444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Europe Online Trading Platform market is a dynamic and rapidly evolving sector within the financial services industry. Online trading platforms have become instrumental in enabling individuals and institutions to buy and sell financial instruments, providing access to a wide range of assets such as stocks, bonds, commodities, and cryptocurrencies. This market overview delves into the current landscape of the Europe Online Trading Platform market, offering insights into key trends, market dynamics, growth drivers, challenges, and emerging opportunities.

Meaning

Online trading platforms are digital tools that facilitate the buying and selling of financial instruments over the internet. These platforms offer users the ability to execute trades, access real-time market information, and manage their investment portfolios from the convenience of their computers or mobile devices. In the European market, online trading platforms play a crucial role in democratizing access to financial markets and empowering both seasoned investors and newcomers.

Executive Summary

The Europe Online Trading Platform market has witnessed exponential growth, driven by factors such as technological advancements, increased adoption of digital financial services, and a growing interest in investment activities. This executive summary provides a concise overview of the current market scenario, highlighting key factors influencing the market’s trajectory.

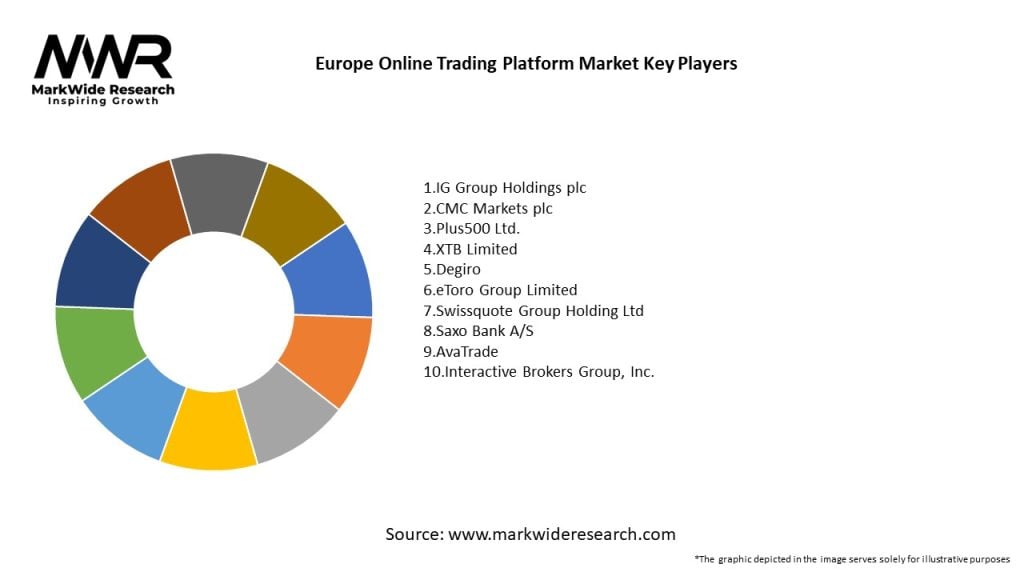

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Europe Online Trading Platform market operates in a dynamic environment influenced by various factors, including technological advancements, regulatory changes, market trends, and investor sentiment. Understanding these dynamics is crucial for industry participants to navigate challenges and capitalize on emerging opportunities.

Regional Analysis

Competitive Landscape

Leading Companies in the Europe Online Trading Platform Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

