444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Europe Online Retail Mobile Payment Transactions market stands at the forefront of the digital commerce landscape, representing a pivotal intersection of e-commerce and mobile payment technologies. This market has witnessed significant growth as consumers increasingly opt for convenient and secure mobile payment methods when making online purchases. Understanding the dynamics of this market is crucial for industry participants to capitalize on emerging opportunities and address evolving consumer preferences.

Meaning

The term “Online Retail Mobile Payment Transactions” refers to the process of conducting financial transactions for online retail purchases through mobile devices. This includes smartphones and tablets, where consumers can securely authorize payments using mobile payment apps or integrated payment systems. The convenience and accessibility of mobile payments have contributed to their widespread adoption in the context of online retail.

Executive Summary

The Europe Online Retail Mobile Payment Transactions market has experienced remarkable growth, fueled by the region’s tech-savvy consumer base and the increasing prevalence of mobile devices. This market offers lucrative prospects for businesses and financial institutions, but it also poses challenges related to security concerns and the need for seamless integration with online retail platforms. Navigating these dynamics is essential for stakeholders aiming to stay competitive in the evolving digital commerce landscape.

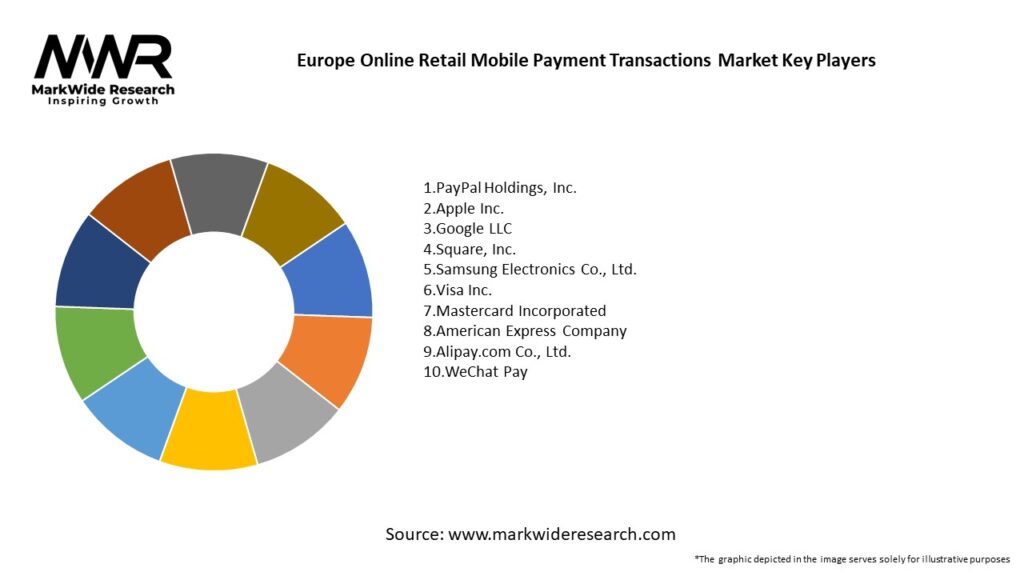

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Europe Online Retail Mobile Payment Transactions market operates in a dynamic landscape influenced by factors such as consumer behavior, technological advancements, regulatory developments, and industry collaborations. Understanding and adapting to these dynamics are essential for stakeholders to stay competitive and capitalize on emerging trends.

Regional Analysis

The market exhibits regional variations influenced by factors such as varying levels of smartphone adoption, cultural preferences, and regulatory frameworks. Key regions within Europe, including Western Europe and Eastern Europe, may showcase distinct market characteristics and growth trajectories.

Competitive Landscape

Leading Companies in Europe Online Retail Mobile Payment Transactions Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

