profitability.

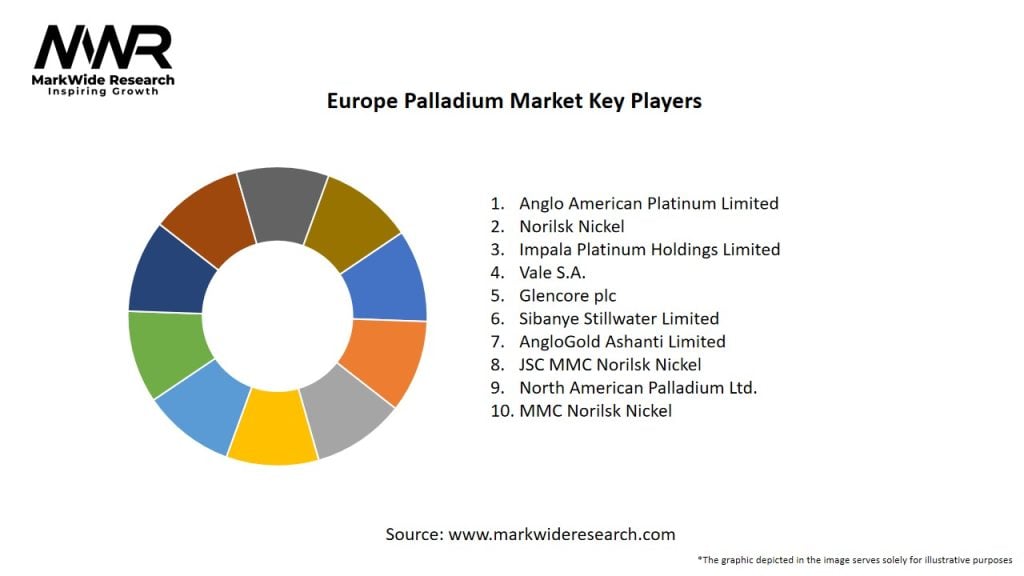

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The Europe palladium market operates in a dynamic environment shaped by global economic trends, geopolitical developments, technological advancements, regulatory changes, and consumer preferences. These dynamics influence market supply, demand, prices, and investment sentiment, requiring stakeholders to adapt, innovate, and collaborate to navigate uncertainties and capitalize on opportunities in the evolving Europe palladium market landscape.

Regional Analysis:

Europe is a significant consumer and importer of palladium, with key markets including Germany, France, the United Kingdom, Italy, and Russia. The region’s automotive, electronics, chemical, and jewelry industries drive demand for palladium-based products and catalysts, supported by robust manufacturing capabilities, technological expertise, and consumer demand for high-quality goods and services.

Competitive Landscape:

Leading Companies in the Europe Palladium Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation:

The Europe palladium market can be segmented based on various factors such as application, end-user industry, geographic region, and distribution channel, providing insights into market trends, demand drivers, and growth opportunities across different market segments.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends:

Covid-19 Impact:

The Covid-19 pandemic had a significant impact on the Europe palladium market, disrupting supply chains, reducing demand, and causing price volatility. While automotive production declines and industrial activity slowdowns initially led to palladium price declines, the subsequent recovery in automotive sales, economic stimulus measures, and supply chain adaptations supported market rebound and price stabilization.

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The Europe palladium market is poised for continued growth and evolution, driven by factors such as urbanization trends, infrastructure development, automotive industry recovery, emission reduction mandates, and technological advancements. While challenges such as supply constraints, price volatility, and regulatory uncertainties persist, opportunities for innovation, market diversification, and sustainable growth abound, positioning stakeholders for success in the dynamic Europe palladium market landscape.

Conclusion:

The Europe palladium market plays a vital role in the global precious metals industry, with diverse industrial applications, investment opportunities, and market dynamics shaping its growth and evolution. Despite challenges such as supply constraints, price volatility, and regulatory uncertainties, the market offers significant opportunities for stakeholders to innovate, collaborate, and capitalize on emerging trends, sustainable practices, and market developments in Europe. By embracing technology, sustainability, market diversification, and risk management strategies, stakeholders can navigate uncertainties, achieve growth, and contribute to the long-term sustainability and prosperity of the Europe palladium market.

What is Palladium?

Palladium is a rare, precious metal that is primarily used in catalytic converters for automobiles, electronics, and jewelry. It is known for its excellent catalytic properties and resistance to corrosion.

What are the key players in the Europe Palladium Market?

Key players in the Europe Palladium Market include companies such as Johnson Matthey, BASF, and Anglo American, which are involved in the production and supply of palladium for various applications, among others.

What are the growth factors driving the Europe Palladium Market?

The Europe Palladium Market is driven by the increasing demand for automotive catalysts, the growth of the electronics industry, and the rising interest in investment in precious metals. These factors contribute to the overall expansion of the market.

What challenges does the Europe Palladium Market face?

The Europe Palladium Market faces challenges such as supply chain disruptions, fluctuating prices, and environmental regulations that impact mining and production processes. These factors can hinder market growth and stability.

What opportunities exist in the Europe Palladium Market?

Opportunities in the Europe Palladium Market include advancements in recycling technologies, increasing applications in hydrogen fuel cells, and the growing trend towards sustainable practices in the automotive industry. These factors may enhance market prospects.

What trends are shaping the Europe Palladium Market?

Trends in the Europe Palladium Market include the rising adoption of electric vehicles, innovations in catalytic converter technologies, and a shift towards greener alternatives in industrial applications. These trends are influencing demand and production strategies.

Europe Palladium Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bars, Coins, Ingots, Powder |

| Application | Automotive Catalysts, Electronics, Jewelry, Dentistry |

| End User | Manufacturers, Retailers, Investors, Industrial Users |

| Distribution Channel | Online, Retail Stores, Auctions, Direct Sales |

Leading Companies in the Europe Palladium Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at