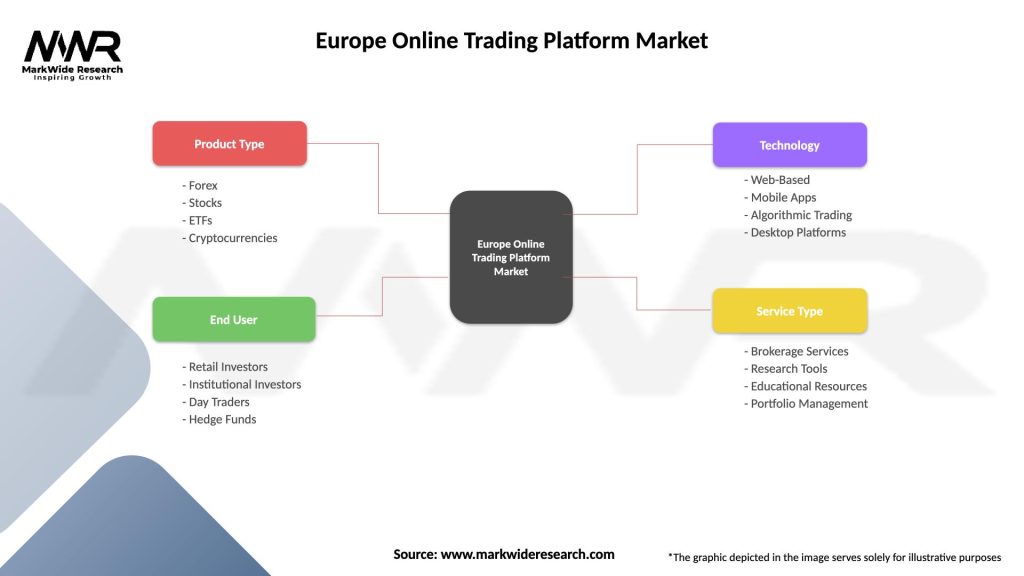

The Europe Online Trading Platform market can be segmented based on various factors:

Category-wise Insights

Key Benefits for Users and Stakeholders

SWOT Analysis

A SWOT analysis provides an overview of the Europe Online Trading Platform market’s strengths, weaknesses, opportunities, and threats:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a notable impact on the Europe Online Trading Platform market:

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Europe Online Trading Platform market is characterized by several key factors:

Conclusion

The Europe Online Trading Platform market stands at the forefront of financial services, providing individuals and institutions with unprecedented access to global financial markets. As the market continues to evolve, driven by technological innovations, regulatory changes, and shifting investor preferences, online trading platforms play a pivotal role in shaping the future of finance. The market’s resilience, coupled with ongoing developments in Fintech, blockchain, and user-centric features, positions online trading platforms for sustained growth. By navigating challenges, embracing innovations, and prioritizing user education and security, stakeholders in the Europe Online Trading Platform market can contribute to a dynamic and thriving ecosystem that empowers users in their financial endeavors.

What is Online Trading Platform?

An Online Trading Platform is a software application that allows users to buy and sell financial securities via the internet. These platforms provide tools for trading, market analysis, and account management, catering to both individual and institutional investors.

What are the key players in the Europe Online Trading Platform Market?

Key players in the Europe Online Trading Platform Market include eToro, IG Group, and DEGIRO, which offer various trading services and platforms for retail and institutional clients, among others.

What are the main drivers of growth in the Europe Online Trading Platform Market?

The growth of the Europe Online Trading Platform Market is driven by increasing internet penetration, the rise of mobile trading applications, and a growing interest in financial markets among retail investors. Additionally, advancements in technology and user-friendly interfaces are attracting more users.

What challenges does the Europe Online Trading Platform Market face?

The Europe Online Trading Platform Market faces challenges such as regulatory compliance, cybersecurity threats, and market volatility. These factors can impact user trust and the overall stability of trading platforms.

What opportunities exist in the Europe Online Trading Platform Market?

Opportunities in the Europe Online Trading Platform Market include the expansion of cryptocurrency trading, the integration of artificial intelligence for personalized trading experiences, and the potential for partnerships with fintech companies to enhance service offerings.

What trends are shaping the Europe Online Trading Platform Market?

Trends shaping the Europe Online Trading Platform Market include the increasing popularity of social trading, the rise of commission-free trading models, and the growing emphasis on sustainable investing. These trends are influencing how platforms attract and retain users.

Europe Online Trading Platform Market

| Segmentation Details | Description |

|---|---|

| Product Type | Forex, Stocks, ETFs, Cryptocurrencies |

| End User | Retail Investors, Institutional Investors, Day Traders, Hedge Funds |

| Technology | Web-Based, Mobile Apps, Algorithmic Trading, Desktop Platforms |

| Service Type | Brokerage Services, Research Tools, Educational Resources, Portfolio Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Europe Online Trading Platform Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at