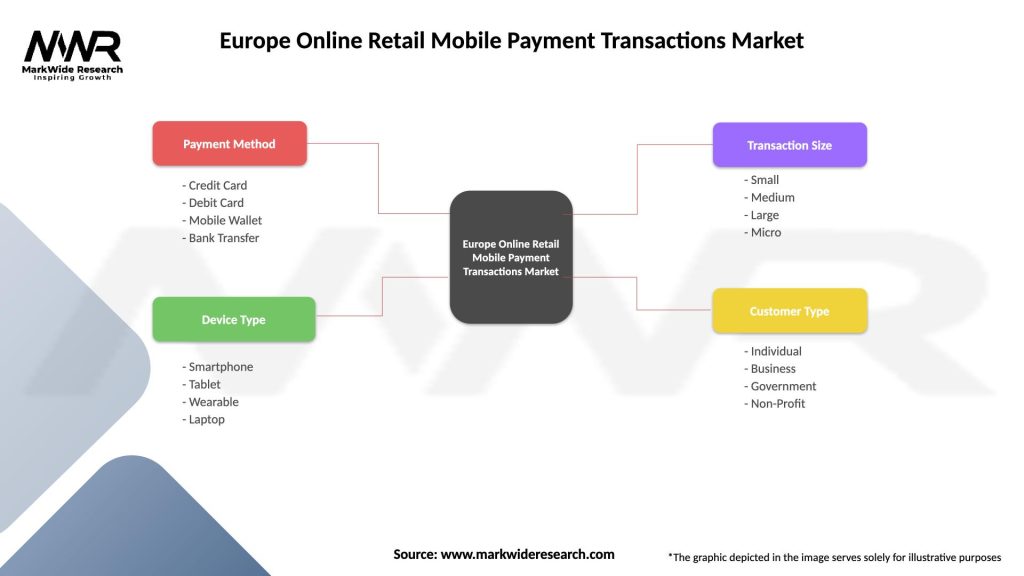

The Europe Online Retail Mobile Payment Transactions market can be segmented based on various criteria:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The Europe Online Retail Mobile Payment Transactions market offers several benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT analysis provides an overview of the Europe Online Retail Mobile Payment Transactions market’s strengths, weaknesses, opportunities, and threats:

Strengths:

Weaknesses:

Opportunities:

Threats:

Understanding these factors through a SWOT analysis enables industry participants to capitalize on strengths, address weaknesses, leverage opportunities, and mitigate potential threats.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the Europe Online Retail Mobile Payment Transactions market:

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Europe Online Retail Mobile Payment Transactions market is characterized by ongoing technological advancements, evolving consumer preferences, and strategic collaborations. Anticipated trends include:

Conclusion

The Europe Online Retail Mobile Payment Transactions market represents a dynamic and rapidly evolving landscape within the broader digital commerce sector. As consumers increasingly turn to online shopping and mobile devices, the market offers substantial opportunities for businesses and financial institutions. Navigating the complexities of security, regulatory compliance, and consumer preferences is essential for stakeholders to succeed in this dynamic and competitive market. By staying attuned to emerging trends, fostering innovation, and prioritizing user experience, industry participants can position themselves for sustained growth and success in the future.

What is Online Retail Mobile Payment Transactions?

Online Retail Mobile Payment Transactions refer to the use of mobile devices to facilitate payments for goods and services purchased online. This includes various payment methods such as mobile wallets, in-app payments, and QR code transactions.

What are the key players in the Europe Online Retail Mobile Payment Transactions Market?

Key players in the Europe Online Retail Mobile Payment Transactions Market include PayPal, Adyen, Stripe, and Square, among others. These companies provide various mobile payment solutions that cater to the growing demand for online retail transactions.

What are the main drivers of the Europe Online Retail Mobile Payment Transactions Market?

The main drivers of the Europe Online Retail Mobile Payment Transactions Market include the increasing adoption of smartphones, the rise of e-commerce, and consumer preference for convenient payment options. Additionally, advancements in mobile payment technology are enhancing user experience.

What challenges does the Europe Online Retail Mobile Payment Transactions Market face?

Challenges in the Europe Online Retail Mobile Payment Transactions Market include security concerns related to fraud and data breaches, regulatory compliance issues, and the need for interoperability among different payment systems. These factors can hinder market growth.

What opportunities exist in the Europe Online Retail Mobile Payment Transactions Market?

Opportunities in the Europe Online Retail Mobile Payment Transactions Market include the expansion of digital wallets, the integration of artificial intelligence for fraud detection, and the potential for partnerships between retailers and payment service providers. These trends can drive further innovation.

What trends are shaping the Europe Online Retail Mobile Payment Transactions Market?

Trends shaping the Europe Online Retail Mobile Payment Transactions Market include the growing popularity of contactless payments, the rise of subscription-based services, and the increasing use of biometric authentication for secure transactions. These trends reflect changing consumer behaviors and preferences.

Europe Online Retail Mobile Payment Transactions Market

| Segmentation Details | Description |

|---|---|

| Payment Method | Credit Card, Debit Card, Mobile Wallet, Bank Transfer |

| Device Type | Smartphone, Tablet, Wearable, Laptop |

| Transaction Size | Small, Medium, Large, Micro |

| Customer Type | Individual, Business, Government, Non-Profit |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Europe Online Retail Mobile Payment Transactions Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at